11 November 2022 Morning Session Analysis

Dollar plunged as inflation eased.

The dollar index, which gauges its value against a basket of six major currencies, lost its ground and plunged more than 3% yesterday as the US inflationary pressures cooled. According to the US Bureau of Statistics, the Consumer Price Index (CPI) for October rose by 7.7%, less than the consensus forecast at 8.0%, mirroring that the US inflation continues to ease from the previous month’s reading of 8.2%. On the other than, the Core CPI, excluding the volatile food and energy costs, increased by 0.3% for the month, yet far lower than the consensus forecast of 0.5%. With such a backdrop, it showed that the Federal Reserve’s barrage of interest rate hikes is beginning to have its intended effect toward sky-high inflation. Following with that, the target rate probabilities for the 14 Dec Fed Meeting show a sharp rise on 50 basis points of a rate hike, from 56.8% to 90.2%. However, it is noteworthy to mention that the inflation rate still remains well-above by the Fed’s 2% target. As of writing, the dollar index dropped -2.31% to 108.00.

In the commodities market, the crude oil price increased by 0.62% to $86.60 per barrel as US inflation came below expectations, dragging down the cost of oil for the non-US buyer. Besides, the gold price went up by 0.10% to $1755.00 per troy ounce amid the cooler-than-expected CPI data yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 4.4% | 2.1% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Sep) | -1.6% | -0.4% | – |

