10 February 2022 Morning Session Analysis

CPI bounds to shake up greenback.

Greenback remains traded within a tight range as market participants waits for the release of Consumer Price Index data due later tonight. On yesterday, Washington has released a forecast report for inflation which has been presented during a live seminar. According to Economic Advisor Brian Deese, they expect inflationary pressure in the US to trend higher over mid-term with tomorrow’s data showing a higher year-over-year reading. The expectation was given based on rising service prices and wage growth that broadens current inflationary rate while high commodity prices such as crude oil will contribute to its rise for the near future. The forecast given on yesterday has sparked optimism among market participants, spurring higher demand for the US dollar prior to the release of the data. As of writing, dollar index was up 0.01% to 95.50.

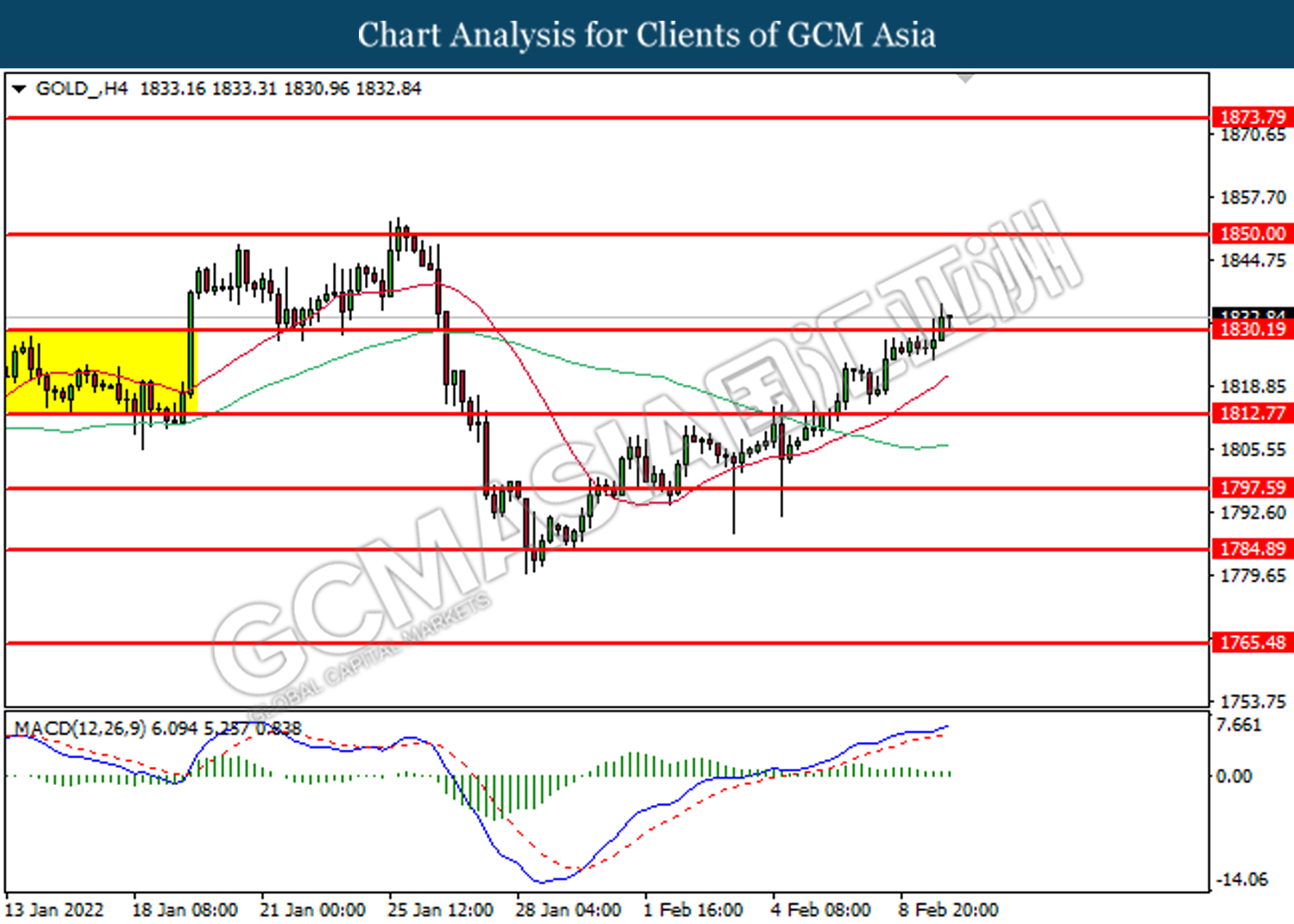

In the commodities market, crude oil price was up 0.02% to $89.97 per barrel over the backdrop of a draw in US crude oil inventories for last week. On the other hand, gold price was up 0.01% to $1,832.66 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 238K | 228K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

