12 July 2022 Morning Session Analysis

US Dollar rose amid the rising inflation expectation.

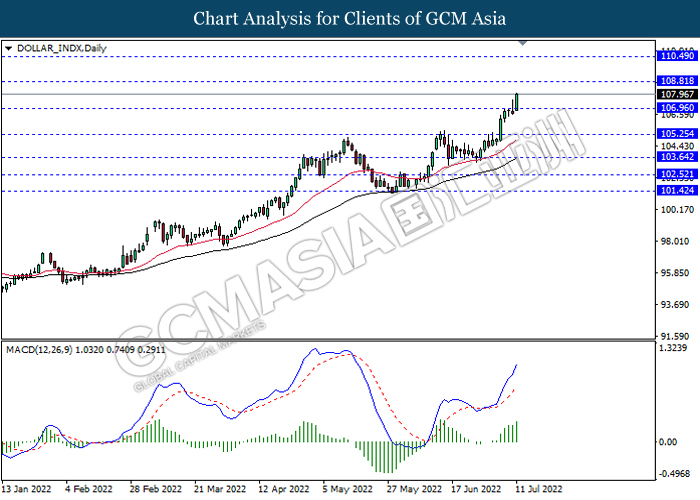

The Dollar Index which traded against a basket of six major currencies surged over the rising expectation of inflation risk. According to US Department of Labor, the US Consumer Price Index (CPI) YoY for June that forecasted by economist has reached 8.8%, which higher than the previous reading of 8.6%. The CPI data was used to measure the monthly change in prices paid by consumers, which is the major indicator to determine the inflation rate. As the economist had given a higher-than-previous reading for the CPI data, it would likely to hint that the soaring inflation risk keep hovering in the US. The Federal Reserve might implement aggressive contractionary monetary policy in order to stabilize the inflation, which sparkling the appeal of US Dollar. Nonetheless, investors would continue to scrutinize the latest updates with regards of the unleash of CPI data on tomorrow in order to receive further trading signals. As of writing, the Dollar Index appreciated by 1.12% to 108.02.

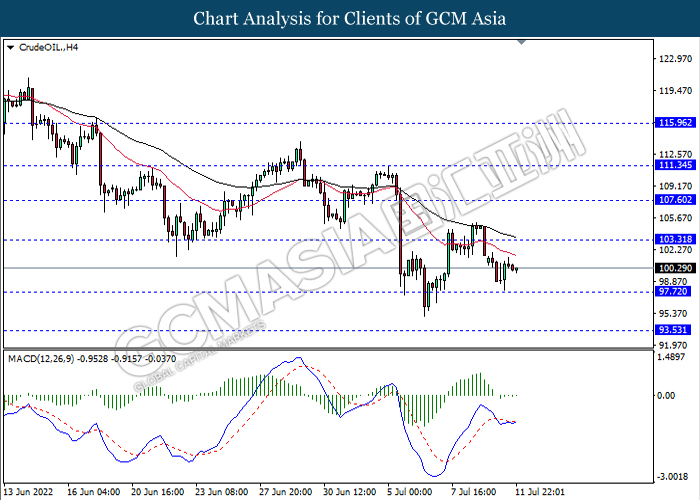

In the commodities market, crude oil price eased by 1.14% to $102.90 per barrel as of writing following China reported its first case of the highly-transmissible Omicron subvariant, which might lead to a lockdown. Besides, gold price edged up by 0.03% to $1732.25 per troy ounce as of writing. However, the overall trend of gold price remained bearish amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Jul) | -28 | -38.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

