11 October 2022 Morning Session Analysis

Greenback surged amid upbeat job reports.

The dollar index, which is traded against a basket of six major currencies managed to extend its gains while heading back to the recent high as the currency was still supported by Friday’s job data from the US. According to the Bureau of Labor Statistics, the US Nonfarm Payrolls came in at 263K, slightly higher than the consensus forecast at 250K. On top of that, another crucial data used to gauge the US labour market condition also posted a solid reading last Friday. The US Unemployment Rate dropped from the previous month’s reading of 3.7% to 3.5%, proving that employment in the US is still growing at a solid pace. This series of positive data diminished the market expectation of a U-turn of an aggressive rate hike by the Federal Reserve while confirming the prospect of another jumbo-sized rate hike in the next meeting. Going forward, the market participants would have all eyes on the upcoming inflation data – CPI, which would definitely provide further hints for the direction of the Fed’s monetary path. As of writing, the US dollar is up 0.34% to 113.20.

In the commodities market, the crude oil price edged down -0.05% to $90.90 per barrel as the trades took profit after the oil price hit the highest level in 6 weeks. Besides, the gold prices depreciated by -0.01% to $1668.40 per troy ounce amid the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Aug) | 5.5% | 5.9% | – |

| 14:00 | GBP – Claimant Count Change (Sep) | 6.3K | 4.2K | – |

Technical Analysis

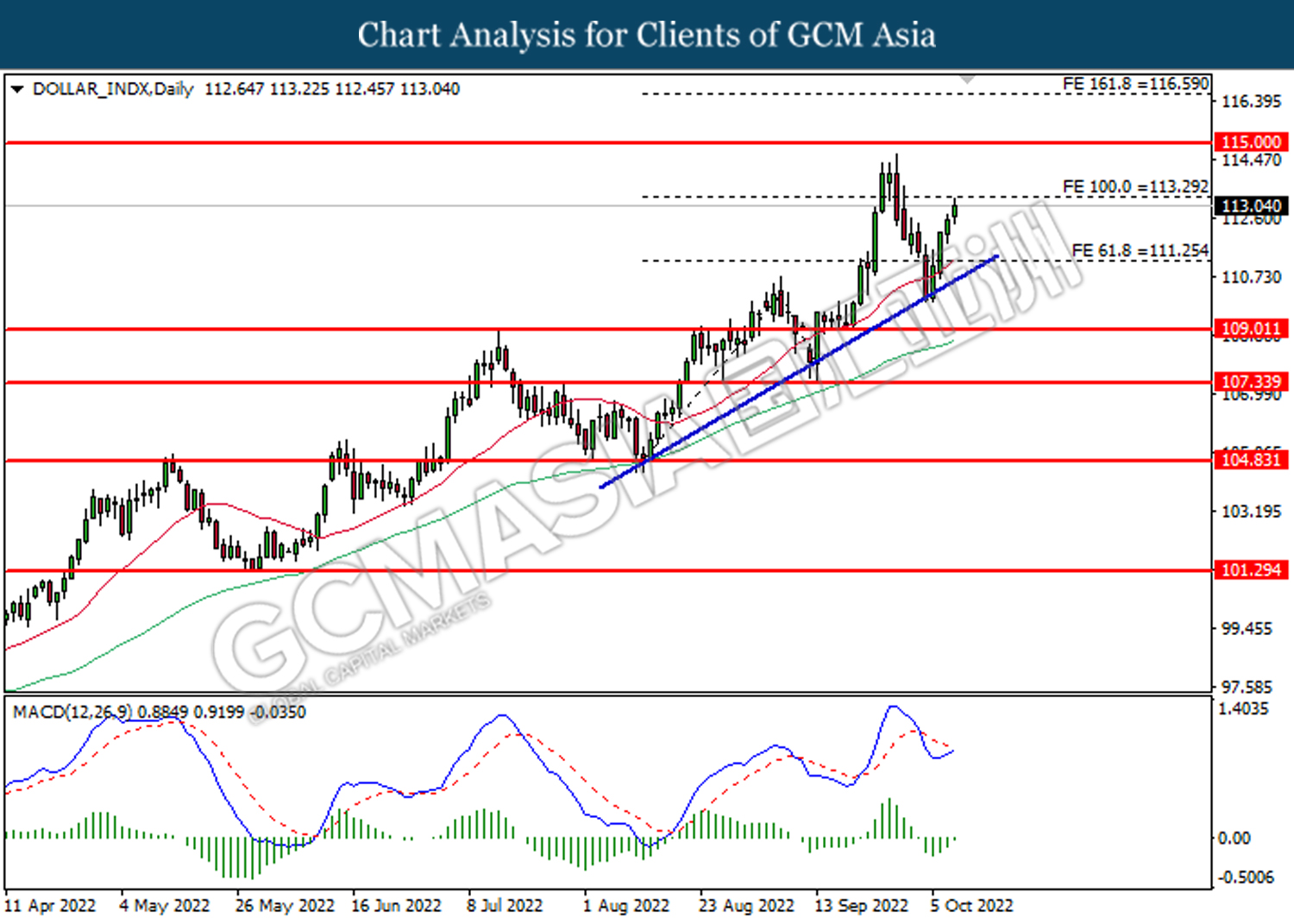

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 113.30. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

