9 November 2022 Afternoon Session Analysis

Dollar dipped ahead of US mid term election result and CPI data.

The dollar index, which gauges its value against a basket of six major currencies, extends its losses to the 2-month low as the market participants expect the inflationary pressures to fall further for the month of October alongside the recent decline in energy prices. On Thursday night, the US government will bring traders the closely-watched Consumer Price Index (CPI) for October. Given the current concerns that inflation remains stubbornly high, the Federal Reserve has vowed to maintain its tightening monetary policy until the inflationary figures are controlled. With that, it further provides a signal to the investors that an inflation reading that is significantly below expectations would diminish the pace of the rate hikes by the Federal Reserve. Other than that, the market participants are also embracing the final result of the US mid-term election. A change of government in either Senate or House of Representatives would trigger market concern over the political uncertainty risk in the US. Therefore, investors are all eyeing the result of the mid-term election as well as the Thursday CPI data. As of writing, the dollar index dropped -0.06% to 109.60.

In the commodities market, the crude oil price edged down by -0.08% to $89.00 per barrel as the EIA institution slashed its forecast of global oil demand in the year 2023. Besides, the gold price dropped by -0.18% to $1709.40 per troy ounce following the rebound in the dollar index market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.115M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 109.00.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

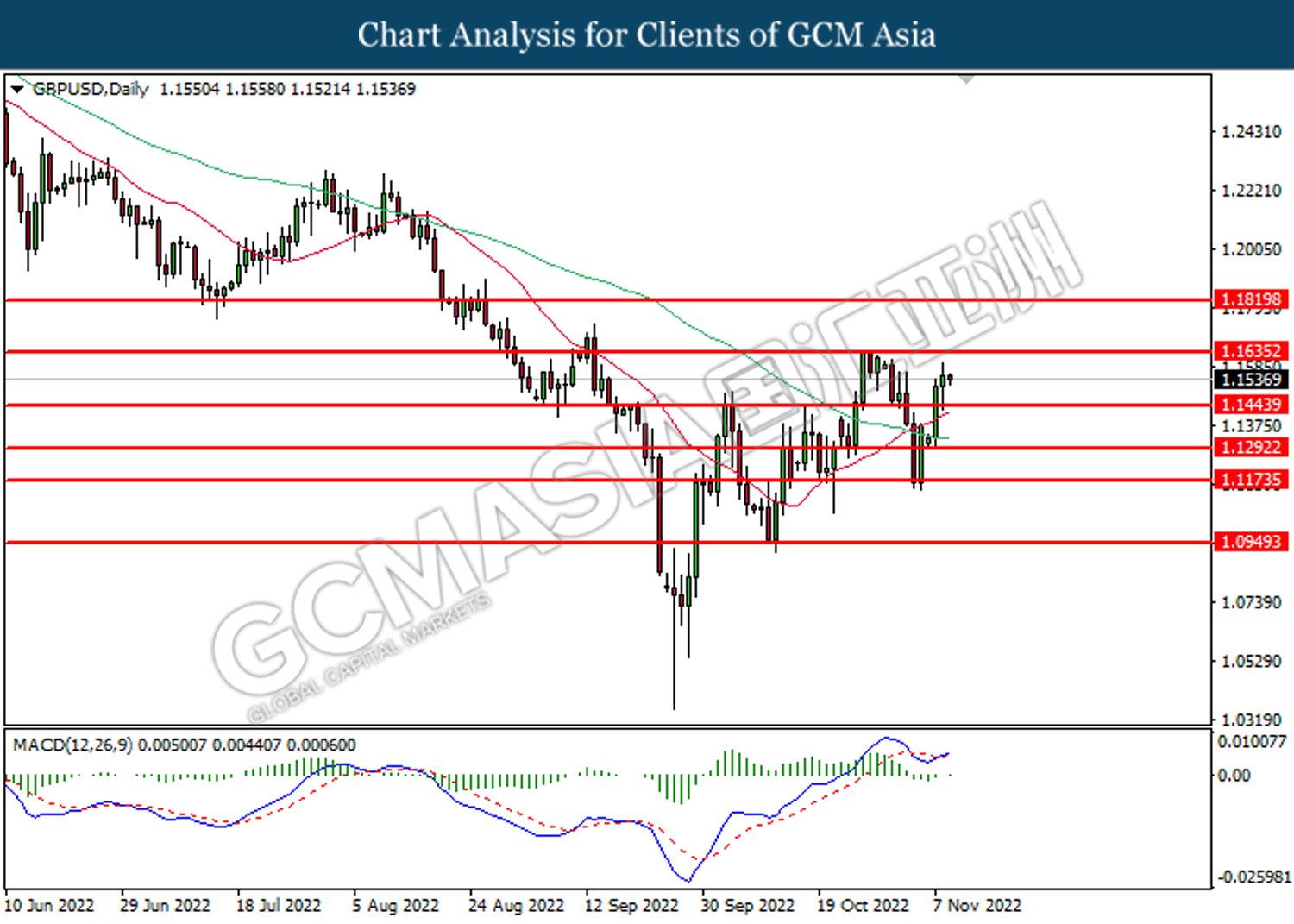

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1445. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1635.