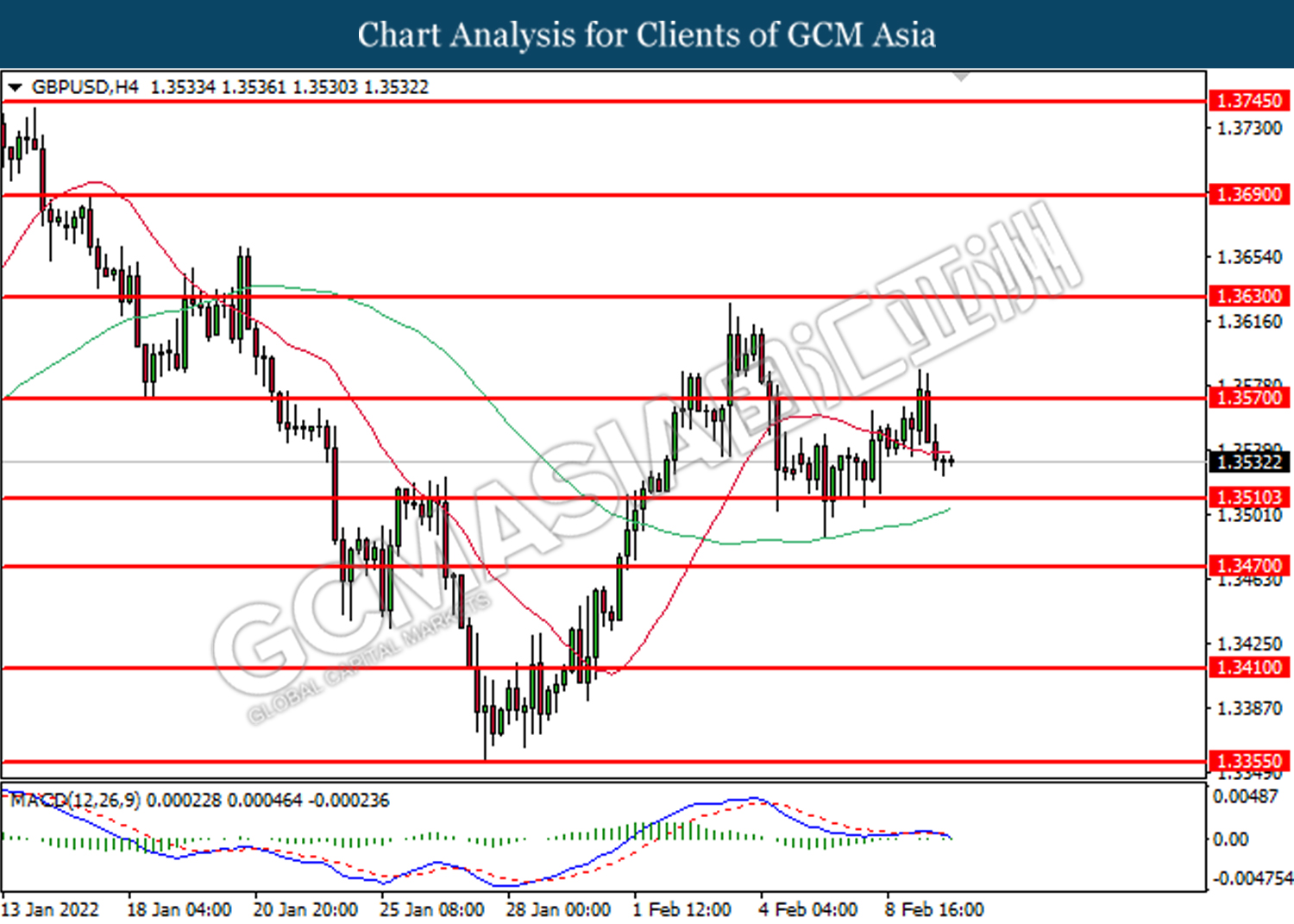

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

