11 May 2023 Morning Session Analysis

US dollar dived as inflation eased further.

The dollar index, which was traded against a basket of six major currencies, reversed its previous trading session gains as yesterday’s downbeat data wiped off the bullish sentiment in the dollar market. According to the US Bureau of Labor Statistics, the Consumer Price Index (CPI), the best and long-awaited inflation-gauge data, posted a reading of 4.9% for the month of April, slightly lower than both the consensus forecast and previous reading at 5.0%. The further drop in CPI data indicated that the rate hikes plan which has been implementing since more than a year ago is working well to curb the stubbornly high inflation in the US. The Federal Reserve (Fed) has adjusted the interest rates consecutively for 10 times, bringing the interest rate to their highest level in nearly 16 years. Despite, the inflation figure of 4.9% is still well-above the Fed’s long term target level at 2.0%. With that, the investors are now facing a fork in the road as the inflation report did not provide a clear signal if the Fed would really stop its rate hike plan in the next meeting. Therefore, the investors are now awaiting for more economic events, data and Fed members’ speak to determine the future path of monetary policy in the US. As of writing, the dollar index ticked down -0.15% to 101.45.

In the commodities market, crude oil prices were traded lower by -1.33% to $72.60 per barrel as the still-high inflation figure in the US pointed to a further rate hike, which dampened the prospect of oil market. Besides, gold prices ticked up by 0.05% to $2031.20 per troy ounce as the CPI eased more than expectation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Interest Rate Decision (May)

