11 October 2022 Afternoon Session Analysis

Escalate tensions between Russia-Ukraine, weigh down Euro.

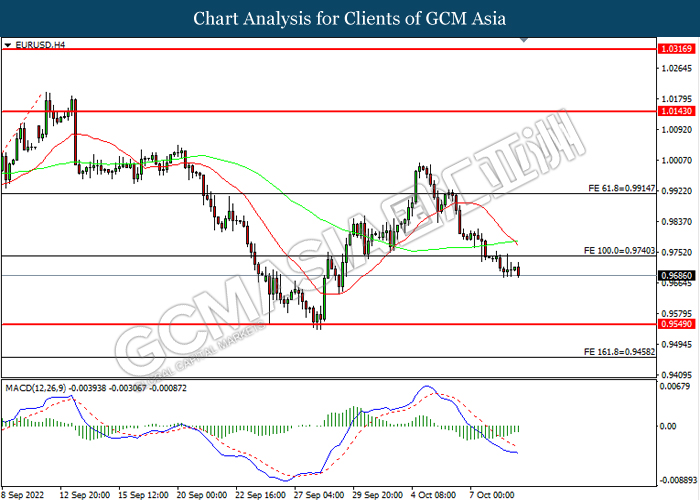

The Euro extends its losses significantly following the heightening tensions between Russia-Ukraine continue to spark further uncertainty toward the economic momentum in European region. According to Reuters, Russia unleashed its most widespread strikes against Ukraine in a month, knocked out power and water, shattered buildings and killed people in Ukraine. Ukraine’s Emergency Services claimed that nearly 100 people were wounded in the morning rush hour attacks that Russia launched from the air. The strike would likely to intensify the tensions between European countries and Russia, leading to a more aggressive sanction as tit-for-tat for Russia. On the other hand, the pair of EUR/USD received further bearish momentum as rate hike expectation from the Federal Reserve continue to prompt investors to shift their investment from Euro into US Dollar. Fed Vice Chair Lael Brainard unleashed his hawkish statement recently, reiterating that the Federal Reserve will keep raising interest rates in the near-term. As of writing, EUR/USD depreciated by 0.07% to 0.9690.

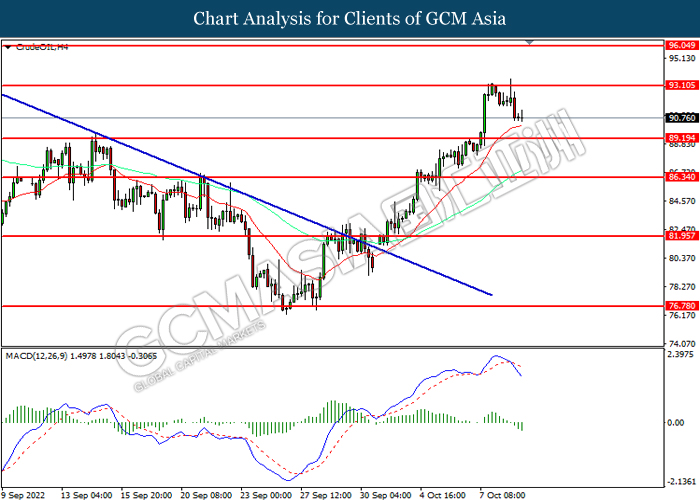

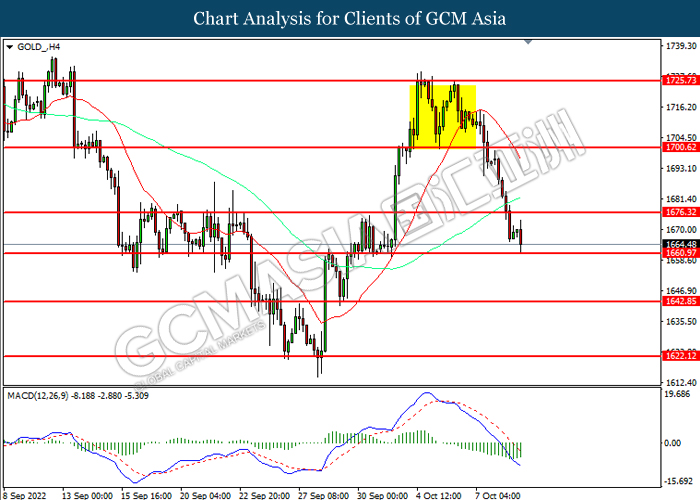

In the commodities market, the crude oil price appreciated by 0.01% to $90.75 per barrel as of writing. The overall prospect for the crude oil still remained bullish as market participants remained concerns that potential escalation conflict between Russia-Ukraine would lead to supply disruption for this black-commodity. On the other hand, the gold price depreciated by 0.15% to $1665.45 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Aug) | 5.5% | 5.9% | – |

