12 May 2023 Morning Session Analysis

US dollar rallied amid market’s risk aversion heightened.

The dollar index, which was traded against a basket of six major currencies, managed to extend its gains yesterday as the market risk aversion spiked following the poor performance in the US stock market. The safe haven currency, dollar index, has gathered bullish momentum as the US stock market were under huge selling pressures from the downbeat quarter report from Disney and continued sell-off of shares, especially in the US banking sector. Yesterday, the investor worry over the regional banks exacerbated as a regulatory filing showed that the PacWest Bancorp deposits fell another 9.5% during the week of May 5. With the ongoing banking crisis and debt ceiling overhang, investors chose to run away from the riskier asset, such as US stock market. On the other side, the tamer US PPI data which came in at 0.2%, slightly lower than the forecast at 0.3%, failed to stop the strong rally in the US dollar market. Besides, the US Bureau of Labor Statistics reported that the number of American who filed for unemployment claims in the past week was 264K, hitting the 1.5 year high while also pointing to a slowing labor market condition in the US. As of writing, the dollar index rose 0.58% to 102.05.

In the commodities market, crude oil prices were traded lower by –0.04% to $71.40 per barrel after the OPEC hold its global oil demand forecast steady as the recovery of demand from China may be offset by the US banking crisis and debt ceiling issue. Besides, gold prices ticked down by -0.03% to $2015.60 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q1) | 0.6% | 0.2% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Mar) | 0.0% | -0.1% | – |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 63.5 | 63.0 | – |

