12 January 2023 Afternoon Session Analysis

Japanese Yen surged ahead of policy review next week.

The Japanese Yen, which was widely traded by the investors around the world, jumped on expectation that the Bank of Japan (BoJ) may review the monetary policy in the next meeting. According to the latest news from Yomiuri, the BoJ is expected to review the side effects of its massive monetary easing in the upcoming meeting despite the last month’s modification of bond yield controls strategy. In the prior month, the BoJ has tried to stabilize the bond market by widening the band of long-term bond yield target from the previous cap of 0.25% to 0.50%. However, it failed to address the distortion in the bond market, and on the contrary, it heightened the speculation activity. Therefore, it urged the BoJ members to take a step back and review on its current monetary policy. A major policy tweak would likely to be seen in the upcoming meeting if it is necessary. As of writing, the pair of USD/JPY plummeted by -0.68% to 131.60.

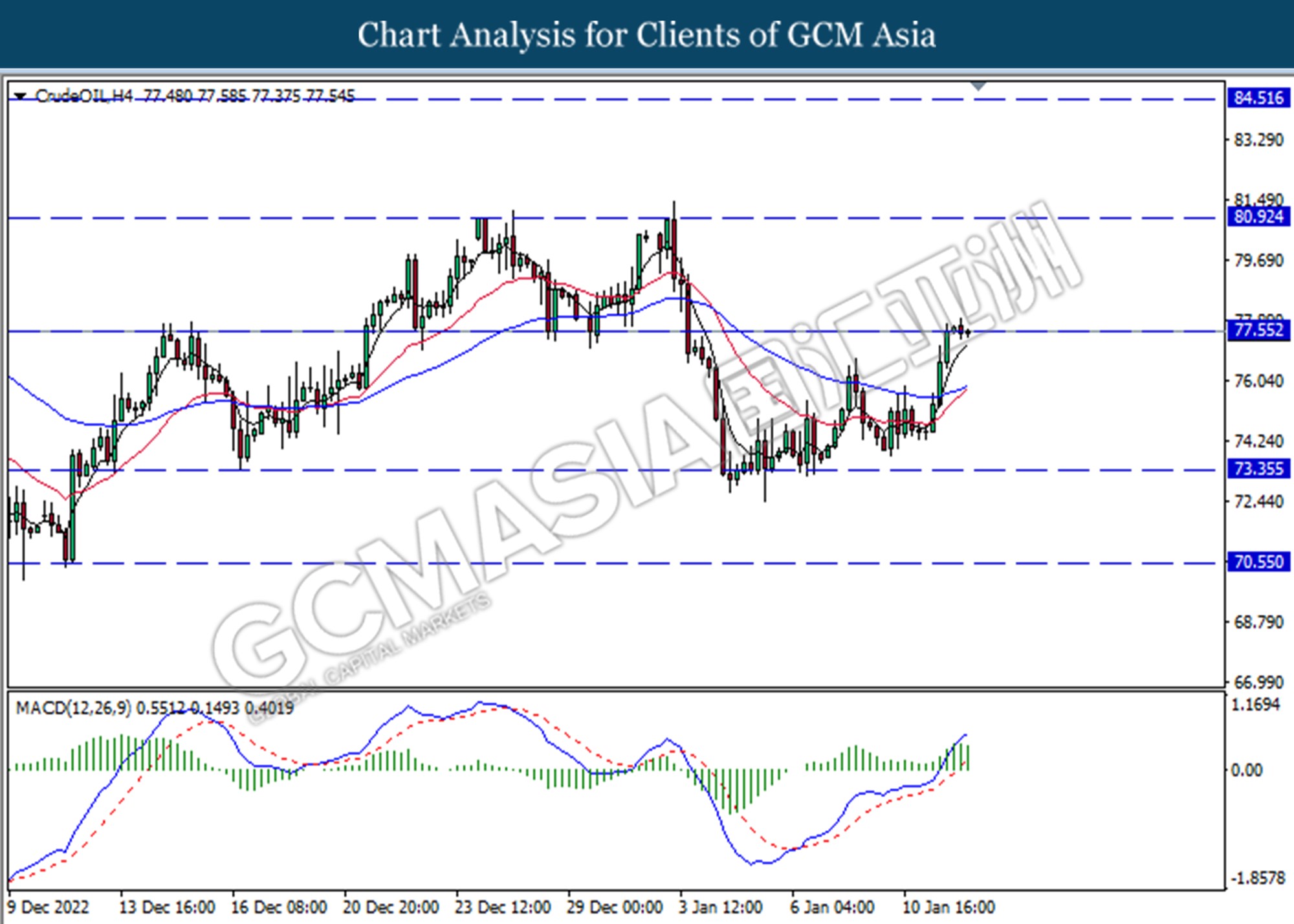

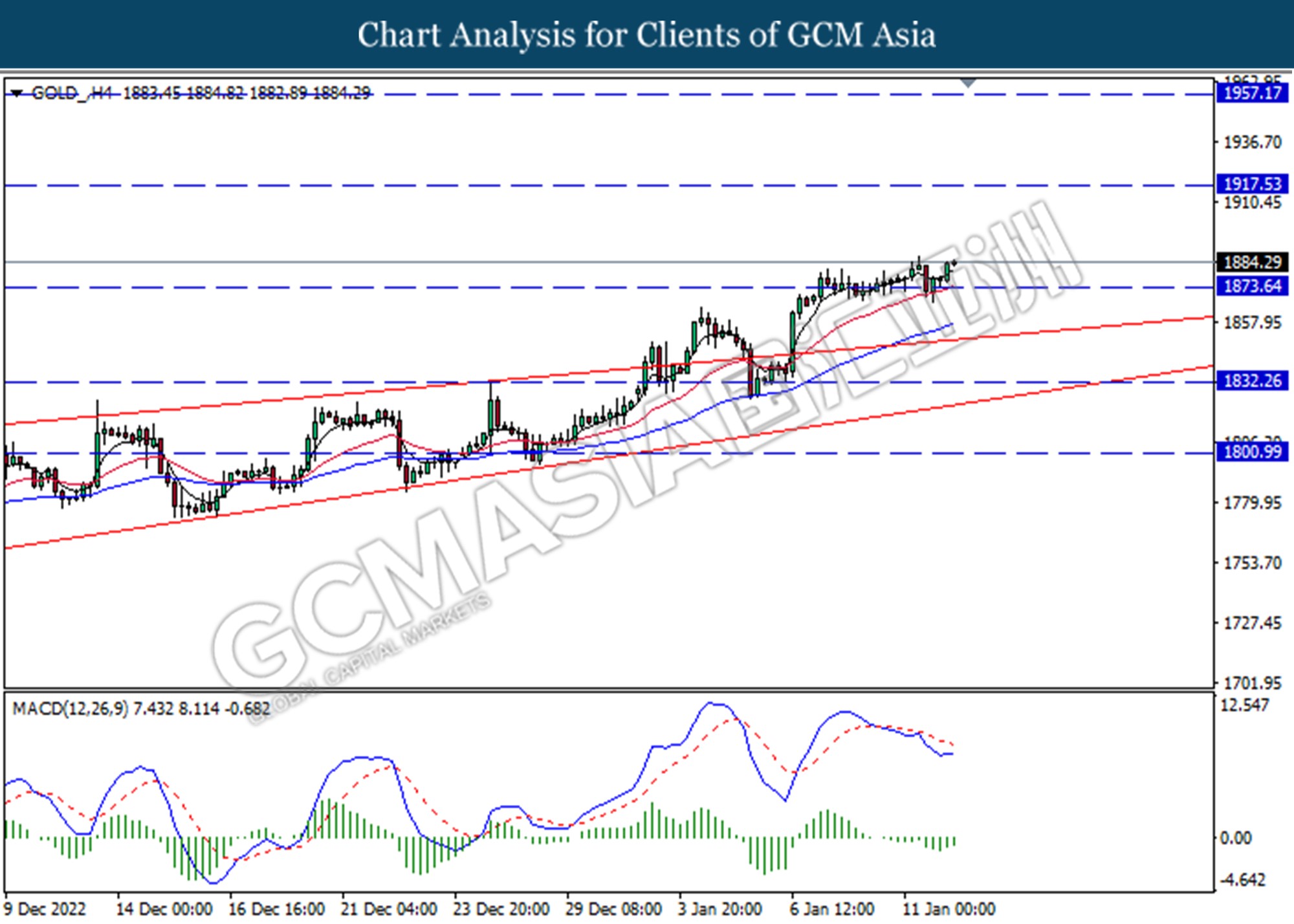

In the commodities market, the crude oil price edged down by -0.36% to $77.50 per barrel after jumping significantly yesterday as the EU’s sanctions against the petroleum products from Russia overshadowed the effect of stockpiles in the US over the past week. Besides, the gold prices rose by 0.44% to $1883.85 per troy ounce as the majority of the investors are expecting the US CPI data would come in at a weaker pace.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Dec) | 0.20% | 0.30% | – |

