11 April 2023 Afternoon Session Analysis

Aussie rebounded after upbeat economic data released.

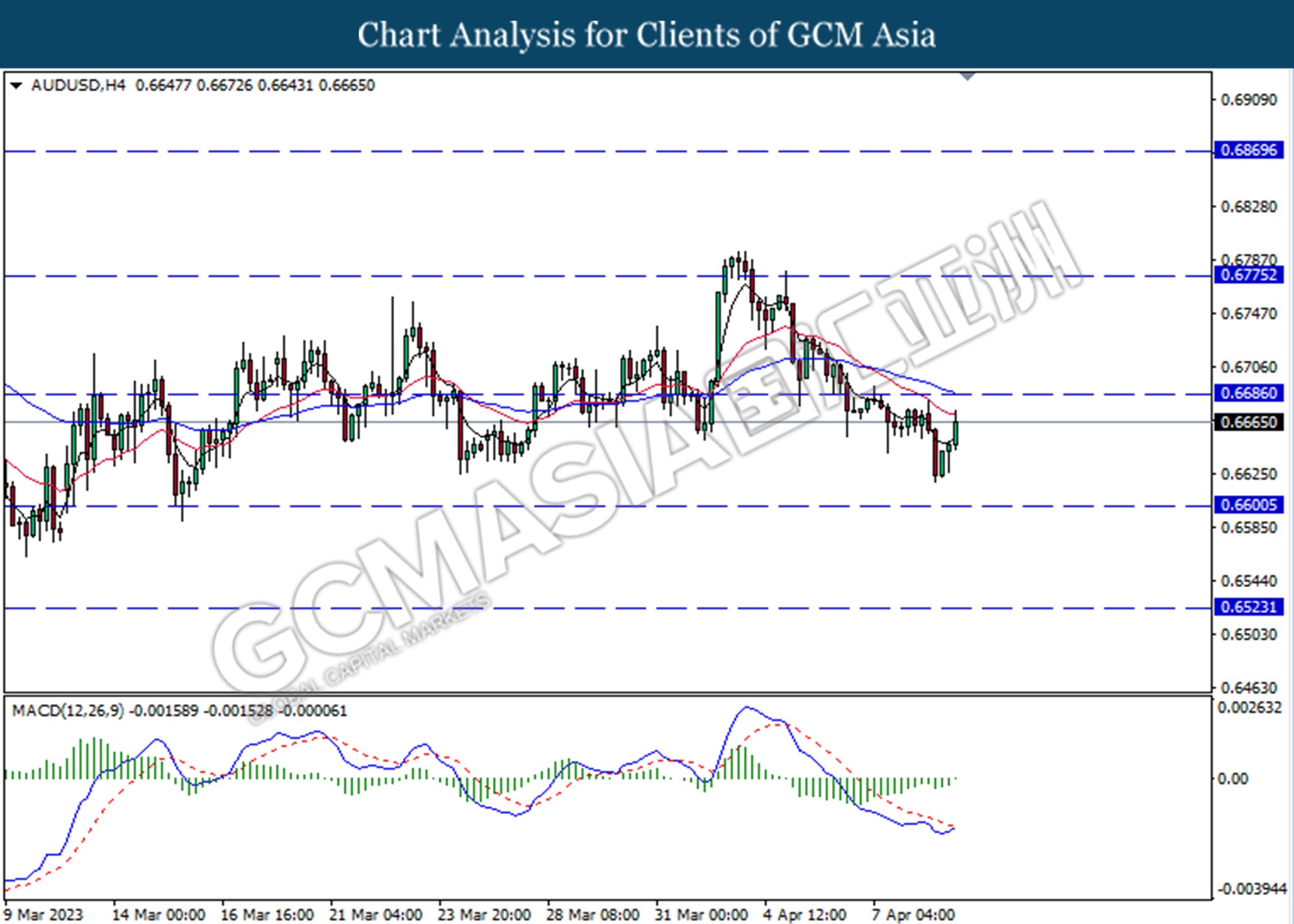

The Aussie dollar rebounded after a series of upbeat economic data released during the Asian trading hours. Australian consumer confidence surged 9.4%, beating market expectation at 1.5%, according to the Westpac Consumer Confidence Statement. The survey was conducted over the four days of April 4 – 6 with about 1200 consumers on the board. Judging by the survey result, the index’s strong recovery was largely attributed to the decision of the Reserve Bank of Australia (RBA) to pause its cash rate increase at the April meeting. Besides, the confidence amongst respondents with a mortgage lifted by 12.2% although it is still below its 14.5% level before RBA tightening cycle began. However, both data still indicated an increase in consumer confidence, boosting consumer spending. Moreover, business confidence continued to show resilience in March, despite the reading remaining 1 index point below the long-run average According to National Australia Bank (NAB) statement, the reading grew higher than the prior reading’s -4 and out beat market expectation at the index level at -2. Importantly, price and cost growth measures showed a sign of easing in March. A series of optimistic data increased the odds of maintaining the central bank stance on tightening monetary policy. Also, the Westpac’s economists are expecting a 25-basis points rate hike at the May board meeting. As of writing, the AUD/USD appreciated by 0.49% to $0.6669.

