12 April 2022 Morning Session Analysis

US Treasury yield hit recent high, Dollar received bullish momentum.

The Dollar Index which traded against a basket of six major currencies extend its gains, buoyed by continued rising of US Treasury yield. In earlier, St. Louis Fed President James Bullard stated that the central bank needs to increase their interest rates by another 3% by year end. The benchmark 10-year Treasury yield rose significantly to 2.77%. Recently, the Treasury yields have been on extend its bullish trend recently, with concerns that the rising inflation rate would prompt the Federal Reserve to announce a more aggressive contractionary monetary policy. Market participants have raced to price in the risk of larger rate hike from Federal Reserve with implying the rises of 50 basis point during both May and June monetary meeting. As of writing, the Dollar Index appreciated by 0.18% to 99.97.

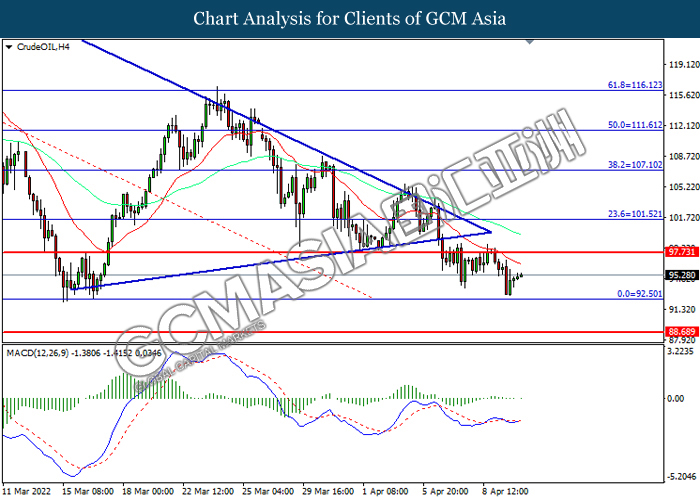

In the commodities market, the crude oil price depreciated by 3.74% to 94.90 per barrel as of writing. The oil market extends its losses following the European Union officials claimed that they will hold a talk in Vienna with OPEC representative to discuss about the oil output plan. On the other hand, the gold price appreciated by 0.13% to $1949.95 per troy ounces as of writing amid risk-off sentiment in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 4.80% | – | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -48.1K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | -39.3 | -48 | – |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.50% | – |

