10 March 2023 Morning Session Analysis

US Dollar slumped amid pessimistic labor market outlook.

The Dollar Index which traded against a basket of six major currencies dropped significantly after the economic data showed that the labor market in the US weakened. According to the US Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 190K to 211K, exceeding the market expectation of 195K. With that, it had reduced the possibility of aggressive rate hike plan which might by implemented by Fed, as it hinted that the impact of higher interest rates may be starting to bite. The CME FedWatch Tool has shown that the likelihood of half-percentage rate hike has decreased to 63.1% from prior 78.6%. Though, it is note-worthy that the speech given by Fed Chair has changed the market anticipation over interest rate decision. Federal Reserve Chairman Jerome Powell said on Tuesday that the central bank’s terminal rate might be higher than market expectation in order to tame inflation more efficiently. As of now, investors would continue to scrutinize the announcement of NFP data as it could provide a clearer picture on Fed’s rate hike path. As of writing, the Dollar Index eased by 0.38% to 105.23.

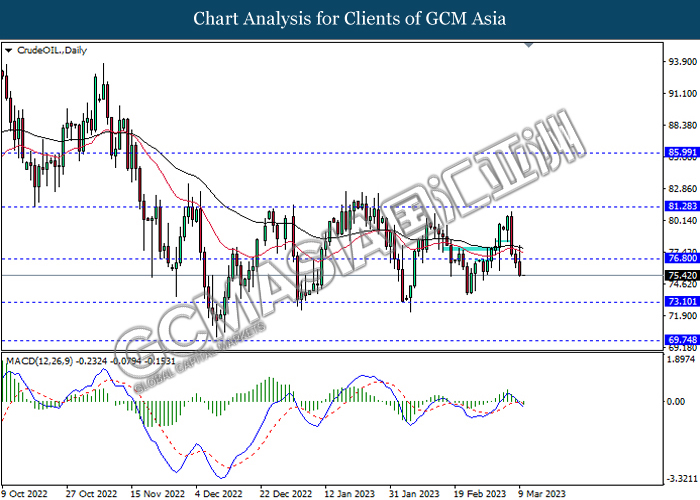

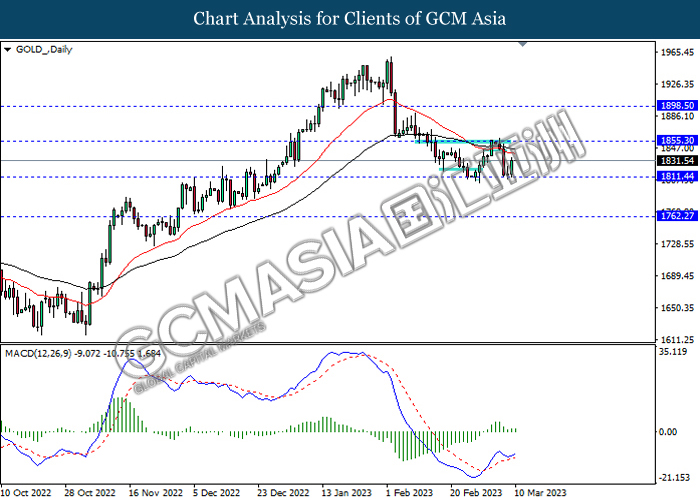

In the commodity market, the crude oil price dropped by 0.22% to $75.50 per barrel as of writing following the worries among aggressive rate hike by Fed still lingering in the market. On the other hand, the gold price appreciated by 0.04% to $1831.29 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

13:00 JPY BoJ Press Conference

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) (Jan) | -0.50% | 0.10% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.00% | -0.20% | – |

| 15:00 | GBP – Monthly GDP 3M/3M Change (Jan) | -0.30% | -0.10% | – |

| 15:00 | EUR – German CPI (YoY) (Feb) | 8.70% | 8.70% | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 517K | 200K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 3.40% | 3.40% | – |