| 15:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.4% | – |

Technical Analysis

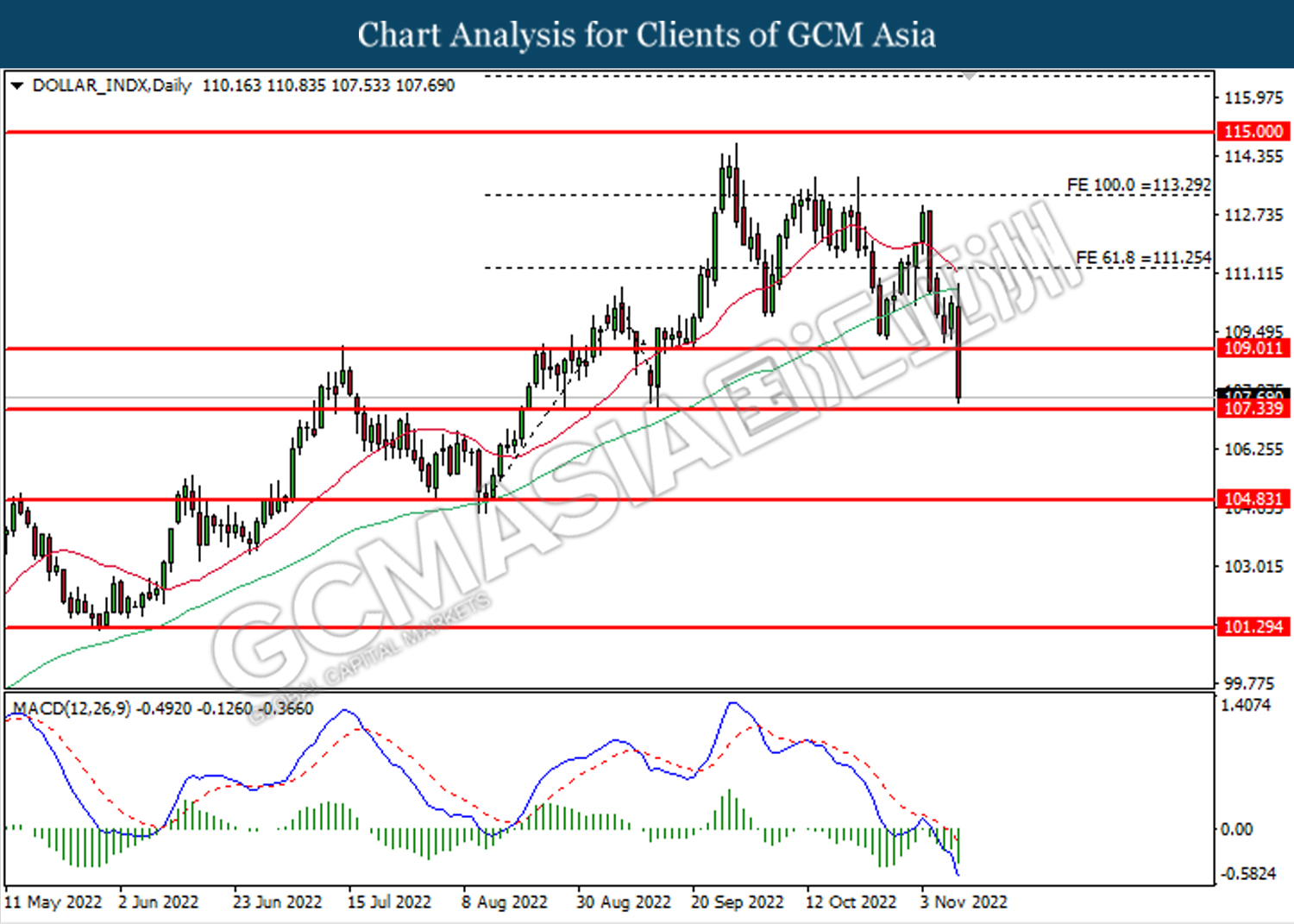

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 109.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 107.35.

Resistance level: 109.00, 111.25

Support level: 107.35, 104.85

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1635. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1635, 1.1820

