10 March 2022 Afternoon Session Analysis

Euro jumped, commodities price beaten down from recent high.

The Euro started rebounding since its recent low, while commodities product are easing from its recent high. Oil prices retreated on Thursday after the United Arab Emirates said it is committed to major producers’ pact to add 400,000 barrels per day of supply monthly, hours after UAE’s ambassador to Washington said his country favored a bigger increase. Euro is benefited amid the backdrop of increasing supply of crude oil, led to easing of oil price and reducing the cost of importing crude oil. It spurred the market optimism toward European economy, prompting market participants to buy Euro. On the other hand, the European Central Bank would likely to make few policy commitments on Thursday in order to offset the impact of Russia’s invasion of Ukraine while combating with inflation rate. Investor should continue to focus the latest updates of European Central Bank’s announcement to gauge the likelihood movement of Euro. As of writing, Euro edged down by 0.18% to 1.1054.

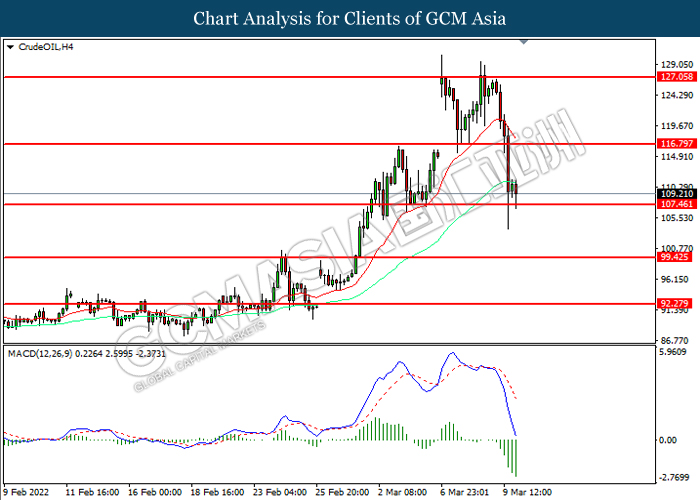

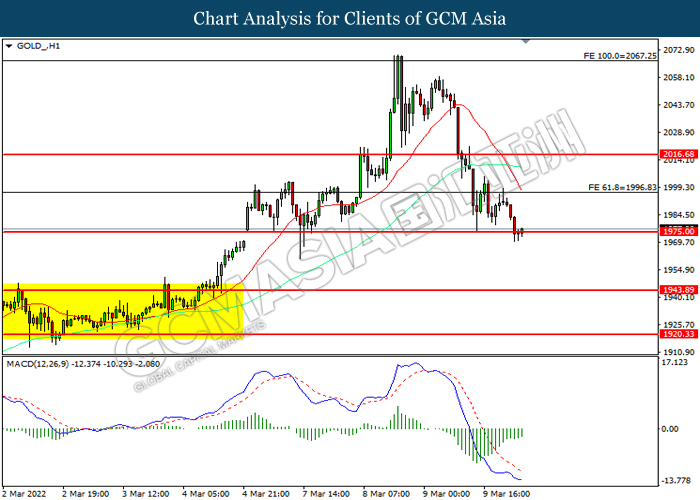

In the commodities market, the crude oil price has slumped by 0.49% to $109.13 per barrel as of writing following UAE committed to add 400,000 barrels of oil per day of supply monthly. Besides, gold price dumped by 0.72% to $1976.88 per ounce amid market optimism toward risk-appetite products following the easing tensions of Russia-Ukraine conflict.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

20:45 EUR ECB Monetary Policy Statement

20:45 EUR ECB Interest Rate Decision (Mar)

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Feb) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 215K | 216K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

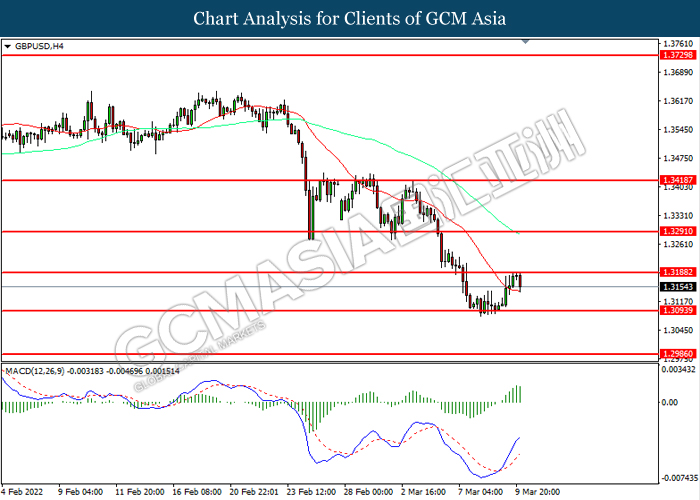

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3190. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

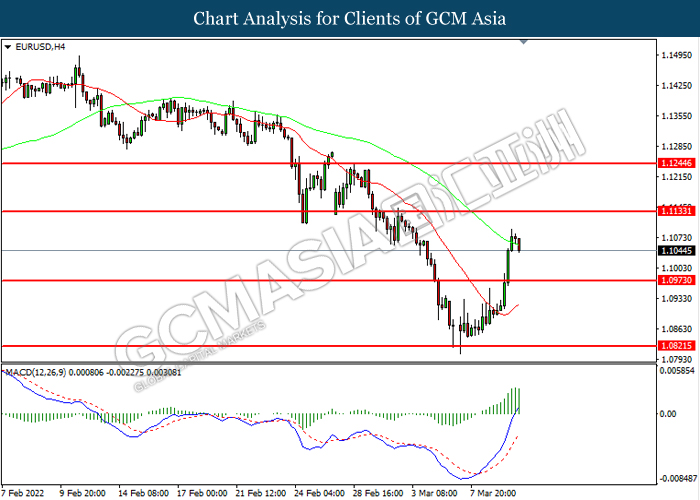

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0975. MACD which illustrated increasing bullish momentum suggest the pair to extend its gain.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 116.25, 117.50

