10 November 2022 Afternoon Session Analysis

Dollar lingered ahead of the long-awaited CPI.

The dollar index, which gauges its value against a basket of six major currencies, regained part of its luster yesterday while the market participants are embracing the closely-watched inflation figure. Later today, the US Bureau of Labor Statistics will announce its scheduled CPI data, whereby it would provide the market participants with a clear path of the Federal Reserve monetary policy. A strong price rise would likely reinforce the Federal Reserve’s hawkish rate hike plan, whereas a significant drop in inflation figure would further slowdown the pace of the rate hike going forward. On the other side, the ongoing mid-term election also boosted the appeal of the Greenback. At this point in time, the US Senate is still pending a run-off in Georgia state as neither of the candidates from the parties achieved a vote above 50%. On the other hand, the Republicans would likely regain control of the House of Representatives as the party is leading with more seats. However, the final result of the mid-term election is still subject to any changes as the counting of the vote is still going on.

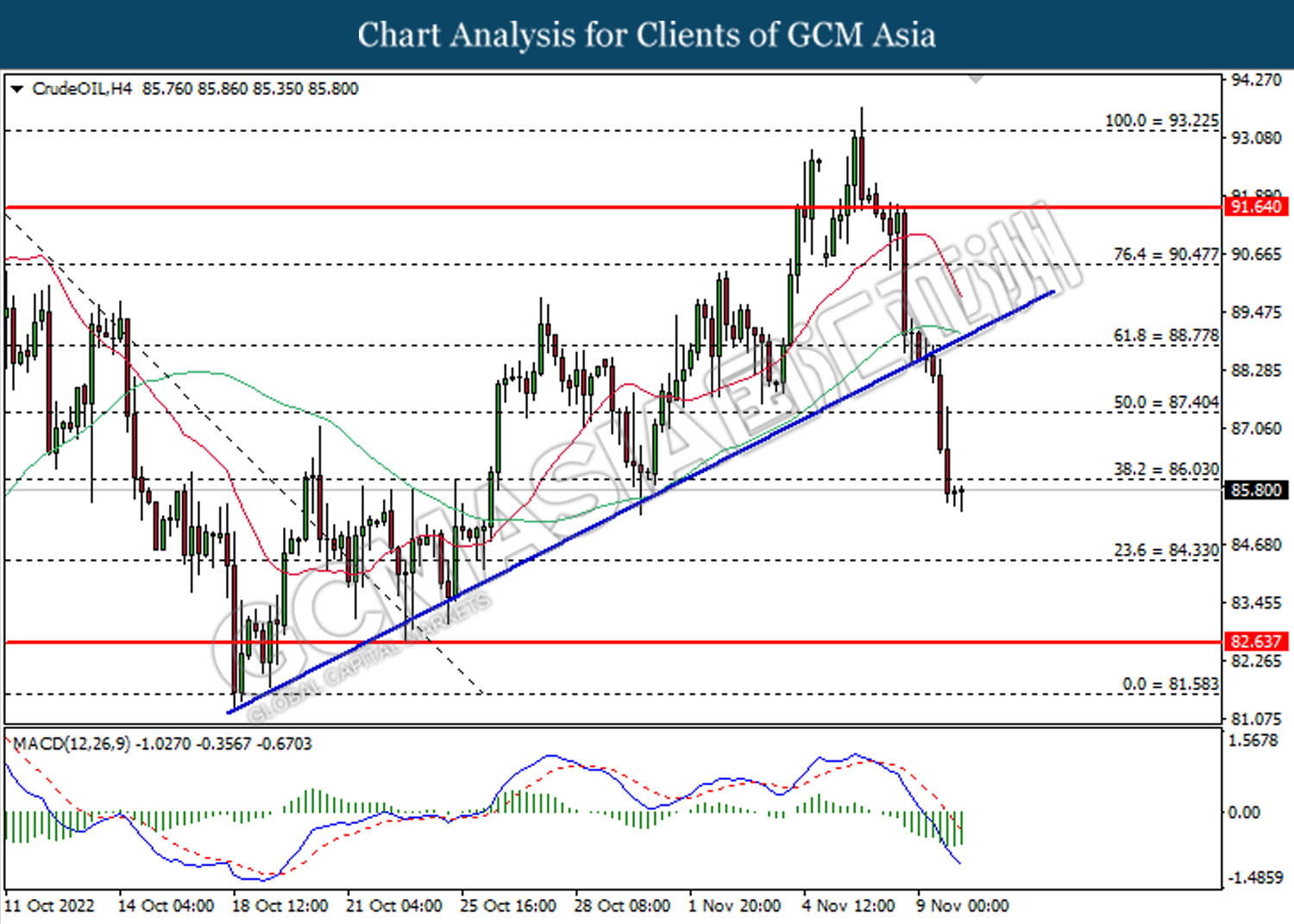

In the commodities market, the crude oil price edged down by -0.05% to $85.75 per barrel as the Chinese Health Official insisted on maintaining their “Zero Covid” policy, in which could diminish the oil demand in the future. Besides, the gold price went up by 0.08% to $1708.05 per troy ounce amid the slight retracement in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.6% | 0.5% | – |

