10 January 2023 Afternoon Session Analysis

Aussie dollar surged amid the market optimism of China reopening.

The Australian dollar, which is broadly known as the Aussie dollar, was boosted by the heightening of market demand for riskier assets following the reopening of China. On 8th January 2023, China finally reopened its border for international travelers for the first time since the outbreak of Covid-19 in March 2020. In detail, the incoming travelers are no longer required to undergo the quarantine process, but proof of a negative PCR test needs to be shown within 48 hours of traveling. With that, the China economy is expected to recover strongly in the year of Rabbit, although the high Covid-19 cases still overshadow the nation. As China is Australia’s largest trading partner in terms of imports and exports, the country’s recovery prospect is expected to boost Australia’s economic activity concurrently. Alongside, as the rate hike cycle is getting closer to the end of the cycle, the appeal of the dollar index faded while urging the investors to sell off their Greenback holdings.

In the commodities market, the crude oil price dropped by -0.91% to $74.35 per barrel as global recession risk overshadowed the oil market outlook. Besides, the gold prices rose 0.11% to $1873.70 per troy ounce as the dollar index extended its losses in the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

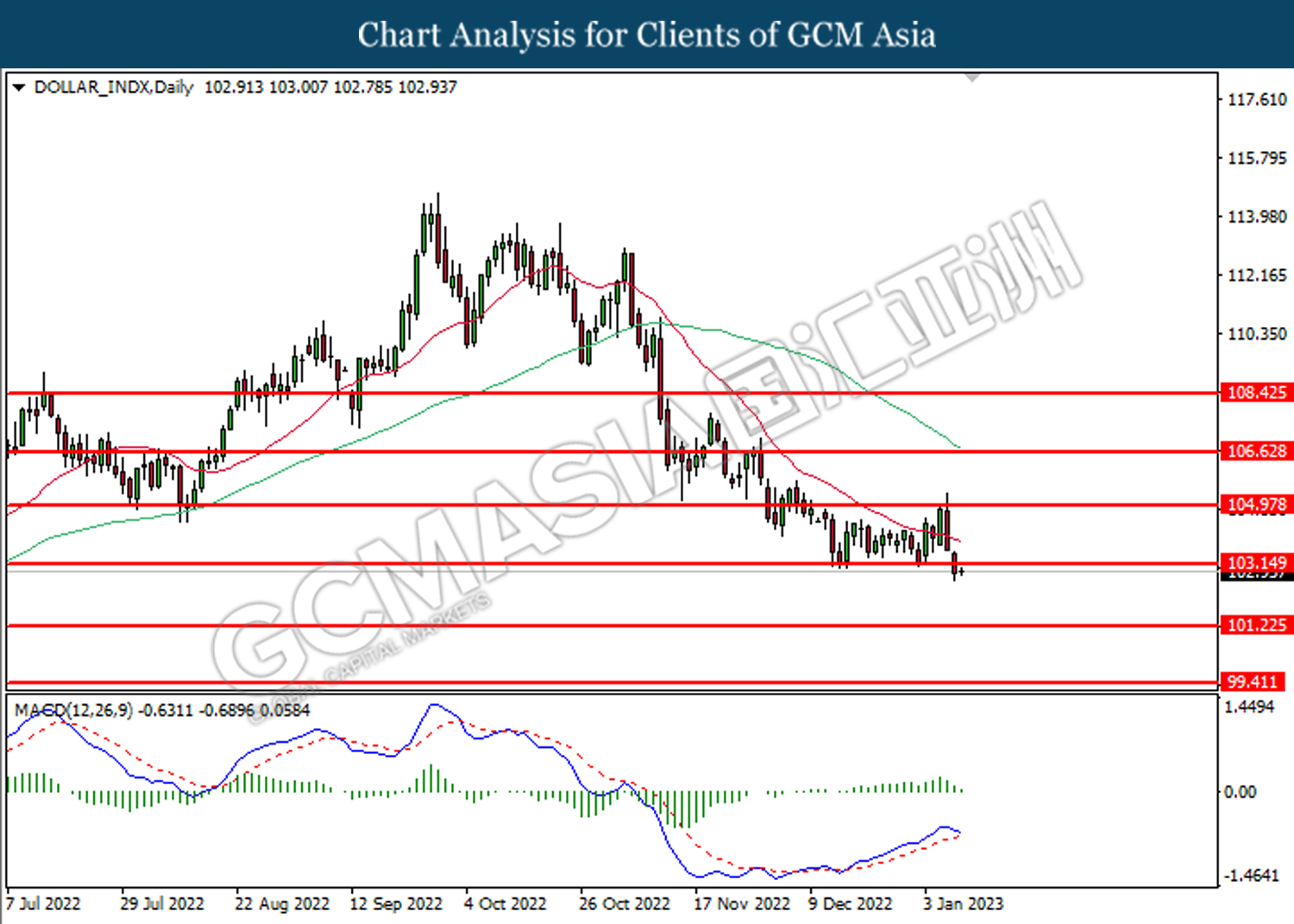

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

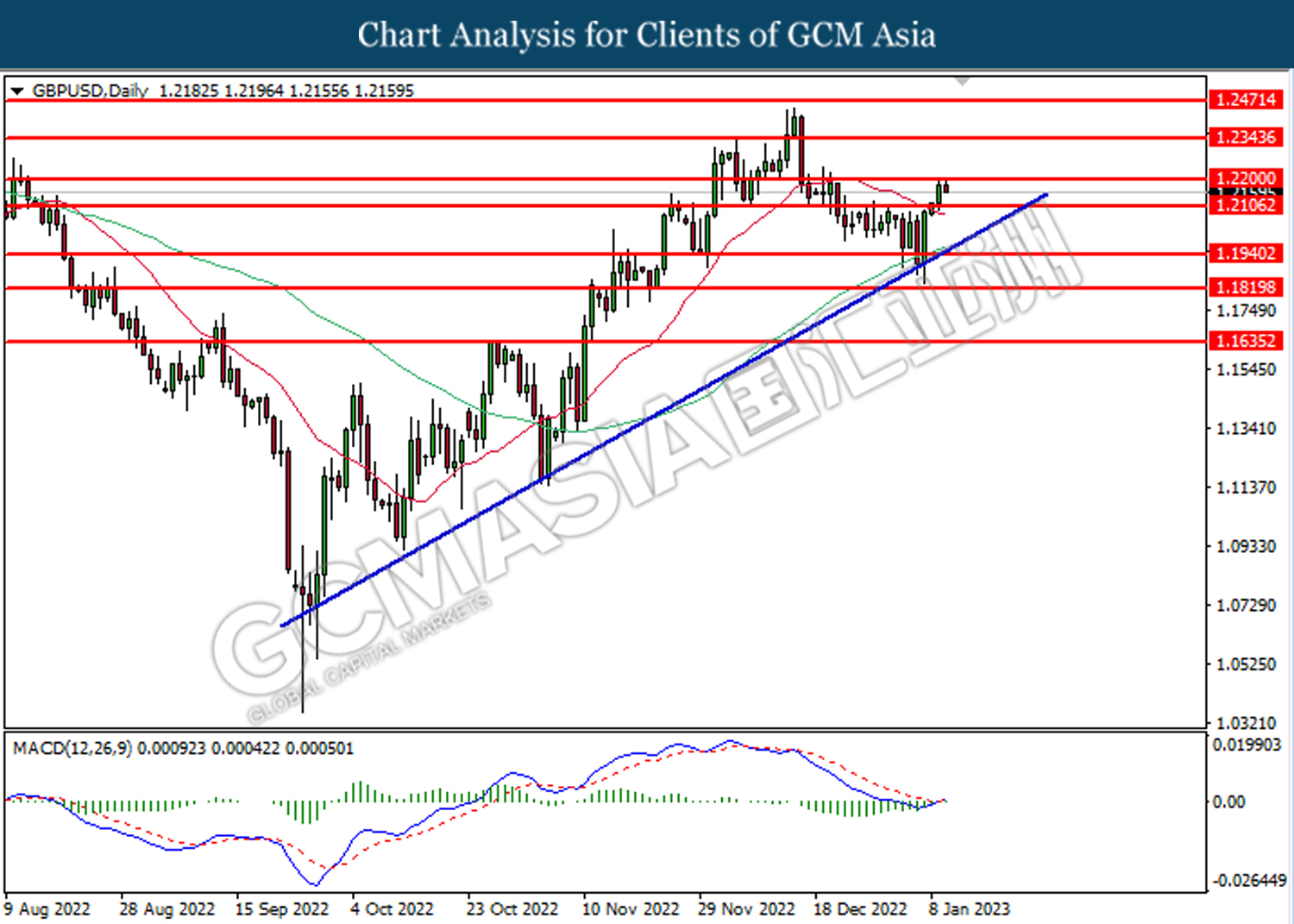

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

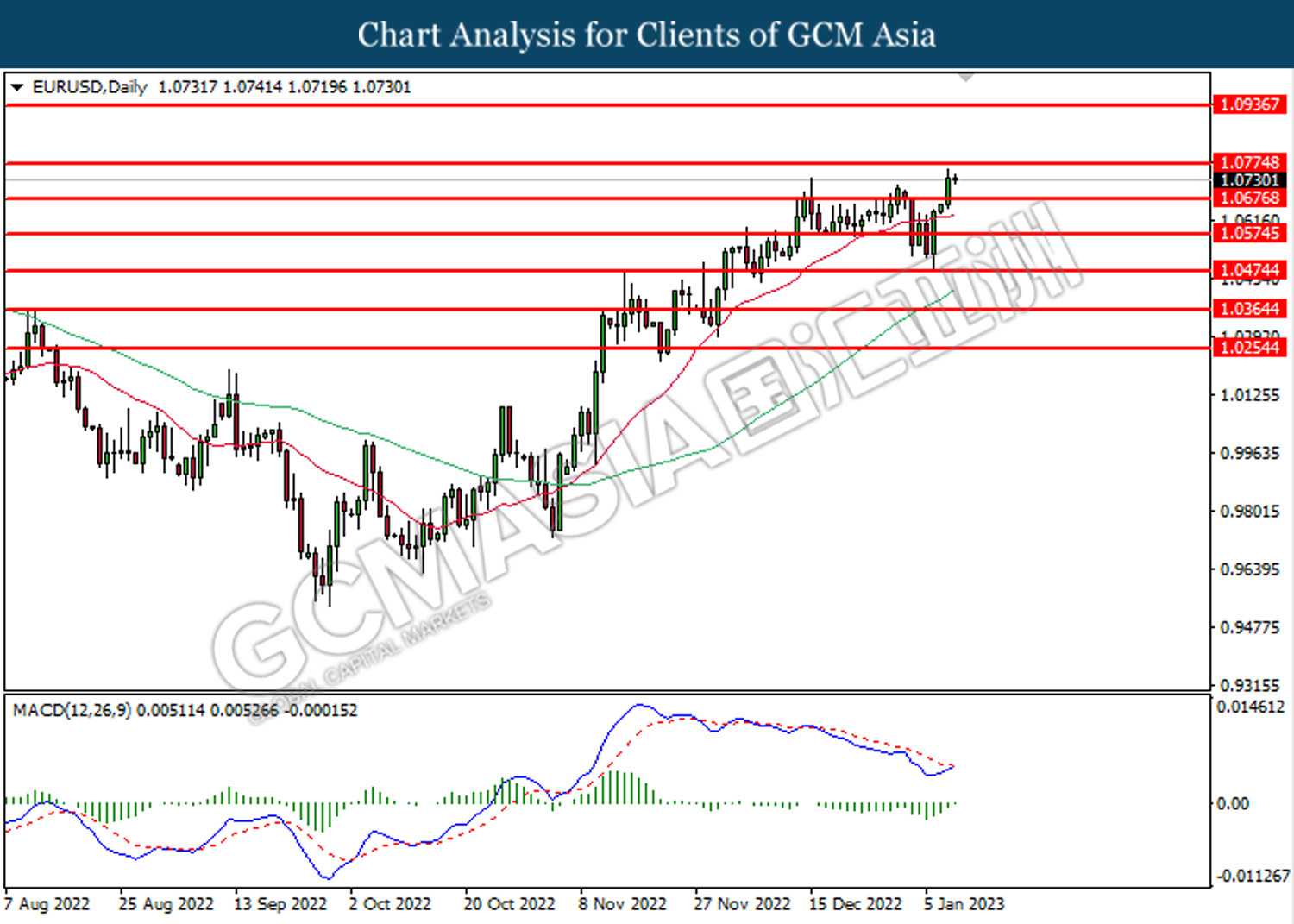

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0775. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

