10 December 2018 Afternoon Session Analysis

Dollar slips amid increasing geopolitical tensions.

US Dollar remains pressured against its basket six major currency pairs amid tensions between US and China continue to ratchet up after China’s tech giant Huawei’s CFO Meng Wan Zhou arrested in Canada. According to Bloomberg, the detention was made by orders from U.S authorities due after its company being accused of violating American sanctions by selling its technology to Iran. China has summoned Canadian ambassador John McCallum to lodge a strong protest and threaten Canada will face a “grave consequences” if she is not freed, demanding the release of Meng Wanzhou. The arrest has already worsened the ongoing tension between China and US from its trade war and investors fear a full-scale trade war will be inevitable. Dollar index was down 0.08% to 96.33 as of writing. On the other hand, GBP/USD inched down 0.03% to 1.2745 at the time of writing ahead of Tuesday’s final Brexit vote. Pound sterling remains pressured due to Brexit referendum chaos where UK Prime Minister Theresa May battles on the Brexit deal and likely to face strong resistance from opposing party in its Brexit plan. According to UK Times, 48 letters of no-confidence vote have been delivered by the British parliament which is the minimum number for no-confidence vote to oust Theresa May’s government while market will remain focused on tomorrow voting results.

As for commodities market, crude oil price soars 0.85% to $52.55 per barrel as of writing amid reports on OPEC and oil producers including Russia have reach an agreement for a supply cut of 1.2 million bpd from January. Meanwhile, gold price extends its gains by 0.04% to $1248.05 at the time of writing amid dollar weakness caused by weak data on Friday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 17:30 | GBP – GDP (YoY) (Q3) | 1.5% | 1.6% | – |

| 17:30 | GBP – Manufacturing Production (MoM) (Oct) | 0.2% | 0.0% | – |

| 23:00 | USD – JOLTs Job Openings (Oct) | 7.009M | 7.220M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently test the support level 96.35. MACD which illustrate bearish momentum with formation of death cross suggest the pair to extend its losses after It breaks below the support level 96.35.

Resistance level: 96.85, 97.45

Support level: 96.35, 95.75

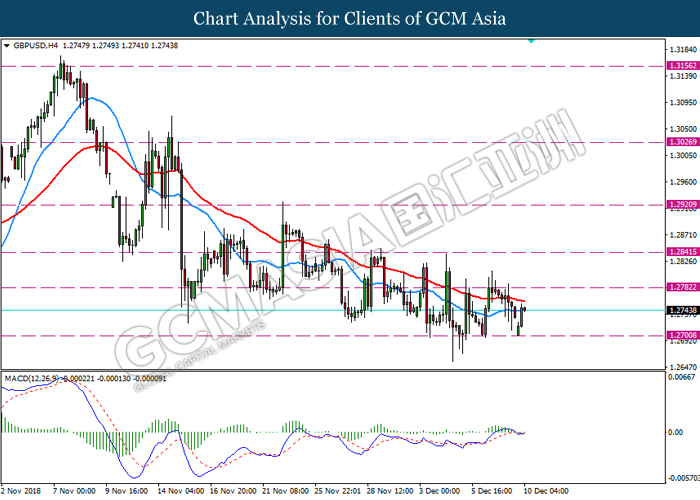

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level 1.2700. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.2780.

Resistance level: 1.2780, 1.2840

Support level: 1.2700, 1.2585

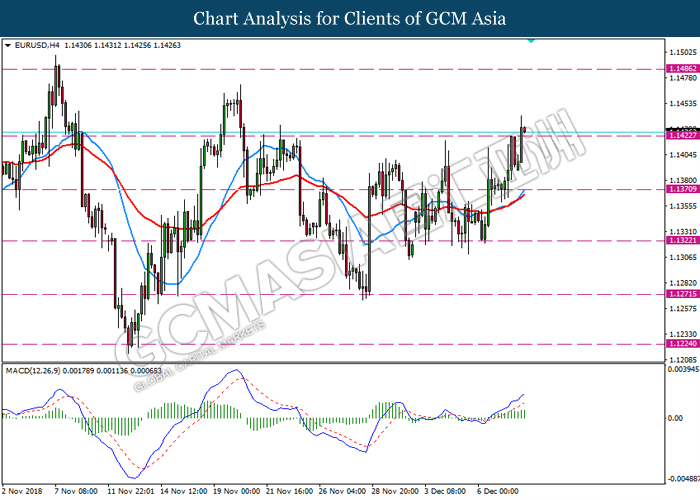

EURUSD, H4: EURUSD was traded higher after it breaks above the previous resistance level 1.1420. MACD which illustrate bullish momentum with golden cross formation suggest the pair to extend its gains towards the resistance level 1.1485.

