09 June 2023 Afternoon Session Analysis

Euro climbs despite downbeat EU GDP data.

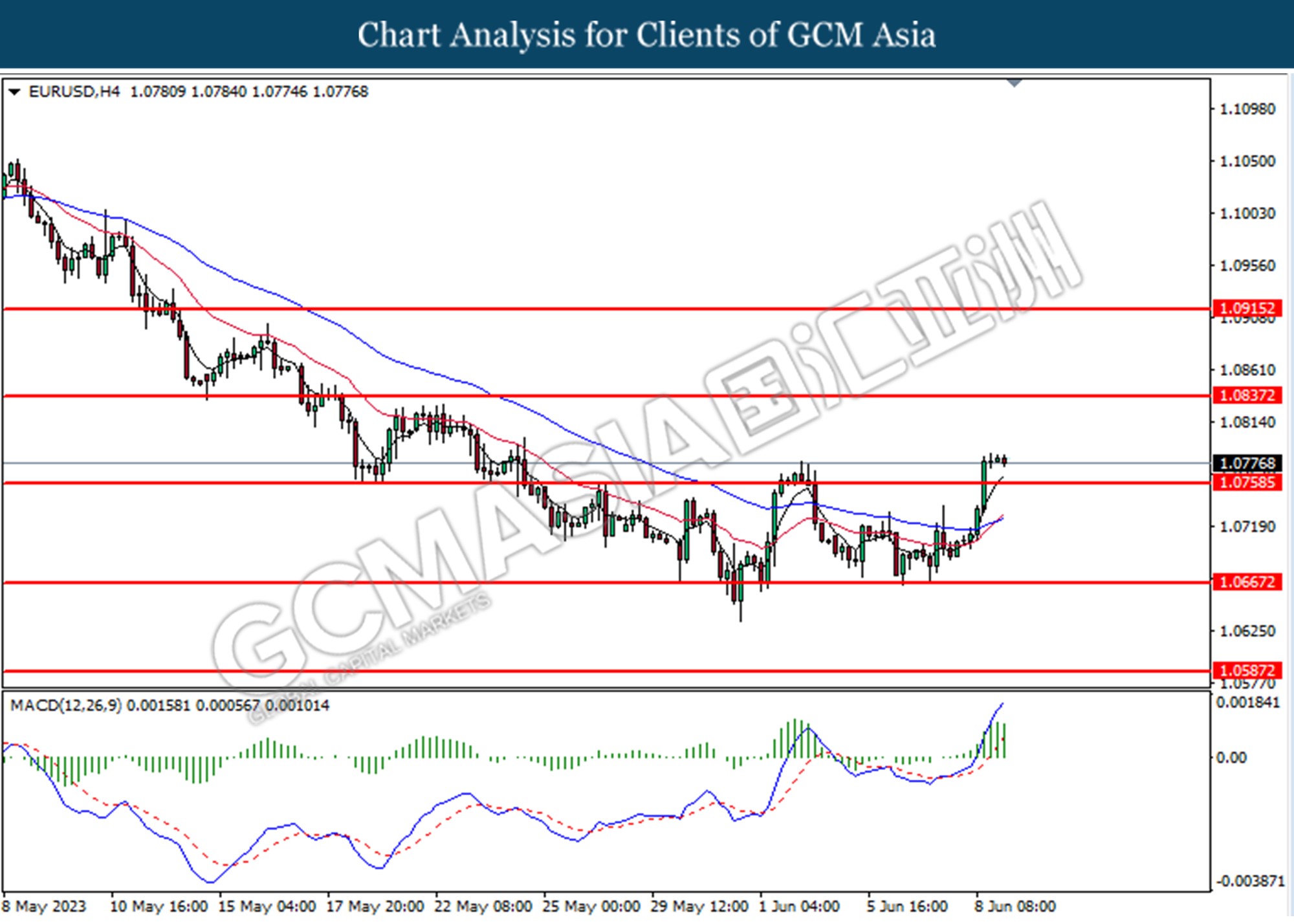

The pair of EUR against the dollar index climbed higher despite downbeat GDP data released by Eurostat on Thursday. Eurozone Gross Domestic Product (GDP) was growth to 1.0%, lower than the estimation of growth of 1.3%, Eurostat data showed. Slow economic growth in the European Union has been hurt after German officials indicated that the bloc’s largest economy would enter recession early in 2023 According to a survey in Germany, consumer spending accounts for half of Germany’s GDP. After being hit by high inflation, consumers are cautious and reduce spending. Nonetheless, a slowing down of the eurozone economy cannot limit the gains of the pair of EURUSD. Eurostat said that employment remains in tightened conditions with a growth accelerated at the start of 2023, rising to 0.6% in the first quarter from 0.3% in the fourth quarter of 2022, in line with economist estimation. Moreover, price pressure and inflation data in the EU were reduced, but not enough to deter the ECB from continuing to tighten its monetary policy. Following that, ECB President Christine Lagarde make her hawkish tone in the early week and said that “it was too early to call a peak in core inflation”. The message prompted investors that the central bank will raise the interest rate again at the upcoming meeting. As of writing, the EUR/USD traded down by -0.05% to 1.0779.