| 21:30 | USD – CPI (YoY) (Oct) | 8.2% | 8.0% | – |

| 21:30 | USD – Initial Jobless Claims | 217K | 220K | – |

Technical Analysis

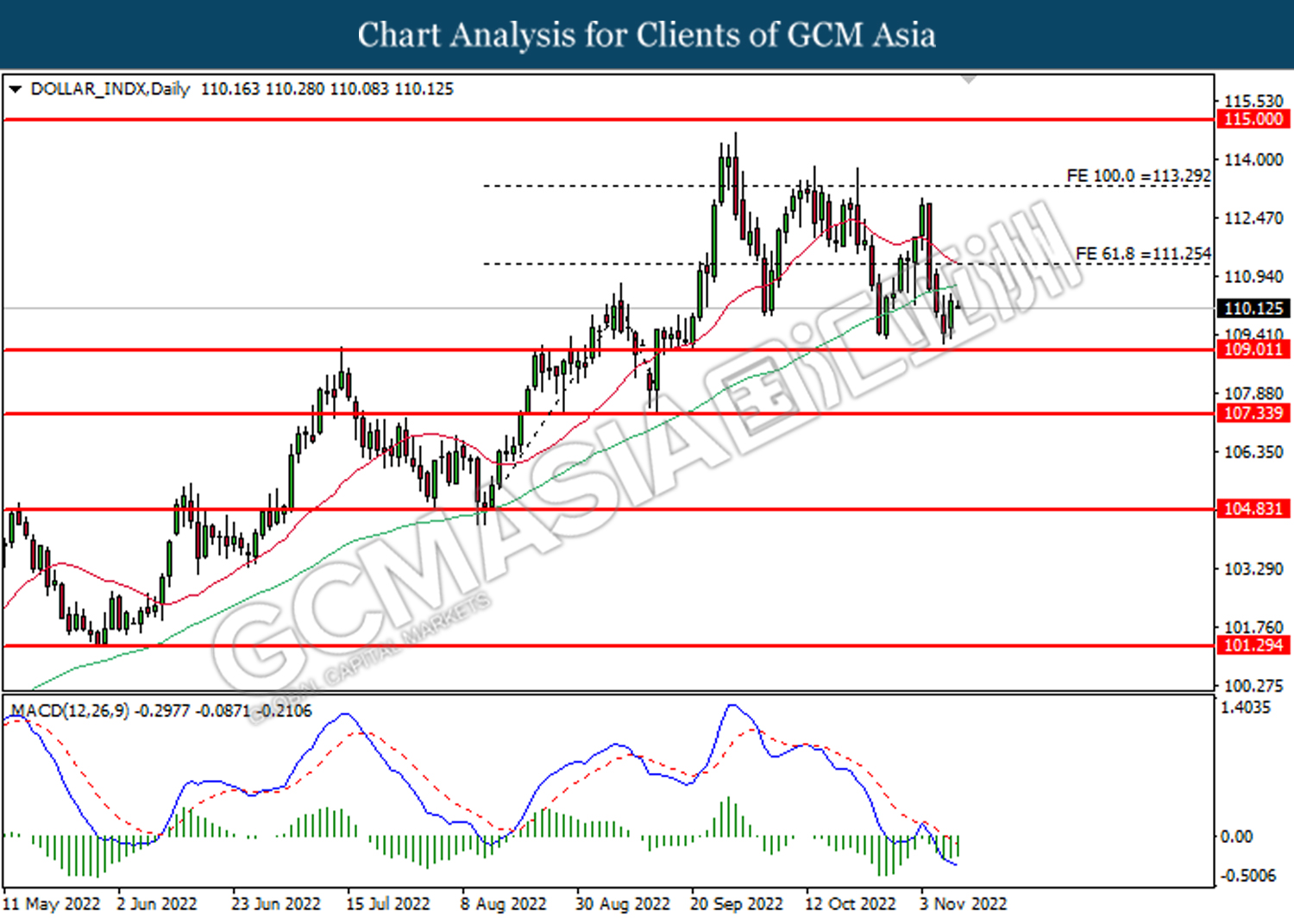

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 109.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 111.25.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