19:00 GBP BoE MPC Meeting Minutes

19:00 CrudeOIl OPEC Monthly Report

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 242K | 245K | – |

| 20:30 | USD – PPI (MoM) (Apr) | -0.5% | 0.3% | – |

Technical Analysis

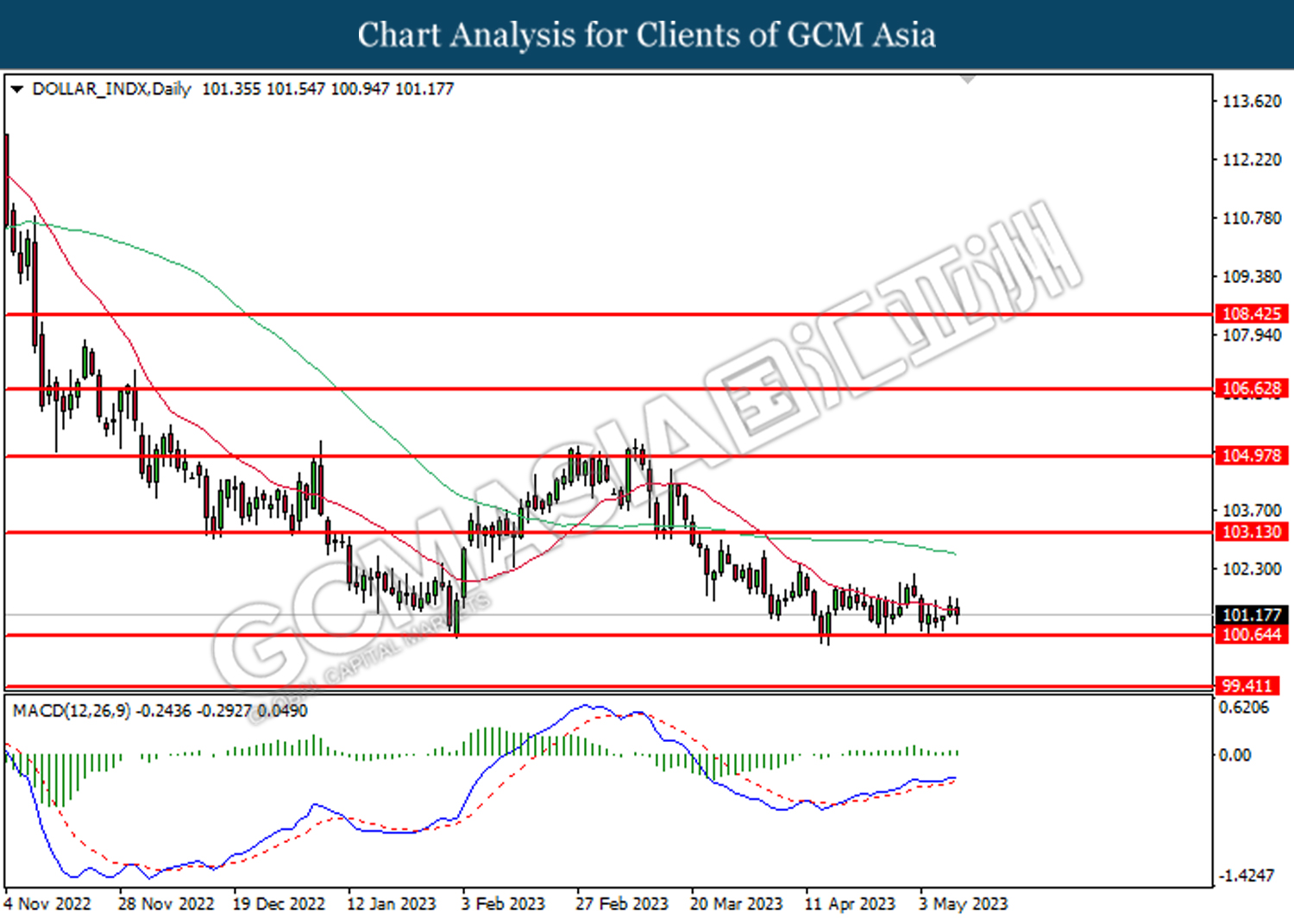

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

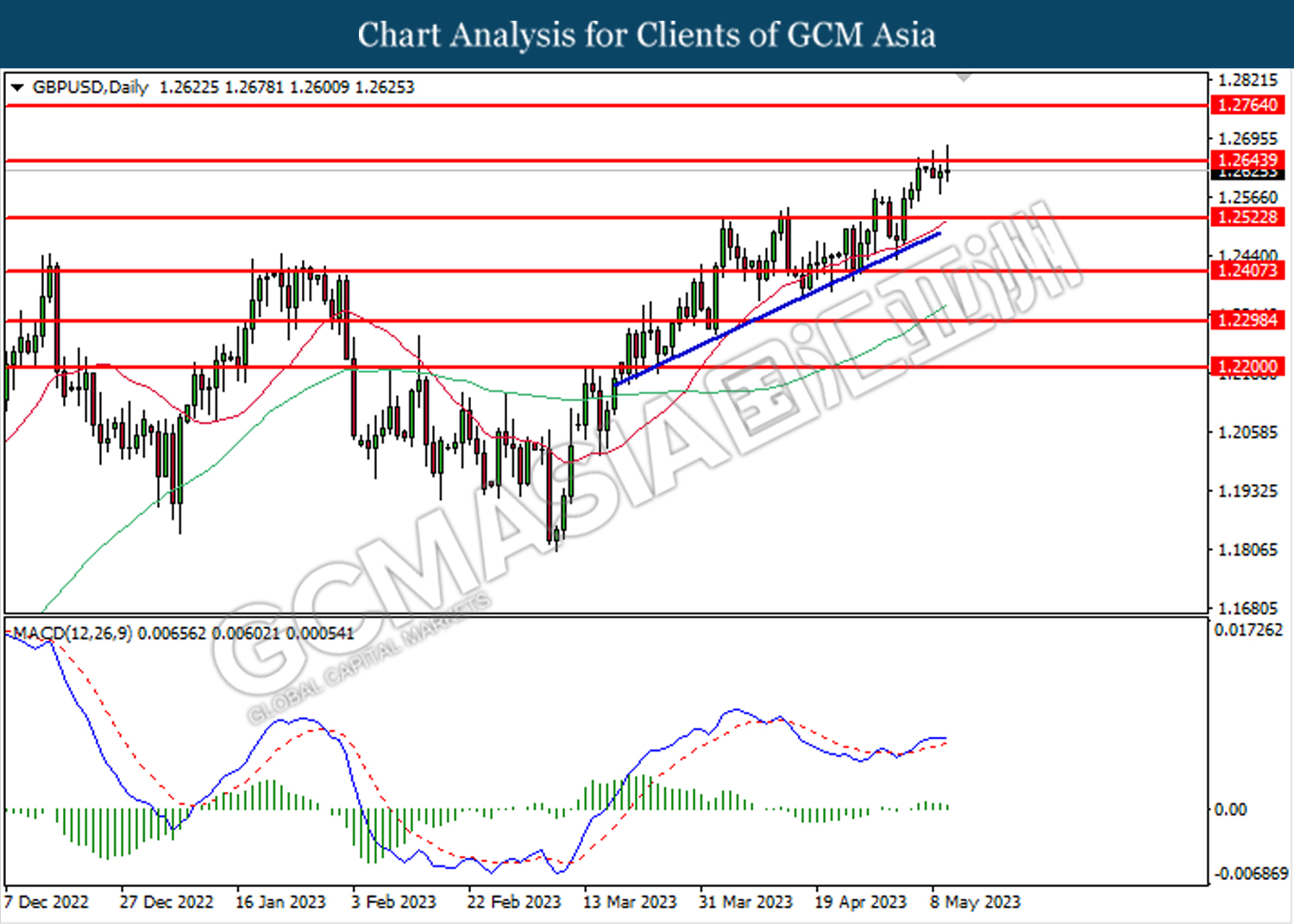

