10 February 2022 Afternoon Session Analysis

Pound dived amid rising post-Brexit uncertainty.

The Pound Sterling slumped over the backdrop of rising political tensions between UK and Europe, which spurring negative prospect toward the economic momentum. According to CNBC, UK Prime Minister Boris Johnson told the EU that UK is ready and willing to unilaterally tear up post-Brexit borders rules in Northern Ireland unless both parties achieved consensus on talk. If EU still failed to compromise with UK, they will likely to trigger Article 16. Triggering Article 16 of the protocol would mean the UK deciding on its own to suspend border checks and increase the tariff for the European region. The UK and EU remain locked in talks amid they try to agree solution to smooth the operation of the protocol but a breakthrough remains elusive. As of writing, GBP/USD appreciated by 0.01% to 1.3535.

In the commodities market, the crude oil price dived 0.44% to $89.85 per barrel as of writing. The crude oil price extends its losses amid investors are closely speculating the outcome of US-Iran nuclear talks which resumed this week. A deal could lift US sanction on Iranian oil and increase the global oil supply. On the other hand, the gold price appreciated by 0.06% to $1834.40 per troy ounces as of writing amid rising inflation risk continue to increase the appeal for this safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 238K | 228K | – |

Technical Analysis

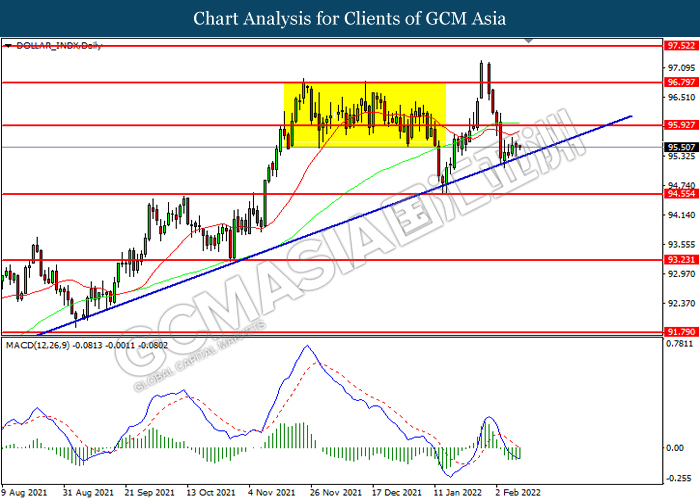

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

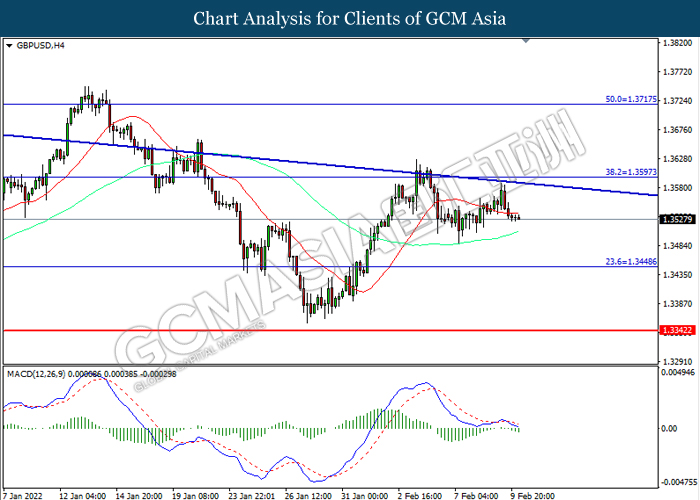

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

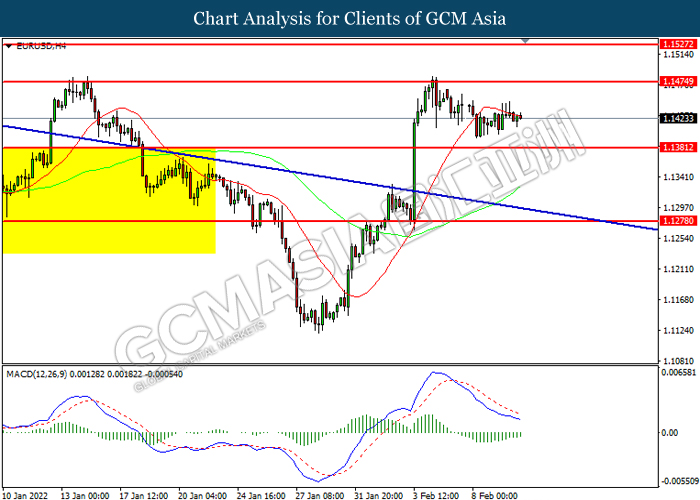

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.65. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.65, 116.25

Support level: 113.65, 112.85

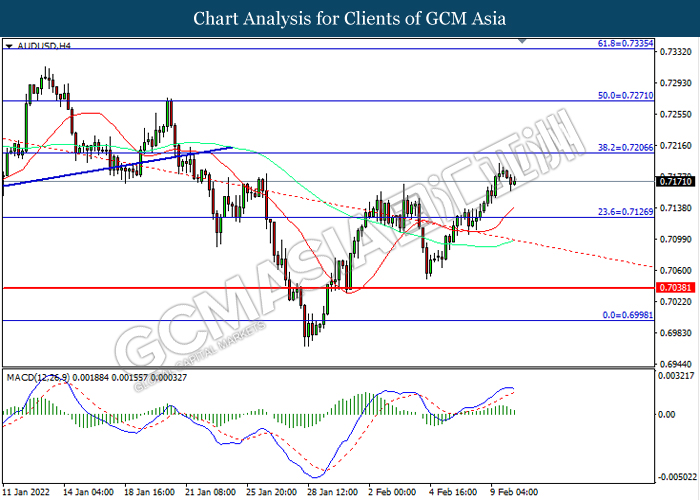

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7125. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7040

