12 May 2023 Afternoon Session Analysis

The Pound fell aftermath Bank of England (BoE) hikes rate

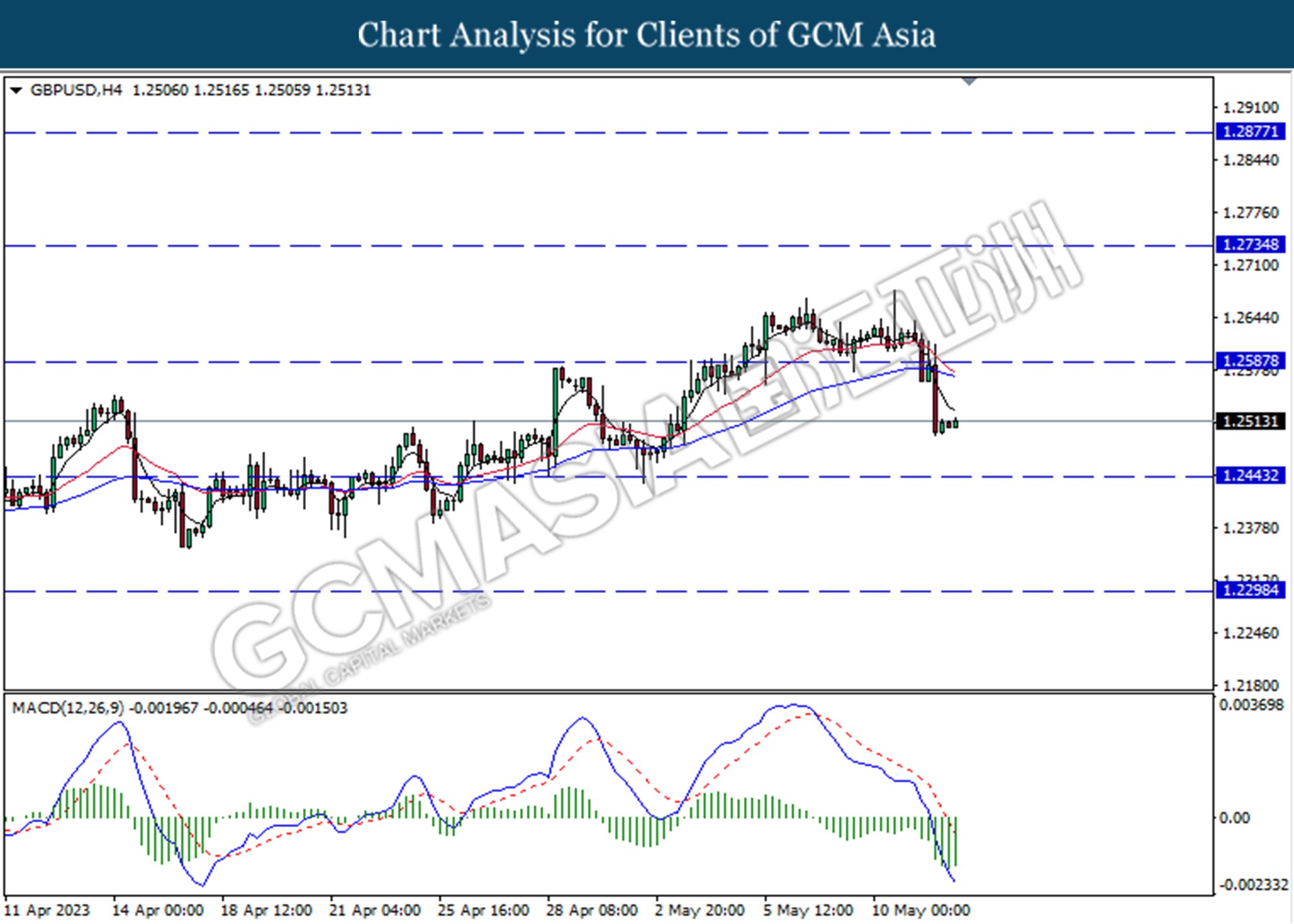

The pound sterling which traded against the greenback lost its ground after the Bank of England (BoE) raised the official cash rate by 25 basis points to 4.5%. Firstly, The Monetary Policy Committee (MPC) voted 7-2 in favor of a rate hike to curb high inflation. According to BoE monetary statement, one of the reasons for the high inflation rate is due to food price inflation as the prices are likely to fall back more slowly than expected. Investors anticipated the 25bps tightening move after CPI came in at 10.2% in March, and lowered their expectations for a Bank of England rate decision. However, the pound revised its losses from gains after Andrew Bailey, BoE Governor speak. Bailey said the past rate hike weighs more economy in coming quarters, as the effect of high-interest rate lagging filters into the economy. These comments prompted investors that the BoE will consider a more softened decision on the next interest rate decision. Besides, investors’ eyes are on upcoming economic data such as quarter GDP and manufacturing production conditions. The economists are expecting the UK economy to show contraction in quarter 1. As of writing, the GBP/USD traded up by 0.10% to $1.2521.

