12 August 2022 Afternoon Session Analysis

Pound topped, while investors wait for GDP data.

The Pound Sterling, which is widely traded by global investors, lingered near the higher level in 1-week amid the dollar index softening, while the market participants are waiting for the crucial economic data to be released. Over the past two days, the US has released a series of downbeat inflation figure, whereby the inflationary pressures in the nation has peaked and signaled some sign of easing. The lower-than-expected inflation figure urged the investors to flee away from the dollar market as they bet the Federal Reserve would implement a less aggressive rate hike plan going forward. On the UK front, the Bank of England (BOE) warned last week that the UK economy will enter its longest recession since the global financial crisis (GFC) in the fourth quarter of 2022. With the pessimistic forecast, the investors are all-eyed on the GDP, which will be announced later today, in order to gauge the direction of the currency before the recession comes in. As of writing, the pair of GBP/USD dropped 0.17% to 1.2190.

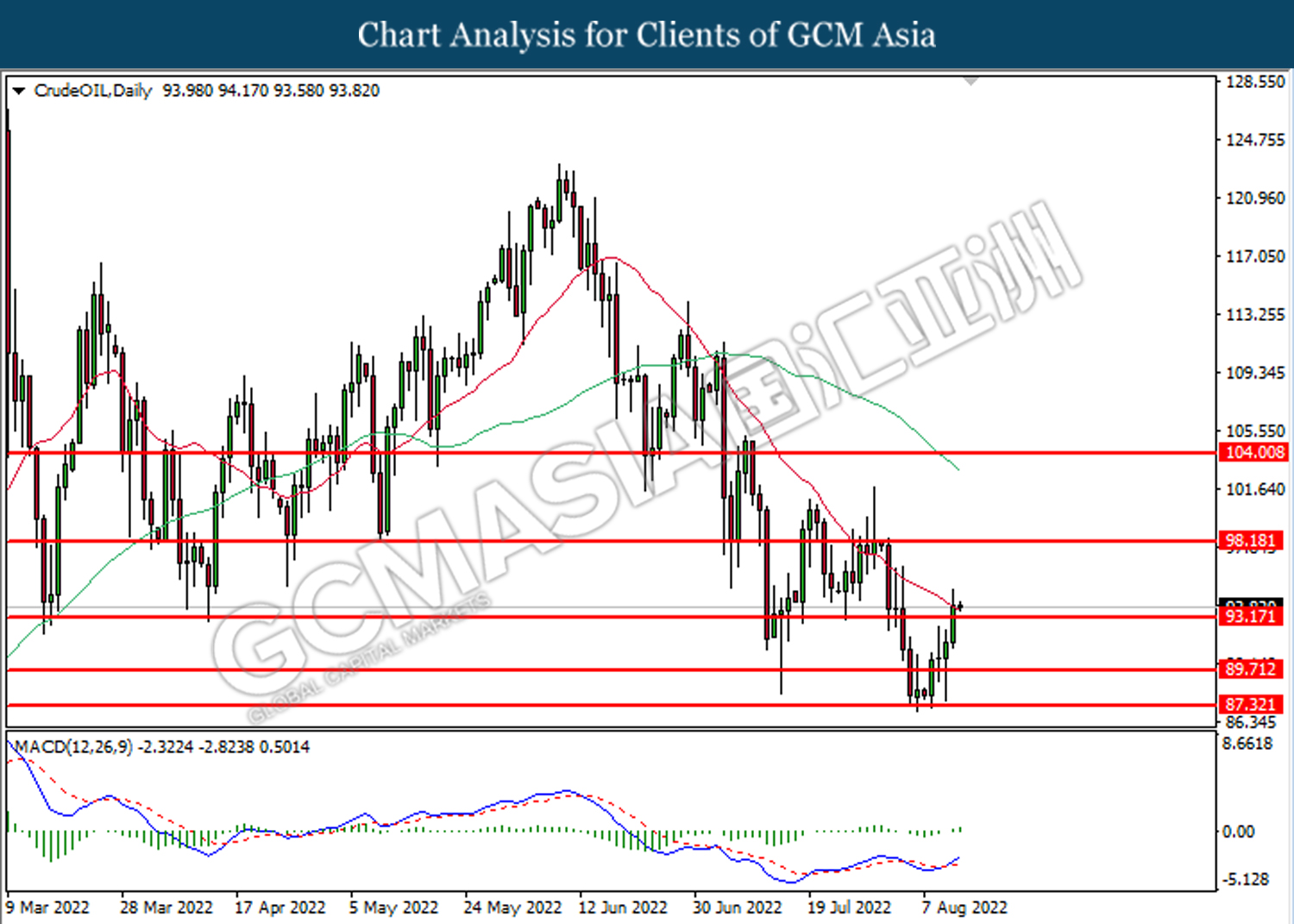

In the commodities market, the crude oil price dipped 0.22% to $93.85 a barrel as the demand outlook remains clouded amid an extension of lockdown in China’s cities. Besides, the gold prices appreciated by 0.04% to $1790.00 per troy ounce amid dollar index weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q2) | 8.70% | 2.80% | – |

| 14:00 | GBP – GDP (QoQ) (Q2) | 0.80% | -0.20% | – |

| 14:00 | GBP – GDP (MoM) | 0.50% | -1.20% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Jun) | 1.40% | -1.20% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.40% | – | – |

