9 December 2021 Afternoon Session Analysis

Loonie fell amid dovish note from BoC.

The Canadian Loonie which traded against the dollar and other currency pairs have fell after the Bank of Canada (BoC) announced its latest decision on monetary policy. The Bank of Canada has maintained its interest rate unchanged at 0.25% as expected by the market. However, in its statement, the central bank stated that that it expects CPI inflation to remain elevated in the first half of 2022 but expects it would moderate by the second half, towards 2%. Besides that, BoC also commented that the Canadian economy would continue to require monetary policy support and they are commited to maintain the rate until economic slack is absorb. The statement suggest that the BoC is likely to maintain its loose monetary policy in a longer period of time, thus diminishing the appeal for the Loonie. At the time of writing, USD/CAD rose 0.03$ to $1.2655.

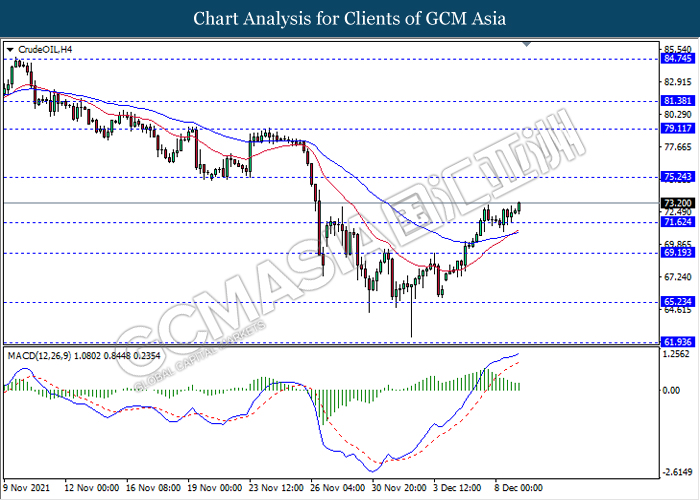

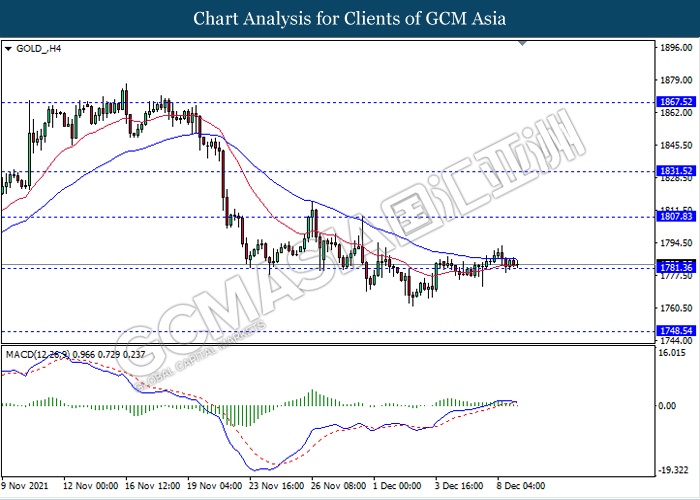

In the commodities market, crude oil price rose 0.73% to $73.24 per barrel as of writing amid easing concerns over Omicron. Following latest development, BioNTech and Pfizer reported that a three-shot course of their COVID-19 vaccine may protect individuals against the infection from Omicron variant and a third dose also showing promising signs of higher protection against the new variant. On the other hand, gold price fell 0.03% to $1783.05 a troy ounce at the time of writing amid dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 222K | 228K | – |

Technical Analysis

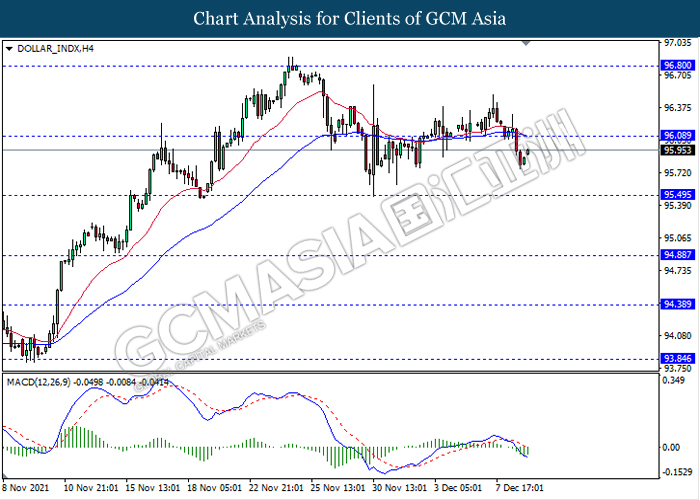

DOLLAR_INDX, H4: Dollar index was traded lower following recent breakout below the previous support level 96.10. MACD which illustrate bearish momentum signal with the formation of death cross suggest the dollar to extend its losses towards the support level 95.50.