Technical Analysis

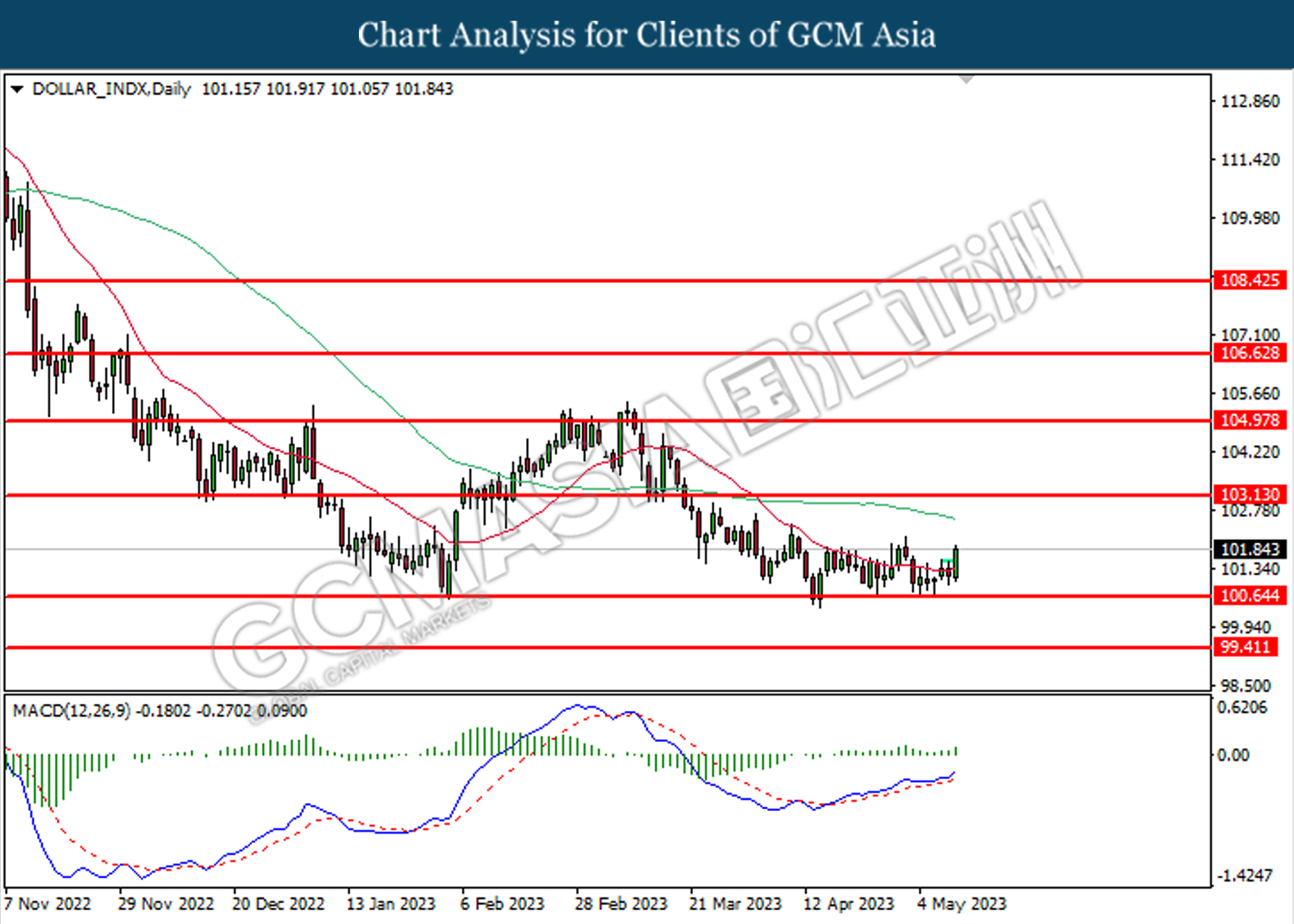

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

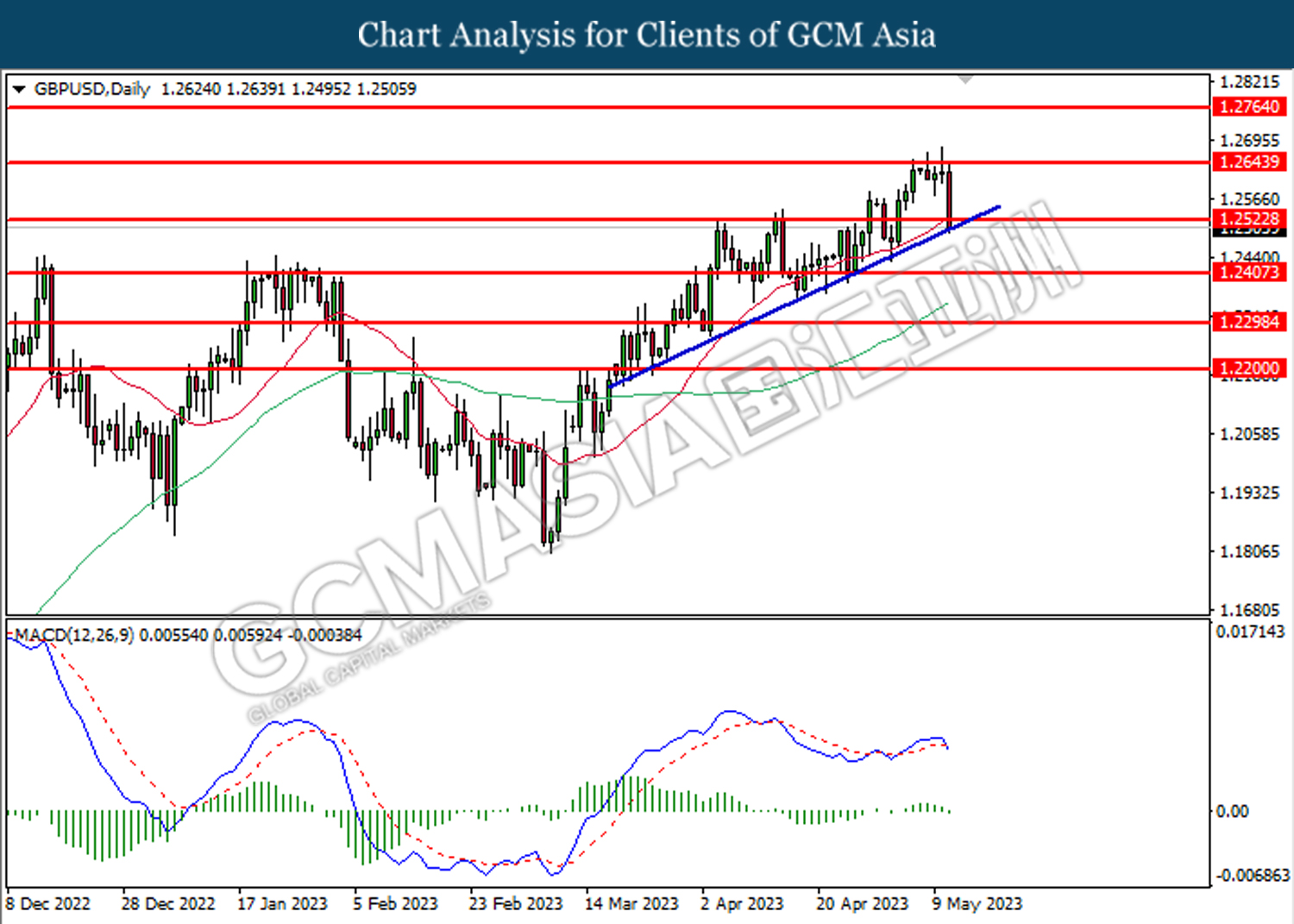

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2525. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2525.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