Support level: 114.60, 113.65

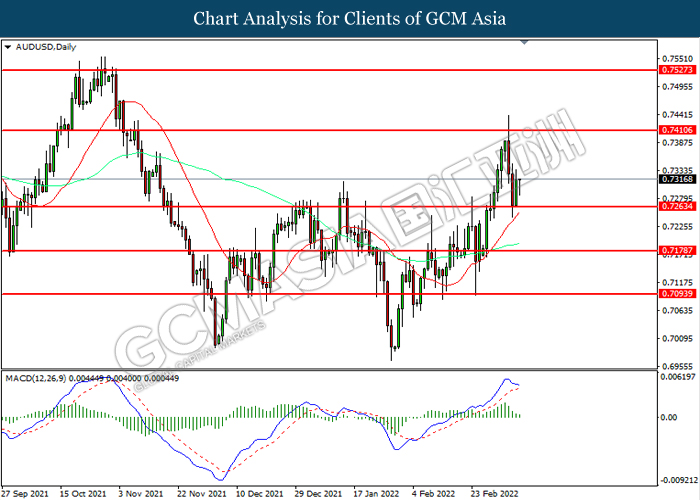

AUDUSD, Daily: AUDUSD was traded higher following prior rebounded from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

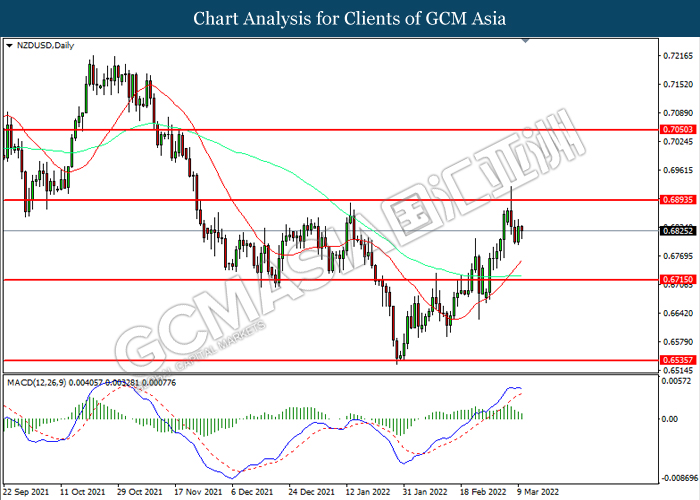

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

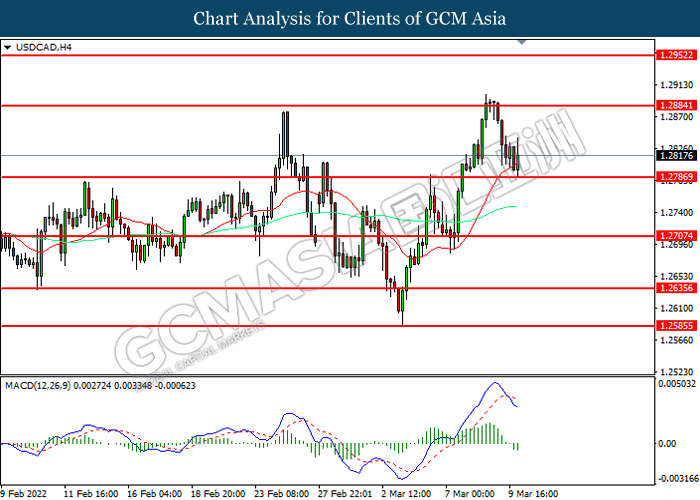

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

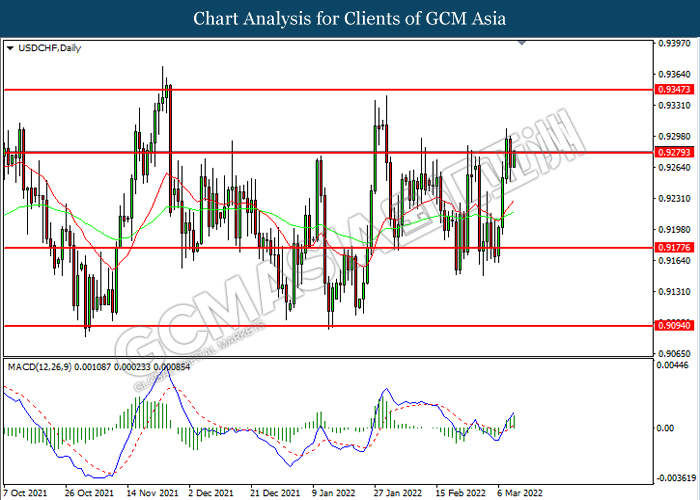

USDCHF, Daily: USDCHF was traded higher while testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.9280, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after successfully breakout.

Resistance level: 116.80, 127.05

Support level: 107.45, 99.45

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1975.00. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1996.85, 2016.70

Support level: 1975.00, 1959.60