Resistance level: 1.1485, 1.1550

Support level: 1.1420, 1.1370

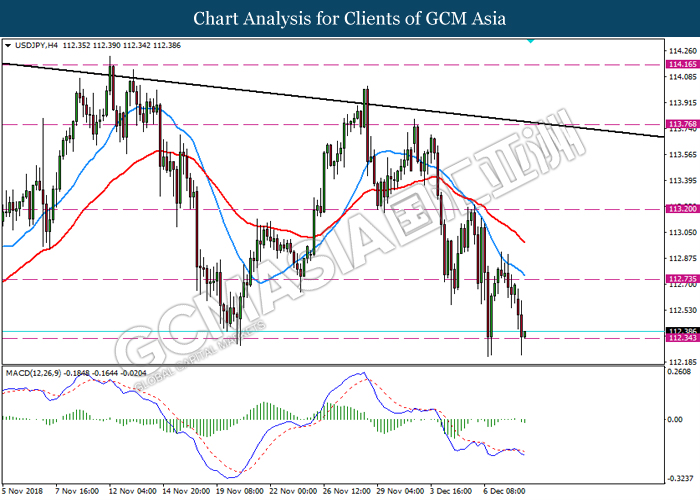

USDJPY, H4: USDJPY was traded lower while currently testing the support level 112.35. MACD which display diminished bearish momentum suggest the pair to undergo a short term technical correction towards the resistance level 112.75.

Resistance level: 112.75, 113.20

Support level: 112.35, 111.60

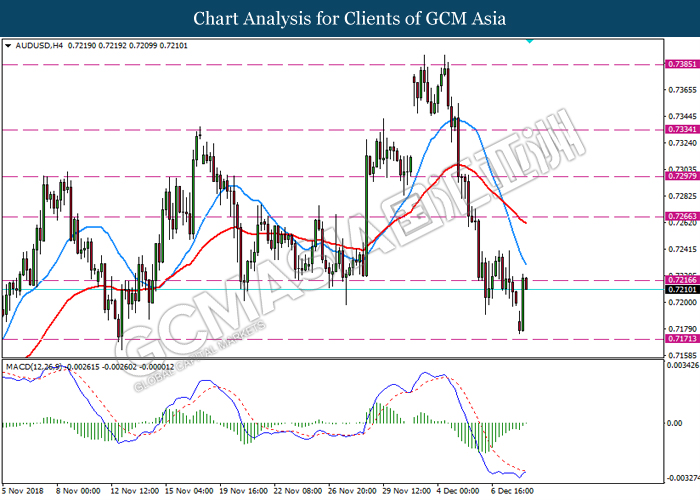

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.7215. MACD which display bullish momentum with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 0.7215.

Resistance level: 0.7215, 0.7265

Support level: 0.7170, 0.7140

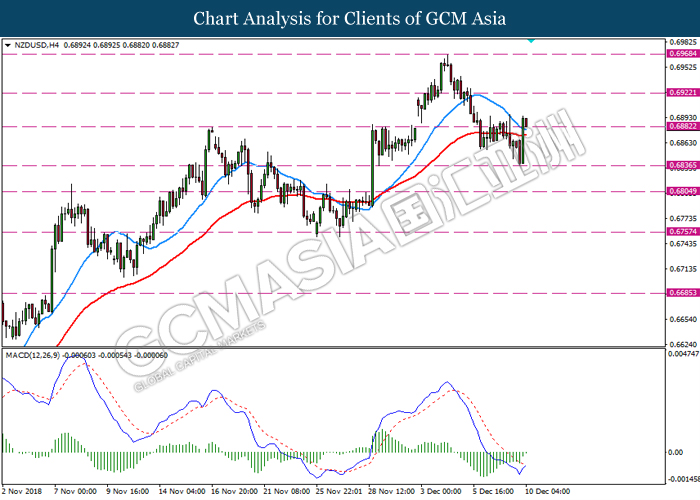

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6880. MACD which illustrate bullish momentum suggest the pair to extend its gains towards the resistance level 0.6920.

Resistance level: 0.6920, 0.6970

Support level: 0.6880, 0.6840

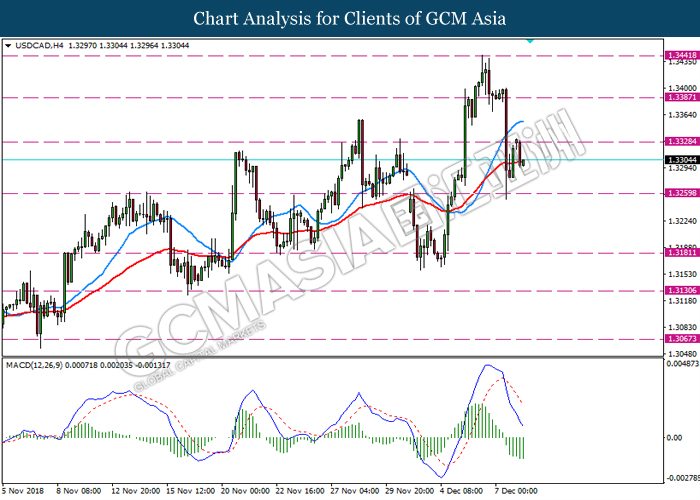

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3330. MACD which illustrate bearish bias with the formation of death cross suggest the pair to extend its retracement towards the support level 0.6840.

