11 February 2022 Afternoon Session Analysis

EURUSD slips as dollar strengthens.

Euro suffered losses after a spike due to possible rate hike from US Consumer Price Index data released yesterday. That said, the US Consumer Price Index (CPI) and comments from various Fed speakers weighed on the pair prior to European Central Bank (ECB) President Christine Lagarde’s statements. According to reports, US CPI data for January rallied to a nearly five-decade high with a 7.5%, versus 7.3% expected and 7.0% prior. However, the latest comments from Fed Richmond President Thomas Barkin seemed to help the major currency pair in trimming intraday losses to 0.30%. Although the hot inflation figures were already expected, St. Louis Fed President James Bullard went a step farther while supporting 100 bps rate hikes by July and for the balance sheet reduction to start in the second quarter, Fed’s Bullard also cited the potential for 50 basis points (bps) of Fed rate hike in March, hence brought the pair lower. Nonetheless, investors will continue to scrutinize updates from the US to gauge the movement of the pair. As of writing, EURUSD dropped by 0.42% to 1.1383.

In the commodities market, crude oil down 0.41% to $88.60 per barrel due to optimism grows in the progress of Iranian nuclear talks. On the other hand, gold price was down 0.18% to 1823.72 per troy ounce due to US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GDP (YoY) (Q4) | 6.80% | 6.50% | – |

| 15:00 | Manufacturing Production (MoM) (Dec) | 1.10% | 0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.95. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