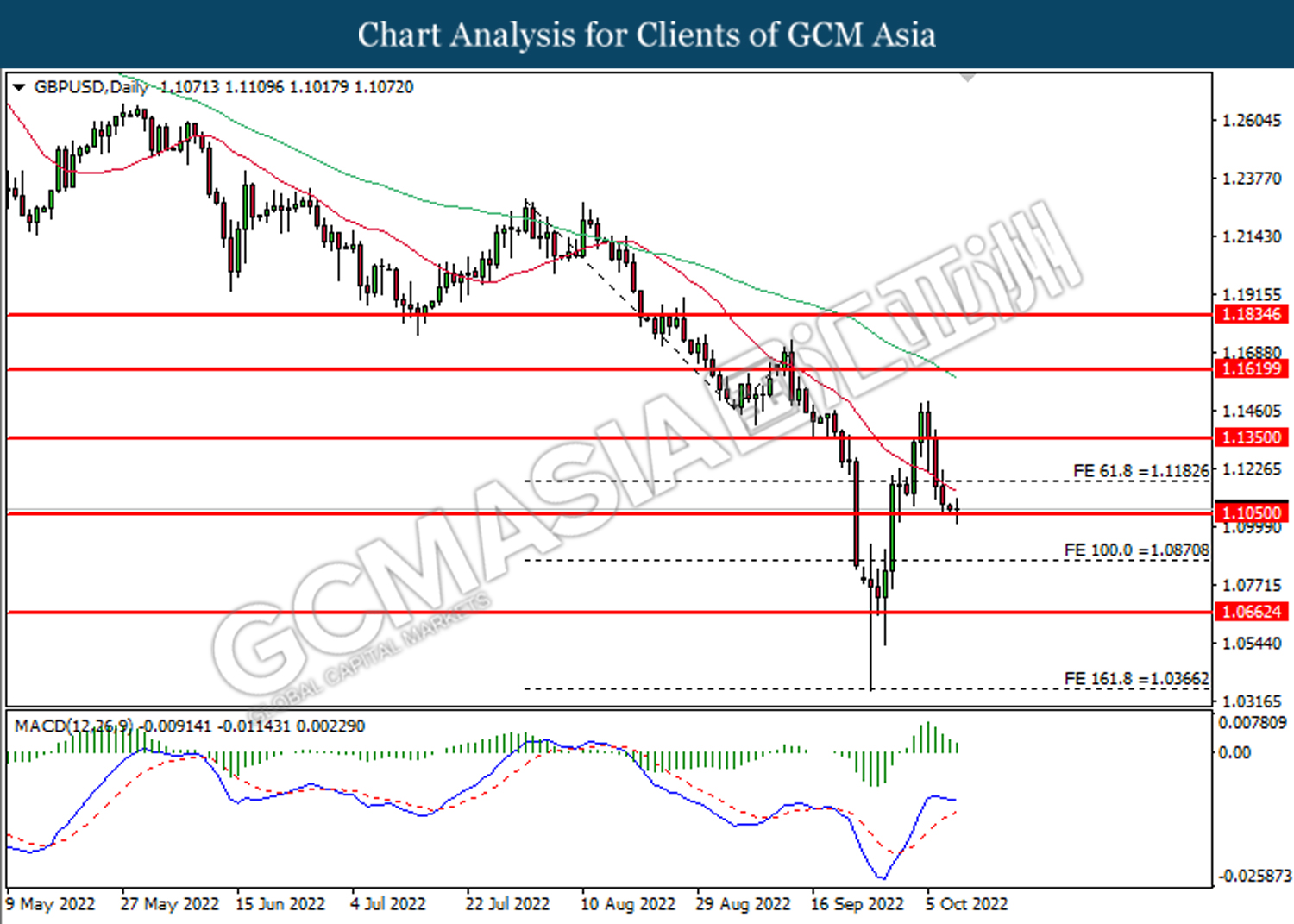

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1050. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1185, 1.1350

