12 April 2022 Afternoon Session Analysis

Pound edged down amid downbeat economic data.

GBPUSD has been dragged down since yesterday over the backdrop of passive economic data. According to Office for National Statistics, UK Gross Domestic Product (GDP) MoM notched down from the previous reading of 0.8% to 0.1%, which lower than the market forecast of 0.3%. Besides, UK Manufacturing Production MoM recorded at the reading of -0.4%, worst than the previous reading of 0.9% and the market forecast of 0.3%. Both downbeat economic data has indicated that the UK economic prospects are not as good as they once were. It dialed down the market optimism toward economic progression in UK region, prompting investors to selloff Pound. On the other hand, the US Dollar Index was back above 100 on Tuesday morning, supported by high U.S. yields ahead of inflation data that is expected to show US prices gained the most in over 16 years, reinforcing expectations of aggressive Fed tightening policy. The rate hike expectation from Federal Reserve had stoked a shift sentiment toward US Dollar which having better prospects, spurring further bearish momentum on the Pound. As of writing, GBPUSD depreciated by 0.05% to 1.3022.

In commodities market, crude oil price appreciated by 2.10% to $96.28 per barrel as of writing following the market weighed the potential for more sanctions on Russia’s energy sector and OPEC warned it would be impossible to increase output enough to offset lost supply. Besides, gold price appreciated by 0.49% to $1957.50 per troy ounces as of writing amid the rising tension between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 4.80% | – | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -48.1K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | -39.3 | -48 | – |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.50% | – |

