12 June 2023 Morning Session Analysis

Doller rebound weak China economic data.

The dollar index, which was traded against a basket of six major currencies, rebounded after a sharp loss in the previous session after weak employment data prompted the Fed to pause the monetary tightening. The rebound of the greenback comes after the weak China economic data. China, the second largest economy, showed some softening demand and falling exports caused inflation to stay at low levels in May. According to China official’s data, CPI in May was marked at -0.2%, lower than market expectations of -0.1% and the previous reading of -0.1%. While, the PPI index in May reduced the most in seven years, more than economists expected. The PPI data plunged to -4.6% from the previous -3.6%, lower than market estimations of -4.3% signaling that the China economy was struggling to rebound from the COVID hit. Investors put money into U.S. markets and benefited from the greenback as the Chinese economy slowed. At the moment, investors wait for inflation data and the Fed interest rate decision this week for any clues from the Fed. According to CME Fed watch tools, the Fed is expected to hold the rates steady at its 14 June meeting but is likely to remain hawkish in July if the inflations stay above the central bank’s projection. As of writing, the dollar index ticked up by 0.01% to 103.56.

In the commodities market, crude oil prices depreciated by -0.41% to $69.86 per After China’s economy struggles to recover from coronavirus hit and erodes crude demand. Besides, gold prices slipped by -0.06% to $1959.90 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day AUD Australia – King’s Birthday

