9 November 2022 Morning Session Analysis

US Dollar sinks as US midterm election begun.

The Dollar Index, which gauge its value against six major currencies slumped on yesterday over the US midterm election. The US midterm elections officially begun yesterday, while 35 Senate seats and all 435 House of Representatives seats are on the ballot. Currently, the Democratic Party is the governing party in the United States. However, according to Reuters, market participants are expecting Republicans to take back the House of Representatives and possibly win the Senate as well when results start rolling in Wednesday. If Republicans party succeed in retaking the House of Representative or even win the Senate, the Republicans will overturn the Democrats’ previous policy and legislation, which may lead to unstable political issue. As the possibility of unstable political issues heightened, investors are more willing to shift their capitals out of US market. As of now, investors would continue to scrutinize the latest updates with regards of the US midterm election results to anticipate the likelihood movement of the financial markets. As of writing, the Dollar Index dropped by 0.45% to 109.50

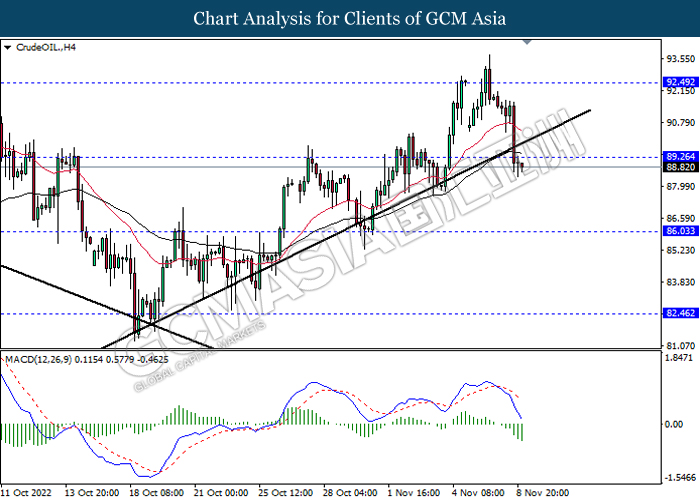

In the commodities market, the crude oil price depreciated by 0.15% to $88.78 per barrel as of writing over the rising of crude oil stocks. According to API, the US API Weekly Crude Oil Stock increased by 5.618M barrel, far higher than market forecast of 1.100M barrel increase. On the other hand, the gold price eased by 0.16% to $1713.00 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.115M | – | – |