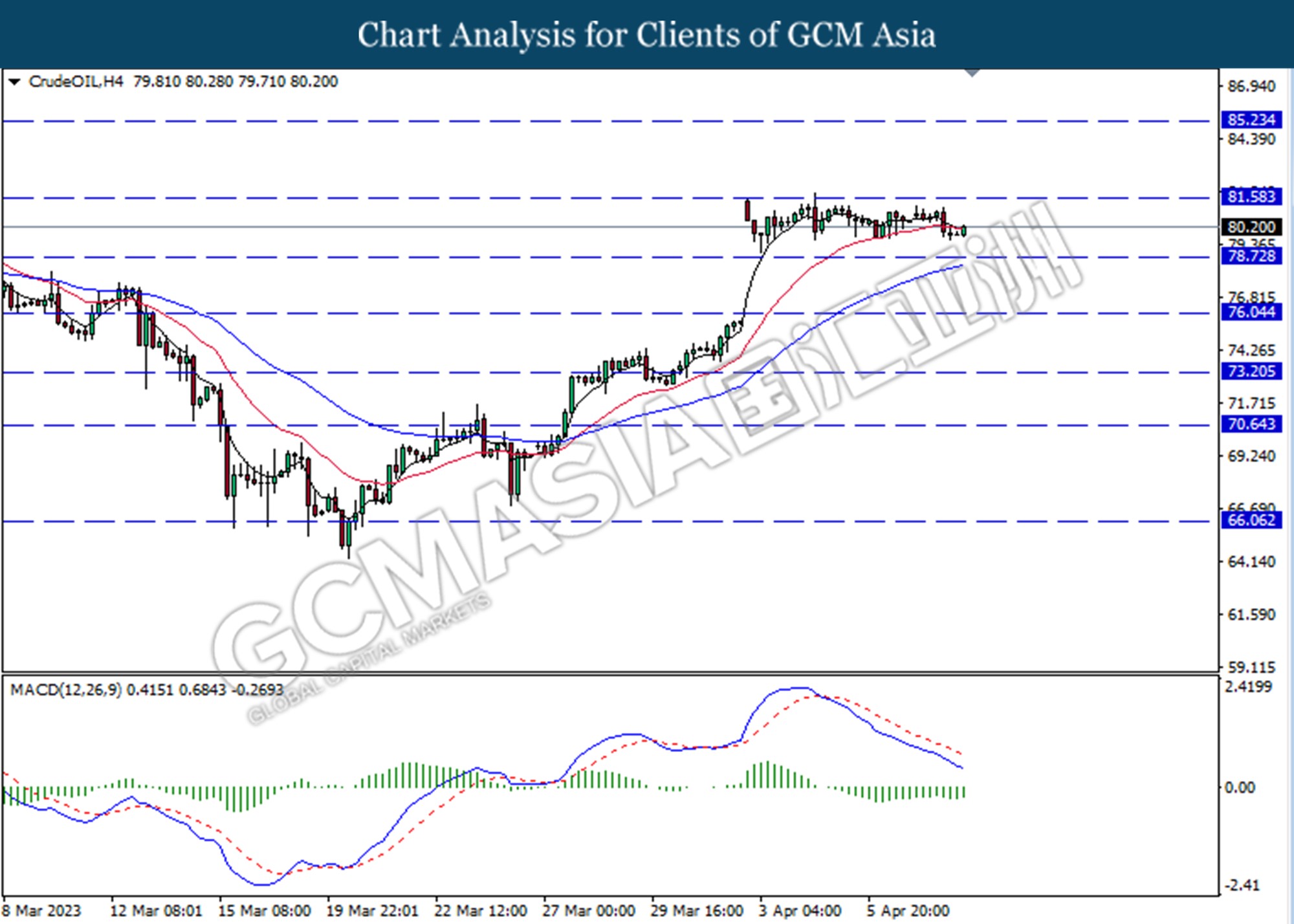

In the commodity market, the crude oil prices edged up by 0.73% to $80.33 per barrel as of writing, buoyed by China tourism hopes. On the other hand, the gold price was traded up by 0.46% to $2012.95 per troy ounce as of writing amid investors awaited the release of the CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the index extended its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