Today’s Highlight Events

Time Market Event

Today’s Highlight Economic Data

N/A

Technical Analysis

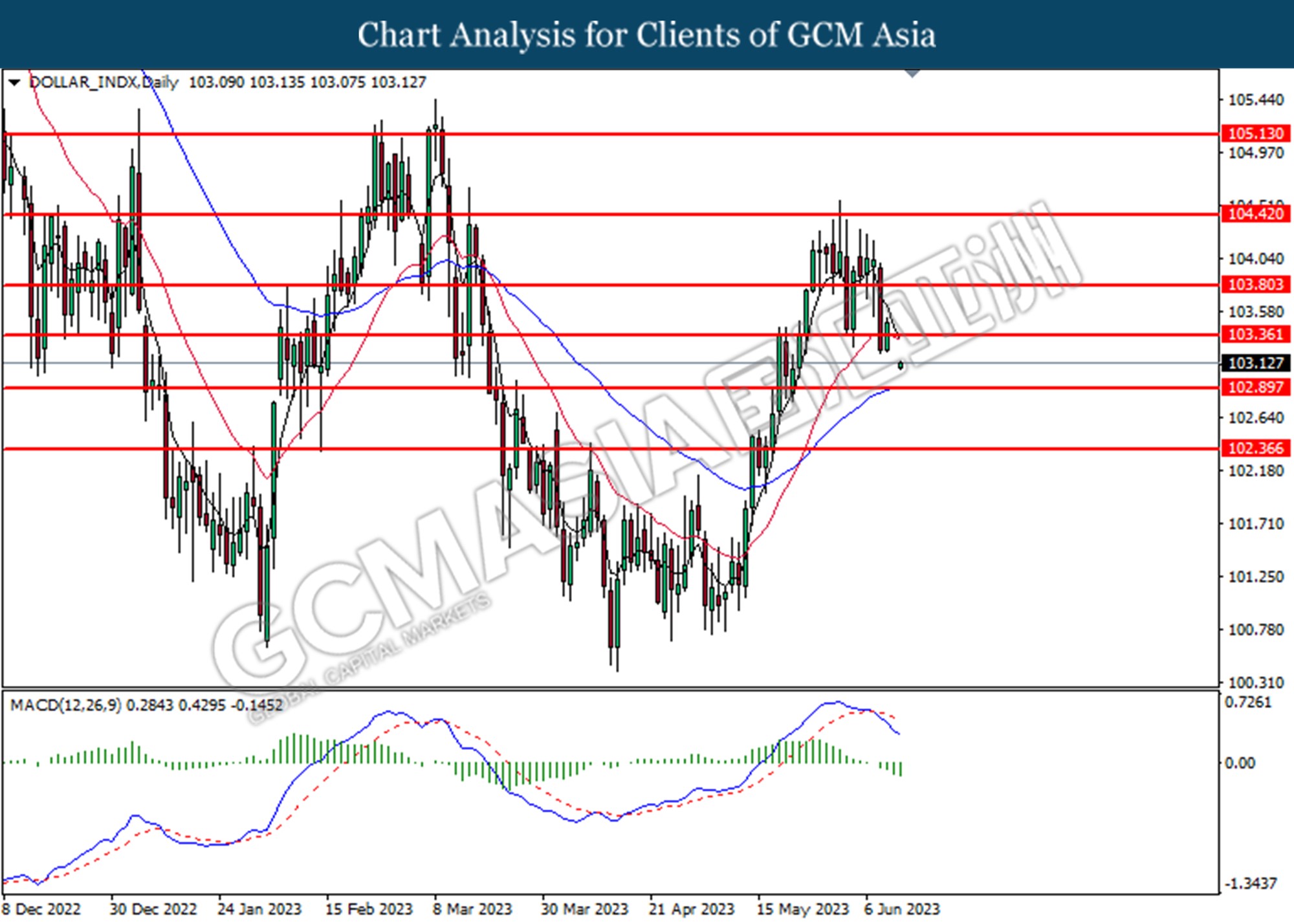

DOLLAR_INDX, DAILY: Dollar index was traded lower following the prior retracement from the higher level at 103.35. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 102.90.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

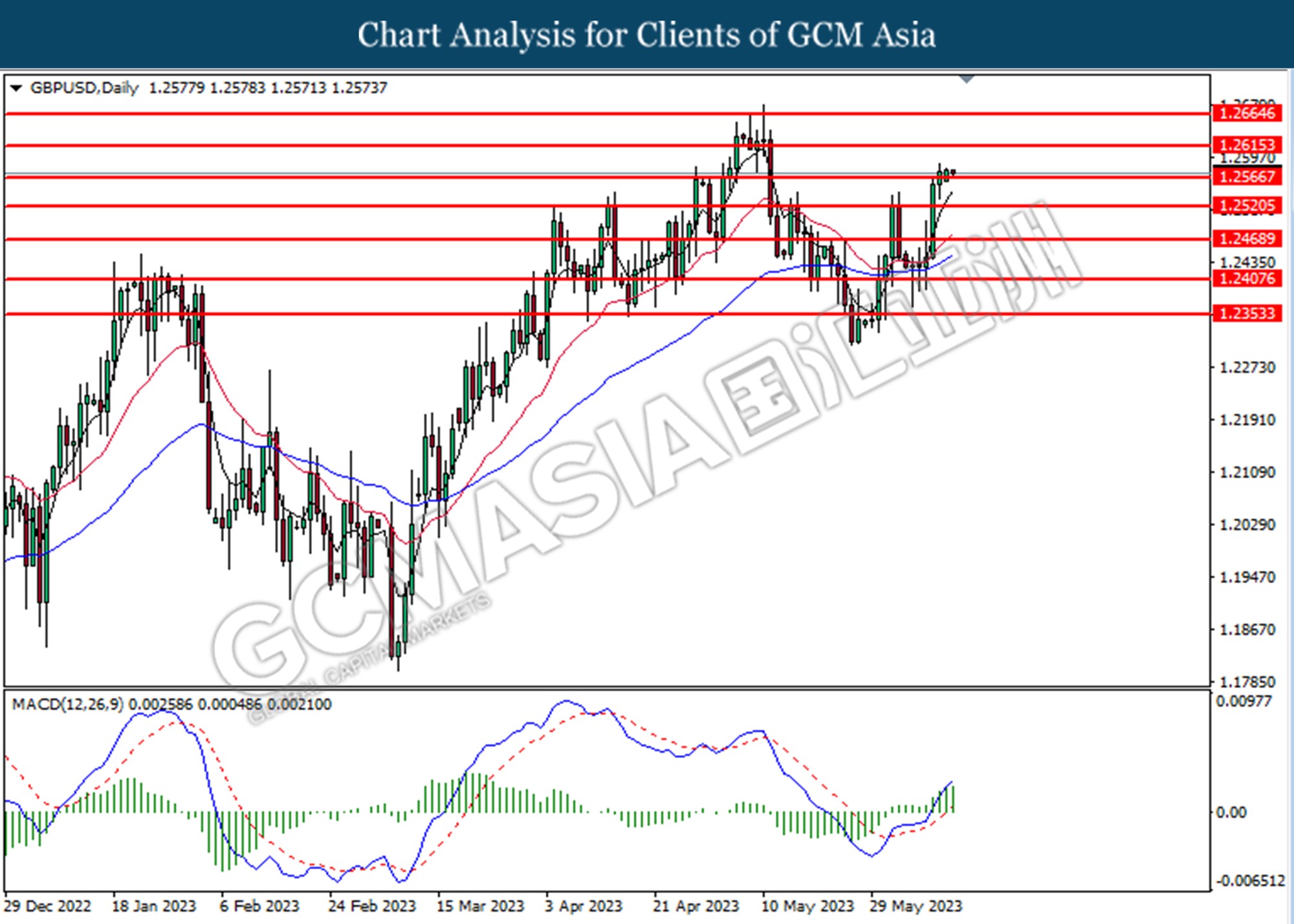

GBPUSD, DAILY: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2565. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.2615, 1.2665