Support level: 1.1445, 1.1290

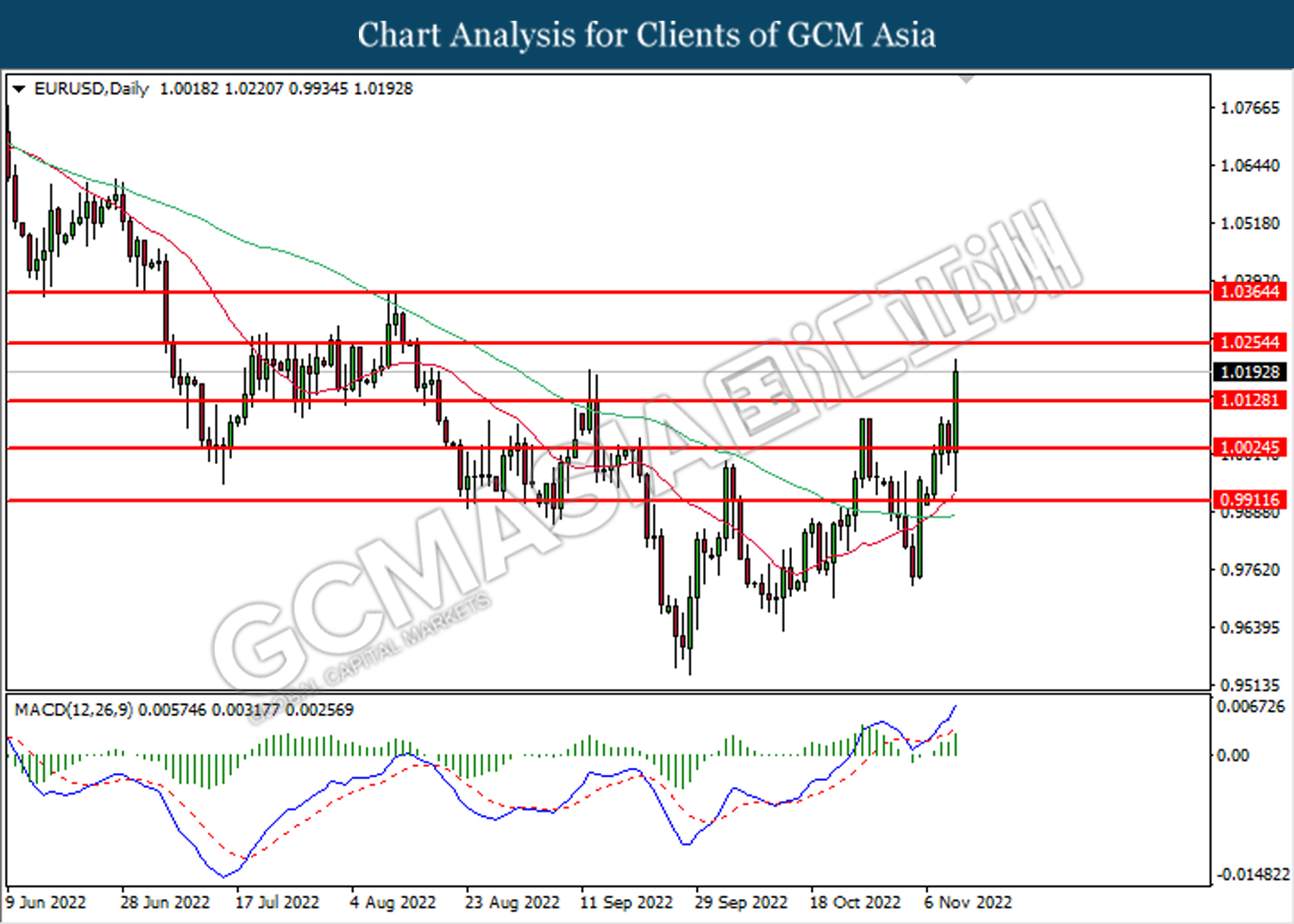

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0130. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0130, 1.0255