| 21:30 | USD – CPI (YoY) (Dec) | 7.10% | 6.50% | – |

| 21:30 | USD – Initial Jobless Claims | 204K | 220K | – |

Technical Analysis

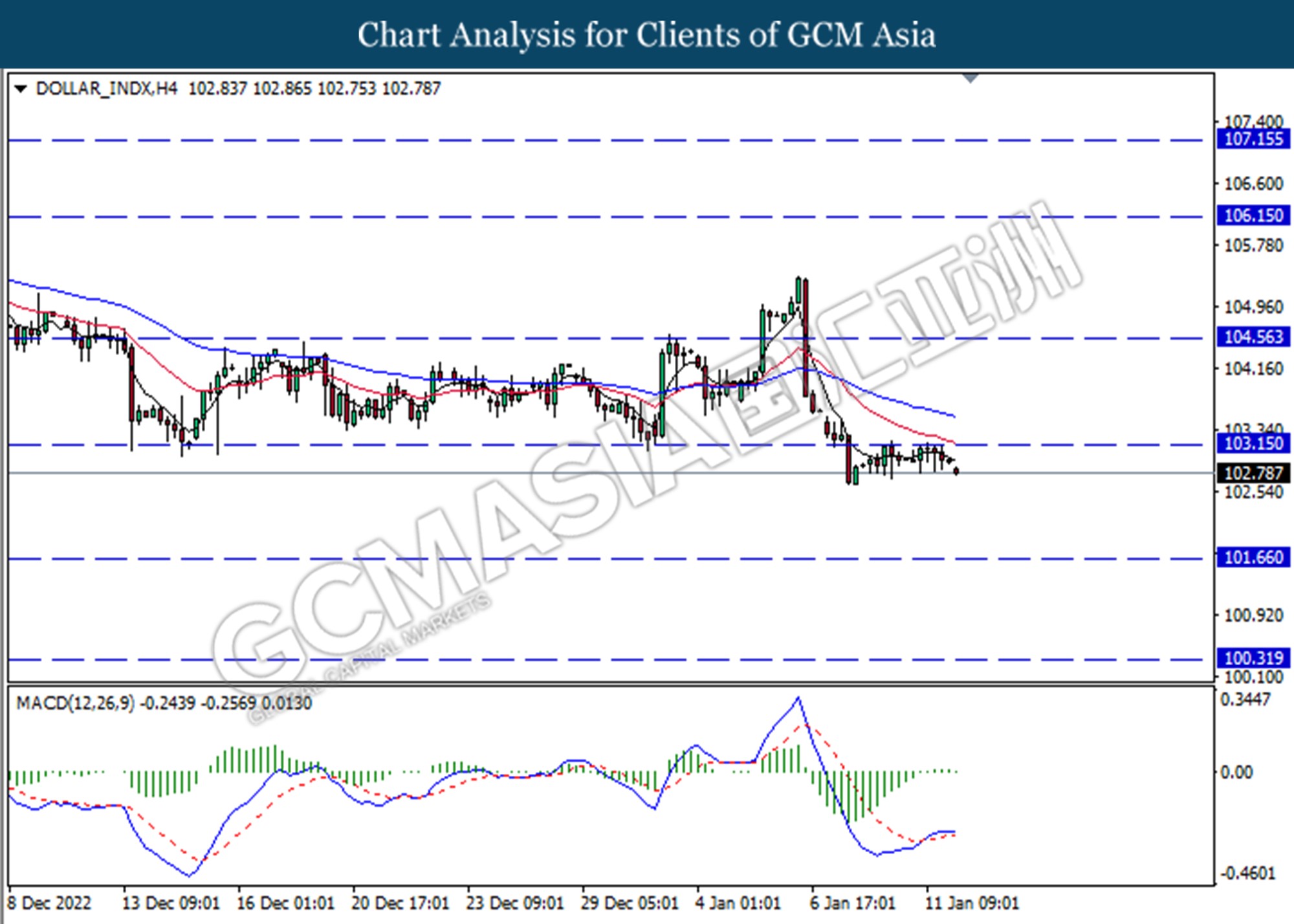

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below the previous support level at 103.15. MACD which illustrated decreasing in bullish momentum suggest the index to extend its losses toward support level at 101.65.