Technical Analysis

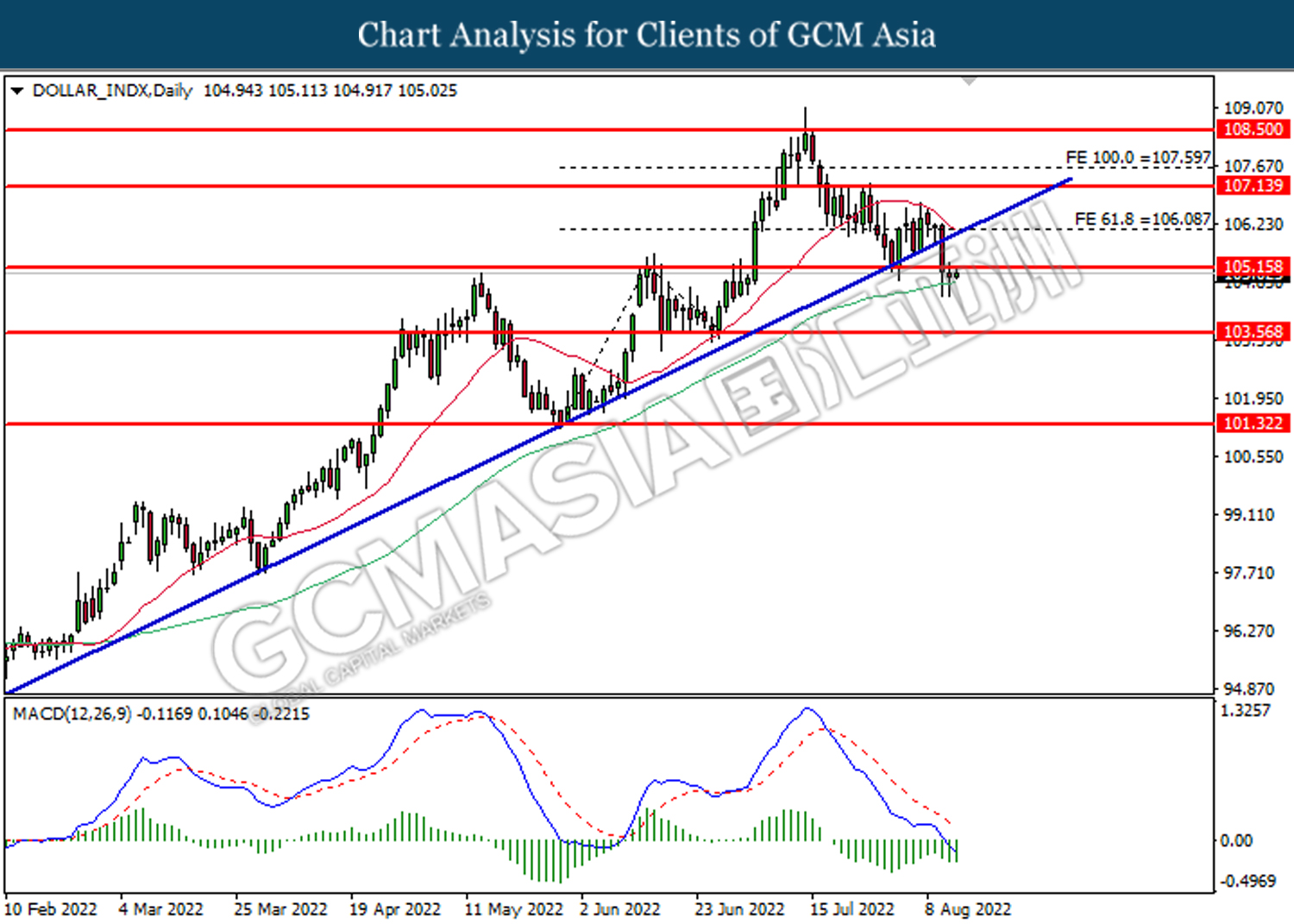

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 105.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.55.

