9 September 2022 Afternoon Session Analysis

Euro surged following an expected rate hike.

The overall trend for the pair of EUR/USD was traded lower yesterday amid a strengthening US Dollar following Fed President Jerome Powell unleashing his hawkish tone. Nonetheless, the losses experienced by the Euro were still limited by the aggressive contractionary monetary policy announced yesterday. According to the latest monetary policy statement, the European Central Bank raised its benchmark interest rates by an unprecedented 75 basis points on Thursday to combat the spiking inflation rate, despite the global recession risks still continuing to linger in the financial market. The ECB lifted its deposit rate to 0.75% from 0% and raised the refinancing rate to 1.25%, the highest since 2011. In the ECB press conference, the chairman of the ECB Christine Lagarde revealed that the tightening path would be remained unchanged, where more rate hikes could be expected in the near-term future in order to cool down the overheating economy. However, she also warned that the EU economy is still trapped in the risk of an energy crisis as insufficient energy will lead to an economic slowdown. As of writing, the pair of EUR/USD rose 0.78% to 10070.

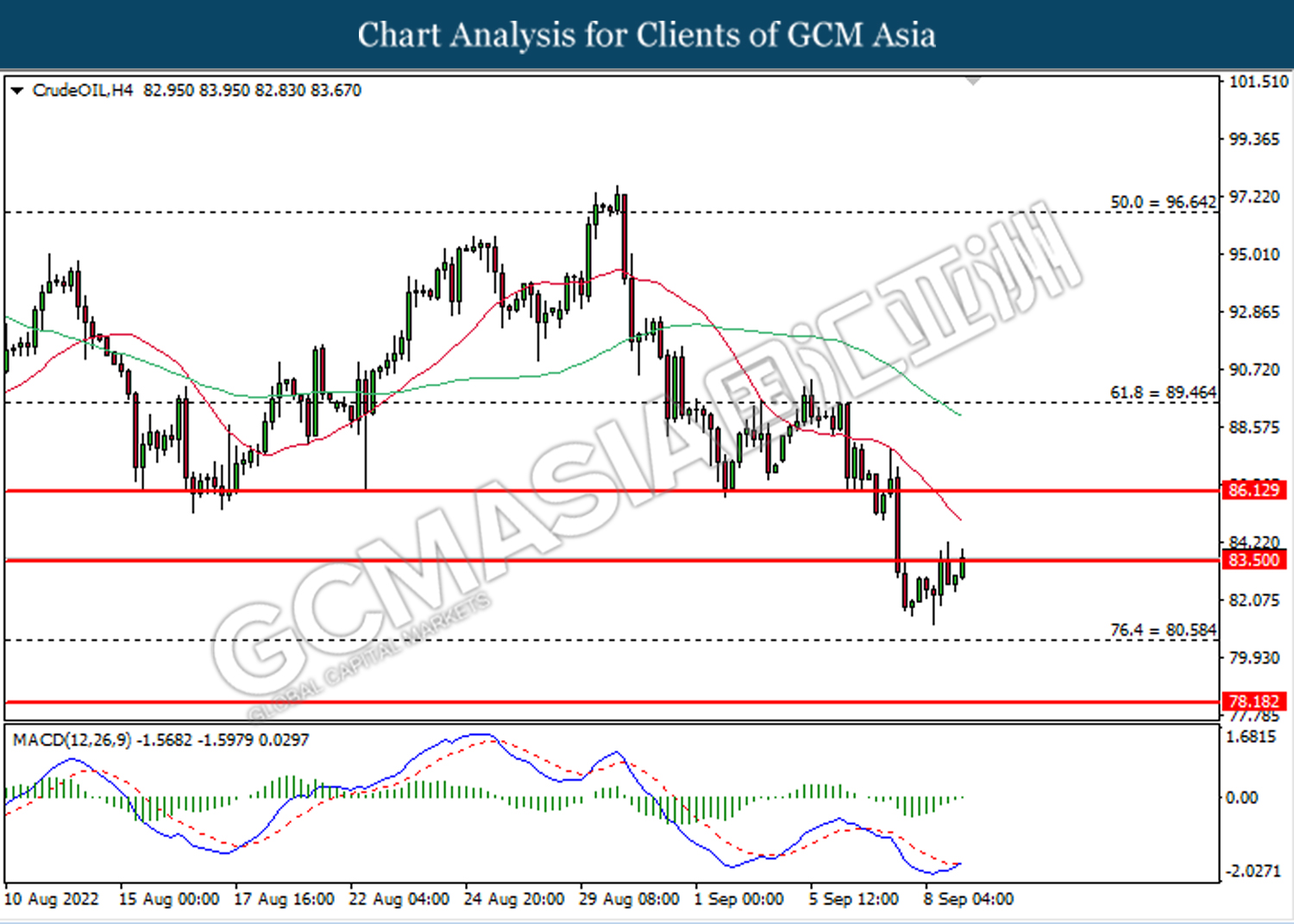