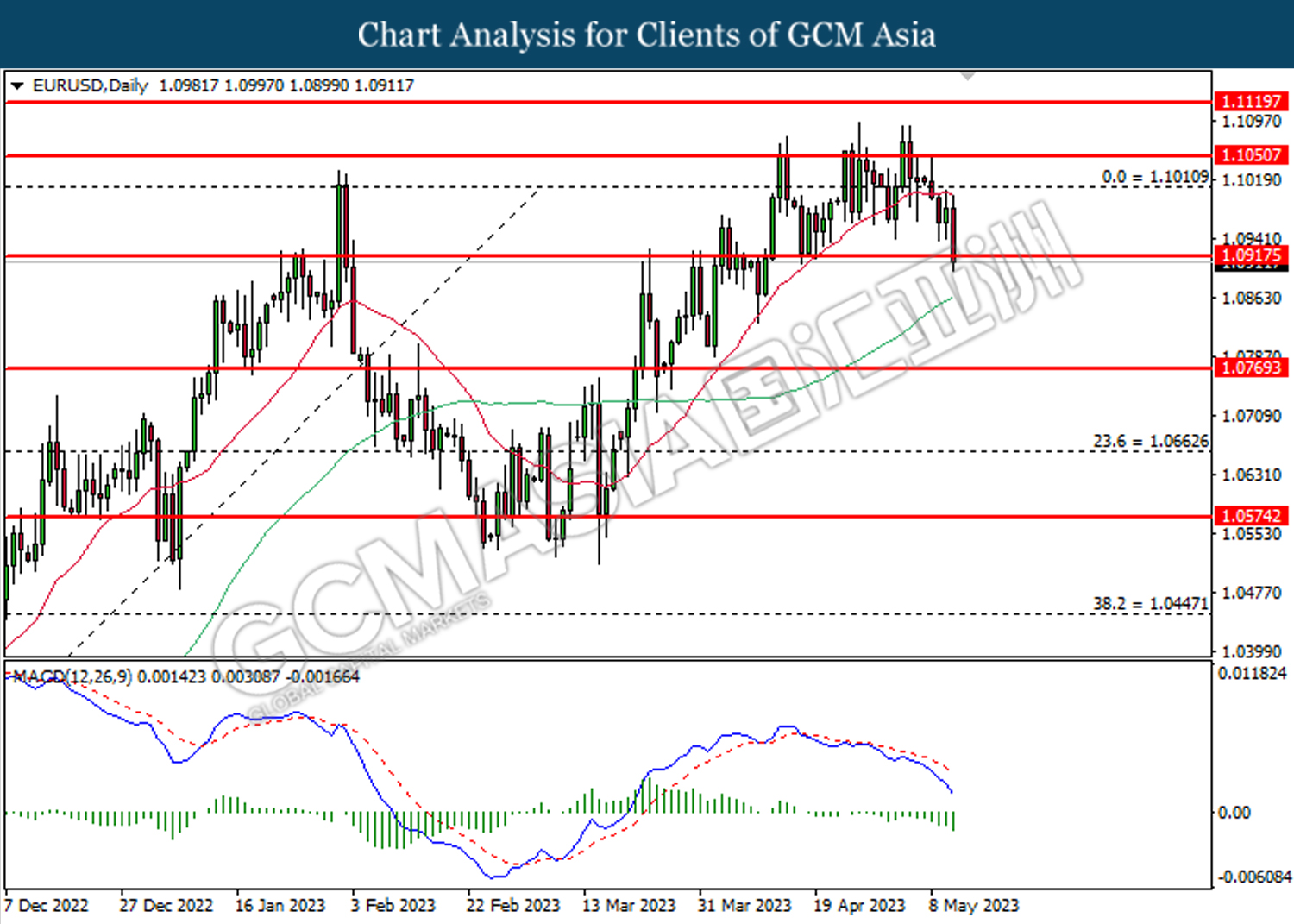

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

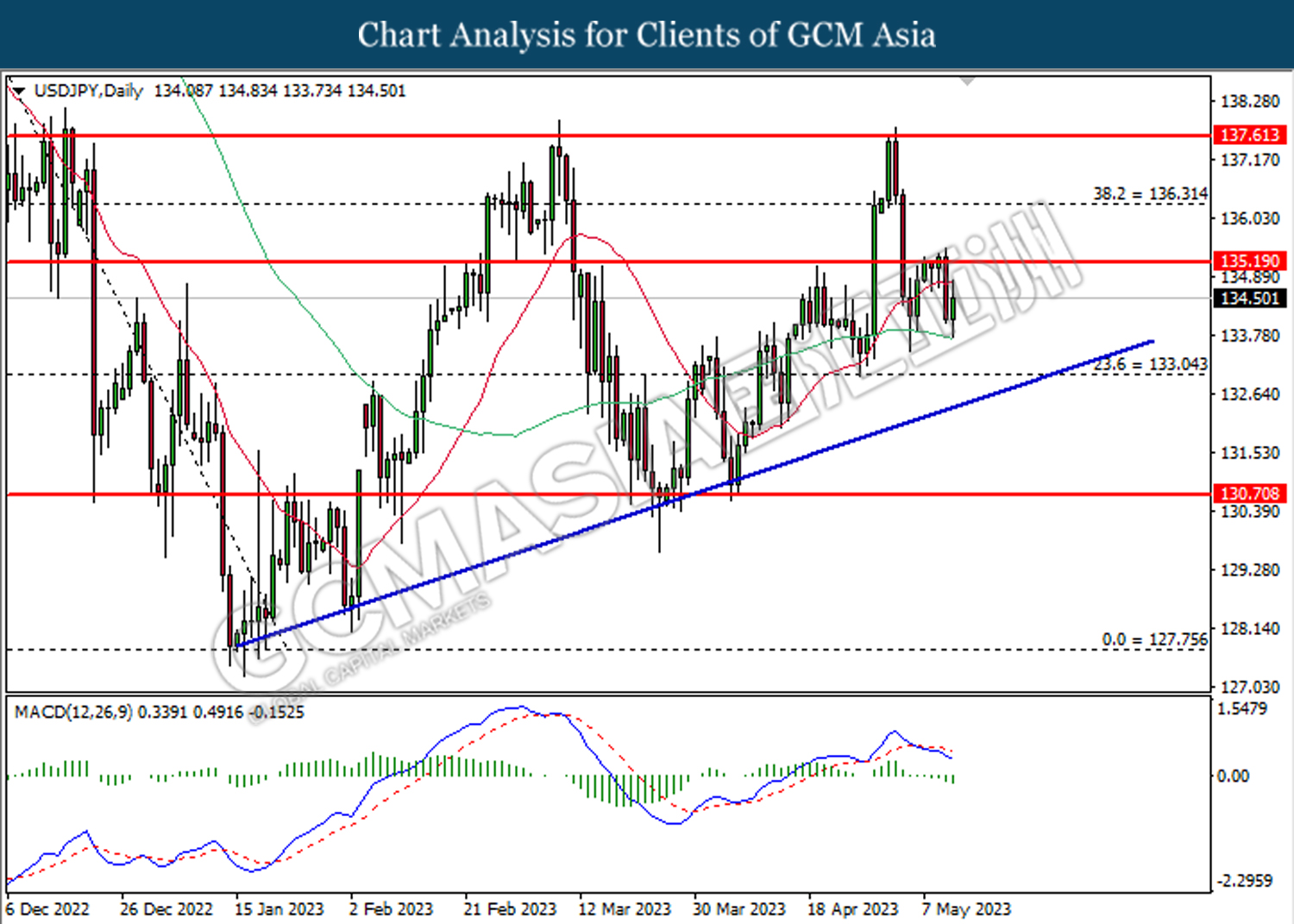