Technical Analysis

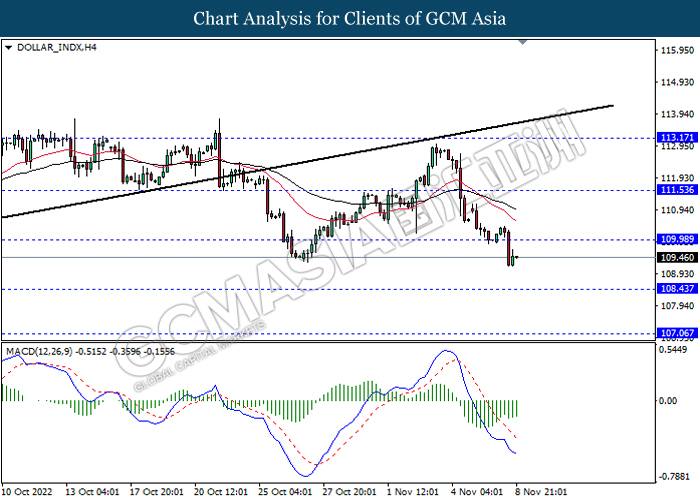

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 109.95, 111.55

Support level: 108.45, 107.05

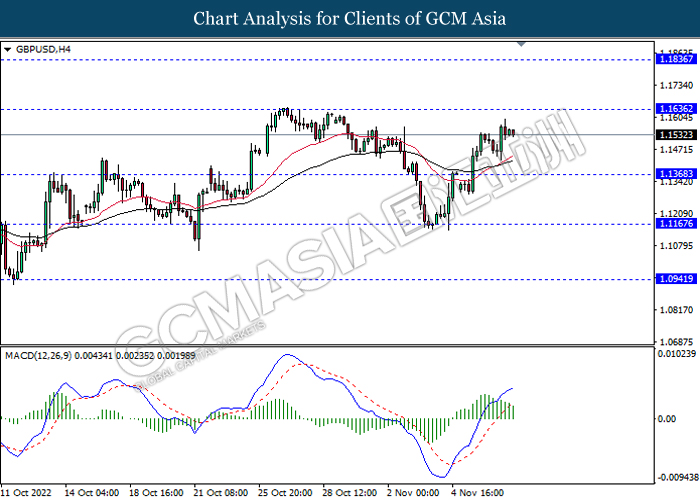

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

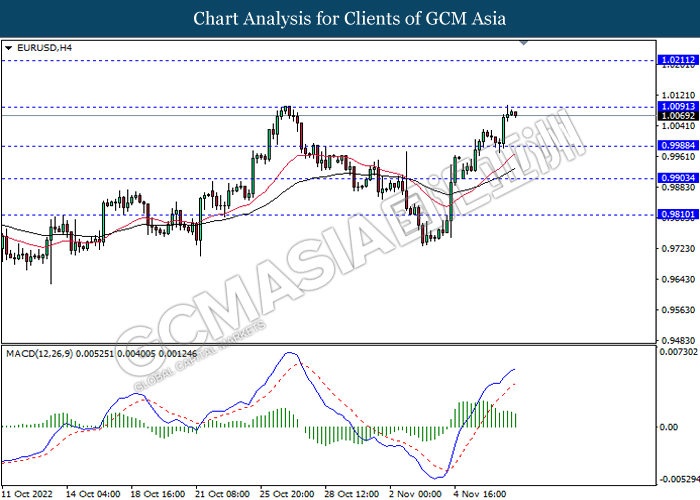

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0090, 1.0210

Support level: 0.9990, 0.9905

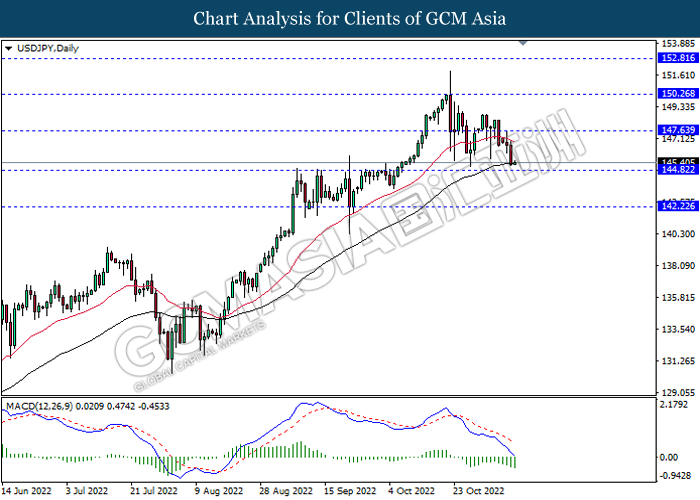

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

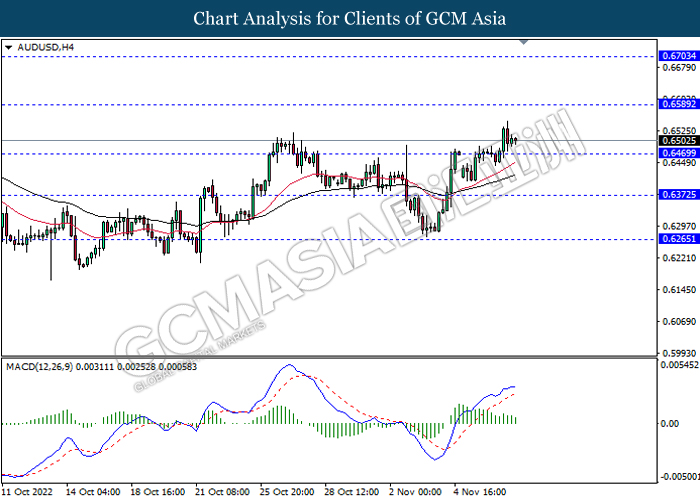

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6705