In the commodities market, crude oil prices were traded lower by -0.42% to $70.56 per barrel after disappointing economic data from China and concern over a potential US recession affecting the oil demand. Besides, gold prices shrank by -0.17% to $2011.62 per troy ounce following the prior strengthening in the US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 63.5 | 63.0 | – |

Technical Analysis

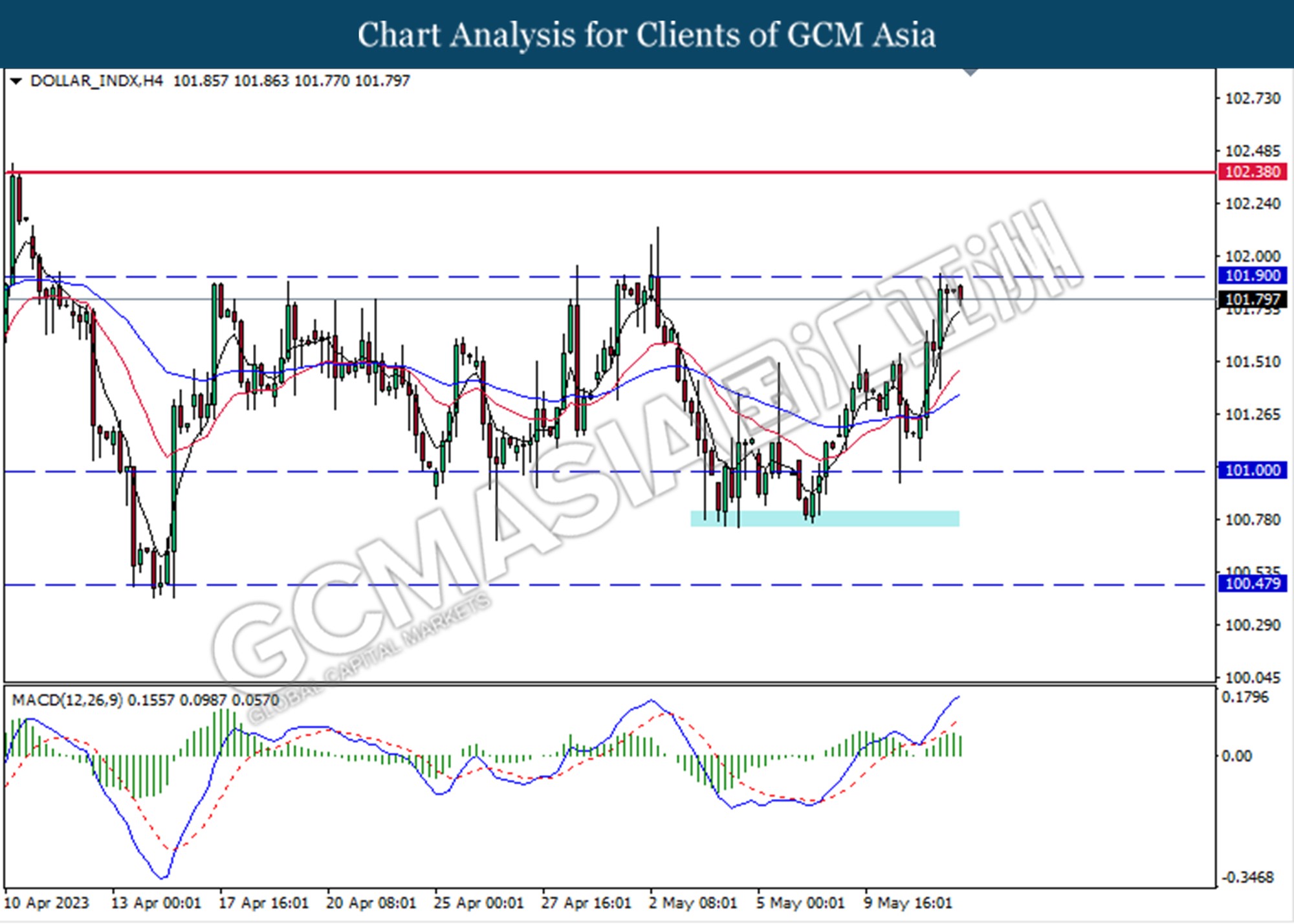

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 101.90. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.40, 101.90

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded lower following a prior break below from the previous support level at 12590. However, MACD which illustrated diminishing bearish momentum suggests the pair traded higher as a technical correction.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