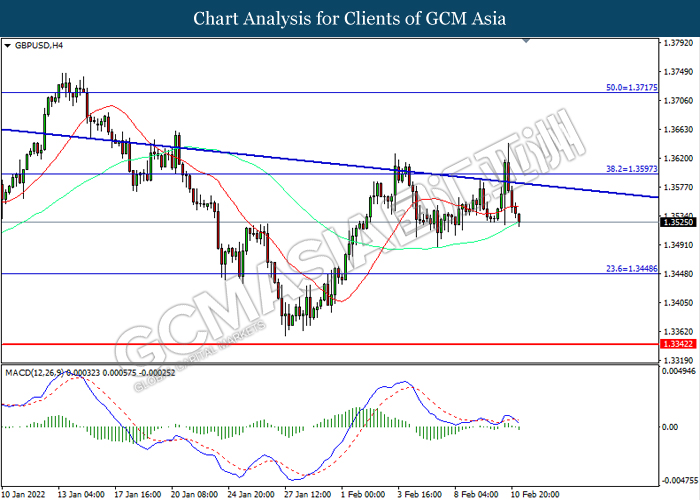

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

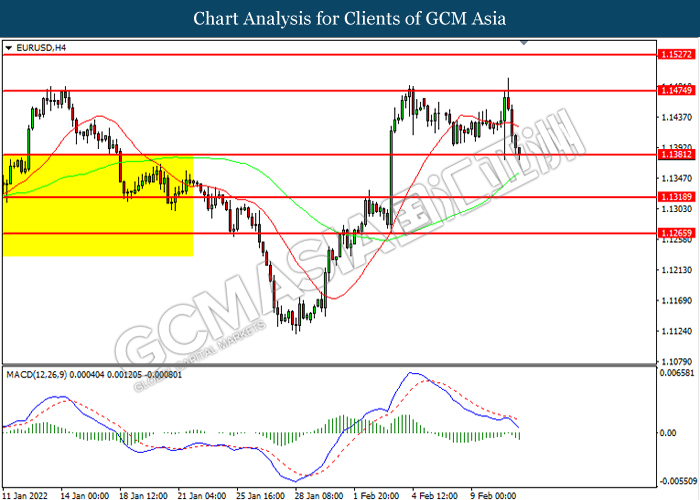

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1320

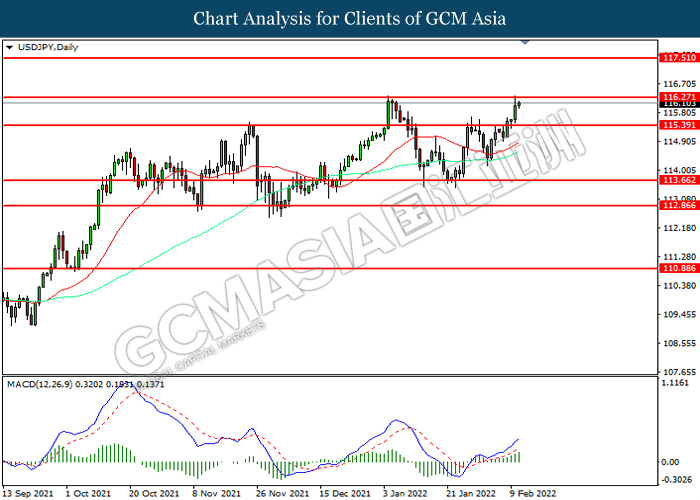

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 116.25. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 116.25, 117.50

