11 January 2023 Afternoon Session Analysis

Upbeat Retail Sales gave a booster to Aussie dollar.

The Australian dollar, which is broadly known as the Aussie dollar, jumped following the release of the Retail Sales data early today. According to the Australian Bureau of Statistics, the Australia Retail Sales data came in at 1.4%, significantly higher than the previous month reading’s 0.4% and the consensus forecast at 0.6%. The stronger-than-expected retail sales data indicated the overall consumer spending in the month of November 2022 grew amid the Black Friday shopping event. With such a backdrop, it raised the market expectation that the Reserve Bank Australia (RBA) would likely to keep the interest rate at high level to avoid the risk of sky-high inflationary pressure happens again. Besides, as mentioned in the prior article, the optimism of China’s reopening continued to spark some bullish momentum in the Aussie dollar market as China plays an important role in Australia’s trading activity. As of writing, the pair of AUD/USD rose 0.09% to 0.6895.

In the commodities market, the crude oil price edged down by -0.24% to $74.55 per barrel after API showed crude oil stockpiles in the US. Besides, the gold prices depreciated by -0.06% to $1876.00 per troy ounce while the market participants are waiting for the CPI data tomorrow.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.694M | -2.243M | – |

Technical Analysis

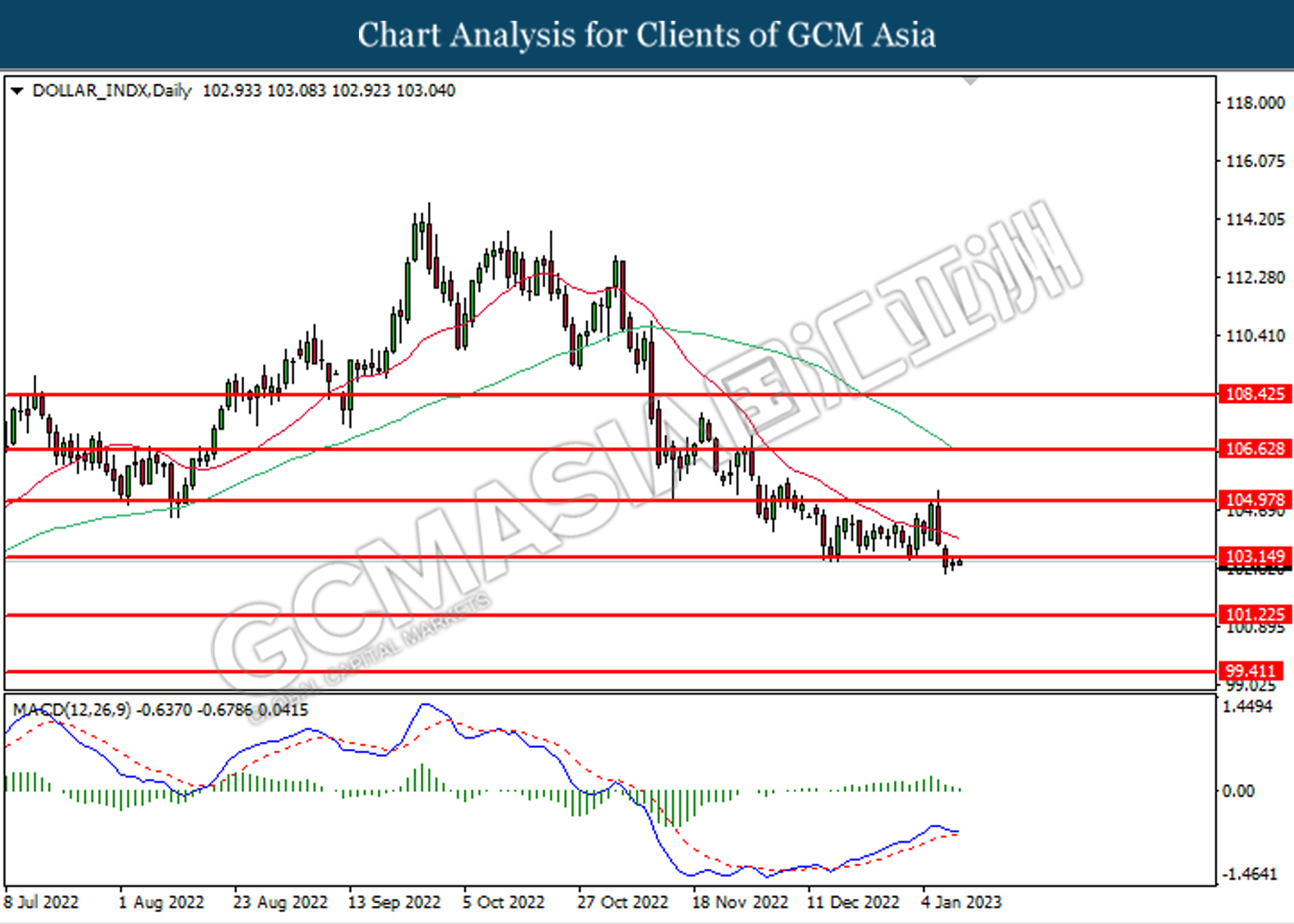

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

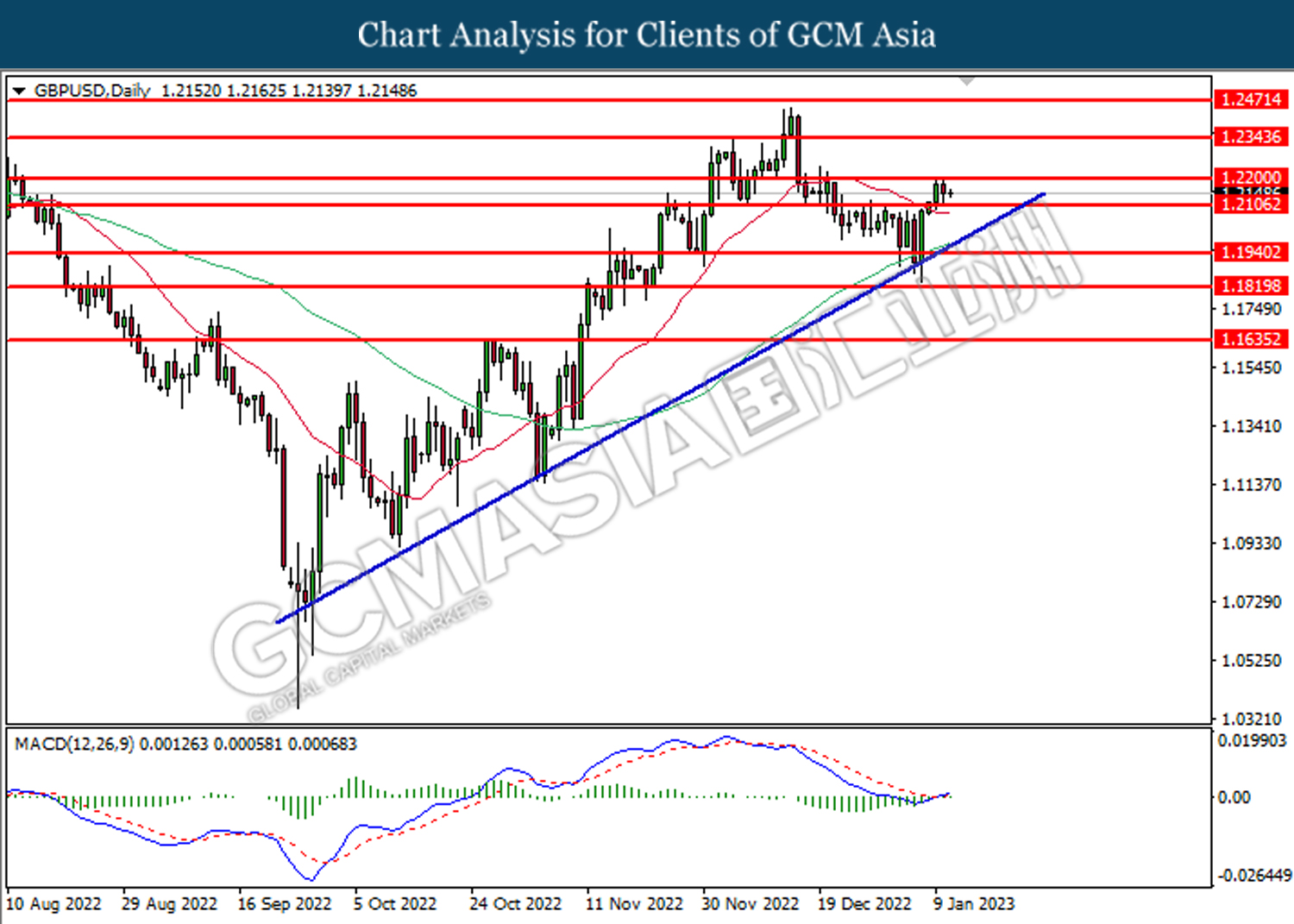

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

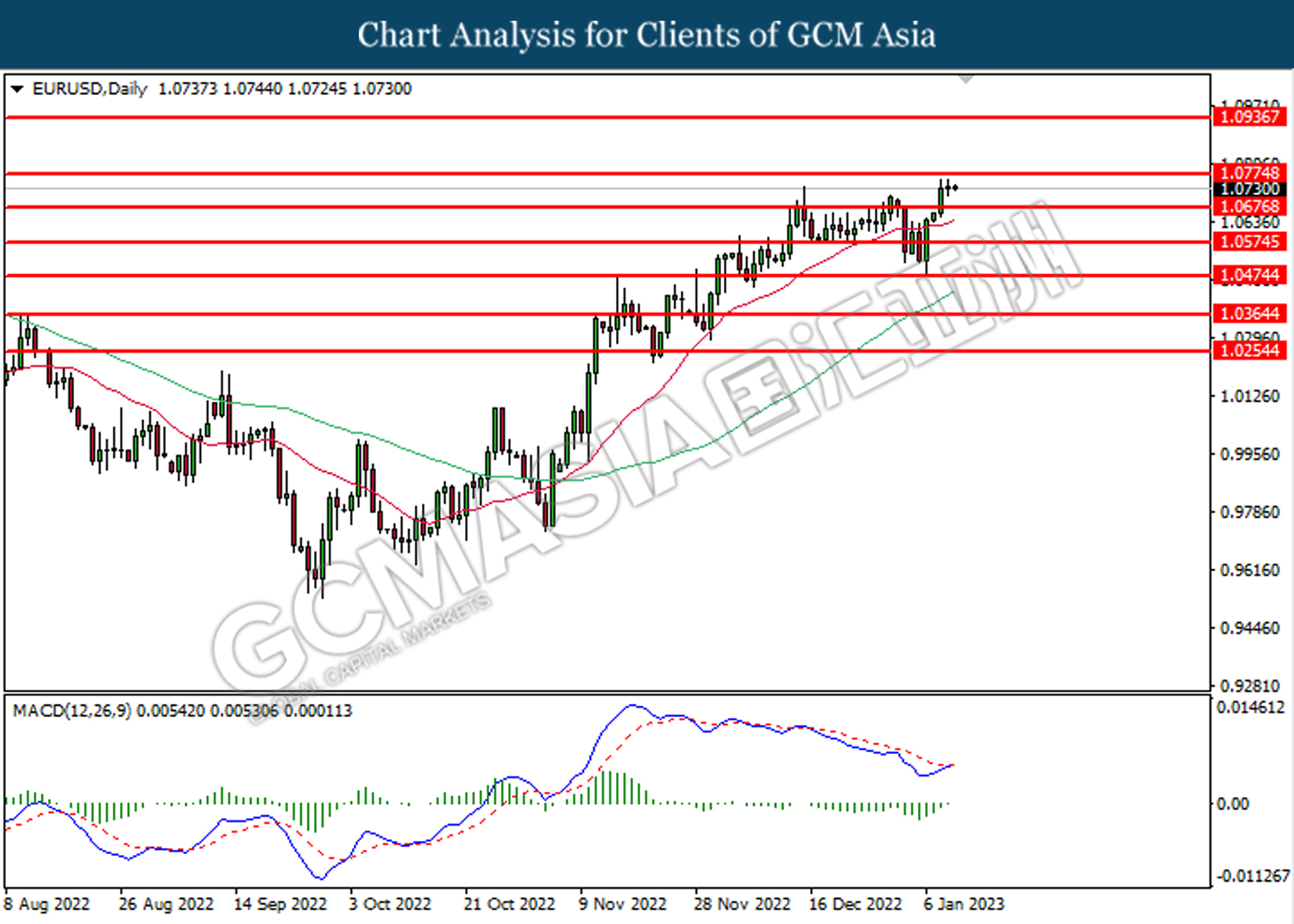

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0775. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