| 14:00 | GBP – Claimant Count Change (Sep) | 6.3K | 4.2K | – |

Technical Analysis

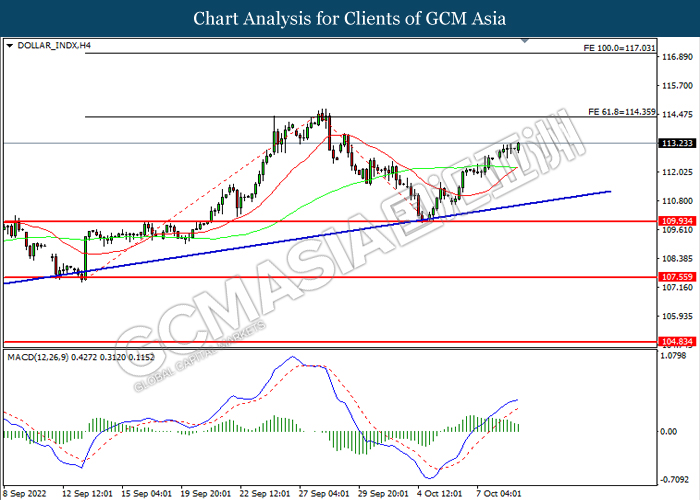

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

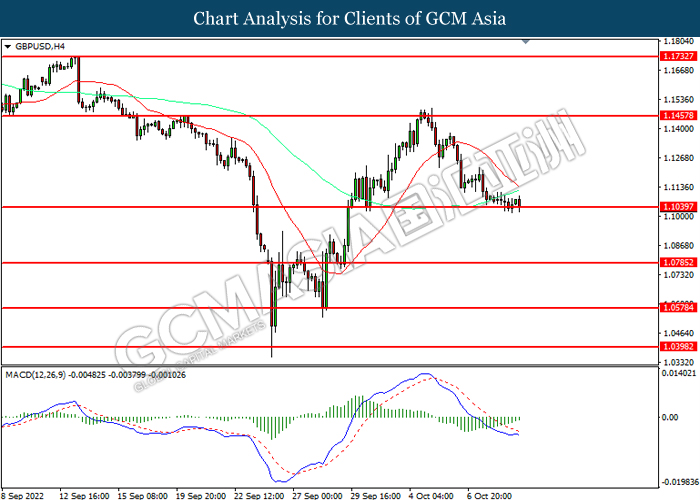

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1040, 1.0785

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9915

Support level: 0.9550, 0.9460

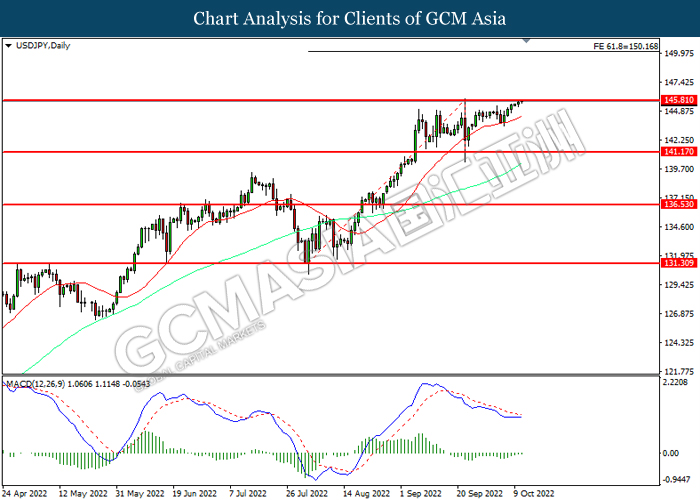

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.80, 150.15

Support level: 141.15, 136.55