In the commodities market, crude oil prices depreciated by -0.53% to $70.91 per barrel as weak economic data from China will erode simple oil demand. Besides, gold prices slipped by -0.04% to $1964.90 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 41.4K | 23.2K | – |

Technical Analysis

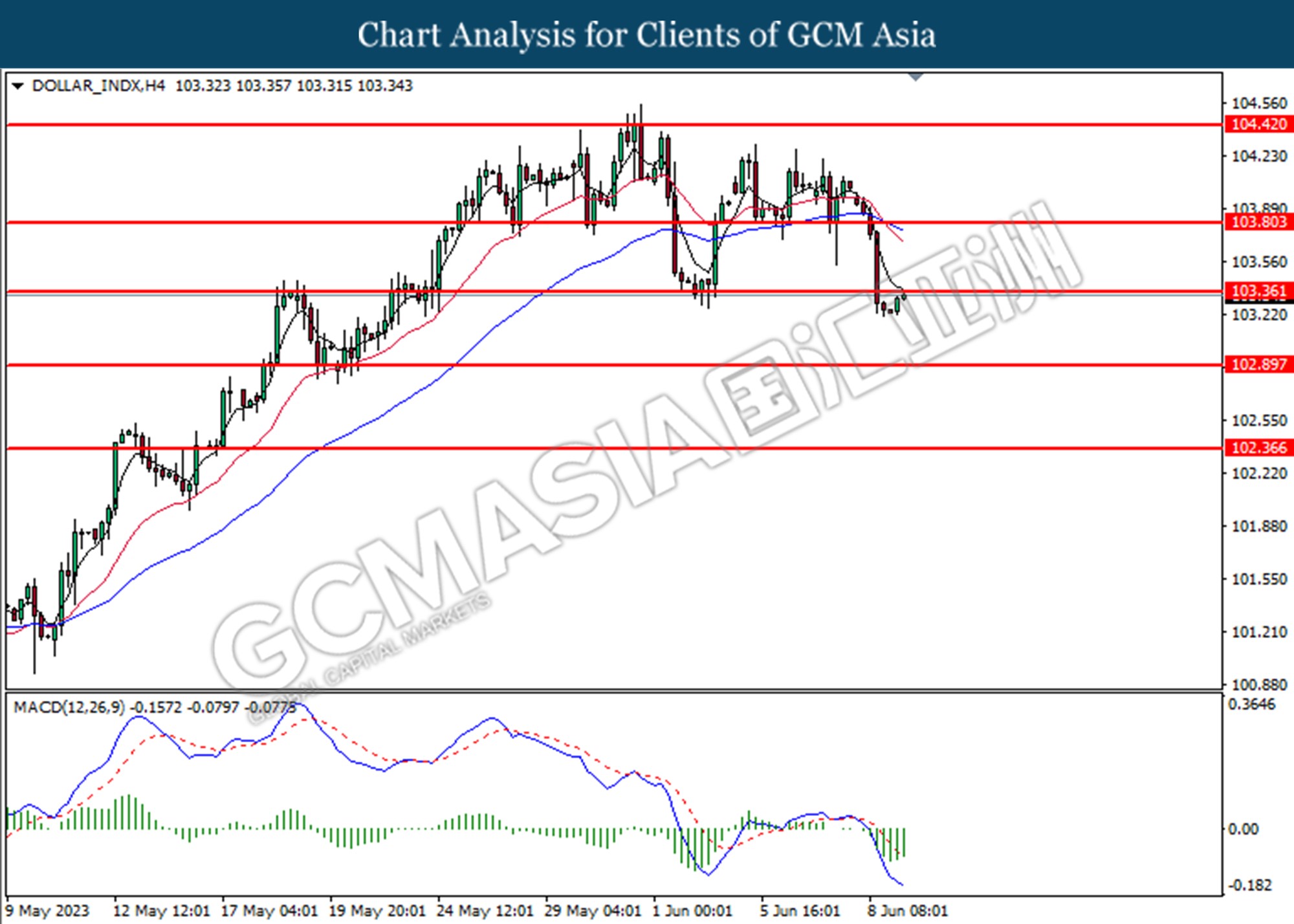

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 103.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breaks above the resistance level.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