| 21:30 | CAD – Employment Change (Feb) | 150.0K | 10.0K | – |

Technical Analysis

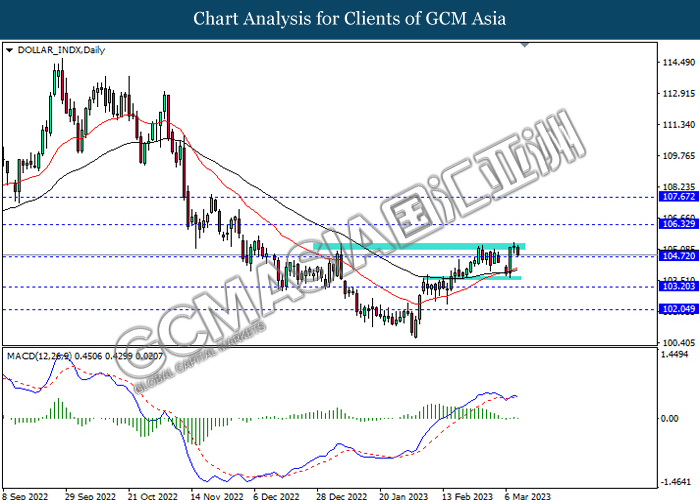

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 106.30, 107.65

Support level: 104.70, 103.20

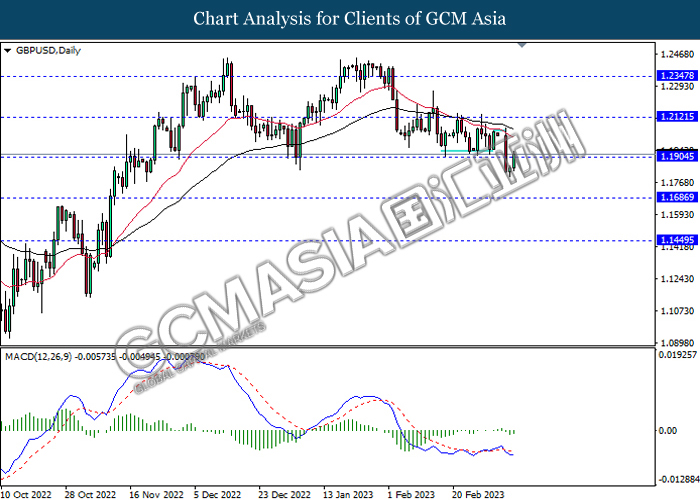

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2120, 1.2345

Support level: 1.1905, 1.1685

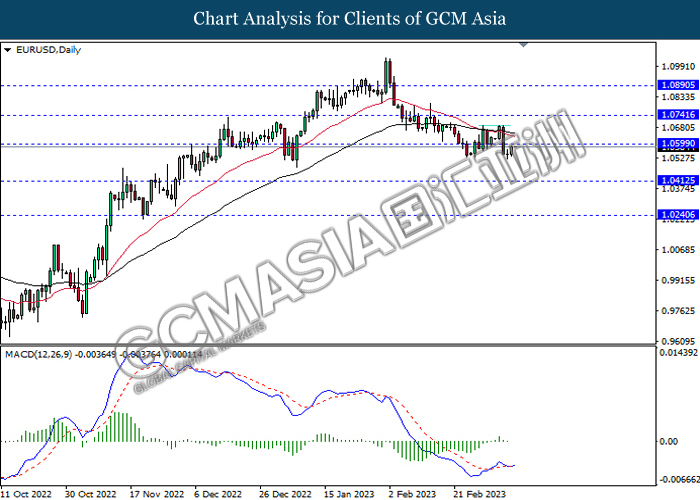

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0410, 1.0240

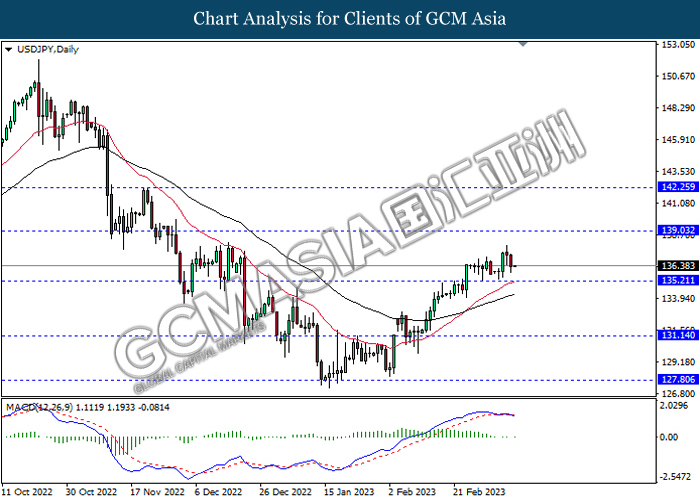

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

