9 October 2017 Weekly Analysis

GCMAsia Weekly Report: October 9 – 13

Market Review (Forex): October 2 – 6

U.S. Dollar

Greenback retreats slightly during late Friday trading amid fresh worries over the tension between United States and North Korea; shadowing a rather optimistic jobs report outlook for the month of September. The dollar index depreciated by 0.16% while ended the week at 93.62 after touching two-months high of 94.10.

The currency received some selling pressure amid fresh reports that North Korea may be preparing to test a long-range missile during their Party Foundation Day which lands on 10th October. Such escalation in geopolitical risk has lead the greenback to give up some gains after last month’s jobs data was seen as a potential driver for higher inflation in the coming period.

Although US economy has lost 33,000 jobs last month, Labor Department reiterated that the decline was mainly propelled by the effects of Hurricanes Irma and Harvey. In a rather positive note, national unemployment rate ticked down by 0.2% to its lowest level since 2001 with only 4.2%. Furthermore, average hourly earnings break the silence from its previous subdued performance with an increase of 2.9% while comparing year-over-year.

The uptick in wage inflation has lifted market sentiment that the Federal Reserve would follow through their place with another rate hike by year, thus limiting any losses caused rising risk from the Korean Peninsula.

US Nonfarm Payrolls

—– Forecast

US Nonfarm Payrolls for the month of September recorded a loss of 33,000 jobs due to tropical storm in the south coast.

US Unemployment Rate

—– Forecast

US Unemployment rate ticked down to 4.2%, its lowest since 2001.

US Average Hourly Earnings

—– Forecast

US Average Hourly Earnings rose 0.5%, raising overall expectation for an interest rate hike by year end.

USD/JPY

Pair of USD/JPY pared its gains by 0.17% to 112.62 in a late trading session.

EUR/USD

Euro recovers by 0.18% to $1.1732 against the greenback, while snapping off some losses due to lack of signal from the European Central Bank regarding their future monetary policy view.

GBP/USD

Pound sterling extended its losses by 0.4% to $1.3056 against the US dollar while recorded its largest weekly decline in more than a year due to onset Brexit risk.

Market Review (Commodities): October 2 – 6

GOLD

Gold prices rebounds from its two months’ low on Friday amid fresh risk at the Korean Peninsula which has spooked off some investors to safe-haven assets. Price of the yellow metal rose 0.48% while ended the week around $1,279.26. However, gains that were achieved by the safe-haven assets remained limited as majority of the market participants expects for an interest rate hike by December.

According to the Fed Rate Monitor Tool, investors are currently pricing in at 87.8% chance for a 25 basis points hike in December as the labor market extends its path towards full employment status. Gold prices are highly sensitive to rising rates as it could lift the opportunity cost for holding non-yielding assets while boosting the dollar which it is priced in.

Crude Oil

Crude oil price plunged on Friday while snapping its multi-week bullish recovery amid renewed oversupply concern in the market. Its prices declined by more than $1.50 or 3% and ended the week below the $50 threshold of $49.29. Otherwise, investors will now shift their focus towards a potential disruption in crude oil production and refinery activities as Tropical Storm Nate approaches the Gulf of Mexico.

In an original deal struck nearly a year ago, OPEC and 10 other non-members has decided to cut their production collectively by 1.8 million barrels a day for six months. The agreement was then extended in May for a period of nine months until March next year in an effort to rebalance global supply and demand which were hindered by rising output from non-participating countries such as US, Nigeria and Libya. The cartel and its non-members will be meeting again in Vienna at November 30th over possibility to extend the agreement beyond 2018 if necessary.

Weekly Outlook: October 9 – 13

For the week, investors will be looking forward for FOMC Meeting Minutes which were due on Wednesday for fresh clues regarding the timing of next interest rate hike Friday’s US data on inflation and retail sales will also be in focus. For the European region, speech given by ECB President Mario Draghi will be scrutinized for signals on when the central bank would shift away from its ultra-loose policy and taper its bond purchasing program.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer. In addition, market participants will also be waiting on US President Donald Trump’s decision on Thursday with regards to Iran’s violation to the international nuclear deal. The nation is one of the key OPEC member and Middle Eastern oil producer.