Support level: 1.0025, 0.9910

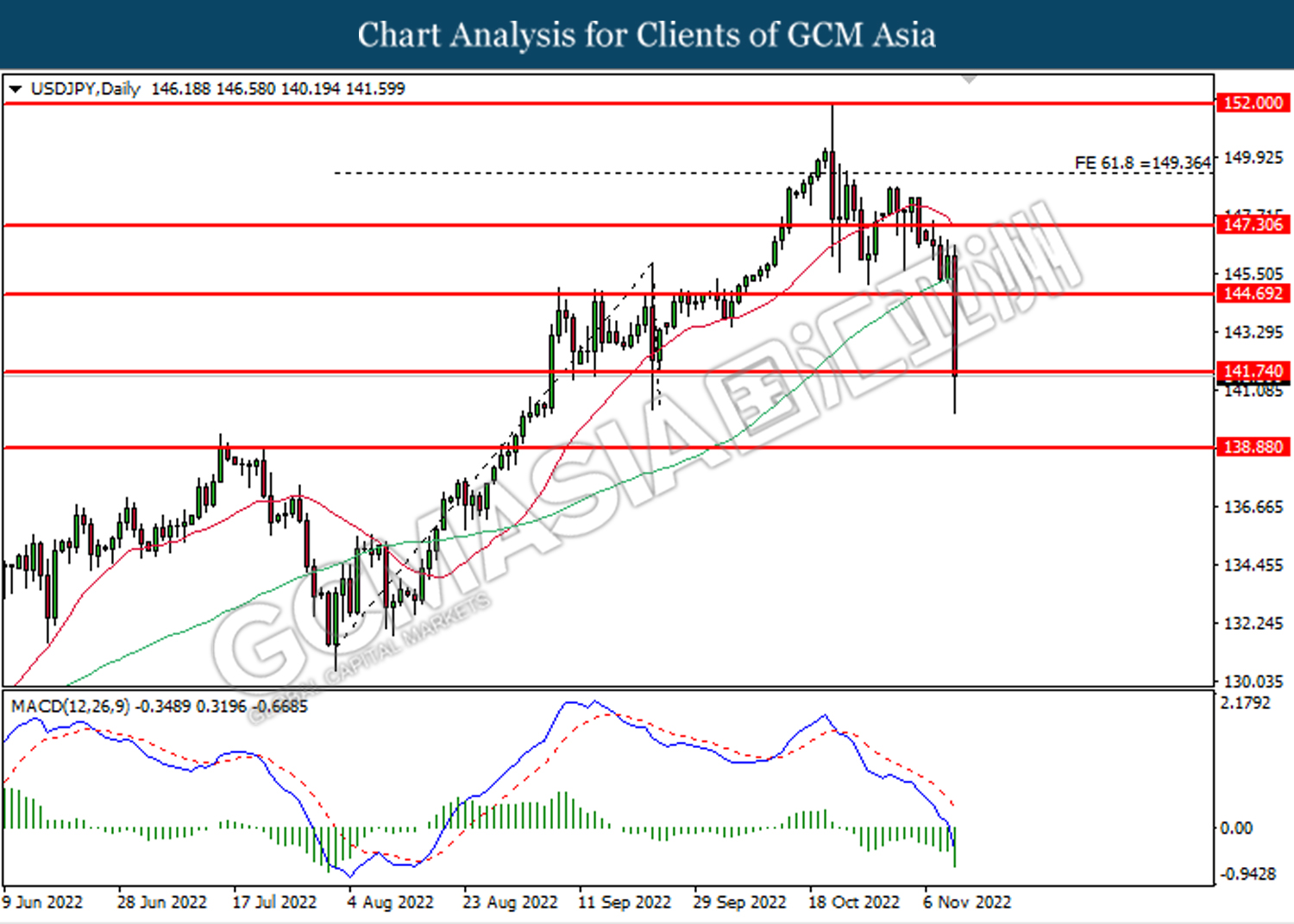

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.75. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 144.70, 147.30