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

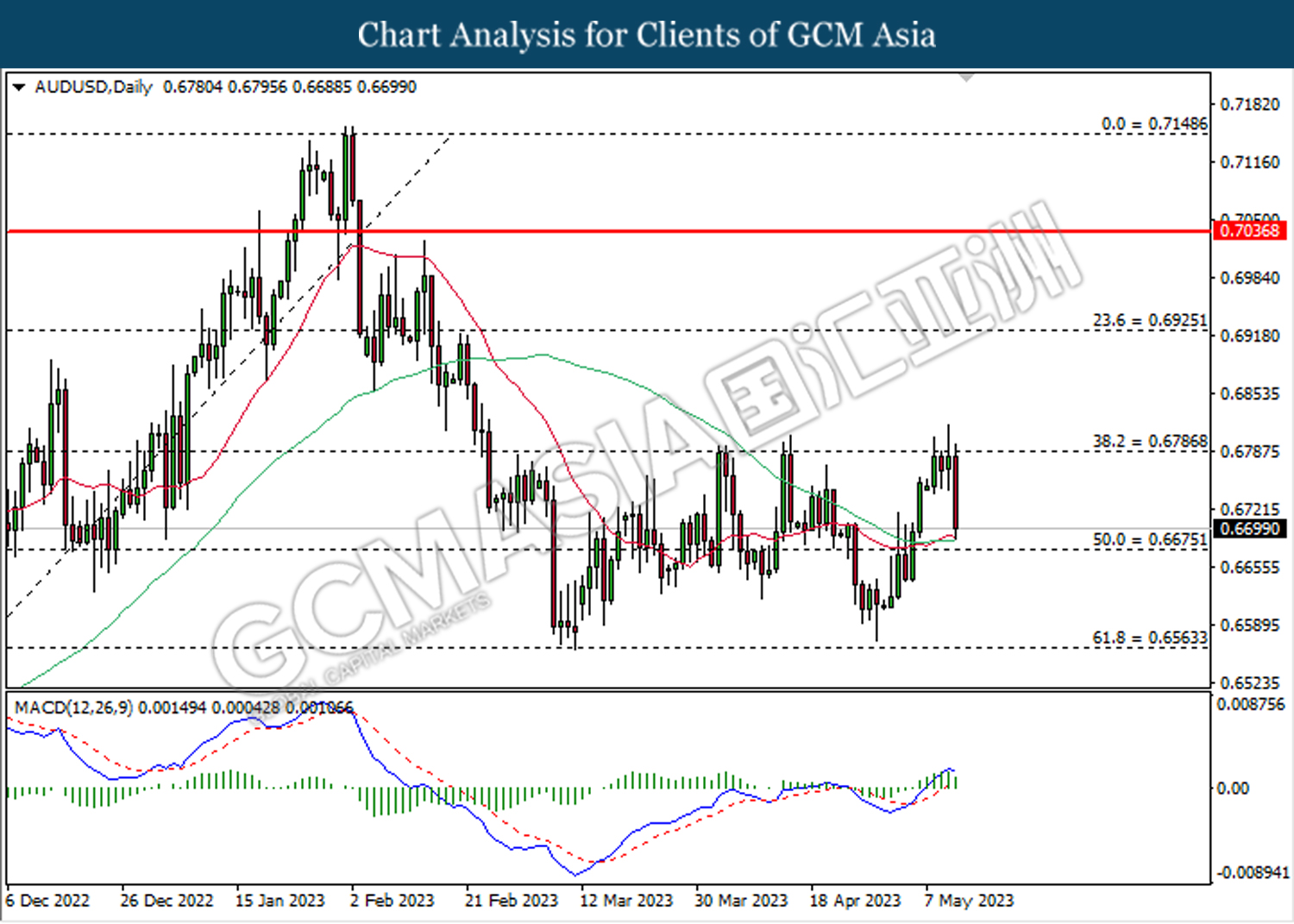

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

