11 February 2022 Morning Session Analysis

Greenback surge over high inflation.

Greenback rebounds sharply from lower levels as high inflation in the United States spurs bullish speculation towards the Federal Reserve. According to US Labor Department, Core CPI for the month of January came in at 0.6%, slightly higher than consensus forecast of 0.5%. Price increase for last month was rather substantial due to higher costs for rents, electricity, and food. Following the data, Fed member James Bullard commented that the data has cemented the course to take a more hawkish approach in terms of monetary policy. When referring to CME FedWatch Tool, the probability for 50 basis point interest rate hike surge to 89.9%, significantly higher than the probability for 25 basis point interest rate hike with only 10.1%. For the time being, investors will wait for further signals from the US to gauge the trend direction of US dollar. As of writing, dollar index was up 0.01% to 95.61.

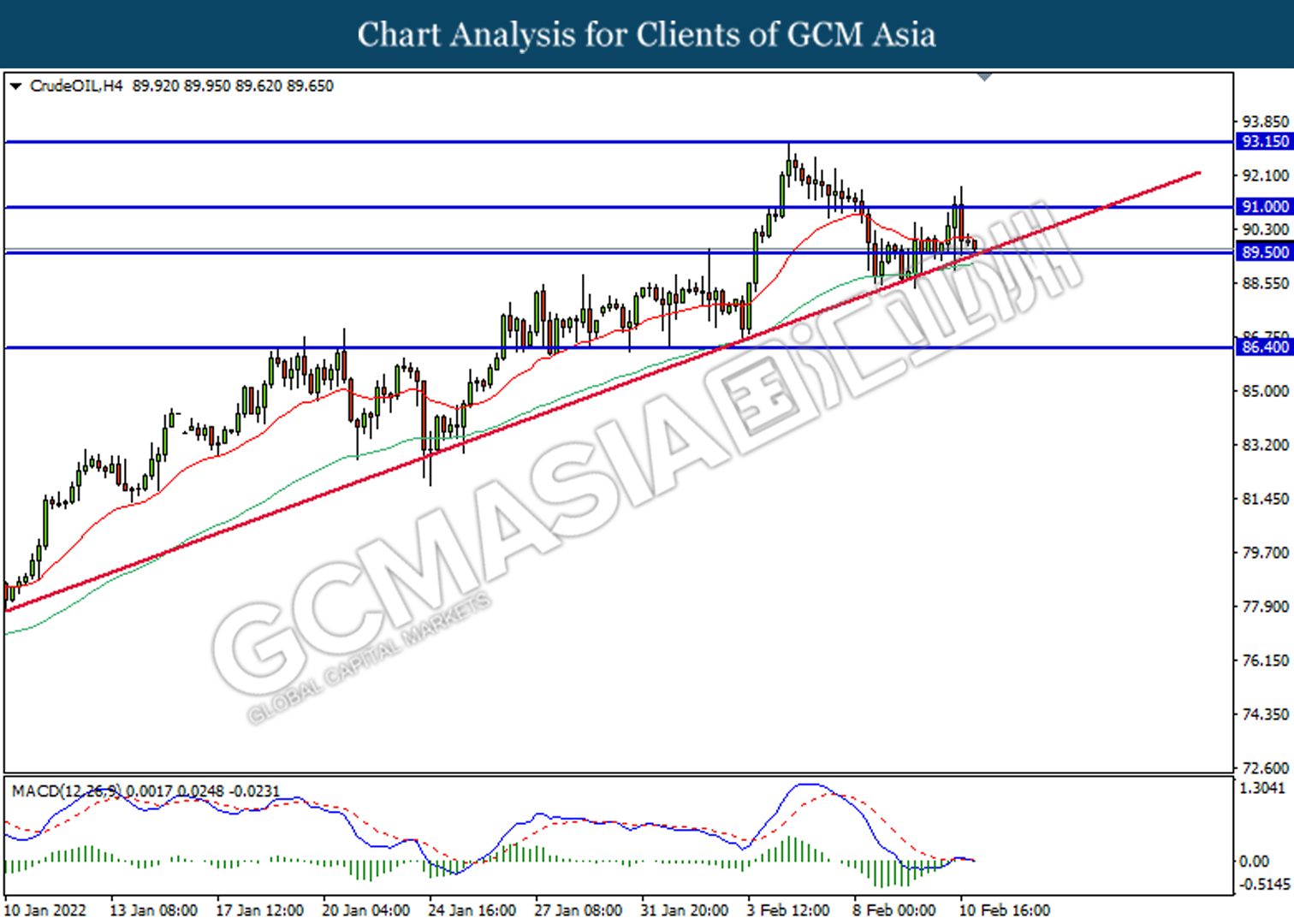

In the commodities market, crude oil price slumped 0.17% to $90.04 per barrel after reports shows an increase in Iran’s oil export despite ongoing sanctions. On the other hand, gold price was down 0.01% to $1,826.89 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Monetary Policy Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GDP (YoY) (Q4) | 6.80% | 6.50% | – |

| 15:00 | Manufacturing Production (MoM) (Dec) | 1.10% | 0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