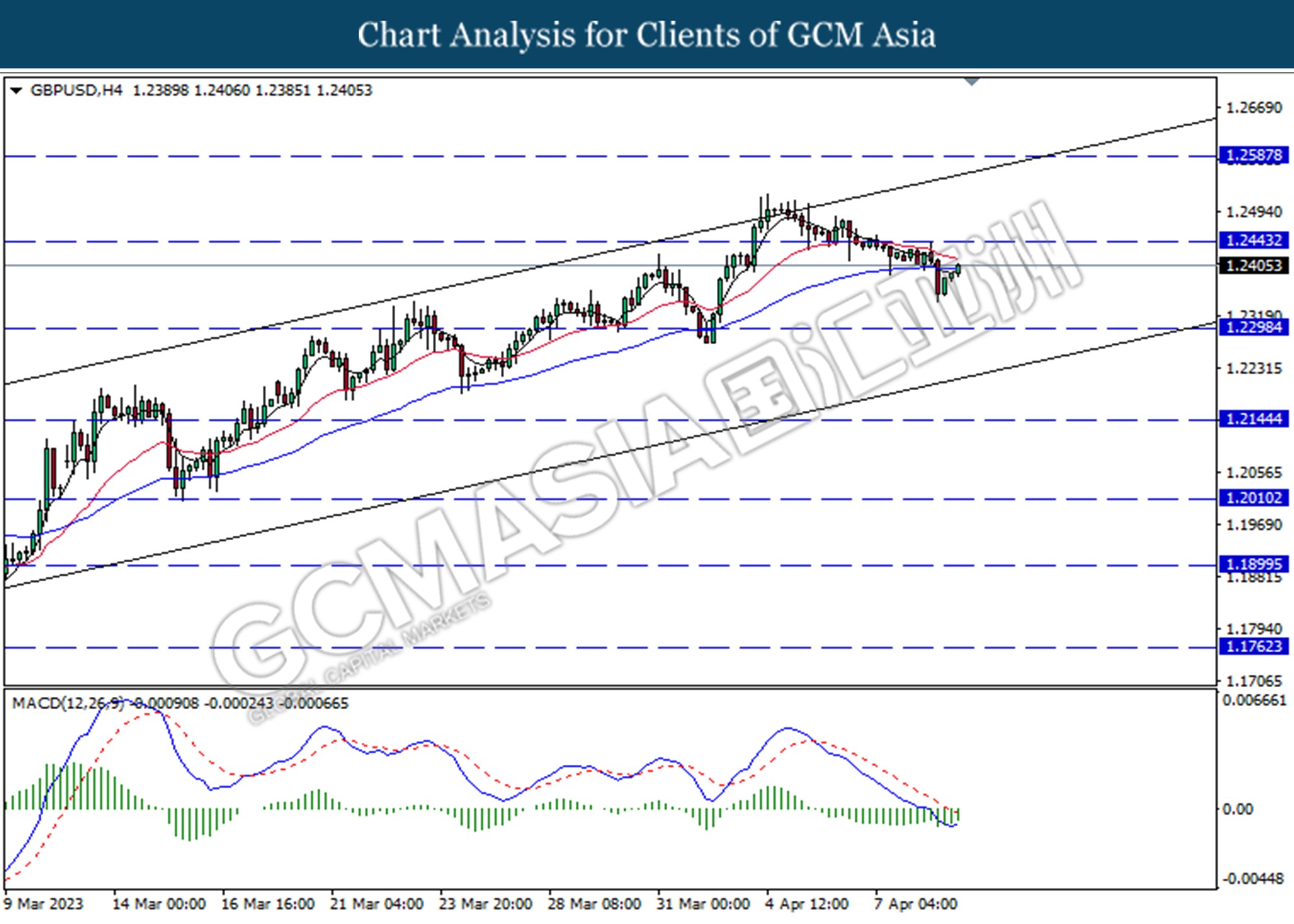

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.1245.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