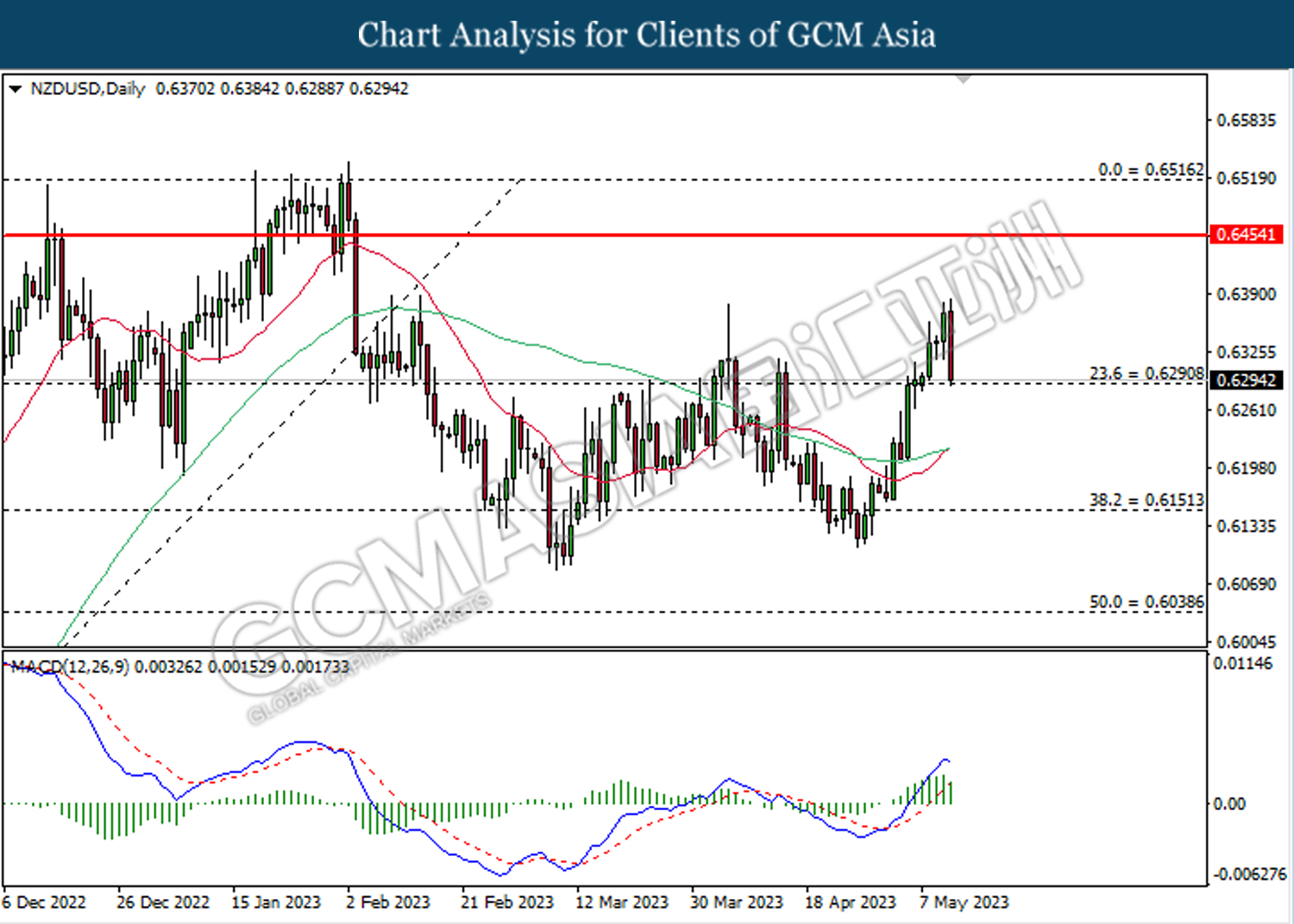

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

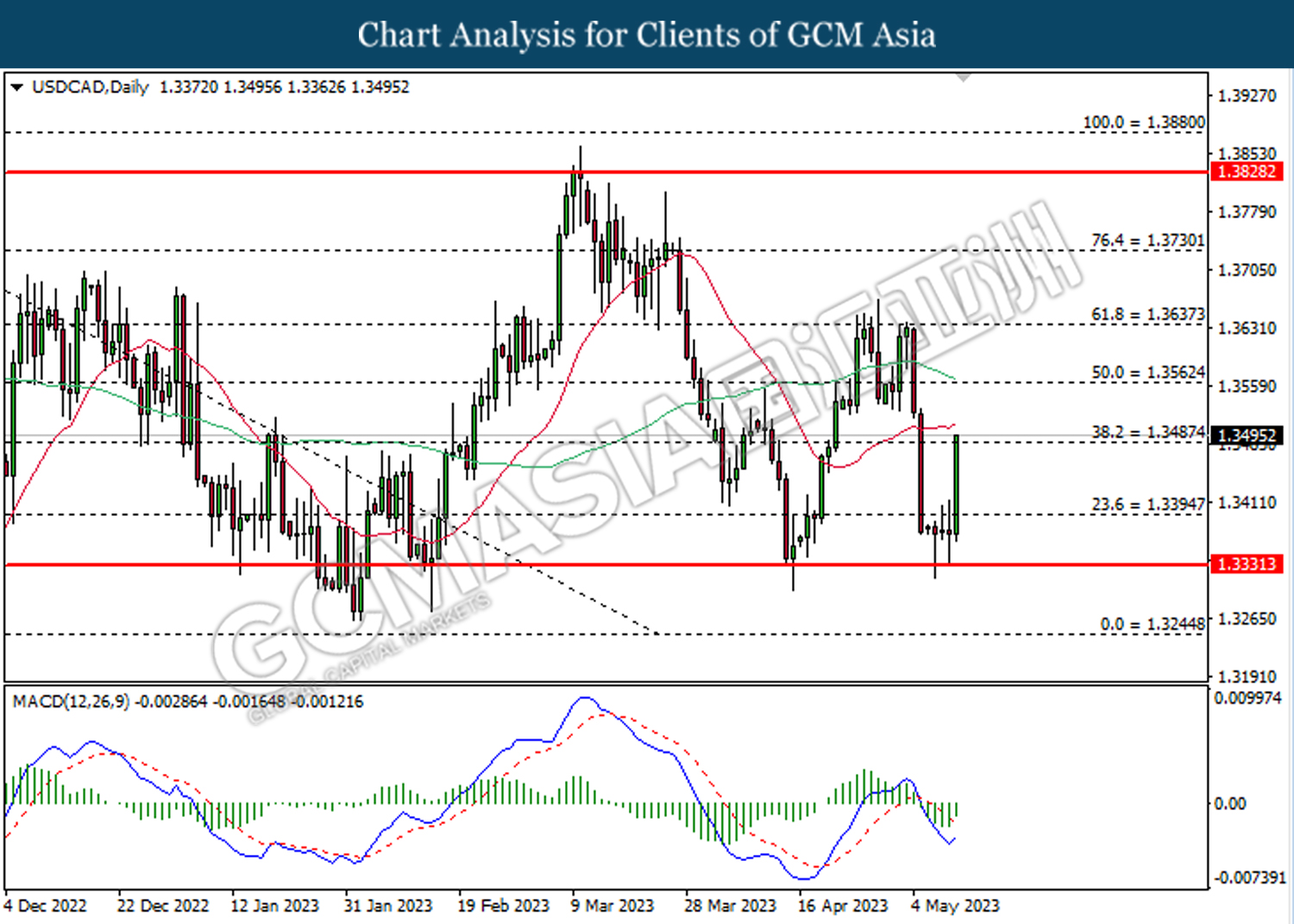

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level at 1.3485.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