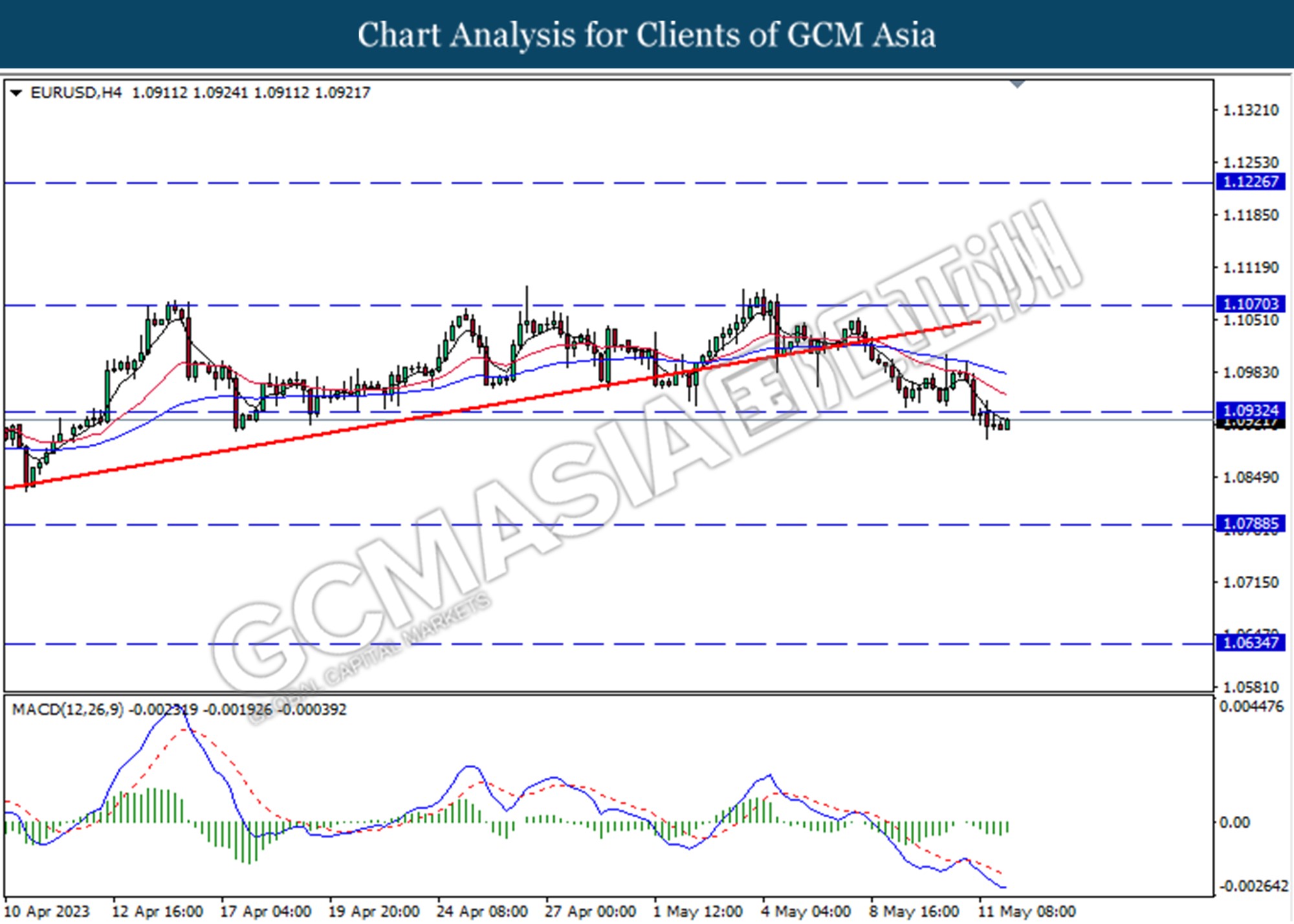

EURUSD, H4: EURUSD was traded lower following a prior break below from the previous support level at 1.0930. However, MACD which illustrated diminishing bearish momentum suggests the pair traded higher as a technical correction.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