Support level: 1.1050, 1.0870

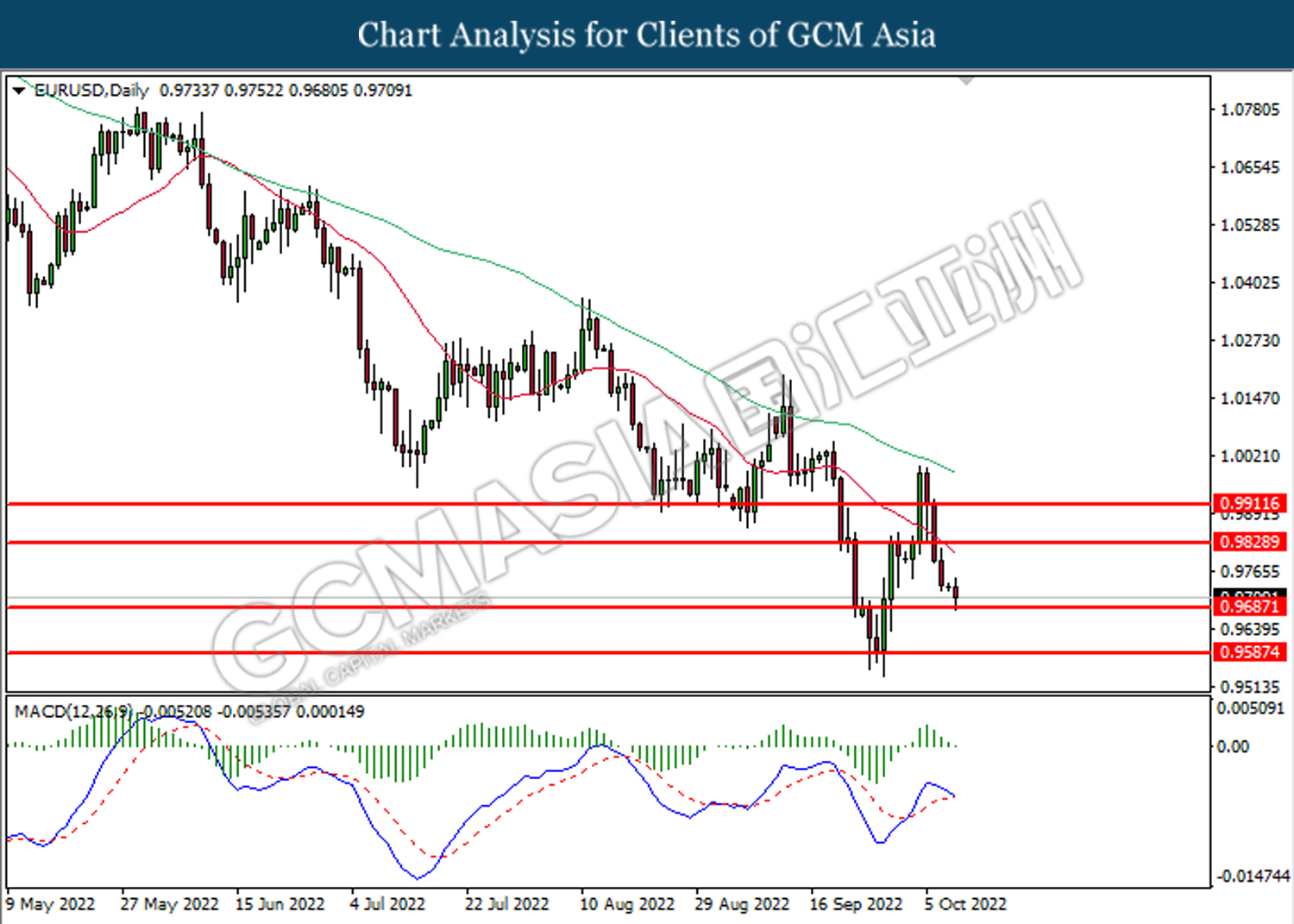

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9685. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

