10 February 2023 Morning Session Analysis

US Dollar plunged following labor market weakened.

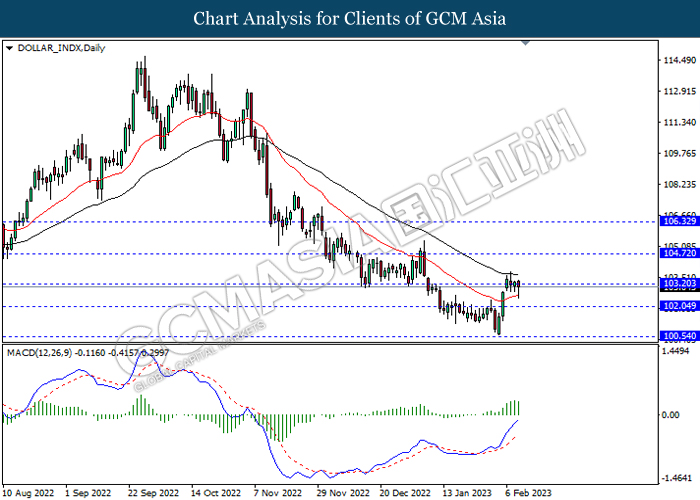

The Dollar Index which traded against a basket of six major currencies recorded some losses on yesterday following the downbeat economic data has been released. According to the US Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 183K to 196K, exceeding the consensus forecast of 190K. With the rising of data figures, it mean the current labor market in the US was turning fragile, as well as bringing negative prospects toward economic progression in the US. On the other hand, the value of US Dollar was hit by the speech of Fed’s member upon a slowing economy in the US. Richmond Fed President Thomas Barkin claimed on Thursday that the contractionary monetary which implemented by Fed was curbing the US economy, whereas allowing Fed to reexamine the rate hike moves in the future path. Nonetheless, the losses of Dollar Index was limited following the expectation of sharp fall in UK inflation from Bank of England Governor Andrew Bailey. As of writing, the Dollar Index dropped by 0.17% to 103.09.

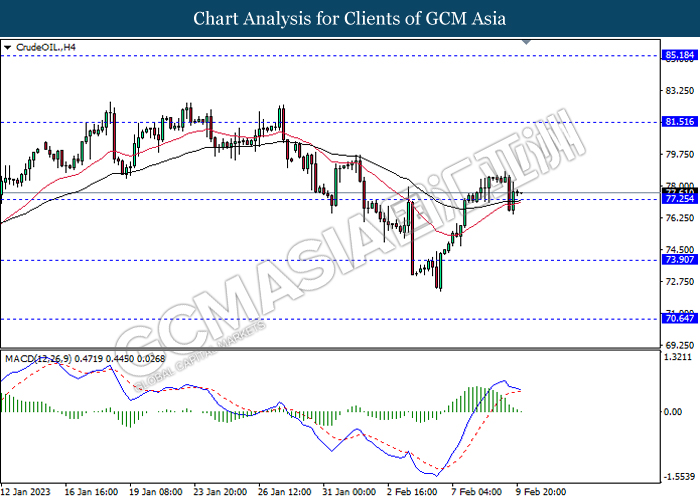

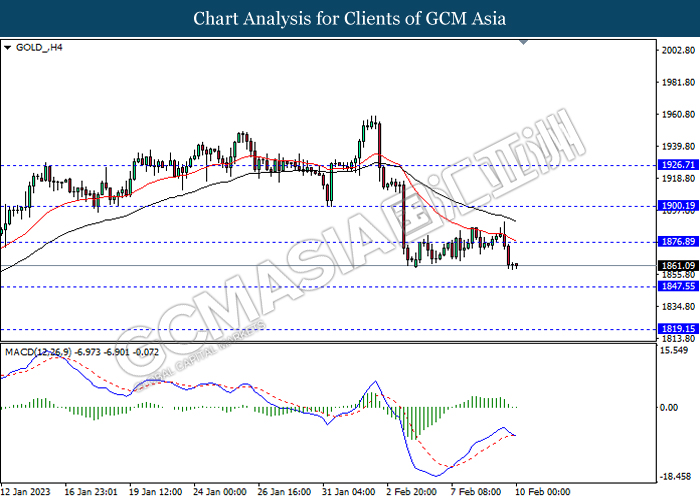

In the commodity market, the crude oil price edged up by 0.01% to $77.67 per barrel as of writing following the market optimism against China reopening keep hovering in the market. In addition, the gold price rose by 0.01% to $1862.32 per troy ounce as of writing over the weakening of US Dollar during Asia morning trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (QoQ) (Q4) | 1.9% | 0.4% | – |

| 15:00 | GBP – Manufacturing Production (MoM) | -0.5% | -0.2% | – |

| 21:30 | CAD – Employment Change (Jan) | 104.0K | 17.3K | – |

| 23:00 | USD – Michigan Consumer Sentiment (Feb) | 64.9 | 64.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.55