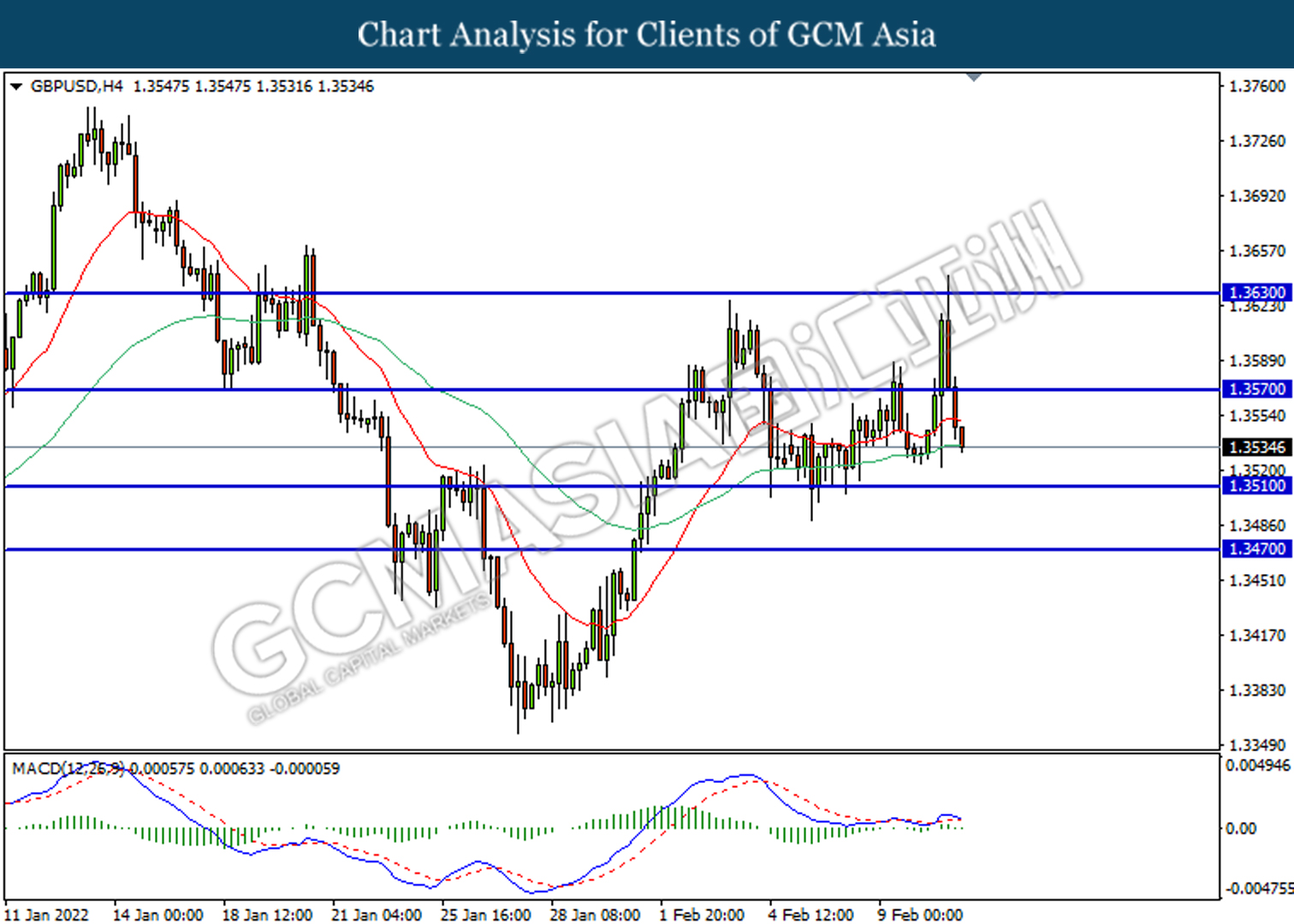

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

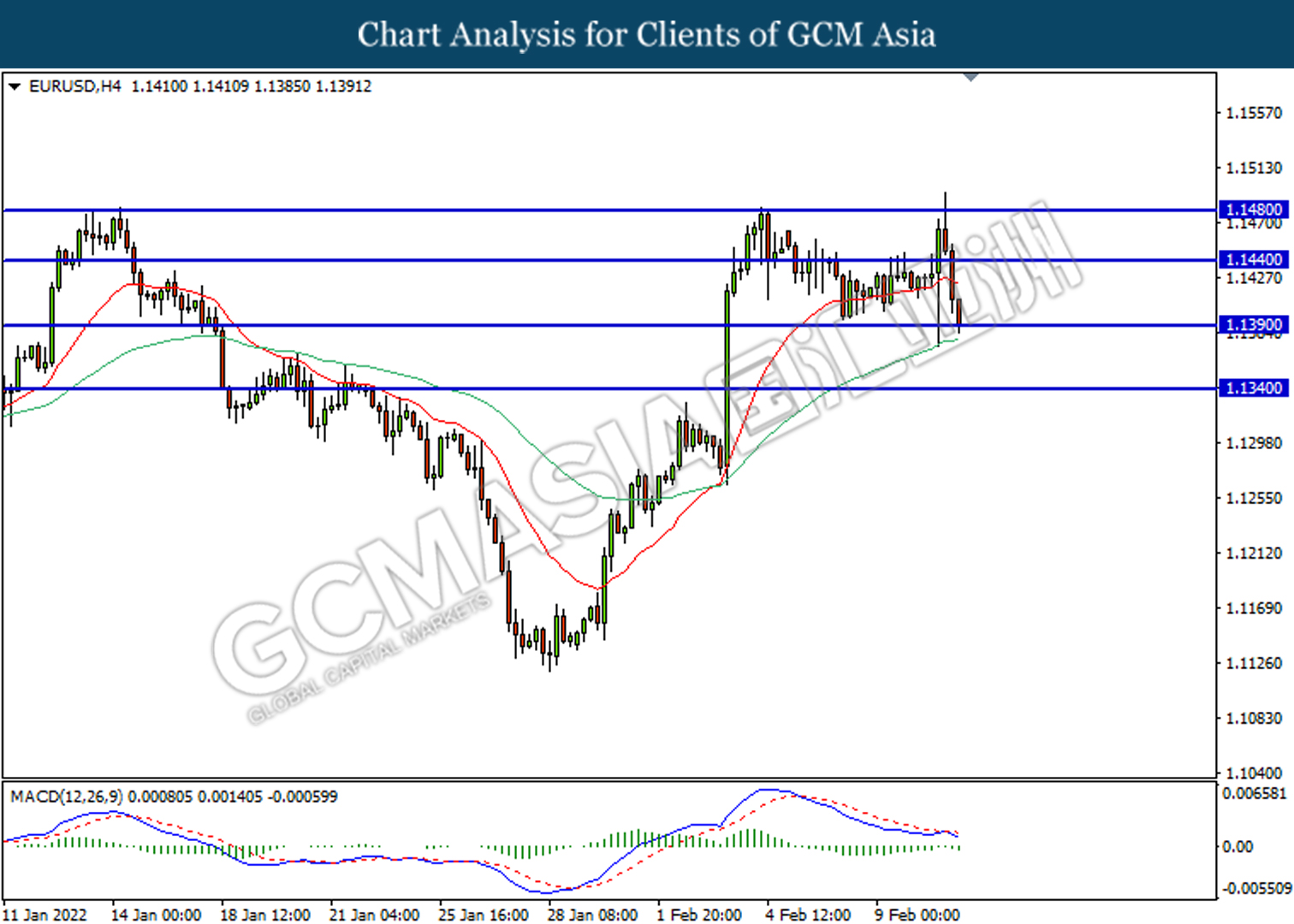