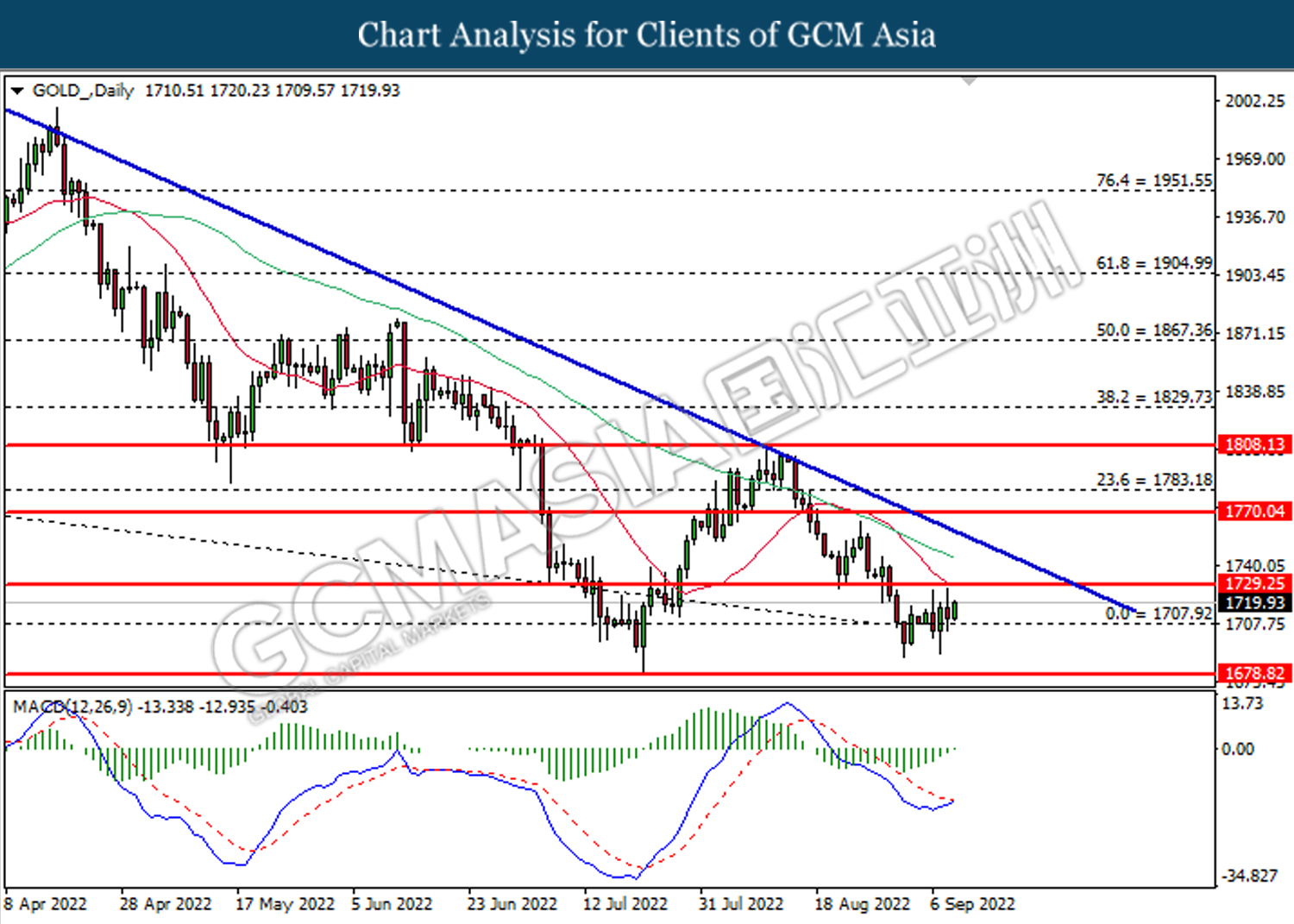

In the commodities market, the crude oil price went up 1.34% to $83.88 a barrel as the strengthening of the dollar index led to a cheaper price for non-US oil buyers, whereby the purchasing volume jumped overnight. Besides, the gold prices edged up by 0.62% to $1719.15 per troy ounce following the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Aug) | -30.6K | 15.0K | – |

Technical Analysis

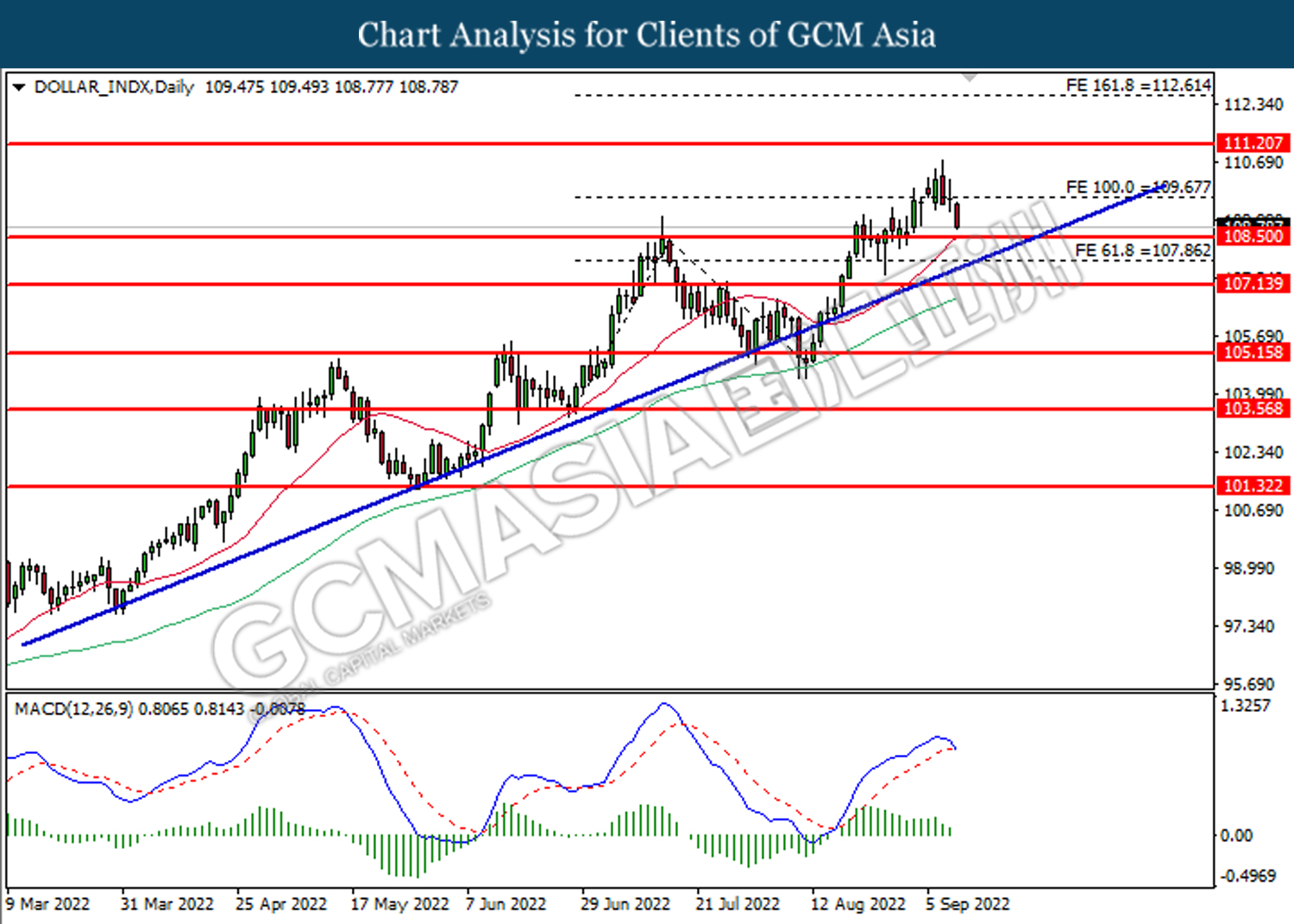

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 109.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1455. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1620.