Support level: 1.2565, 1.2520,

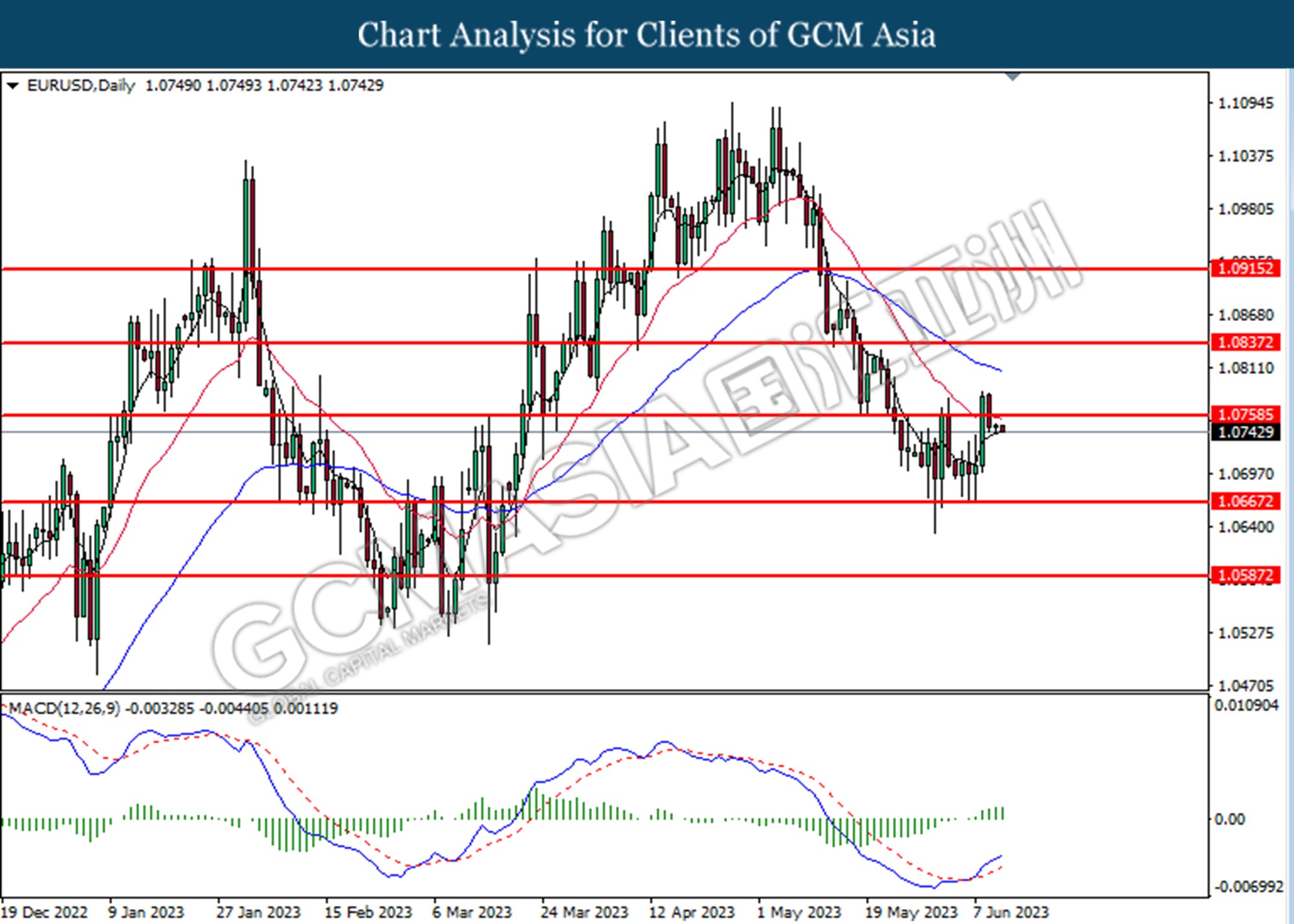

EURUSD, DAILY: EURUSD was traded lower following the prior breaks below from the previous support level at 1.0760. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes technical correction in the short term.