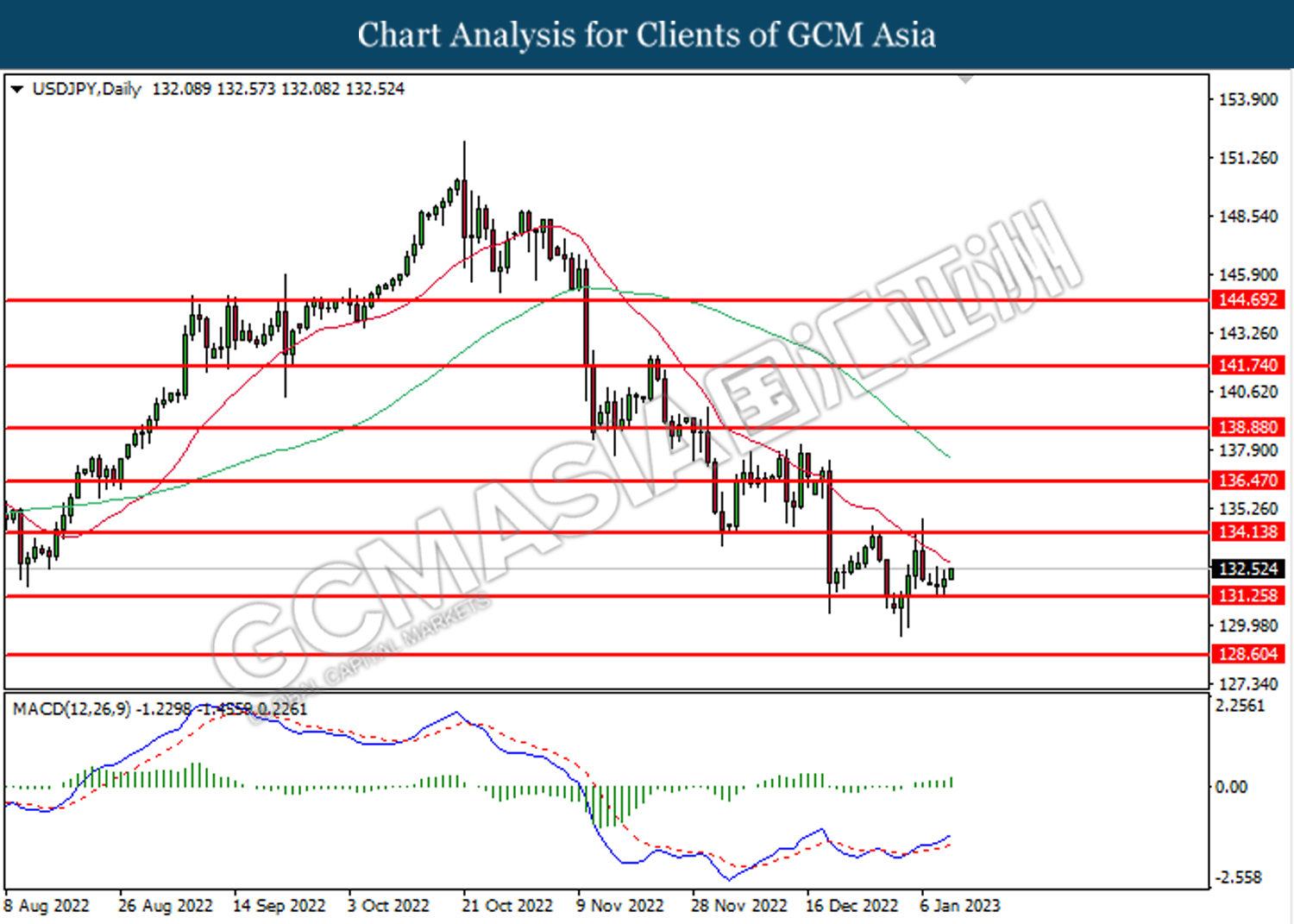

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

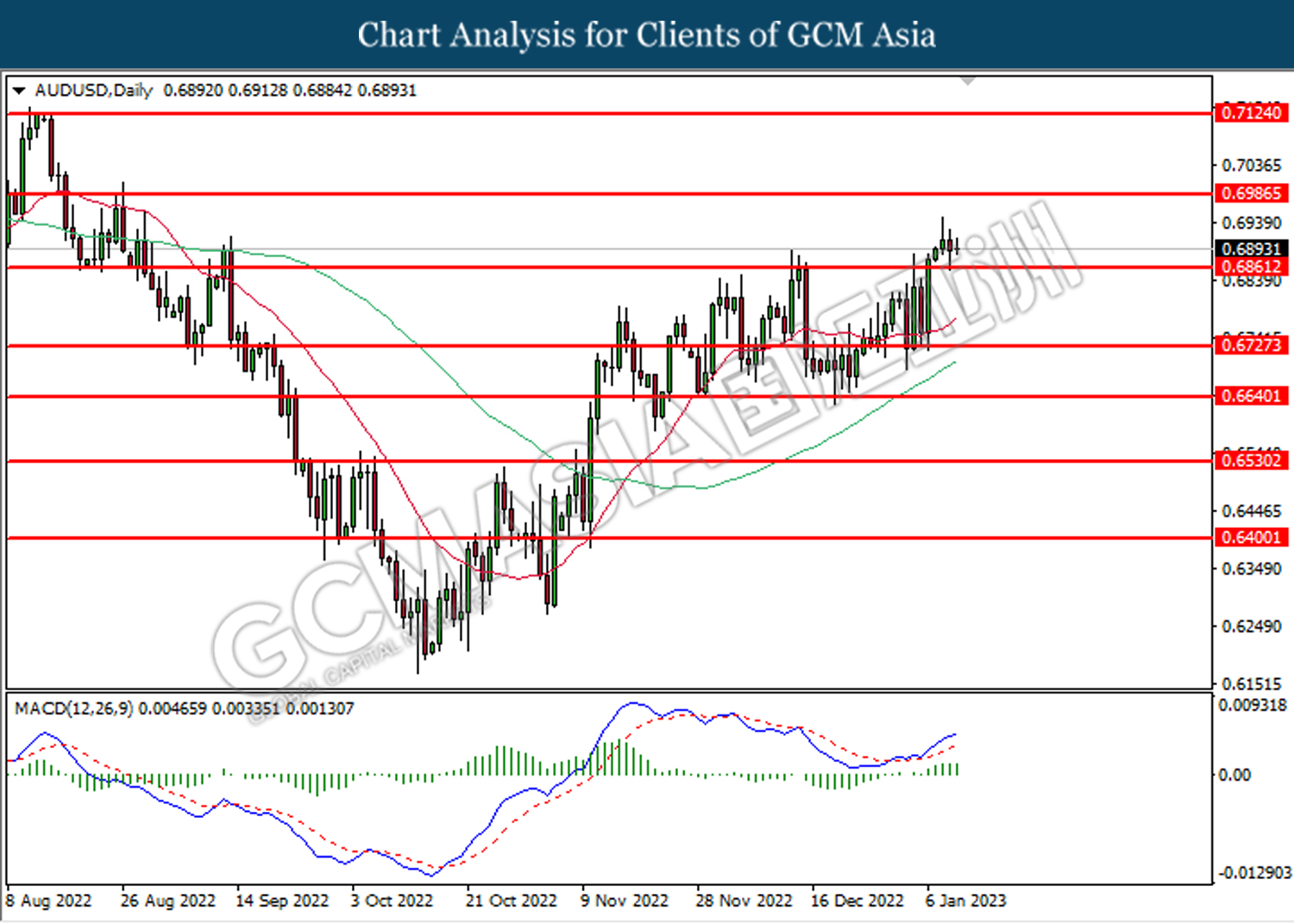