Resistance level: 103.15,104.55

Support level: 101.65, 100.30

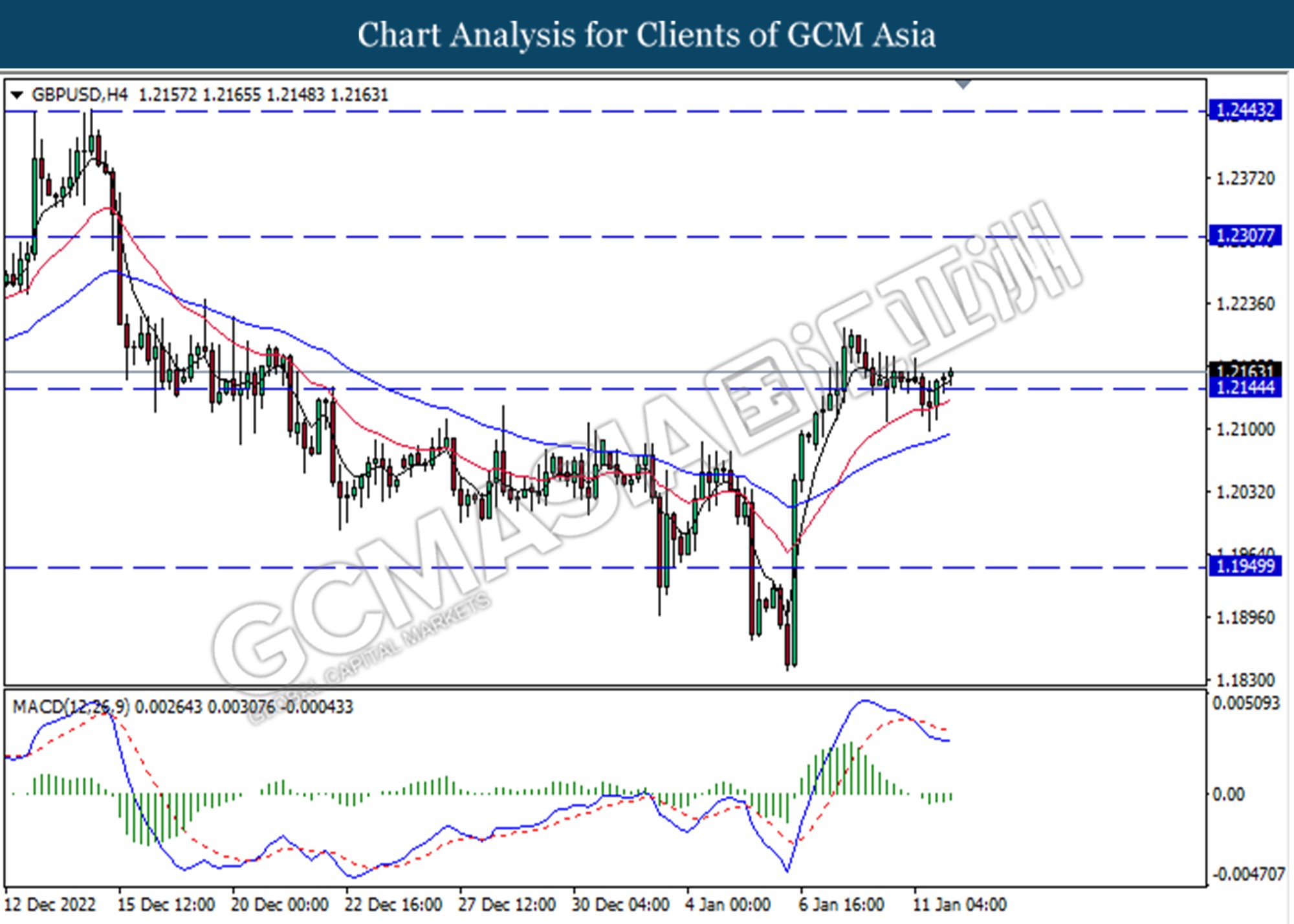

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2145. MACD which illustrated decreasing bearish momentum suggest the pair extend its gains toward the resistance level at 1.2310.