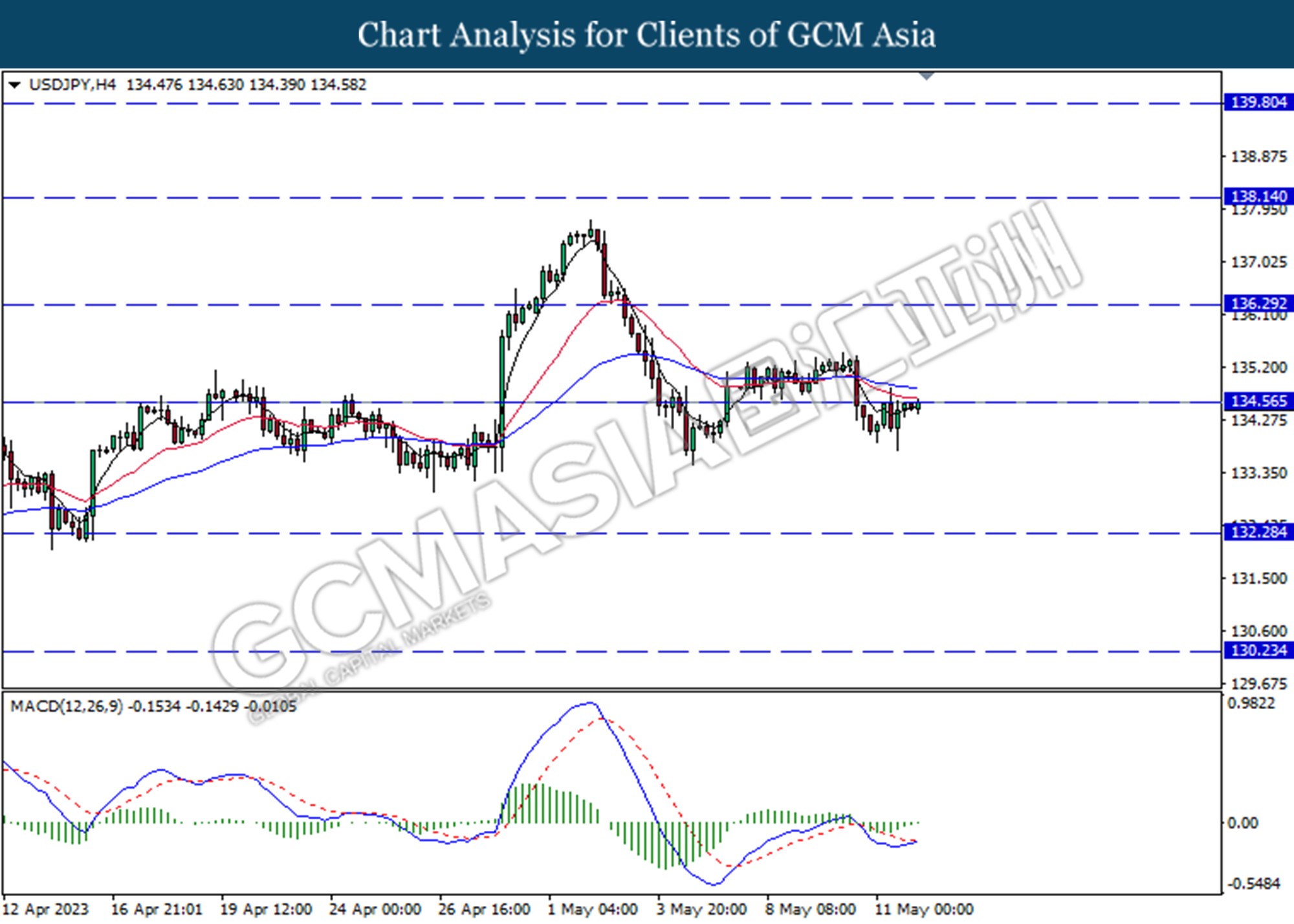

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 134.55. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