Support level: 0.6470, 0.6370

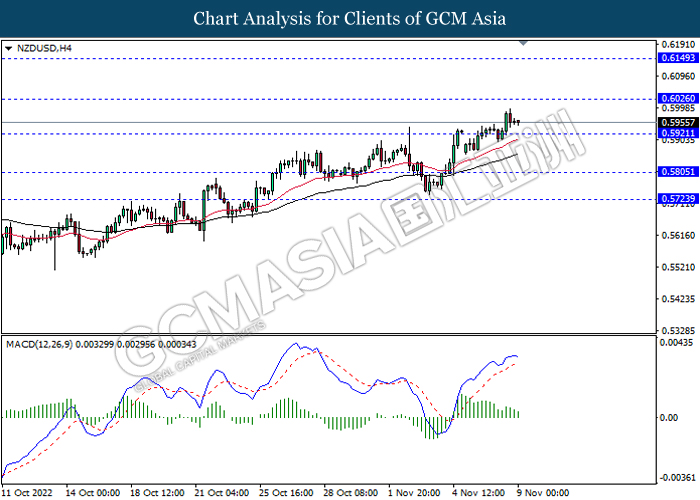

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6025, 0.6150

Support level: 0.5920, 0.5805

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

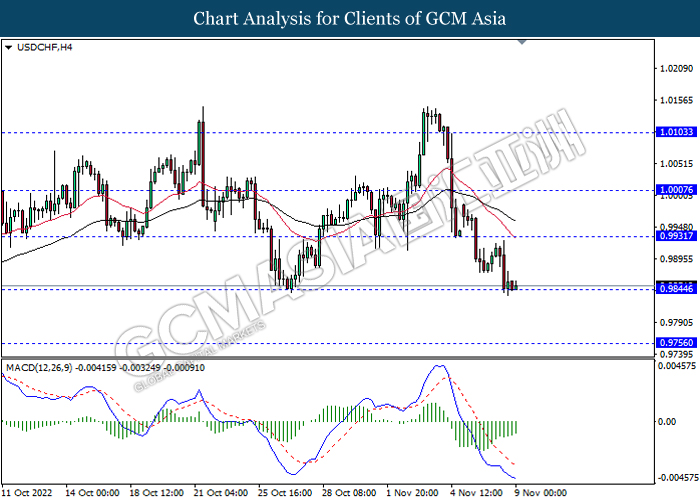

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9930, 1.0005

Support level: 0.9845, 0.9755

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.25, 92.50

Support level: 86.05, 82.45

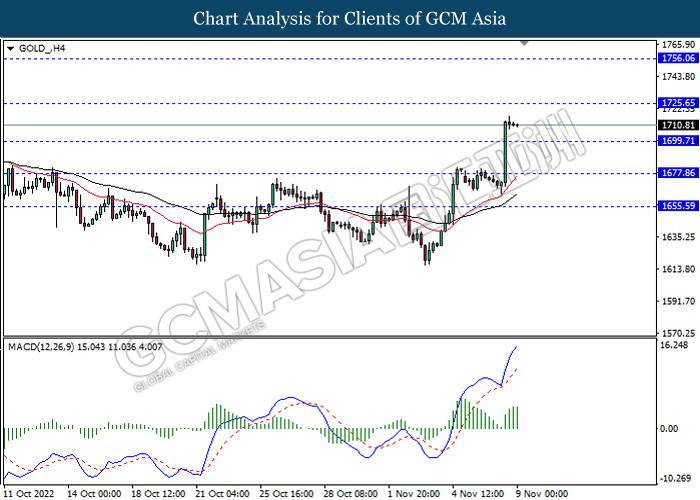

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1725.65, 1756.05

Support level: 1699.70, 1677.85