9 December 2022 Morning Session Analysis

Greenback dipped amid the worsening of labor data.

The dollar index, which was traded against a basket of six major currencies, lost its ground while receiving some sell-off pressures after US released a downbeat labor data. According to the Department of Labor, US Initial Jobless Claims came in at 230K, in line with the consensus expectation, but still refreshed the highest record since early of February 2022. The increase in the recurring application for US unemployment benefits showed that the labor market is experiencing the tentative signs of cooling. With that, the investors interpreted the data as a sign that Fed would likely slowdown the pace of rate hikes soon, which diminished the appeal of the dollar index. Nonetheless, the market attention is now gathered on the next US inflation data point, which is the Friday night’s Producer Price Index (PPI) for the month of November. The data will be on watch by all the investors as it would provide a clear sign of the inflationary pressures in the US. As of writing, the dollar index dropped -0.28% to 104.80.

In the commodities market, the crude oil price edged down -0.34% to $72.25 per barrel as the market concern over the global economic slowdown overshadowed the issue of Keystone pipeline outage. Besides, the gold prices jumped 0.16% to $1789.05 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – PPI | 0.2% | 0.2% | – |

Technical Analysis

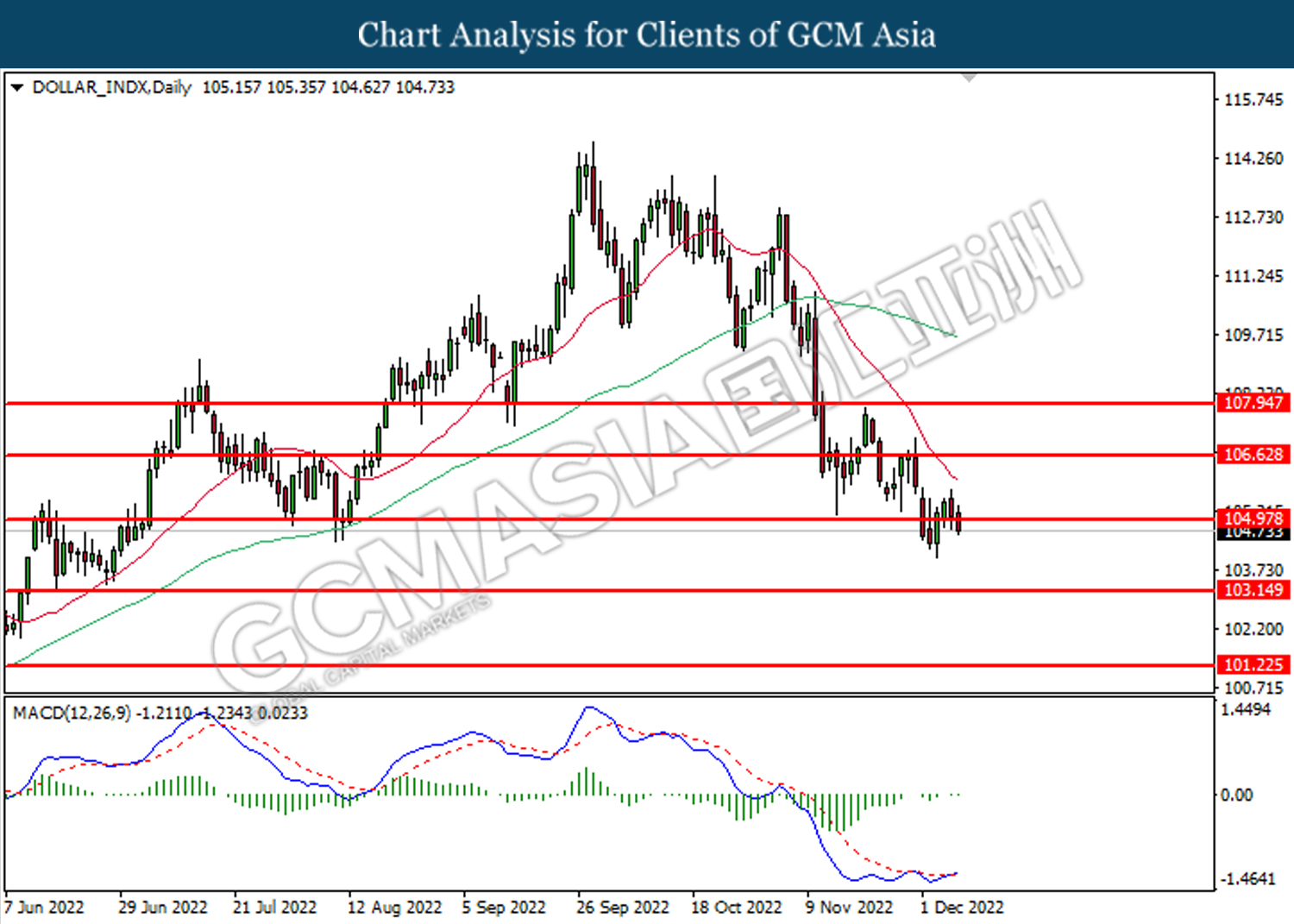

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 105.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