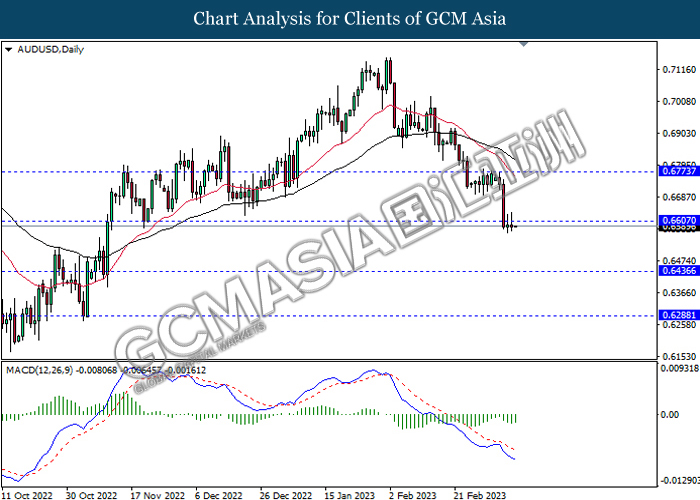

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6605, 0.6775

Support level: 0.6435, 0.6290

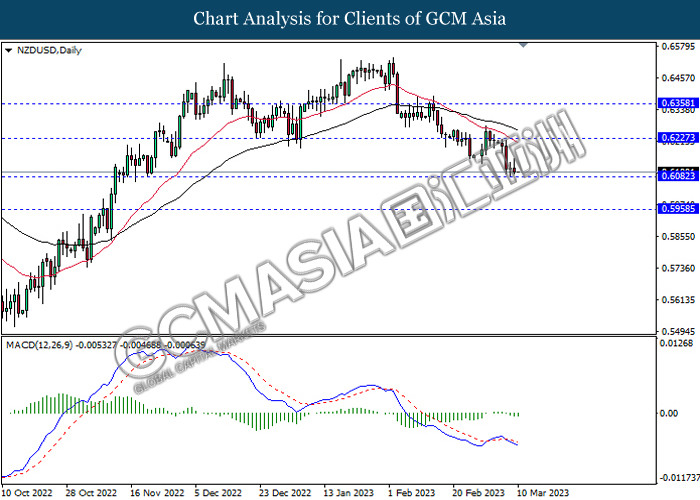

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

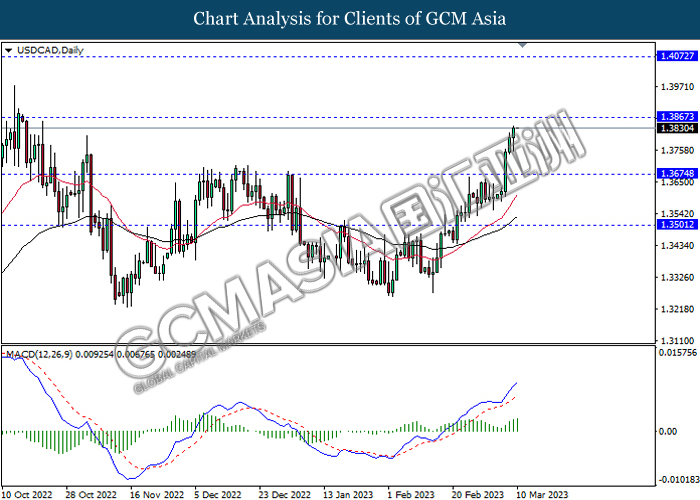

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

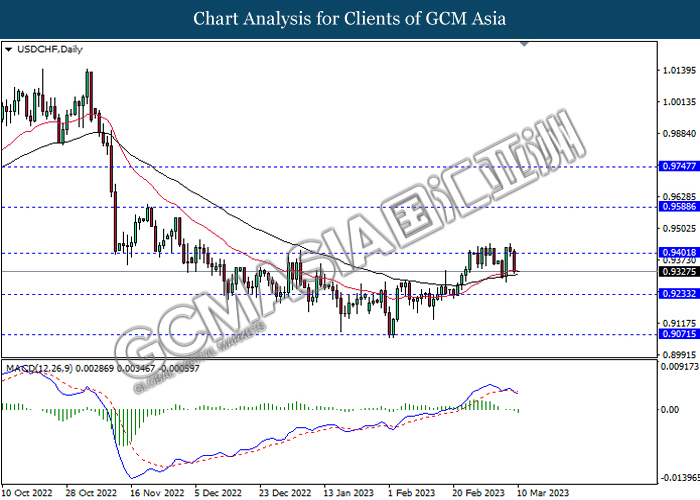

USDCHF, Daily: USDCHF was traded lower following prior breakout above the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.30, 1898.50

Support level: 1811.45, 1762.25