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

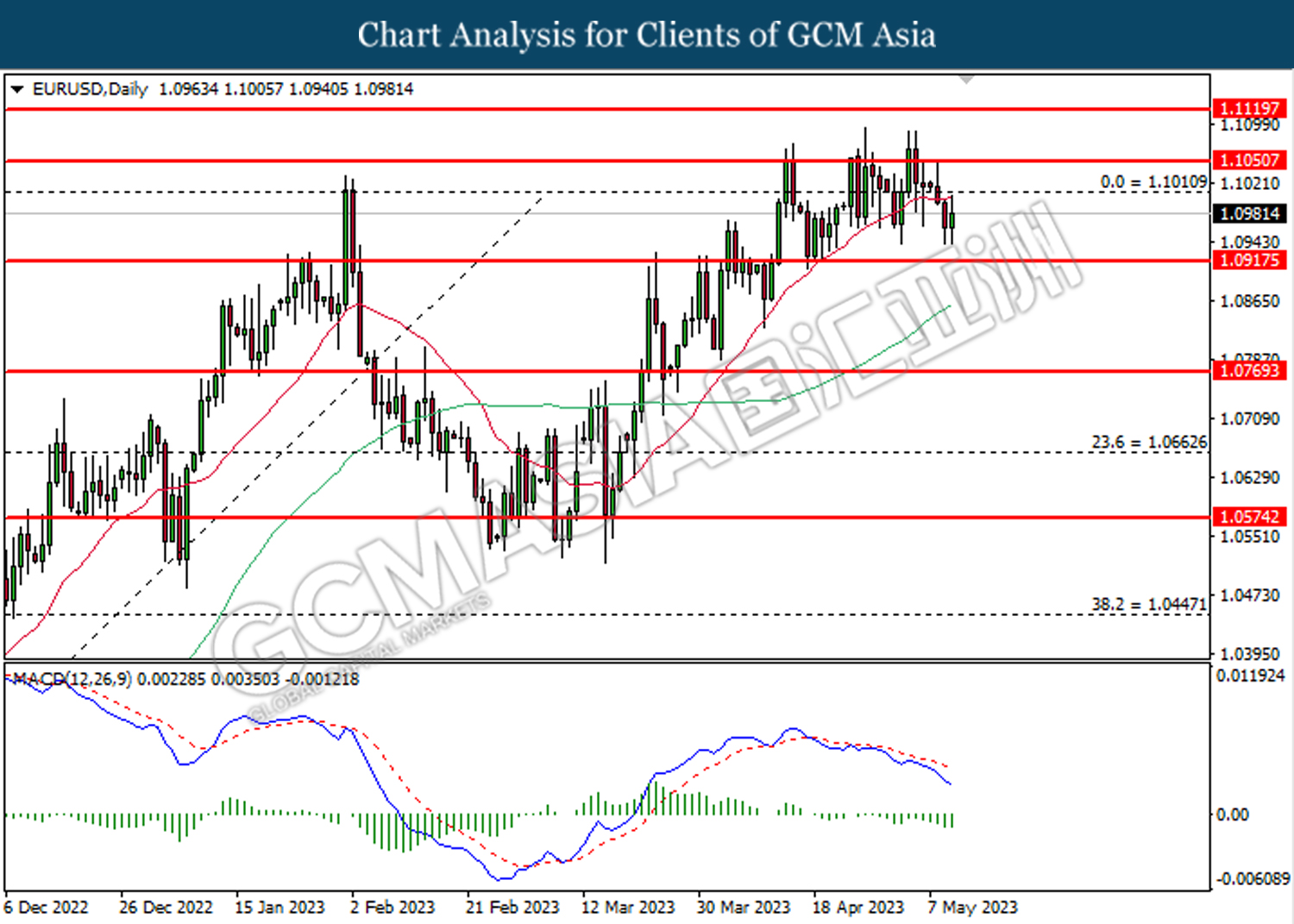

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