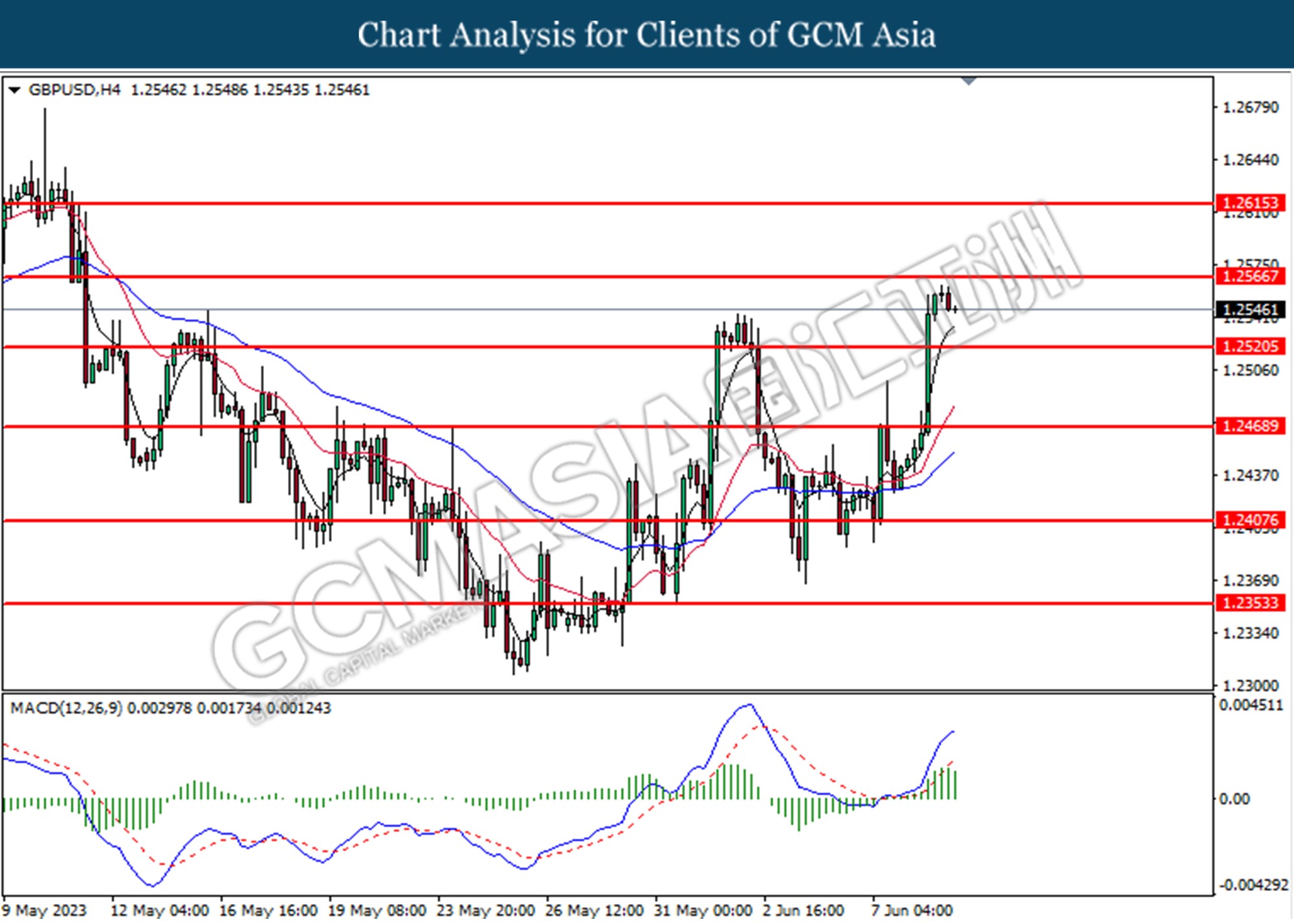

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 1.2565, 1.2615

Support level: 1.2520, 1.2470

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0760.