Resistance level: 105.15, 106.10

Support level: 103.55, 101.30

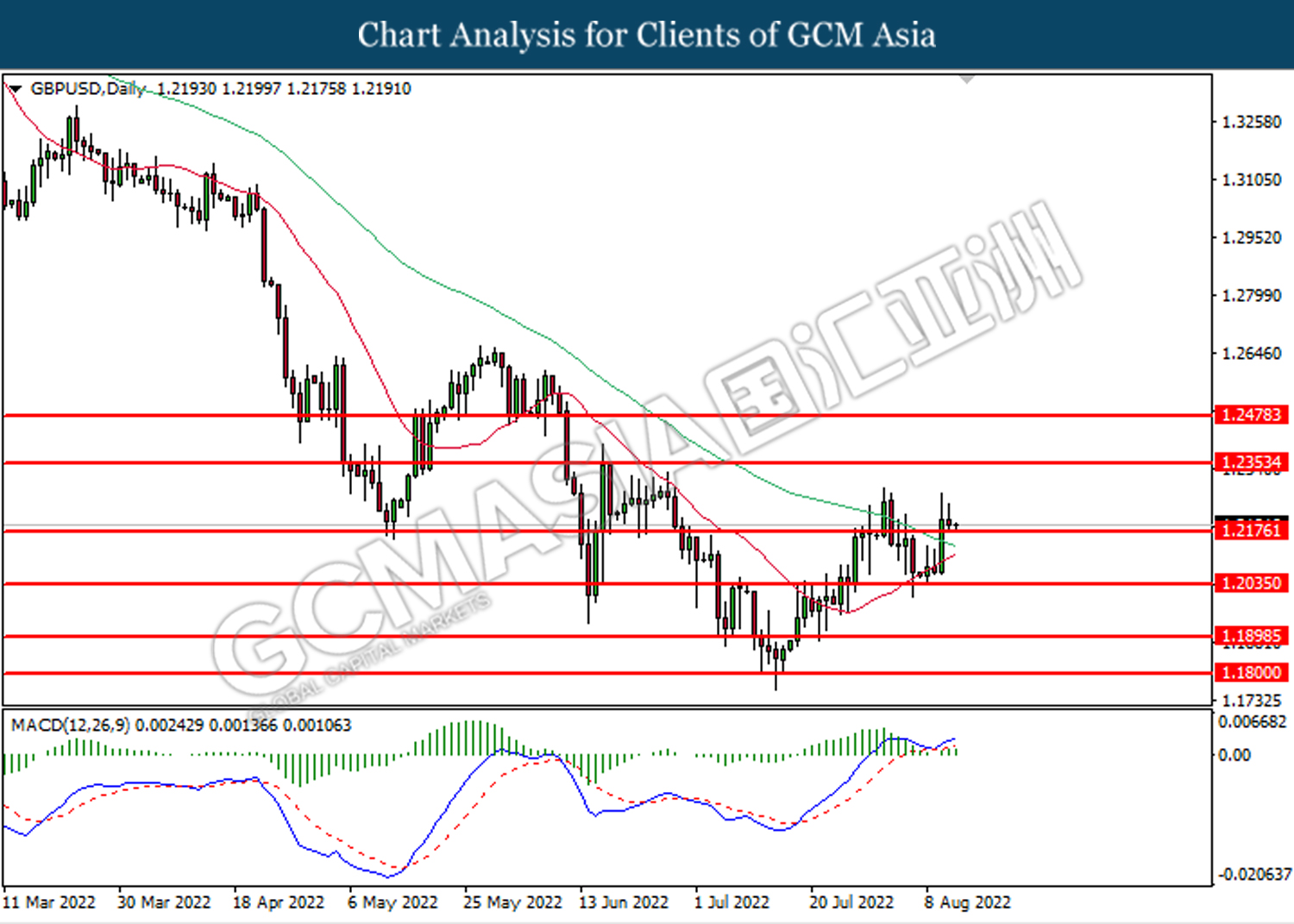

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2355.