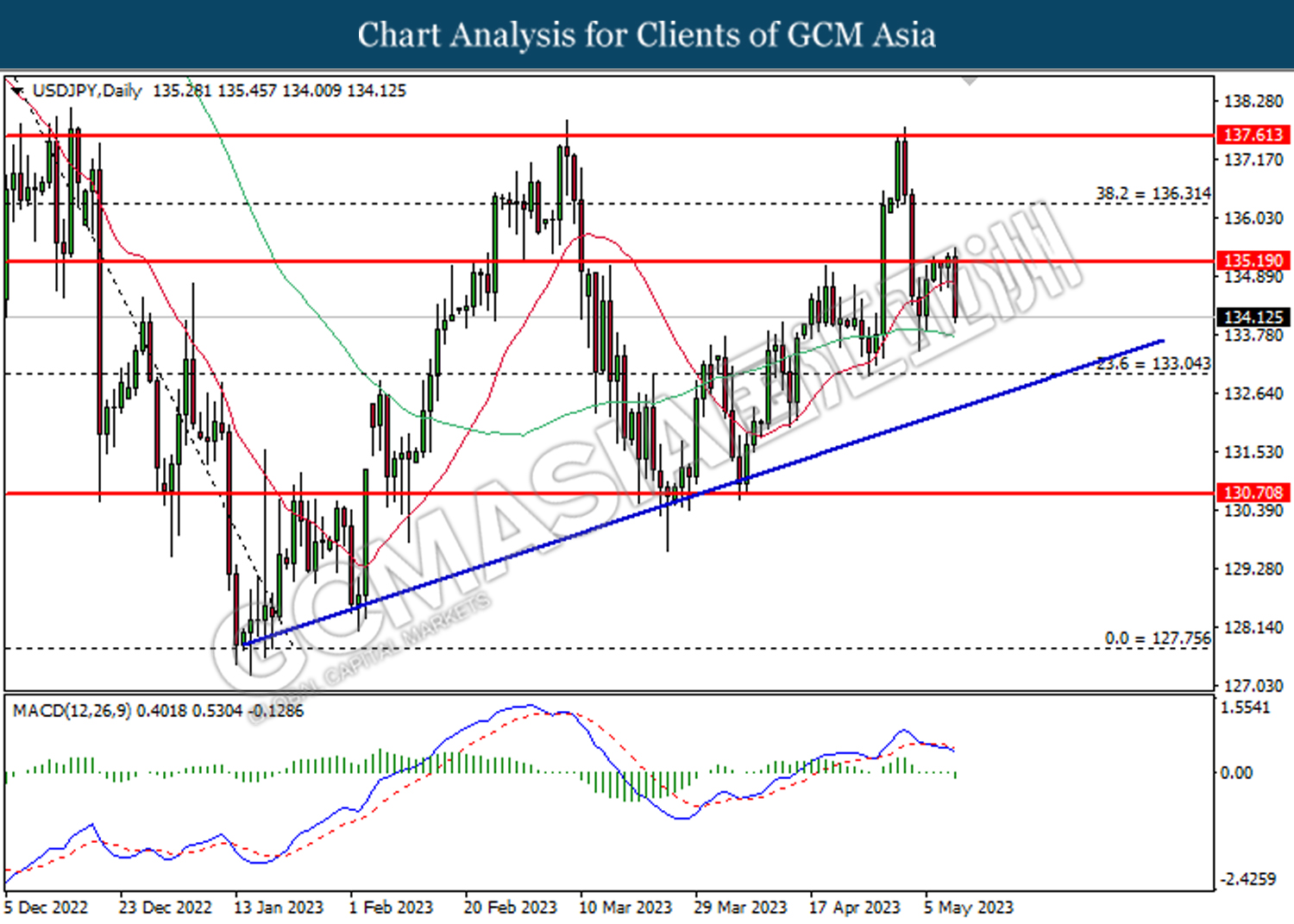

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

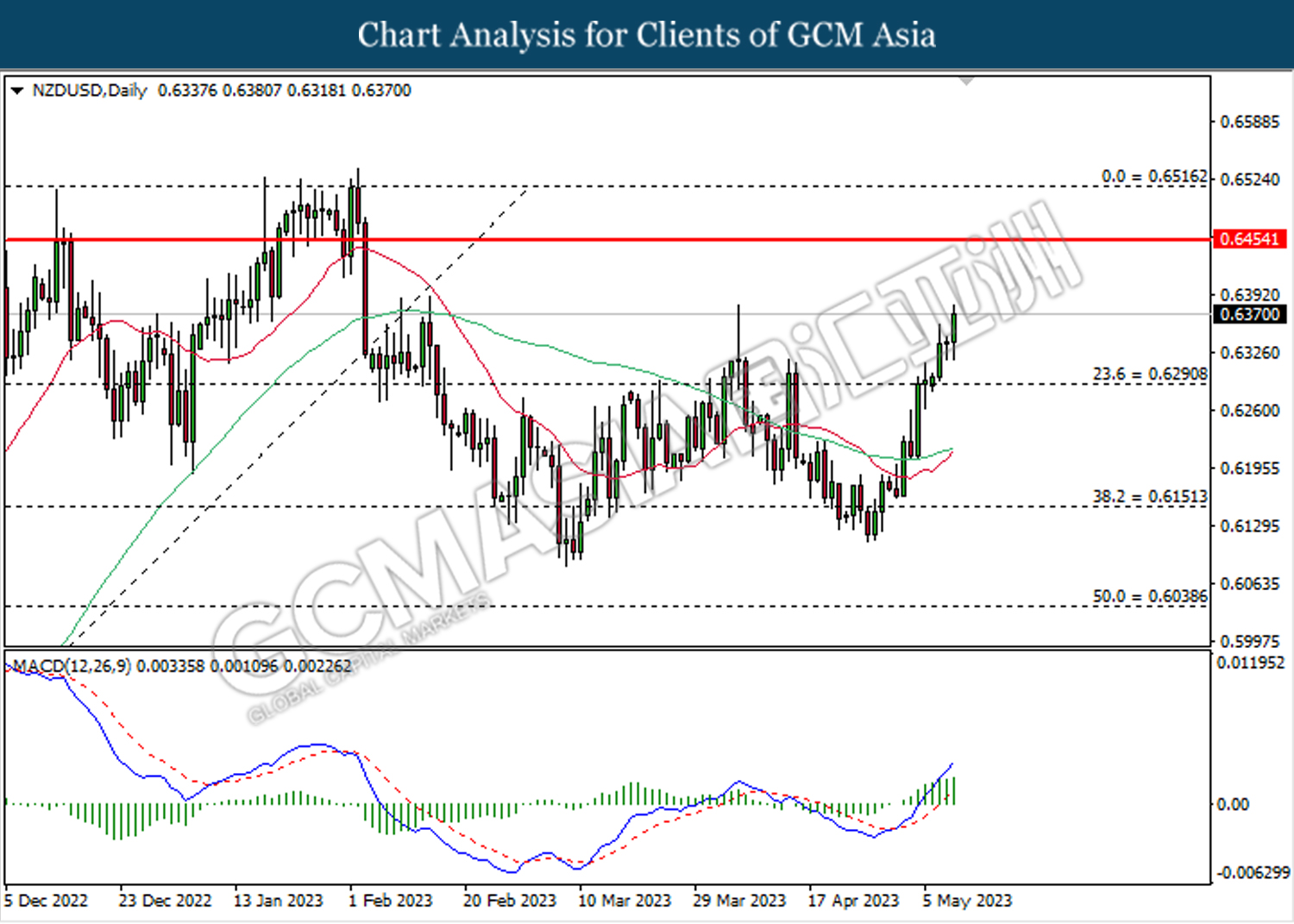

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