Resistance level: 1.1620, 1.1775

Support level: 1.1465, 1.1350

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.0075.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

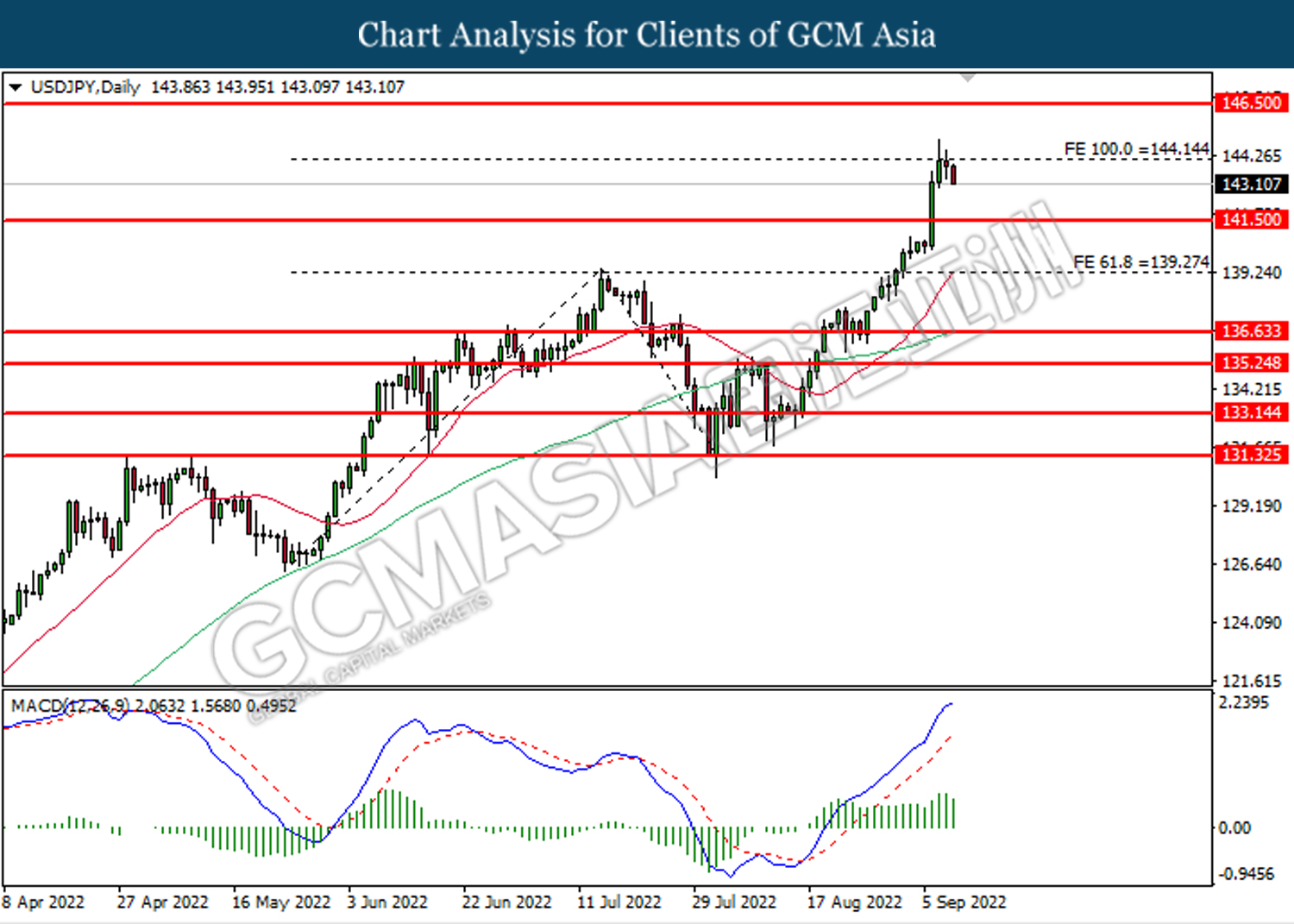

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 144.15. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