Technical Analysis

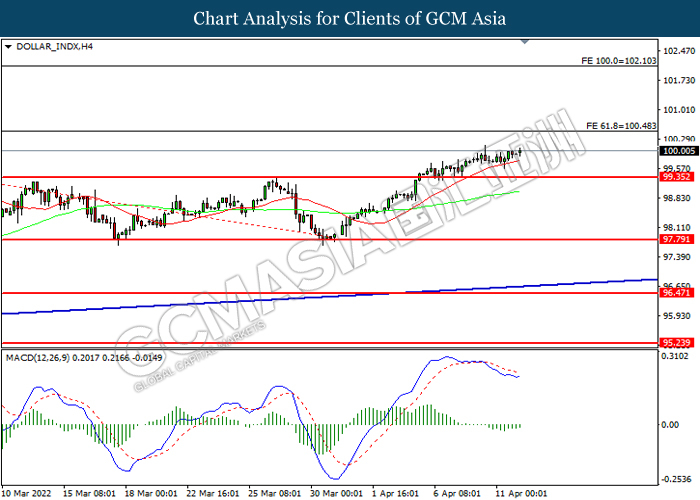

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

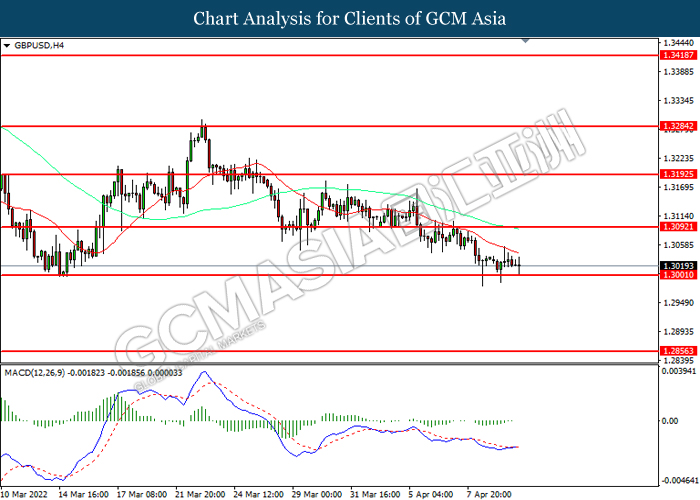

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

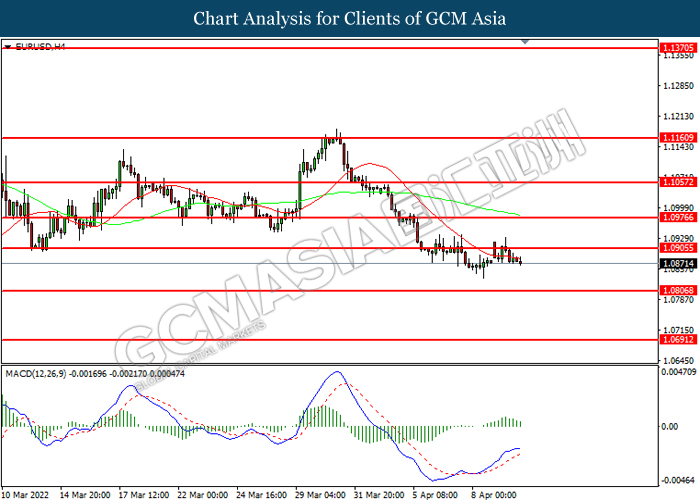

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

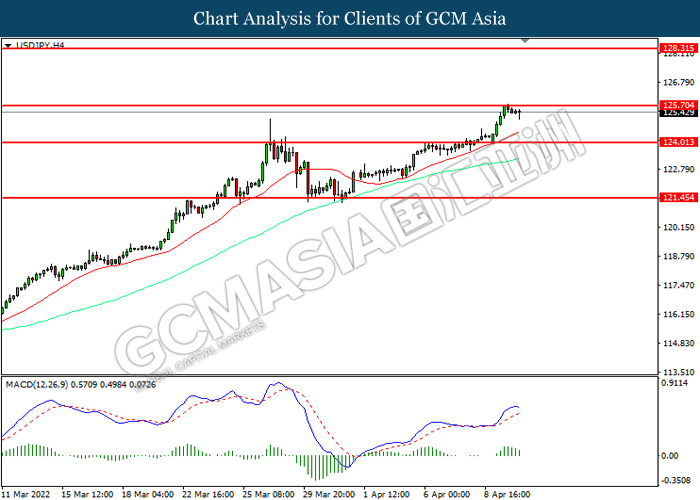

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

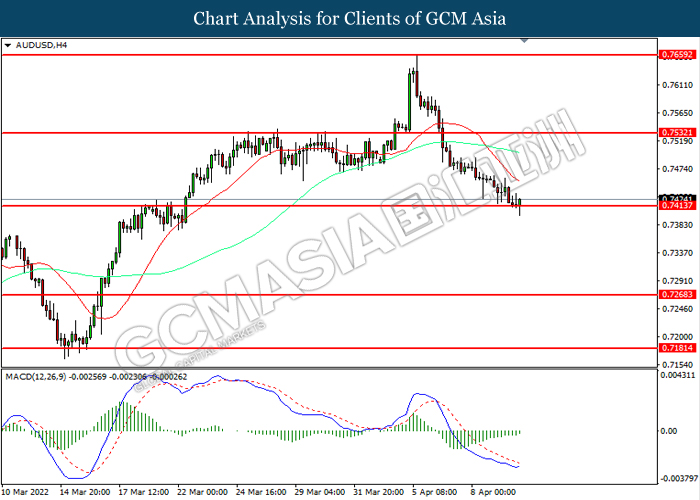

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

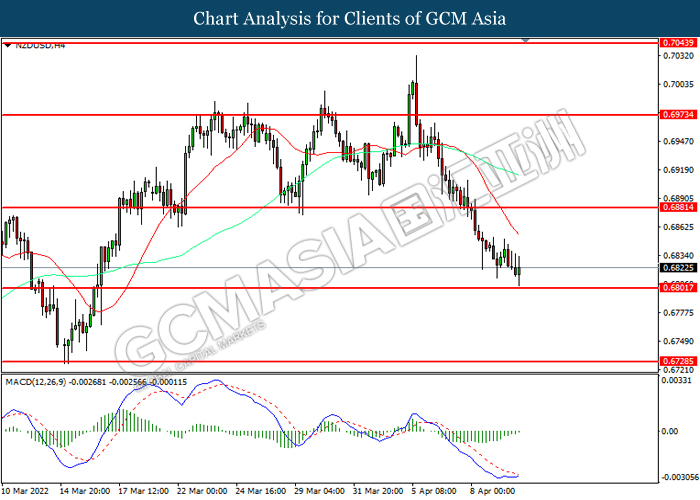