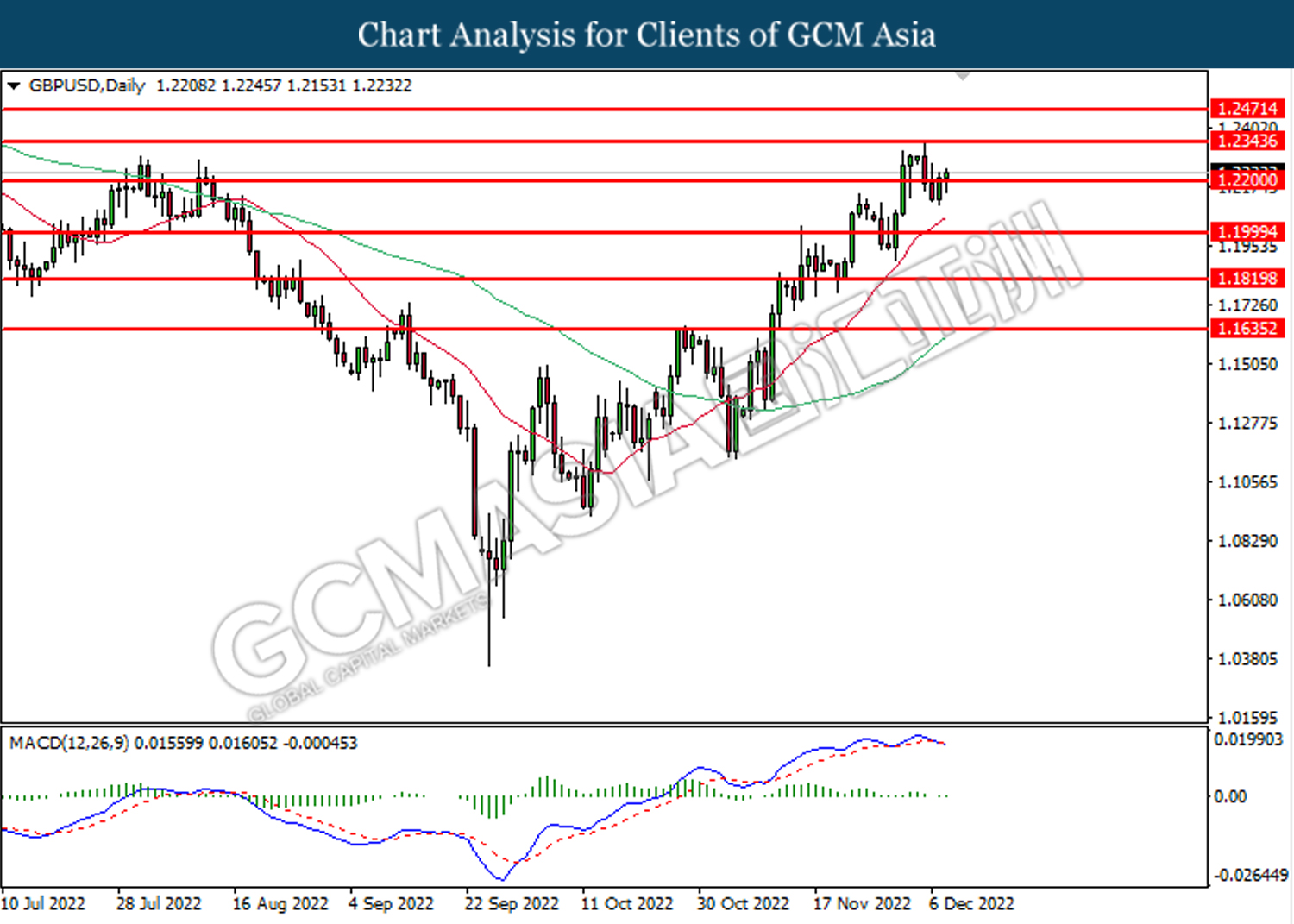

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

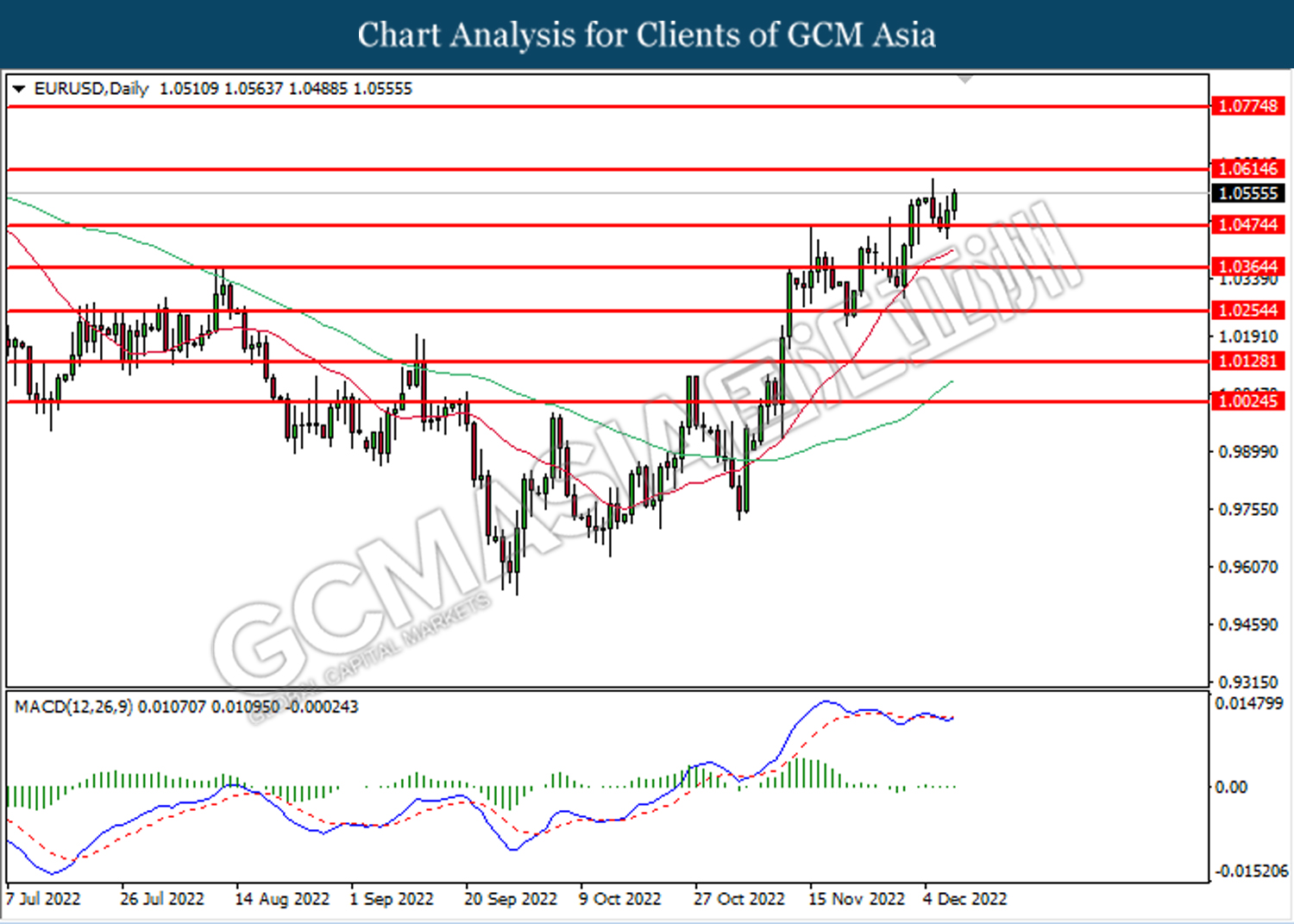

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0475. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

