10 February 2023 Afternoon Session Analysis

Pound slipped after Andrew Bailey’s speech.

The Pound Sterling, one of the most traded currencies by global investors, reversed from its upward trend after the governor of the Bank of England Andrew Bailey speech. Following a series of rate hikes since last year, Bailey told the members of parliament that the inflation rate of the UK is forecasted to drop sharply this year. The central bank has predicted that the inflation rate will drop from 10.5% to 4% by the end of 2023. Thus, investors increased their expectation that the upcoming UK monetary policy rate decision will be more dovish. According to a prior statement from IMF, the UK economy will enter into contraction by -0.6% in 2023, this has also led to investors expecting a more dovish stance from BoE. At this juncture, investors are waiting for more cues from the upcoming GDP report, which will be released later today. The UK yearly GDP reading is expected to have a growth of 0.4%, which is lower than the previous reading of 1.9%. As of writing, GBPUSD slipped -0.21% to $1.2096.

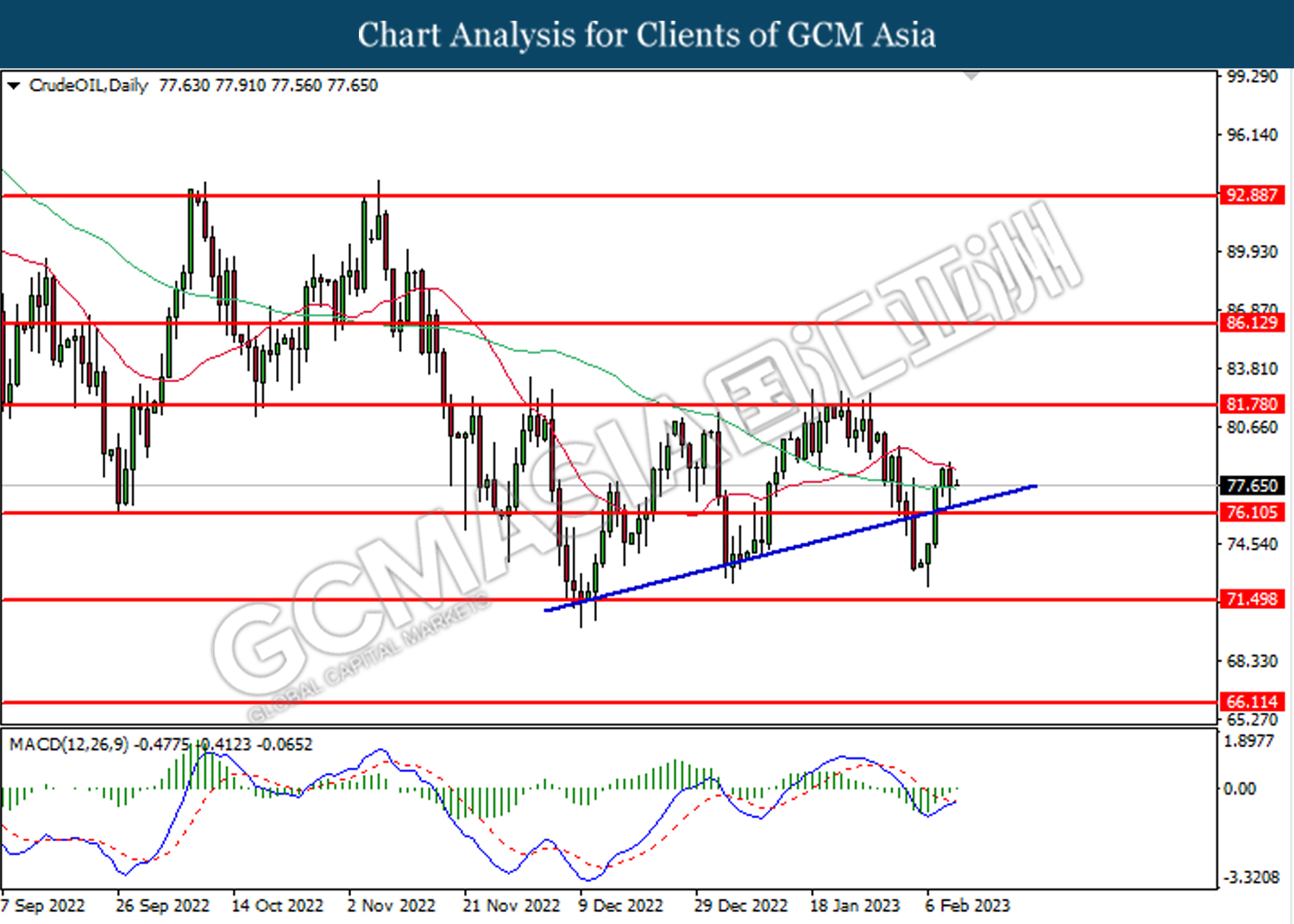

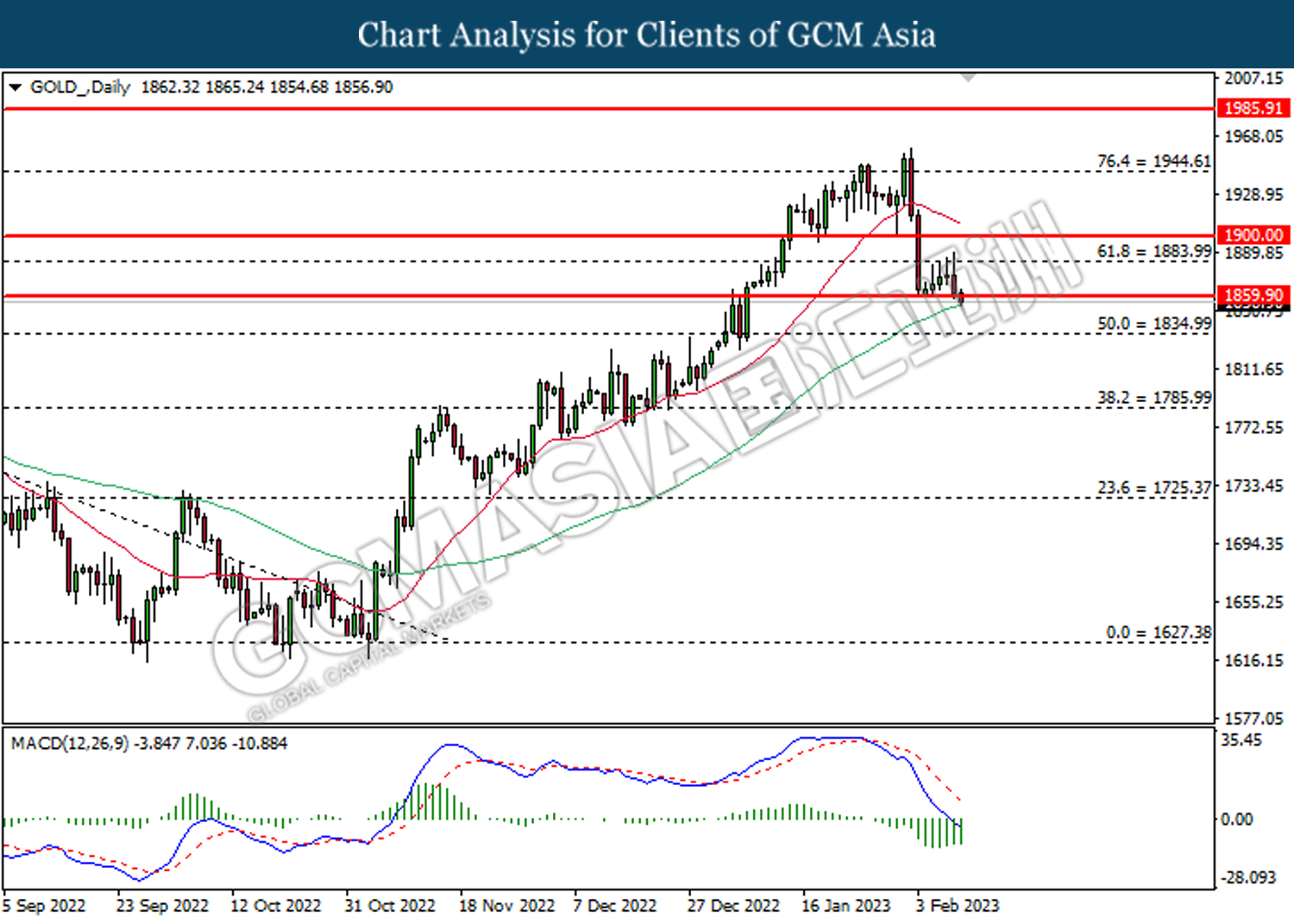

In the commodity market, the crude oil price edged down by -0.44% to $77.72 per barrel following the strengthening position of the dollar index. In addition, the gold price slipped by -0.50% to $1869.25 per troy ounce as the markets reassessed their expectations with more interest rate hikes from the Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15;00 | GBP – GDP (YoY) (Q4) | 1.9% | 0.4% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Dec) | -0.5% | -0.2% | – |

| 21:30 | CAD – Employment Change (Jan) | 104.0K | 17.3K | – |

| 23:00 | USD – Michigan Consumer Sentiment (Feb) | 64.9 | 64.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

