11 April 2023 Morning Session Analysis

US Dollar surged amid the background of weakening Yen.

The Dollar Index which traded against a basket of six major currencies resume its luster on Monday following the depreciation of Japanese Yen. According to Reuters, the Bank of Japan (BoJ) Governor Kazuo Ueda claimed on yesterday that the central bank was not hurry to step back from its ultra-loose monetary policy for stimulating economic growth. Following to that, it led to the larger divergence between Fed and BoJ monetary policy, as the US central bank would likely to raise its interest rate again after the employment data signaled that the US labor market remained hot and resilient. Thus, it prompted investors to flee away from Japan market, as well as shifting their capitals toward US Dollar. Besides, the gains of Dollar Index was extended amid the hawkish statement by Fed official. Federal Reserve Bank of New York President John Williams said on Monday that the aggressive rate hike was not the main issue that driving to the collapse of banks in March. In other words, it was a lapse in the bank’s management of assets and funds, which easing the worries over banking crisis. By now, investors would highly eye on the announcement of CPI data in order to gauge the next step of Fed. As of writing, the Dollar Index rose by 0.50% to 102.23.

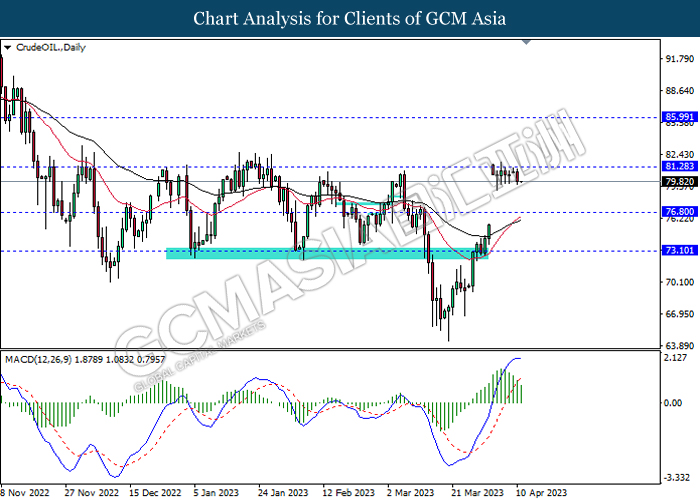

In the commodity market, the crude oil price appreciated by 0.14% to $79.85 per barrel as of writing after a sharp decline throughout overnight trading session following the hawkish statement of Fed. On the other hand, the gold price edged up by 0.02% to $1991.72 per troy ounce as of writing over the retracement of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

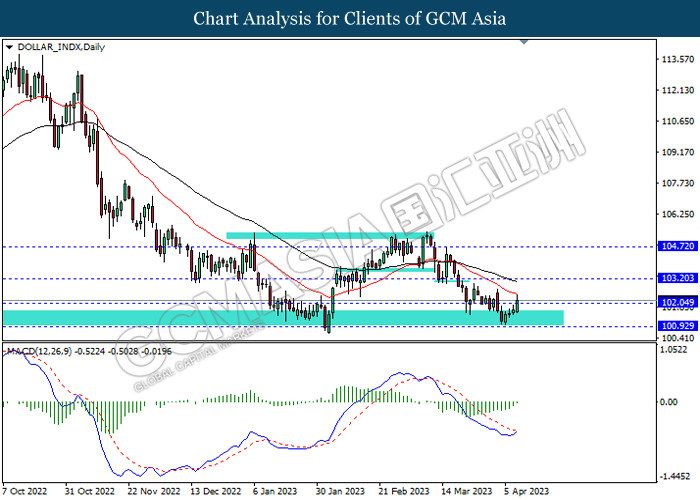

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses is successfully breakout the support level.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