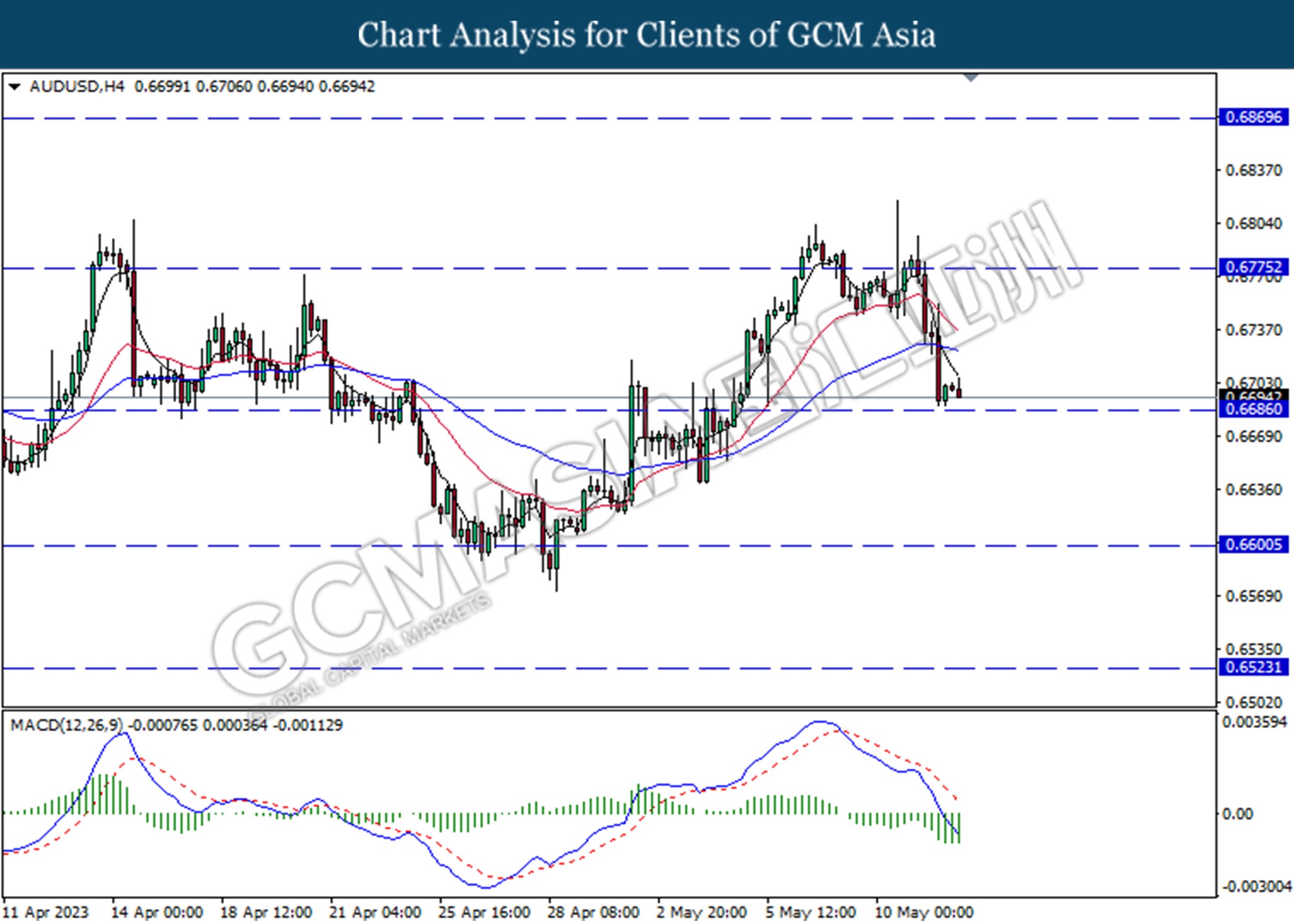

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

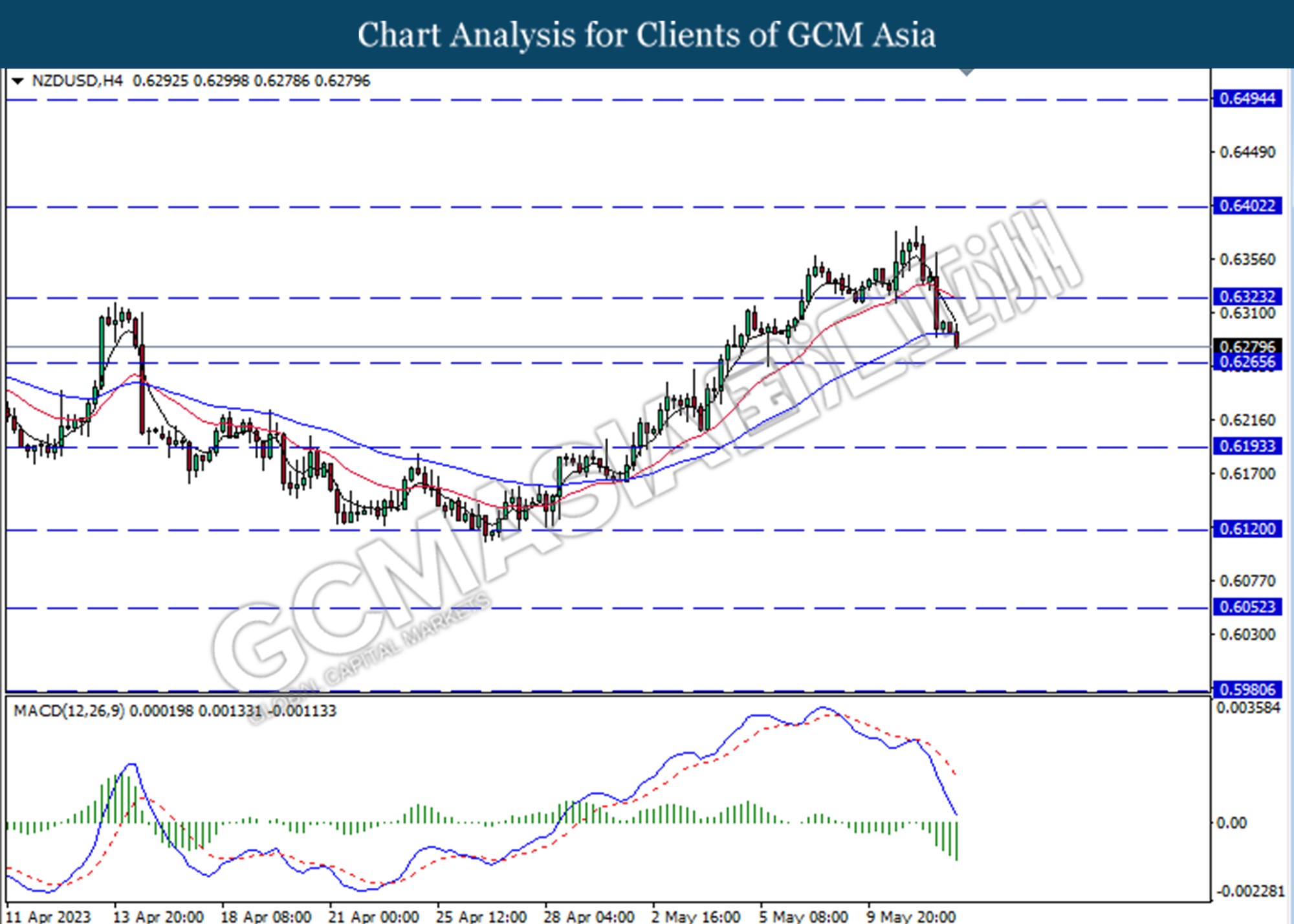

NZDUSD, H4: NZDUSD was traded lower following break below the previous support level at 0.6325. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