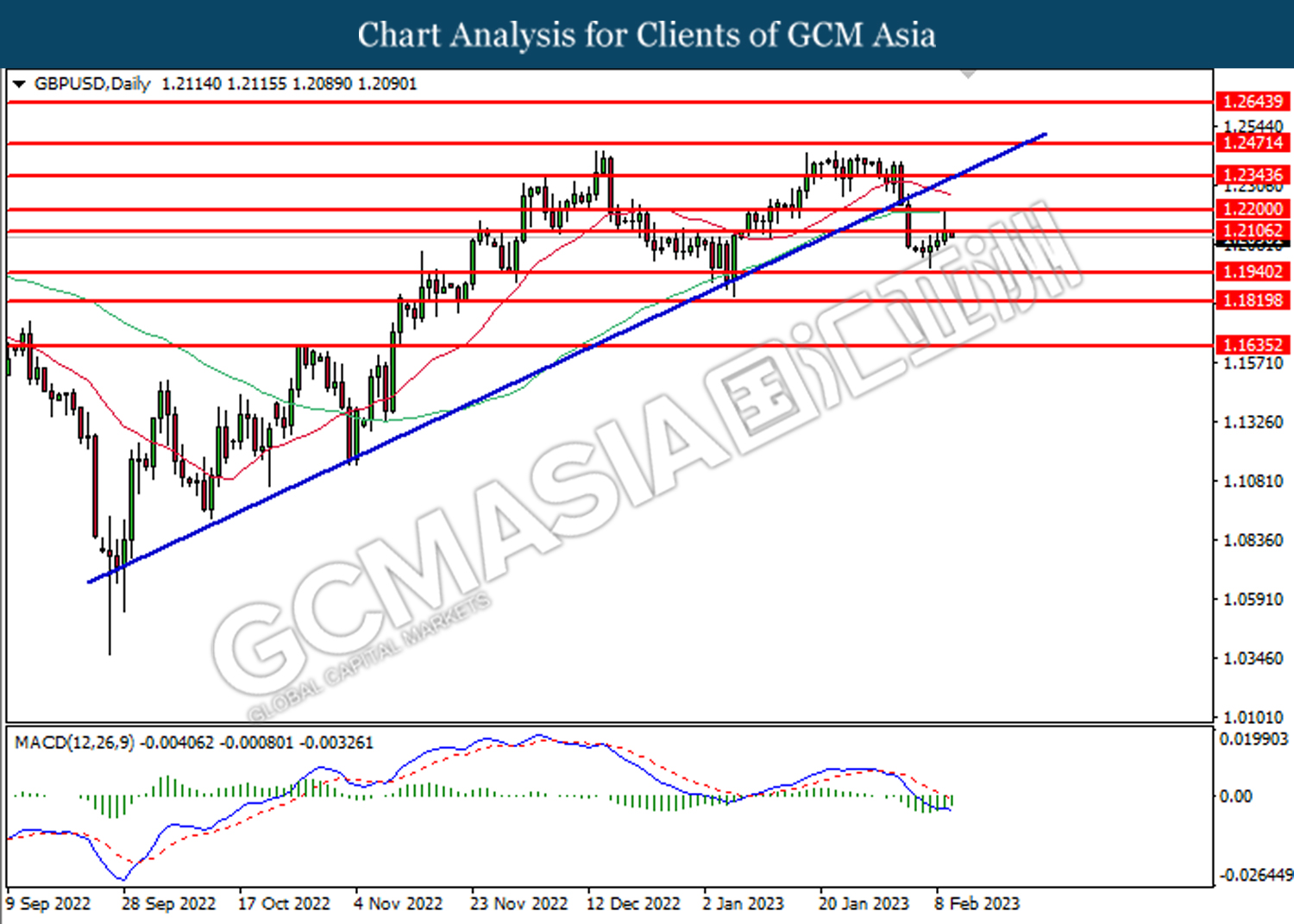

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