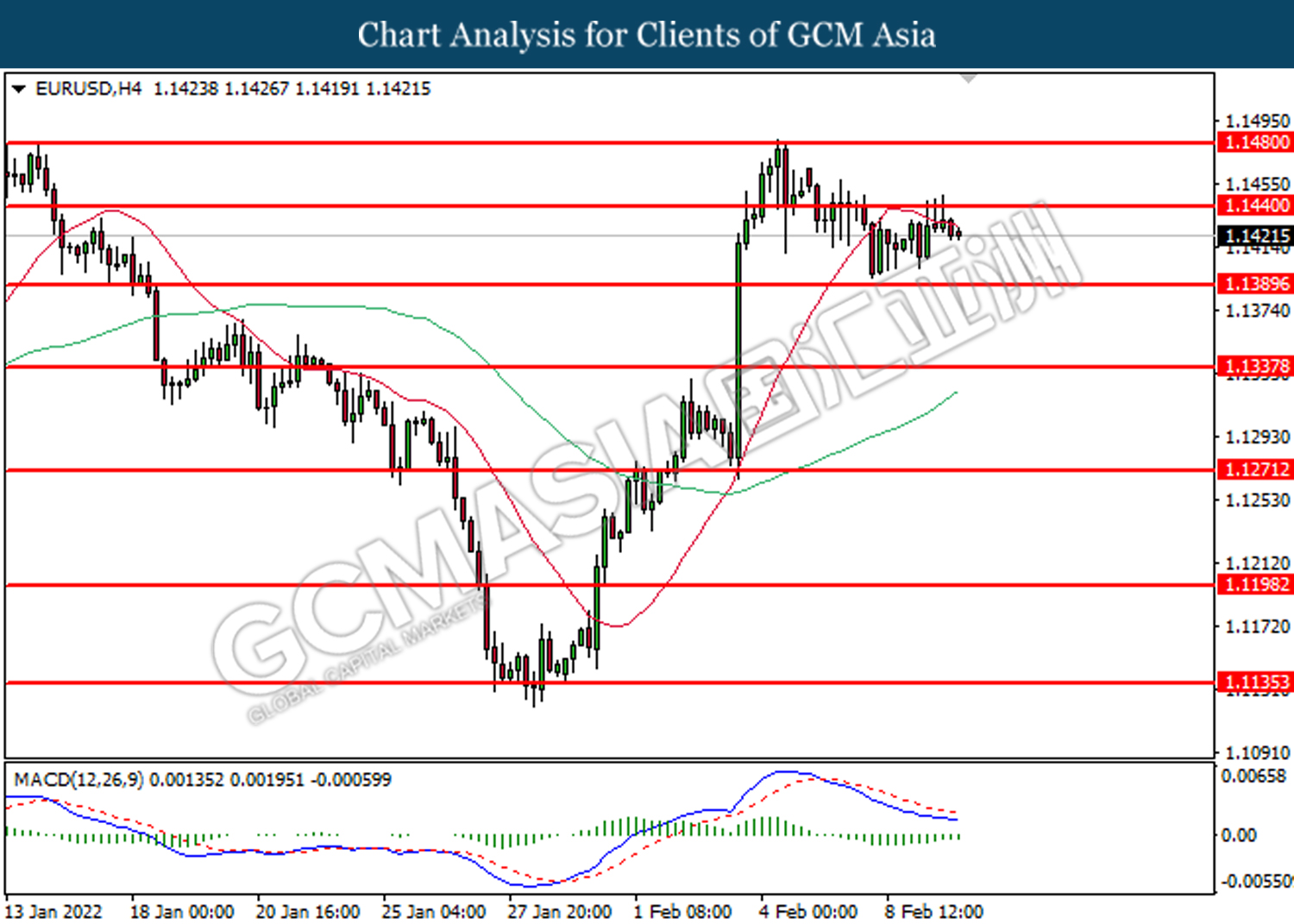

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1440, 1.1480