Resistance level: 1.1635, 1.1820

Support level: 1.1445, 1.1290

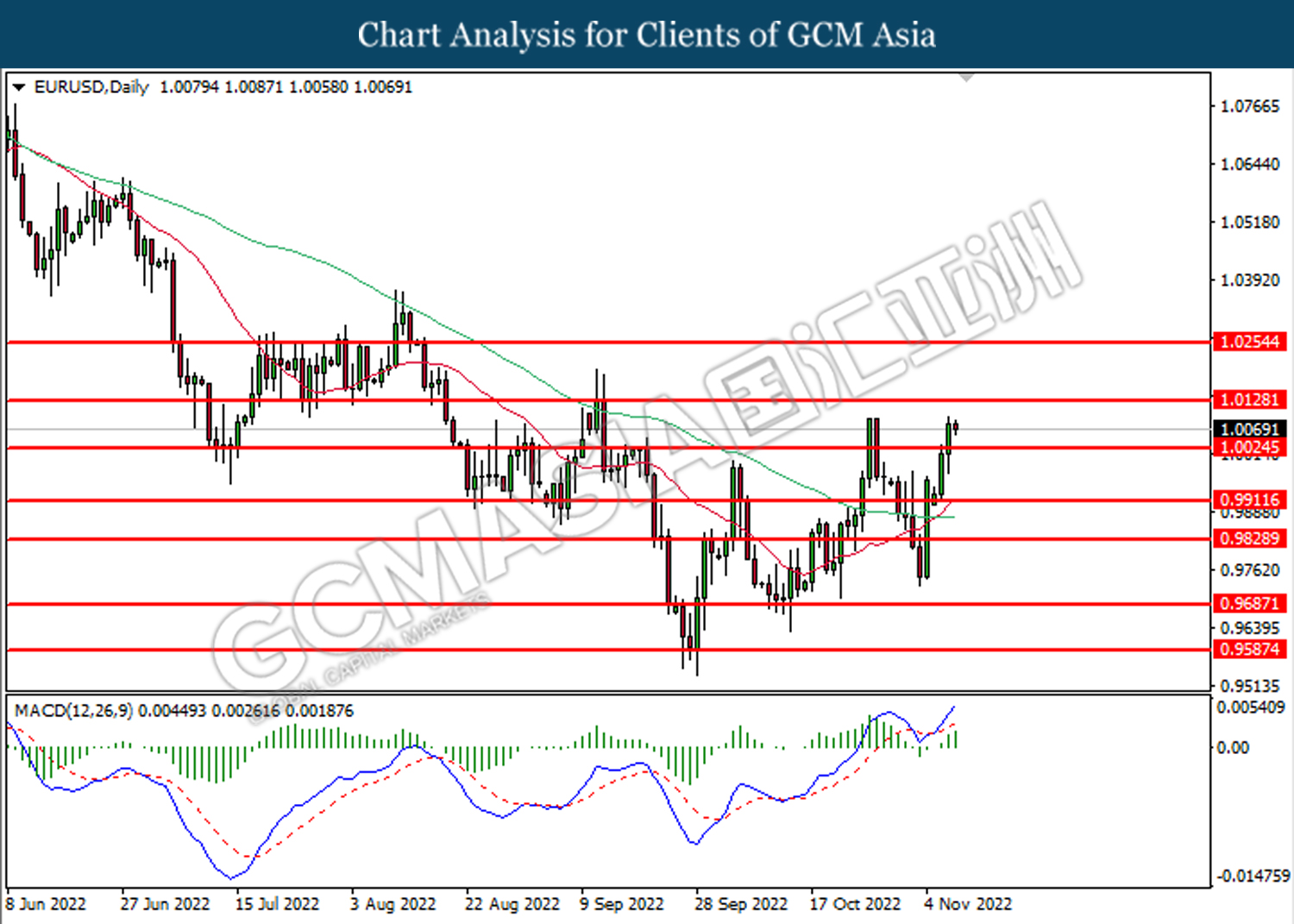

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0025. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0130.