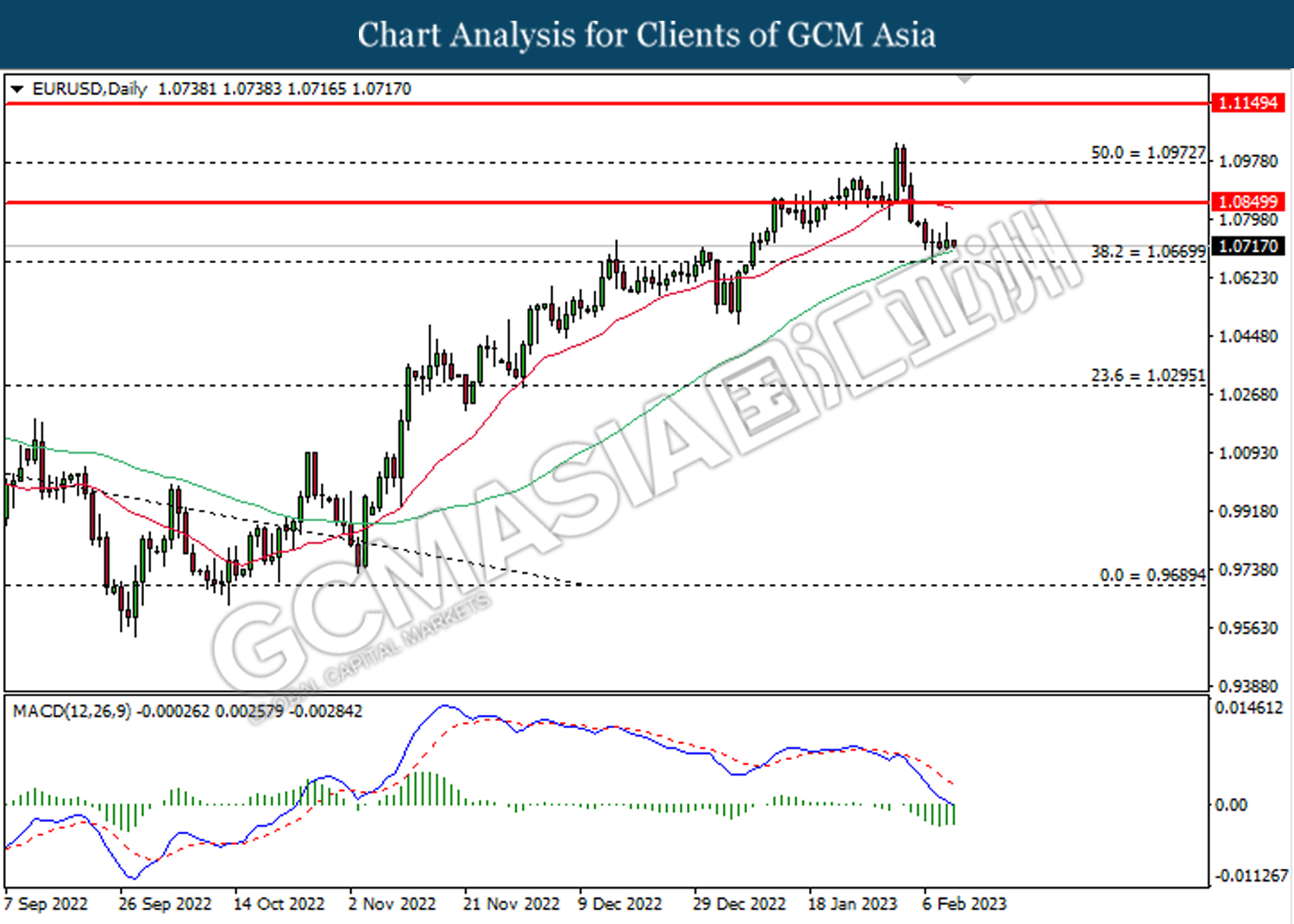

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

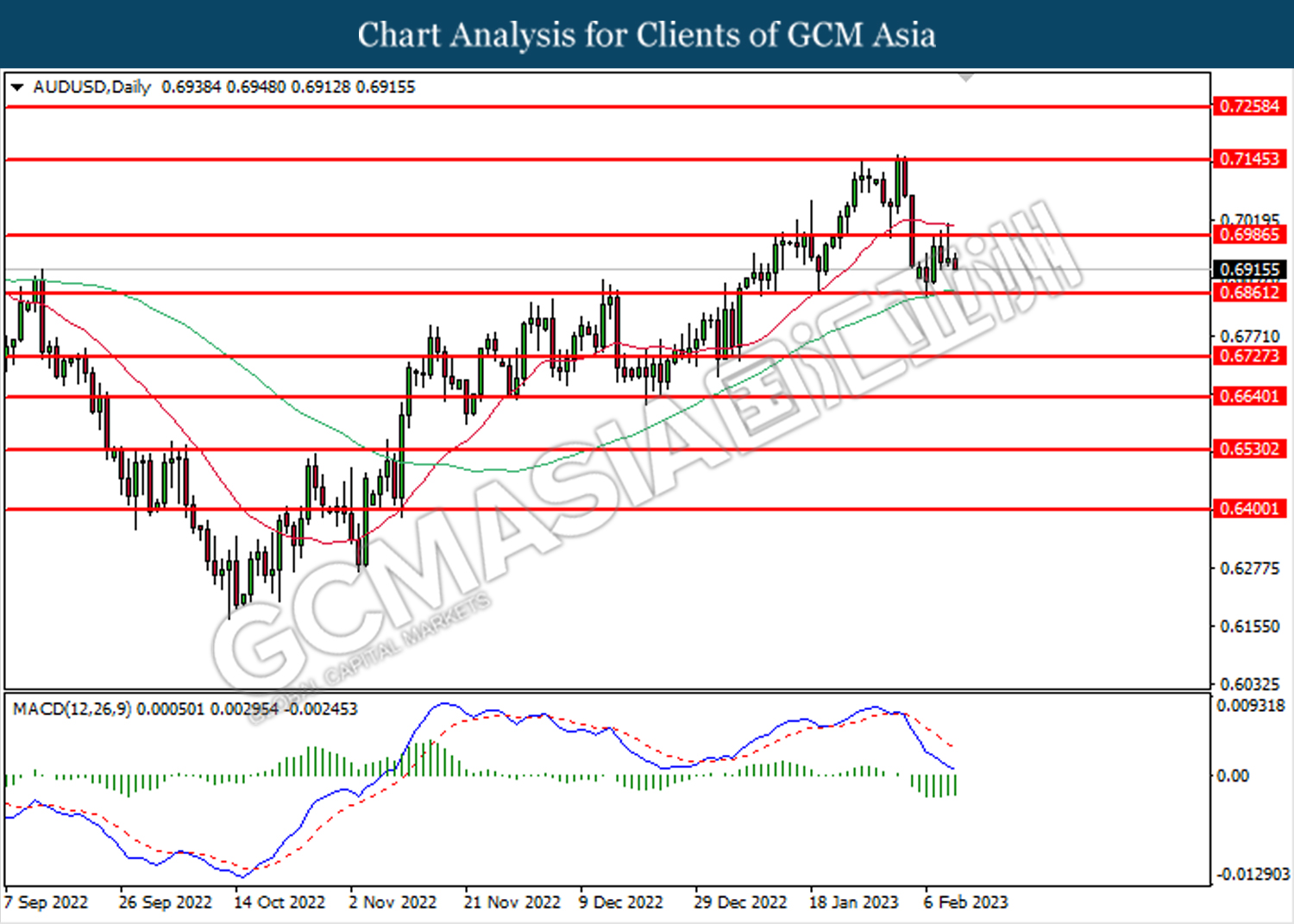