Support level: 1.1390, 1.1340

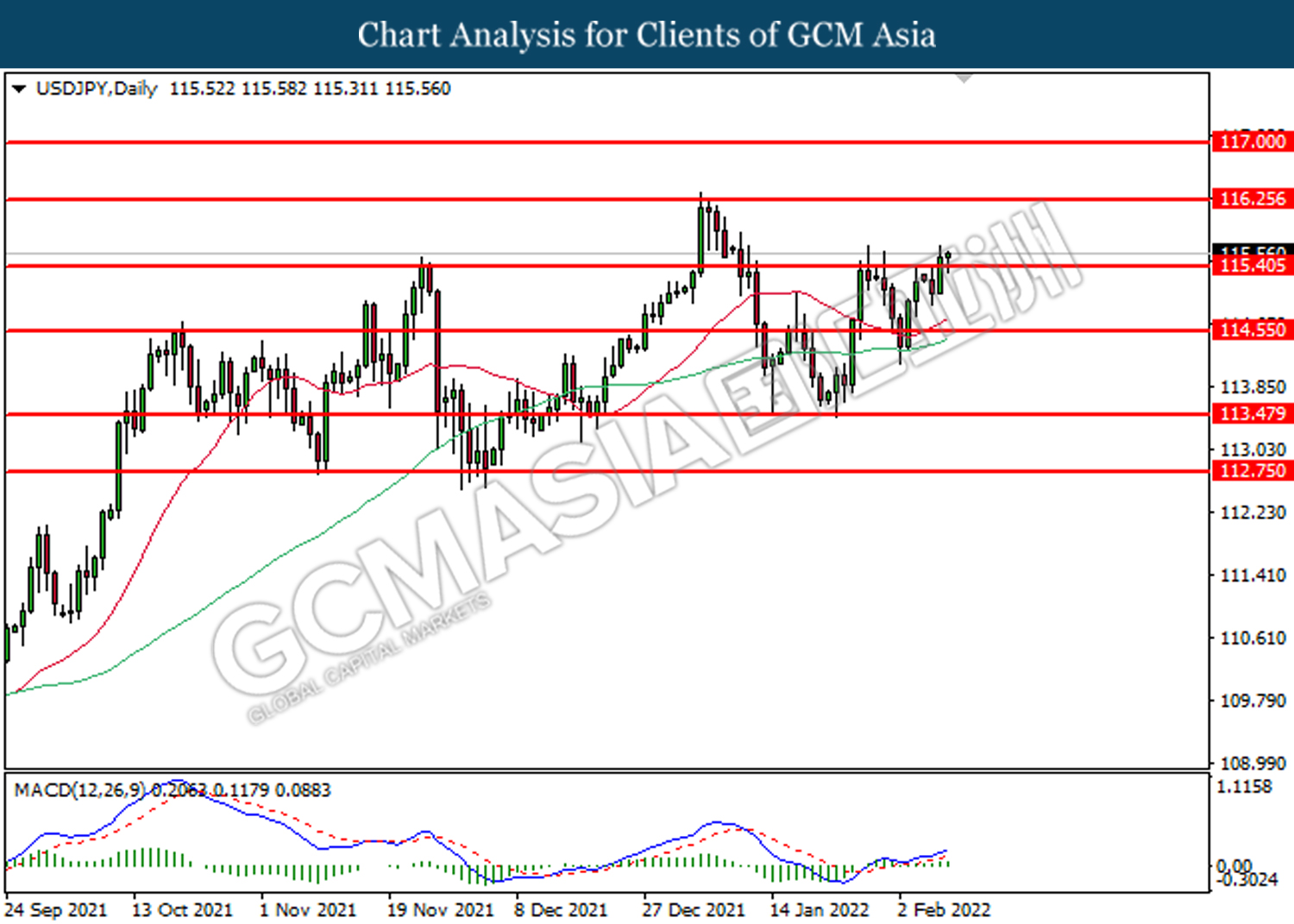

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