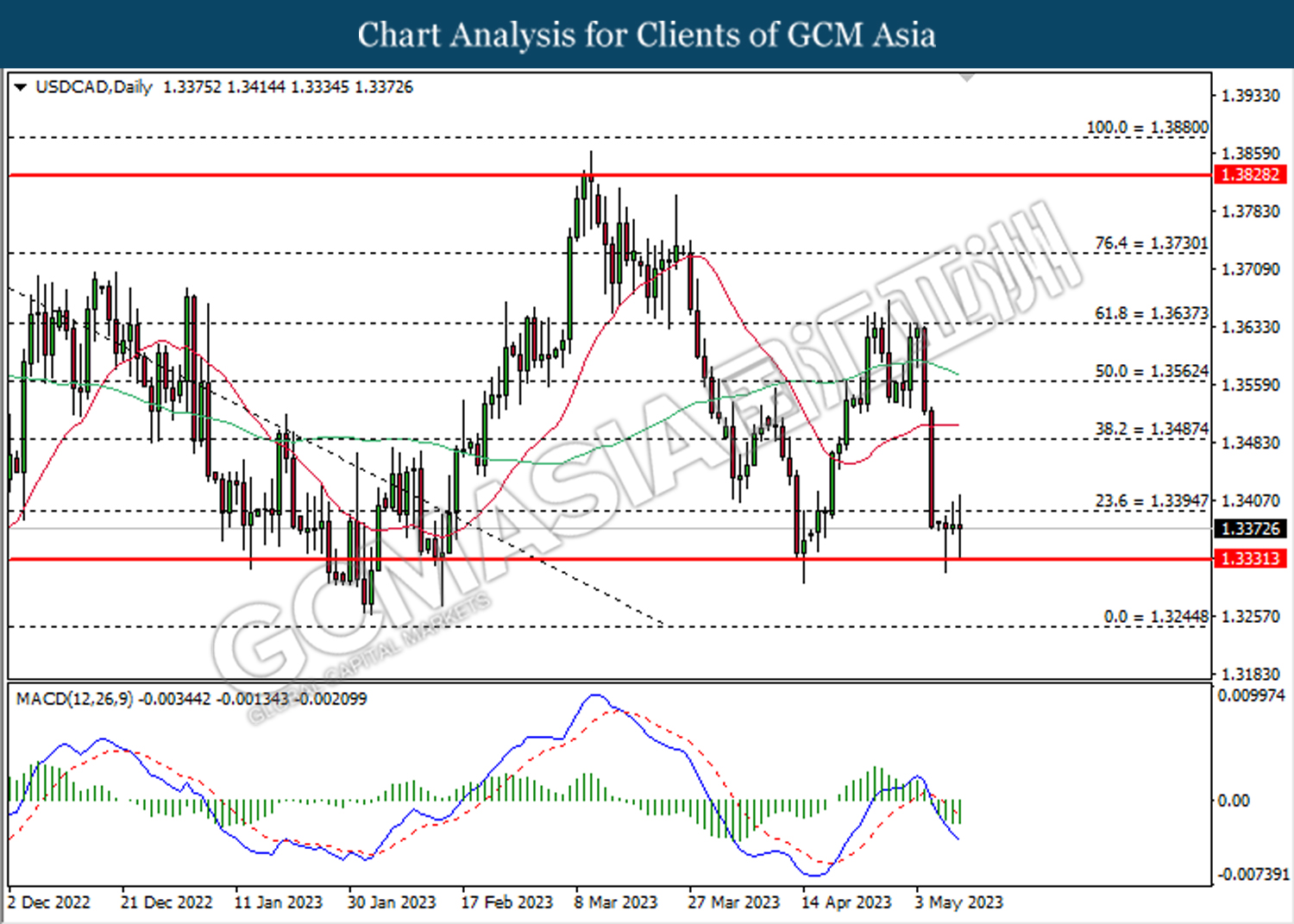

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

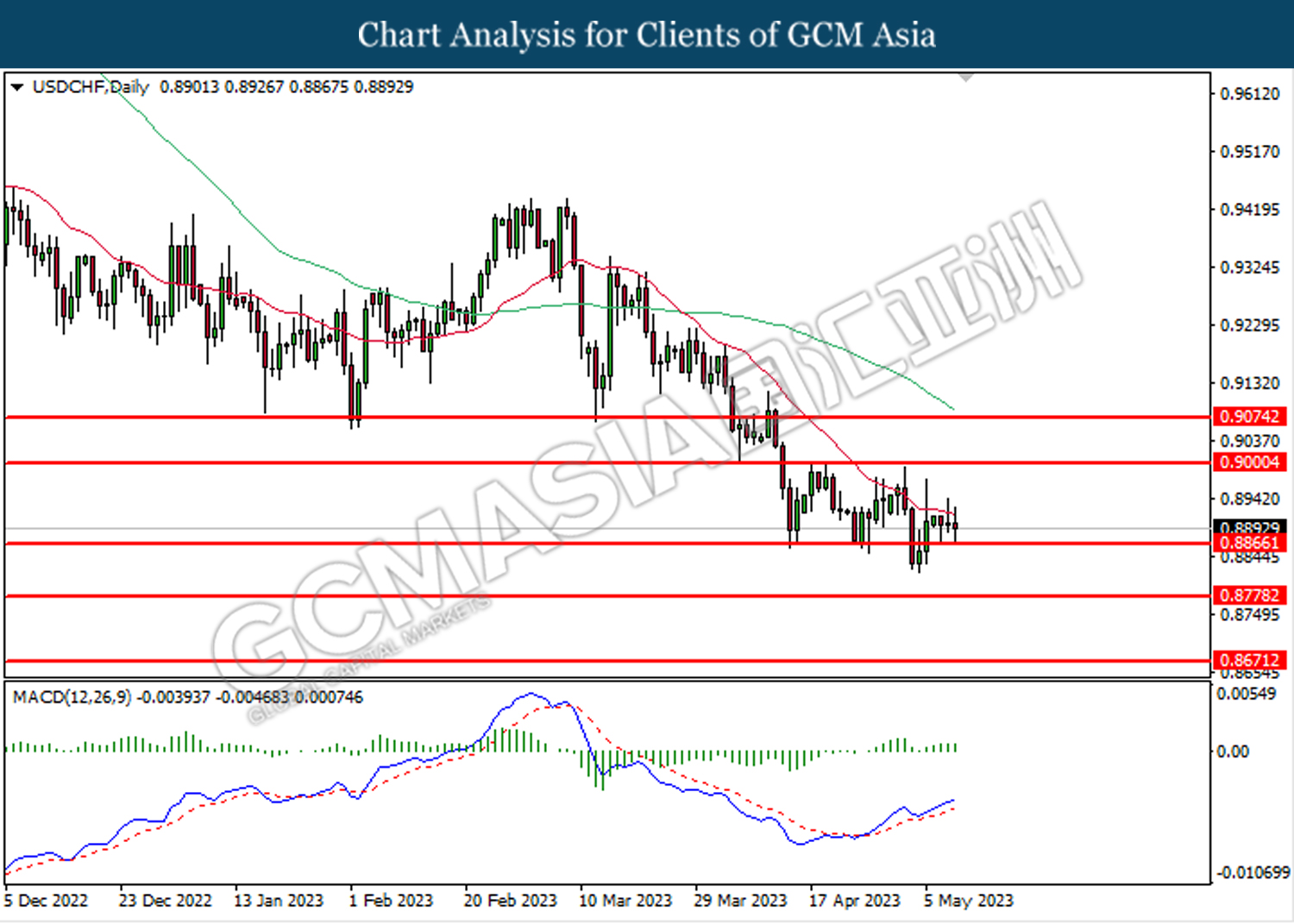

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