Support level: 141.75, 138.90

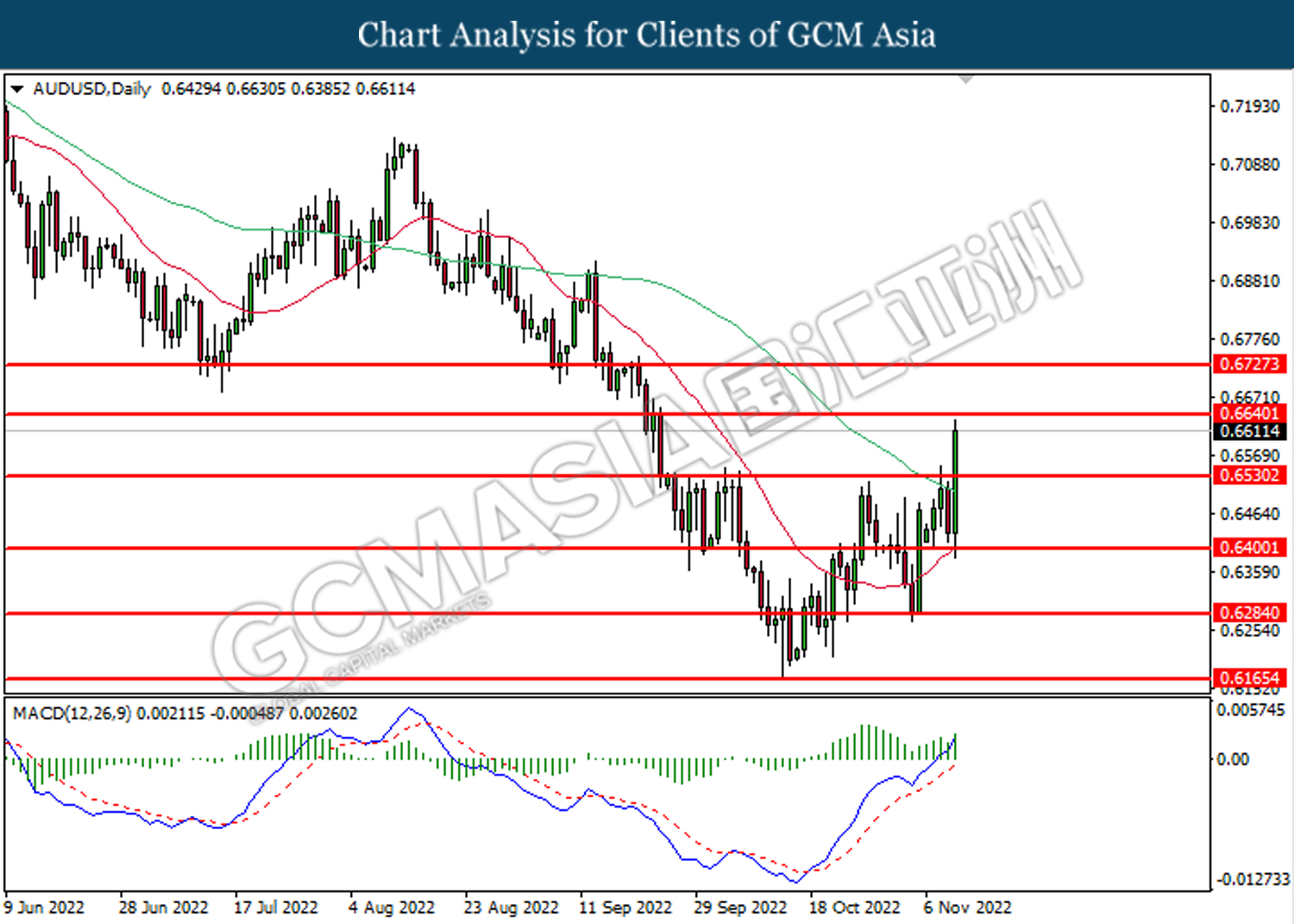

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6530. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6640.

Resistance level: 0.6640, 0.6725