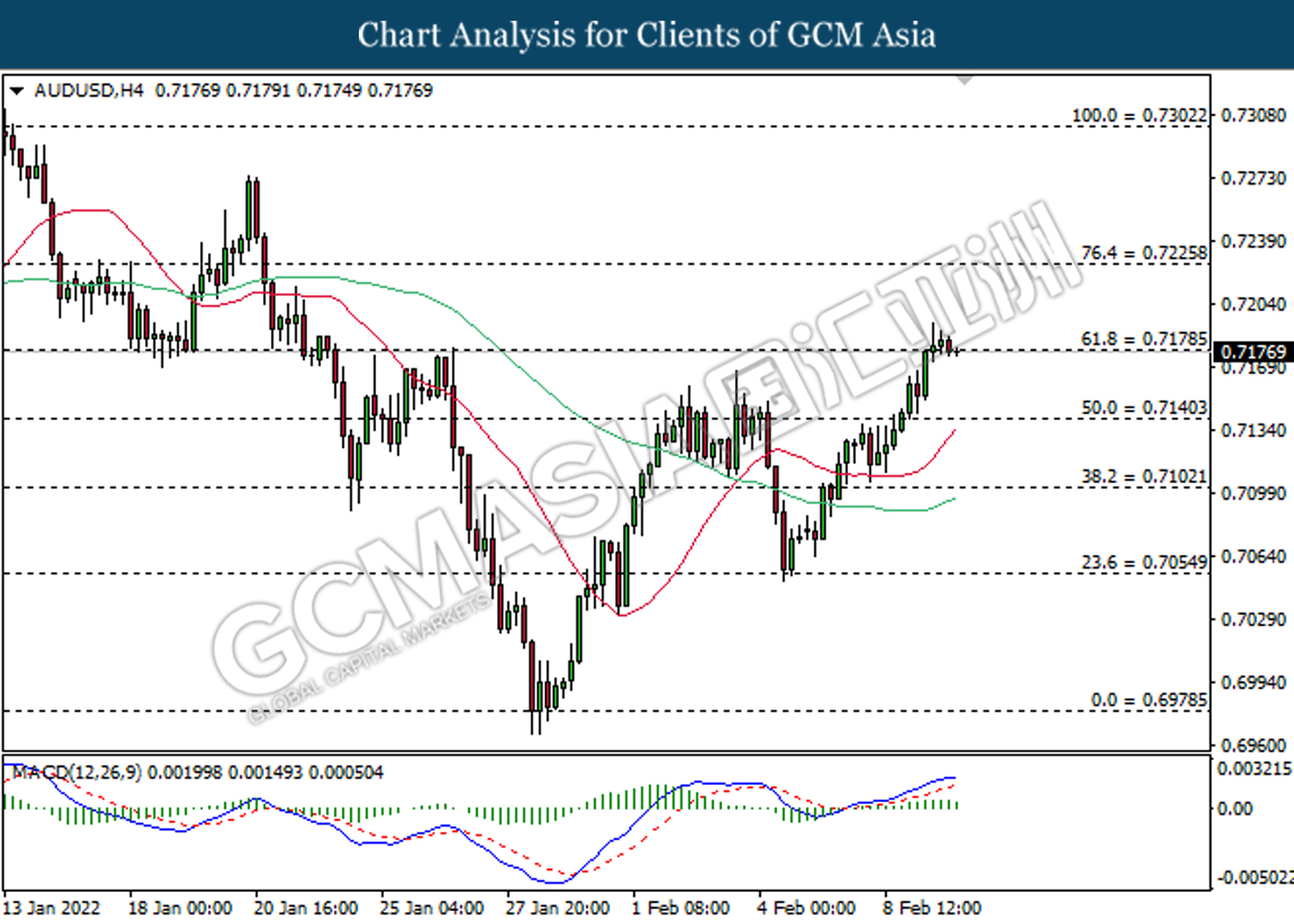

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