Resistance level: 1.0760, 1.0835

Support level: 1.0670, 1.0590

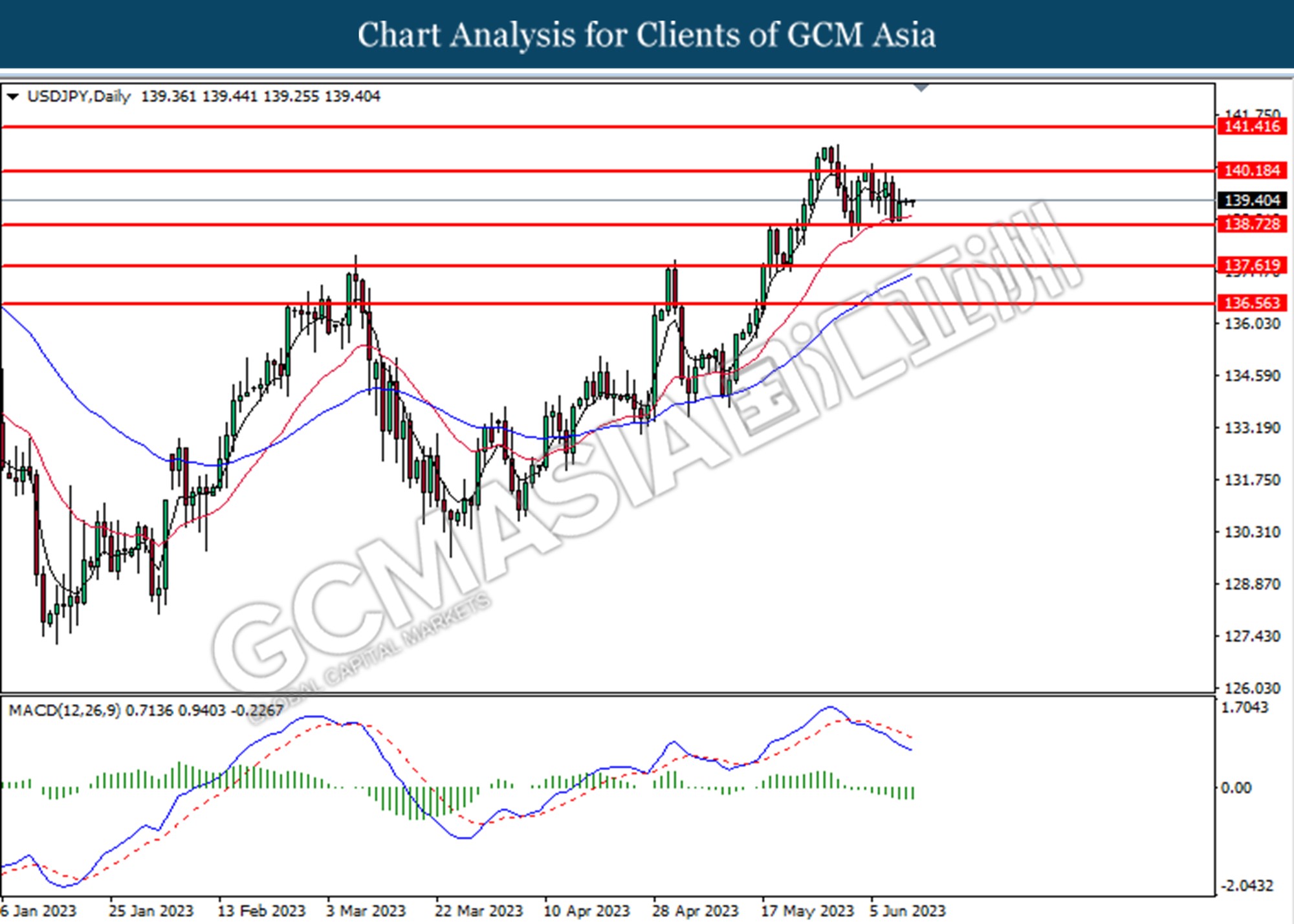

USDJPY, DAILY: USDJPY was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes technical correction in the short term.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