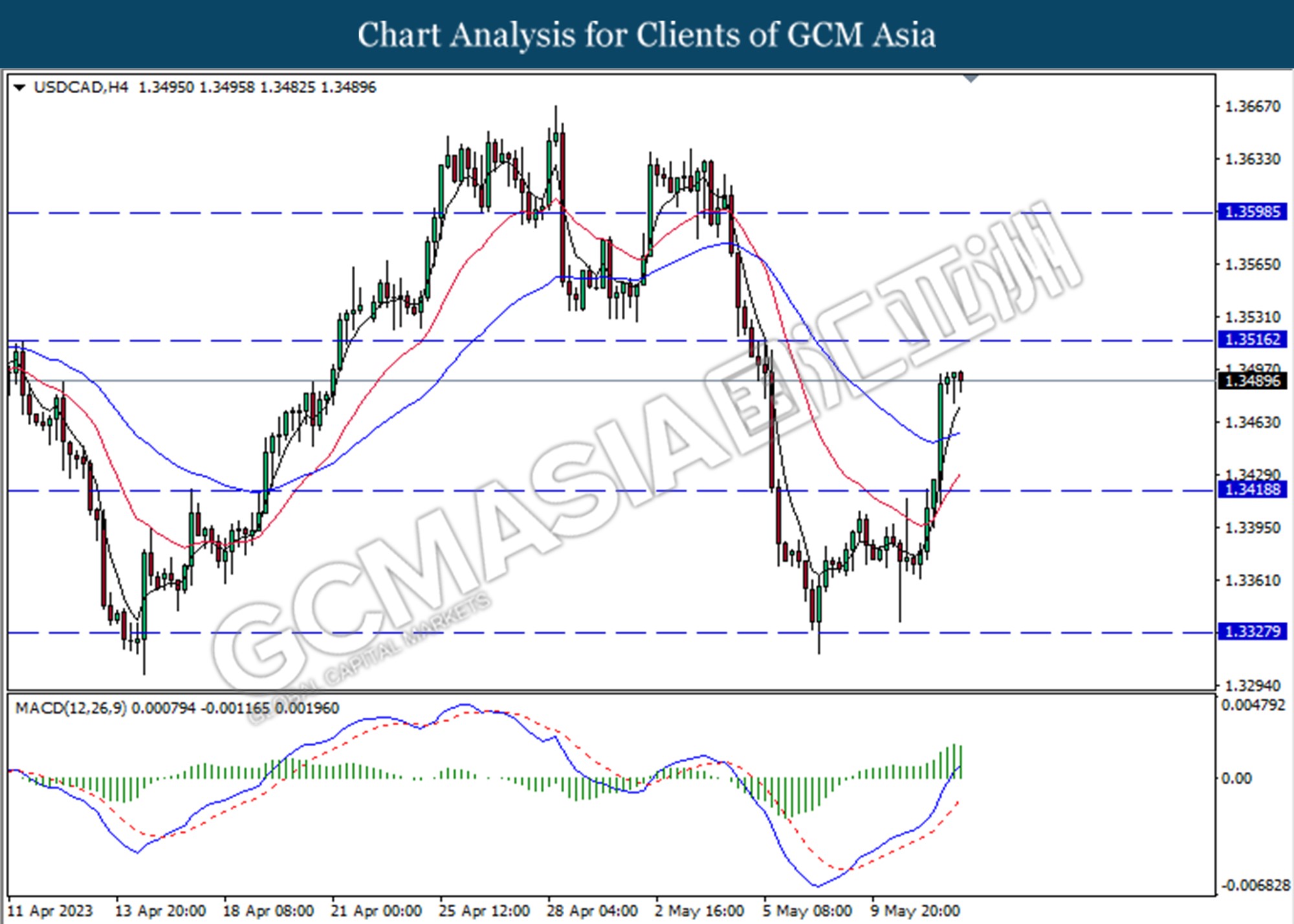

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3420. However, MACD which illustrated diminishing bullish momentum suggests the pair traded lower as a technical correction.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