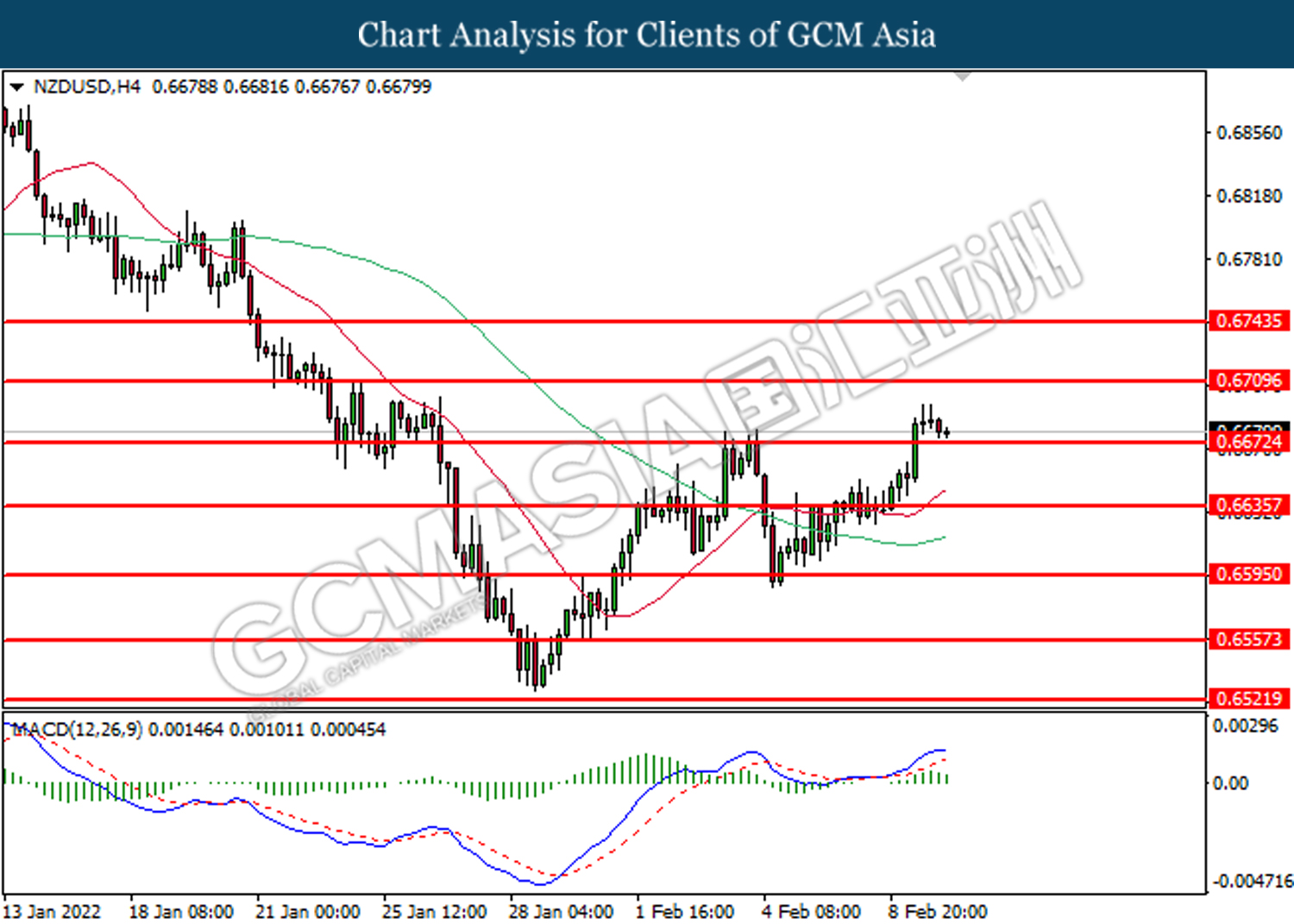

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