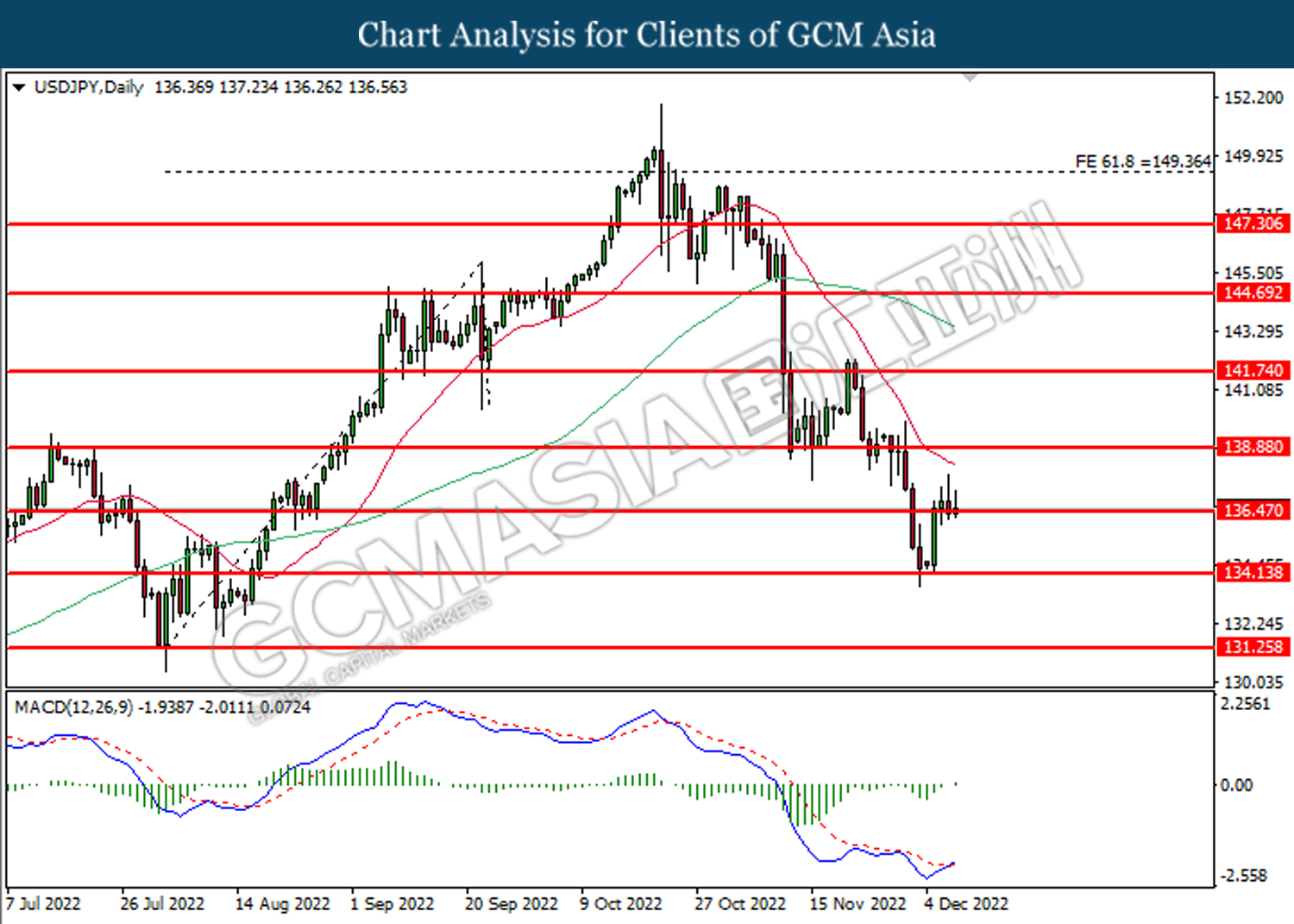

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

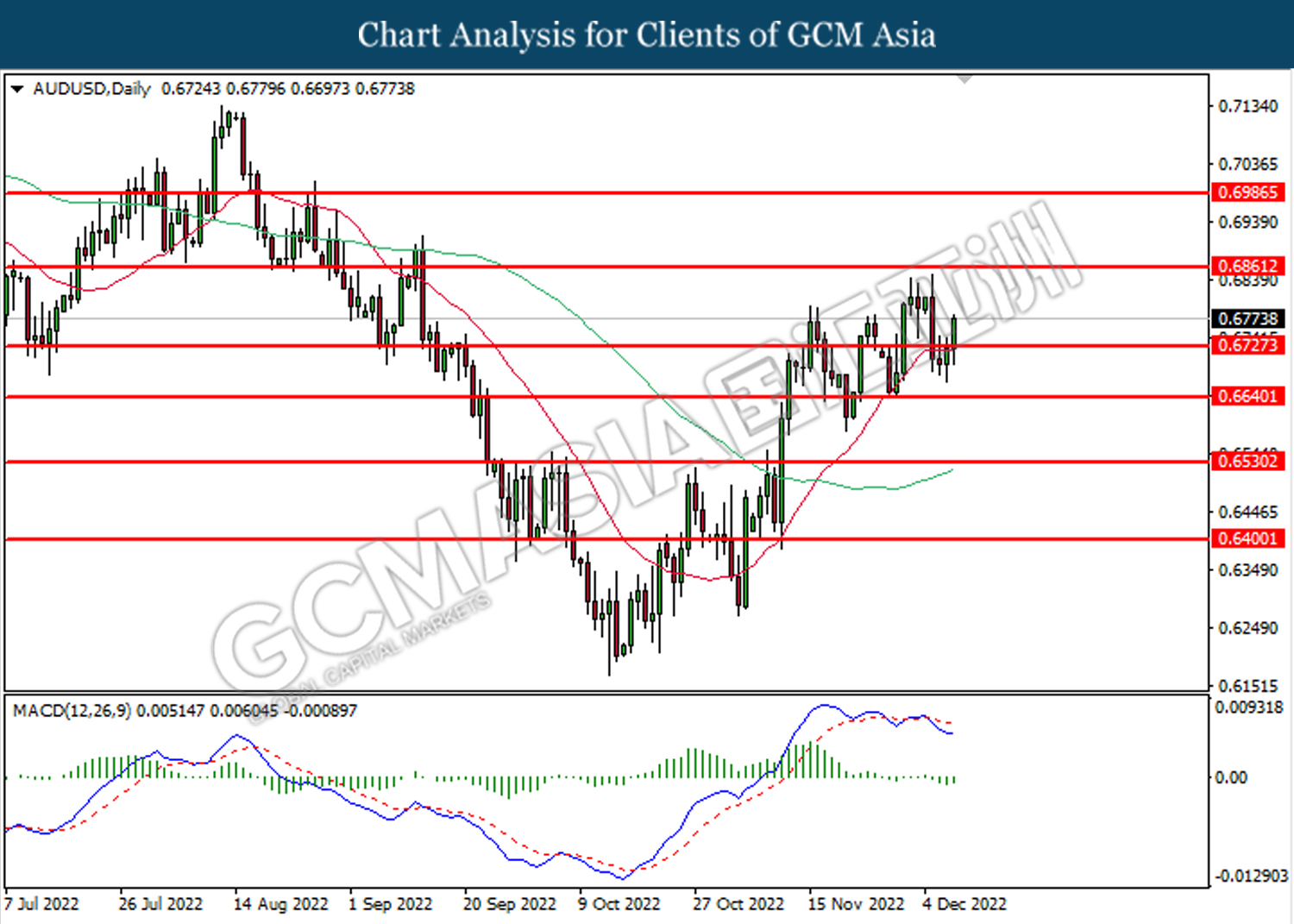