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

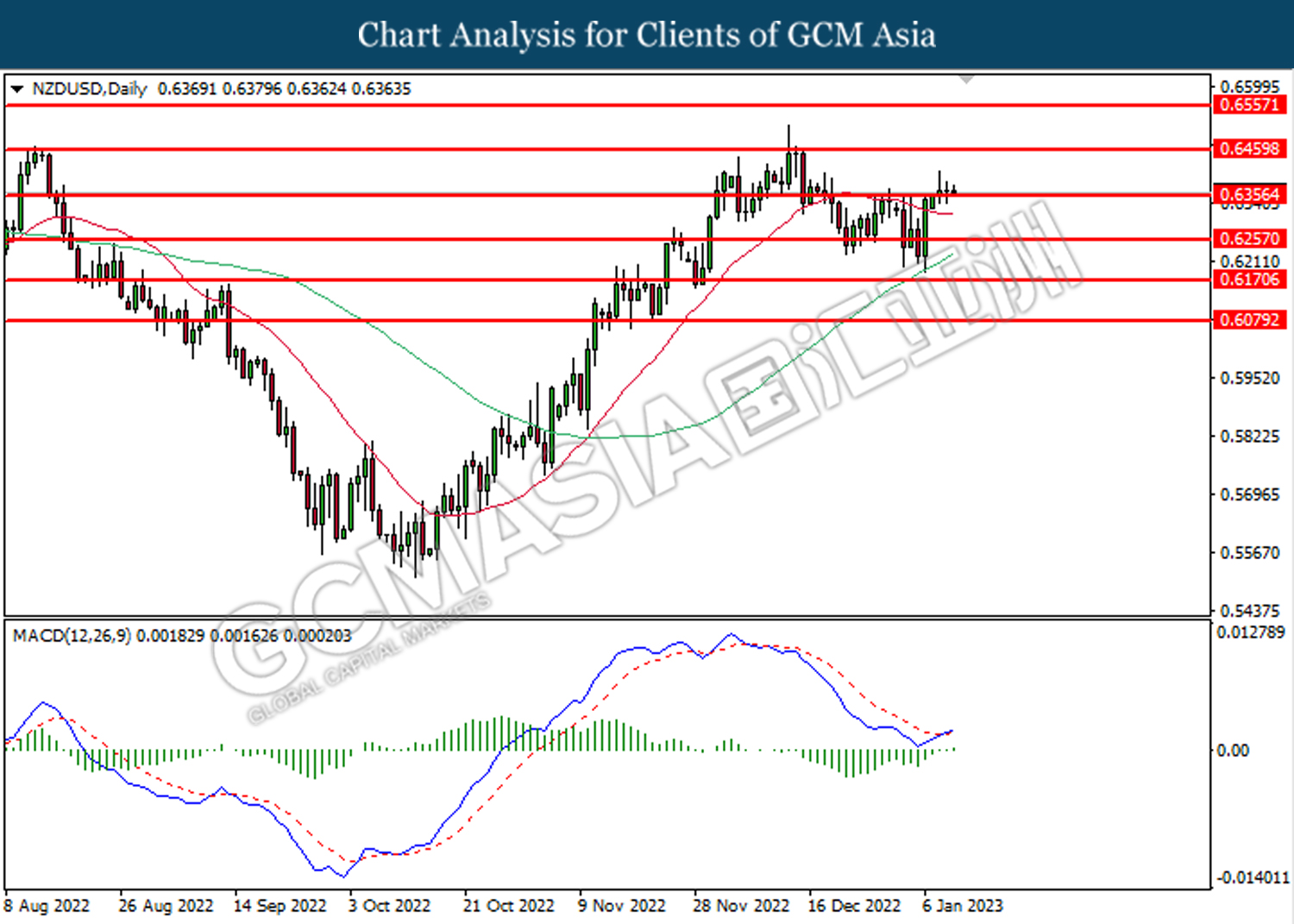

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