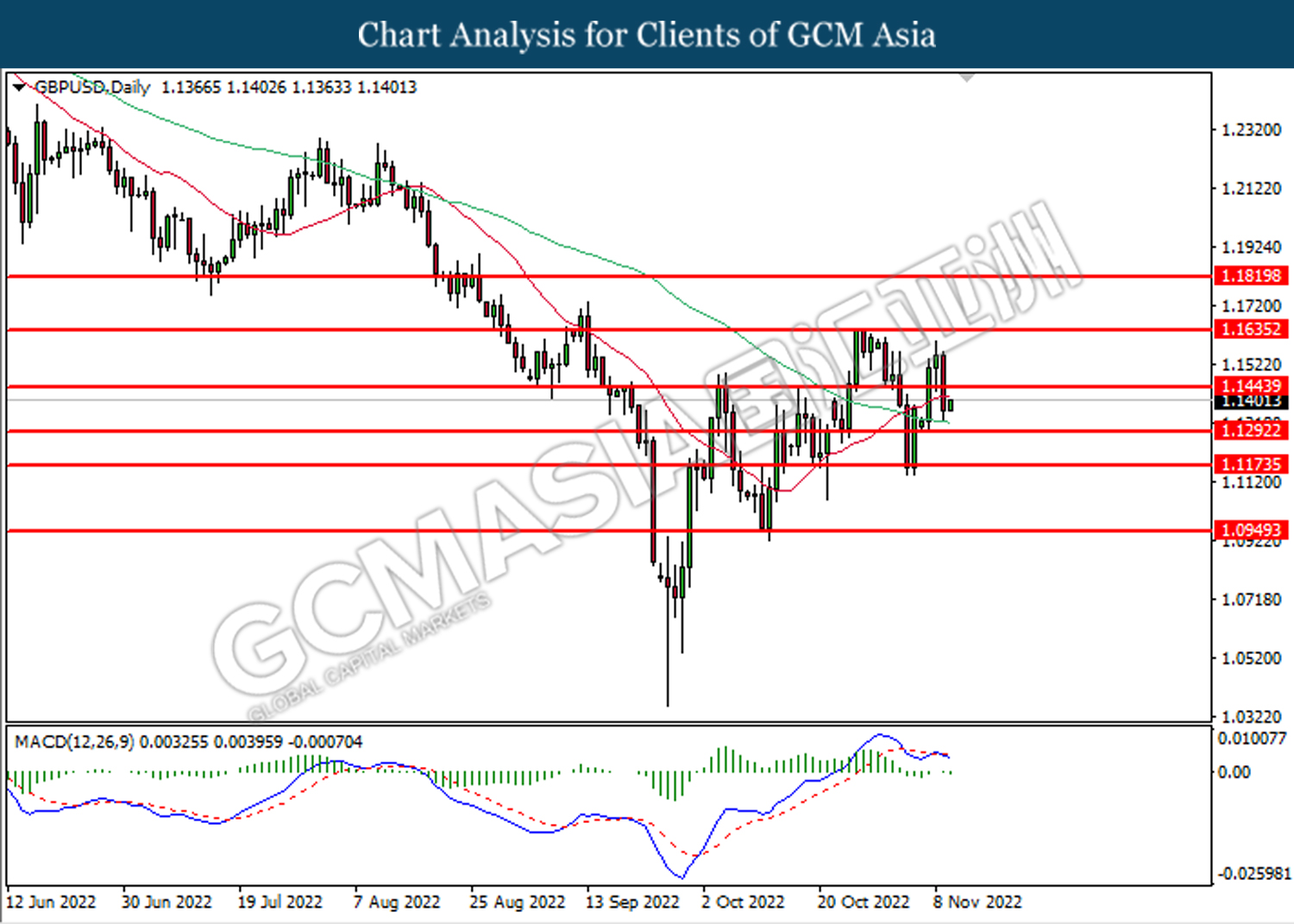

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1445. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1290.