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

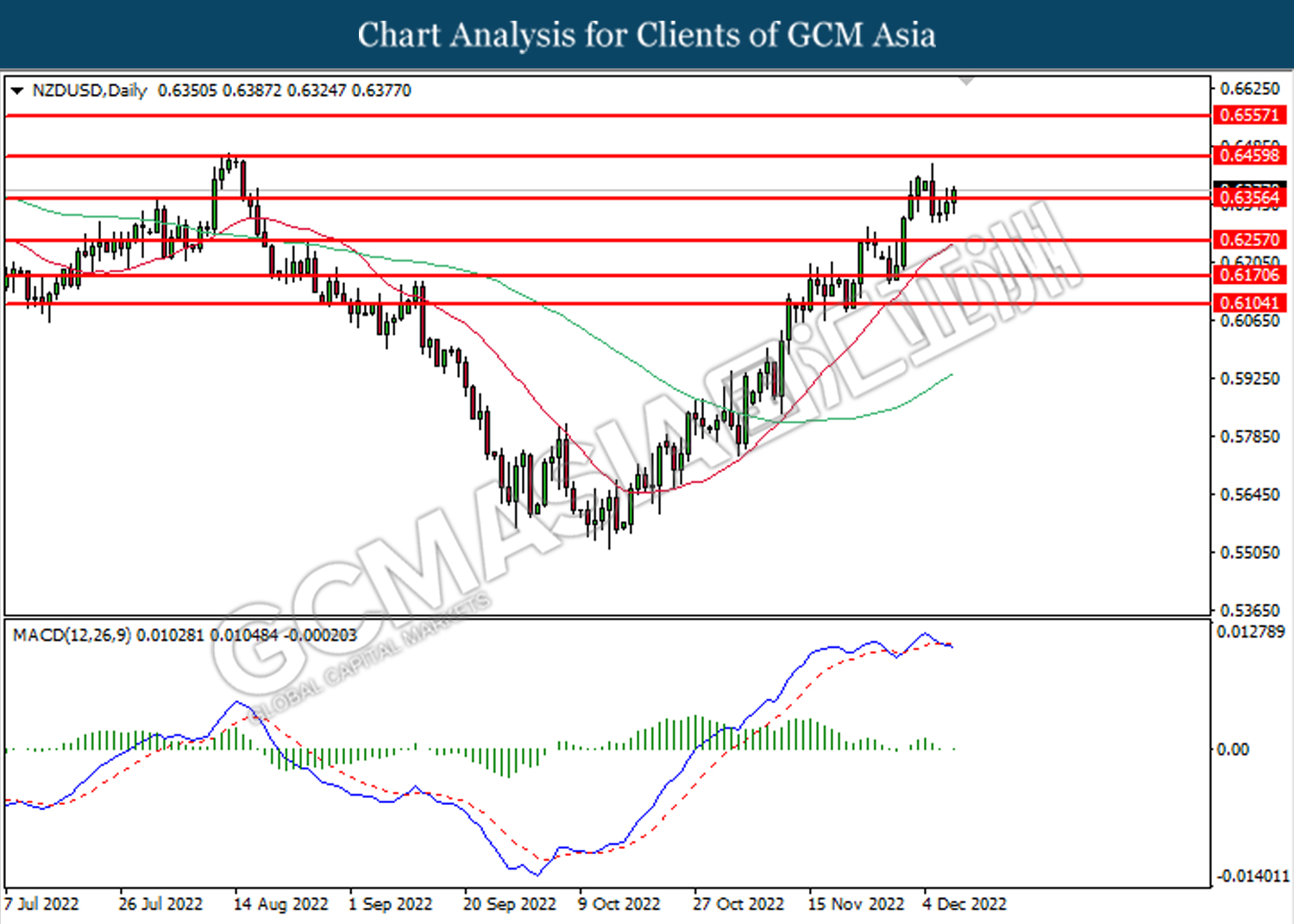

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

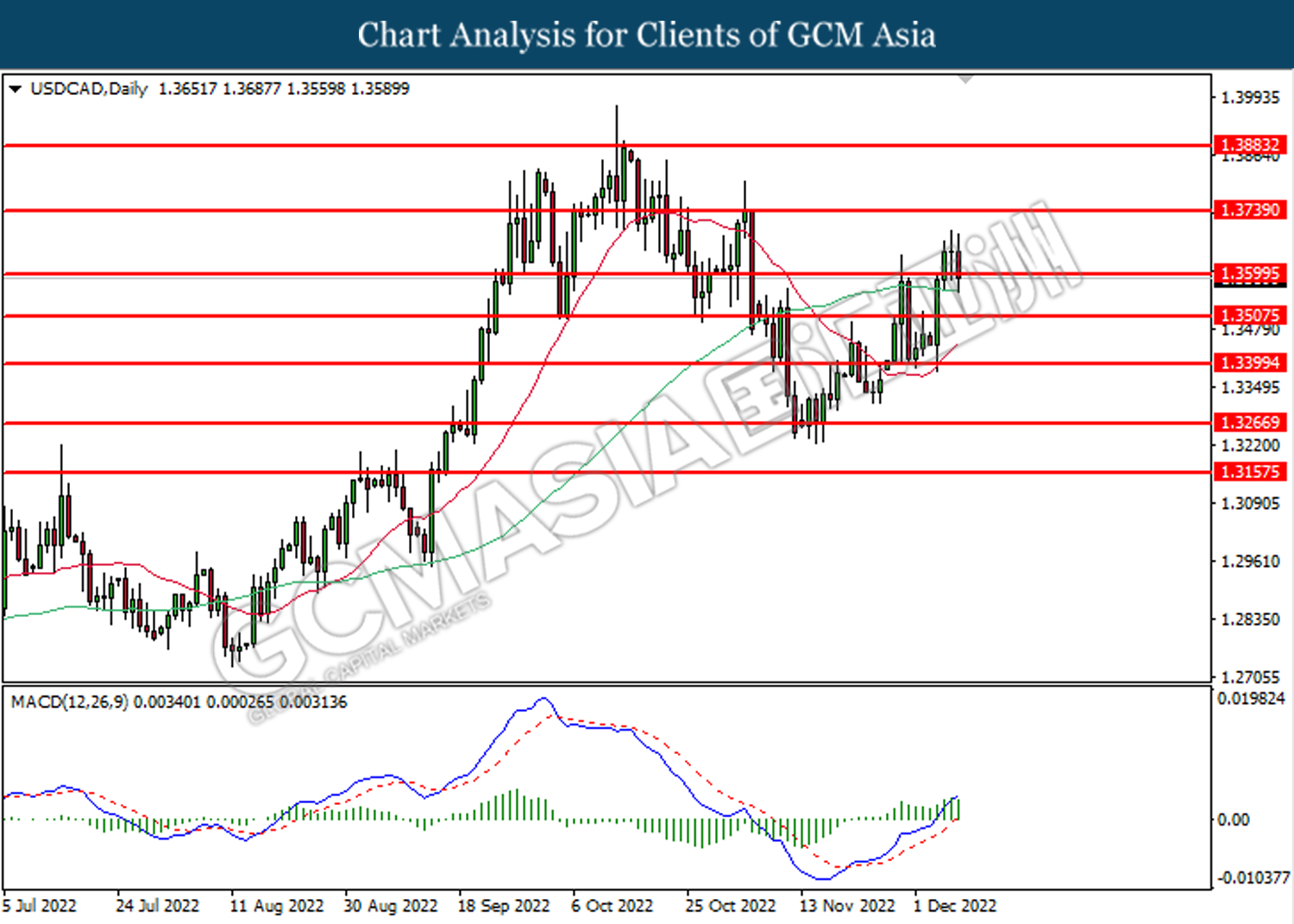