Resistance level: 1.2310, 1.2445

Support level: 1.2145, 1.1950

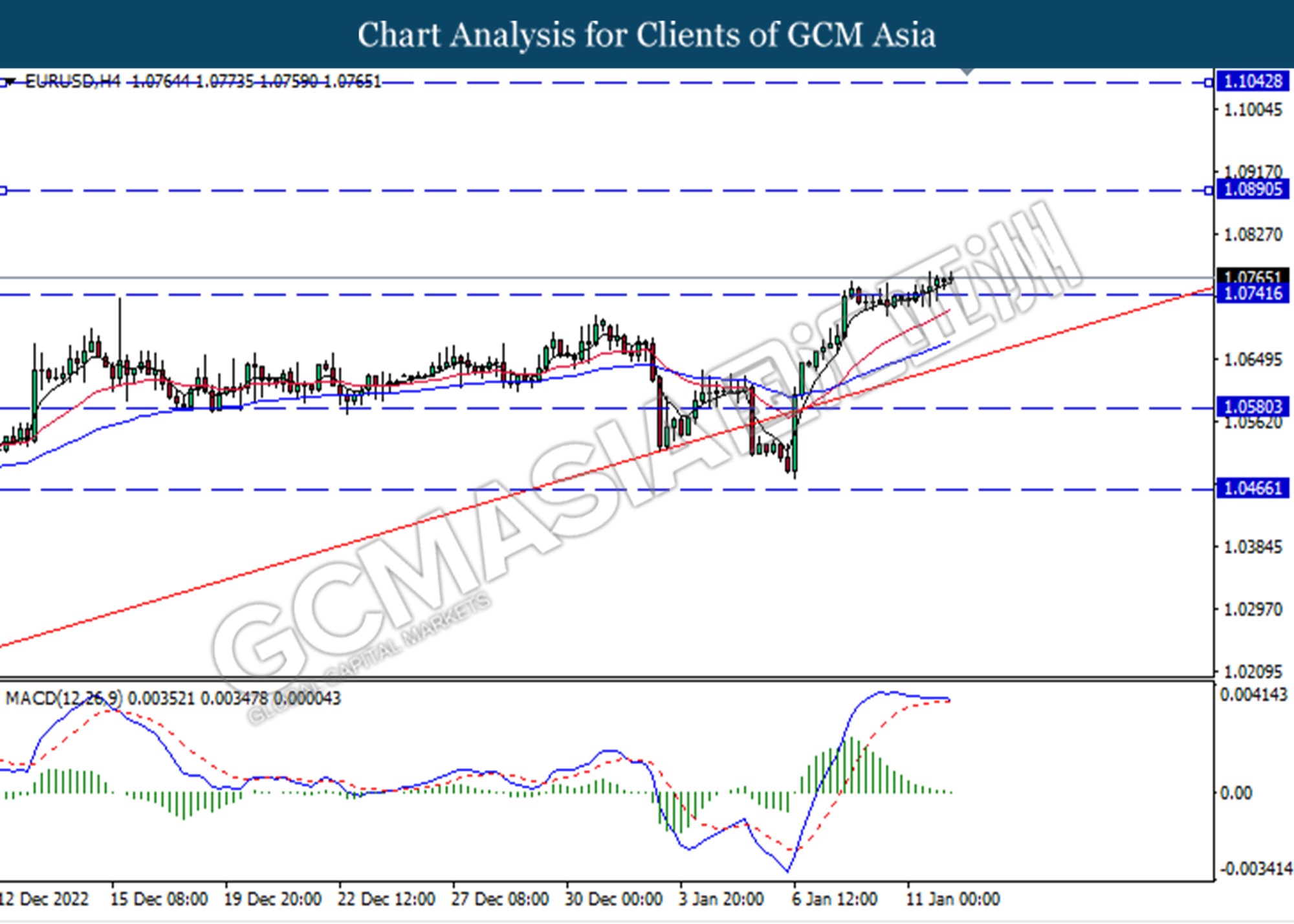

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0740. However, MACD which illustrated decreasing in bullish momentum suggest the pair undergo technical correction.

Resistance level: 1.0890, 1.0425

Support level: 1.0740, 1.0580

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 132.95. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses toward the support level 130.25.