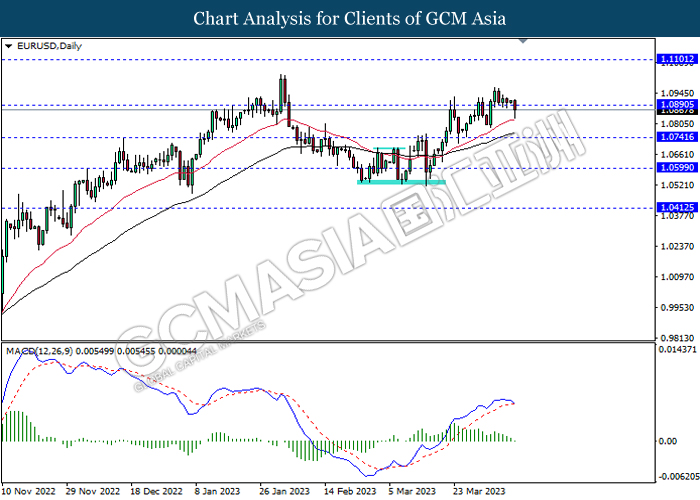

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

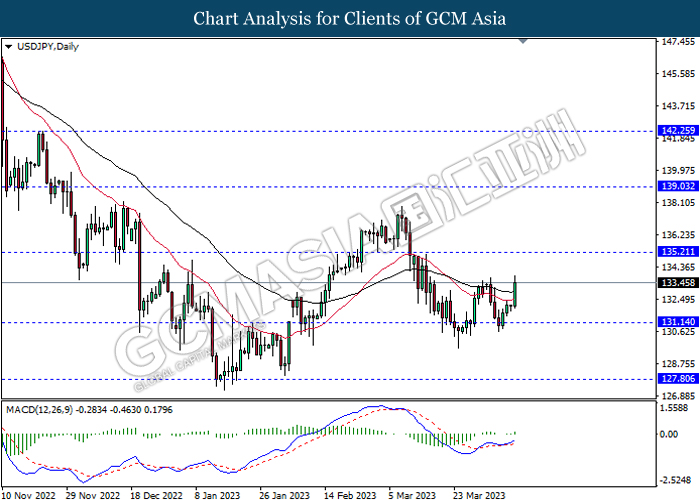

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

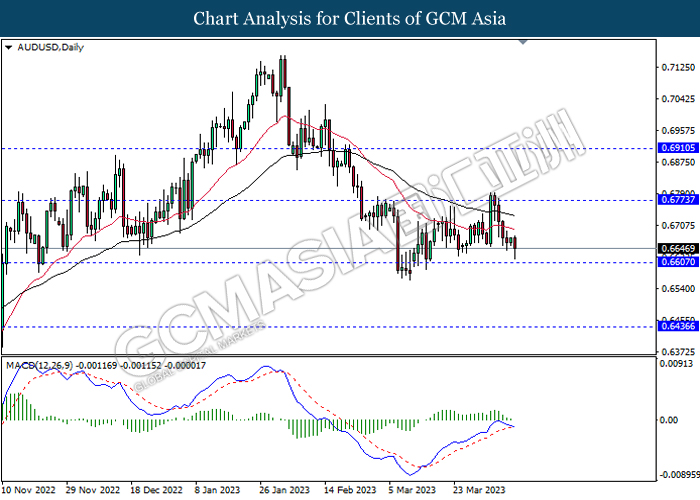

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

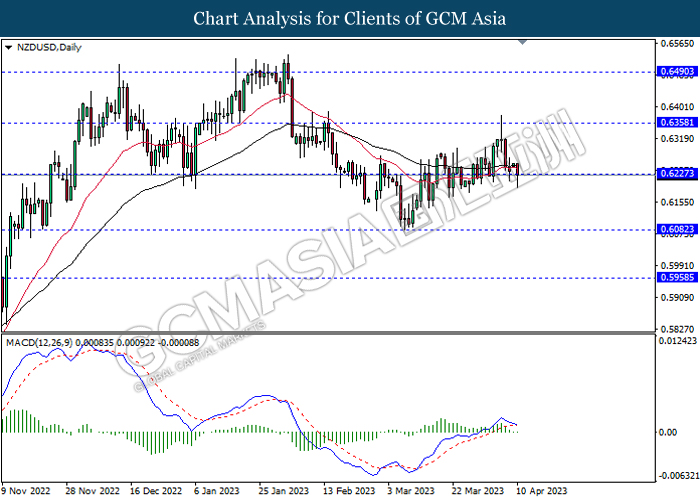