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

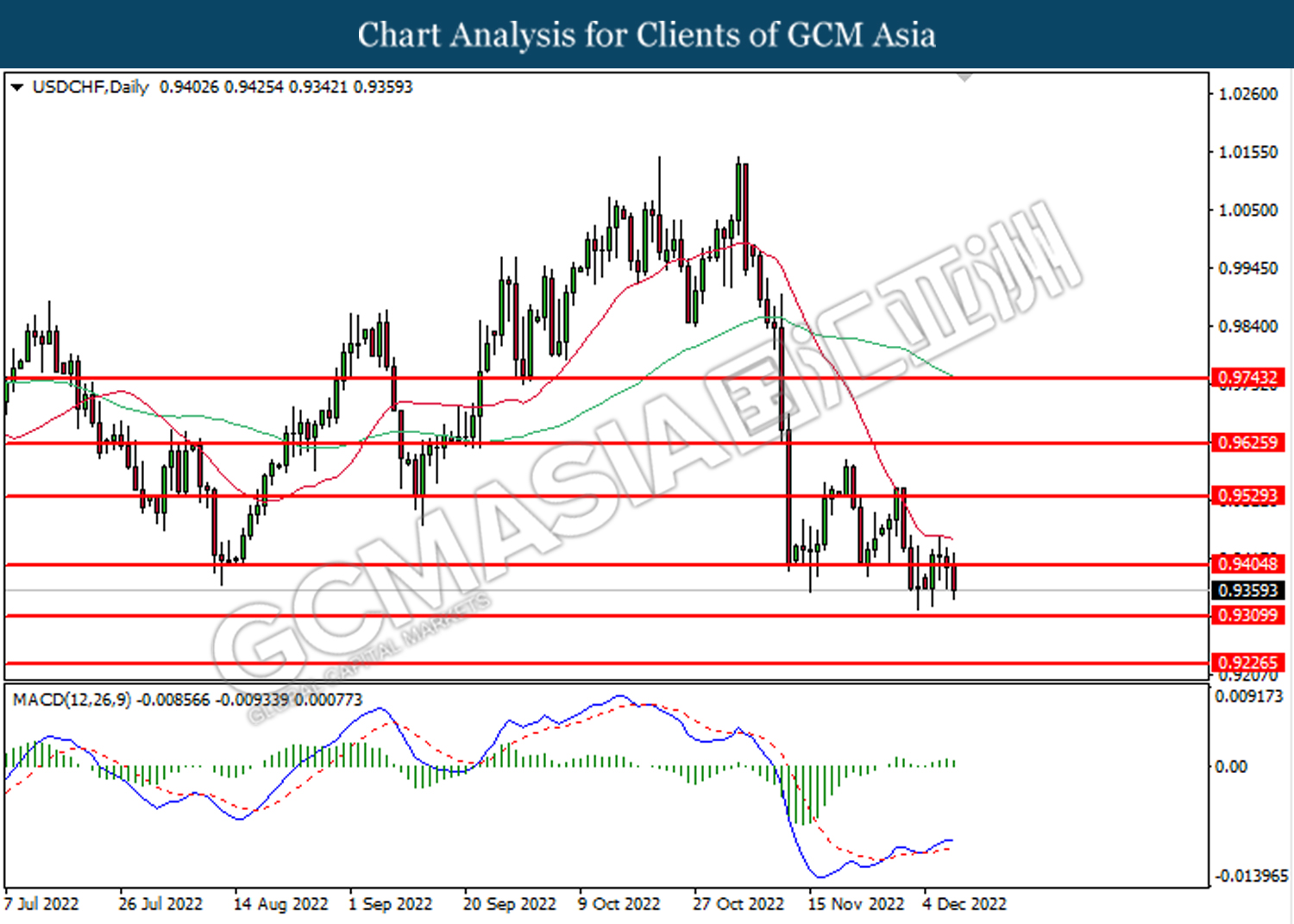

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