Resistance level: 132.95, 134.50

Support level: 130.25,128.00

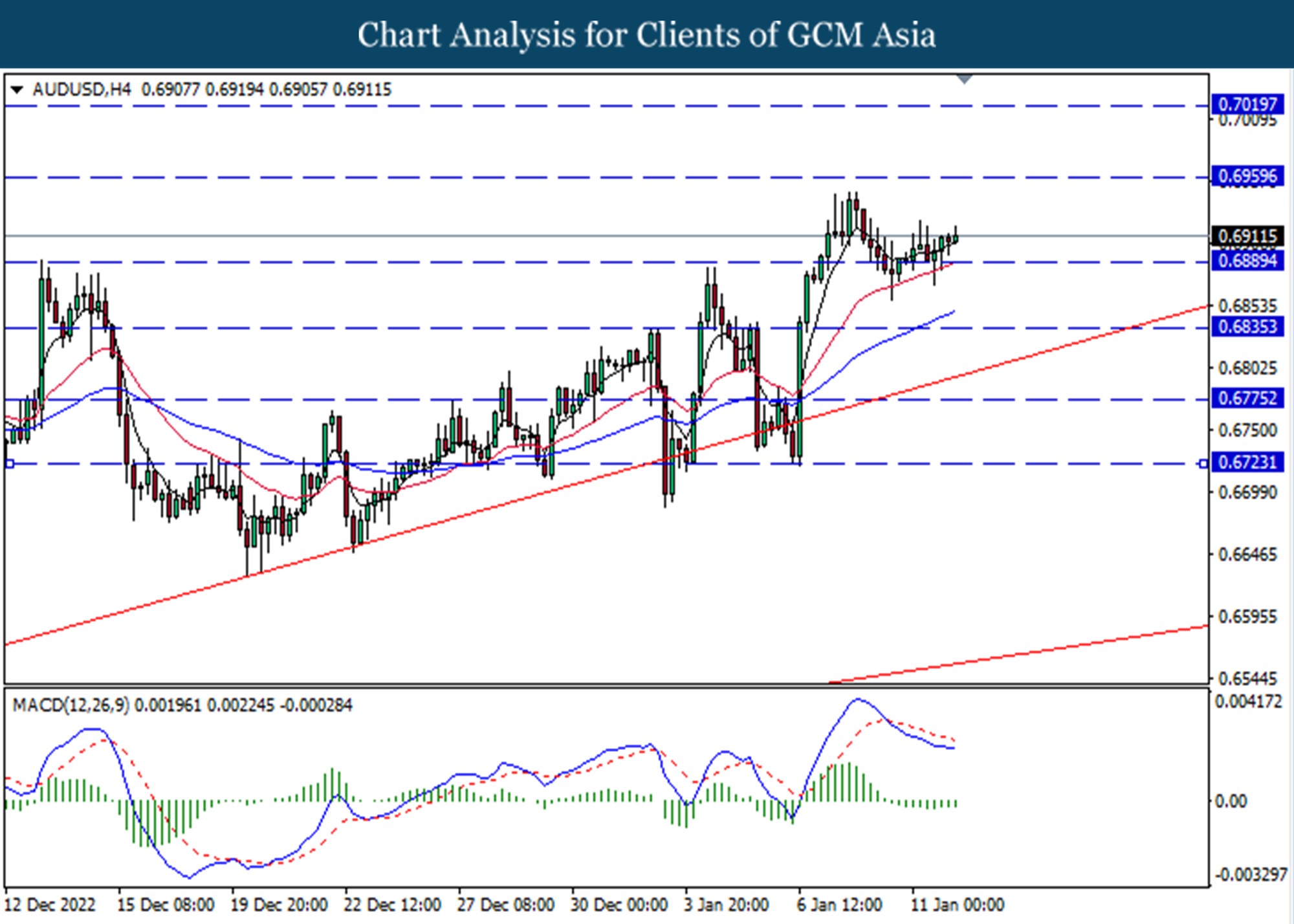

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6890. MACD which illustrated decreasing bearish momentum suggest the pair extend its gains toward the resistance level at 0.6960.