Resistance level: 1.0840, 1.0915

Support level: 1.0760, 1.0670

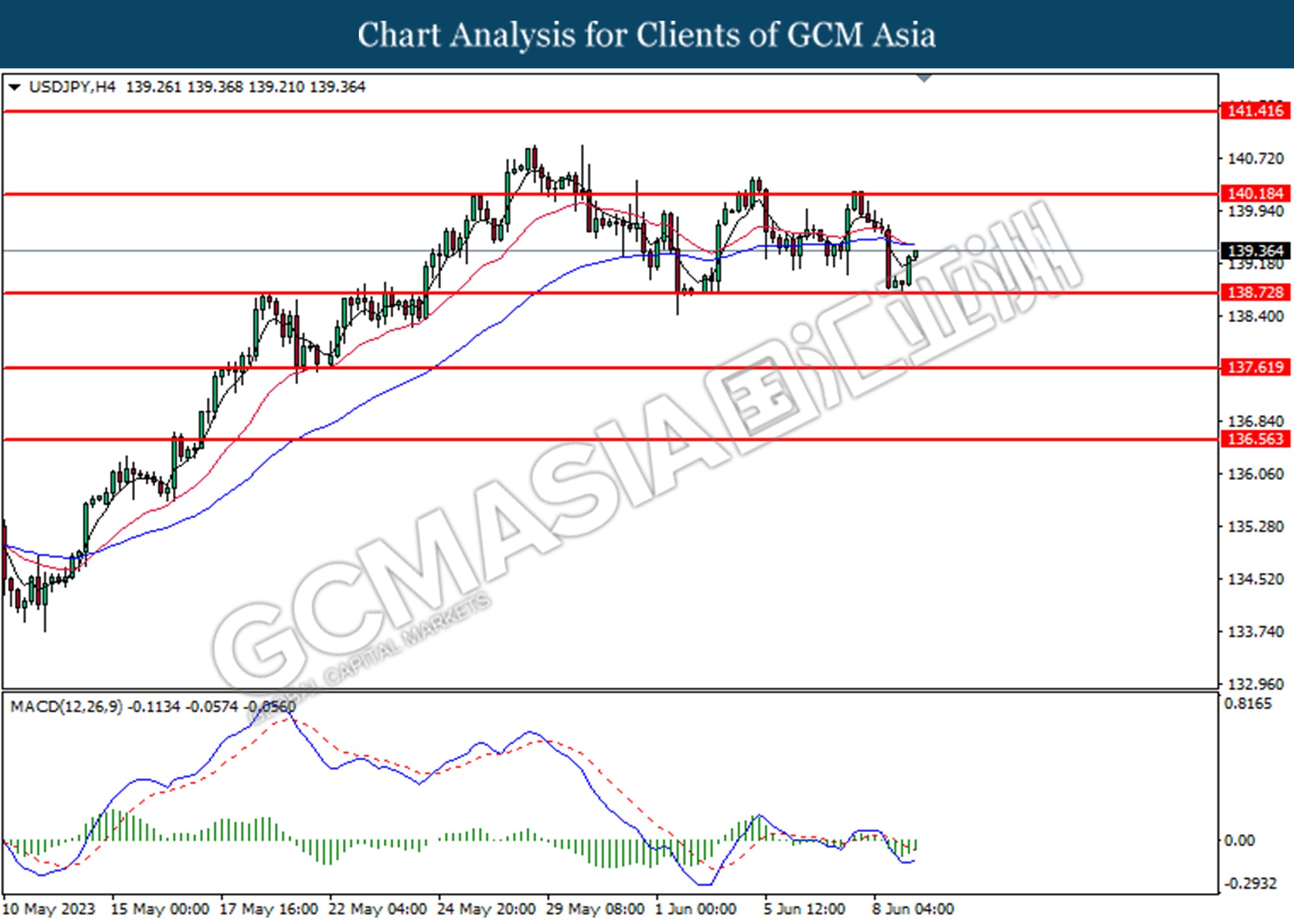

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 138.70. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 140.20.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

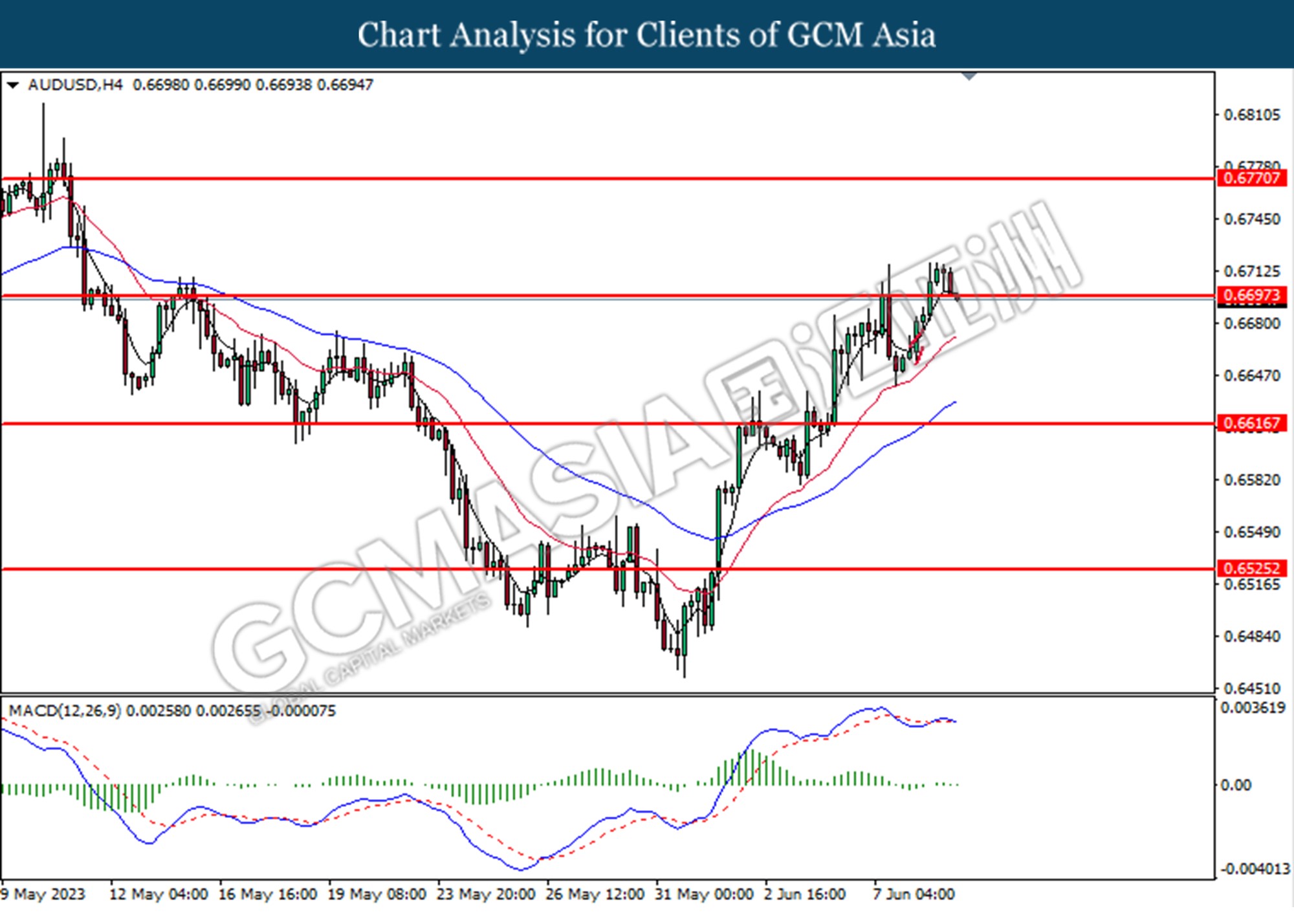

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below the previous support level at 0.6700. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