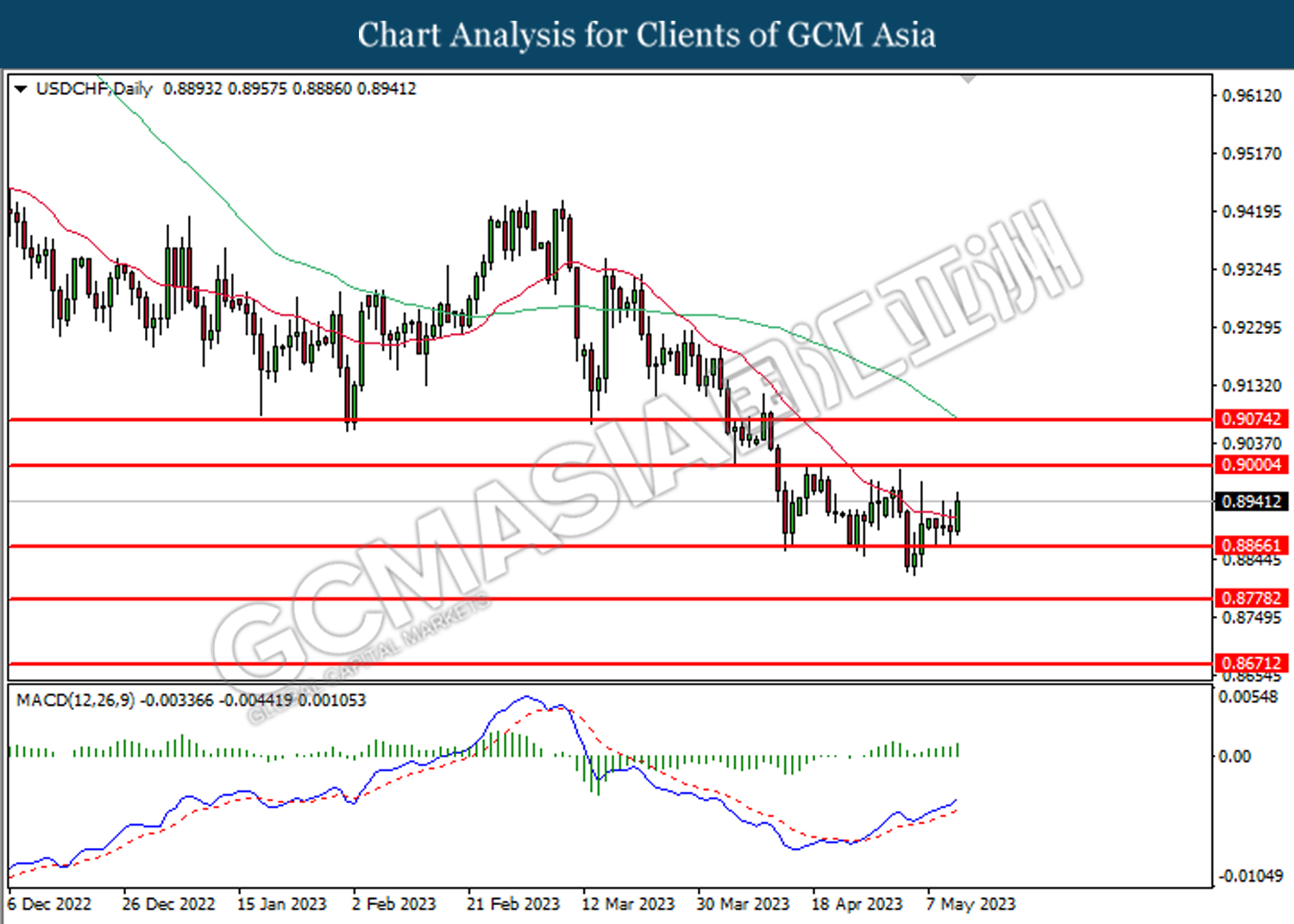

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

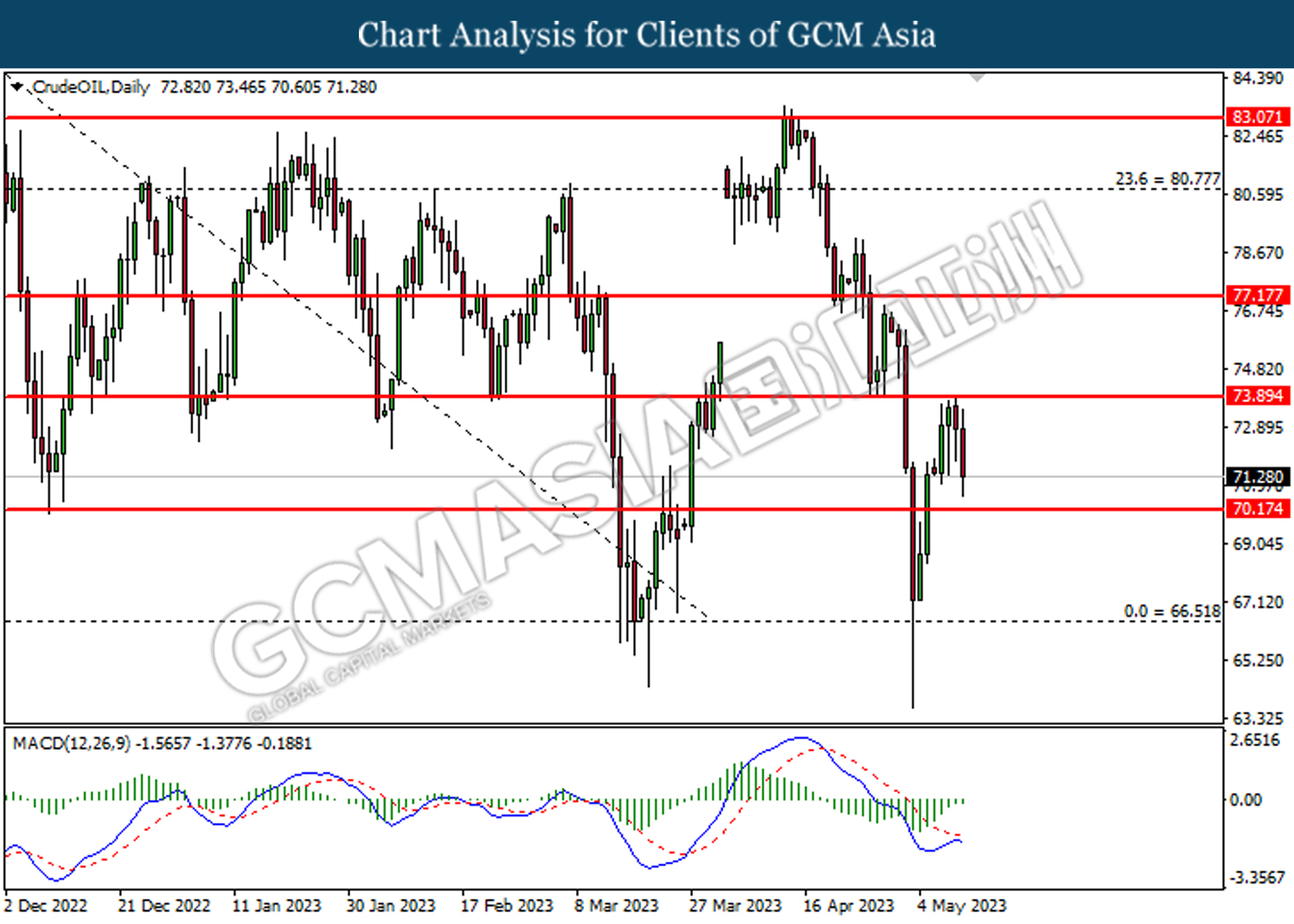

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