Support level: 0.6530, 0.6400

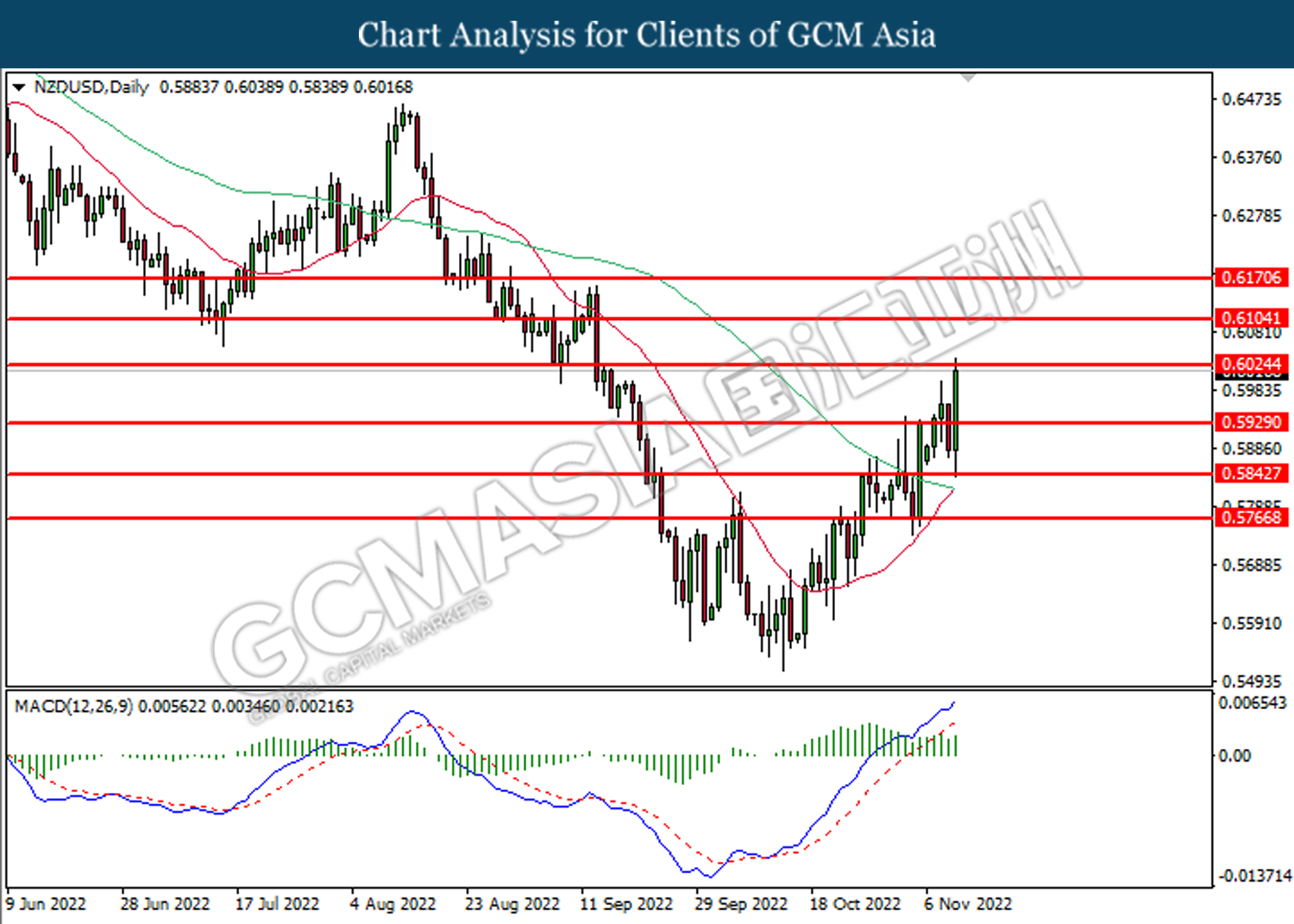

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6025. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6025, 0.6105

