12 May 2022 Morning Session Analysis

US Dollar edged up following upbeat inflation data.

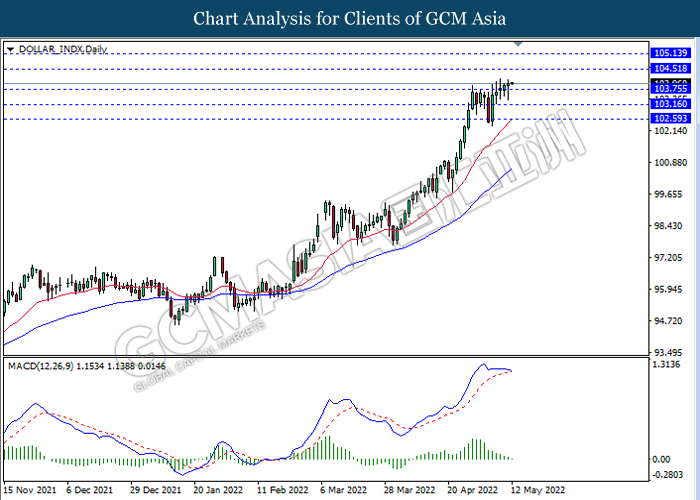

The Dollar Index which traded against a basket of six major currencies edged up on Thursday over the upbeat inflation data. According to US Bureau of Labor Statistics, US Core Consumer Price Index (CPI) MoM notched up from the previous reading of 0.3% to 0.6%, exceeding the market forecast of 0.4%. Core Consumer Price Index (CPI) is used as an indicator to present the changes in purchasing trends and inflation of a country, which measuring the changes in the price of goods and services and excluding food and energy. A higher inflation data would likely to increase the odds of rate hike from Federal Reserve, sparkling the appeal for the US Dollar. Nonetheless, the gains experienced by Dollar Index was limited following the market participants were expecting that April’s CPI report is expected to show inflation has already reached a peak, according to CNBC. As inflation risk was easing, Fed would less likely to implement aggressive tightening monetary policy, says 0.75% rate hike in the next FOMC meeting in order to combat inflation risk, which spurred bearish momentum in the US Dollar. As of writing, the Dollar Index appreciated by 0.08% to 104.02.

In commodities market, crude oil price eased by 0.04% to $105.67 per barrel as of writing. However, the overall trend for crude oil price remained bullish amid Russia sanctioned some European gas companies, adding to uncertainty in world energy markets. On the other hand, gold price depreciated by 0.01% to $1853.65 per troy ounce as of writing following the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 USD IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q1) | 1.3% | 1.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Mar) | -0.4% | -0.5% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 194K | – |

| 20:30 | USD – PPI (MoM) (Apr) | 1.4% | 0.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.50, 105.15