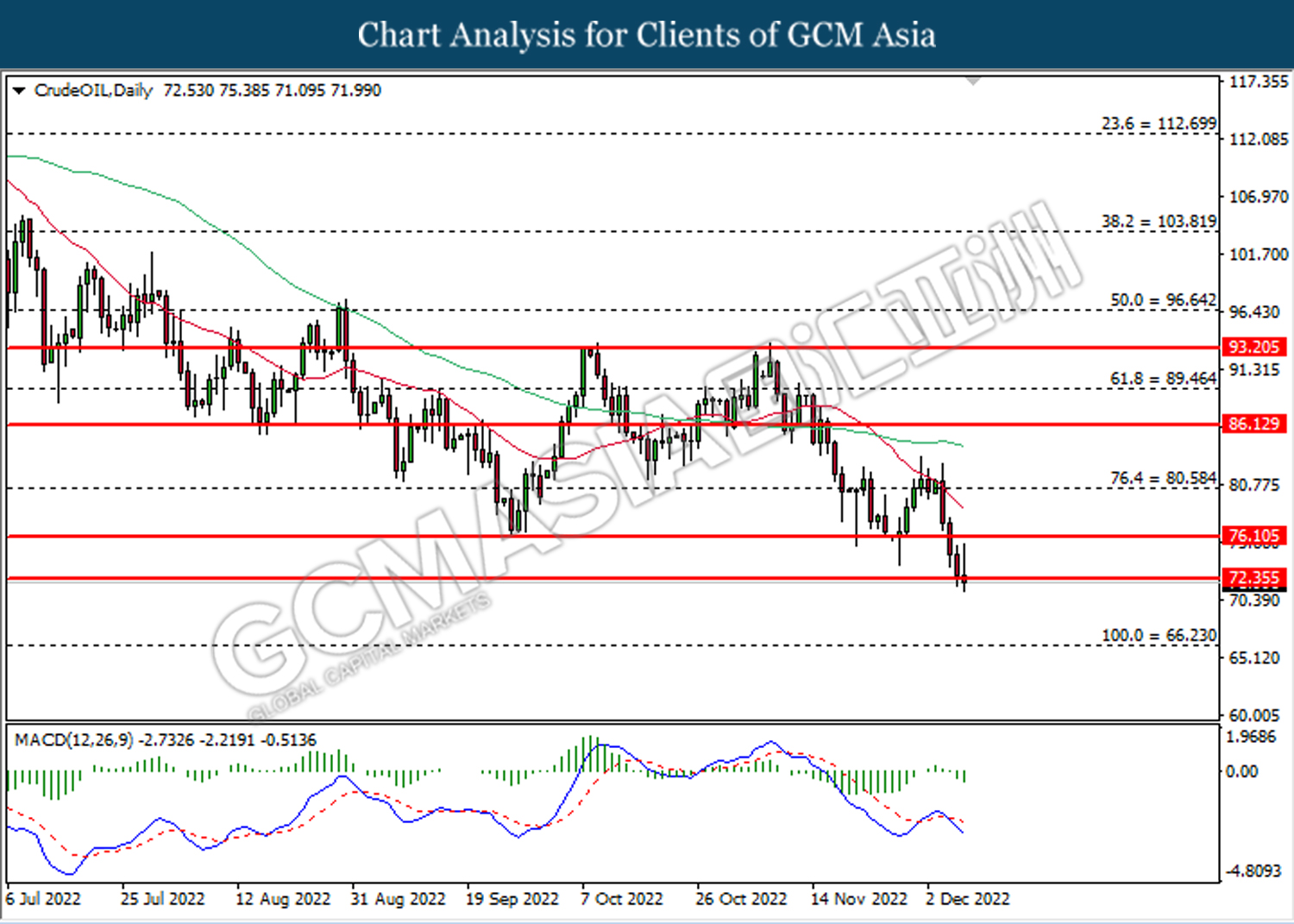

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 72.35. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 76.10, 80.60

Support level: 72.35, 66.25

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1766.50. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15