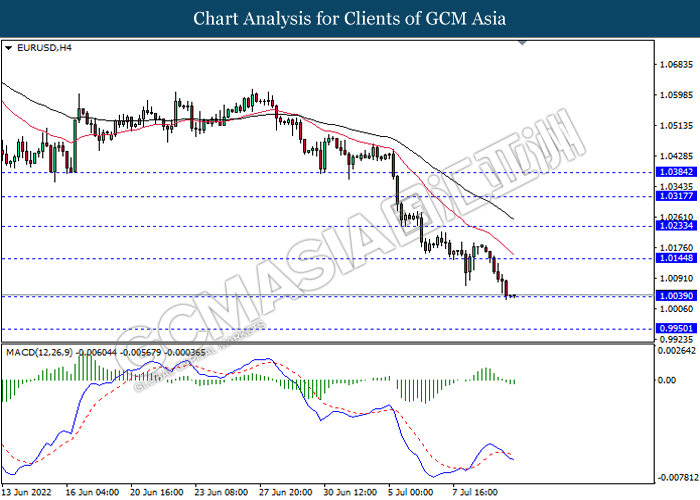

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0145, 1.0235

Support level: 1.0040, 0.9950

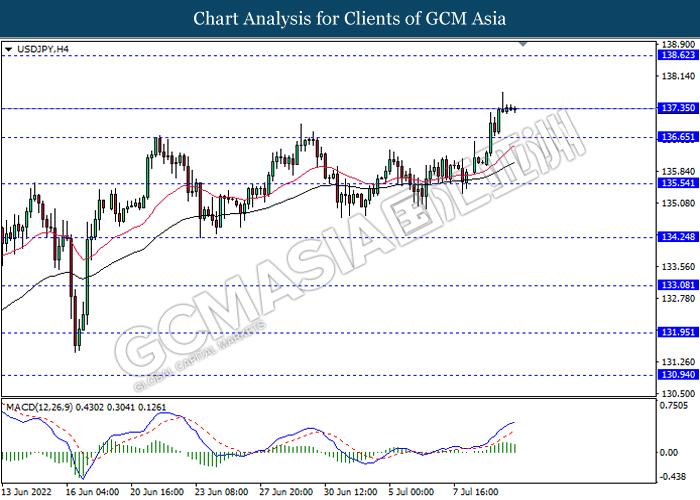

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower a technical correction.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