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

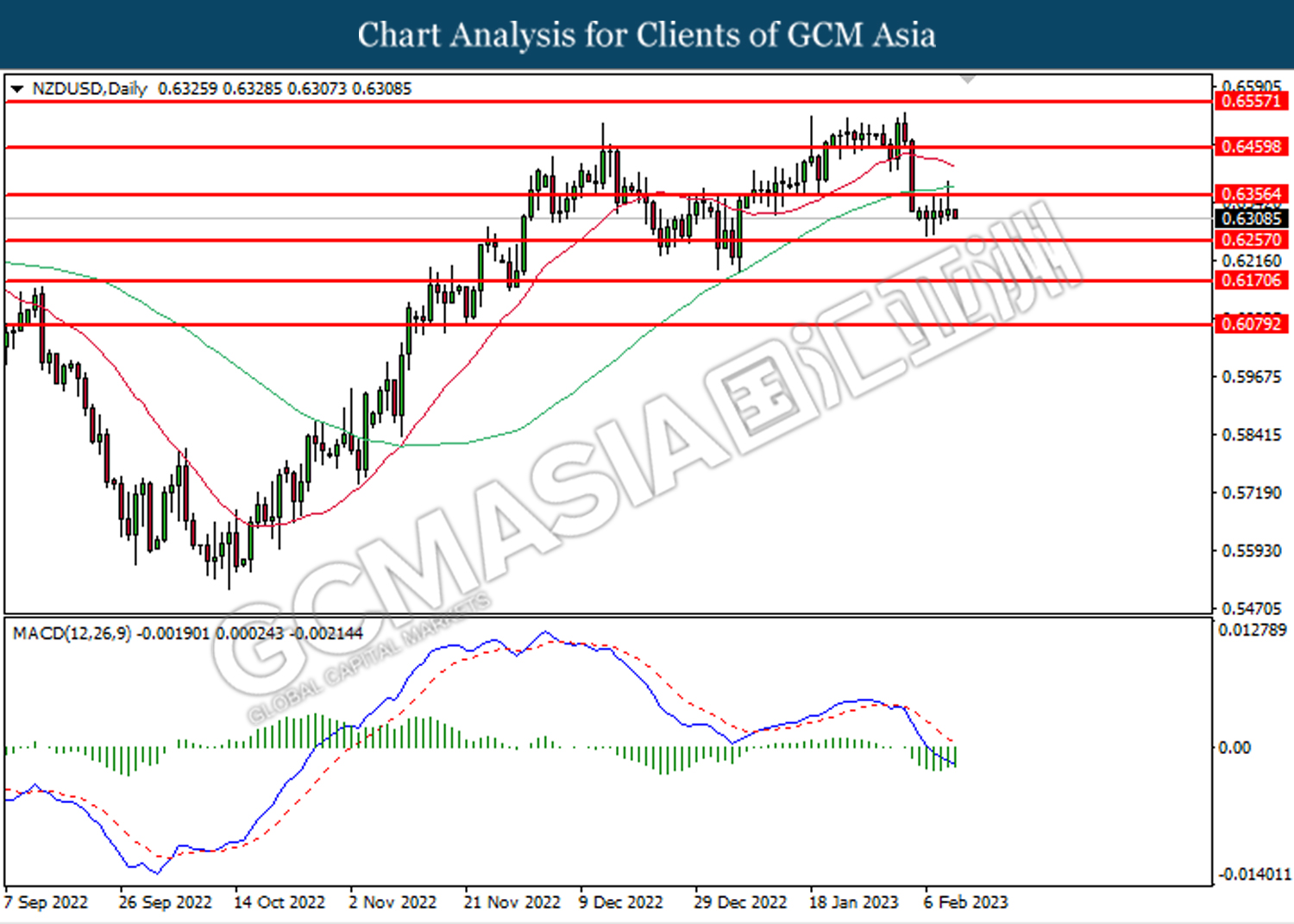

NZDUSD, Daily: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

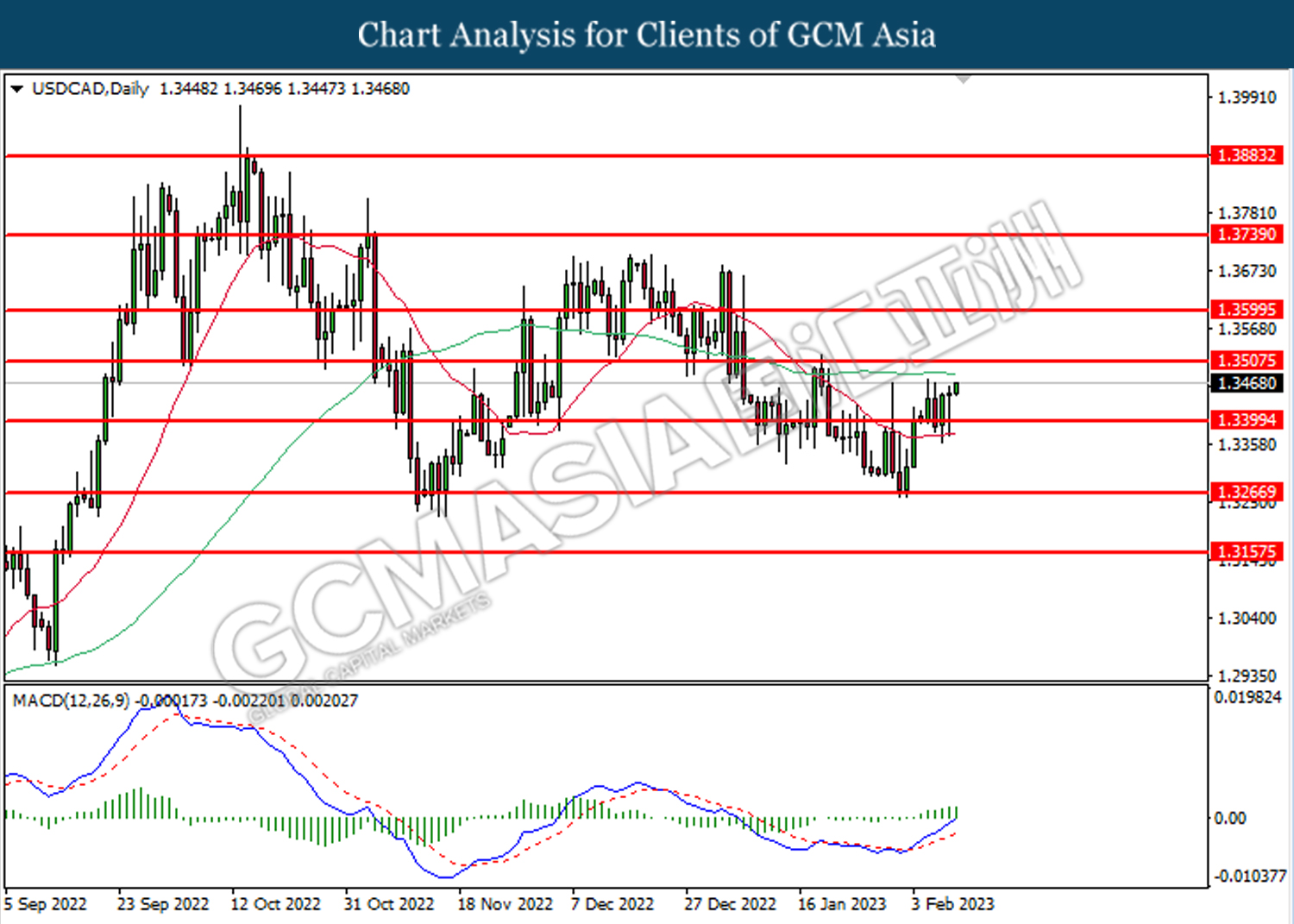

USDCAD, Daily: USDCAD was traded higher following a prior rebound from the support level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