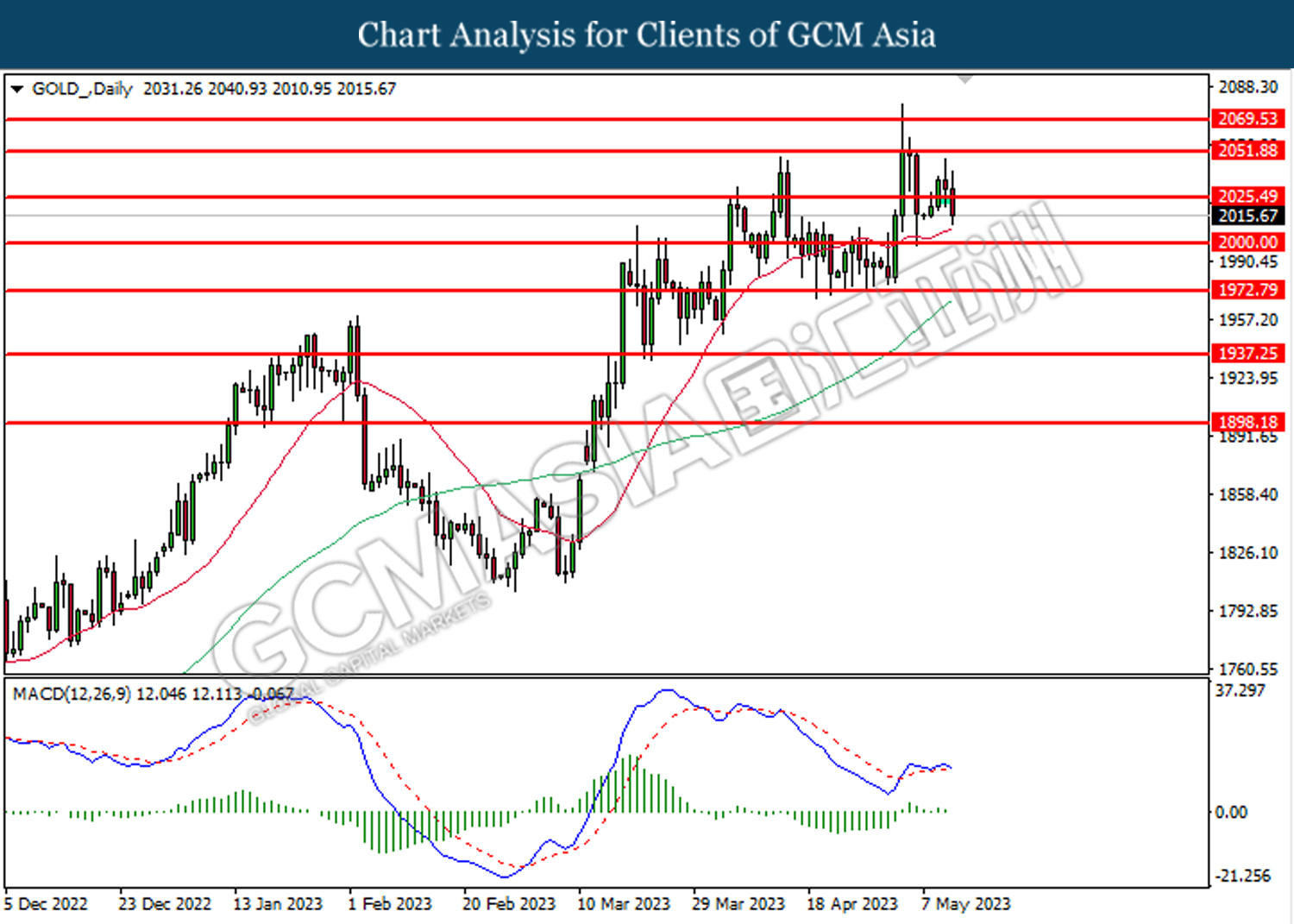

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 2025.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 2025.50.

Resistance level: 2051.90, 2069.55

Support level: 2025.50, 2000.00