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after closing below the support level.

Resistance level: 1.1440, 1.1480

Support level: 1.1390, 1.1340

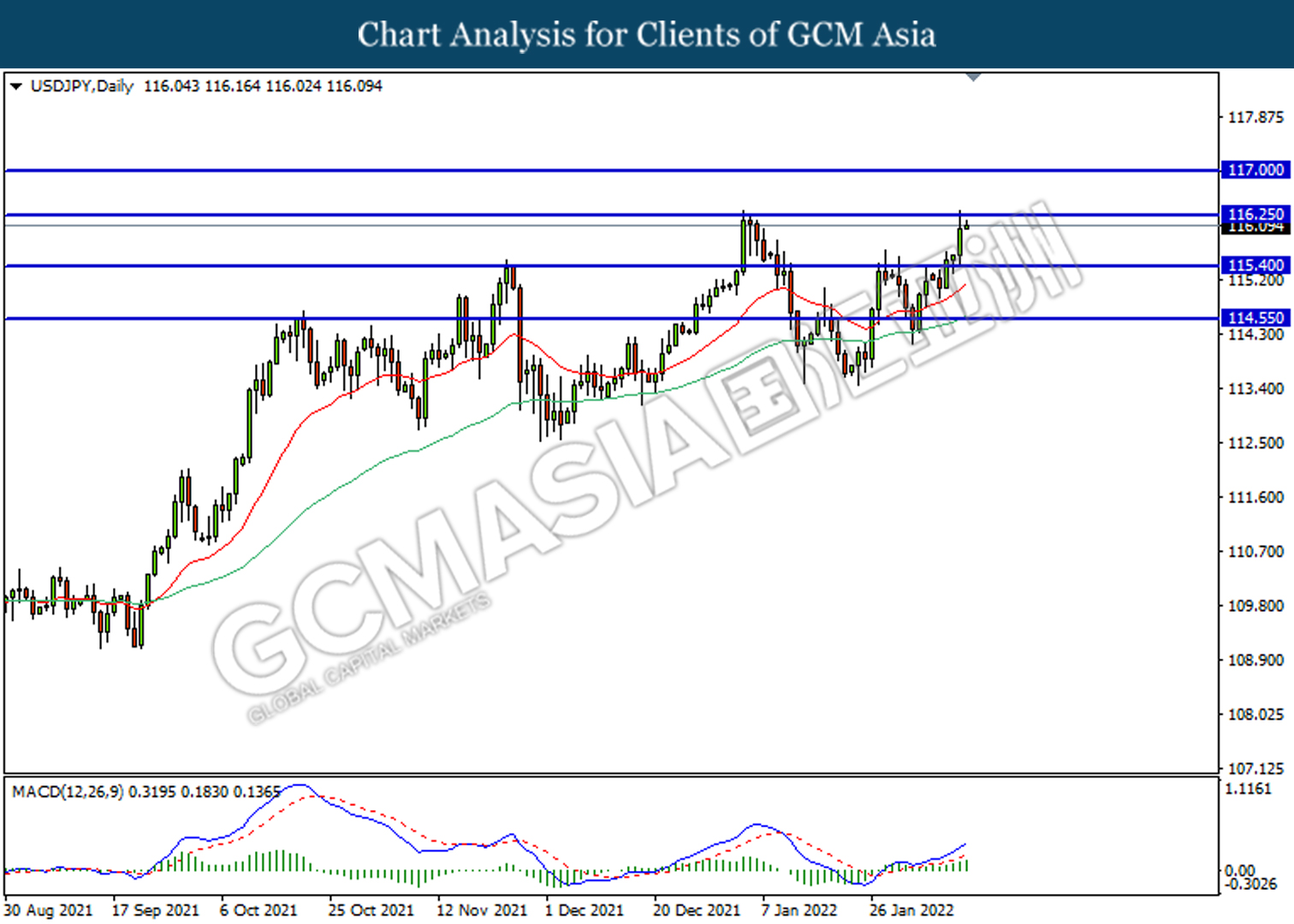

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after closing above the resistance level.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