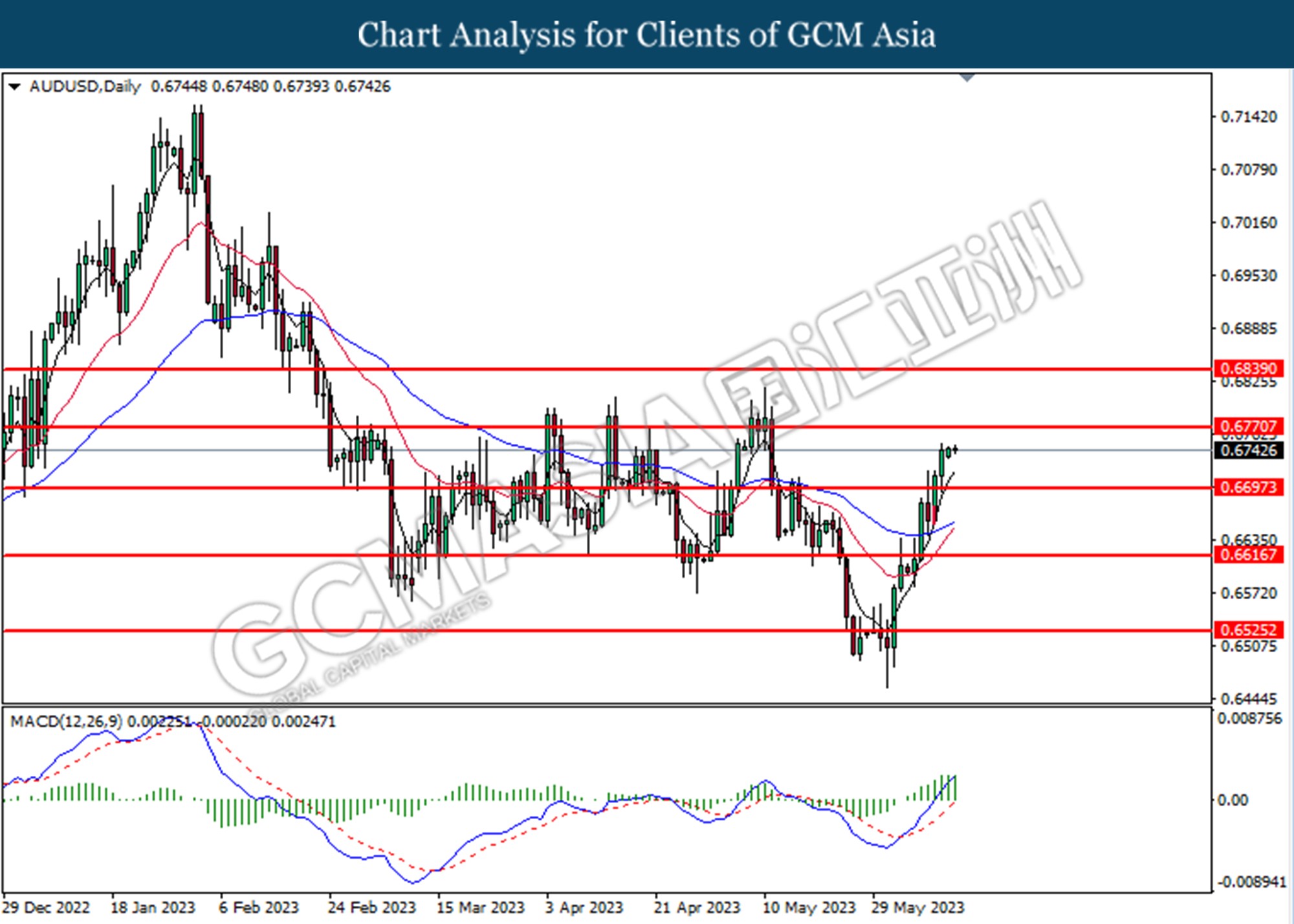

AUDUSD, DAILY: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6770.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