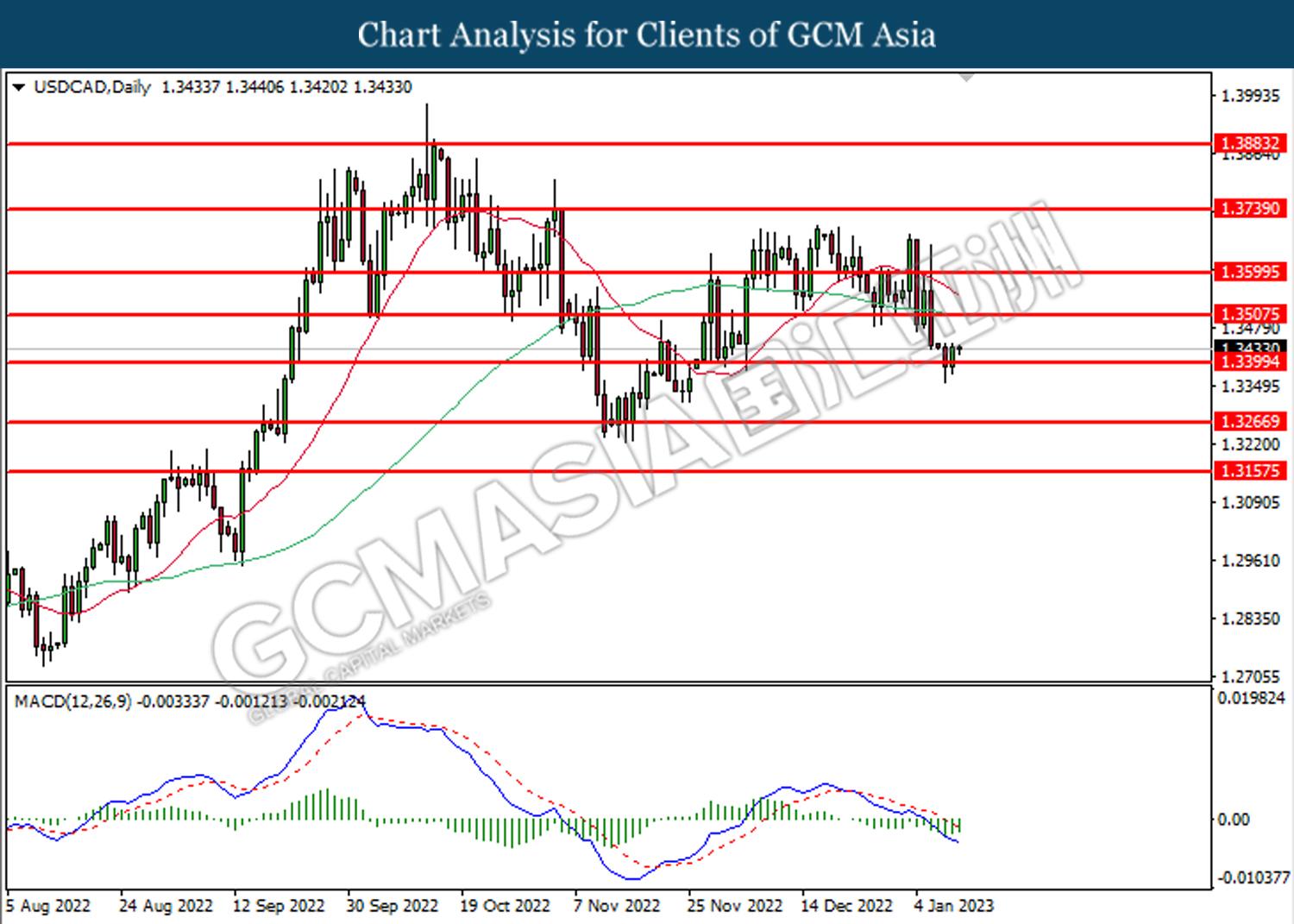

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3400. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