Support level: 103.75, 103.15

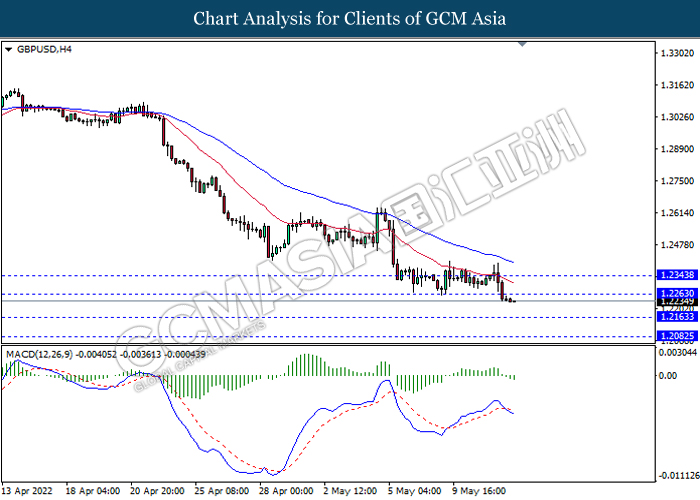

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2265, 1.2345

Support level: 1.2165, 1.2080

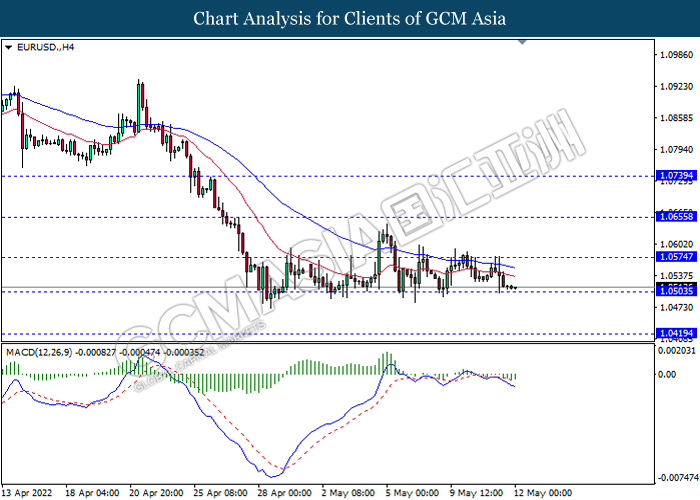

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

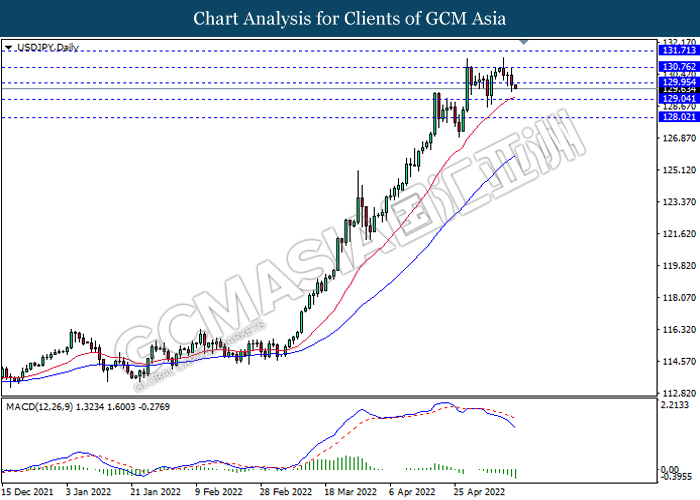

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

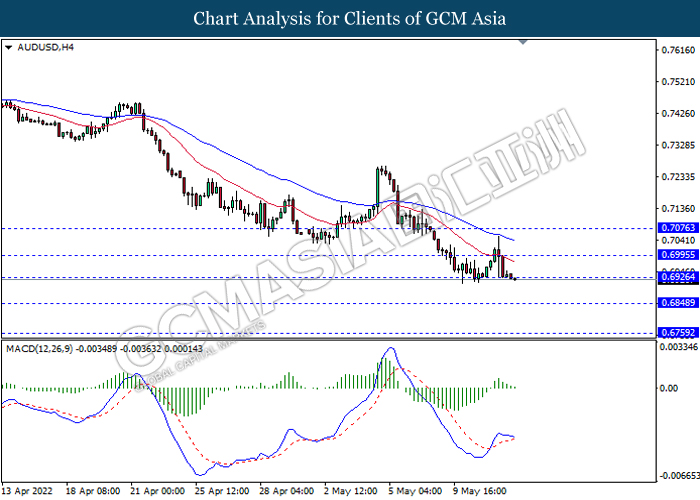

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6925, 0.6995

Support level: 0.6850, 0.6760

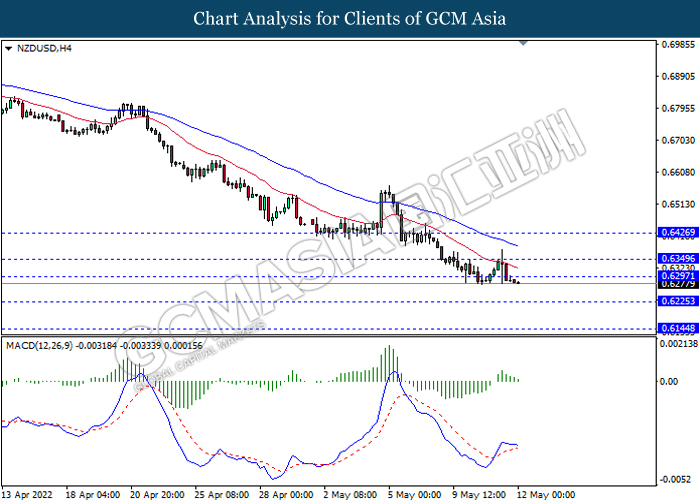