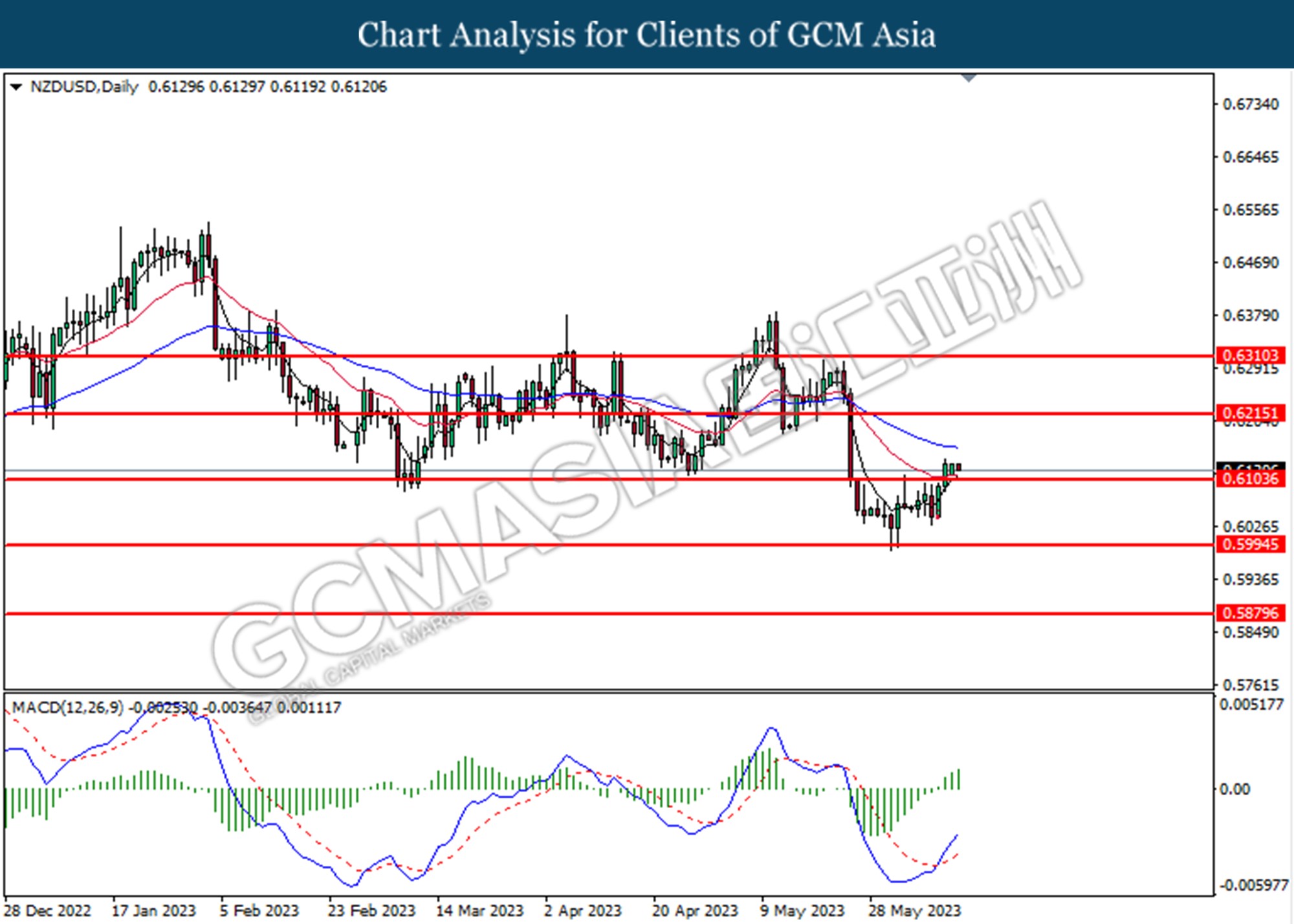

NZDUSD, DAILY: NZDUSD was traded lower following the prior breaks above from the previous resistance level at 0.6105. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