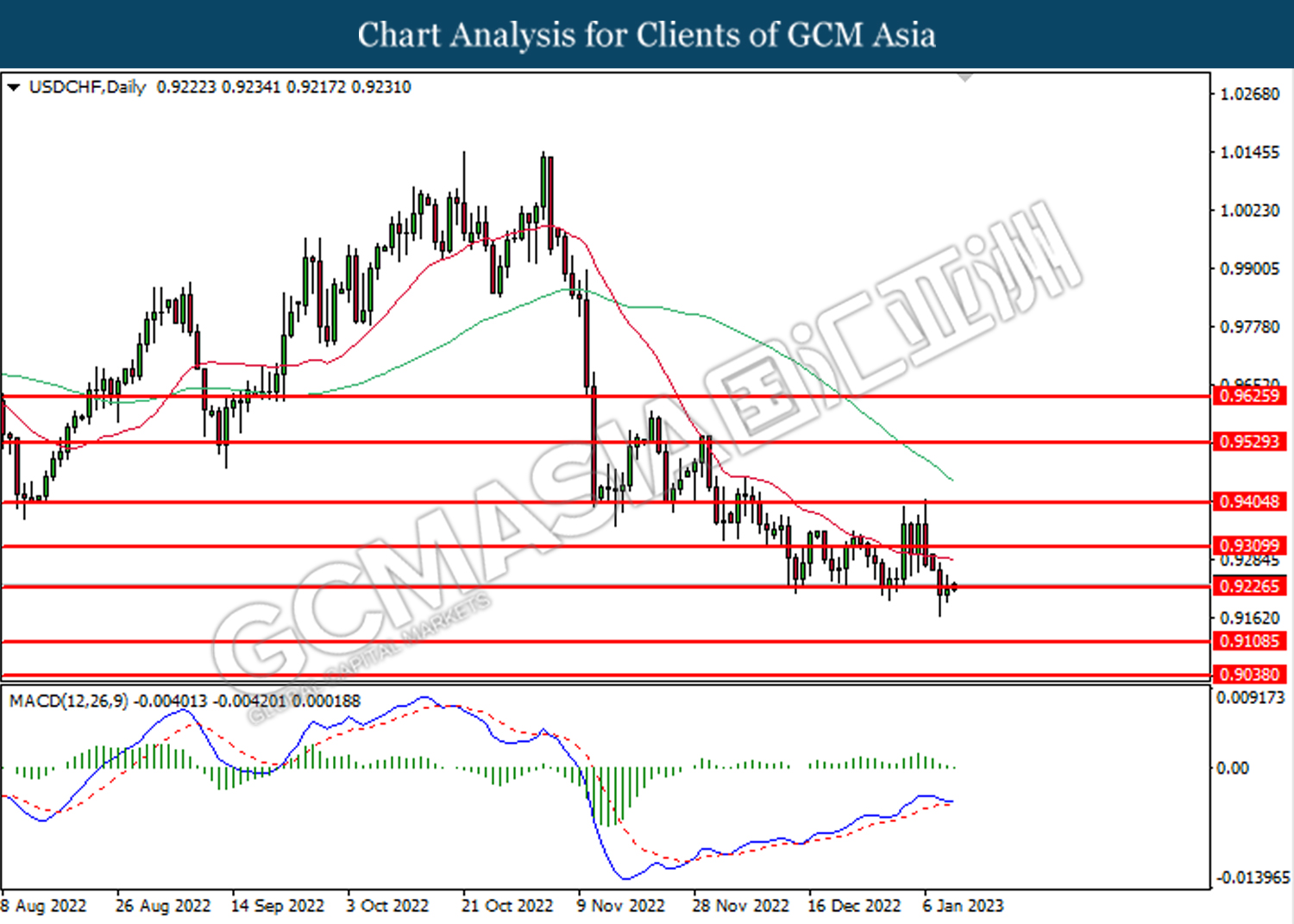

USDCHF, Daily: USDCHF was traded lower following prior breakout below the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

