10 May 2022 Afternoon Session Analysis

Aussie slumped as risk-off sentiment.

The Australia Dollar slumped significantly amid the risk-off sentiment market following the global equity market tumbled to their lowest level in nearly two years on Tuesday. The rate hike expectation from global central bank as well as stagflation risk continue lingered in the financial market. The current stagflation economic environment would lead to high inflation, high unemployment and bearish economic growth in the world. Despite the global central bank strived to implement aggressive contractionary monetary policy to combat the high inflation risk, though the current supply disruption due to the lockdown in China had insinuated further concerns for investors. The China’s export growth slowed to single digits, the weakest in almost two years as tighter and wider Covid-19 restriction halted factory production, adding further pressure on the Chinese-proxy currencies such as Australia Dollar. As of writing, the AUD/USD depreciated by 0.02% to 0.6955.

In the commodities market, the crude oil price slumped 1.08% to $101.25 per barrel as of writing. The oil market dropped drastically amid the negative economic prospect continue to weigh down the appeal for this black-commodity. On the other hand, the gold price appreciated by 0.34% to $1860.20 per troy ounces as of writing amid diminishing risk appetite in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | German ZEW Economic Sentiment (May) | -41.0 | -42.5 | – |

Technical Analysis

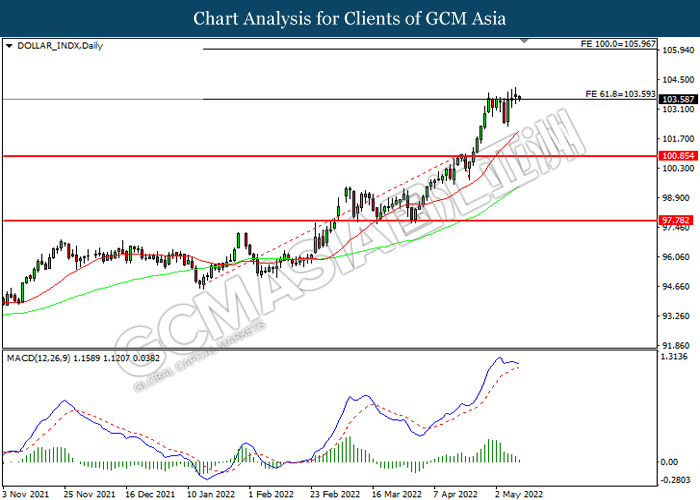

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.60. MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.60, 105.95

Support level: 100.85, 97.80

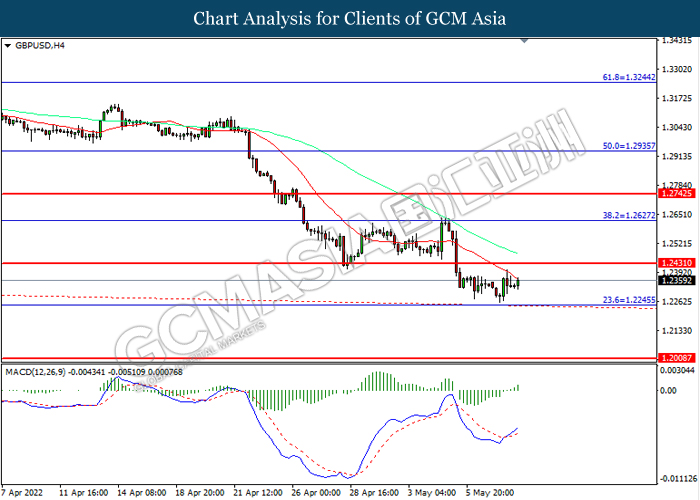

GBPUSD, H4: GBPUSD was traded higher while currently near the resistance level at 1.2430. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains after it breakout above the resistance level.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