Resistance level: 1.0130, 1.0255

Support level: 1.0025, 0.9910

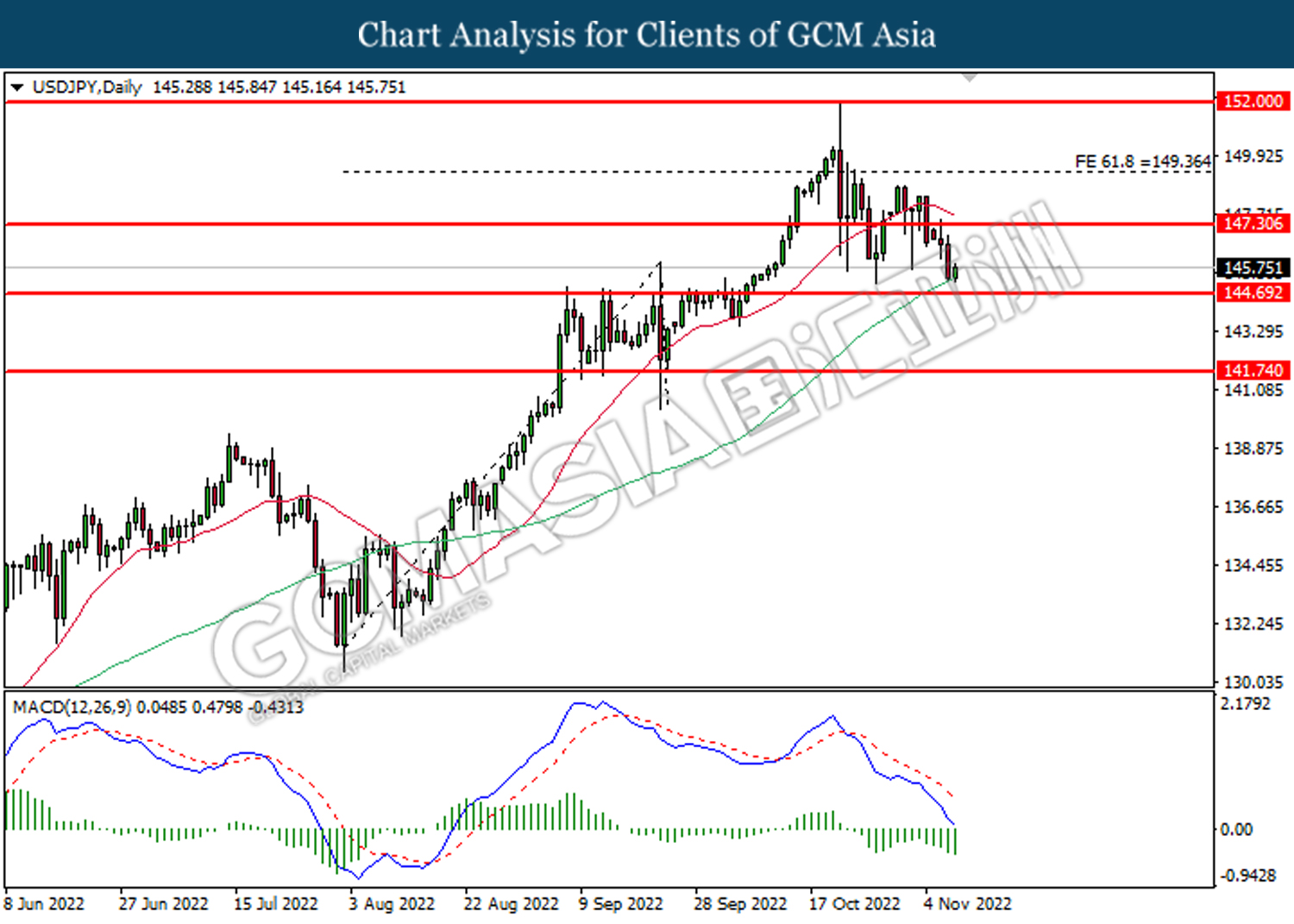

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