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

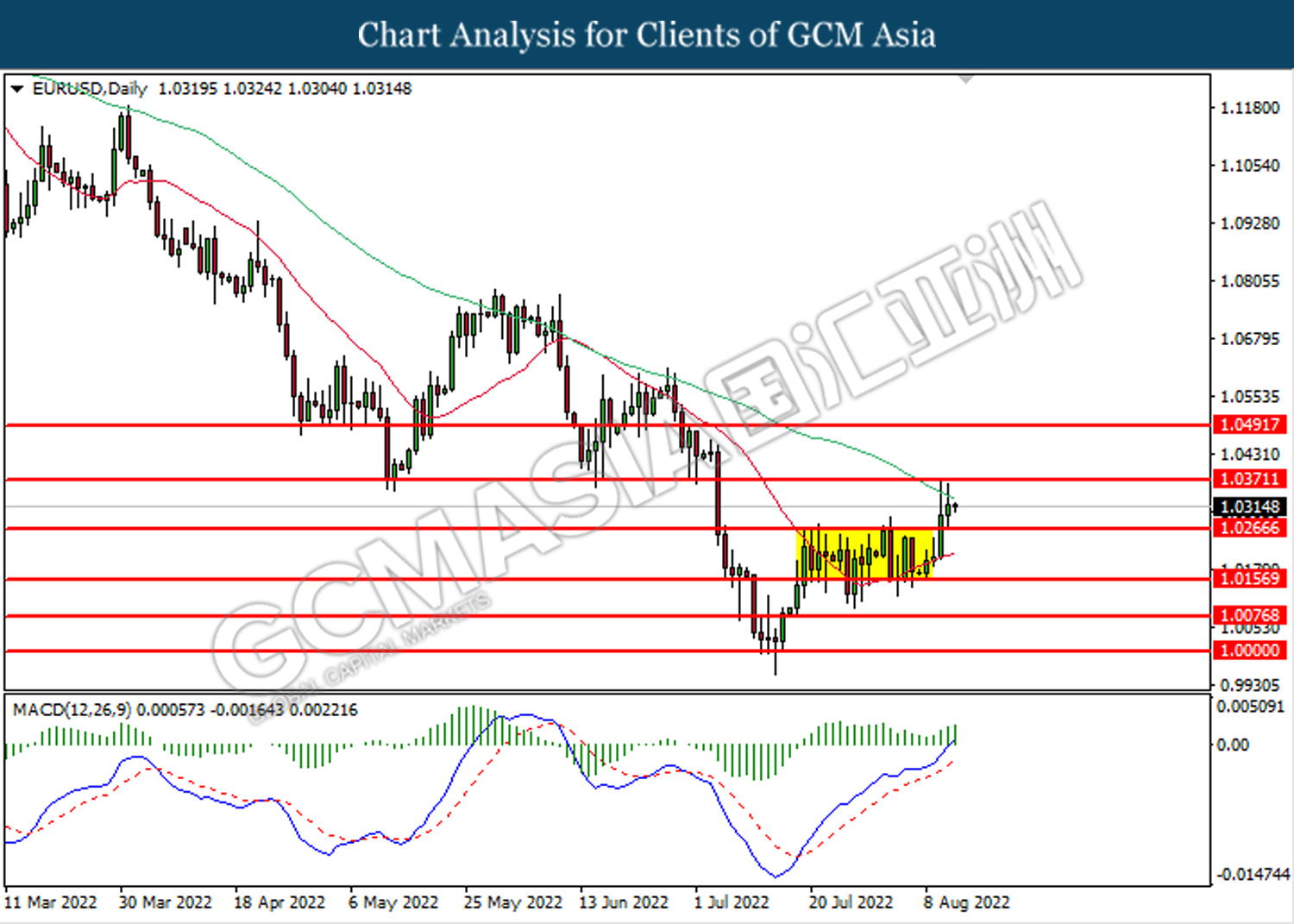

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0265. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0370.