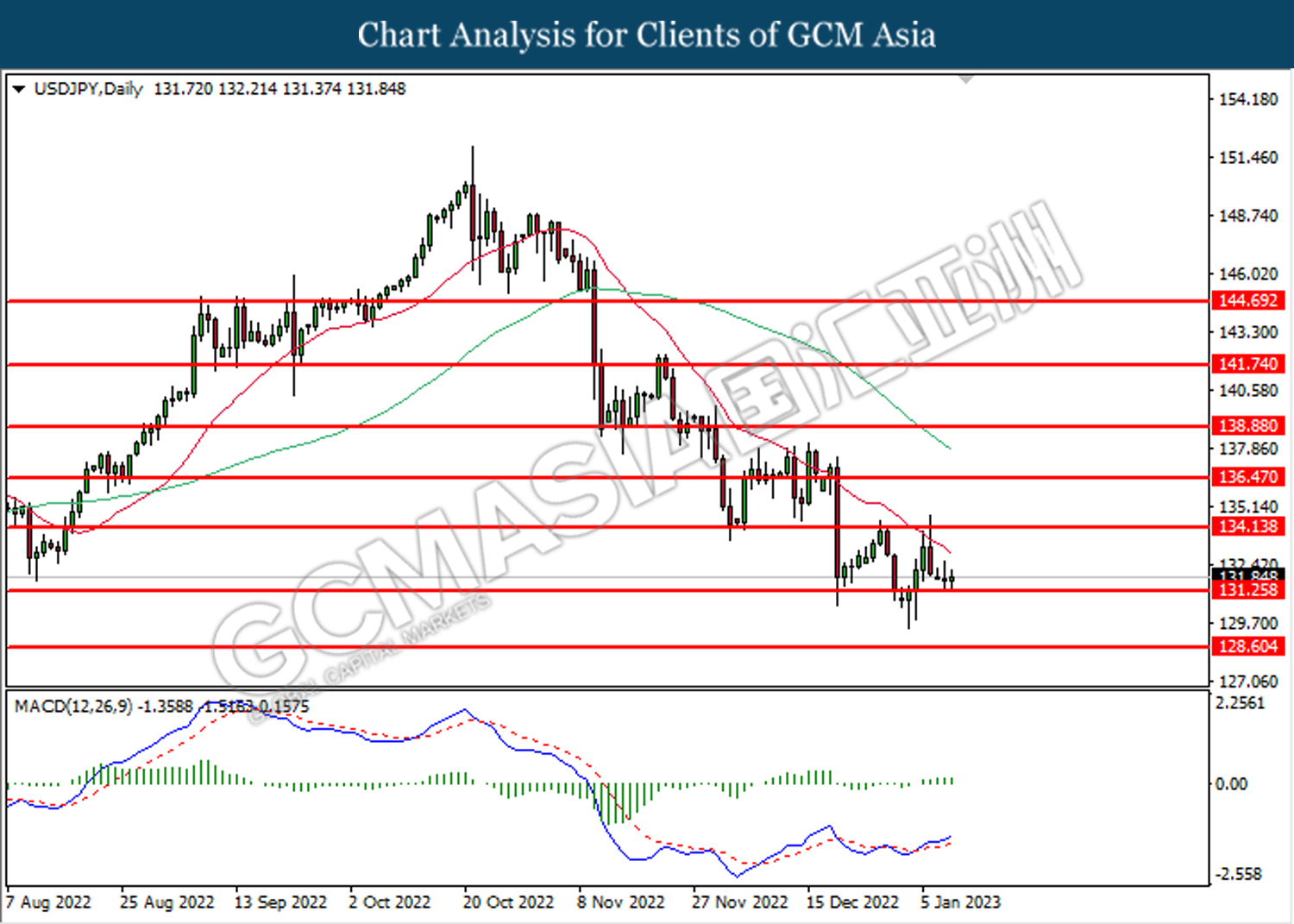

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

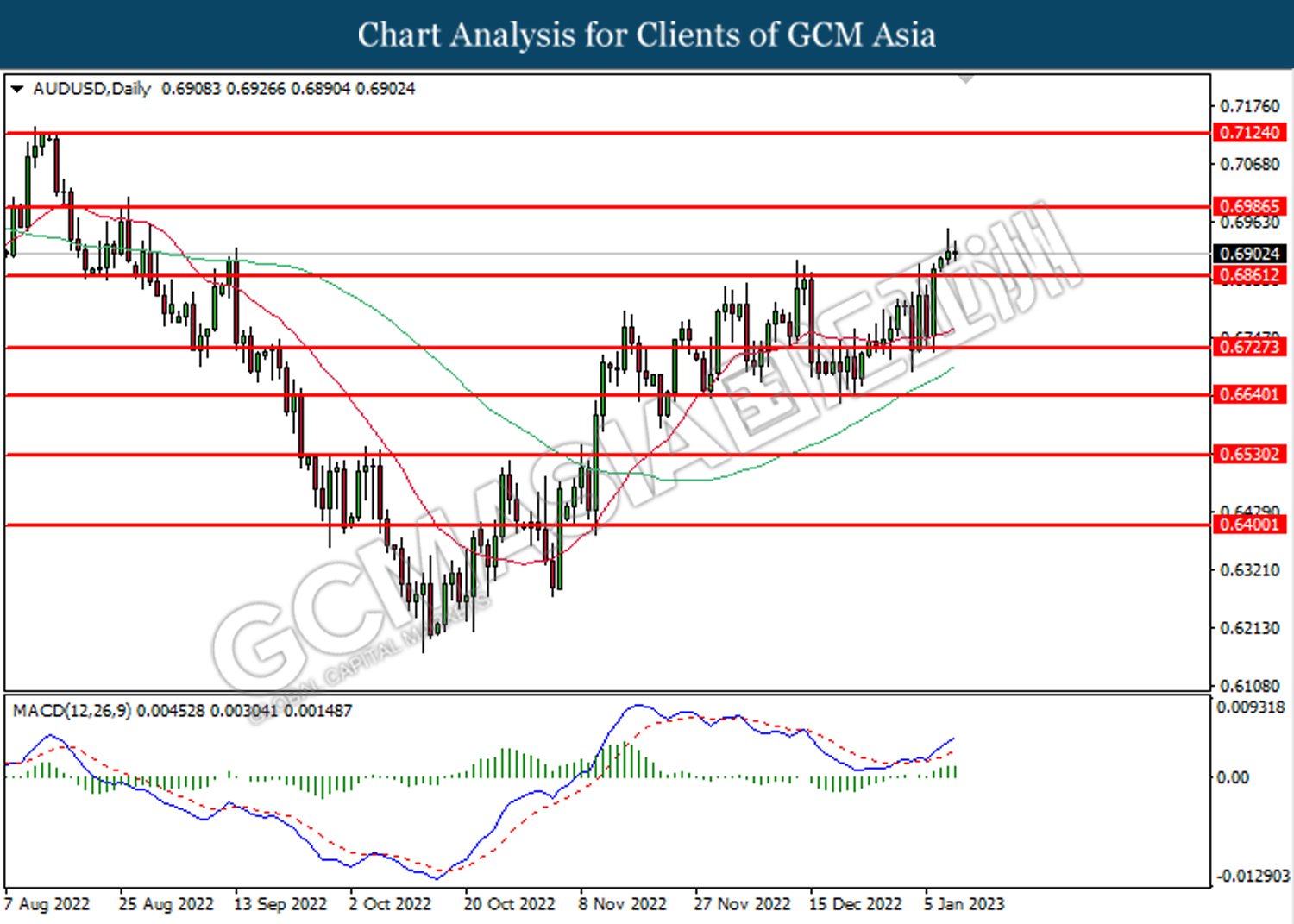