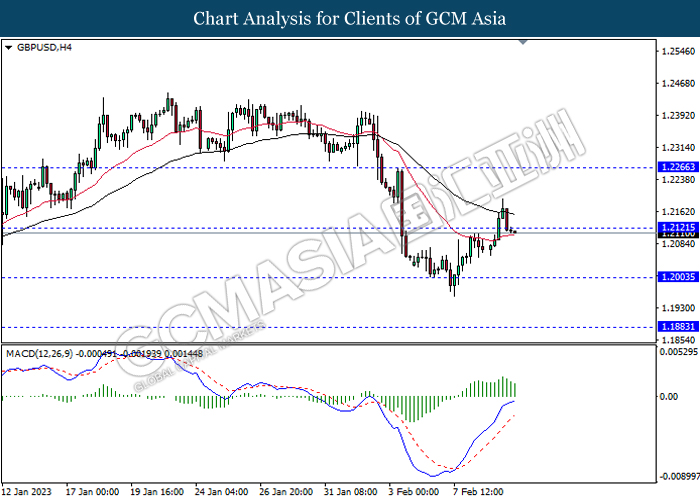

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

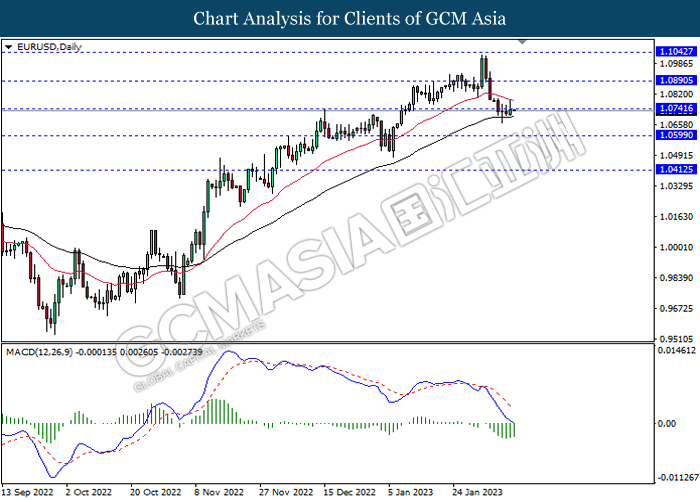

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

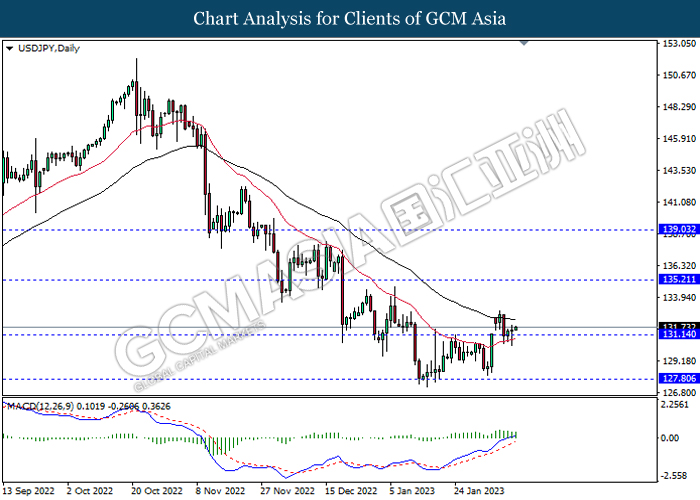

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

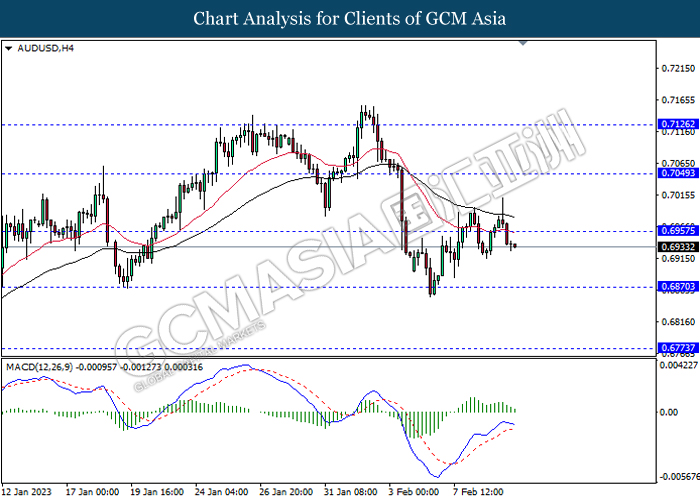