Resistance level: 1.0370, 1.0490

Support level: 1.0265, 1.0155

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 133.15. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 133.15, 135.25

Support level: 131.30, 128.80

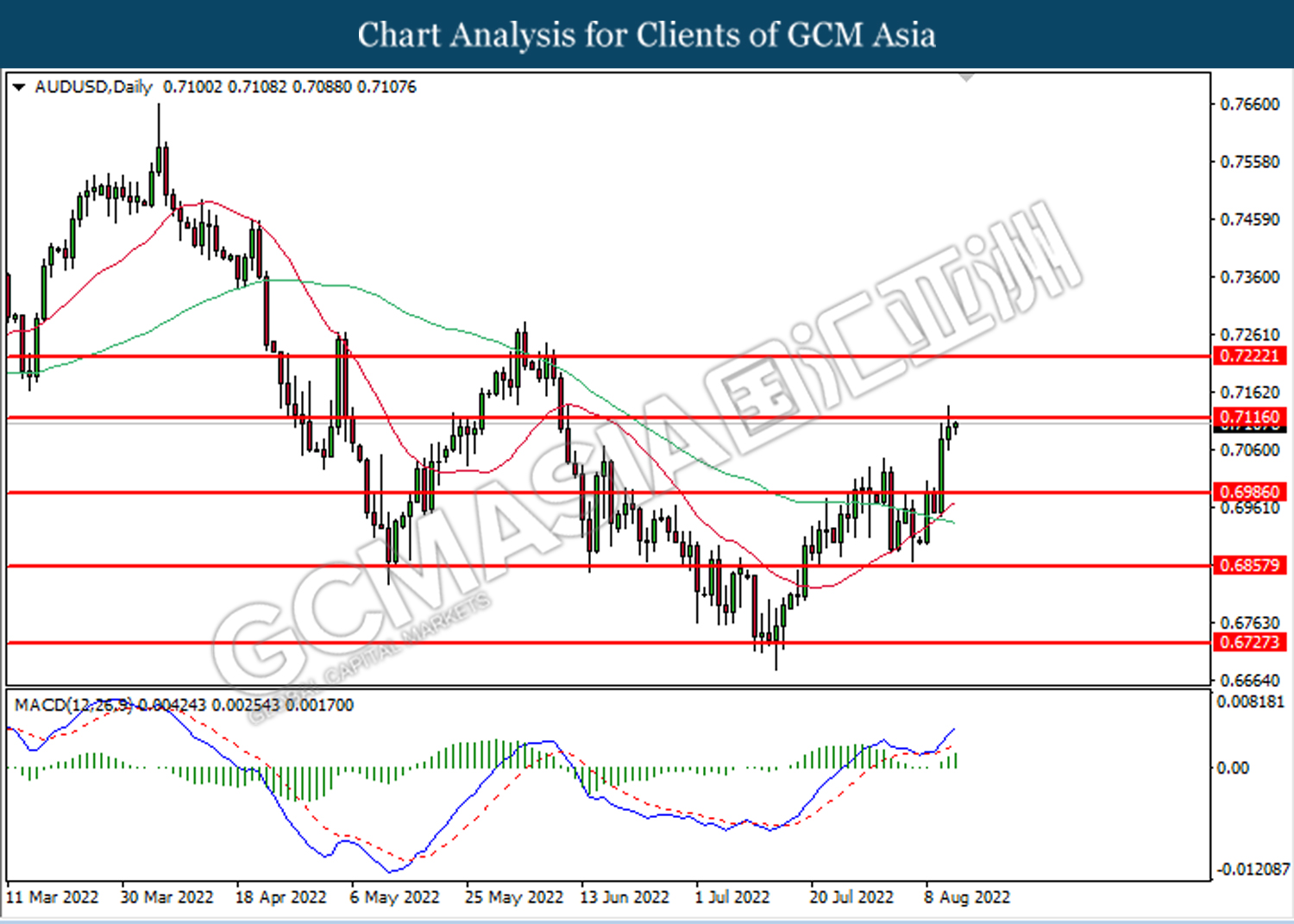

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

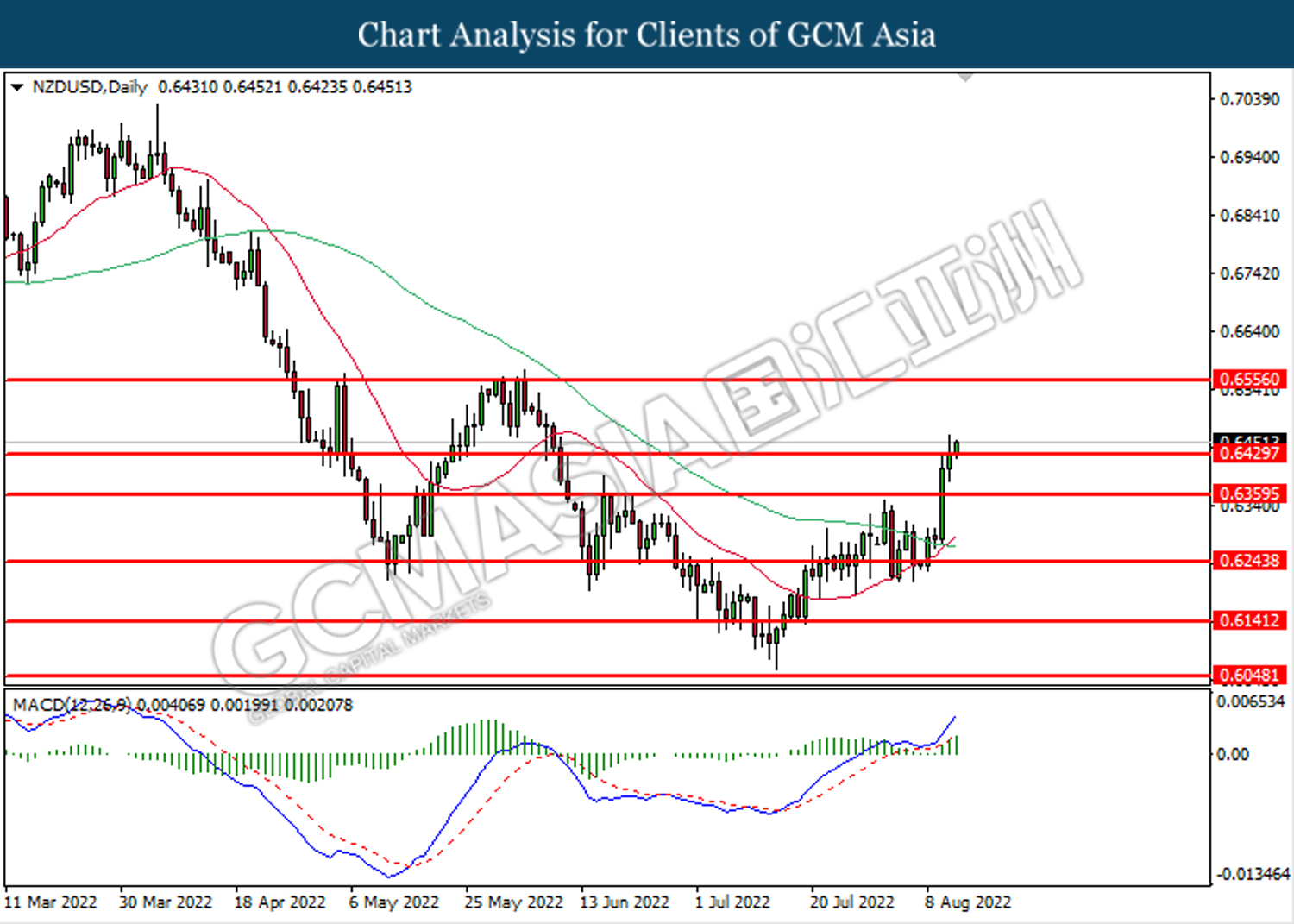

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6430. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6430.