Highlighted economy data and events for the week: October 9 – 13

| Monday, October 9 |

Data CNY – Caixin Services PMI (Sep) EUR – German Industrial Production (MoM) (Aug)

Events N/A

|

| Tuesday, October 10 |

Data AUD – NAB Business Confidence (Sep) EUR – German Trade Balance (Aug) CNY – New Loans GBP – Manufacturing Production (MoM) (Aug) GBP – Trade Balance (Aug) CAD – Housing Starts (Sep) CAD – Building Permits (MoM) (Aug)

Events USD – FOMC Member Kashkari Speaks

|

| Wednesday, October 11 |

Data USD – JOLTs Job Openings (Aug)

Events CrudeOIL – OPEC Monthly Report USD – FOMC Meeting Minutes USD – FOMC Member Williams Speaks

|

| Thursday, October 12 |

Data CrudeOIL – API Weekly Crude Oil Stock EUR – Industrial Production (MoM) (Aug) USD – Initial Jobless Claims USD – PPI (MoM) (Sep) CAD – New Housing Price Index (MoM) (Aug) CrudeOIL – Crude Oil Inventories

Events CrudeOIL – IEA Monthly Report USD – FOMC Member Brainard Speaks USD – FOMC Member Powell Speaks EUR – ECB President Draghi Speaks

|

|

Friday, October 13

|

Data CNY – Trade Balance (USD) (Sep) EUR – German CPI (MoM) (Sep) USD – Core CPI (MoM) (Sep) USD – Core Retail Sales (MoM) (Sep) USD – Retail Sales (MoM) (Sep) USD – Michigan Consumer Sentiment (Oct) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: October 9 – 13

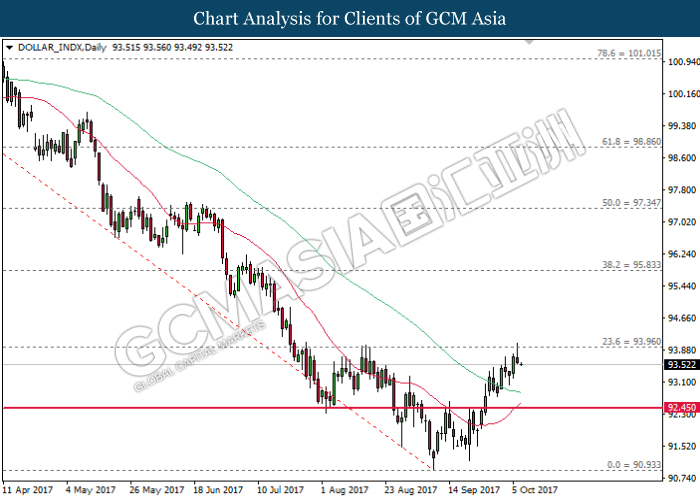

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the 23.6 Fibonacci level of 93.95. Such price action suggests short-term retracement for the dollar index while the upward narrowing of both MA lines advocates for further upside bias after closing above the level of 93.95.

Resistance level: 93.95, 95.85

Support level: 92.45, 90.95

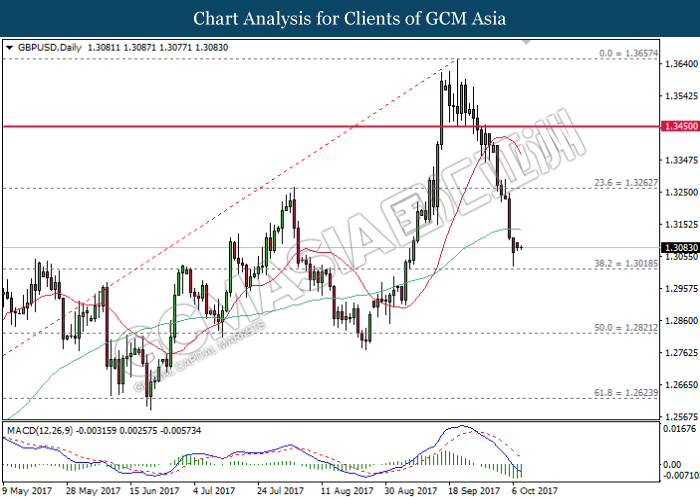

GBPUSD

GBPUSD, Daily: GBPUSD extended its losses following prior closure below the 20-MA line (red). Signal line from MACD histogram which continues to expand downwards suggests the pair to advance further down and retest at the support level of 1.3020.

Resistance level: 1.3260, 1.3450

Support level: 1.3020, 1.2820

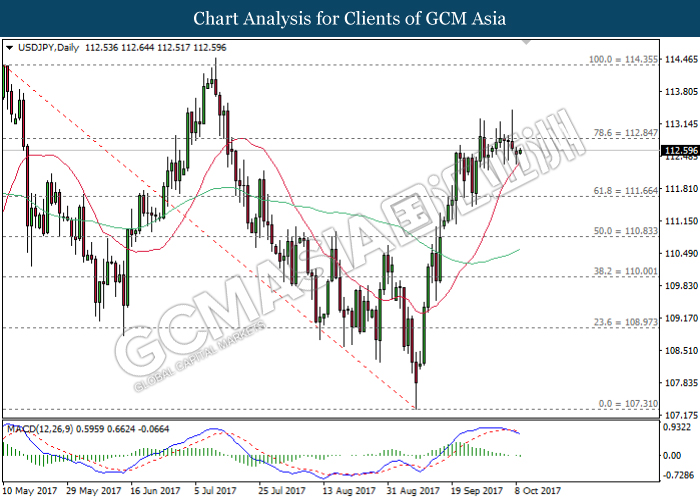

USDJPY

USDJPY, Daily: USDJPY remained seesawed near the strong resistance level of 112.85 due to prior attempts to close above this level. MACD histogram which begins to form a downward signal suggest further downside bias for the pair if it closes below the 20-MA line (red).