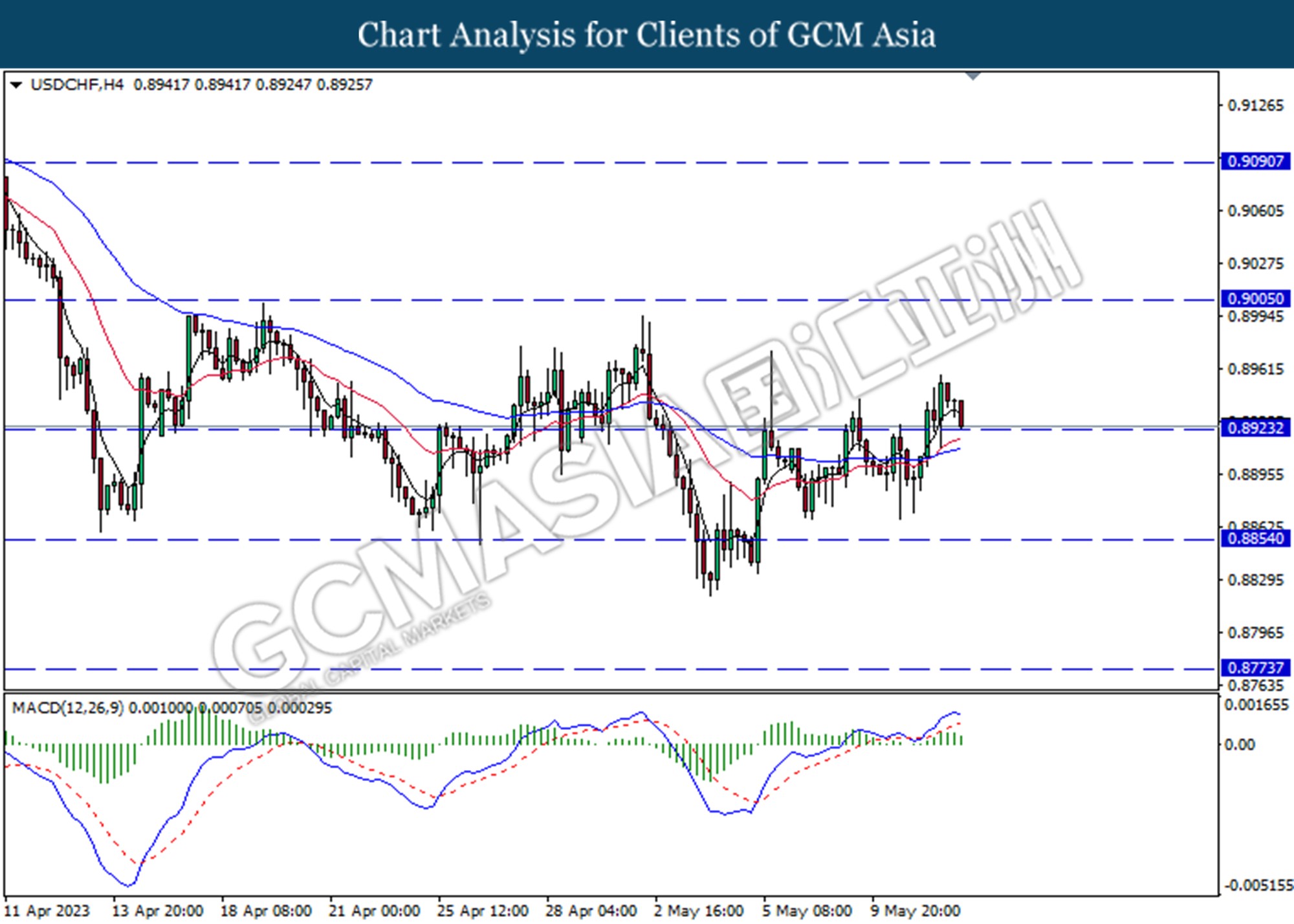

USDCHF, H4: USDCHF was traded lower while currently testing for the support level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully break below the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