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

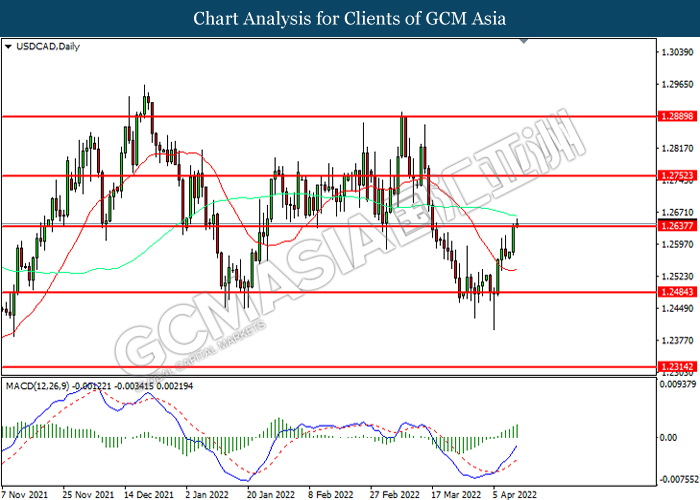

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

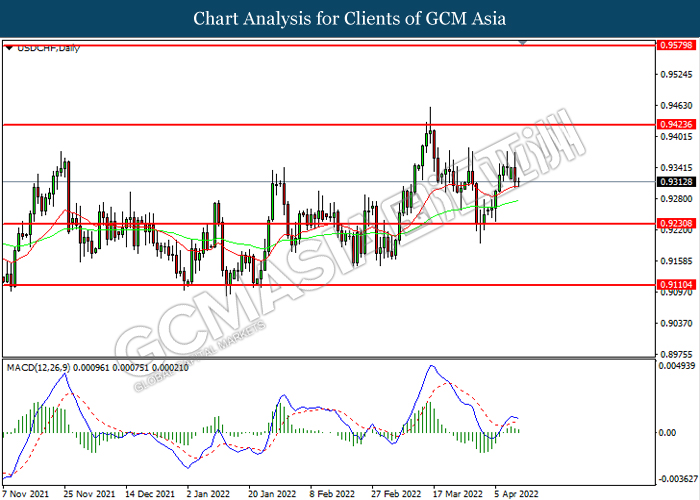

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

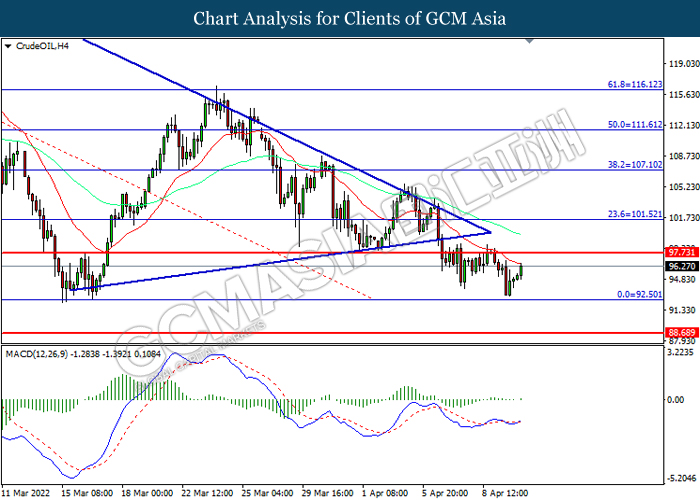

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level at 92.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

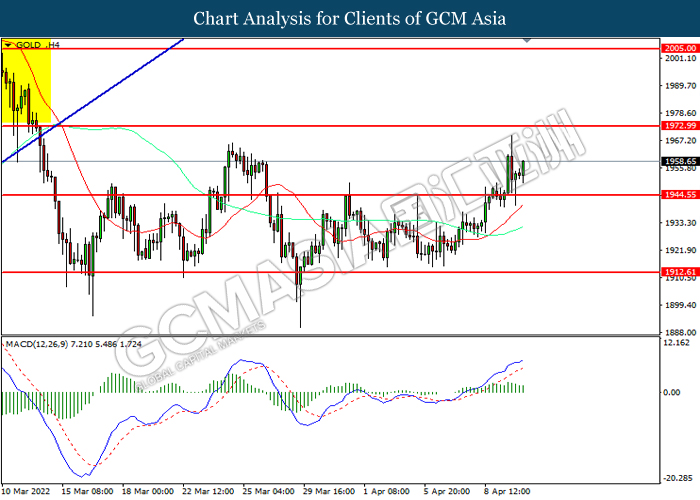

GOLD_, H4: Gold price was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60