Resistance level: 1.1445, 1.1635

Support level: 1.1290, 1.1175

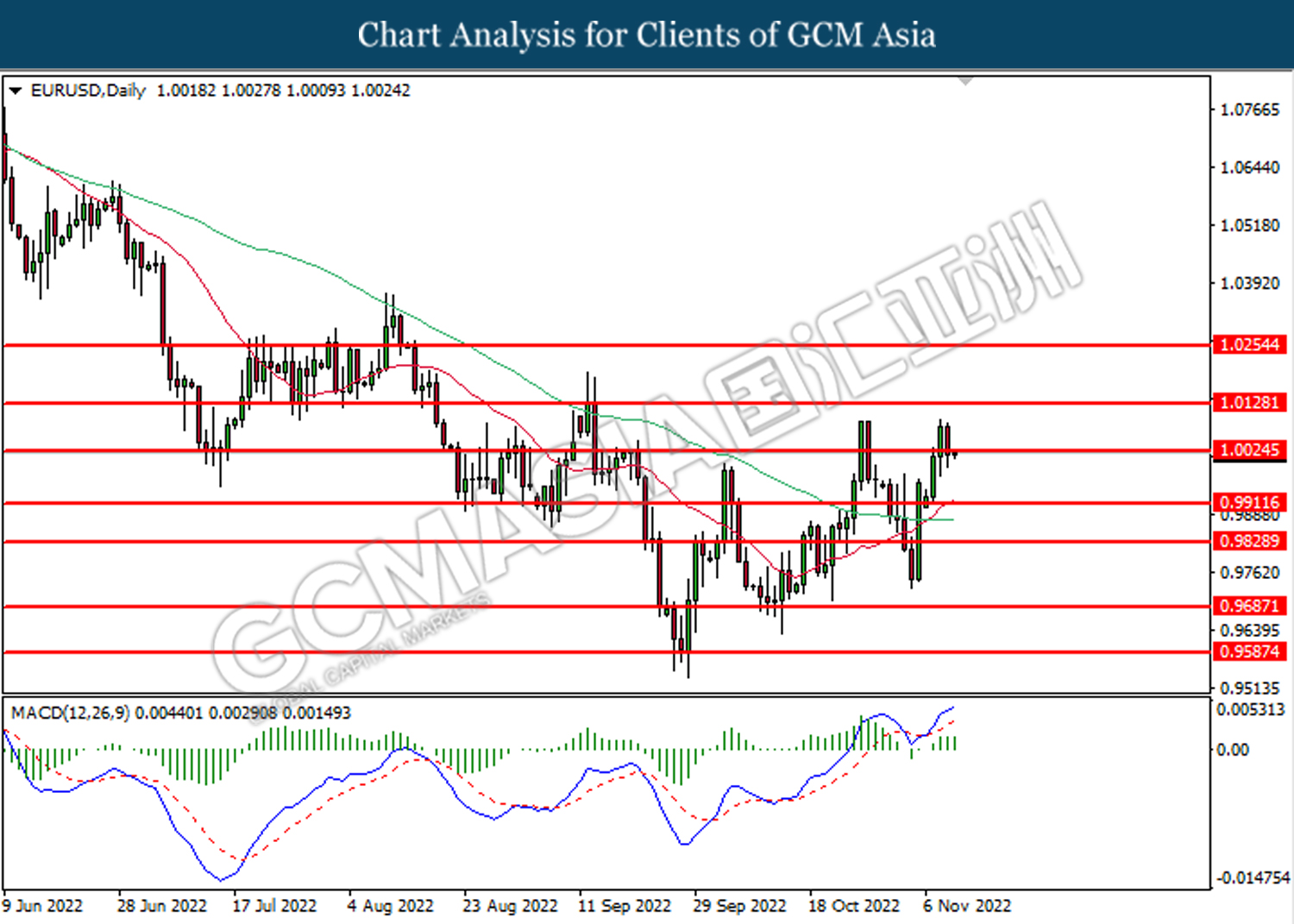

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0025. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 1.0130, 1.0255