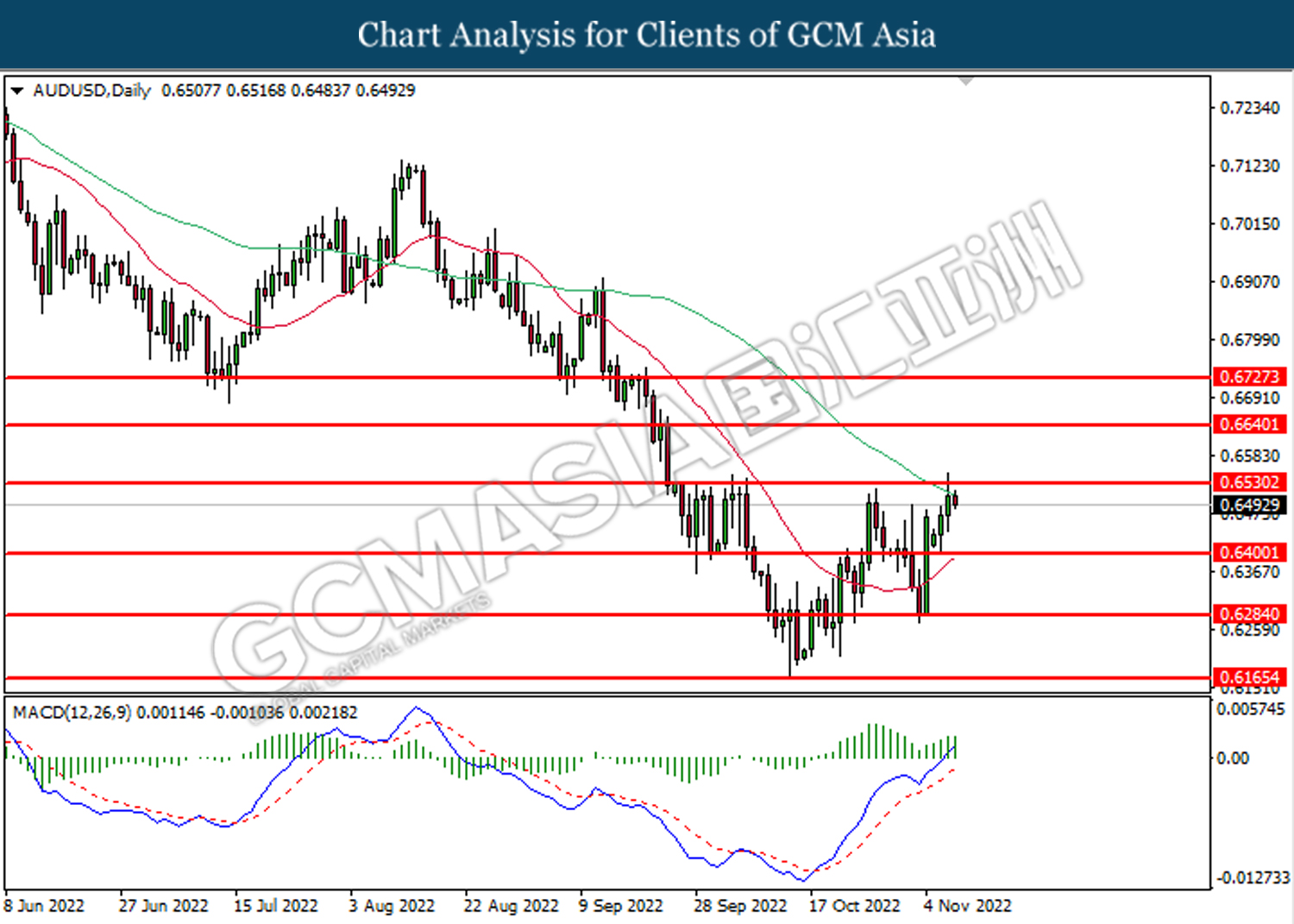

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6530.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