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

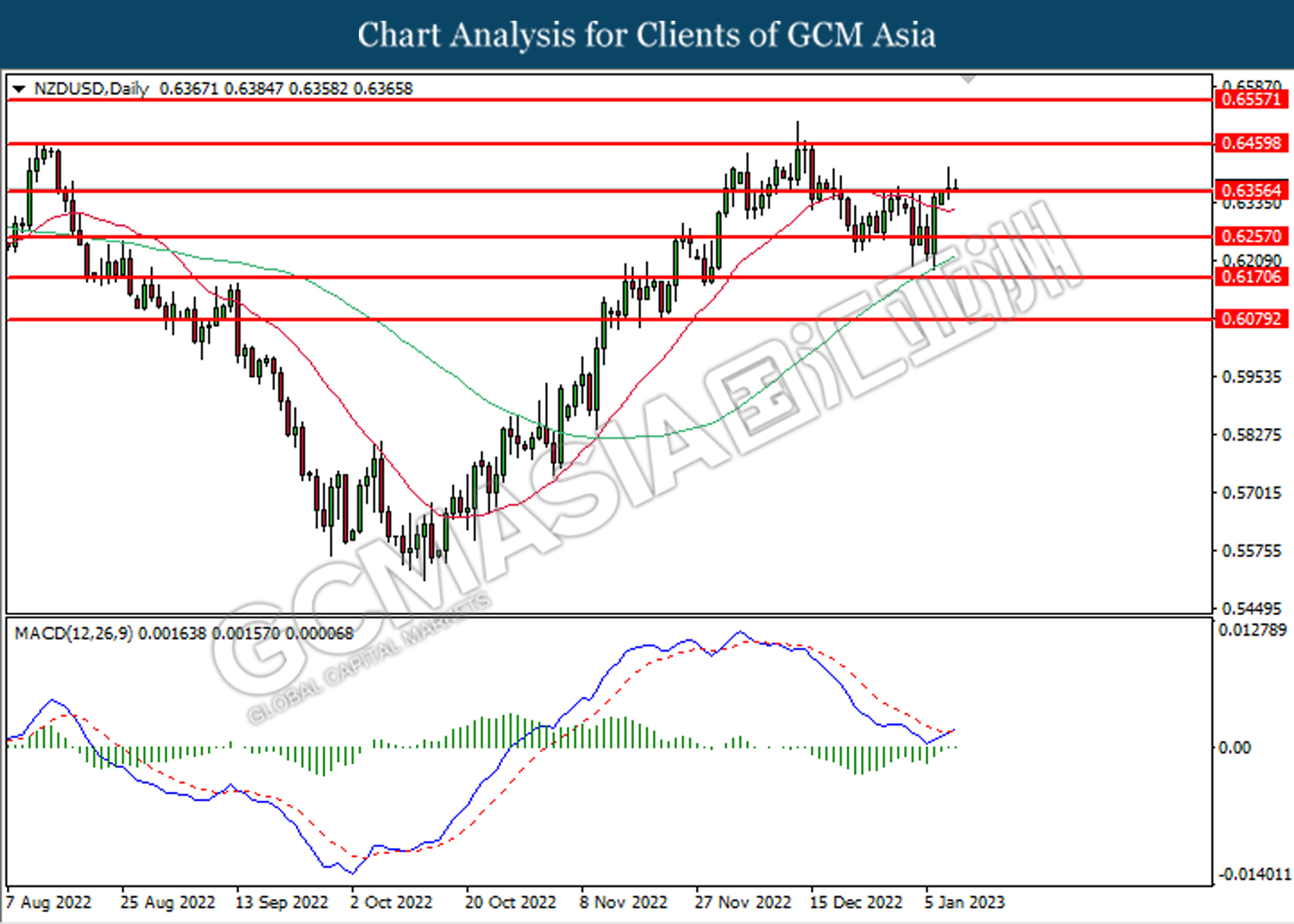

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