Resistance level: 0.6430, 0.6555

Support level: 0.6360, 0.6245

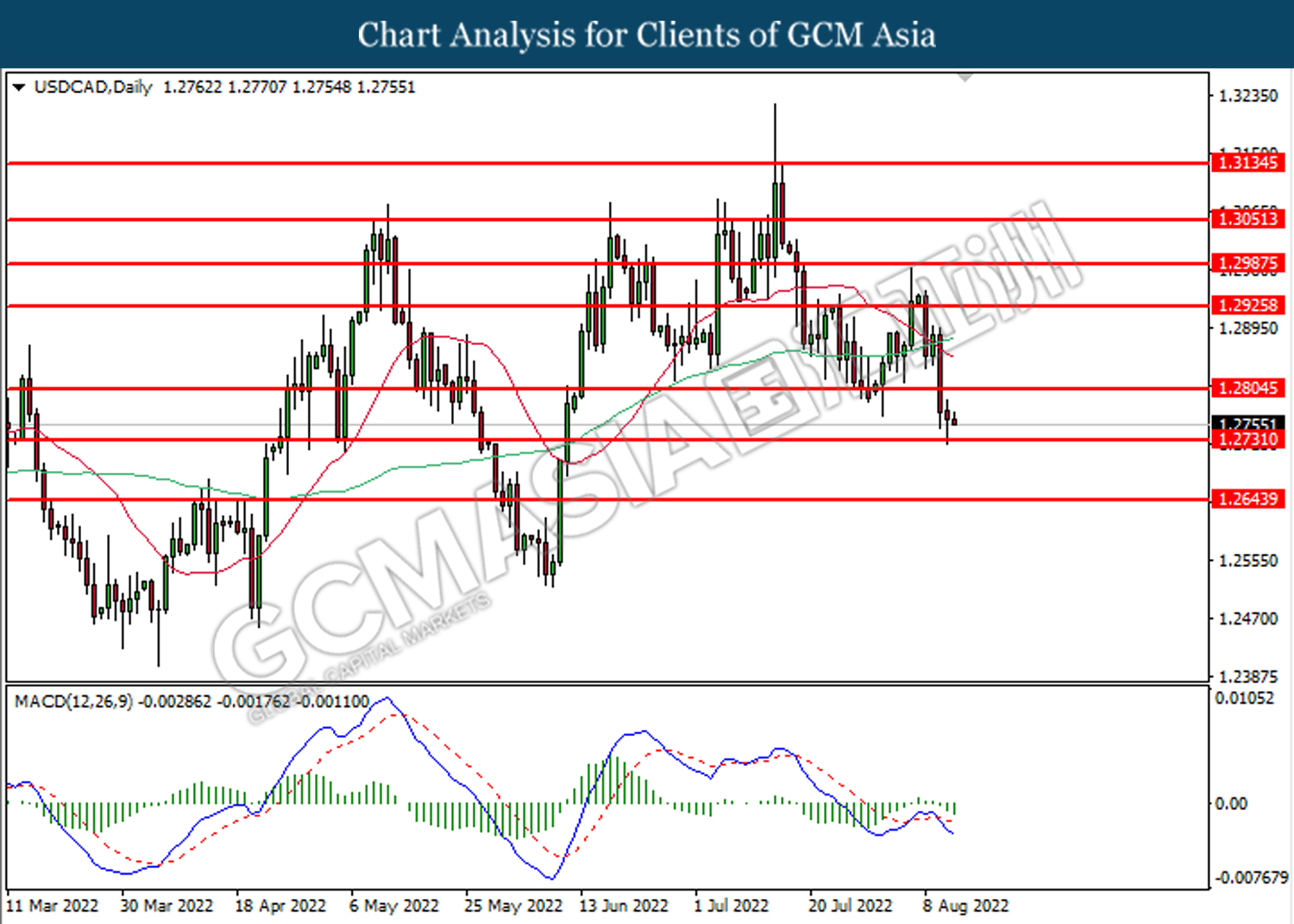

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2805. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.2730.