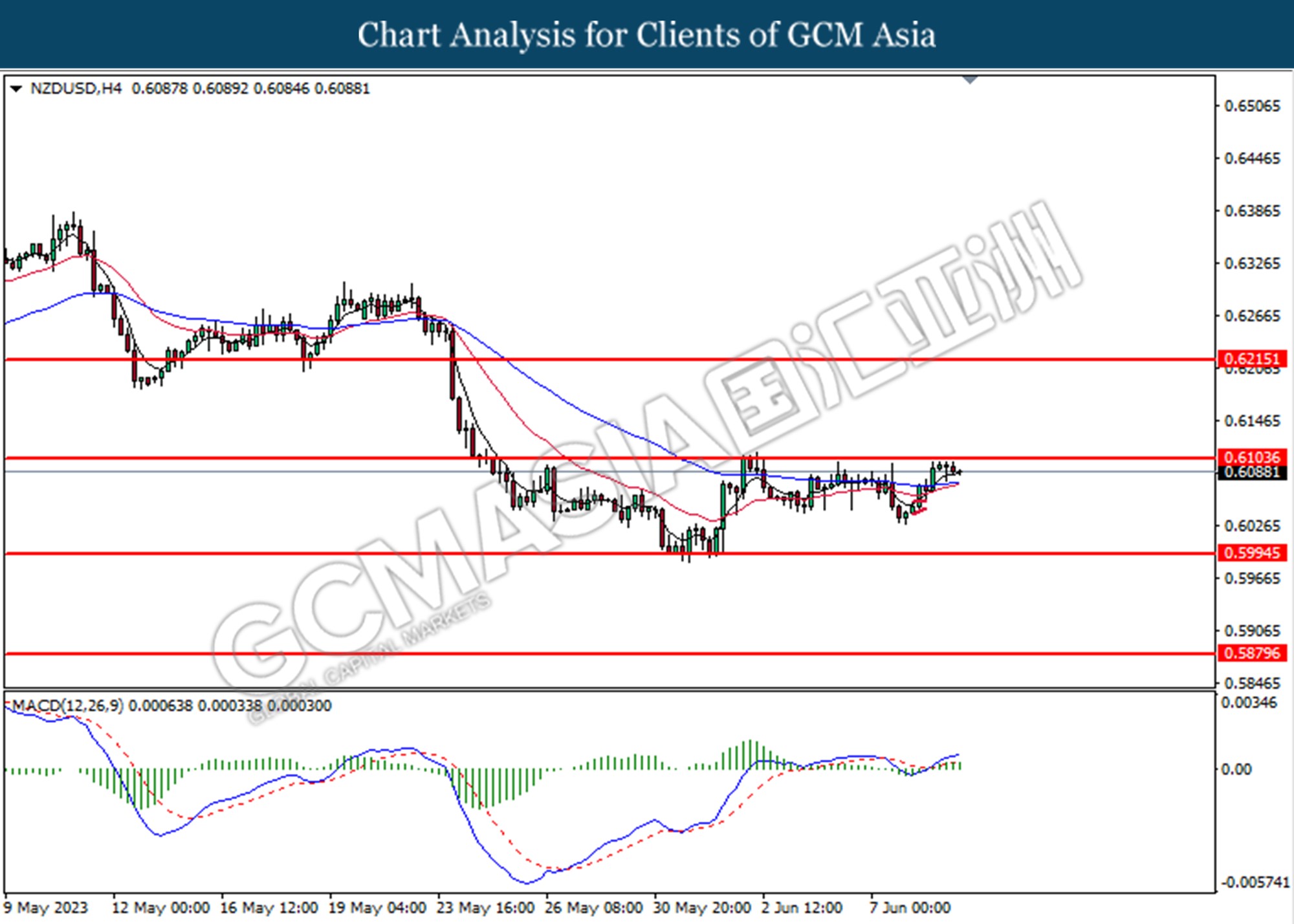

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6135. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6105, 0.6215