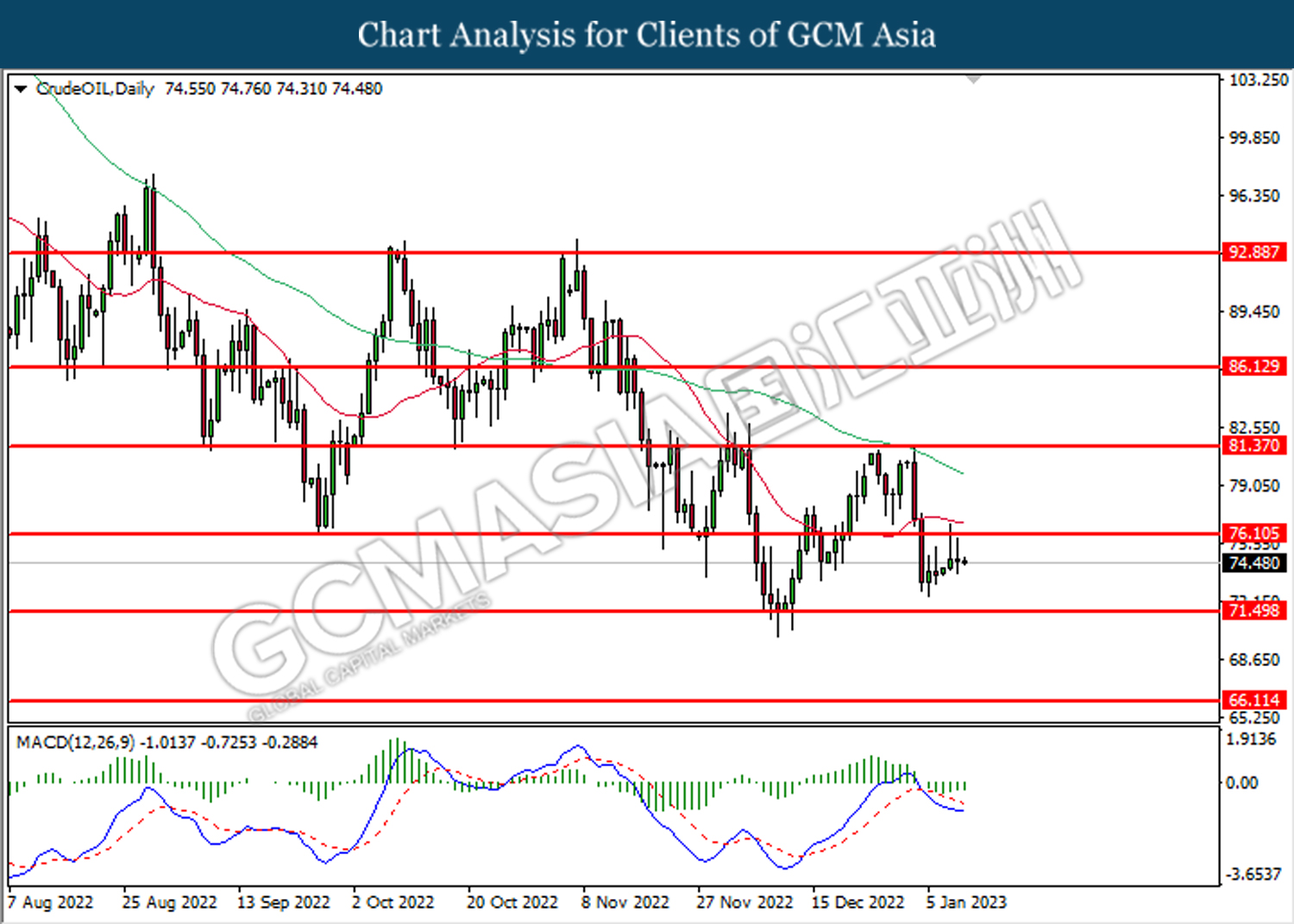

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

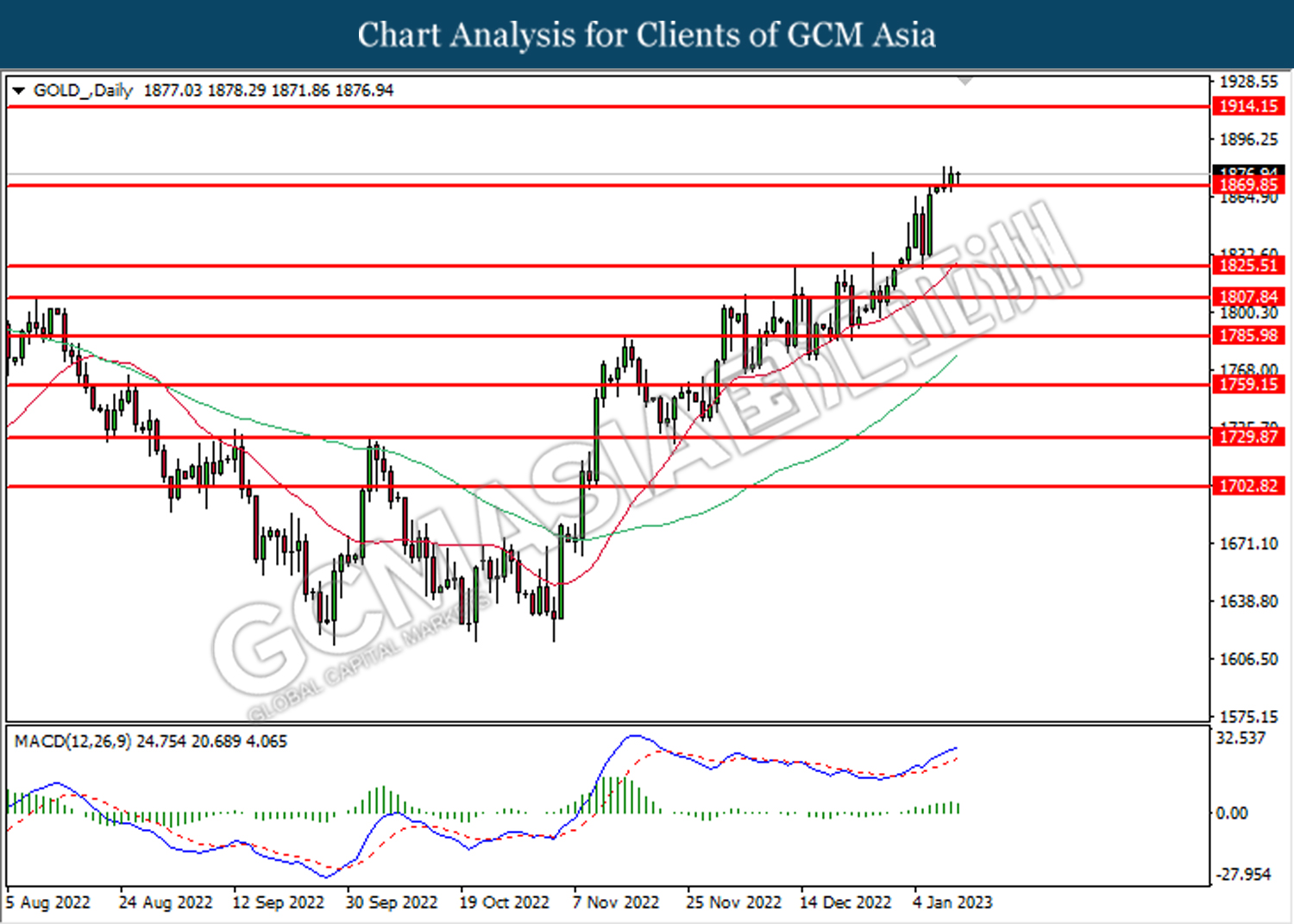

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1869.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1914.15.

Resistance level: 1914.15, 1957.85

Support level: 1869.85, 1825.50