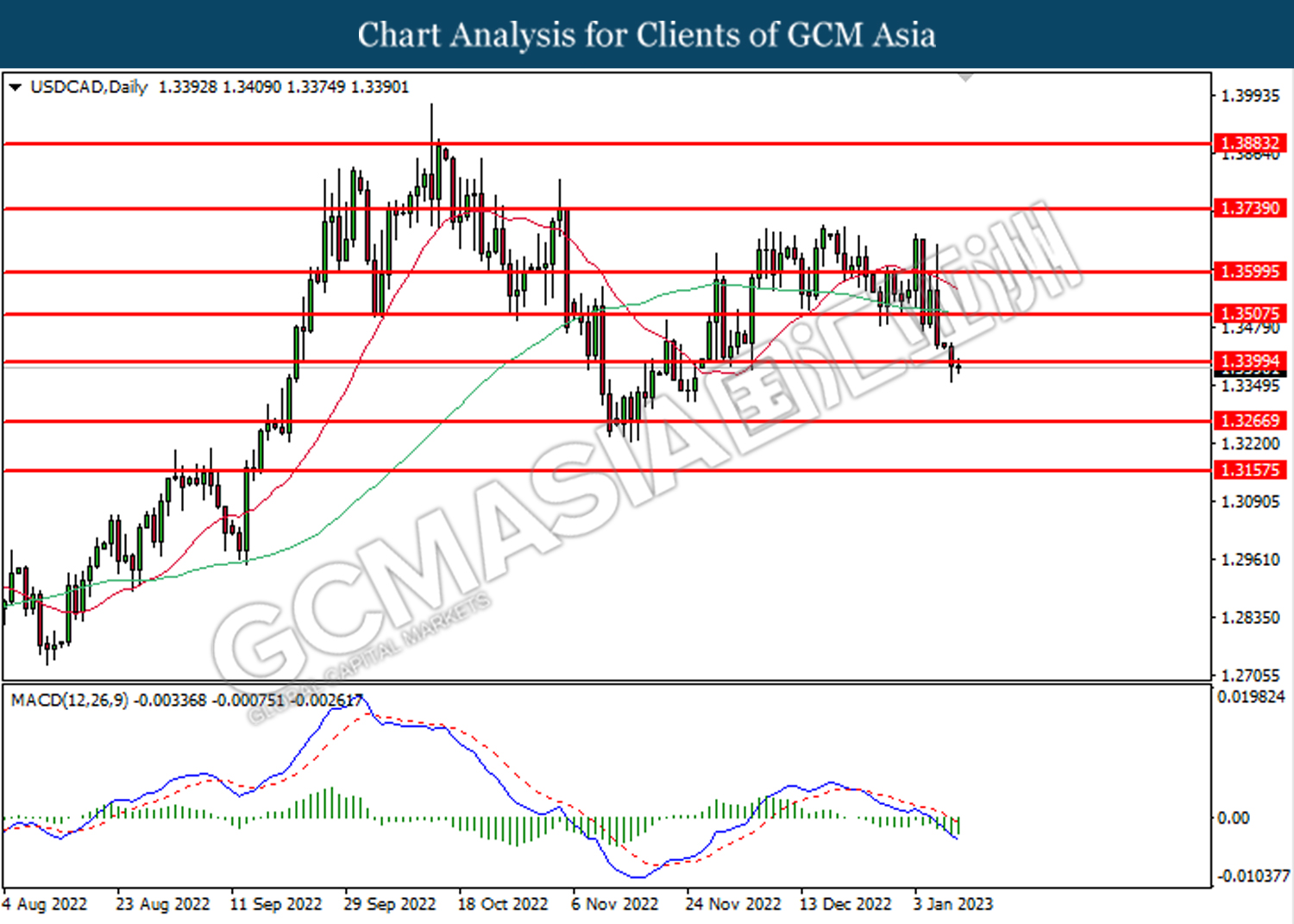

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3400.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