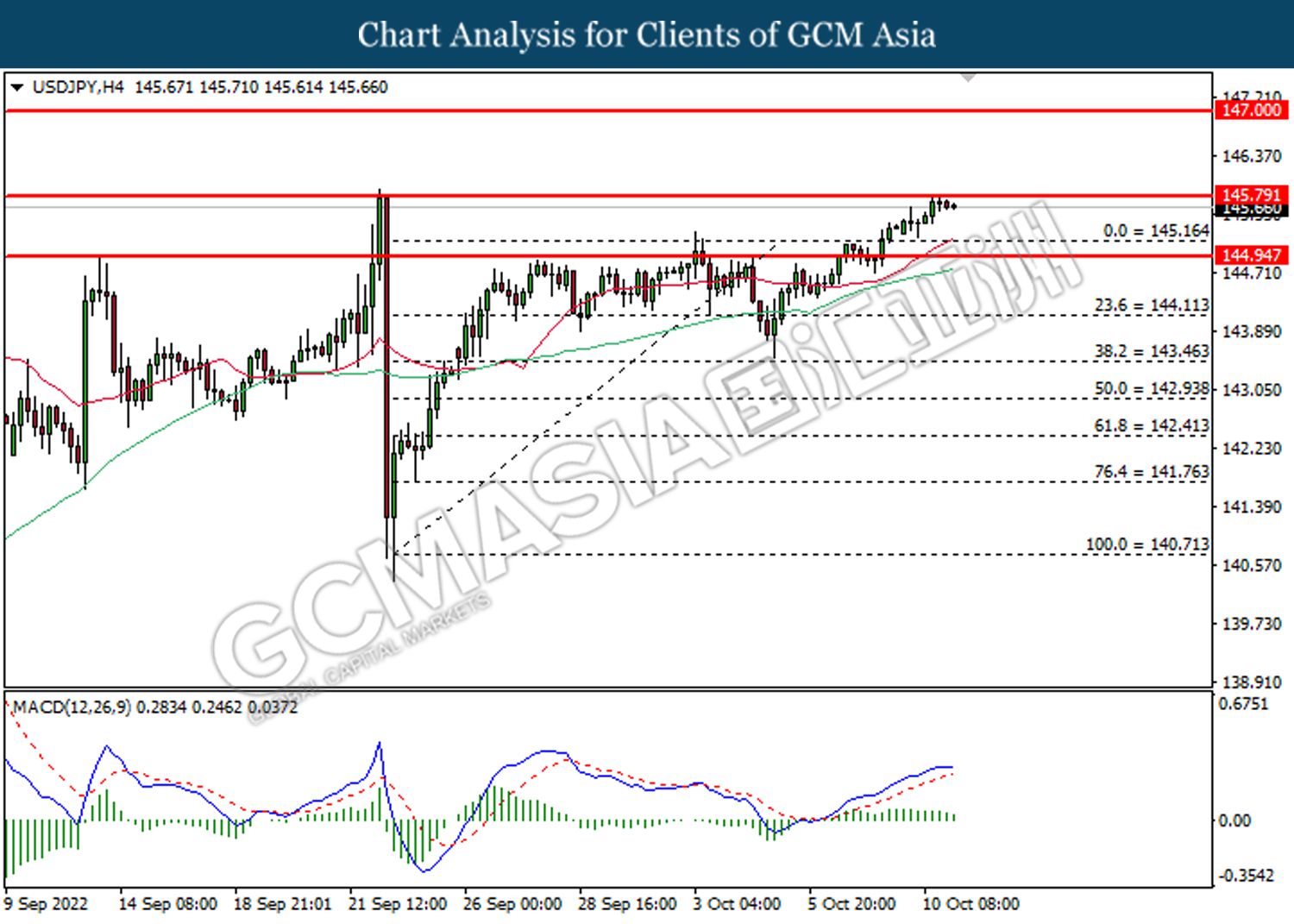

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 145.80. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 145.80, 147.00