Support level: 0.5995, 0.5880

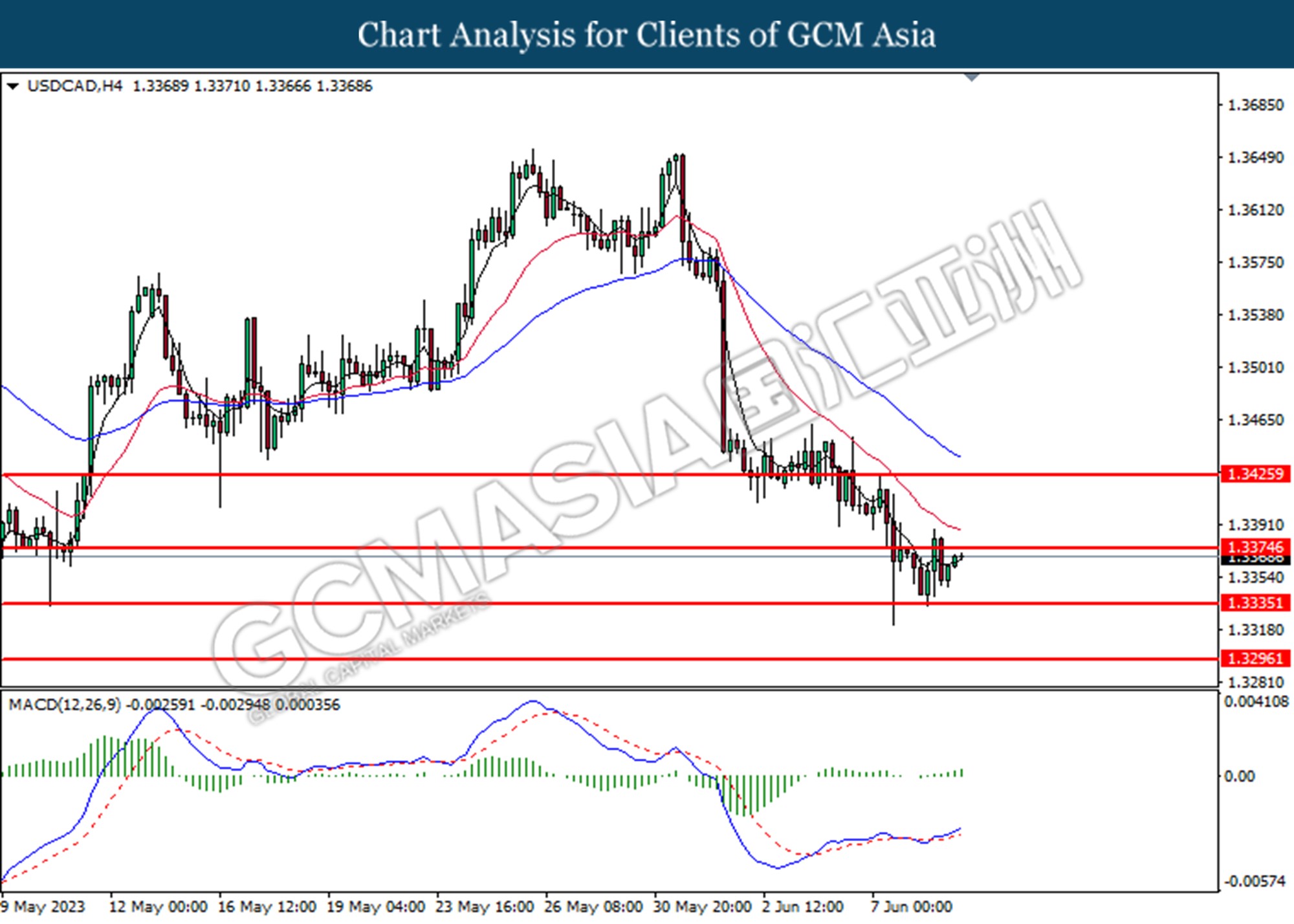

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3375.