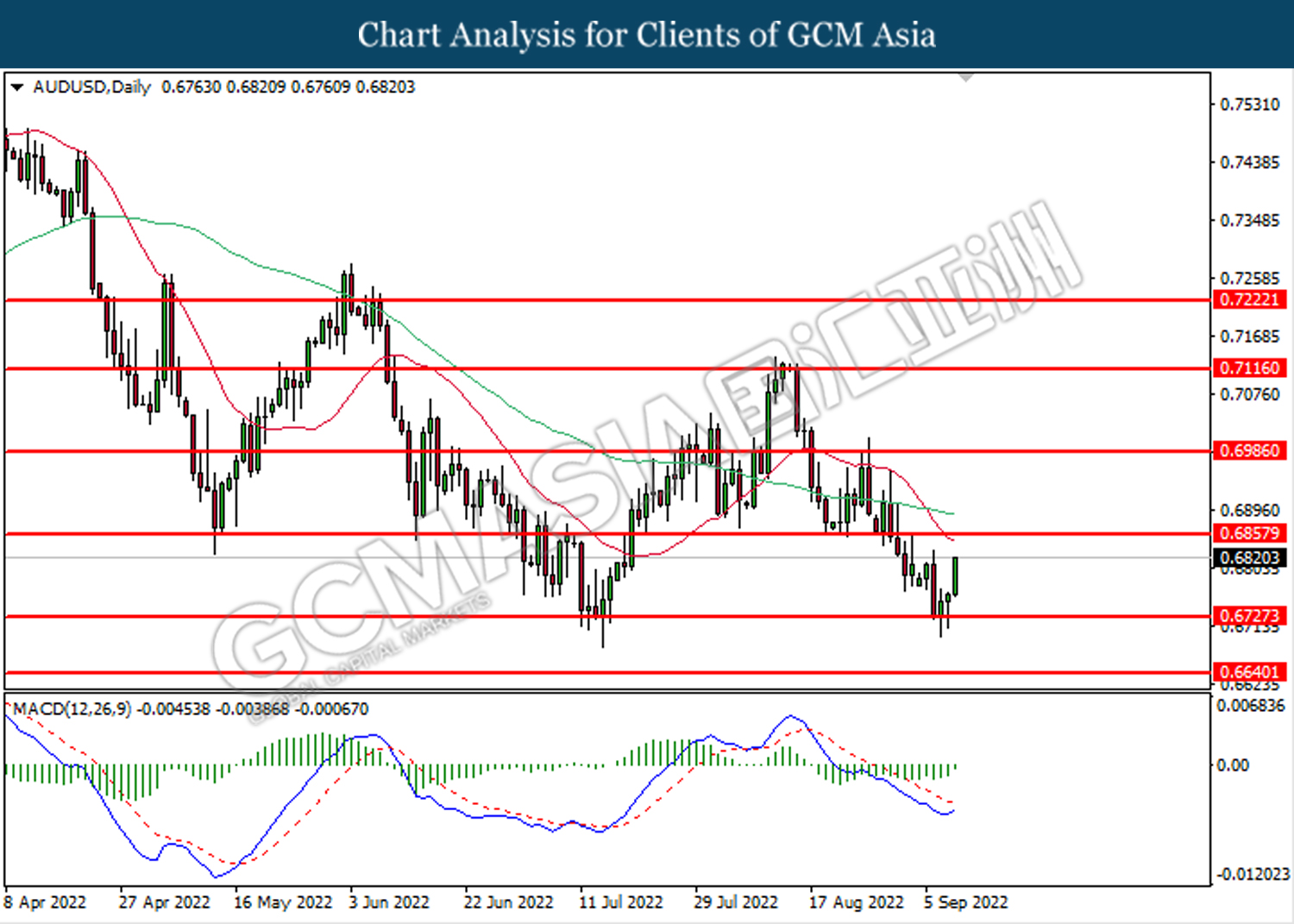

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

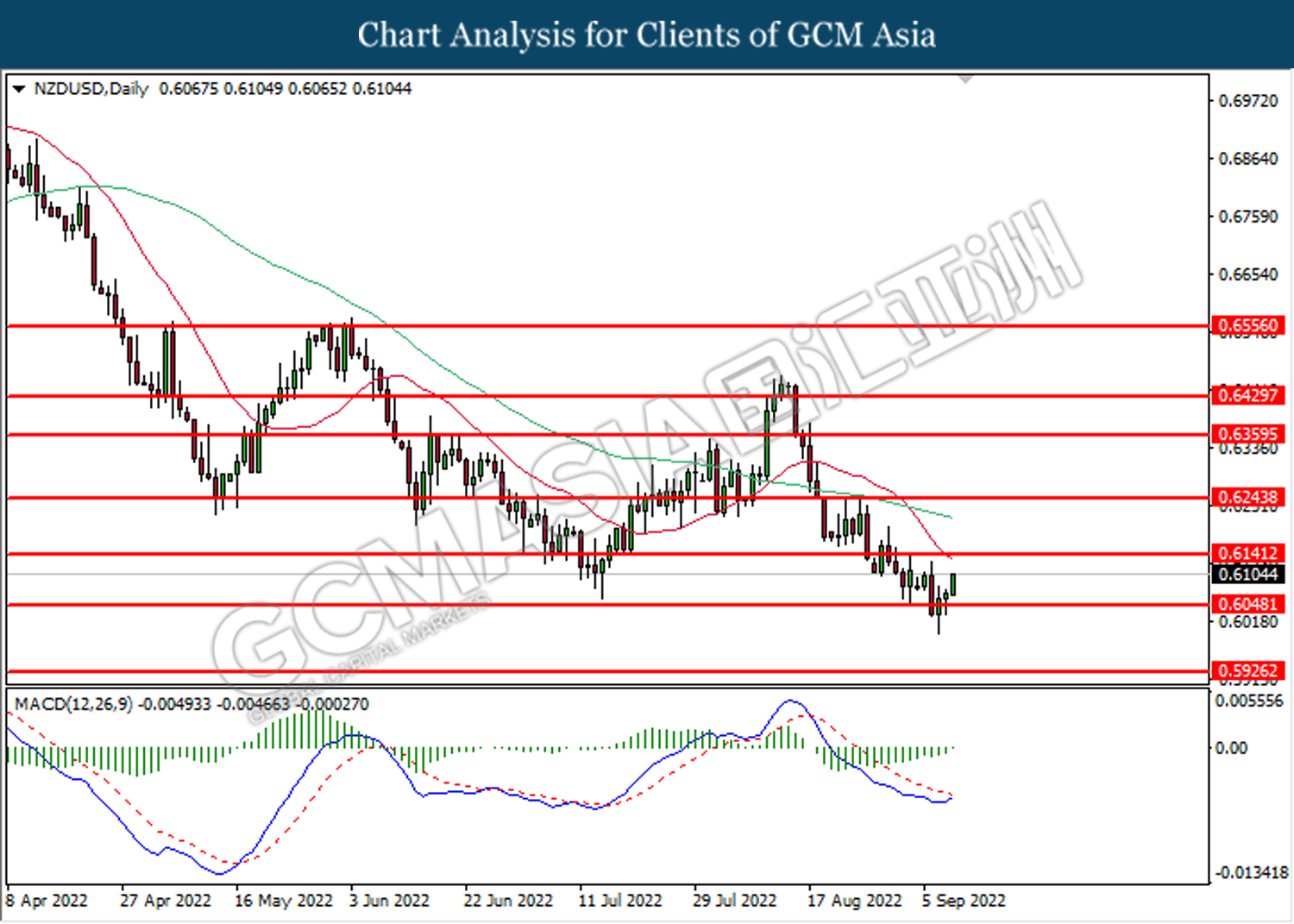

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6140.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3050. MACD which illustrated bearish bias momentum suggests the pair to extend losses after it successfully breakout below the support level.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully closed its candle below the support level.

Resistance level: 0.9750, 0.9825

Support level: 0.9675, 0.9590

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 83.50. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 83.50, 86.15

Support level: 80.60, 78.20

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80