Support level: 145.15, 144.95

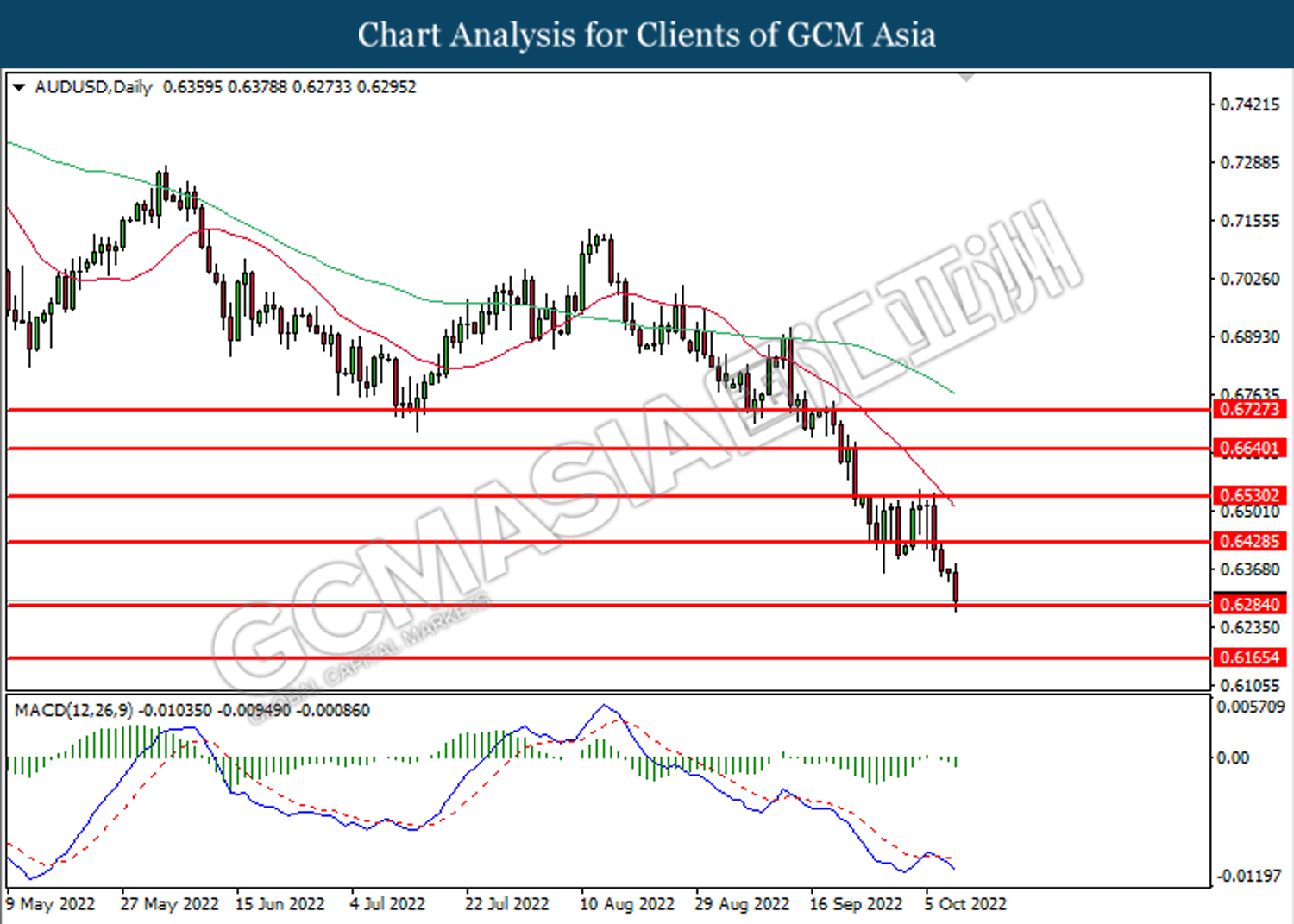

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6285. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