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

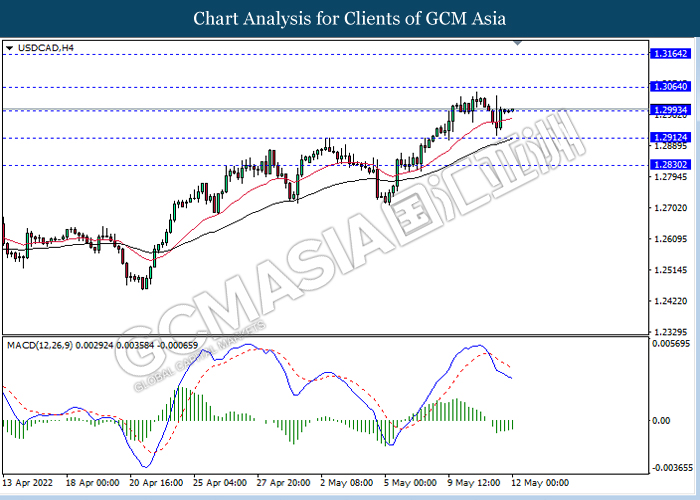

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3065, 1.3165

Support level: 1.2995, 1.2910

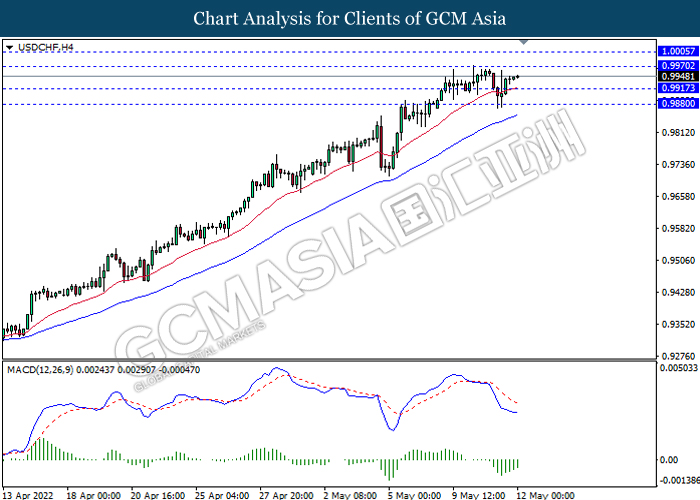

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9970, 1.0005

Support level: 0.9915, 0.9880

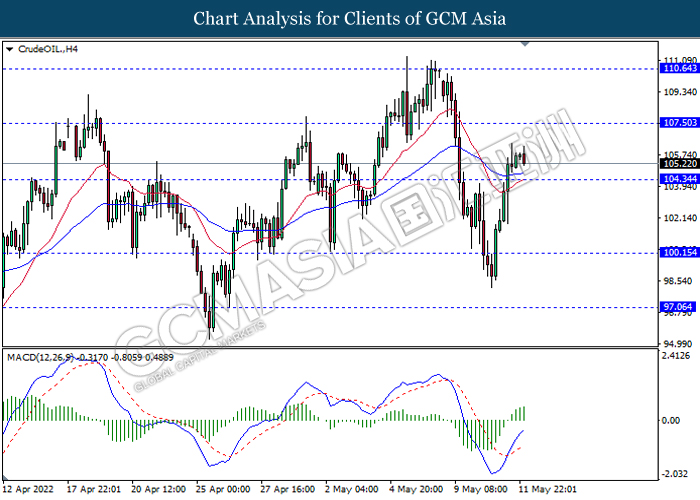

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.50, 110.65

Support level: 104.35, 100.15

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1883.35, 1917.85

Support level: 1851.70, 1830.15