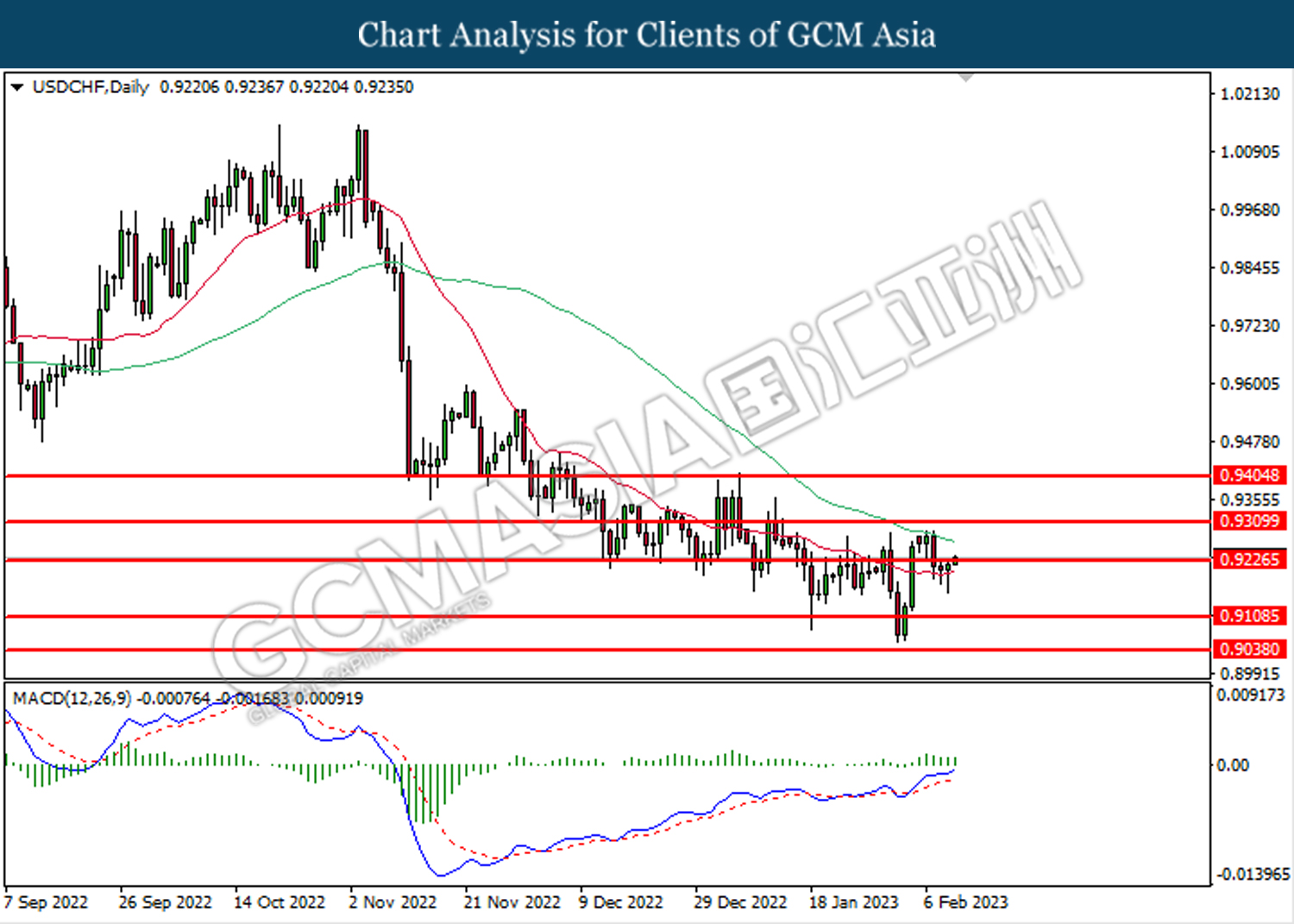

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00