Support level: 115.40, 113.65

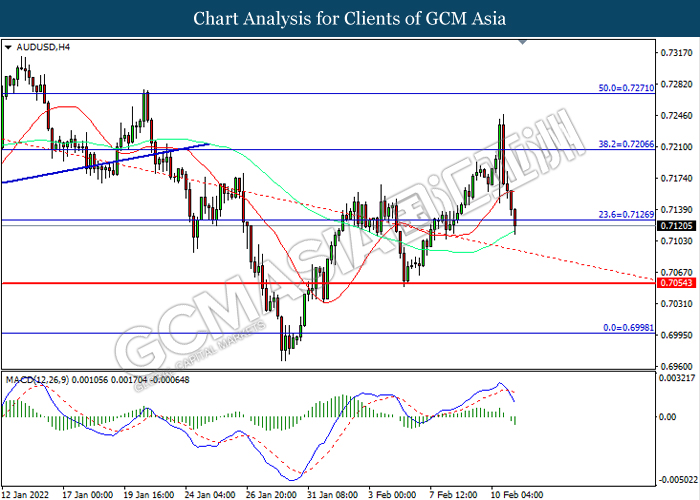

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

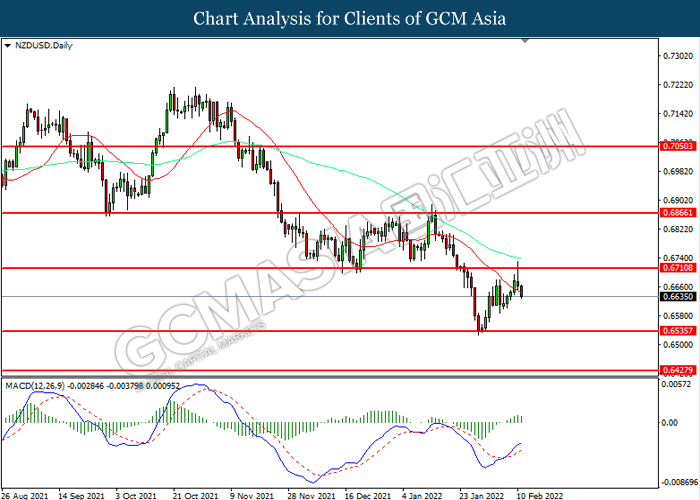

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

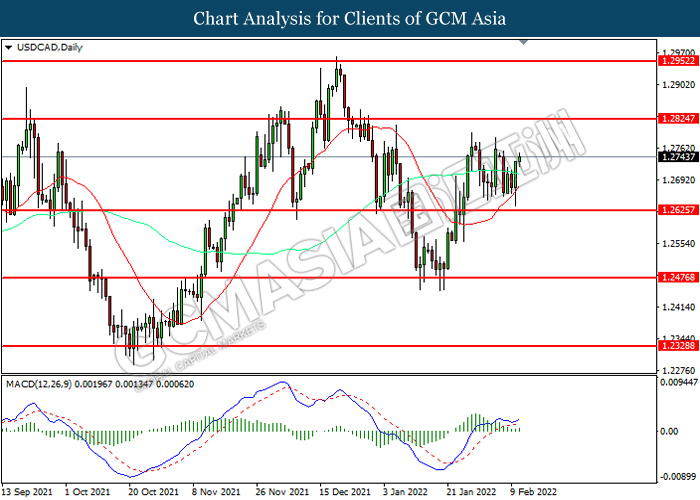

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

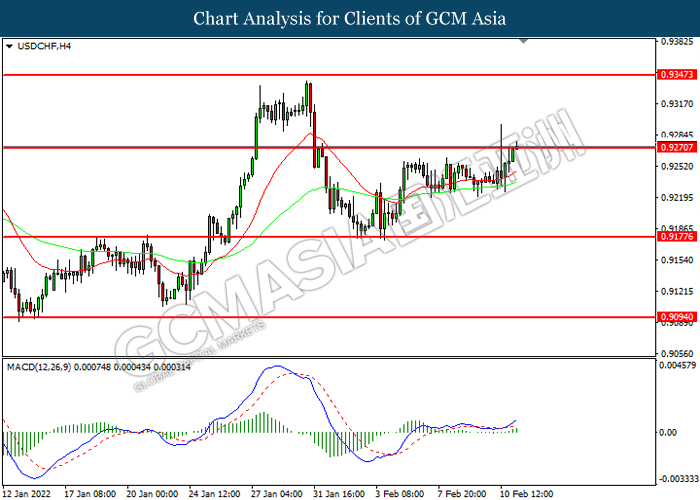

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

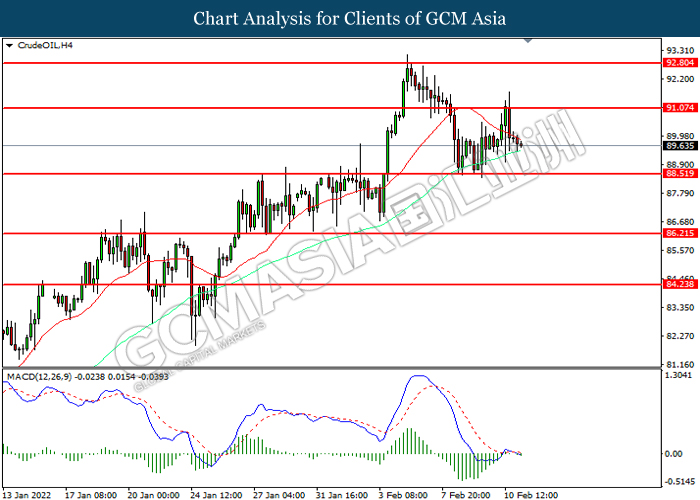

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 91.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 88.50.

Resistance level: 91.05, 92.80

Support level: 88.50, 86.20

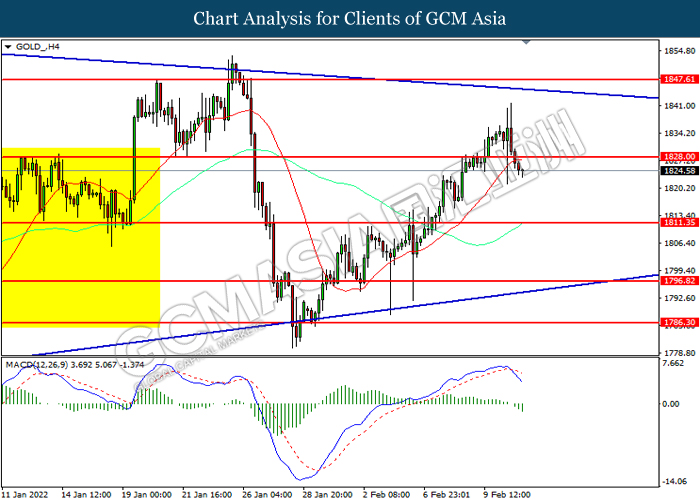

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1828.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1811.35.

Resistance level: 1828.00, 1847.60

Support level: 1811.35, 1796.80