Support level: 1.0025, 0.9910

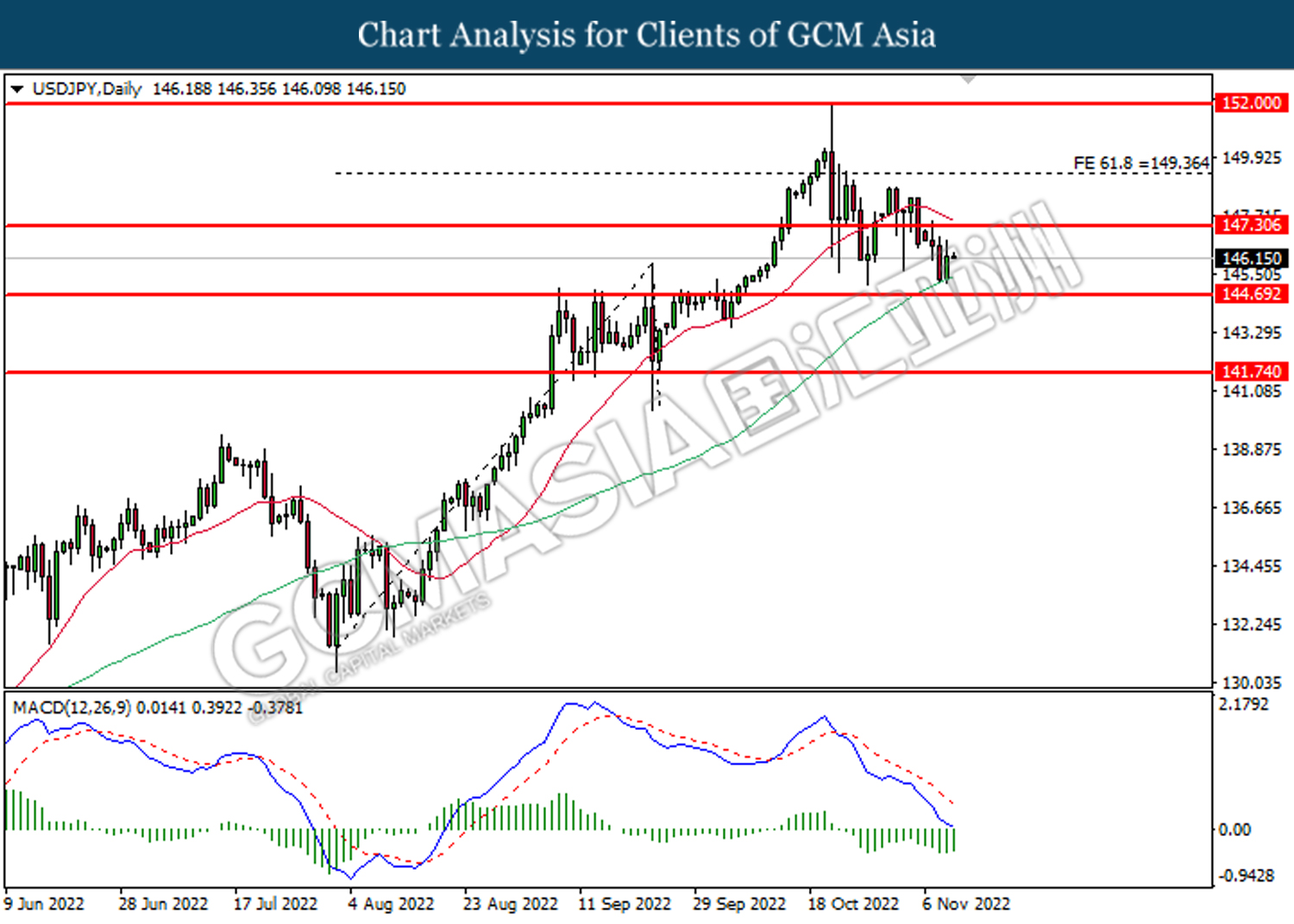

USDJPY, Daily: USDJPY was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 147.30.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