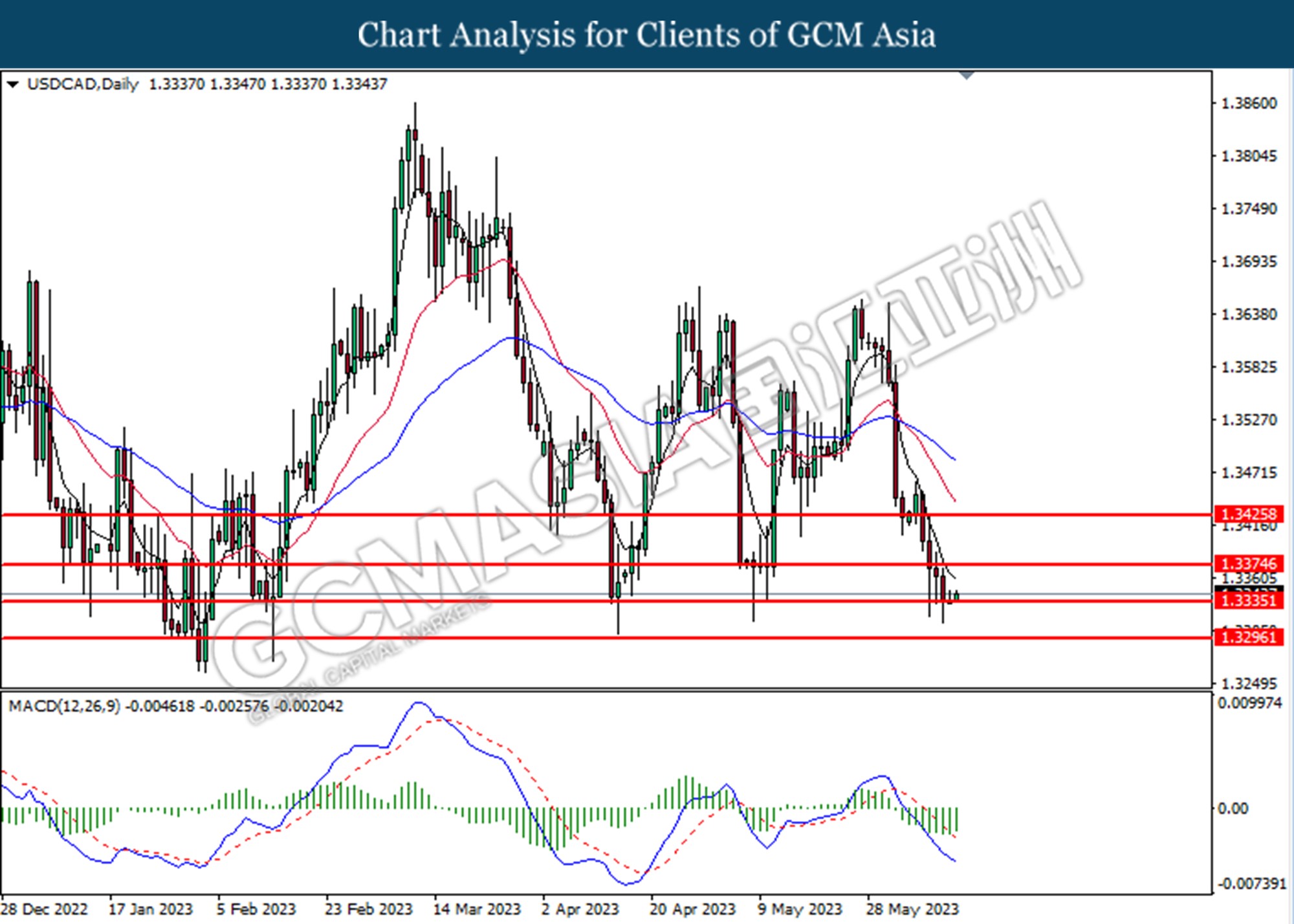

USDCAD, DAILY: USDCAD was traded higher following the prior rebound from the support level at 1.3335. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 13375, 1.3425

Support level: 1.3335, 1.3300

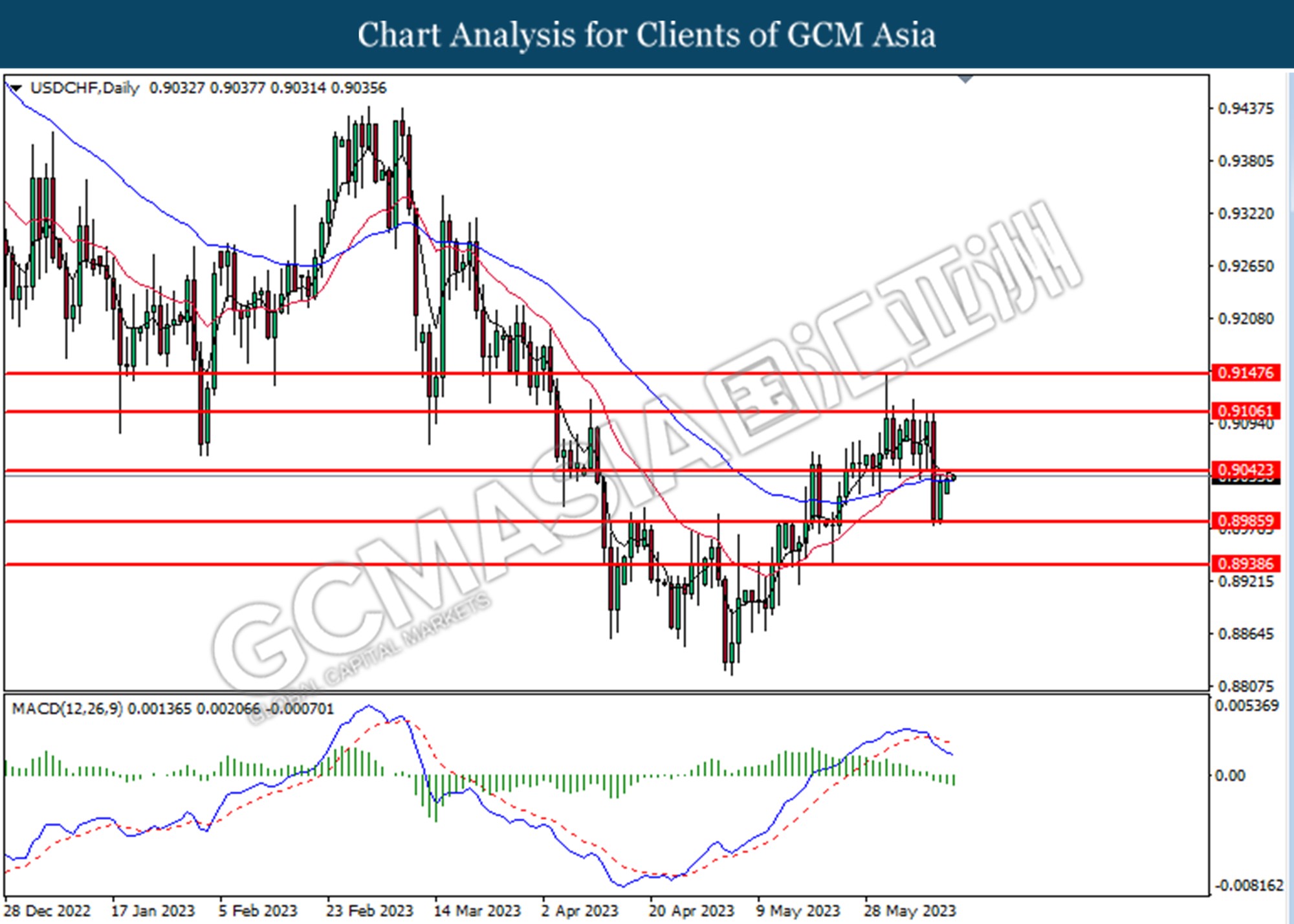

USDCHF, DAILY: USDCHF was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.9040, 0.9105

Support level: 0.8985, 0.8940

CrudeOIL, DAILY: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 69.30.