Resistance level: 96.10, 96.80

Support level: 95.50, 94.90

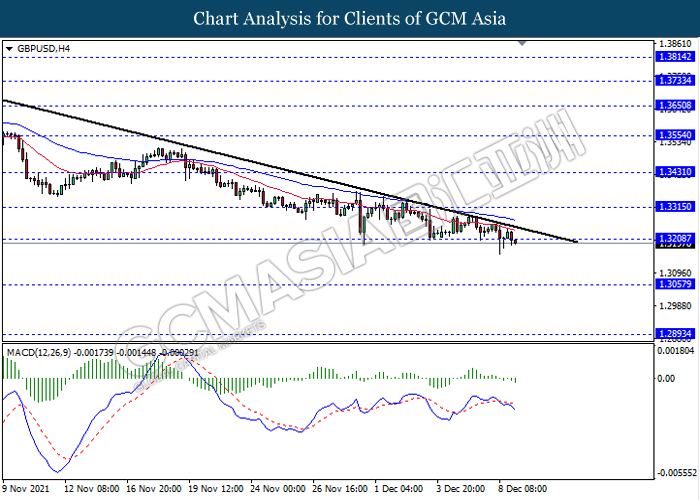

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level 1.3210. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.3055.

Resistance level: 1.3210, 1.3315

Support level: 1.3055, 1.2895

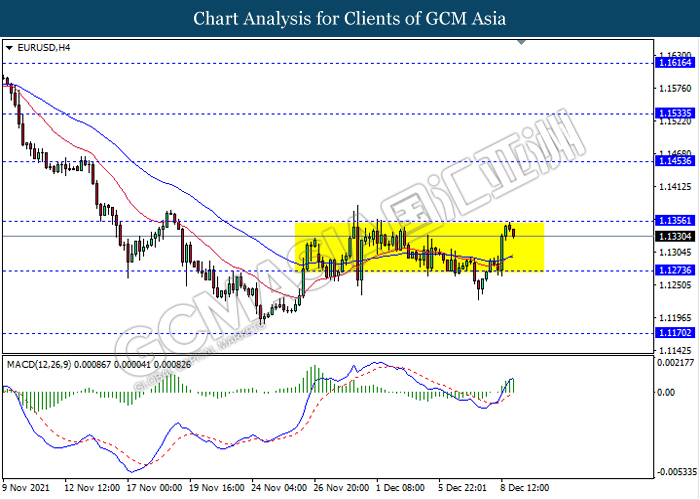

EURUSD, H4: EURUSD remain traded in a sideway channel following recent retracement from the resistance level 1.3455. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term towards the support level 1.1275.

Resistance level: 1.1355, 1.1455

Support level: 1.1275, 1.1170

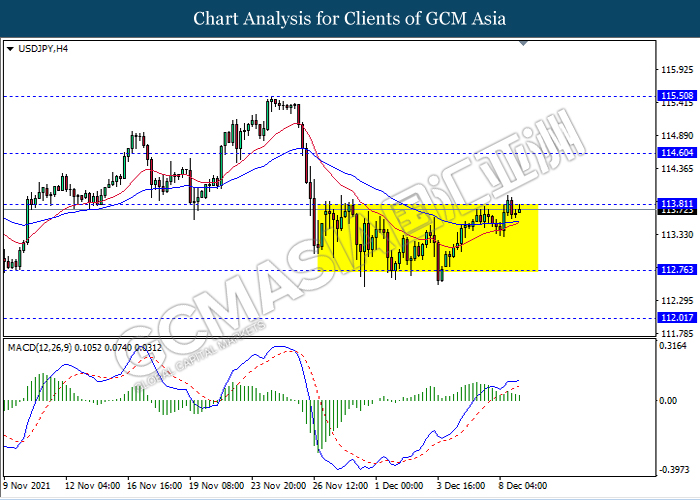

USDJPY, H4: USDJPY remain traded in a sideway channel while currently testing the resistance level 113.80. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term towards the support level 112.75.

Resistance level: 113.80, 114.60

Support level: 112.75, 112.00

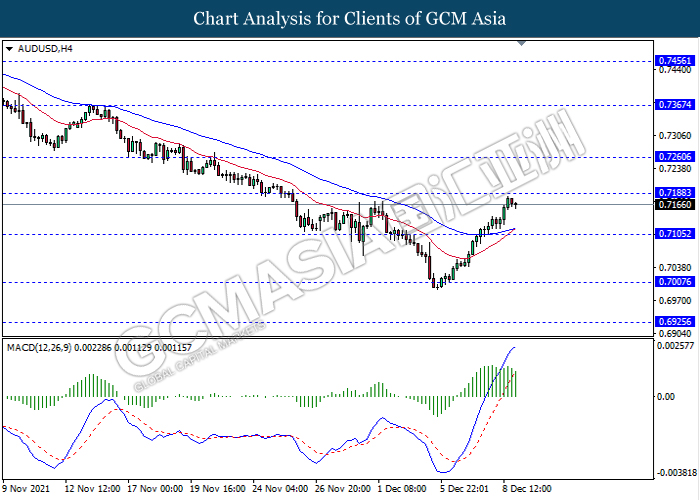

AUDUSD, H4: AUDUSD was traded higher while currently testing near the resistance level 0.7190. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction towards the support level 0.7105.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