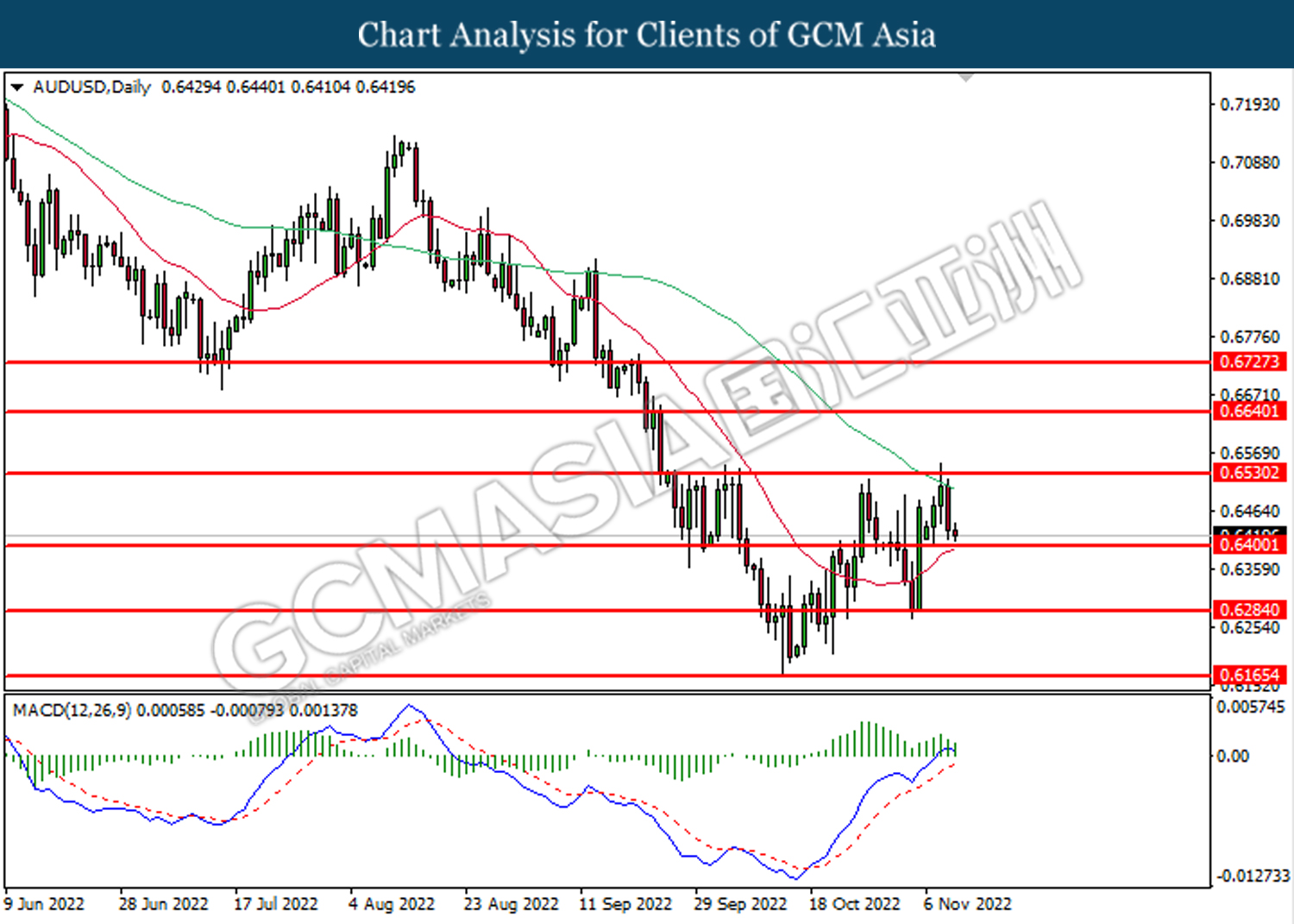

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

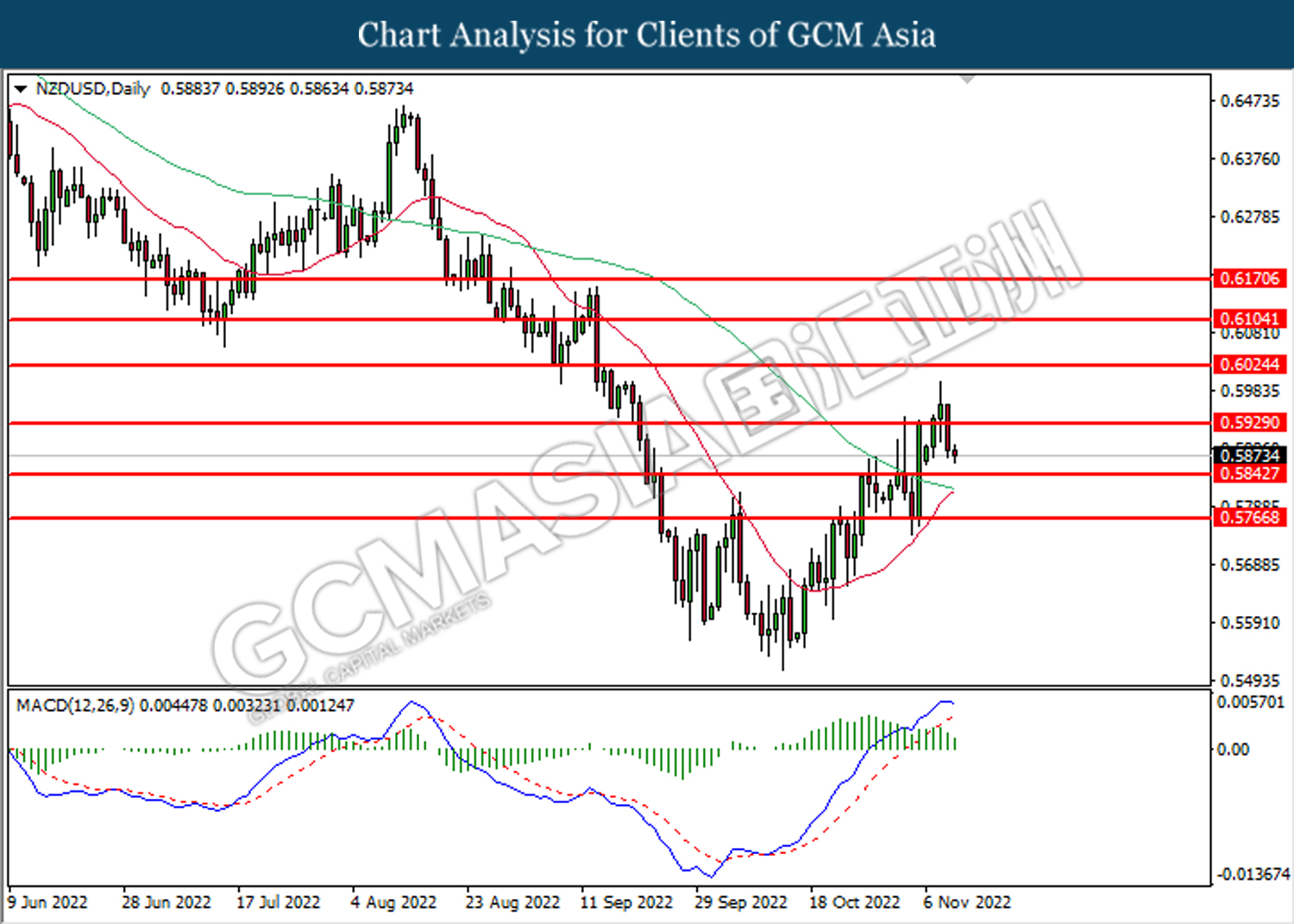

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.5845.

Resistance level: 0.5930, 0.6025

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3505. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3600.