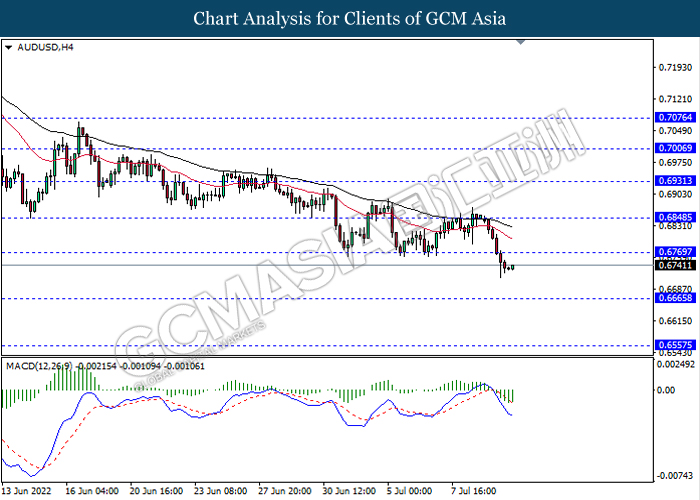

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

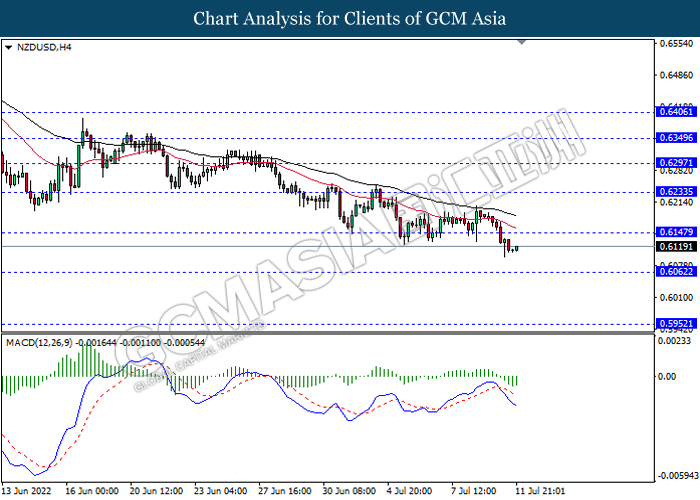

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

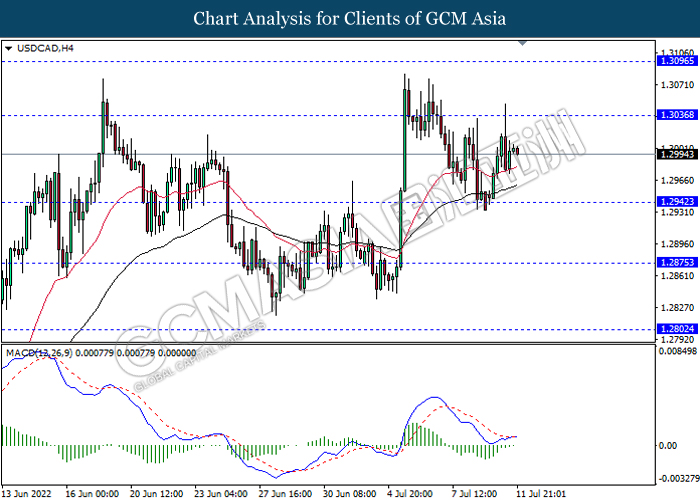

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

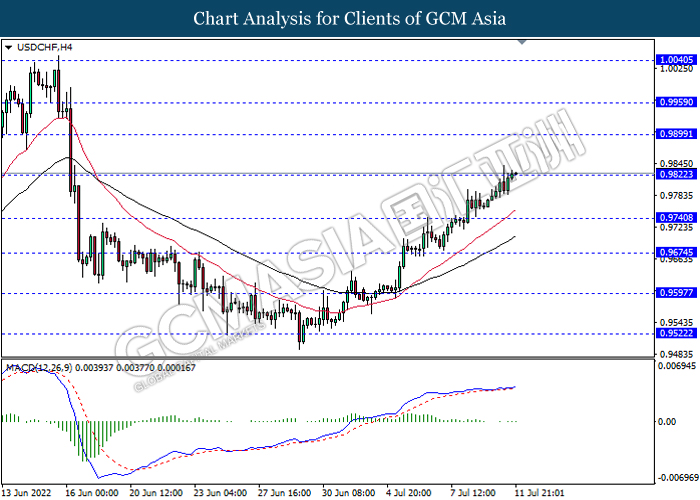

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 0.9960

Support level: 0.9820, 0.9740

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

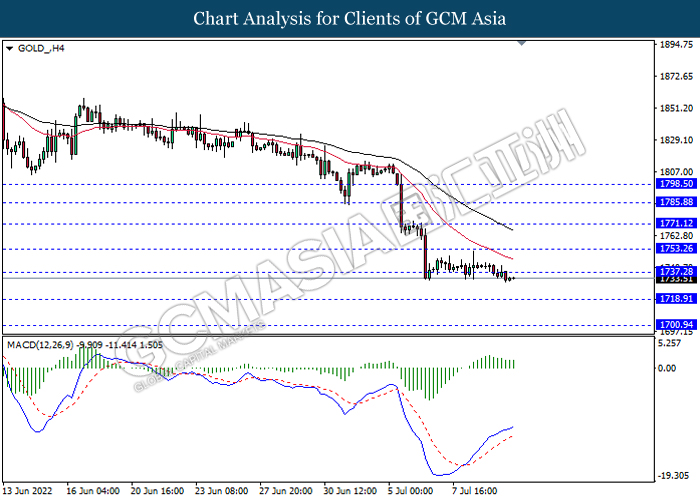

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1737.30, 1753.25

Support level: 1718.90, 1700.95