Support level: 0.5920, 0.5845

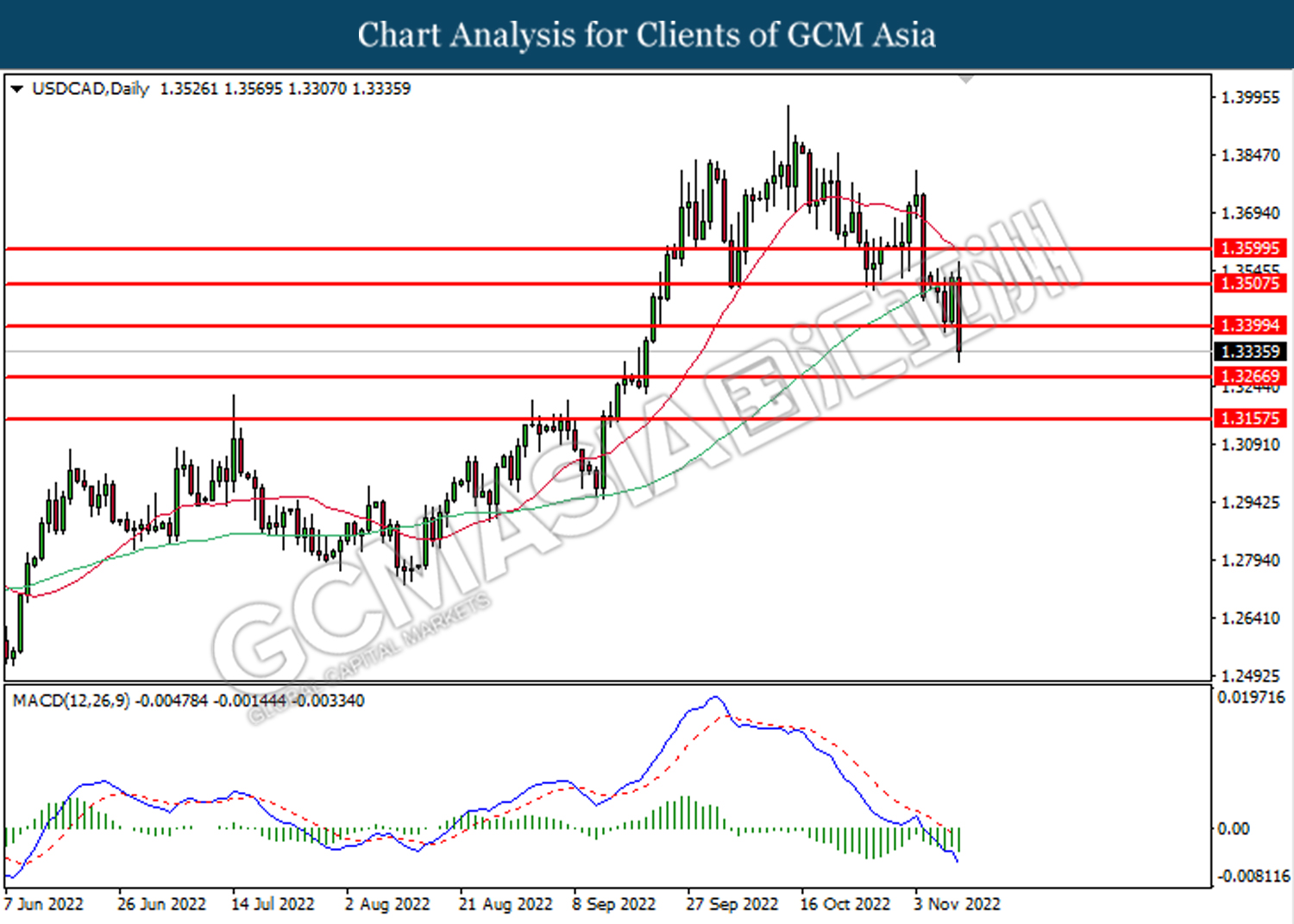

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

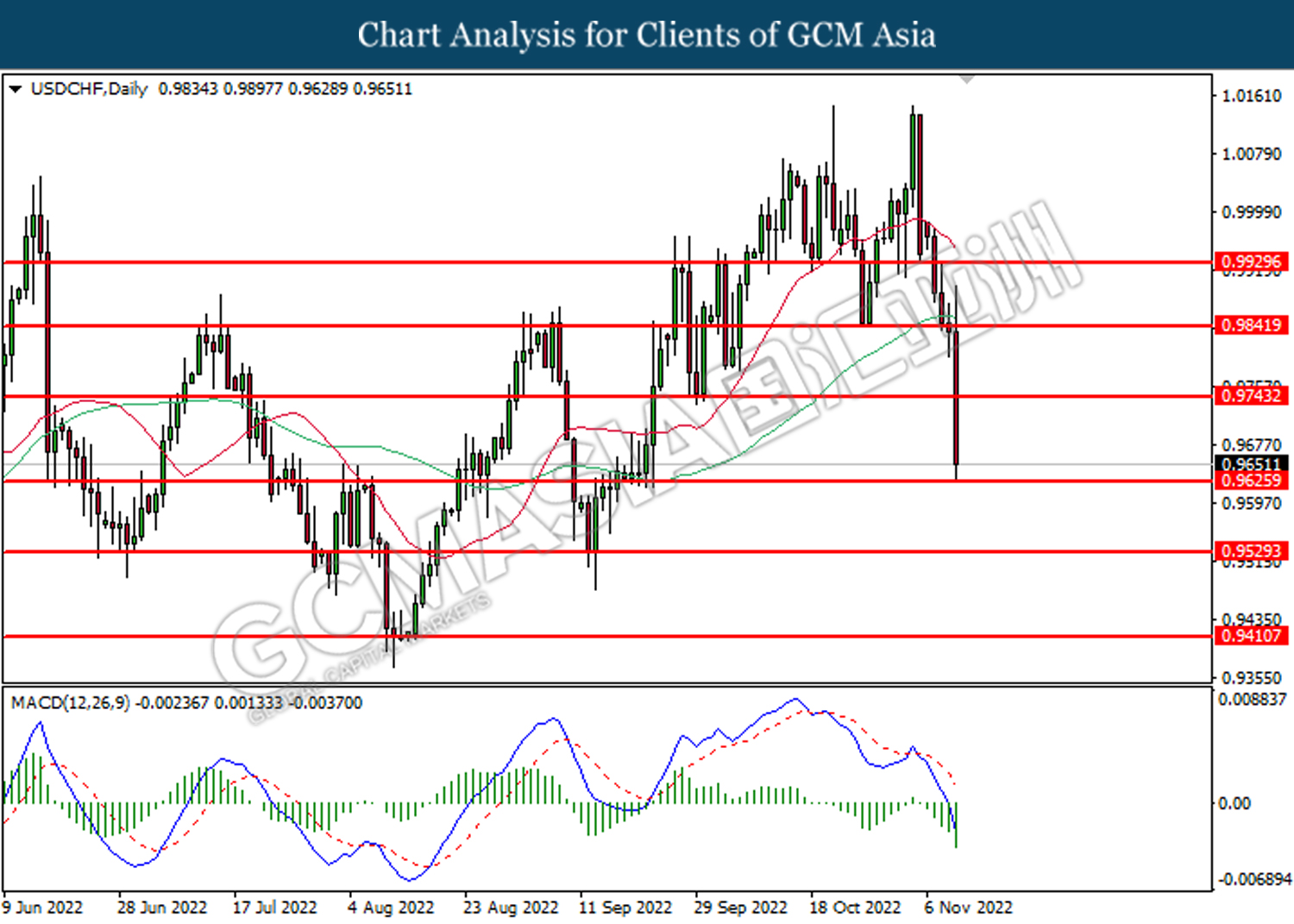

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9625. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9745, 0.9840