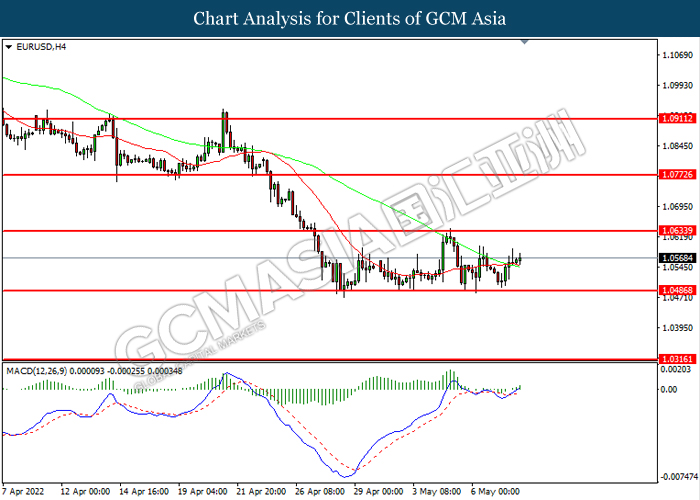

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

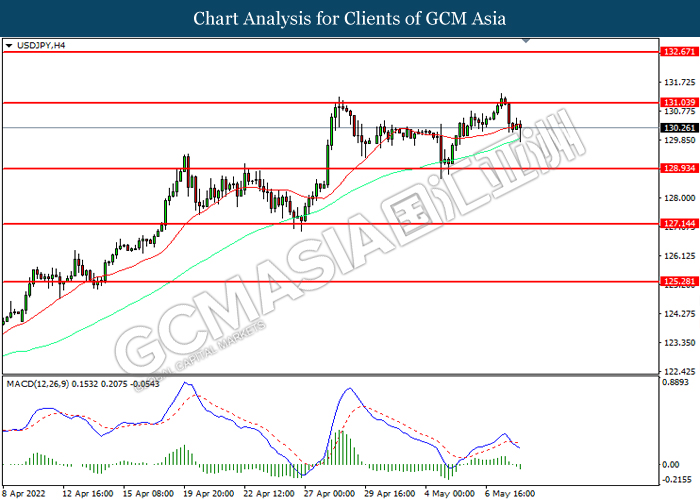

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

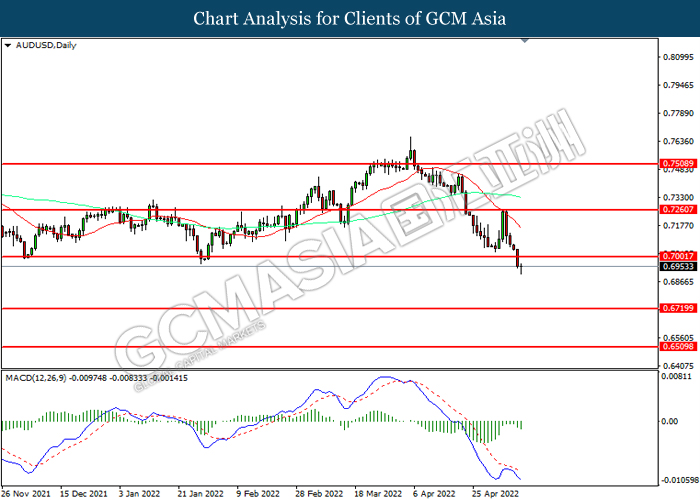

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7000, 0.7260

Support level: 0.6710, 0.6510

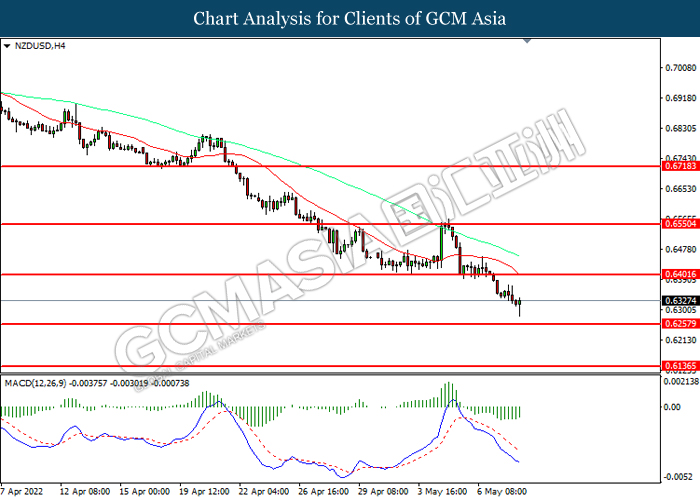

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

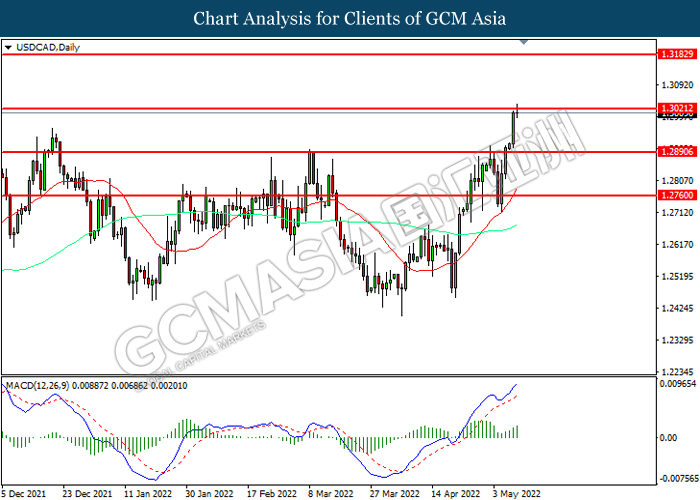