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

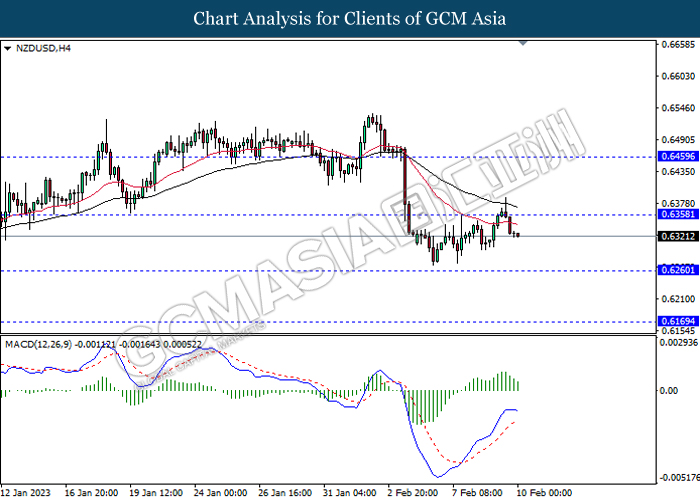

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

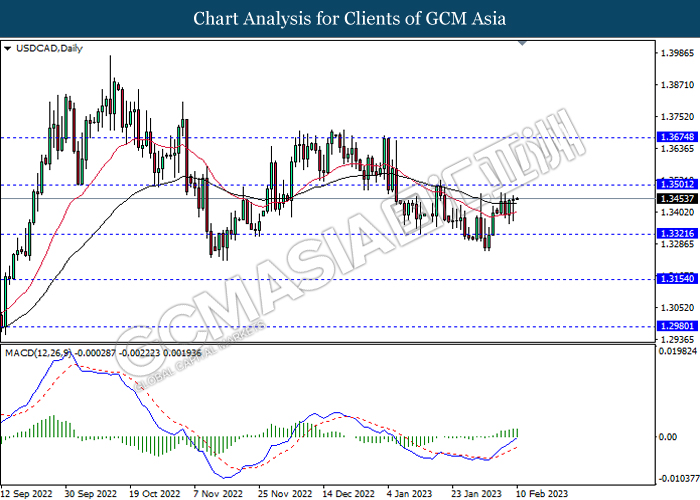

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

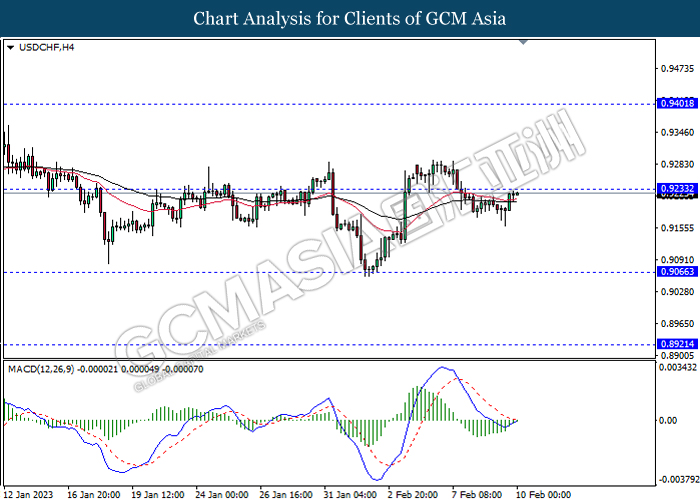

USDCHF, H4: USDCHF was traded higher while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15