Resistance level: 0.6960, 0.7020

Support level: 0.6890, 0.6835

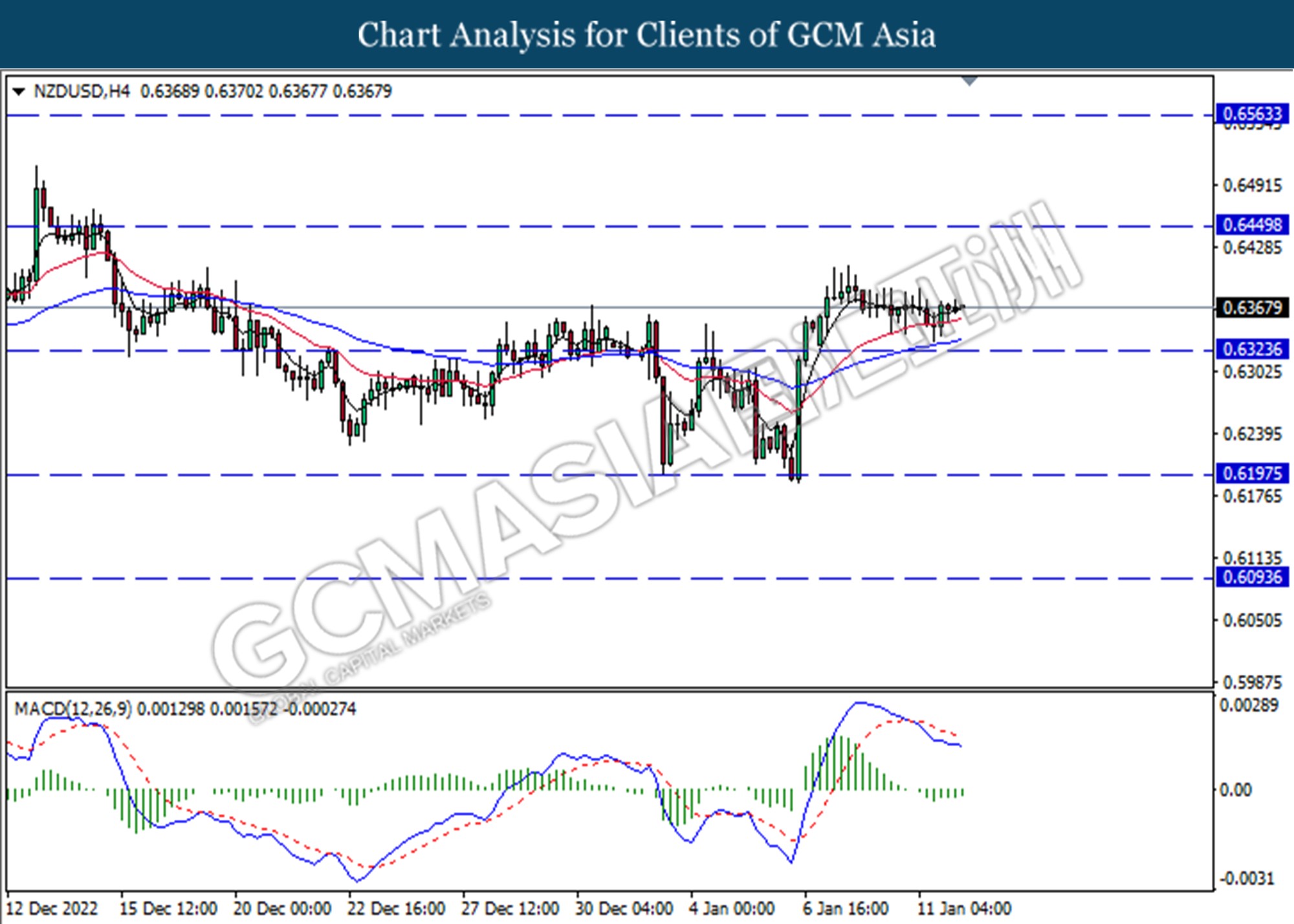

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6325. MACD which illustrated decreasing bearish momentum suggest the pair extend its gains toward the resistance level at 0.6450.