Technical Analysis

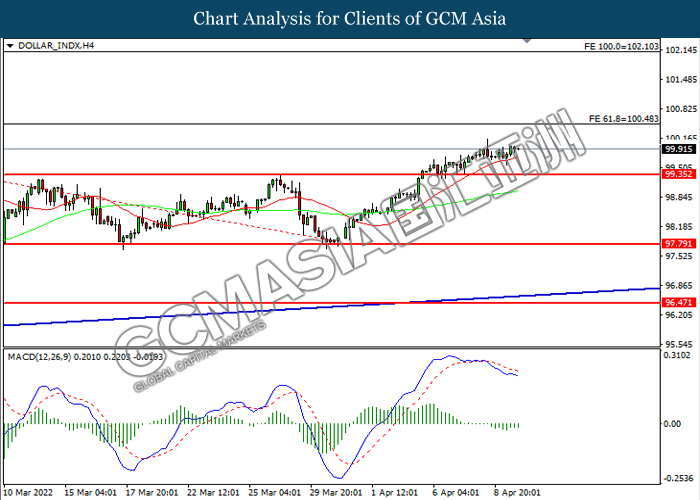

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

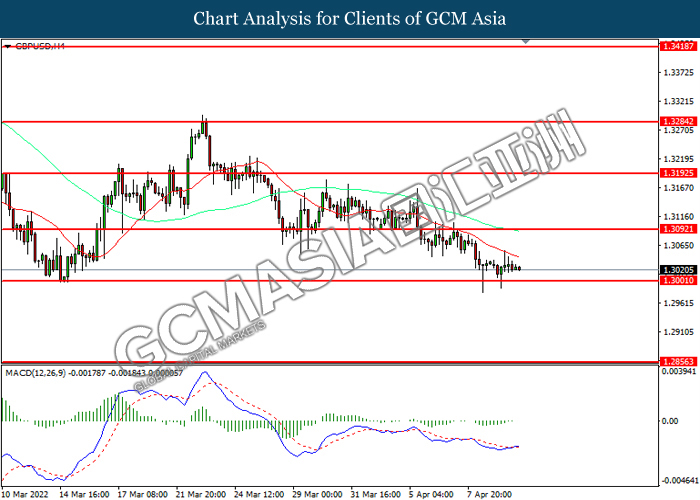

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

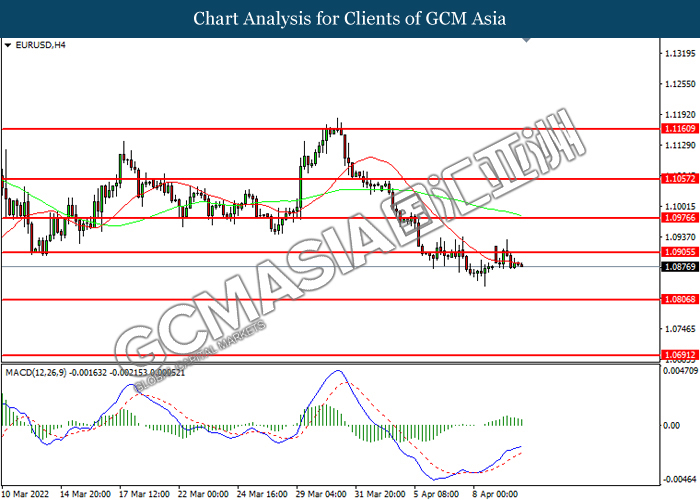

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

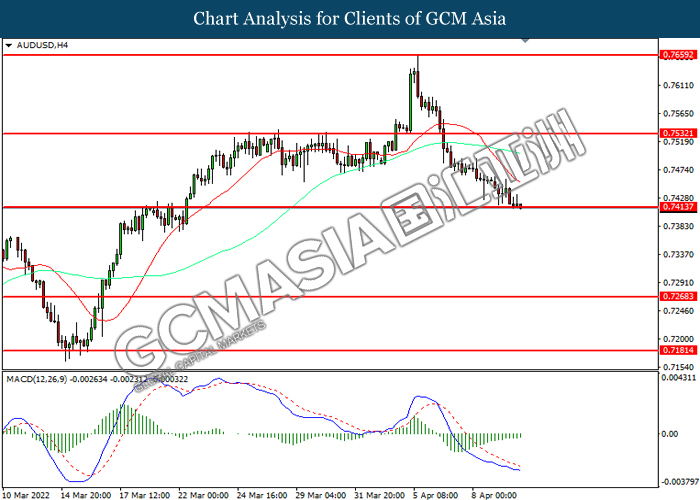

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

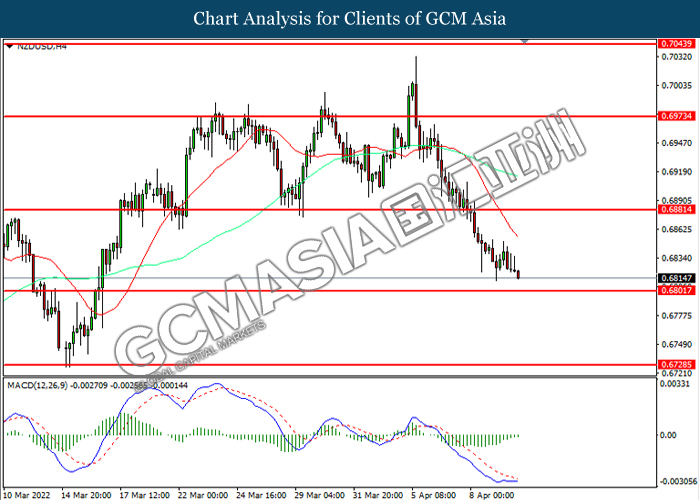

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

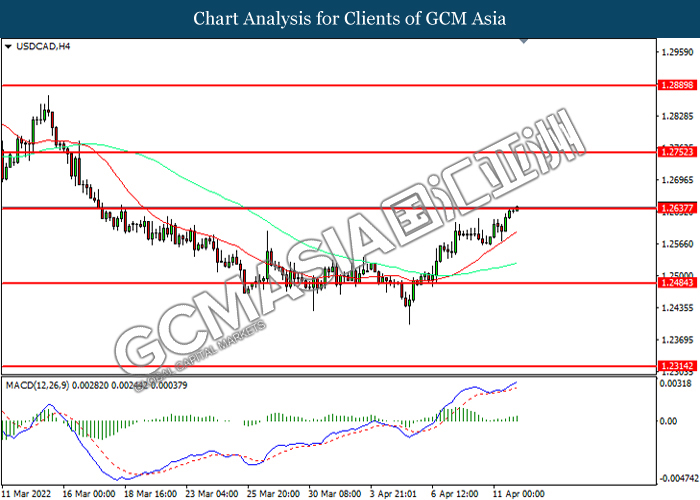

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

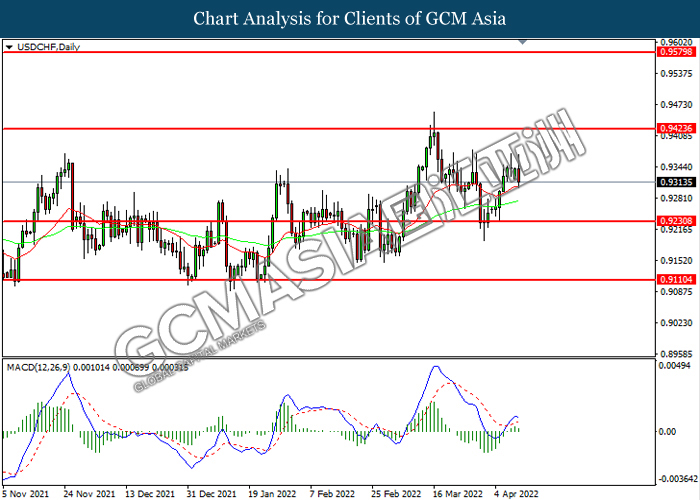

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level at 92.50. MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60