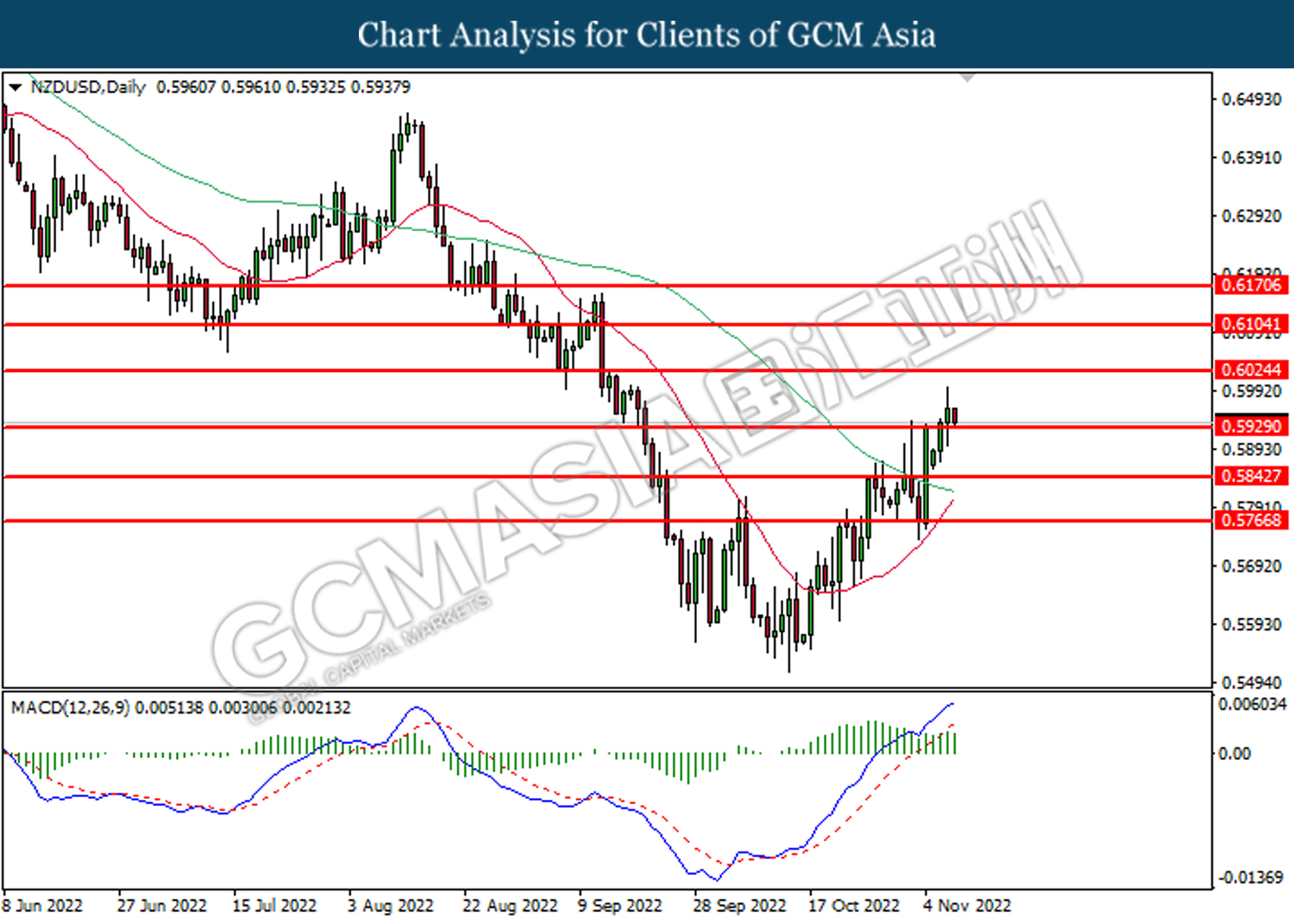

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6025, 0.6105

Support level: 0.5930, 0.5845

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