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3020. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3020, 1.3185

Support level: 1.2890, 1.2760

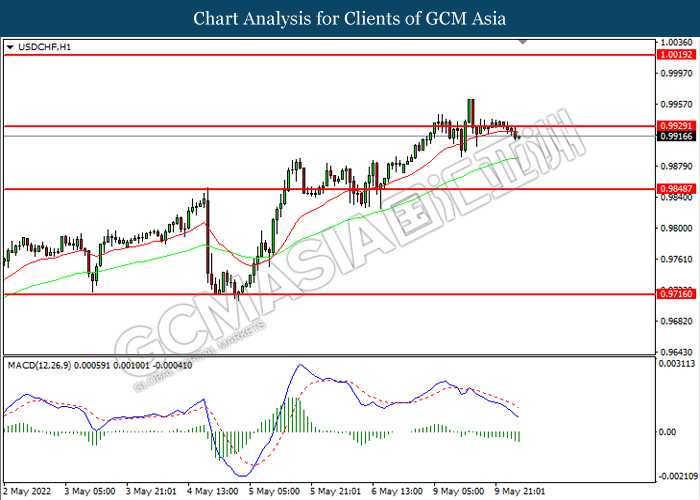

USDCHF, H1: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9930, 1.0020

Support level: 0.9850, 0.9715

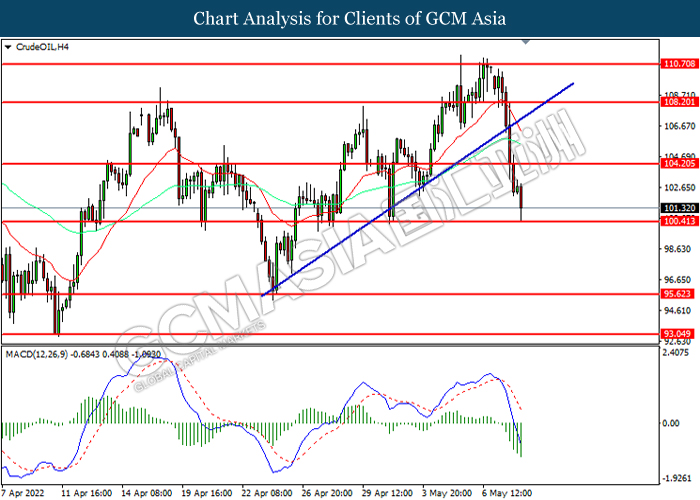

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 104.20, 108.20

Support level: 100.40, 95.60

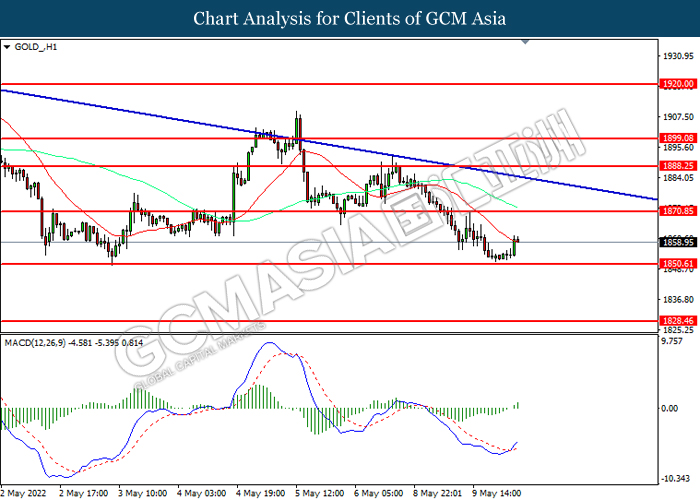

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1870.85, 1888.25

Support level: 1850.60, 1828.45