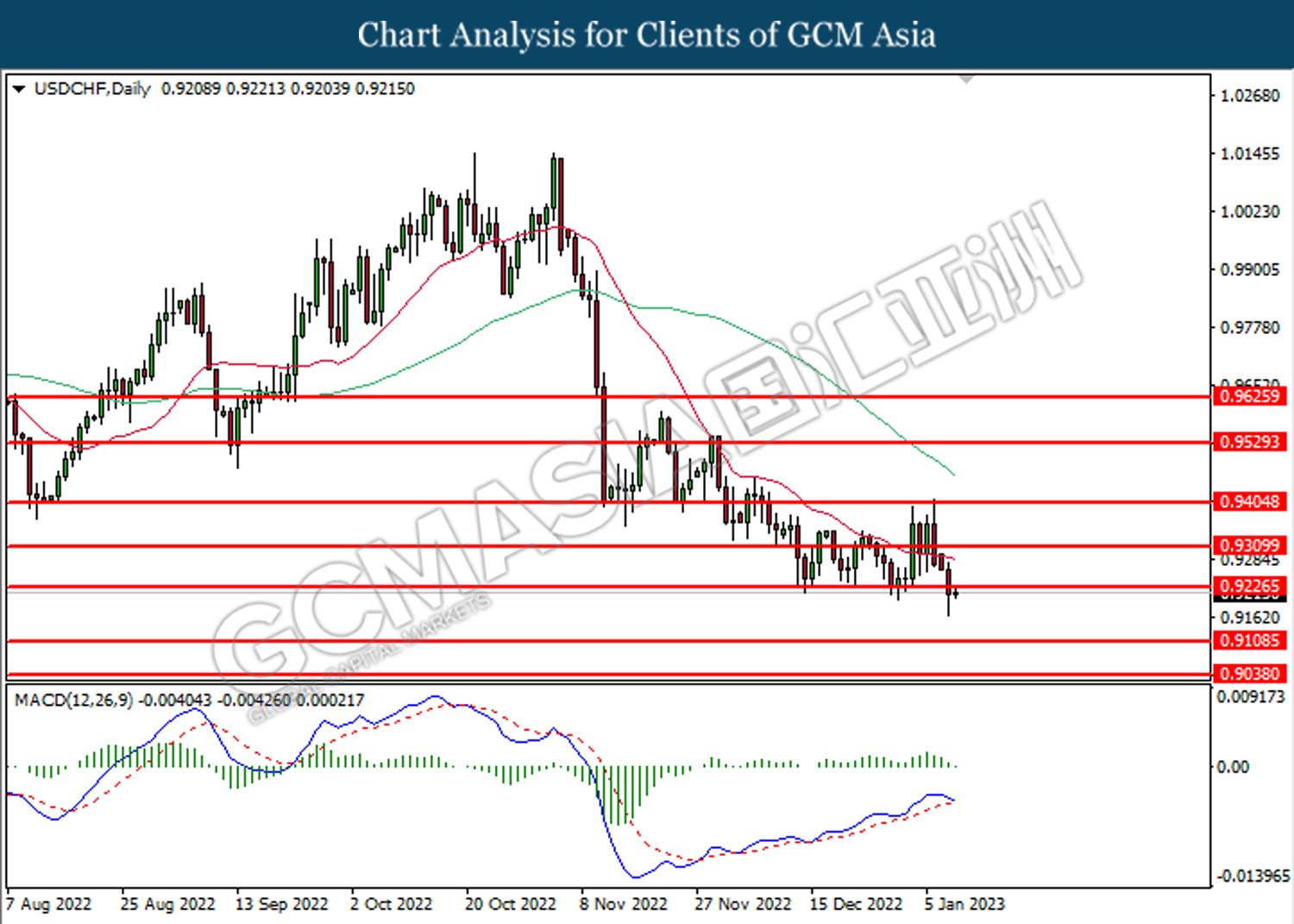

USDCHF, Daily: USDCHF was traded lower following prior breakout below the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