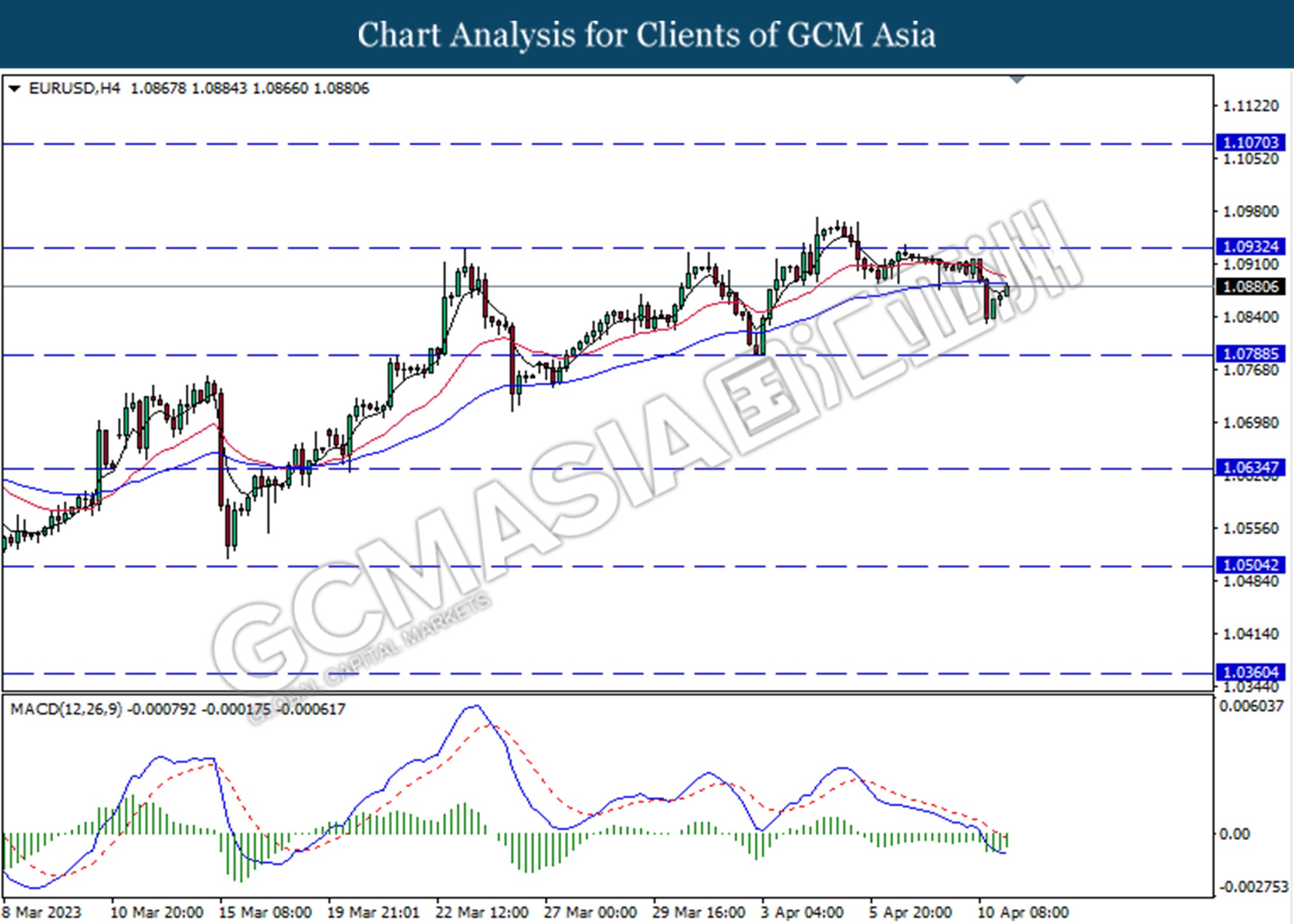

EURUSD, H4: EURUSD was traded lower higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