Support level: 0.9625, 0.9530

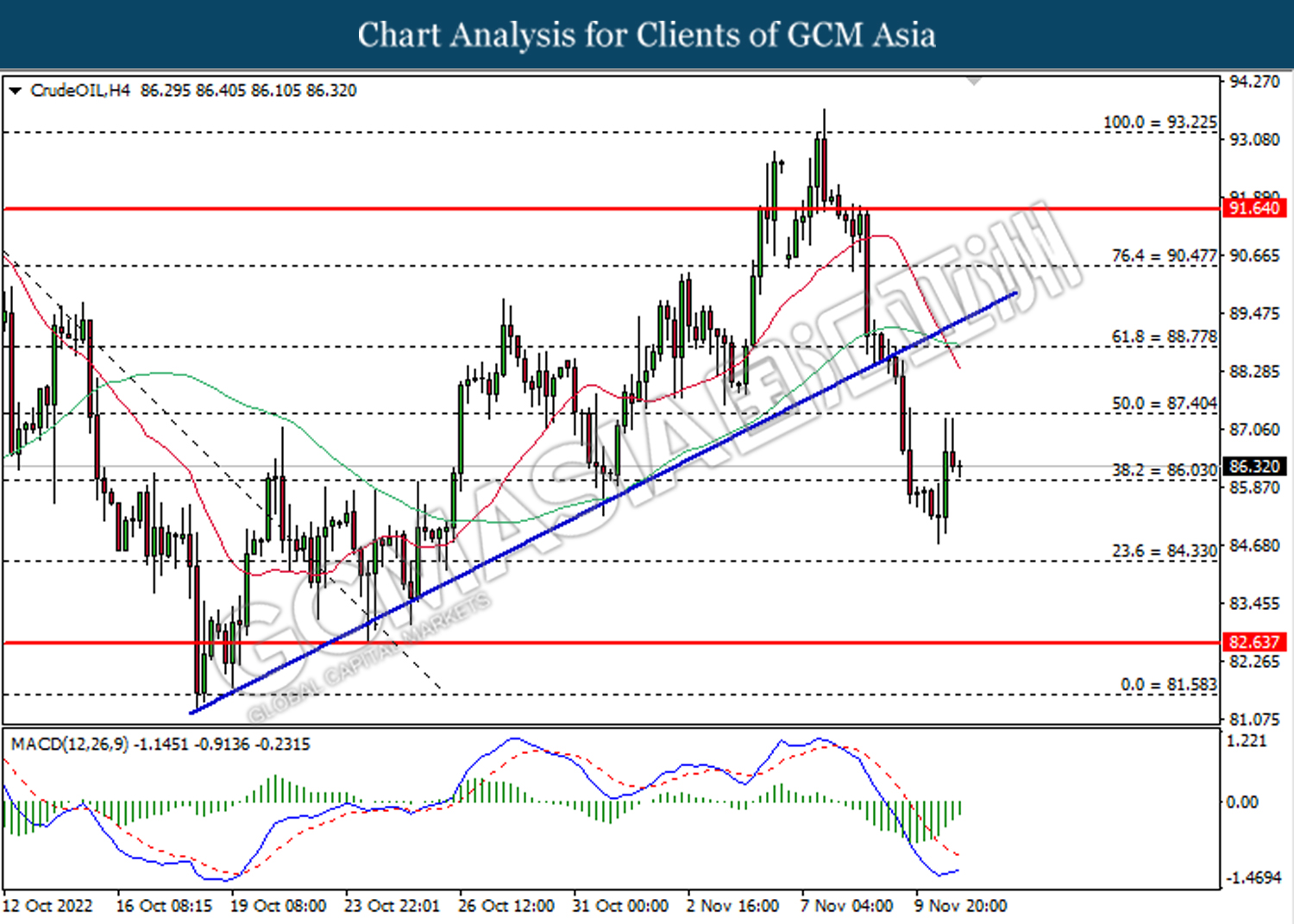

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 86.05. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 87.40, 88.80

Support level: 86.05, 84.35

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1726.15. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1766.50.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1695.35