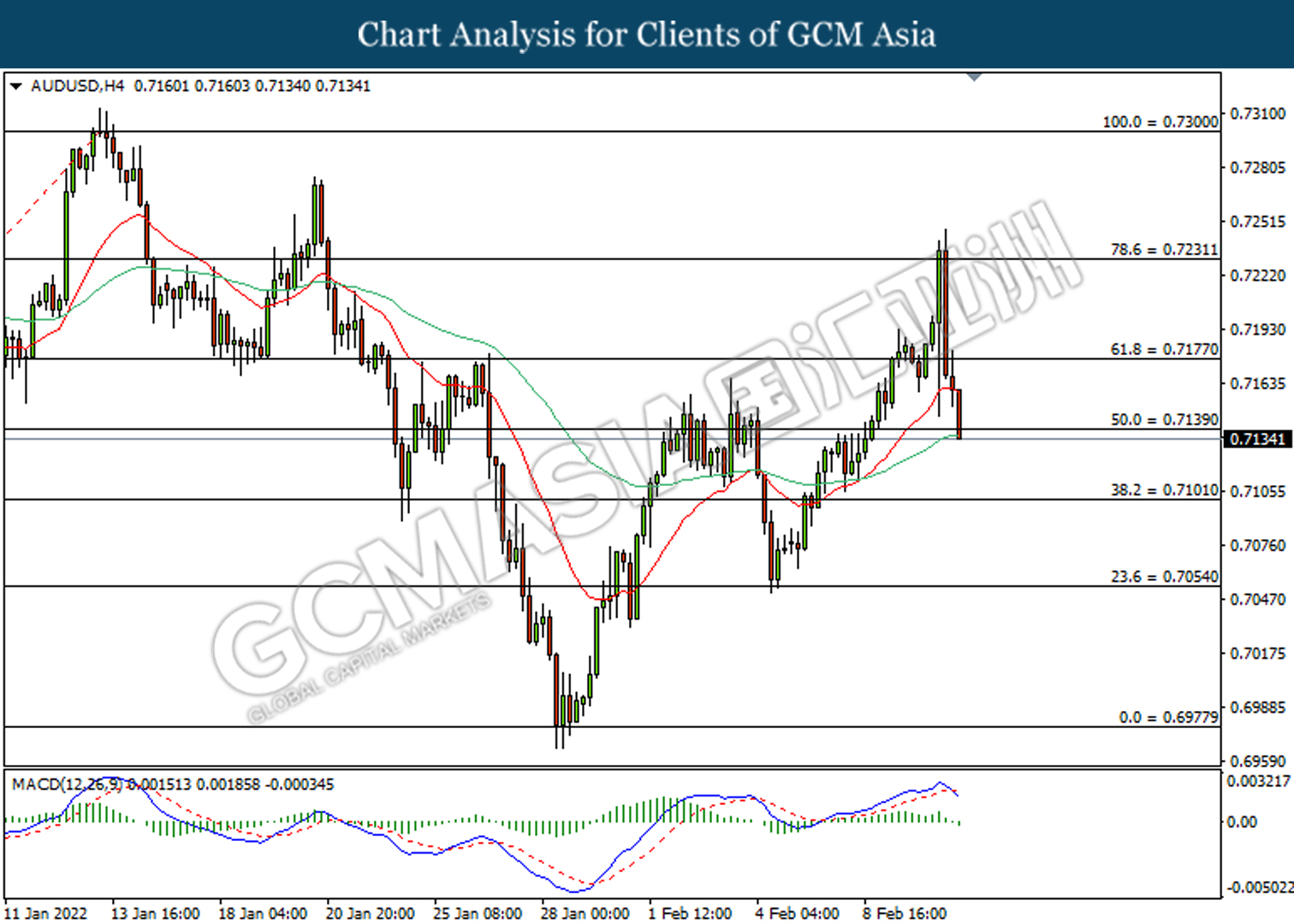

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after closing below the support level.