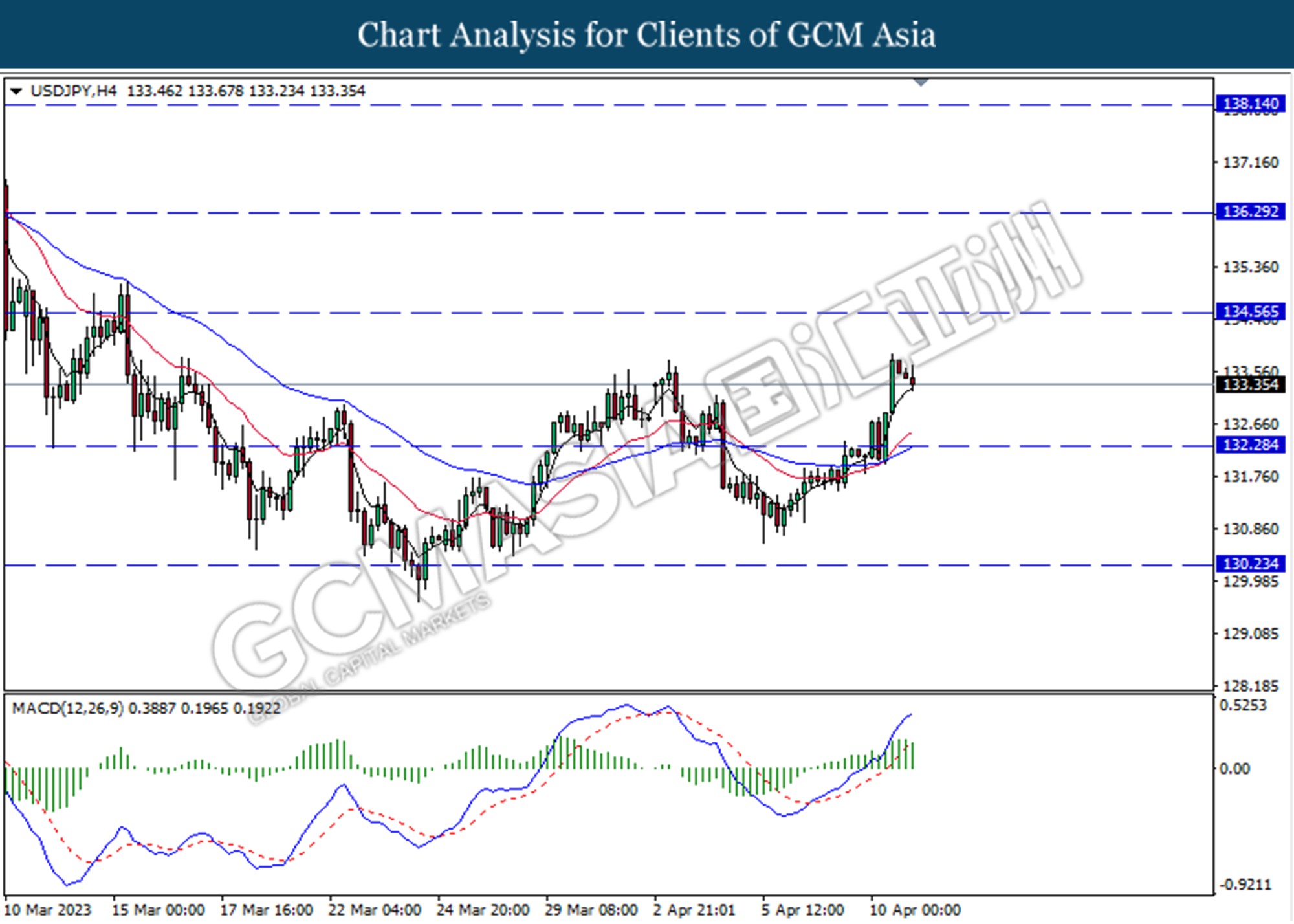

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior rebounded from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