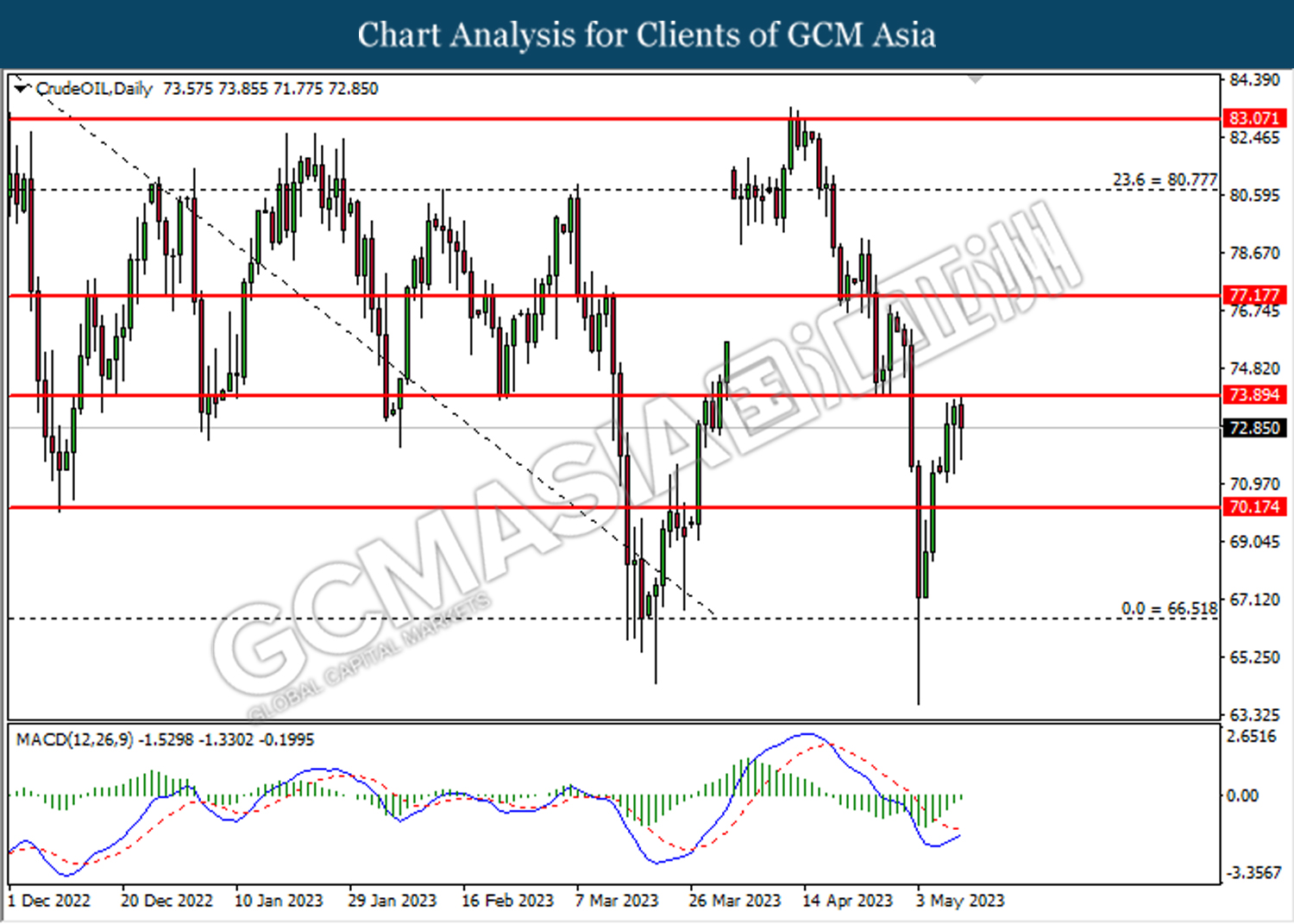

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

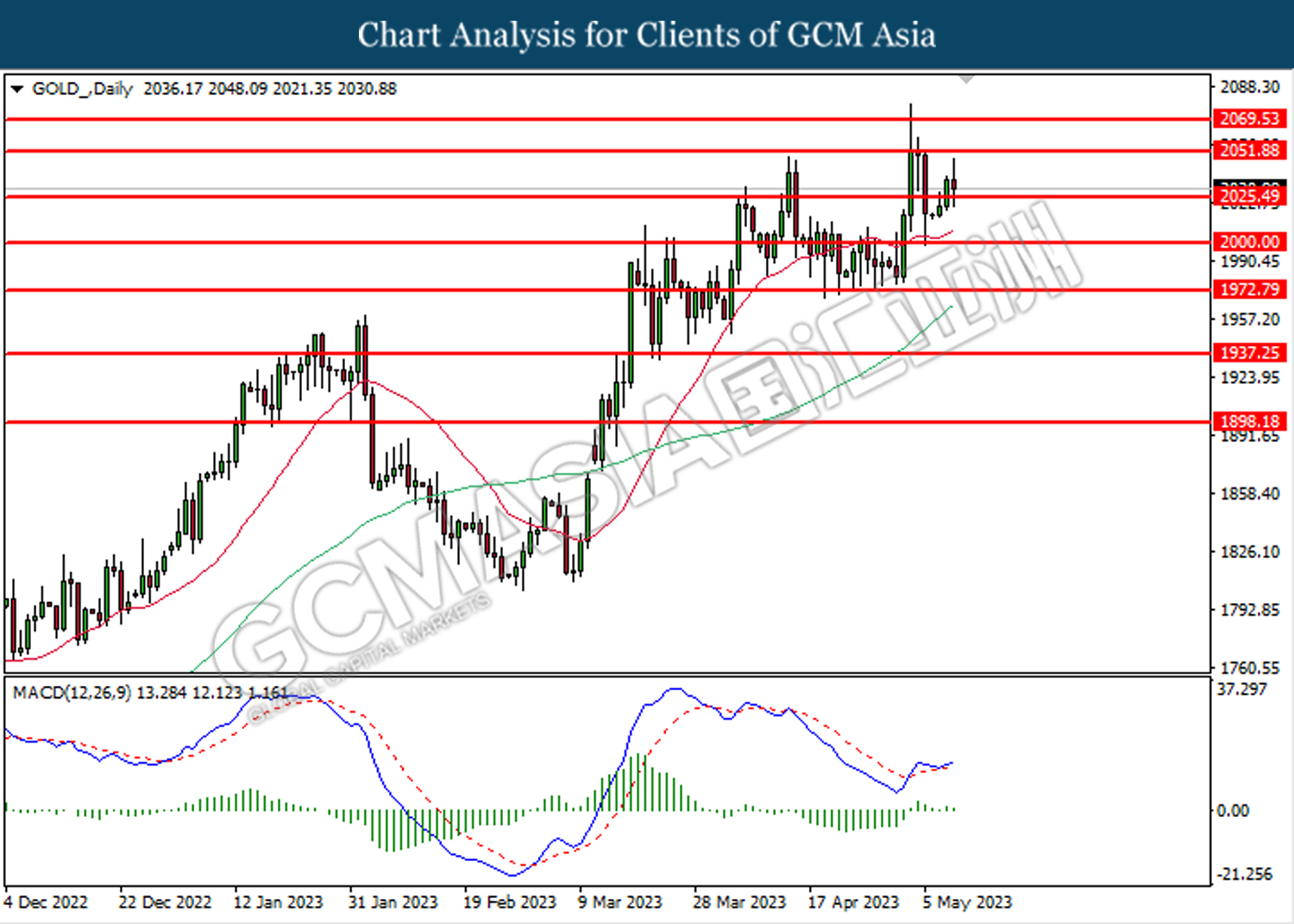

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 2025.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 2051.90.

Resistance level: 2051.90, 2069.55

Support level: 2025.50, 2000.00