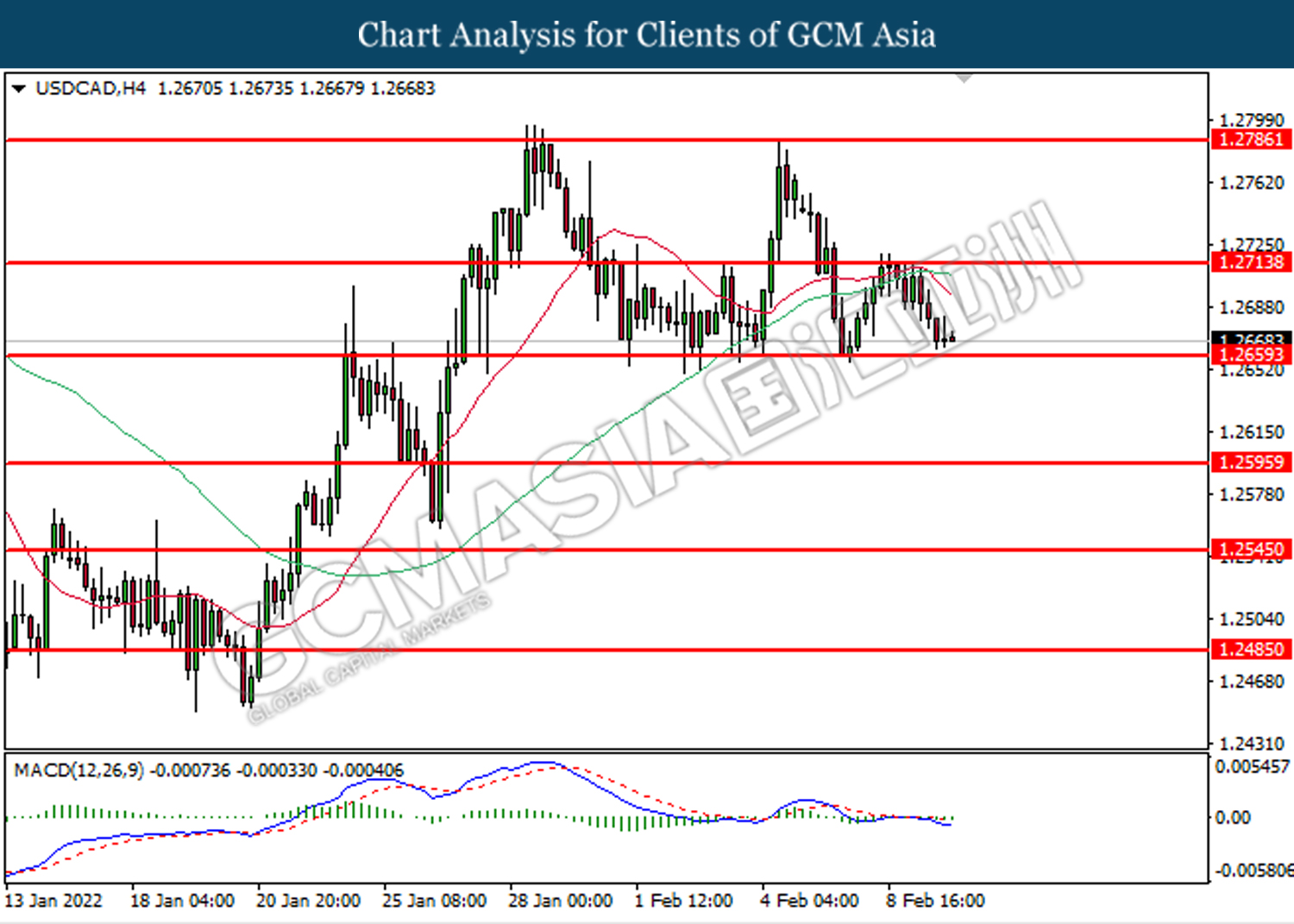

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2595