Resistance level: 0.6450, 0.6560

Support level: 0.6325, 0.6200

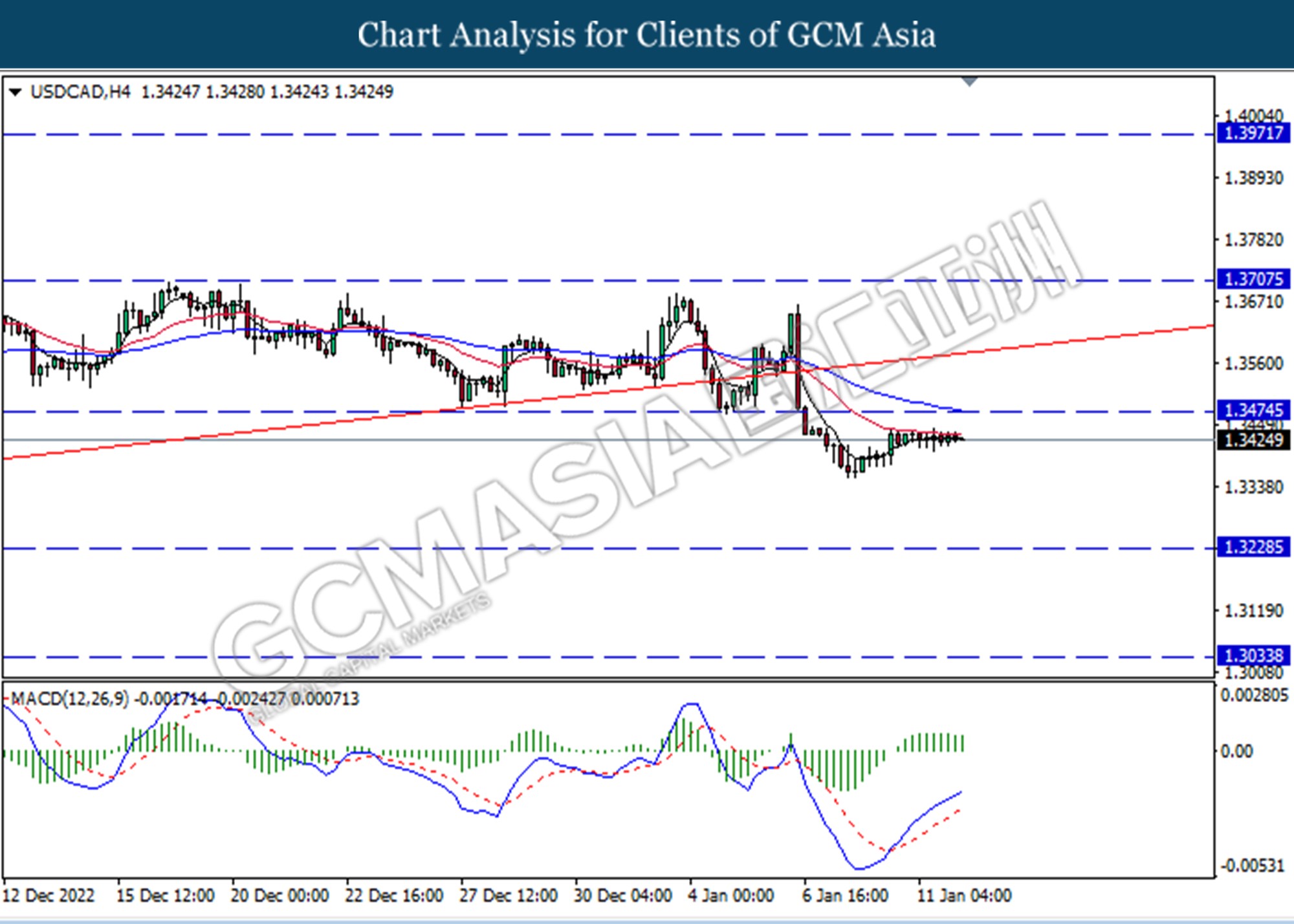

USDCAD,H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3475. However, MACD which illustrated bullish bias momentum suggest the pair undergo technical correction in short term.

Resistance level: 1.3475, 1.3705

Support level: 1.3230, 1.3035

USDCHF, H4: USDCHF was traded higher currently testing for resistance level at 0.9320. MACD which illustrated increasing in bullish momentum suggest the pair extend its gains after it successfully breakthrough the resistance level at 0.9320.

Resistance level: 0.9320, 0.9400

Support level: 0.9240, 0.9200

CrudeOIL, H4: Crude oil was traded higher currently testing for the resistance level at 77.55. MACD which illustrated increasing in bullish momentum suggest the commodity extend its gains if successfully breakthrough the resistance level at 77.55.

Resistance level: 77.55, 80.90

Support level: 73.35, 70.55

GOLD_, H4: Gold was traded higher following prior breakout above the previous resistance level at 1873.65. MACD which illustrated decreasing in bearish momentum suggest the commodity extend its gains.

Resistance level: 1917.55, 1957.20

Support level: 1873.65, 1832.25