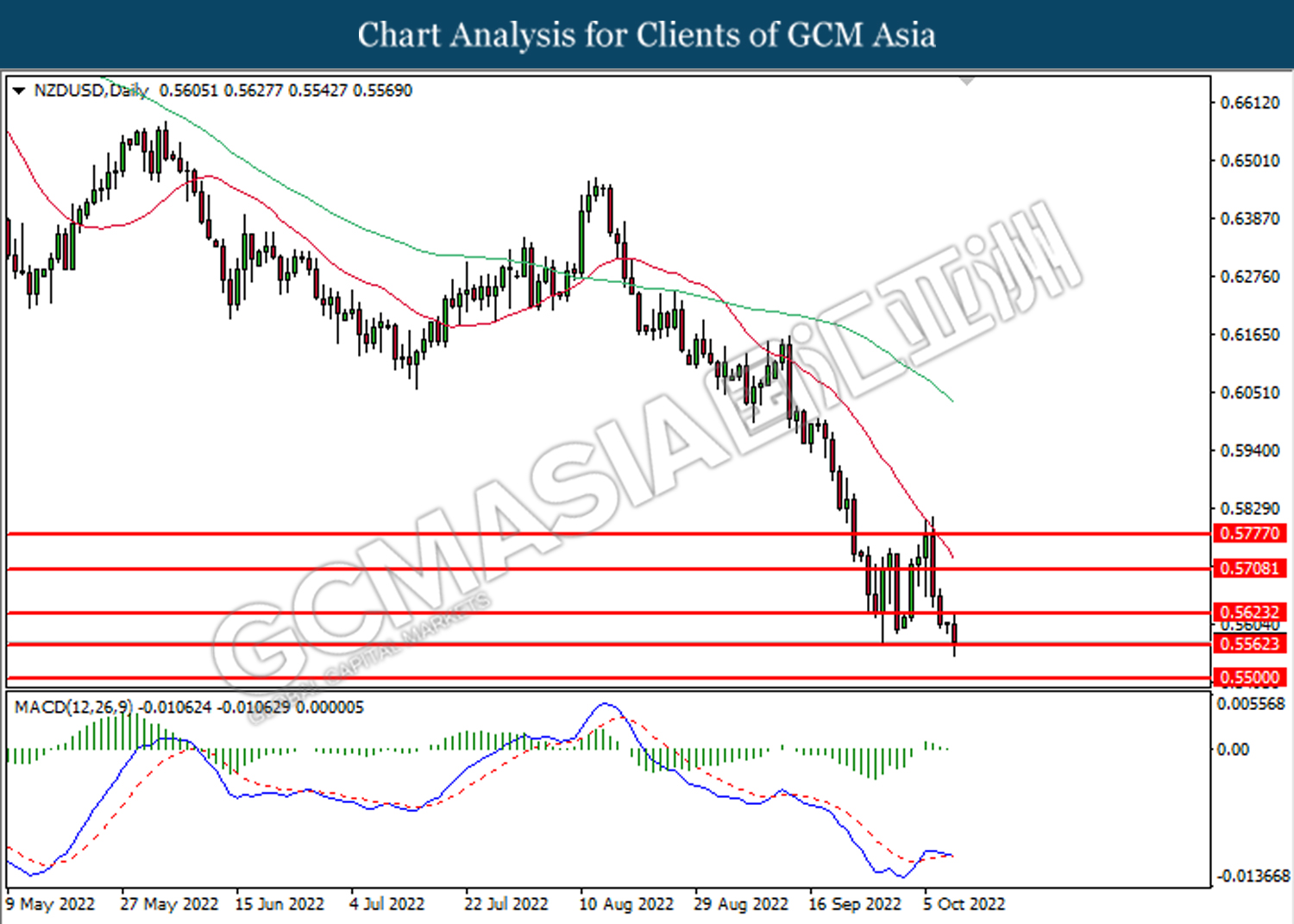

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.5560. MACD which illustrated diminishing bullish momentum suggest the pair to extend losses after it successfully breakout below the support level.