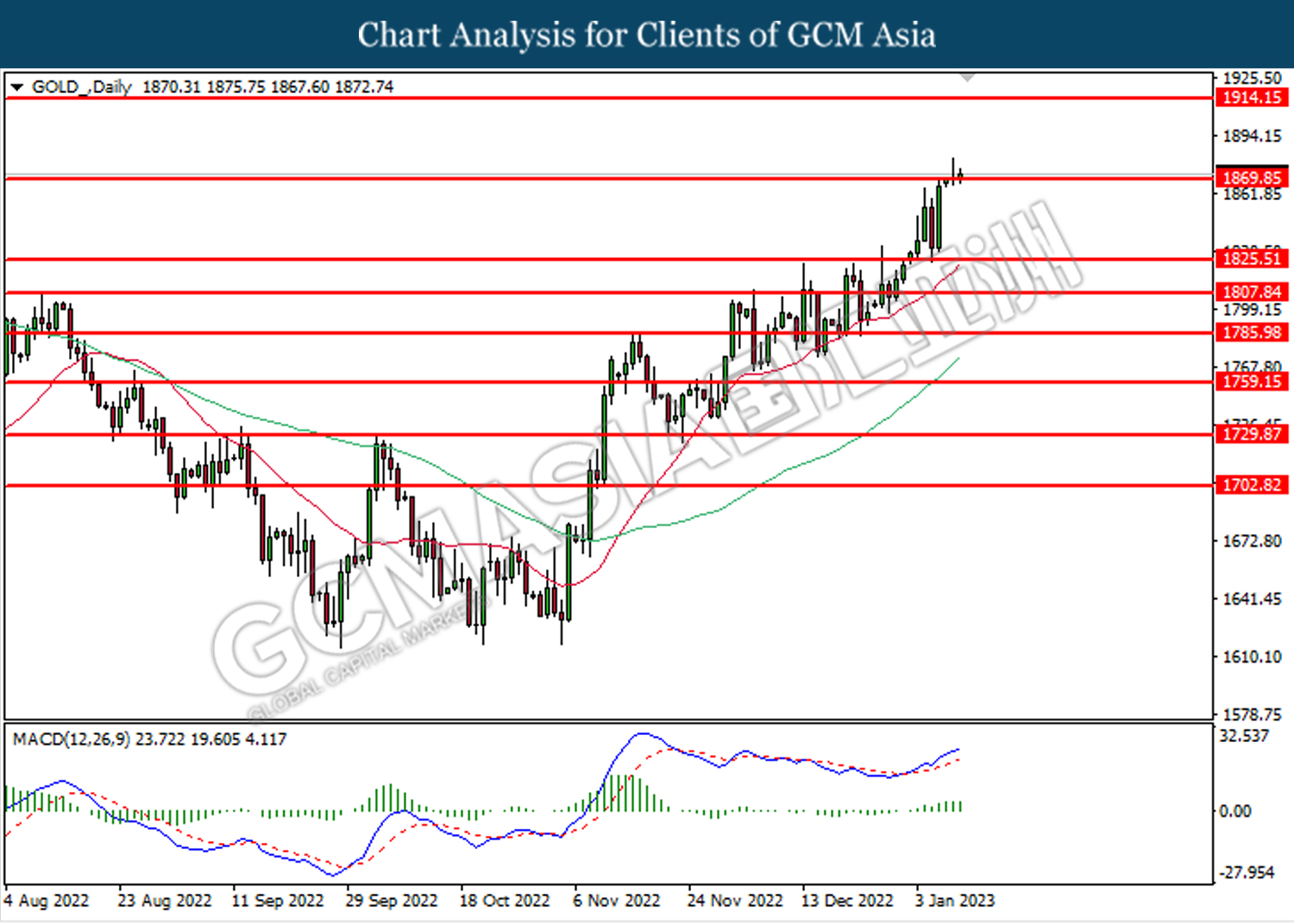

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1869.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1869.85, 1914.15

Support level: 1825.50, 1807.85