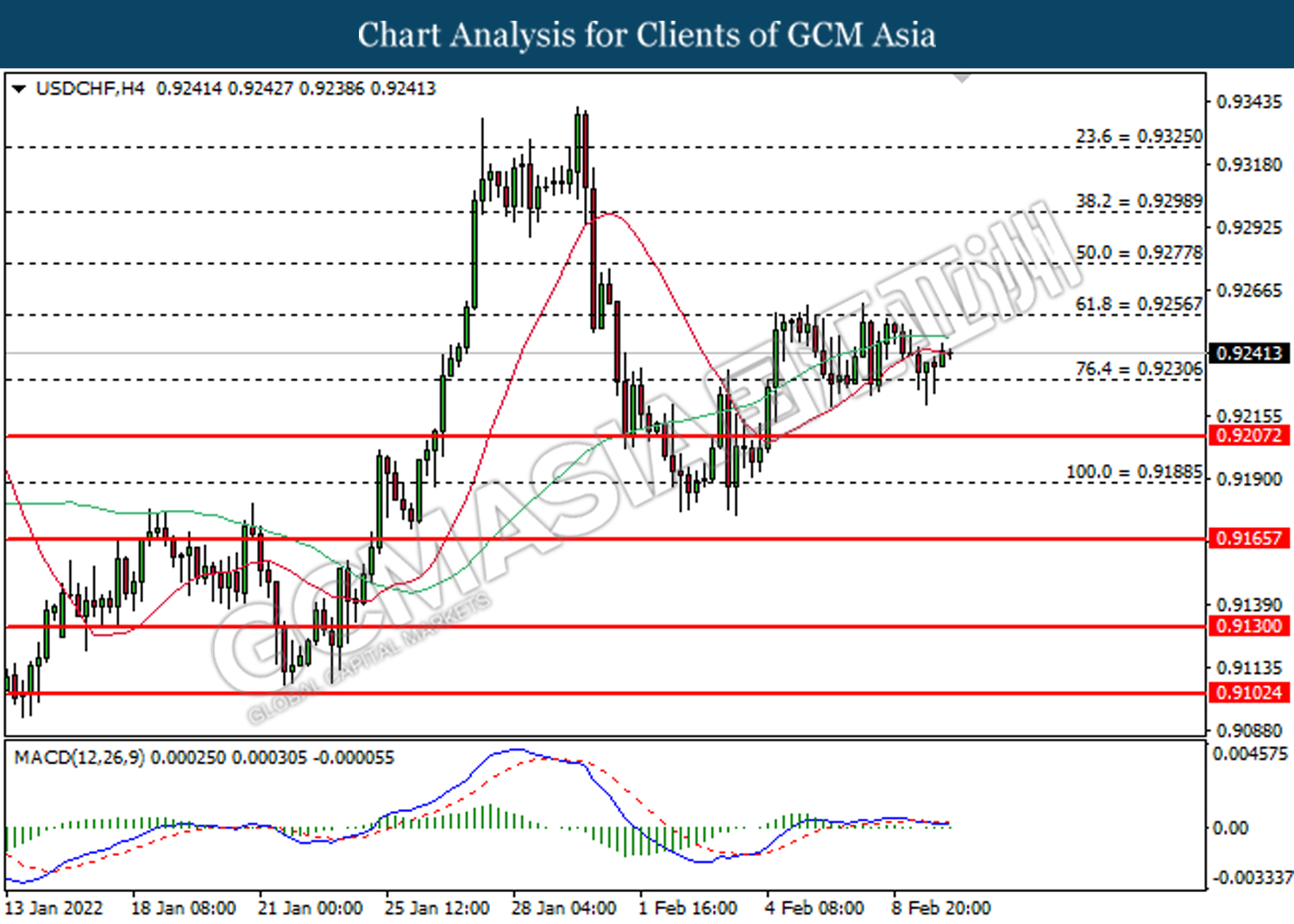

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80