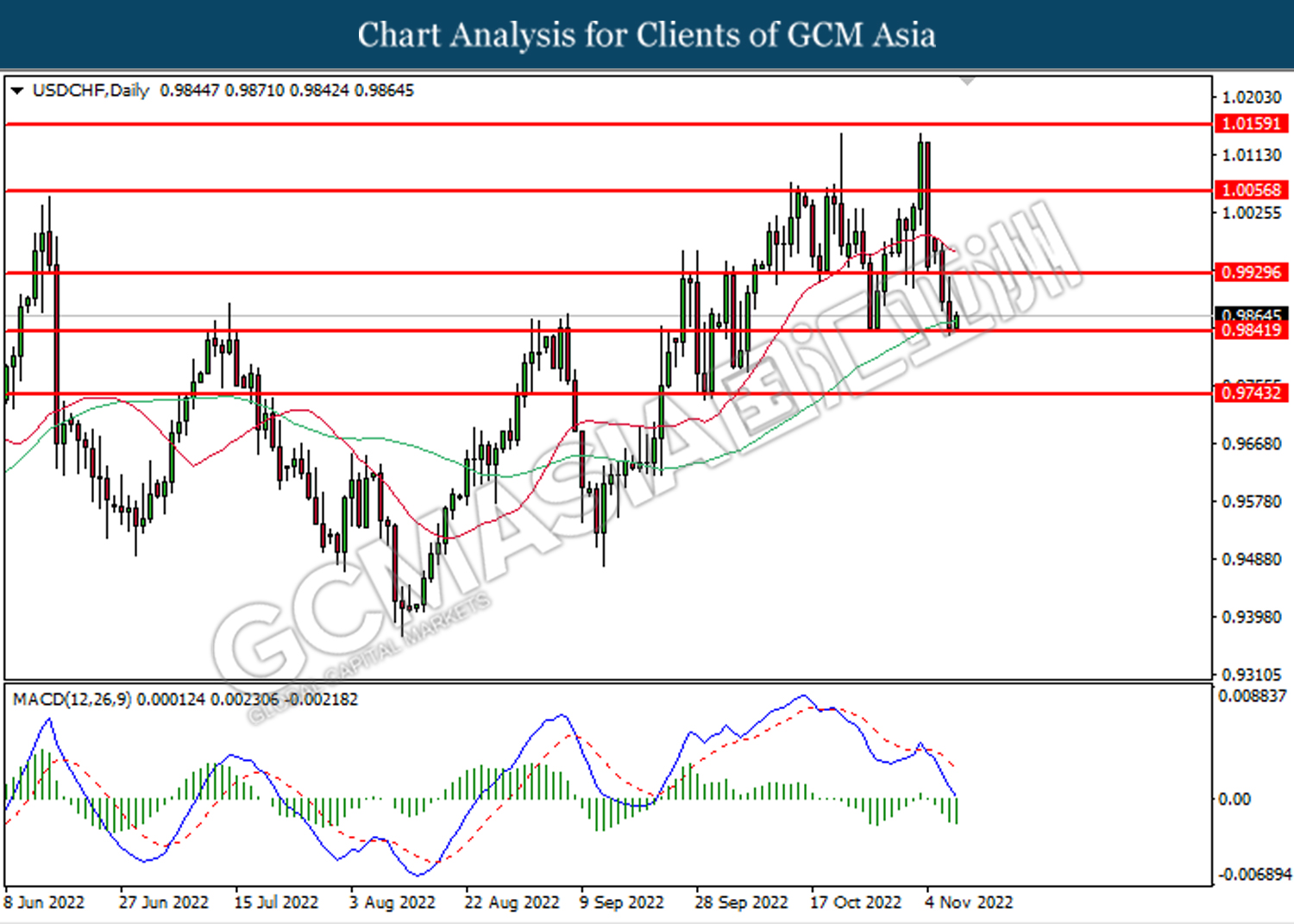

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9840. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9930, 1.0055