Resistance level: 1.3600, 1.3715

Support level: 1.3505, 1.3400

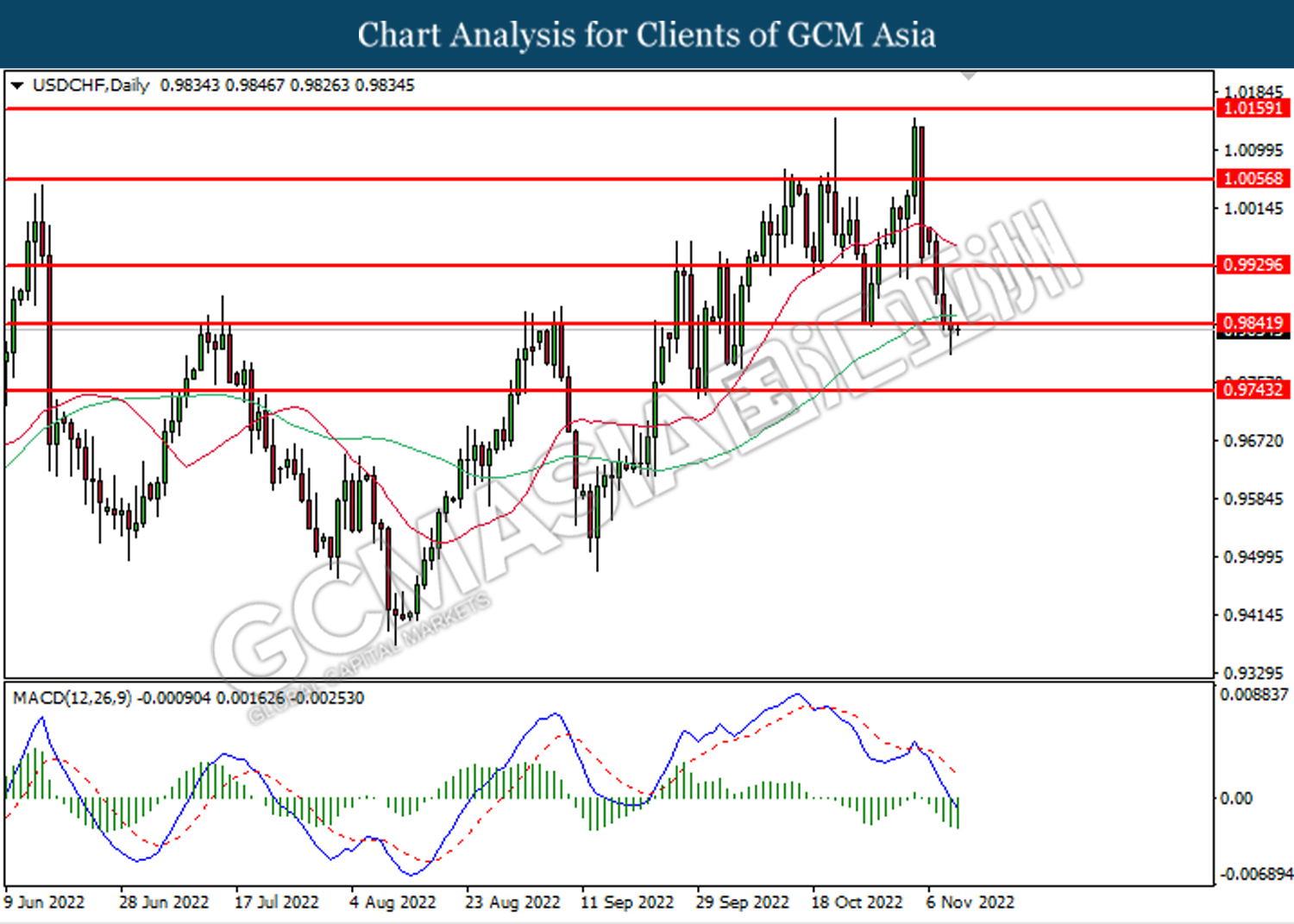

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9840. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9930, 1.0055

Support level: 0.9840, 0.9745

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 86.05. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 84.35.

