10 January 2023 Morning Session Analysis

US Dollar weakened amid lower rate hike background.

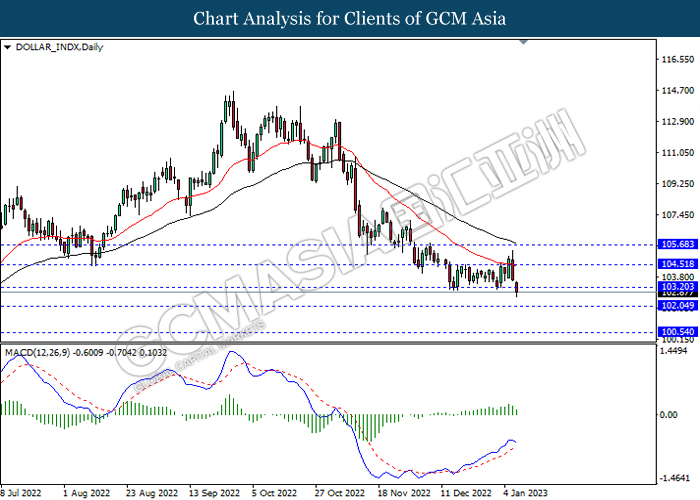

The Dollar Index which traded against a basket of six major currencies dropped to its 7-month low over the investors bet on a lower rate increased by Fed. According to Reuters, market participants belief that Fed would less likely to raise its interest rate more than 5% in the February meeting, as the inflation and economy in the US shown a sign of downturn while the Fed’s rate hike did have some notable effects on it. Based on the CME FedWatch Tool, the likelihood of 25 basis point rate hike was reached 79.2%, as well as the possibility of half-of-a-percentage hike was only about 20.8%. However, it is noteworthy that the interest rate would likely to be higher for a long period in order to curb inflation which still far from Fed’s 2% target, according to the speech of Fed Chairman Jerome Powell. As of now, investors would highly eye on the speech of Fed Chairman Jerome Powell that scheduled tonight as it can provide a clearer views on its rate hikes path. As of writing, the Dollar Index depreciated by 0.69% to 102.93.

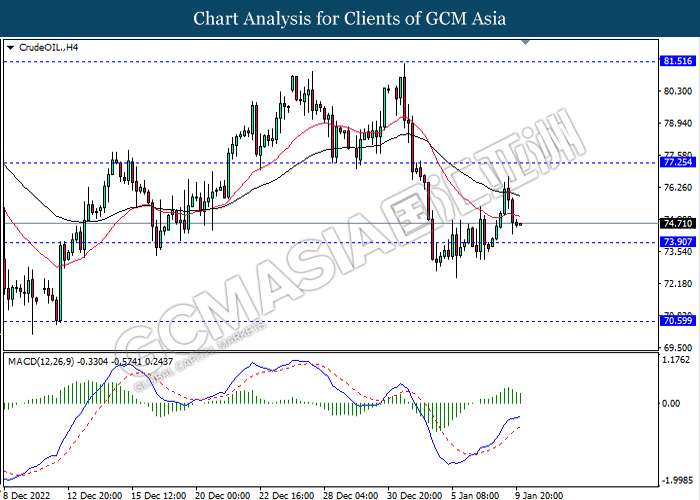

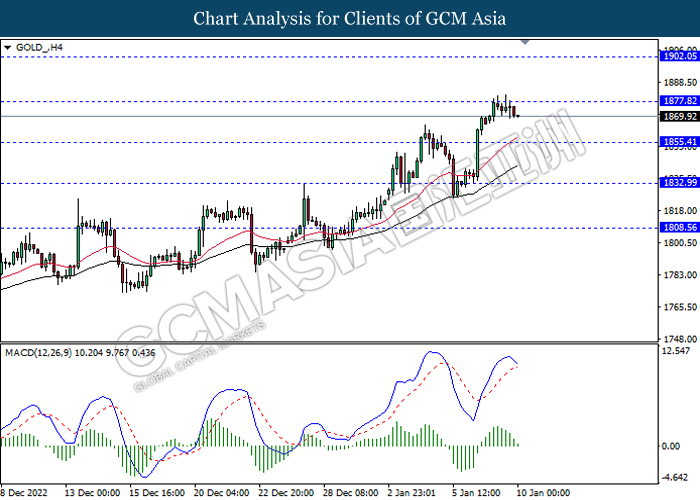

In the commodities market, the crude oil price dropped by 0.20% to $74.75 per barrel as of writing as the concern against global recession still disturbing market sentiment toward oil demand. On the other hand, the gold price edged down by 0.06% to $1870.76 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.20, 104.50