Resistance level: 0.5625, 0.5710

Support level: 0.5560, 0.5500

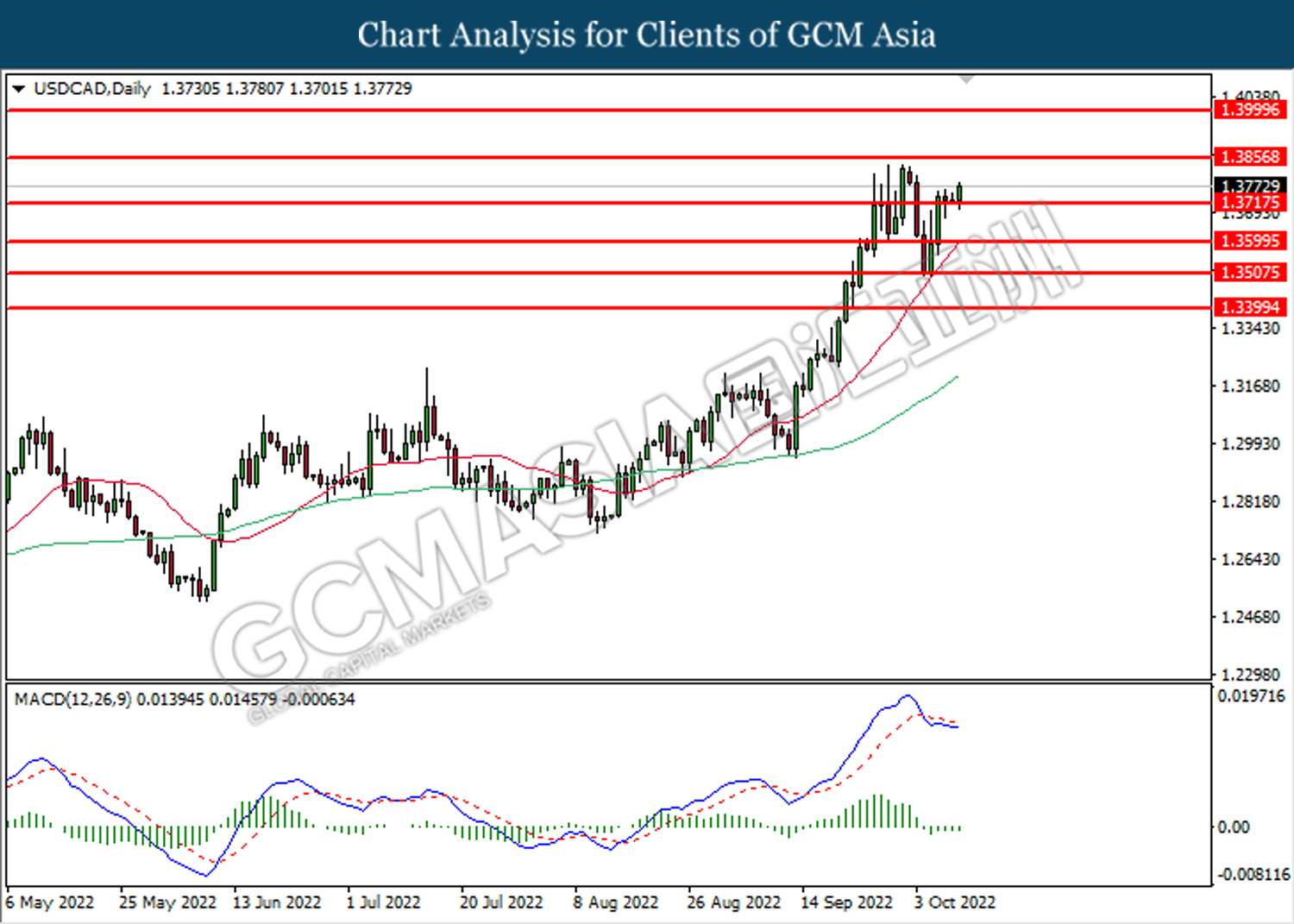

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3715. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3855.

Resistance level: 1.3855, 1.4000

Support level: 1.3715, 1.3600

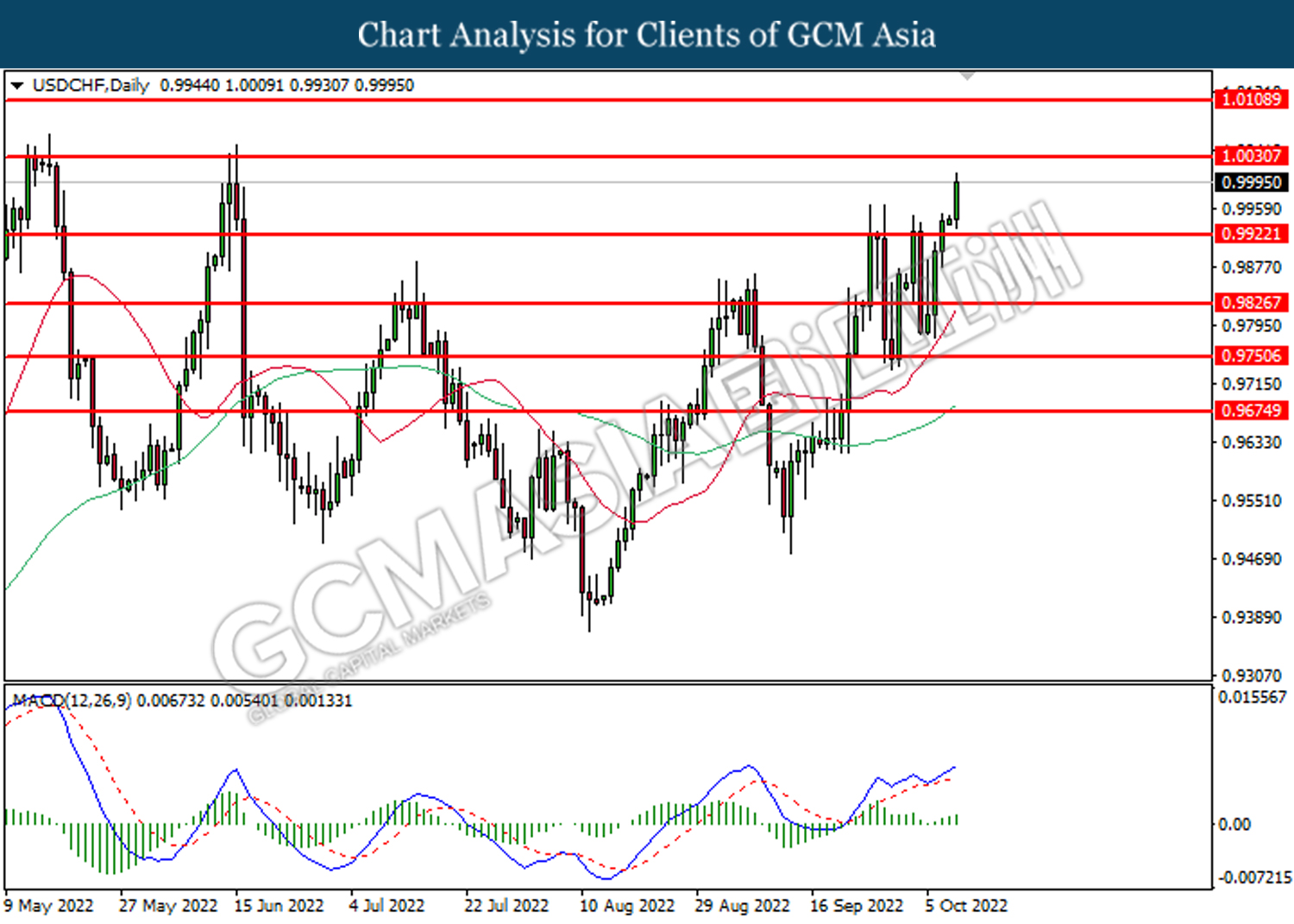

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9920. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0030.