Resistance level: 1.3375, 1.3425

Support level: 1.3335, 1.3300

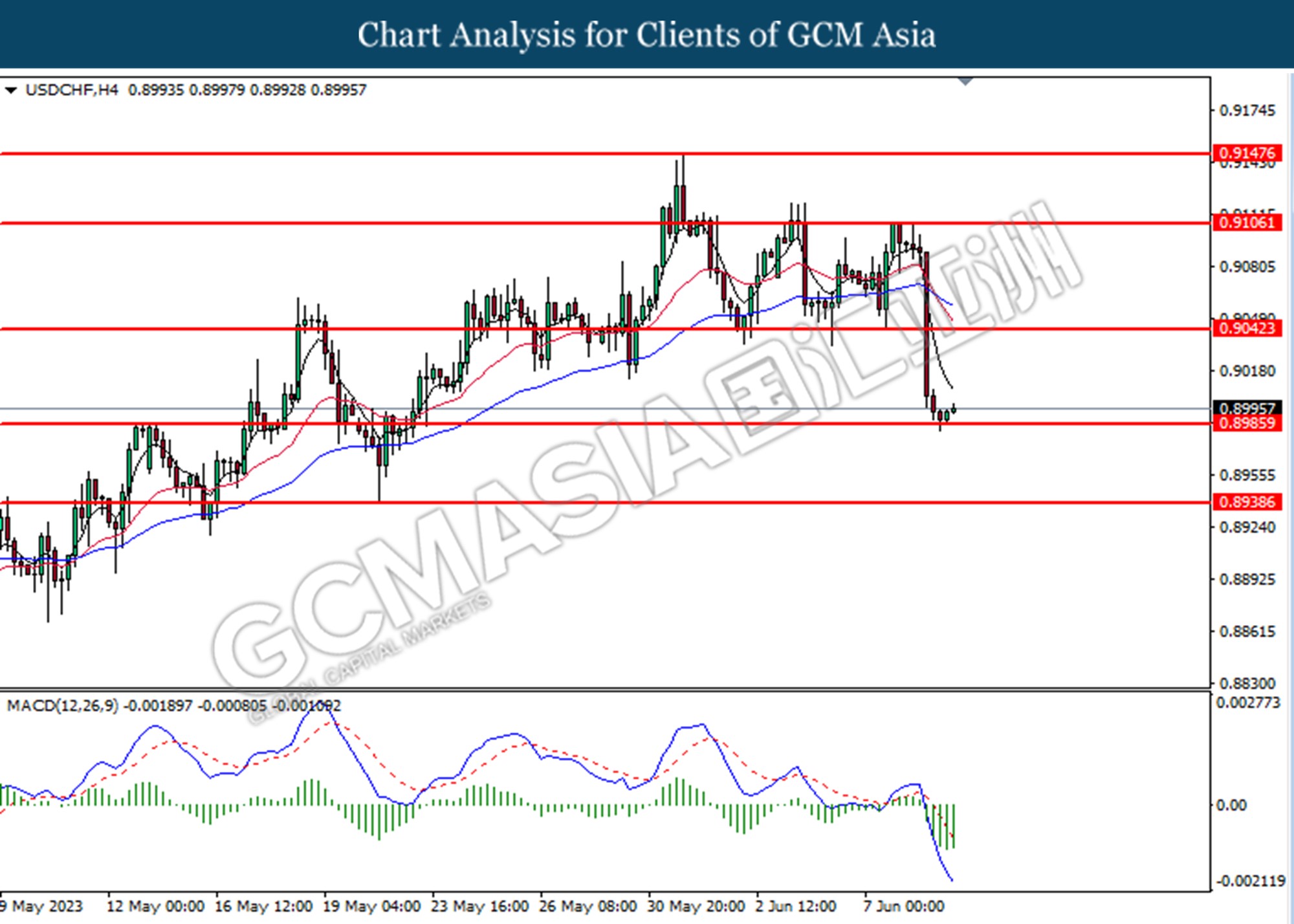

USDCHF, H4: USDCHF was traded higher following the prior rebound from the support level at 0.8985. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 0.9040, 0.9105