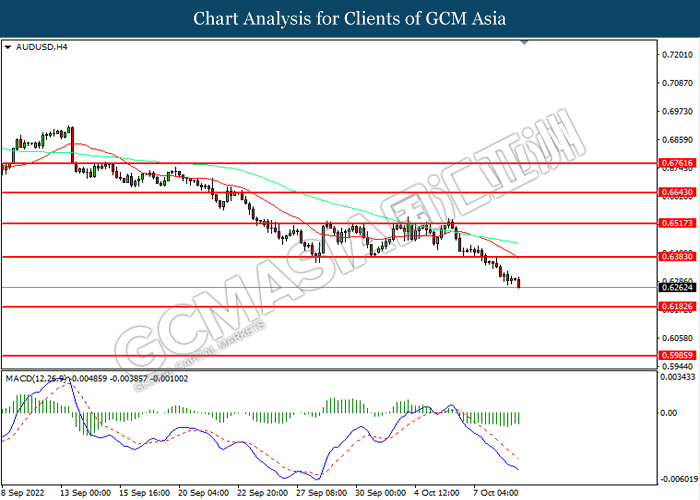

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

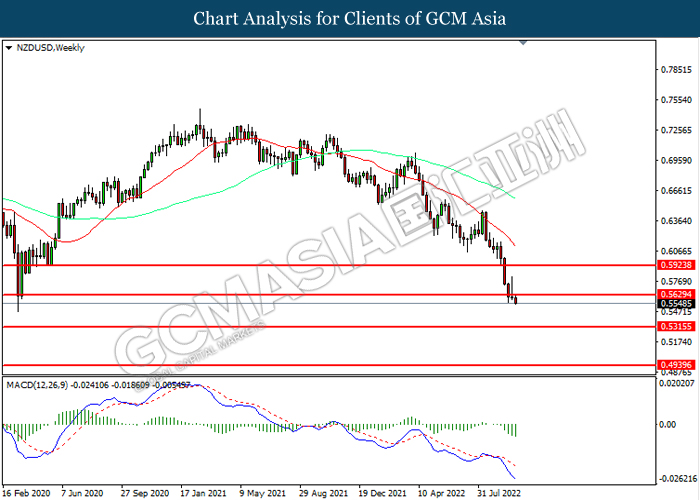

NZDUSD, Weekly: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.5630, 0.5925

Support level: 0.5315, 0.4940

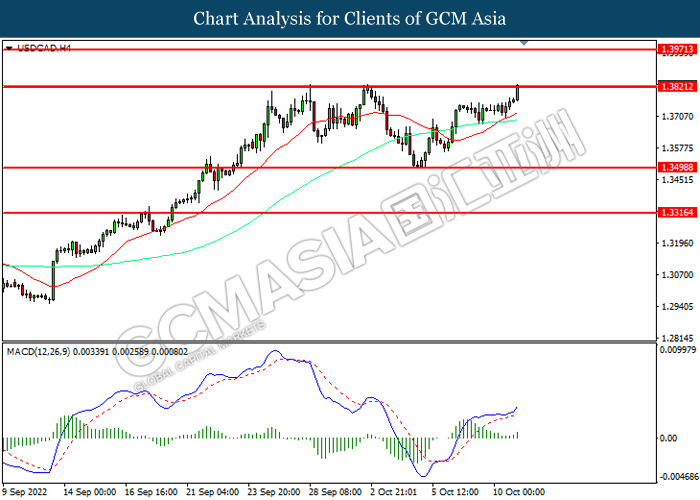

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

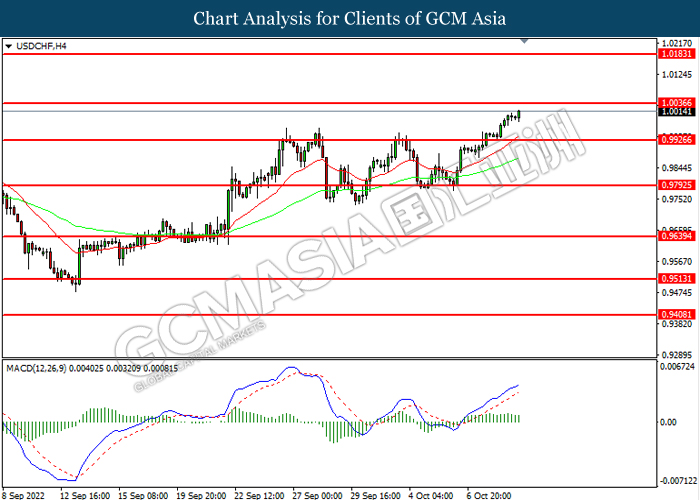

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 93.10, 96.05

Support level: 89.20, 86.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85