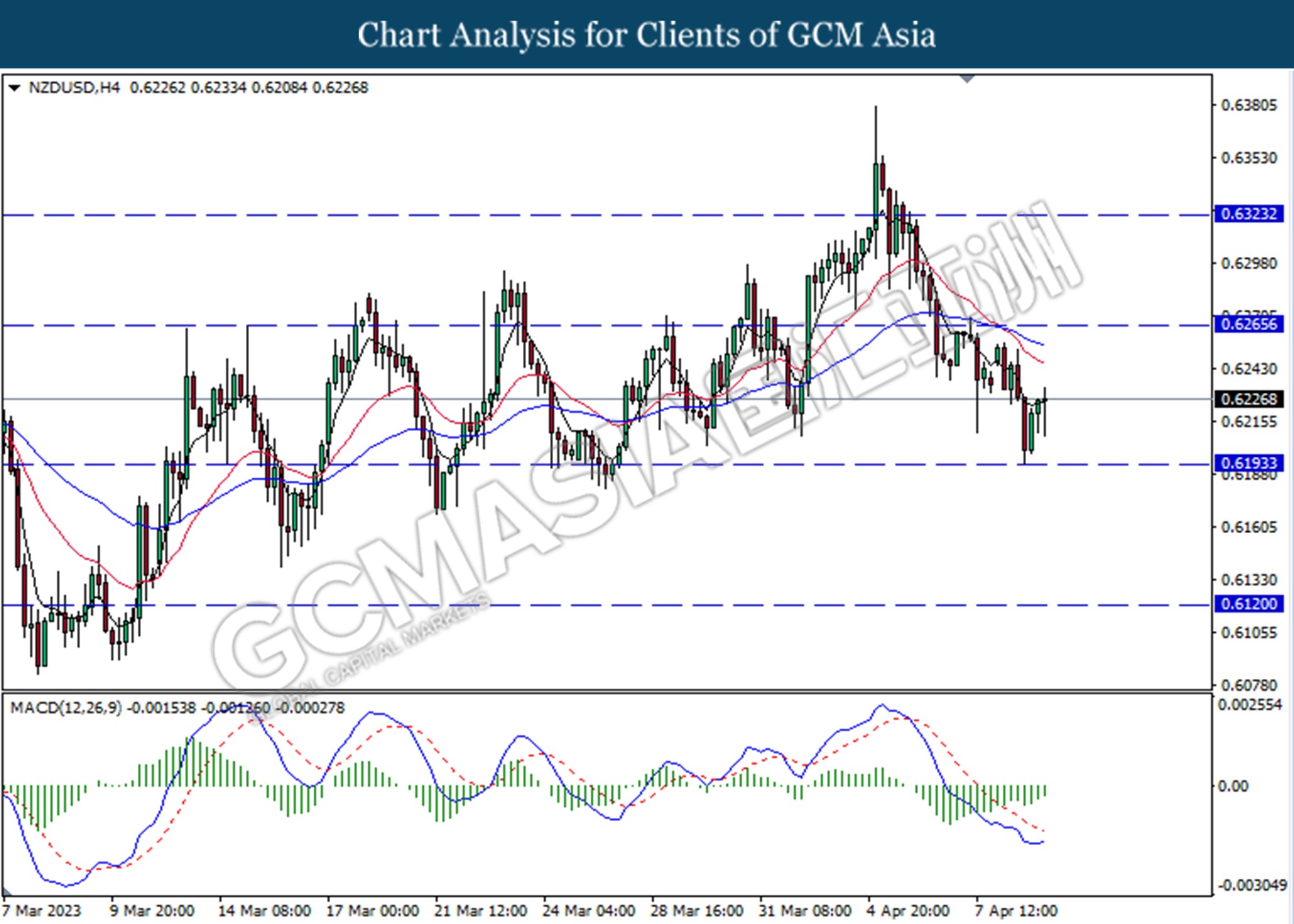

NZDUSD, H4: NZDUSD was traded higher following a prior rebounded from the support level at 0.6195. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