Resistance level: 70.40, 71.35

Support level: 69.30, 67.55

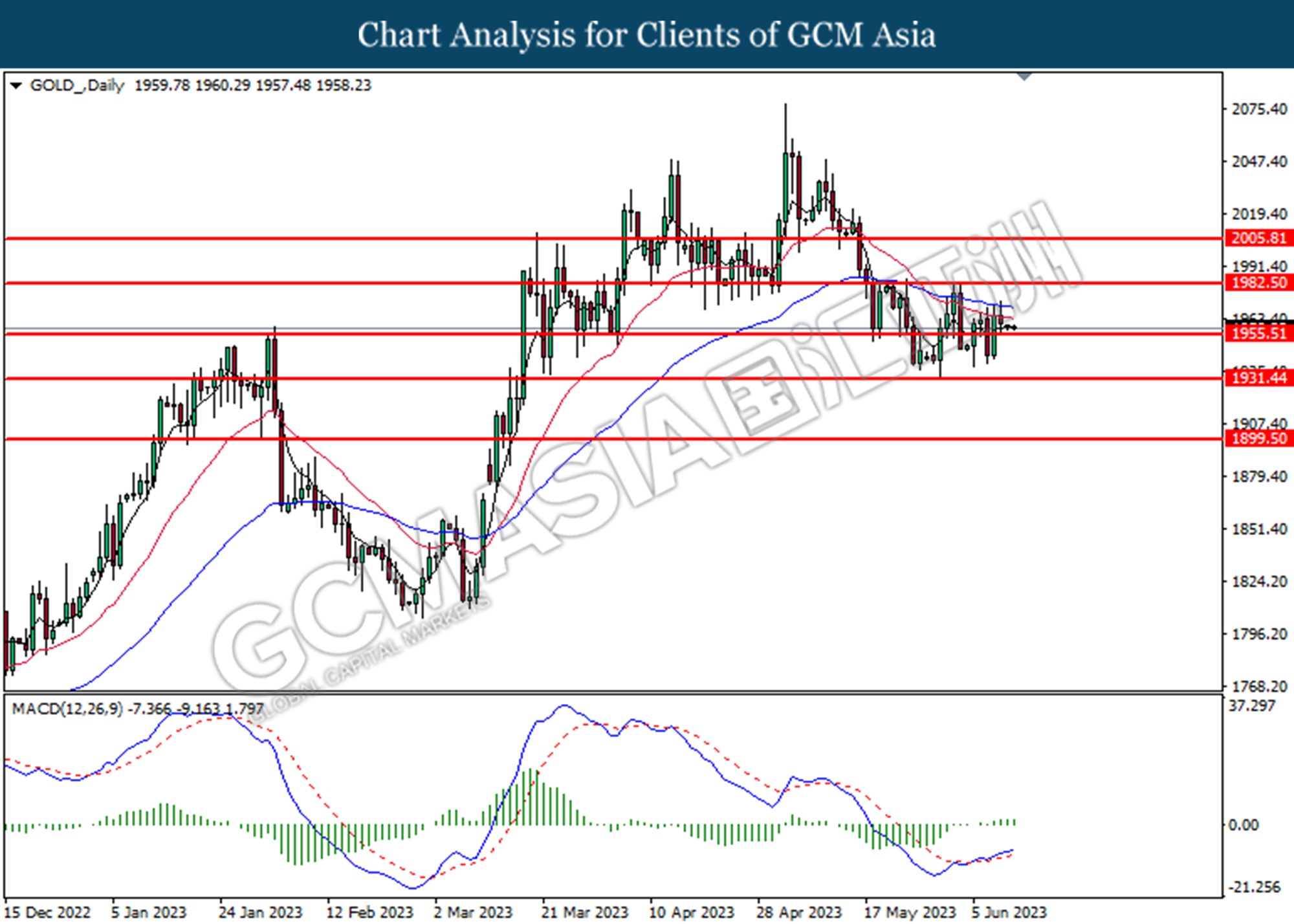

GOLD_, DAILY: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity to undergo a technical correction in the short term.

Resistance level: 1982.50, 2005.80

Support level: 1955.50, 1930.45