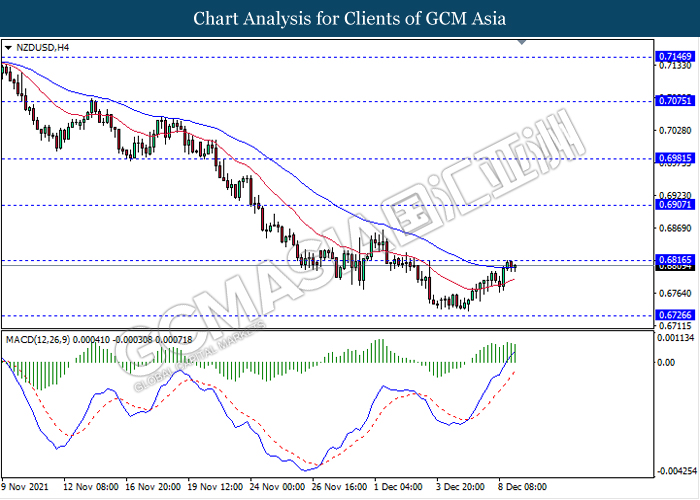

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6815. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 0.6725.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

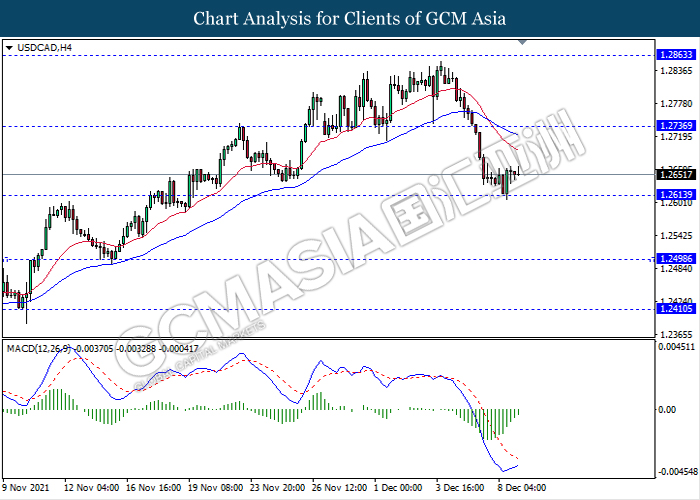

USDCAD, H4: USDCAD was traded higher following recent rebound from the support level 1.2615. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 1.2735.

Resistance level: 1.2735, 1.2865

Support level: 1.2615, 1.2500

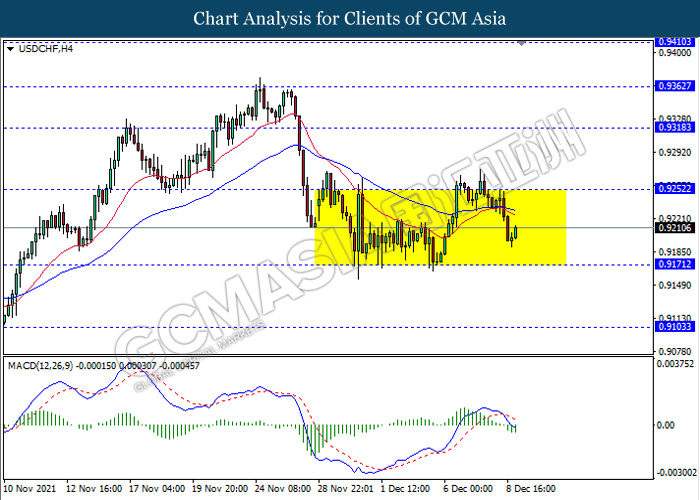

USDCHF, H4: USDCHF remain traded in a sideway channel following recent retracement from the resistance level 0.9250. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its retracement in short term towards the support level 0.9170.

Resistance level: 0.9250, 0.9320

Support level: 0.9170, 0.9105

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 71.60. MACD which illustrate ongoing bullish momentum signal suggest the commodity to extend its gains towards the resistance level 75.25.

Resistance level: 75.25, 79.10

Support level: 71.60, 69.20

GOLD_, H4: Gold price was traded flat while currently testing the support level 1781.35. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower after it breaks below the support level.

Resistance level: 1807.85, 1831.50

Support level: 1781.35, 1748.55