Resistance level: 1.3330, 1.3390

Support level: 1.3260, 1.3180

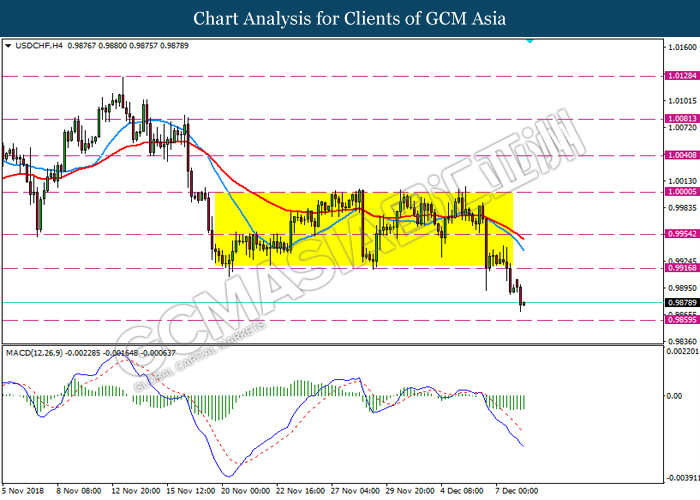

USDCHF, H4: USDCHF was traded lower following recent breakout below the previous support level 0.9915. MACD which illustrate persistent bearish momentum suggest the pair to extend its losses towards the support level 0.9860.

Resistance level: 0.9915, 0.9955

Support level: 0.9860, 0.9800

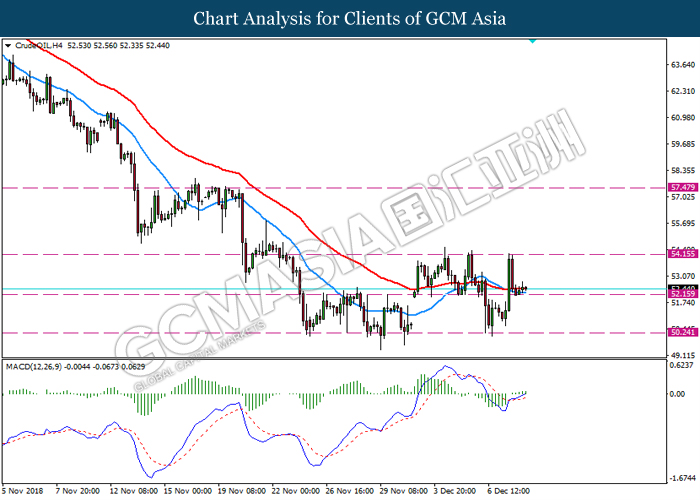

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 52.15 MACD which illustrate bullish momentum with the formation of golden cross suggest the pair undergo a short-term technical correction towards the resistance level 54.15.

Resistance level: 54.15, 57.45

Support level: 52.15, 50.25

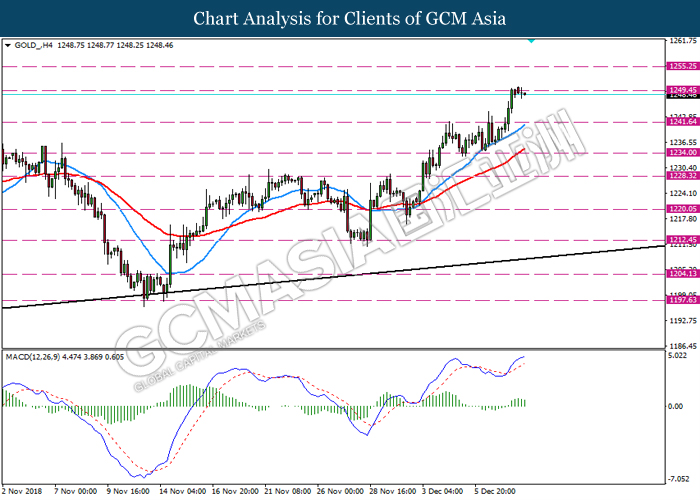

GOLD_, H4: Gold was traded higher while currently testing the resistance level 1249.50. MACD which illustrate diminishing bullish momentum suggest the pair to undergo a short term technical correction towards the support level 1241.50.

Resistance level: 1249.50, 1255.25

Support level: 1241.50, 1234.00