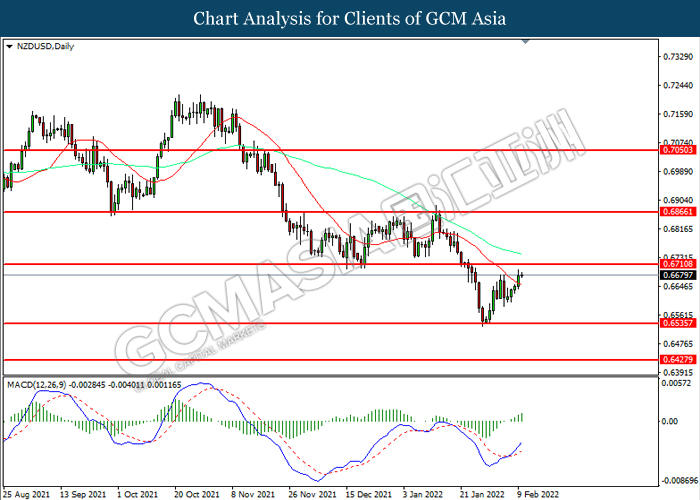

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

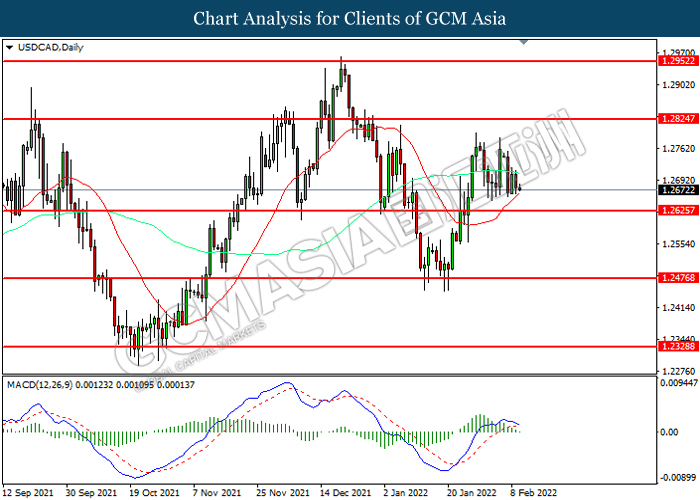

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

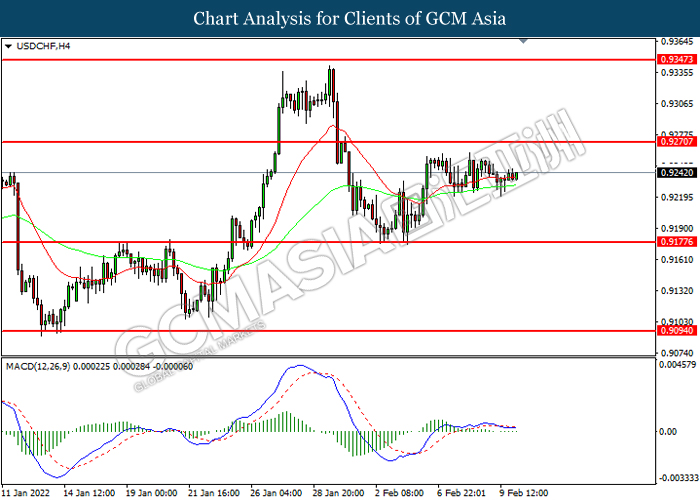

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

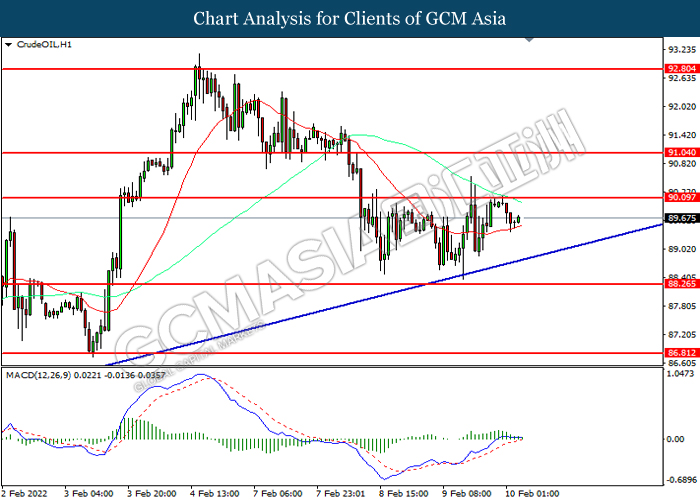

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 90.10. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 88.25.

Resistance level: 90.10, 91.05

Support level: 88.25, 86.80

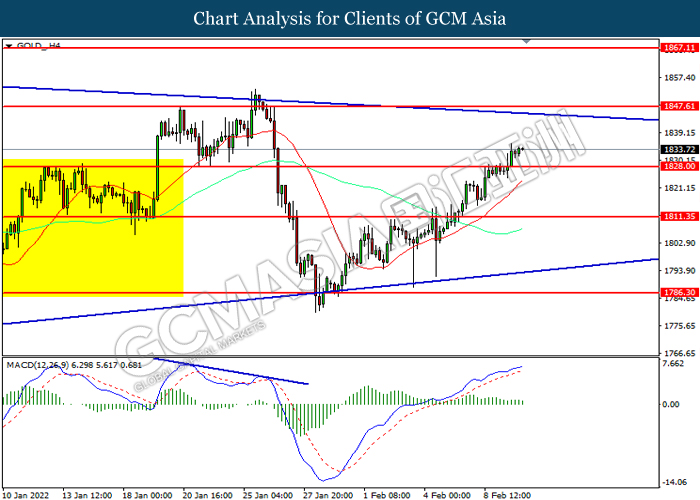

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1828.00. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1847.60, 1867.10

Support level: 1828.00, 1811.35