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

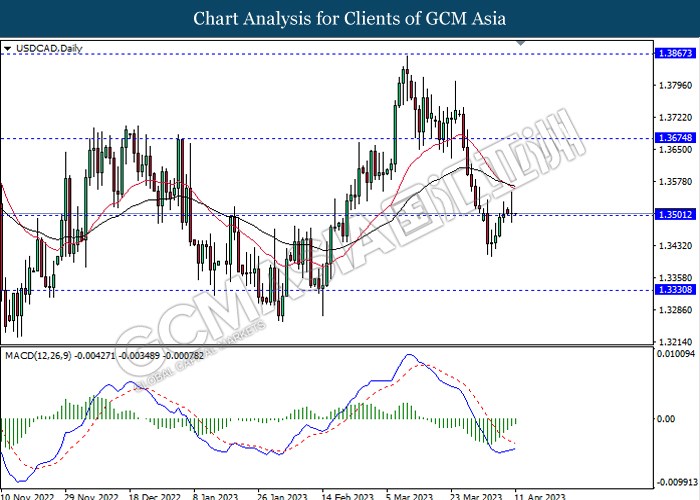

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

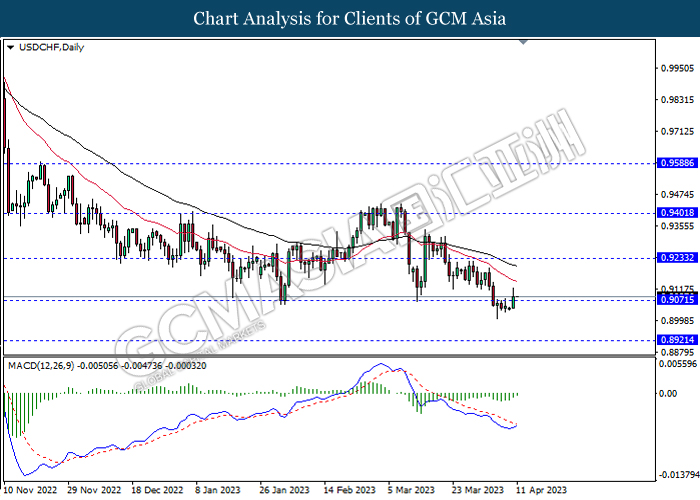

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

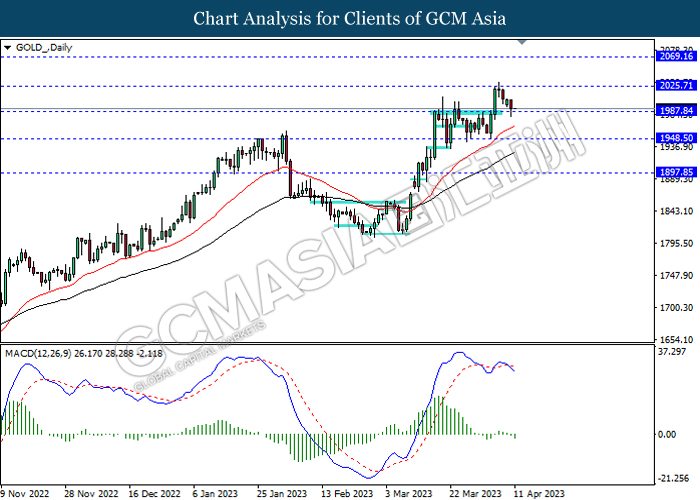

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50