Resistance level: 112.85, 114.35

Support level: 111.65, 110.85

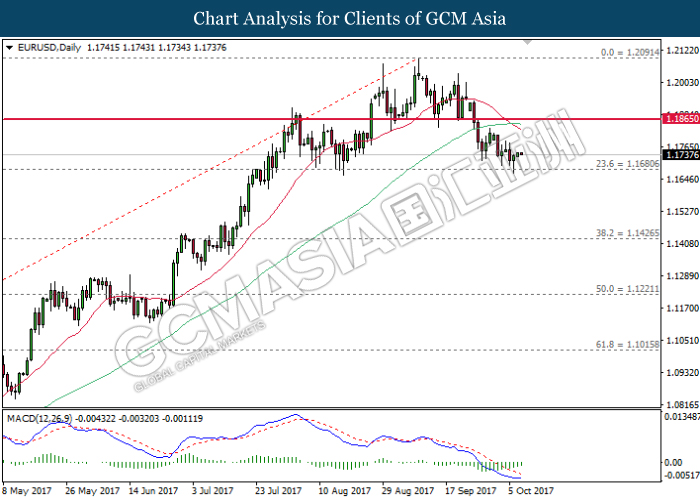

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior rebound from the strong support level at 1.1680. Such price action while coupled with diminishing downward momentum from MACD histogram suggests further upside bias for the pair to advance towards the target of resistance level at 1.1865.

Resistance level: 1.1865, 1.2090

Support level: 1.1680, 1.1425

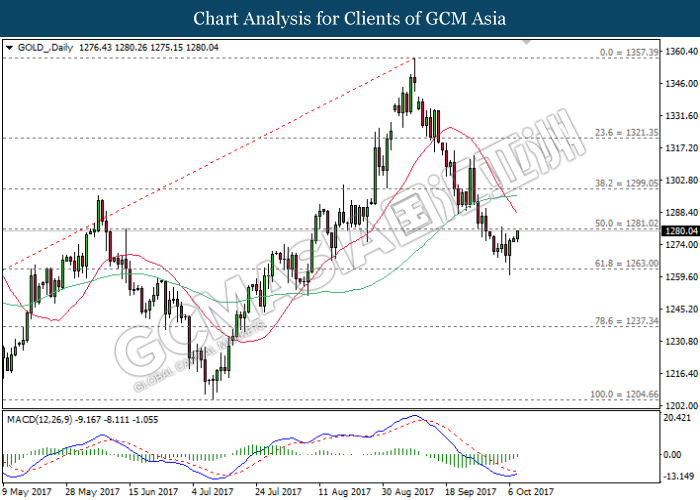

GOLD

GOLD_, Daily: Gold price sheds its prior losses following a rebound from the support level at 1263.00. Both signal line from MACD histogram which continues to narrow upwards suggest the gold price to extend its upward momentum after closing above the level of 1281.00.

Resistance level: 1281.00, 1299.05

Support level: 1263.00, 1237.35

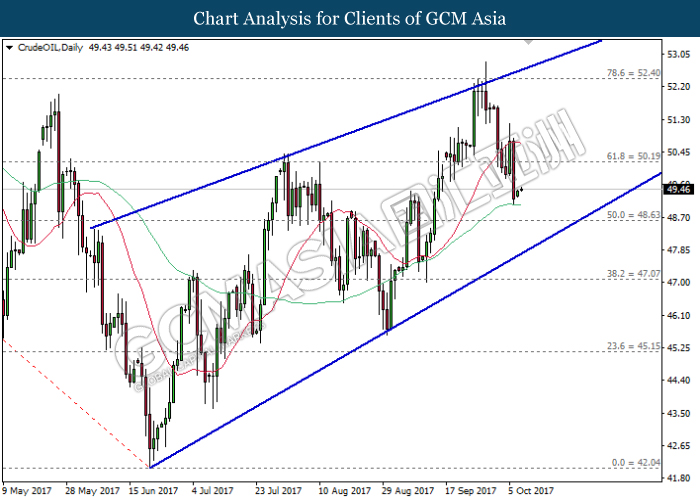

Crude Oil

CrudeOIL, Daily: Crude oil price remained traded within a rising wedge while recently rebounded from the 60-MA line (green). Such price action suggests the commodity price to be traded higher in short-term towards the target of resistance level at 50.20.

Resistance level: 50.20, 52.40

Support level: 48.65, 47.05