Support level: 102.05, 100.55

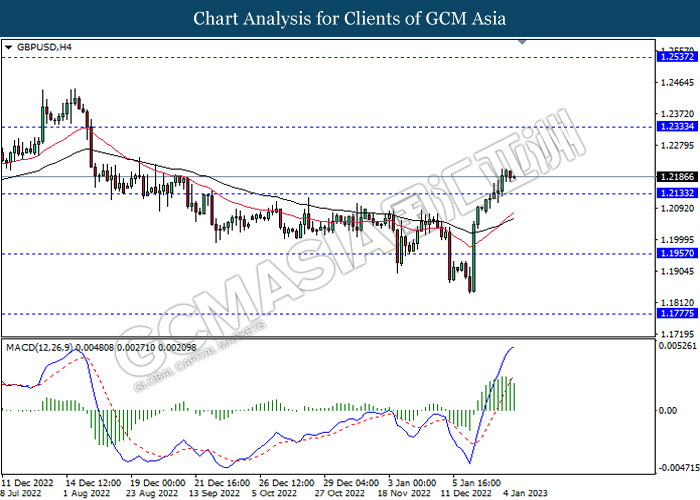

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

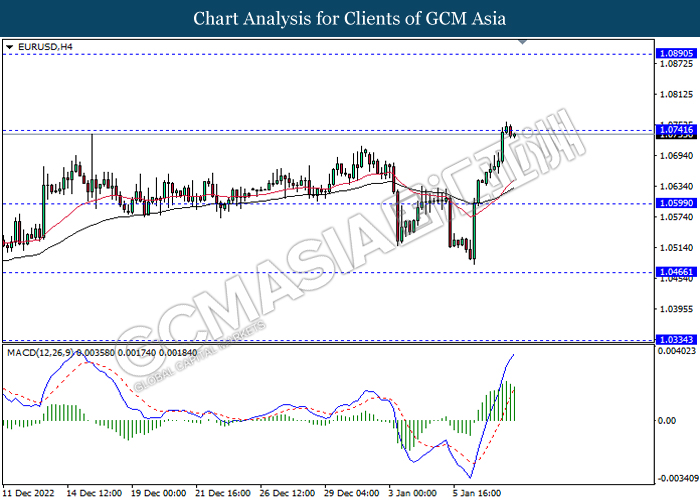

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

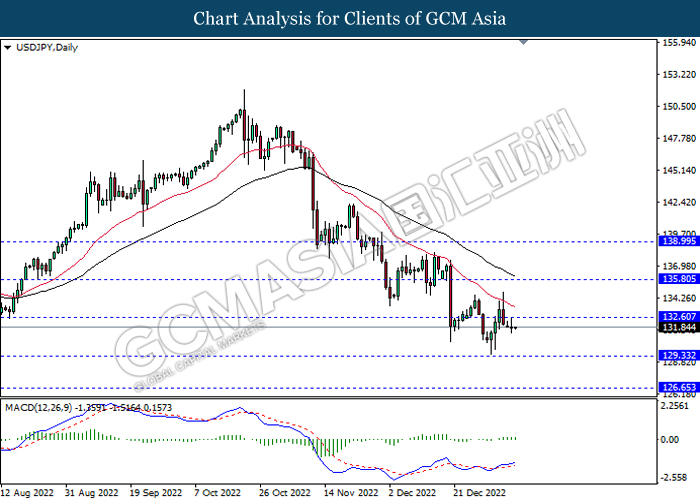

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

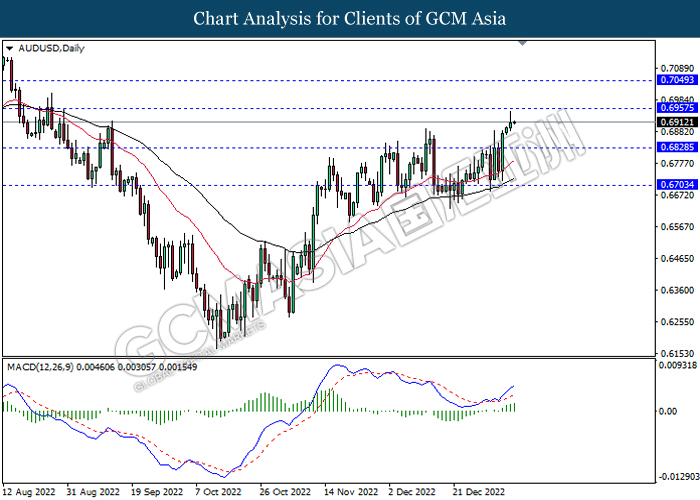

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