Resistance level: 1.0030, 1.0110

Support level: 0.9920, 0.9825

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 89.45.

Resistance level: 96.65, 103.80

Support level: 89.45, 86.15

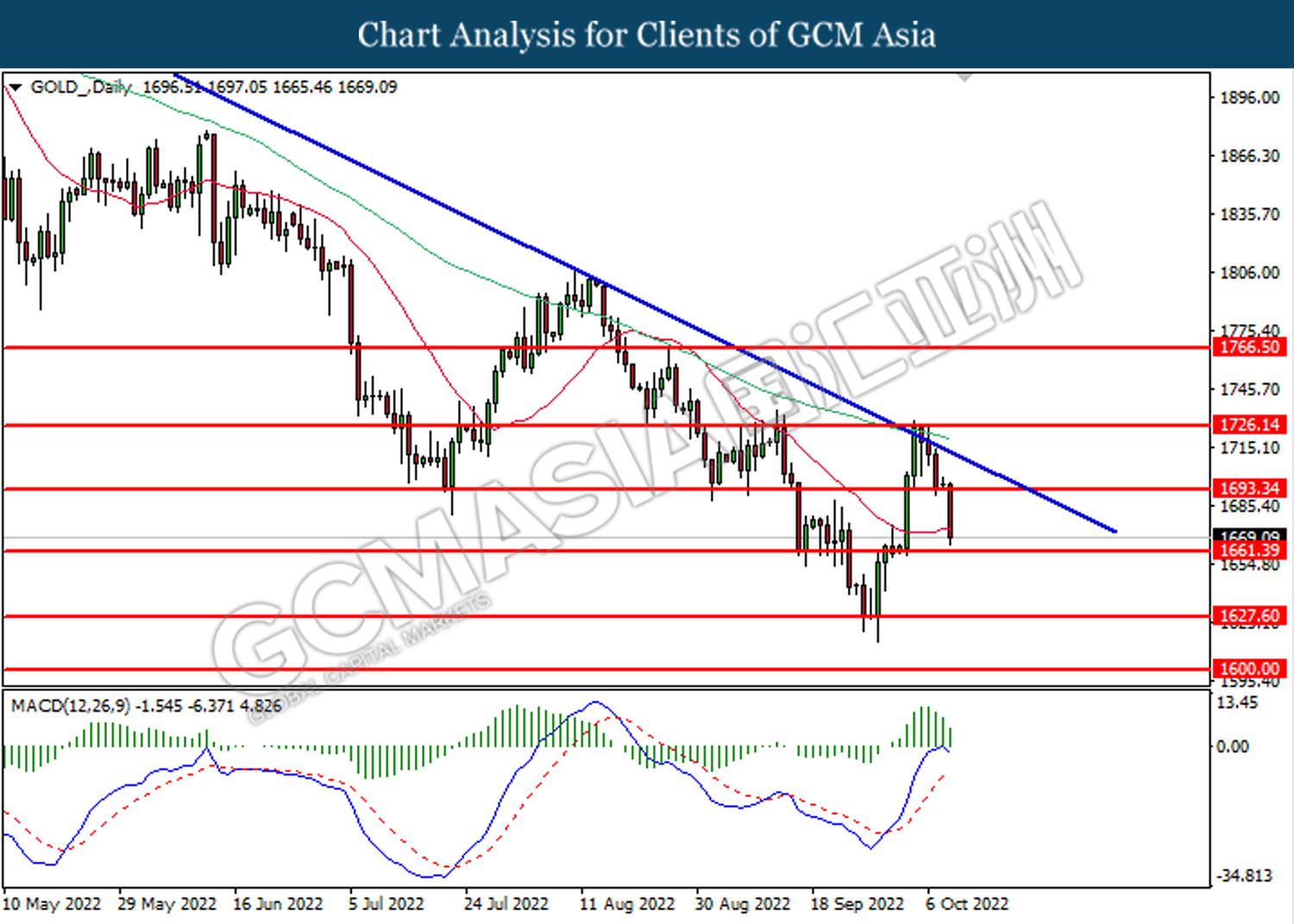

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1661.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60