Support level: 0.9840, 0.9745

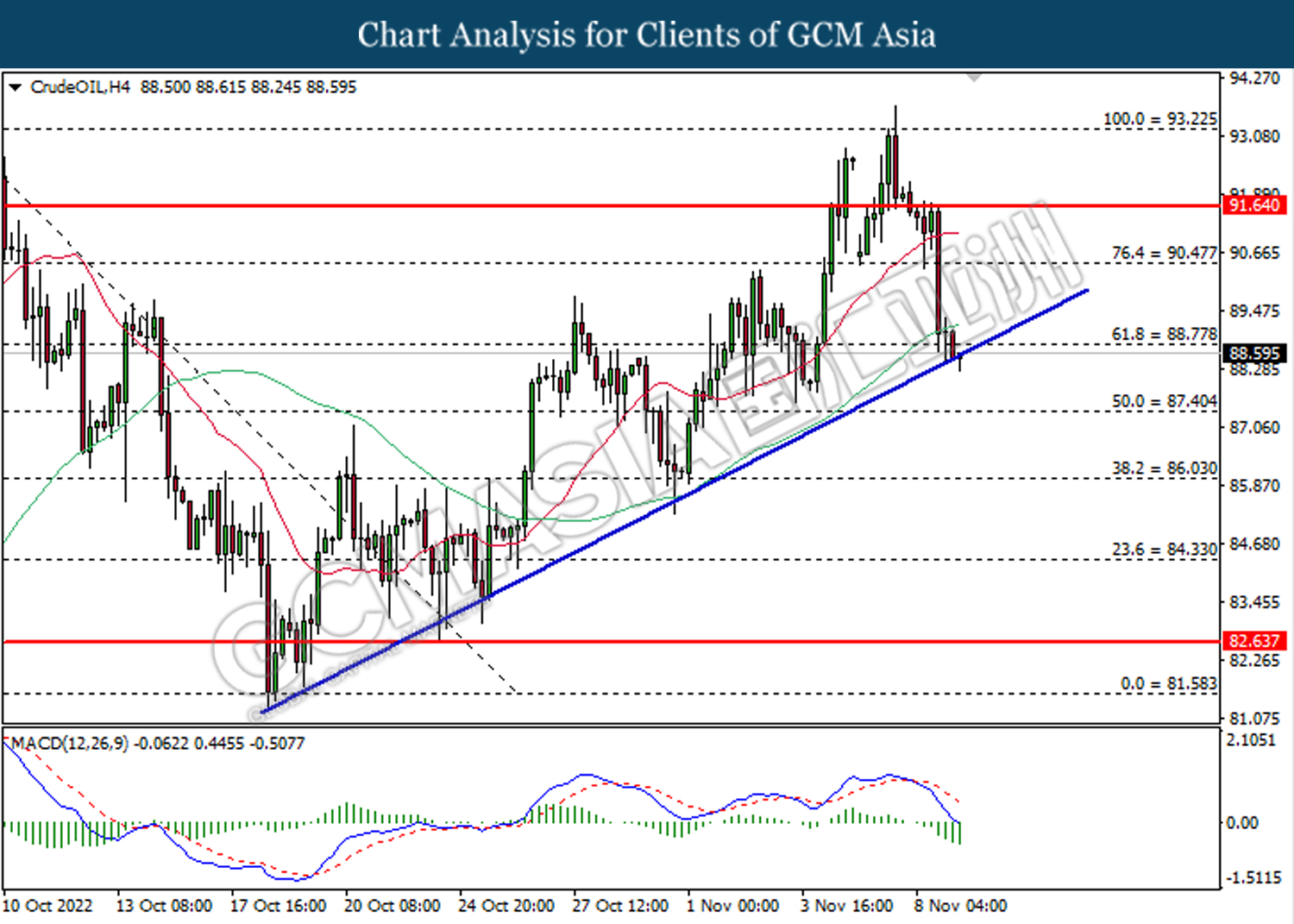

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the trendline.

Resistance level: 88.75, 90.45

Support level: 87.40, 86.05

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1693.35. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1726.15.

Resistance level: 1726.15, 1766.50

Support level: 1693.35, 1661.40