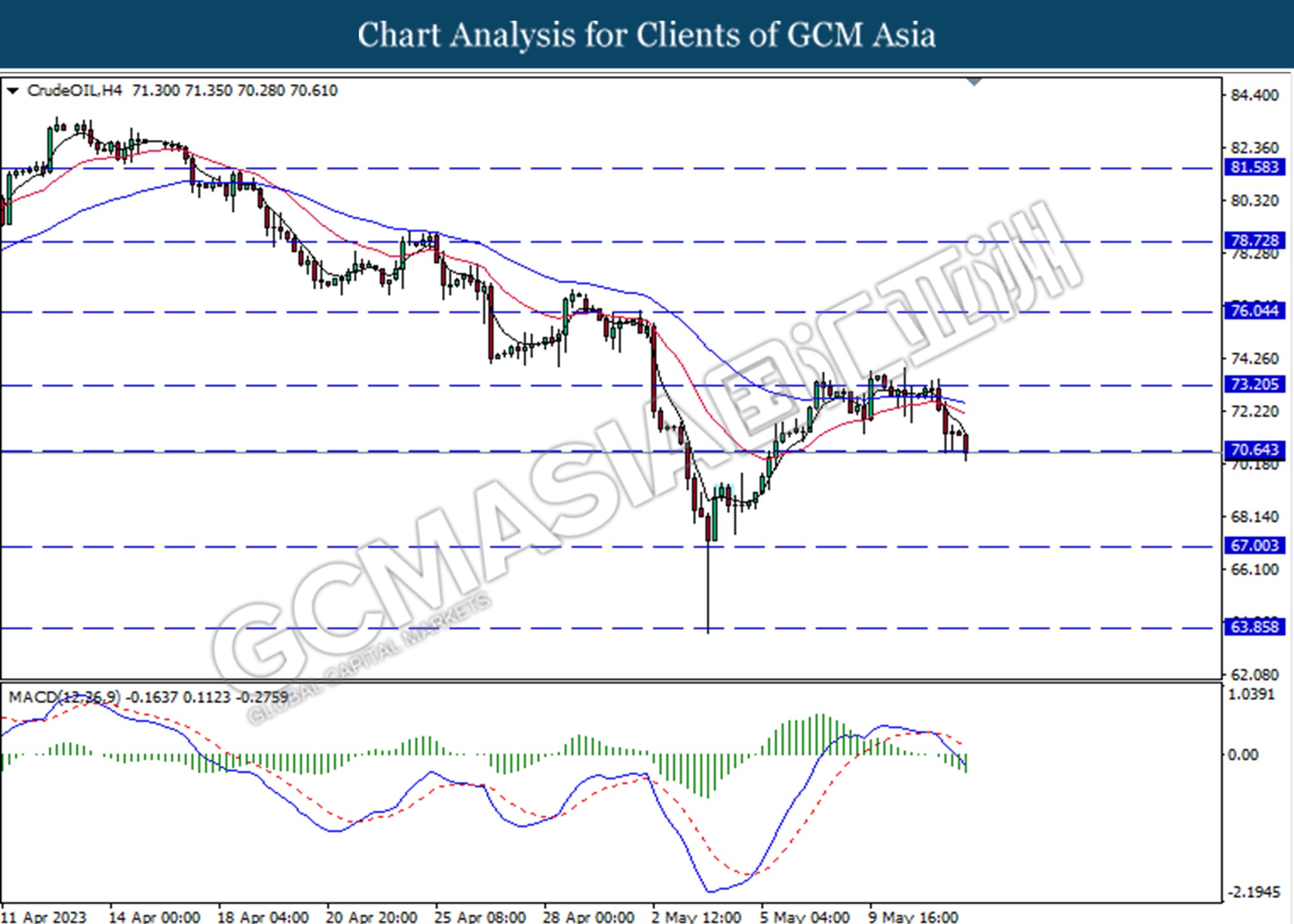

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 70.65. MACD which illustrated diminishing bearish momentum suggests the pair extended its losses after it successfully break below the support level.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded lower while currently testing the support level at 2009.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its losses after it successfully breakout below the support level.

Resistance level: 2030.10, 2049.30

Support level: 2009.10, 1985.50