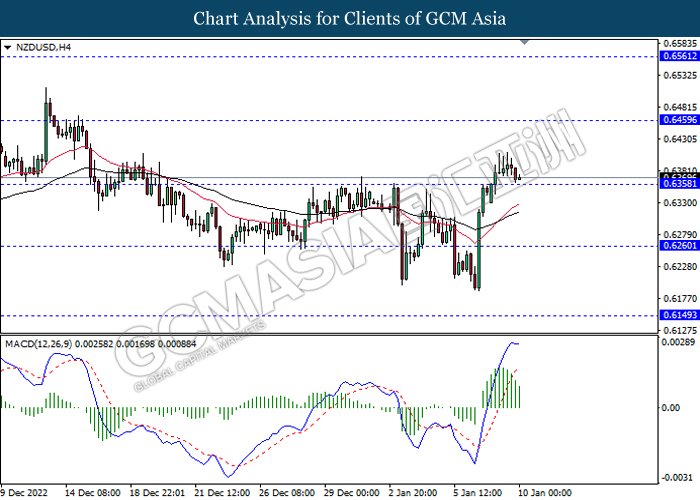

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

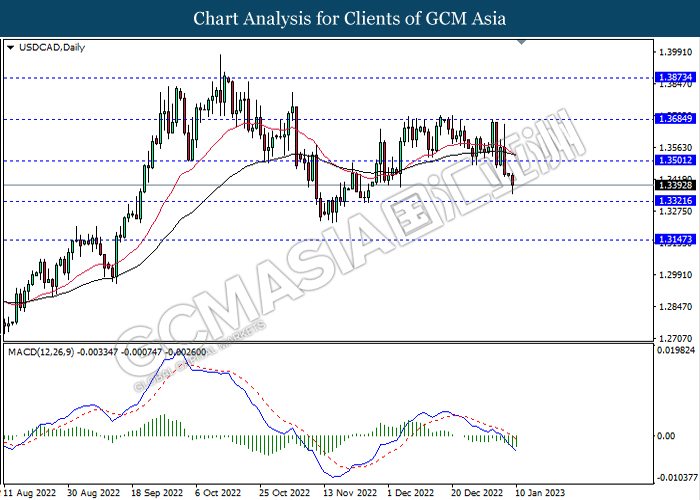

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

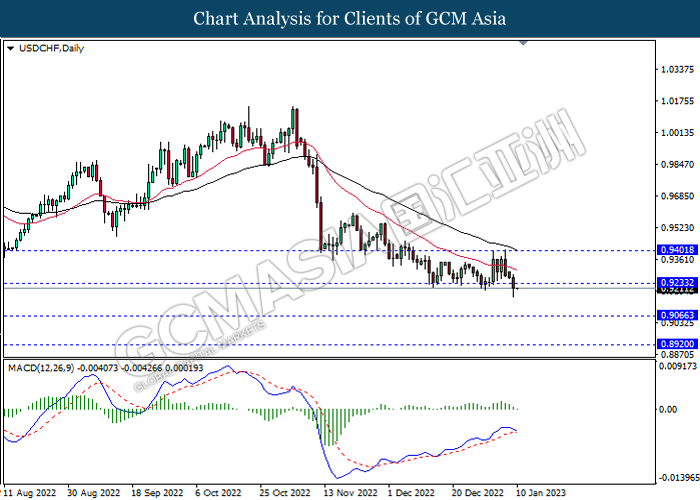

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from a higher price level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity extend its losses.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00