Resistance level: 0.7180, 0.7230

Support level: 0.7140, 0.7100

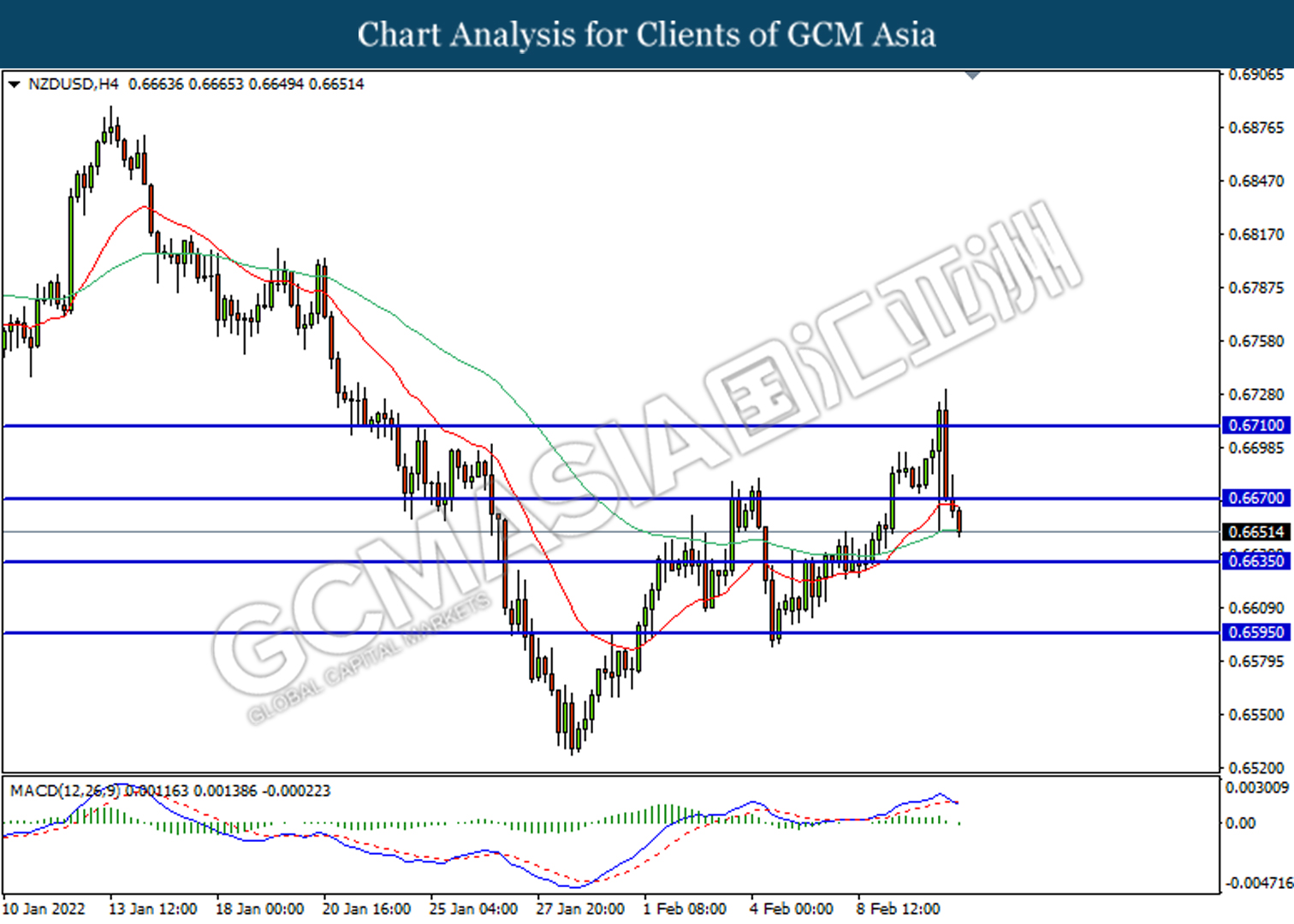

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

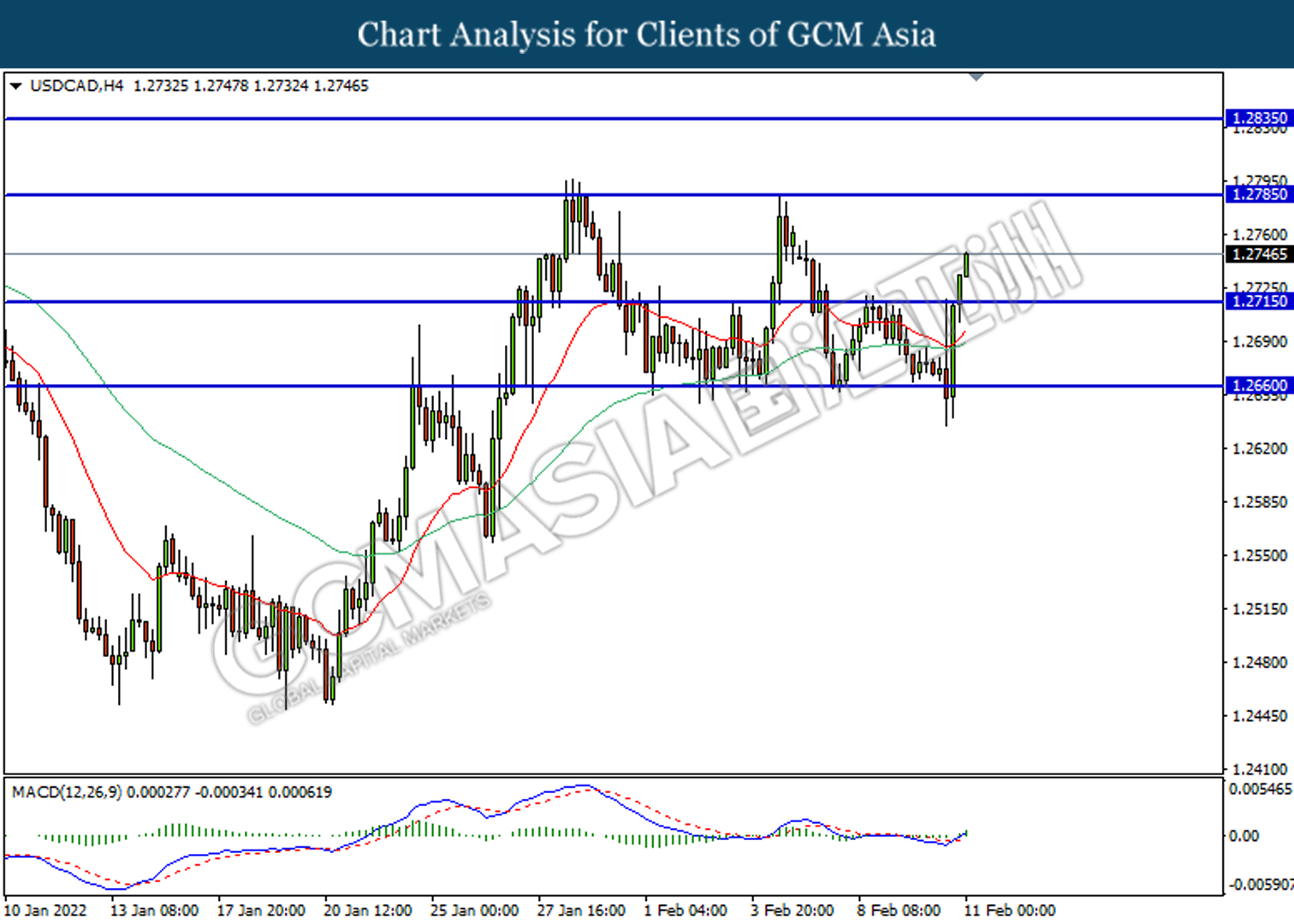

