10 June 2022 Afternoon Session Analysis

US Dollar rallied ahead of the unleash of CPI data.

The Dollar Index which traded against a basket of six major currencies surged on Thursday over the backdrop of Core CPI data which would release tonight. The US Core Consumer Price Index (CPI) MoM used to show the monthly change in price which paid by US consumer, excluding the price of food and energy. The moment of releasing data would likely to cause high volatility in the market, which cause investor to shift their capitals toward safe-haven Dollar temporarily from the riskier market in order to avoid any uncertainty risk. Besides, the Dollar Index extended its gains following the slump of Euro. According to CNBC, the ECB had lowered down its economic growth forecast, which revised down significantly to 2.8% in 2022 and 2.1% in 2023 respectively. As the comparison, the ECB’s forecast in March meeting was 3.7% in 2022 and 2.8% in 2023 respectively. It dialed down the market optimism toward economic progression in Europe region, leading investors to look for other currencies which having better prospects such as US Dollar. At this juncture, investors would continue to focus on the unleash of CPI data in order to receive further trading signals. As of writing, the Dollar Index appreciated by 0.02% to 103.22.

In the commodities market, crude oil price eased by 0.85% to $120.48 per barrel as of writing amid the fears over new COVID-19 lockdown measures in Shanghai. On the other hand, gold price depreciated by 0.30% to $1847.55 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 15.3K | 30.0K | – |