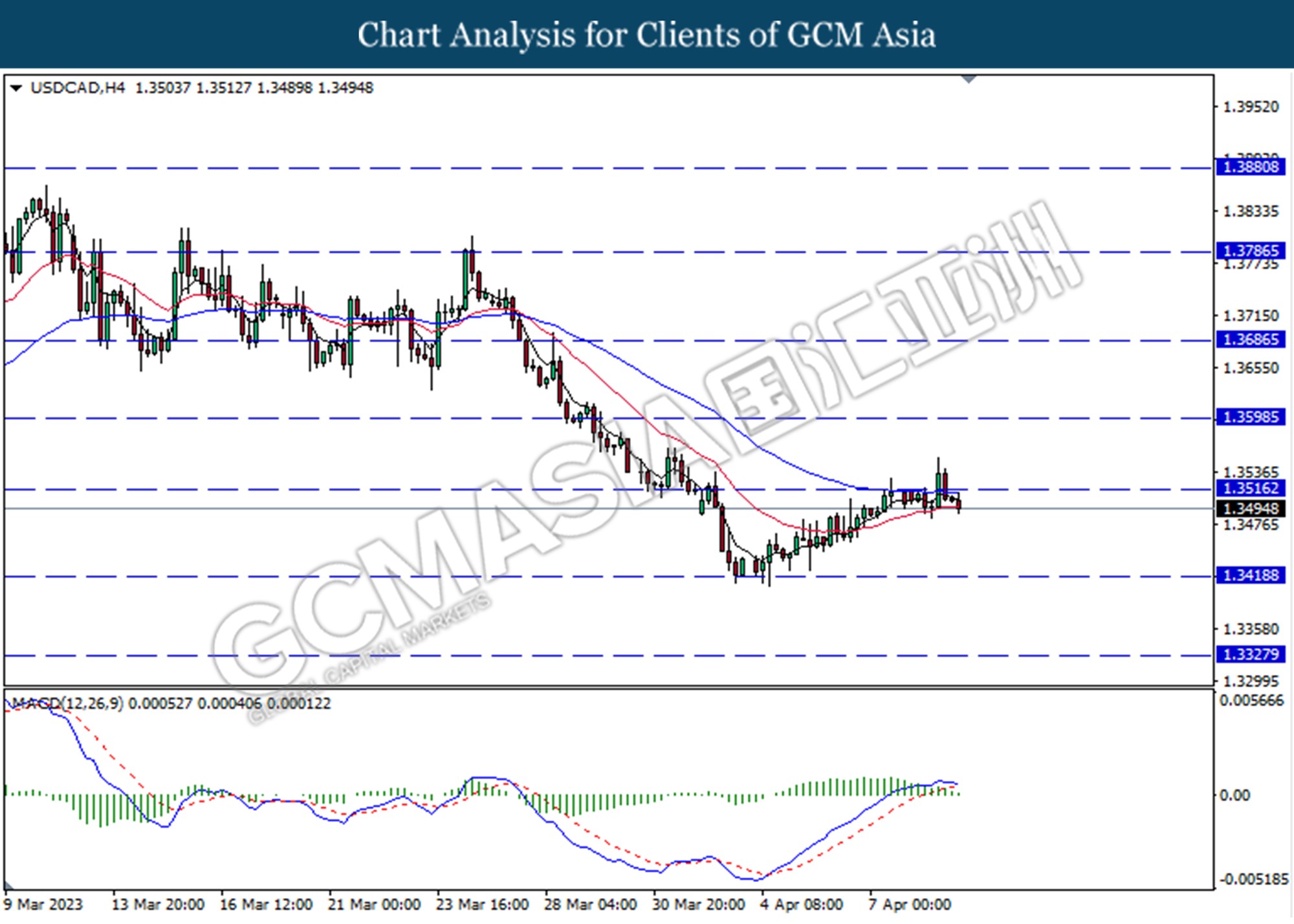

USDCAD, H4: USDCAD was traded lower following a prior breakout below the previous support level at 1.3515. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses towards the support level at 1.3420.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

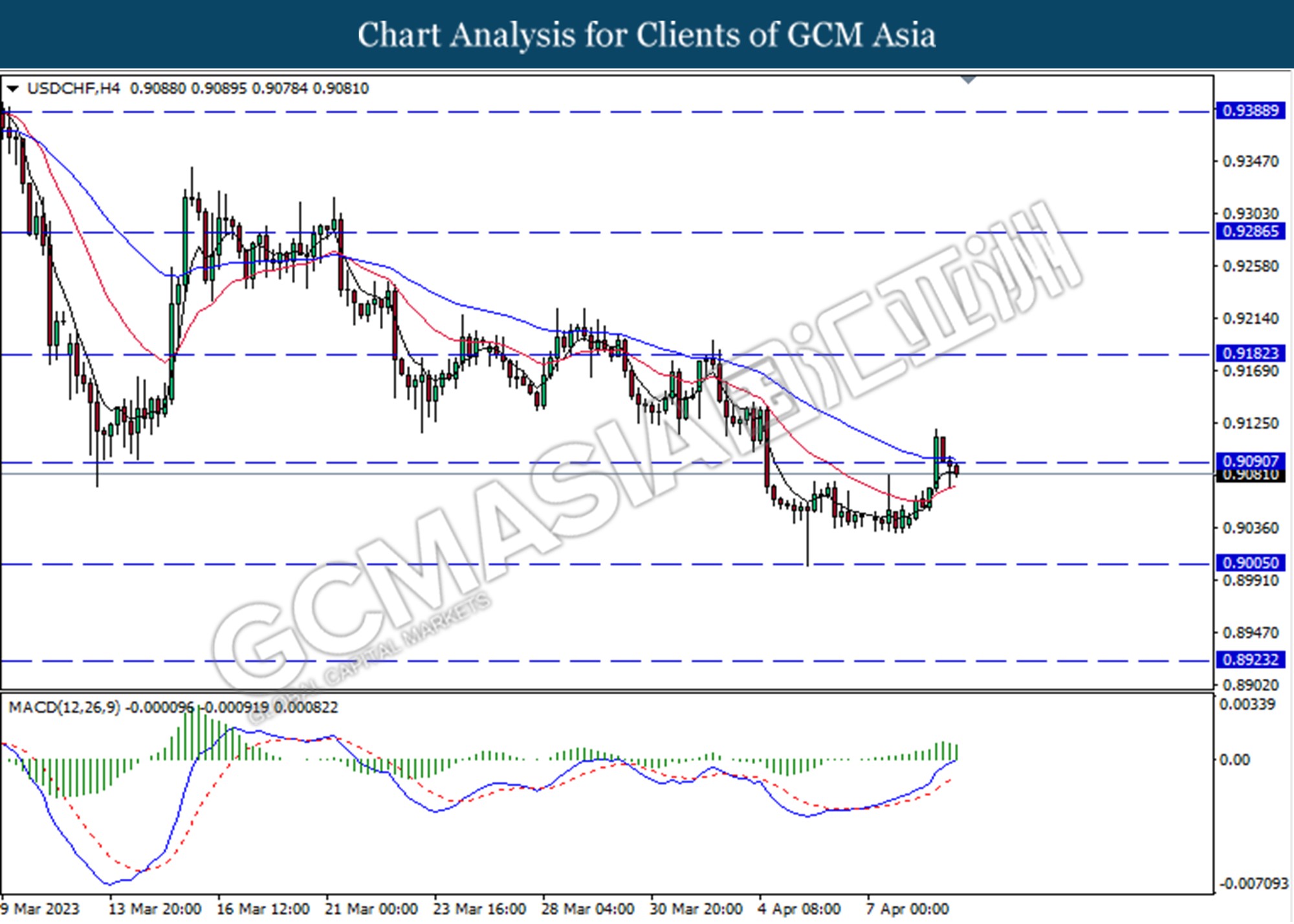

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9090. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses towards the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains toward the resistance level at 81.60.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