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

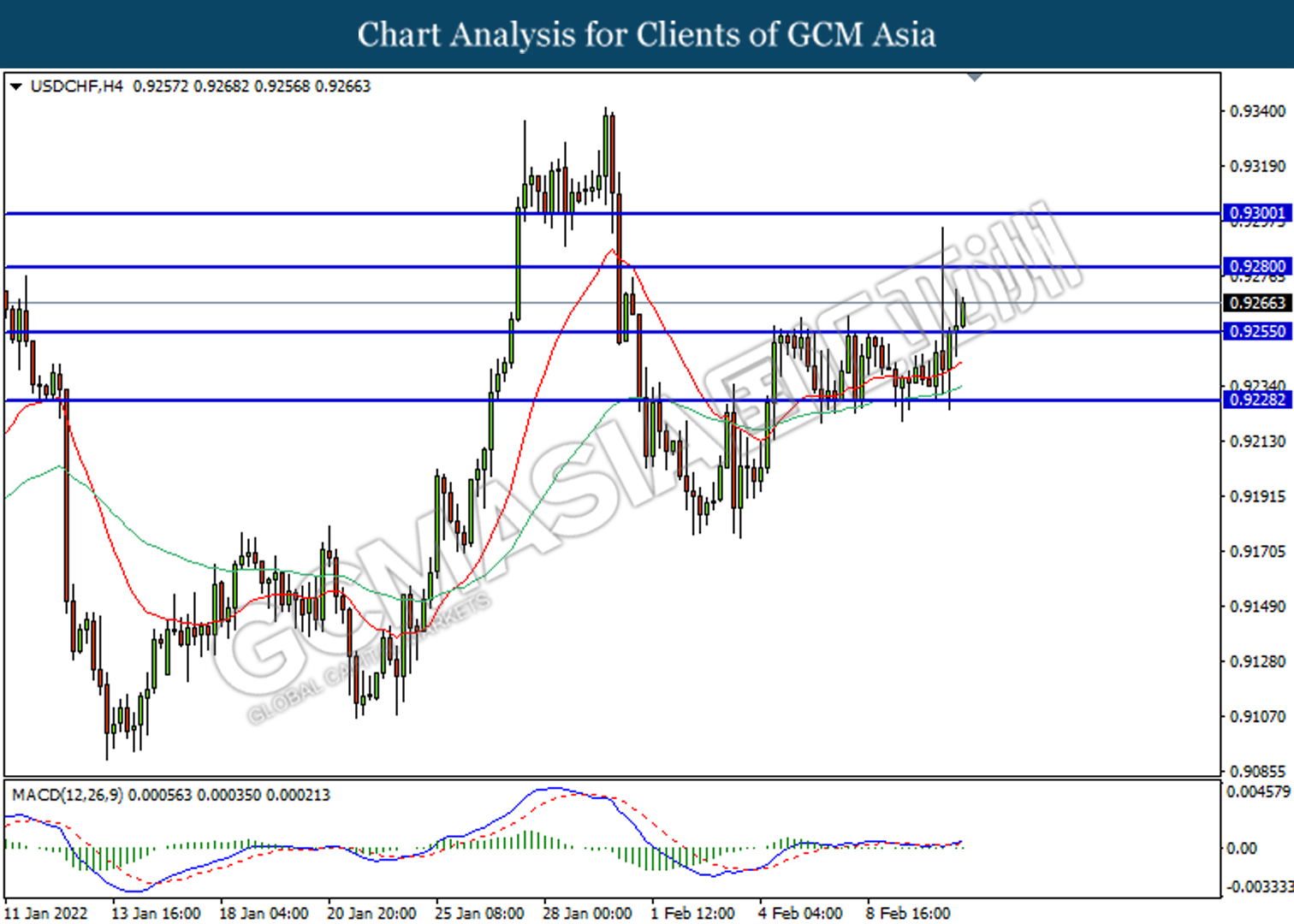

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9280, 0.9300

Support level: 0.9255, 0.9230

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower after closing below the support level.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1830.00, 1850.00

Support level: 1812.80, 1797.60