Support level: 0.8985, 0.8940

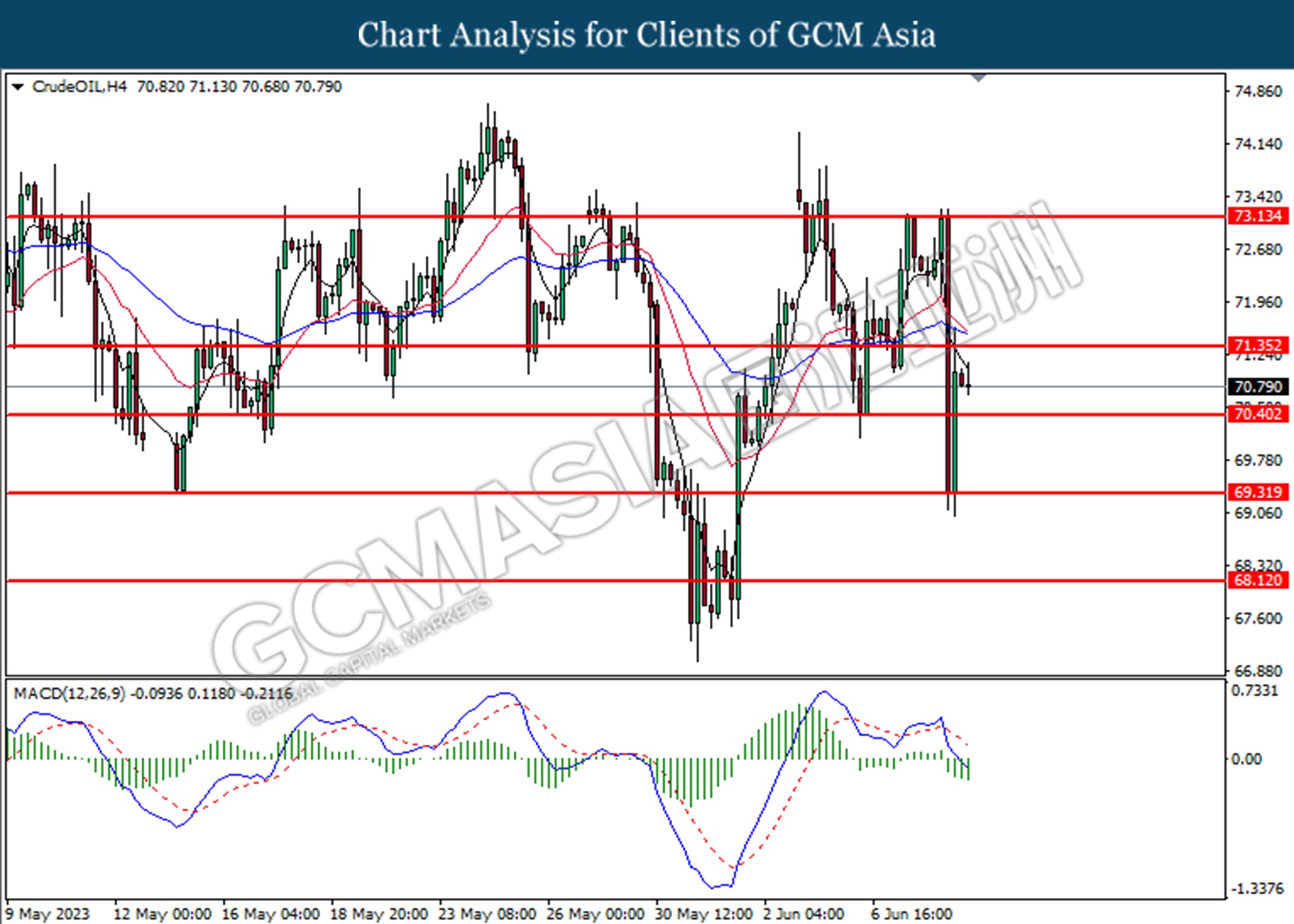

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 70.40.

Resistance level: 71.35, 73.15

Support level: 70.40, 69.30

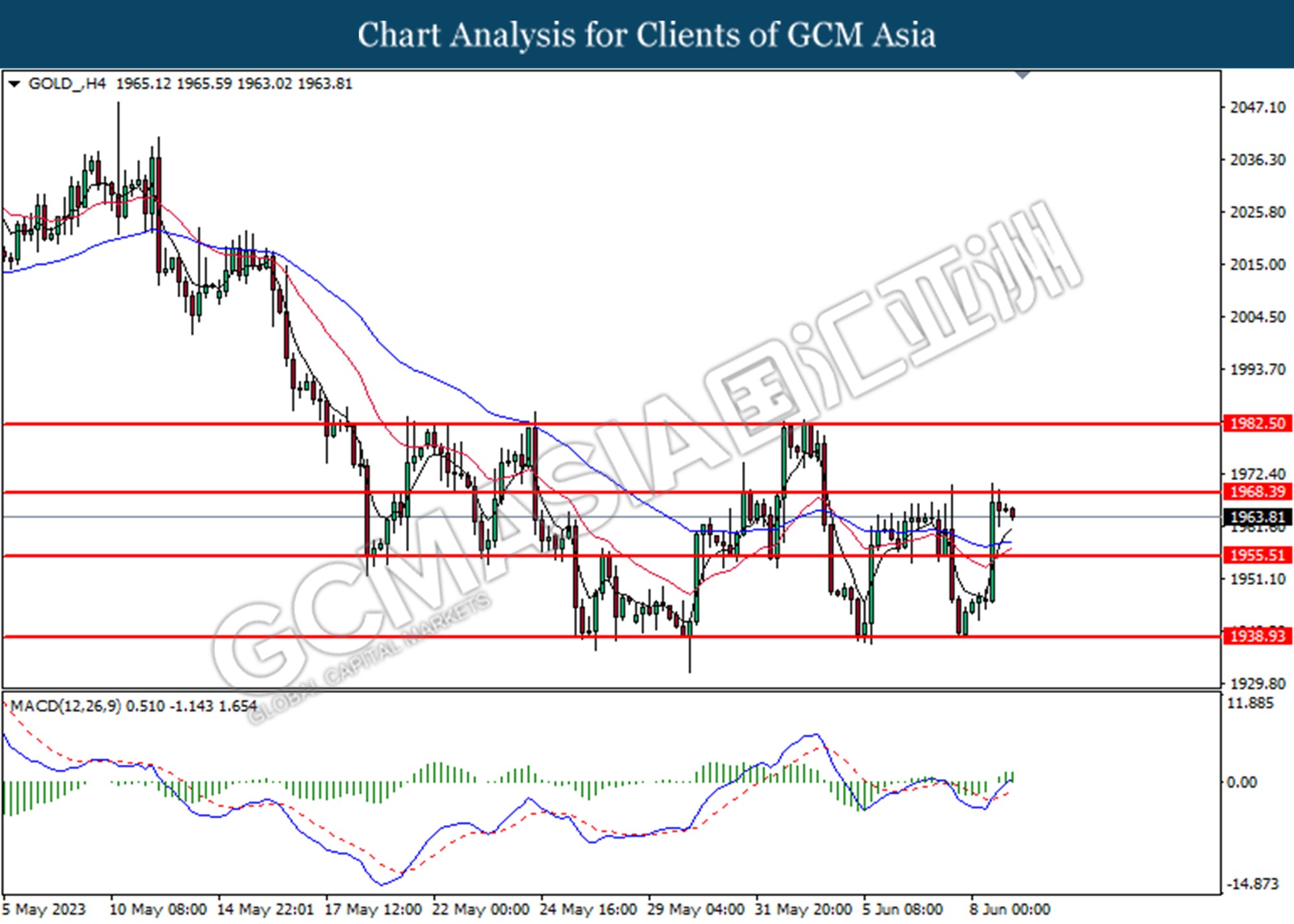

GOLD_, H4: Gold price was traded lower following the prior retracement from the resistance level at 1968.40. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1968.40, 1982.50

Support level: 1955.50, 1938.95