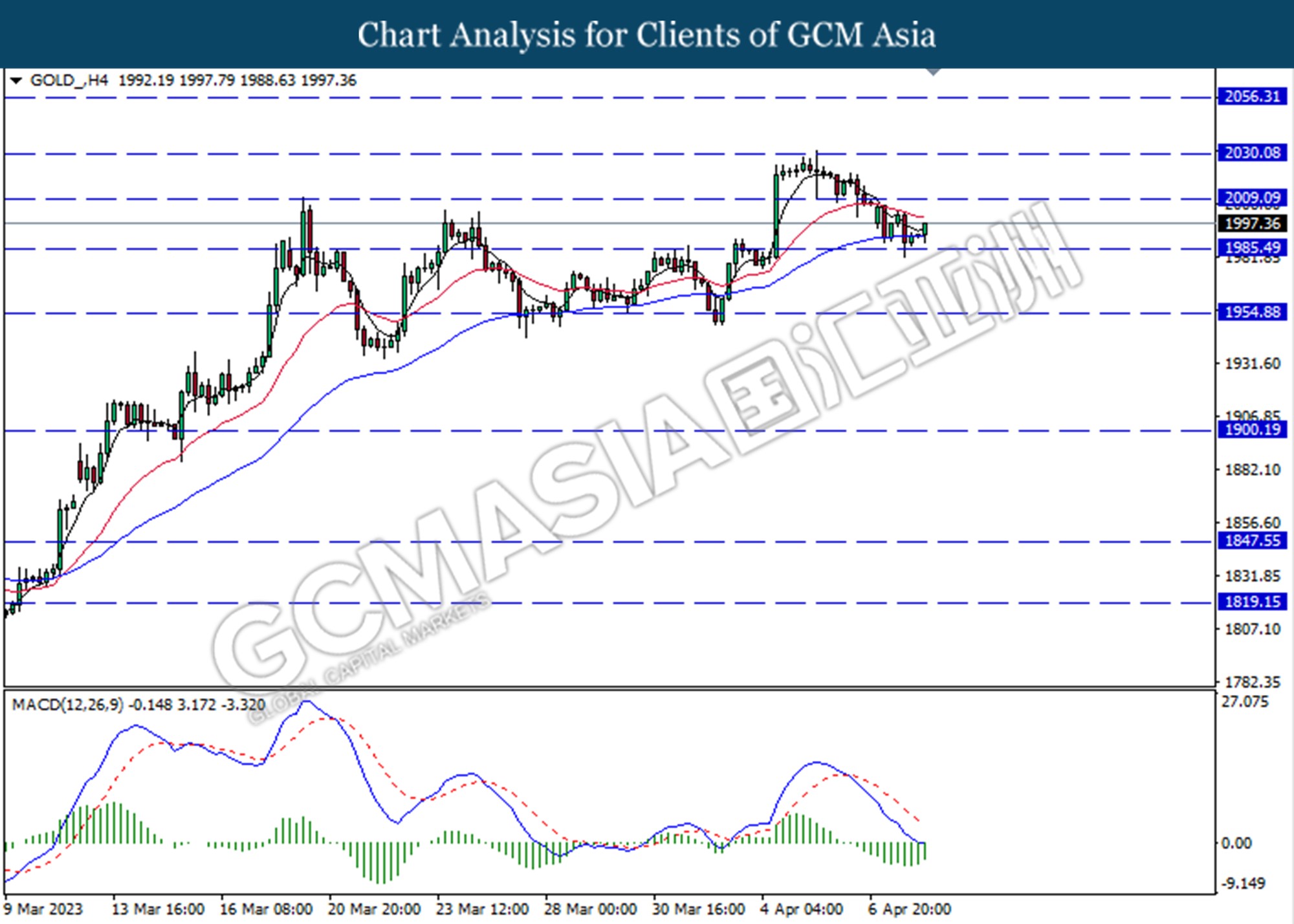

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1985.50. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains toward the resistance level at 2009.10.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90