Resistance level: 86.05, 87.40

Support level: 84.35, 82.65

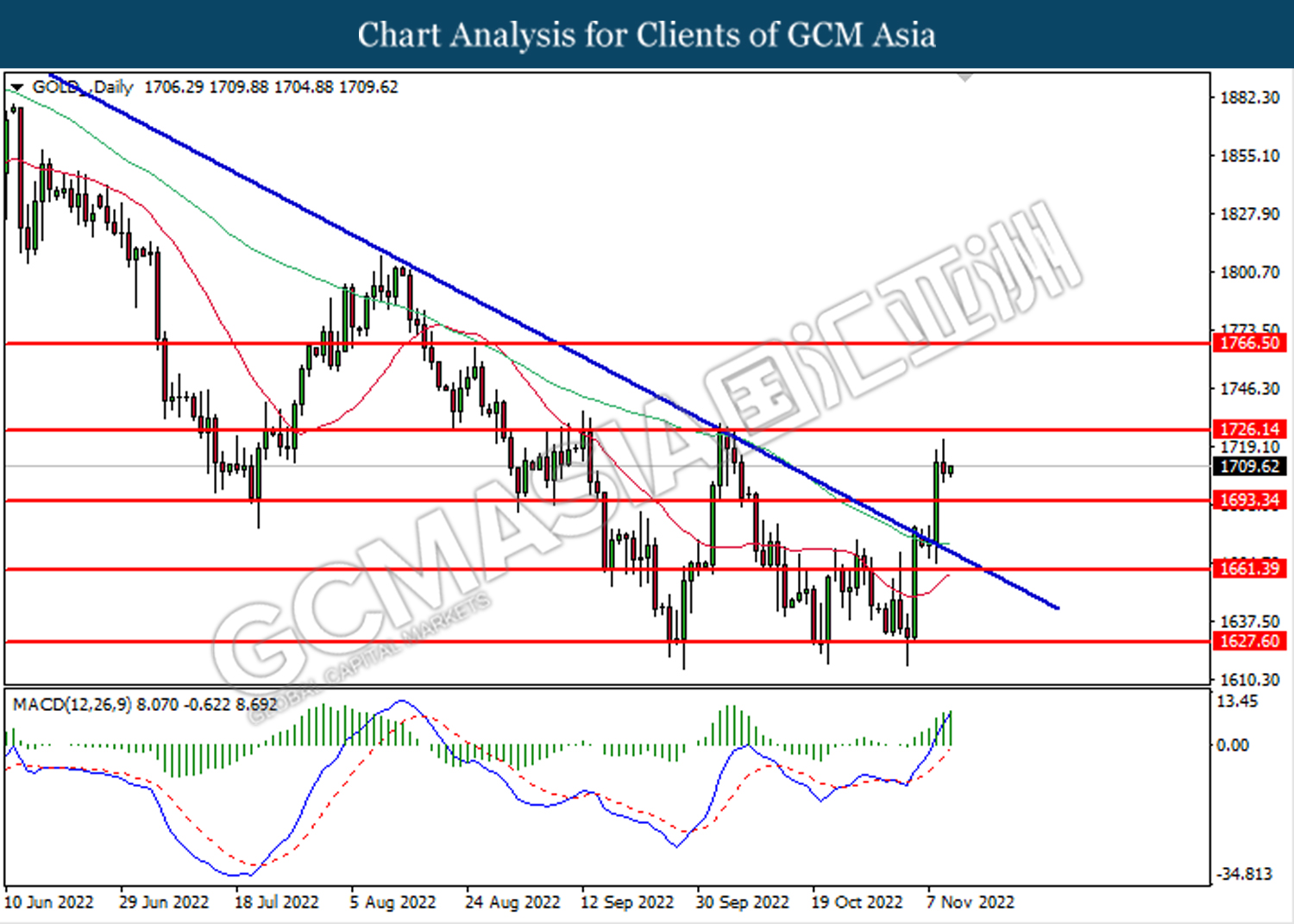

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1693.35. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1726.15.

Resistance level: 1726.15, 1766.50

Support level: 1693.35, 1661.40