| 20:30 | USD – Core CPI (MoM)(May) | 0.6% | 0.5% | – |

Technical Analysis

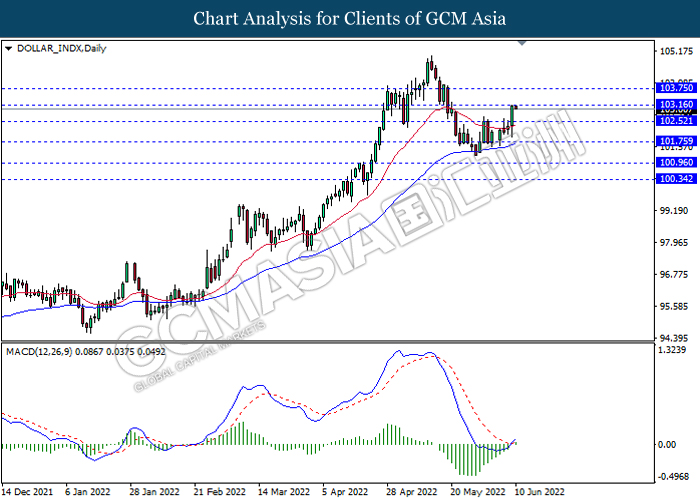

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.15, 103.75

Support level: 102.50, 101.75

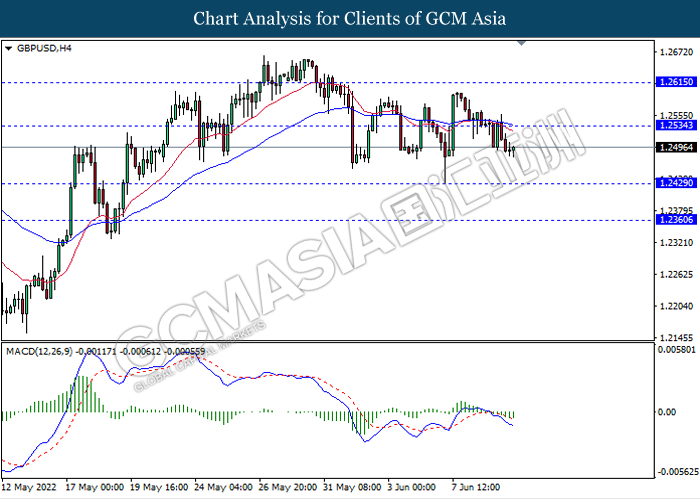

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

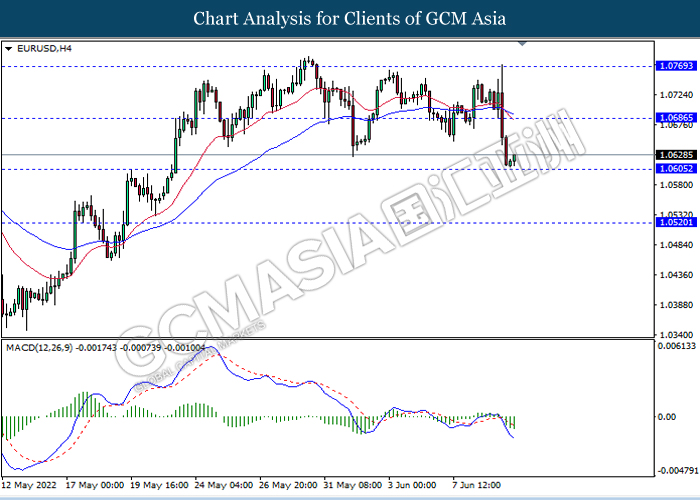

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0520

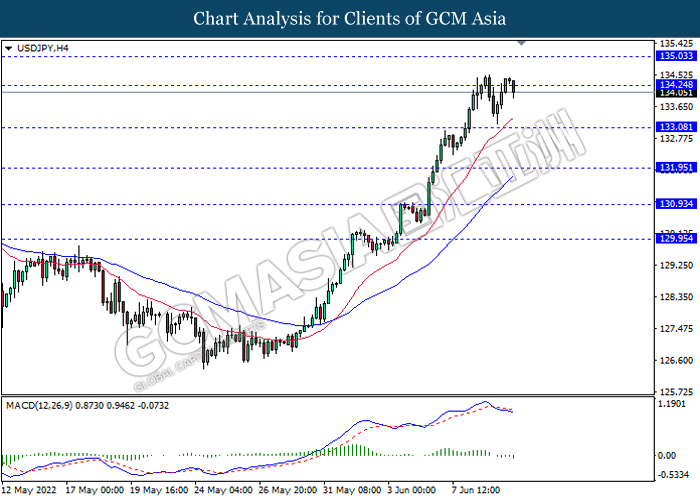

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

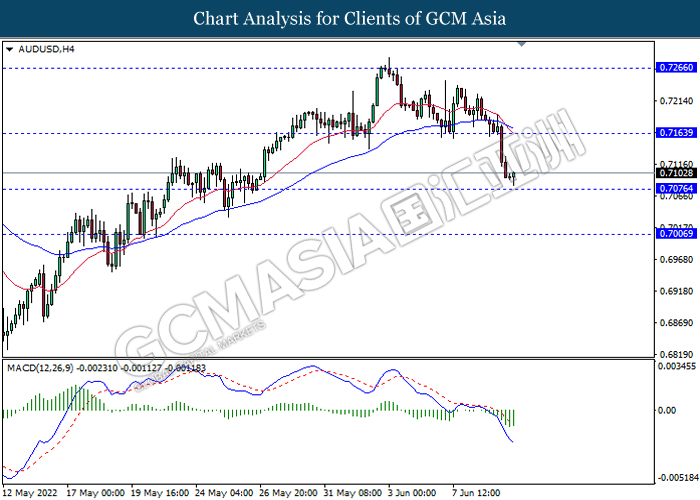

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7165, 0.7265

