11 November 2022 Afternoon Session Analysis

Euro rallied over the ECB hawkish stance.

The EUR/USD, which widely traded by majority of investors surged on yesterday amid the hawkish statement from European Central Bank (ECB) policymakers. According to Reuters, three of the ECB policymakers claimed on Thursday that the aggressive rate hike was necessary in order to tame sky-high inflationary pressure which faced by Eurozone. The Eurozone CPI that unleashed on October has reached a high level of 10.7%, as well as it did not show a sign of diminishing. Besides, the ECB board member Isabel Schnabel had reiterated that there is no time to pause the contractionary monetary policy, which sparkling the appeal of Euro. On the other hand, the GBP/USD rose significantly during overnight trading session over the Bank of England gilt selling plan. The BoE would start selling its bonds on 29 November. By doing this, the circulation of Pound Sterling in the market would likely to be reduced, which spurring bullish momentum on the GBP/USD. As of writing, EUR/USD depreciated by 0.21% to 1.0187 while GBP/USD eased by 0.31% to 1.1677.

In the commodities market, the crude oil price rose by 0.38% to $86.81 per barrel as of writing upon the tight oil supply, which caused by the price cap which implemented on Russia crude oil. In addition, the gold price appreciated by 0.05% to $1751.13 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 4.4% | 2.1% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Sep) | -1.6% | -0.4% | – |

| 15:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.4% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 108.45, 109.95

Support level: 107.05, 105.20

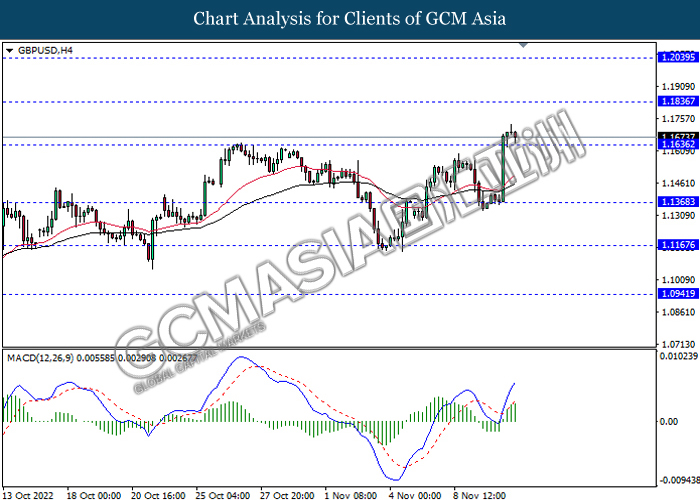

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1835, 1.2040

Support level: 1.1635, 1.1370

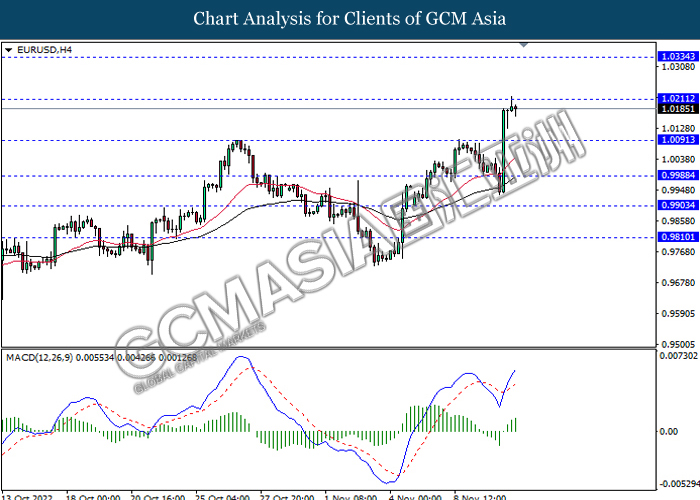

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0210, 1.0335

Support level: 1.0090, 0.9990

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

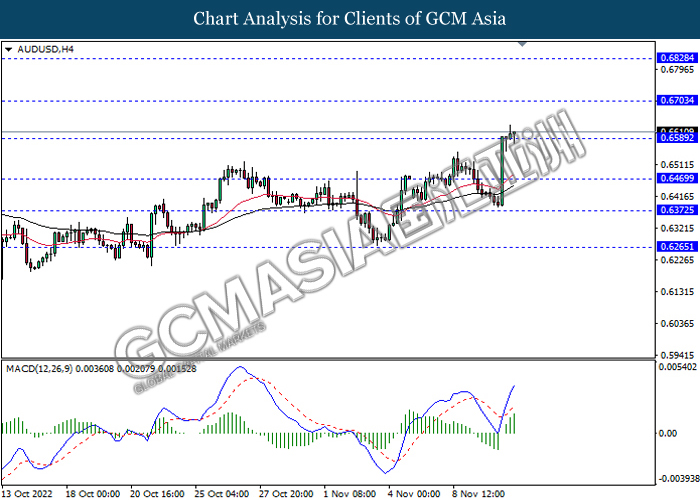

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6470

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully brekaut the resistance level.

Resistance level: 0.6025, 0.6150

Support level: 0.5920, 0.5805

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9665, 0.9755

Support level: 0.9565, 0.9445

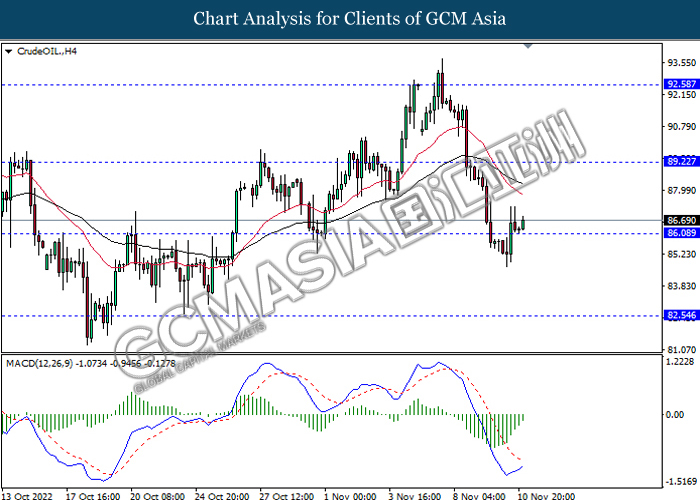

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 89.20, 92.60

Support level: 86.10, 82.55

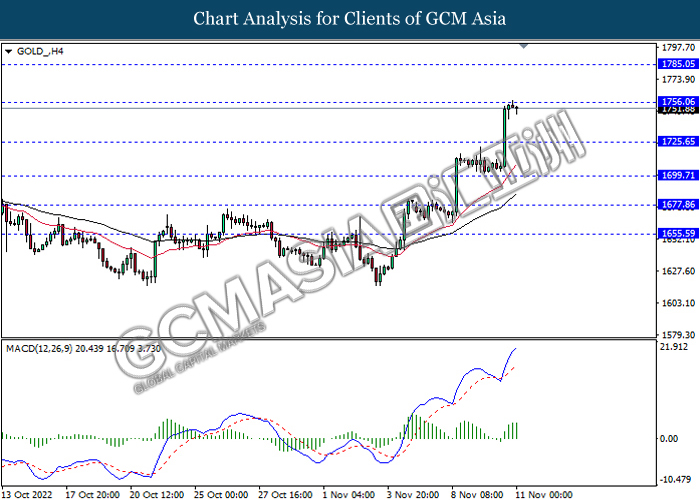

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1756.05, 1785.05

Support level: 1725.65, 1699.70