Support level: 0.7075, 0.7005

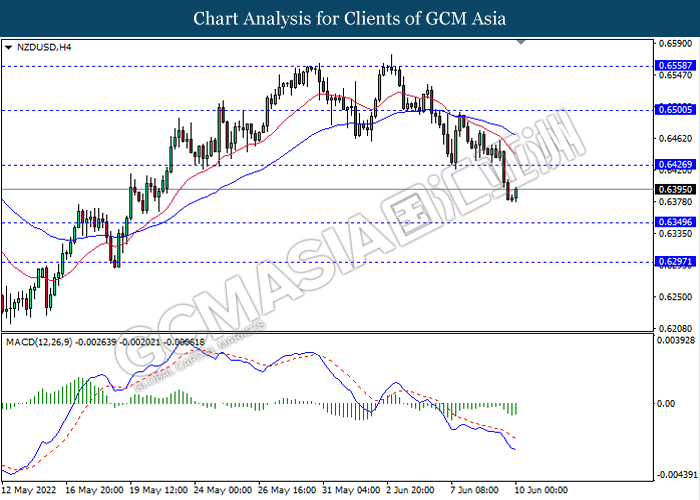

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6295

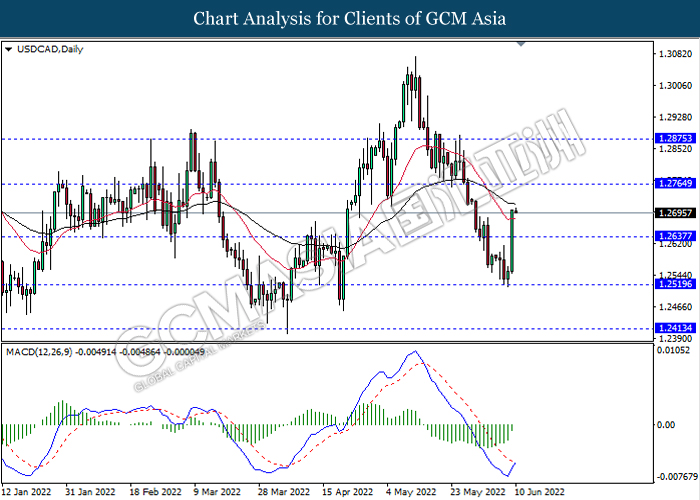

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

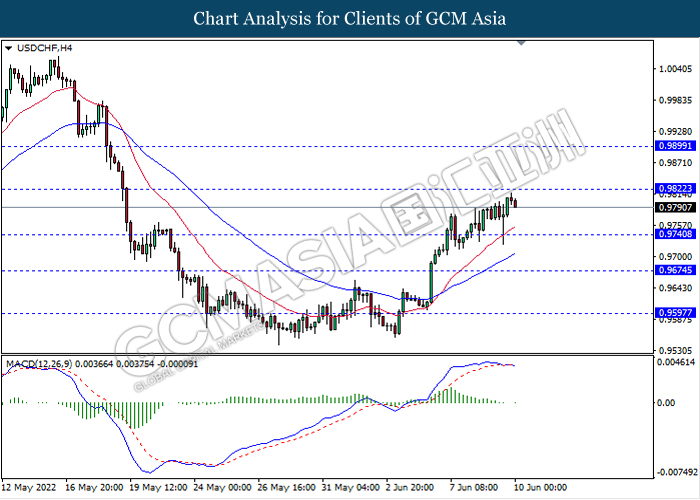

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

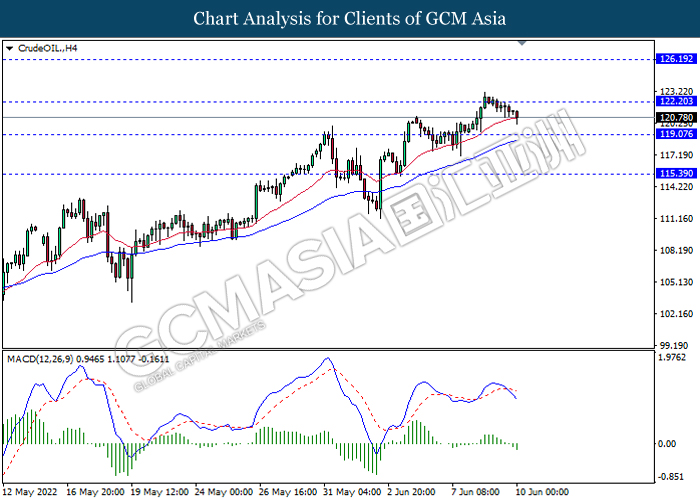

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 122.20, 126.20

Support level: 119.05, 115.40

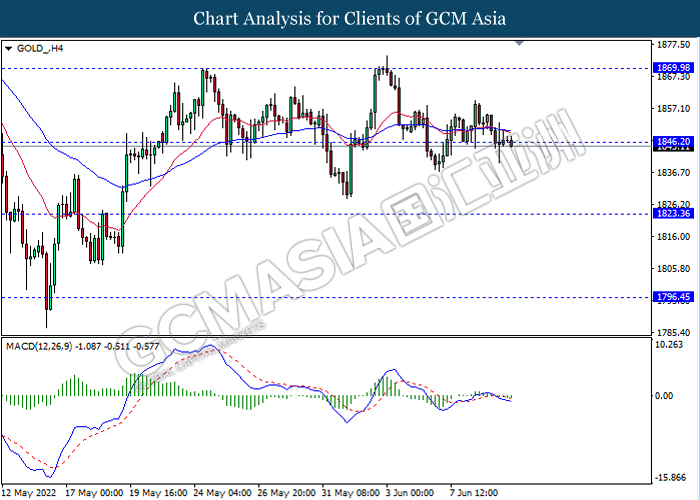

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend it losses.

Resistance level: 1846.20, 1870.00

Support level: 1823.35, 1796.45