Resistance level: 1.2805, 1.2925

Support level: 1.2730, 1.2645

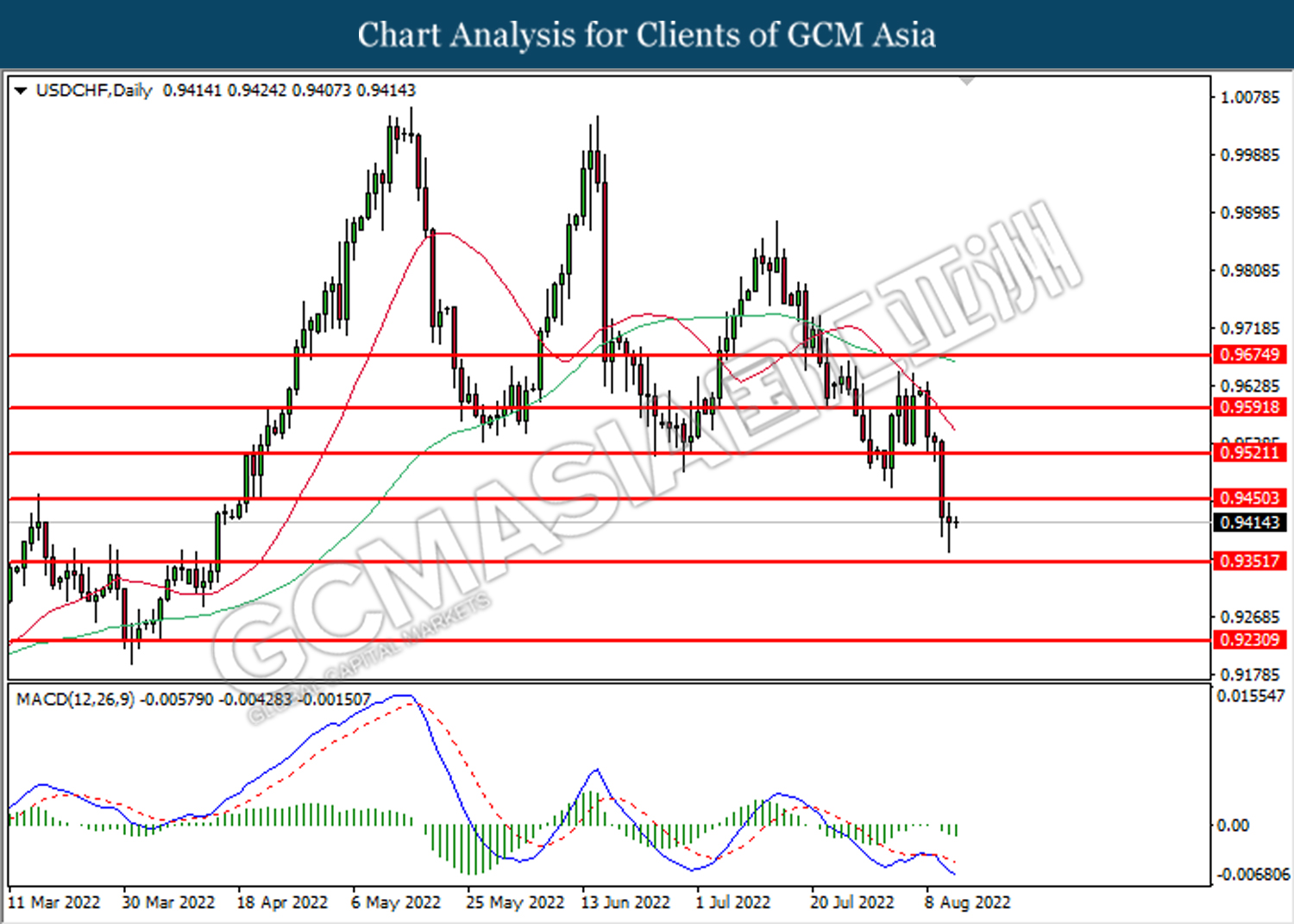

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9450. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9350.

Resistance level: 0.9450, 0.9520

Support level: 0.9350, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 93.15. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 98.20.

Resistance level: 98.20, 104.00

Support level: 93.15, 89.70

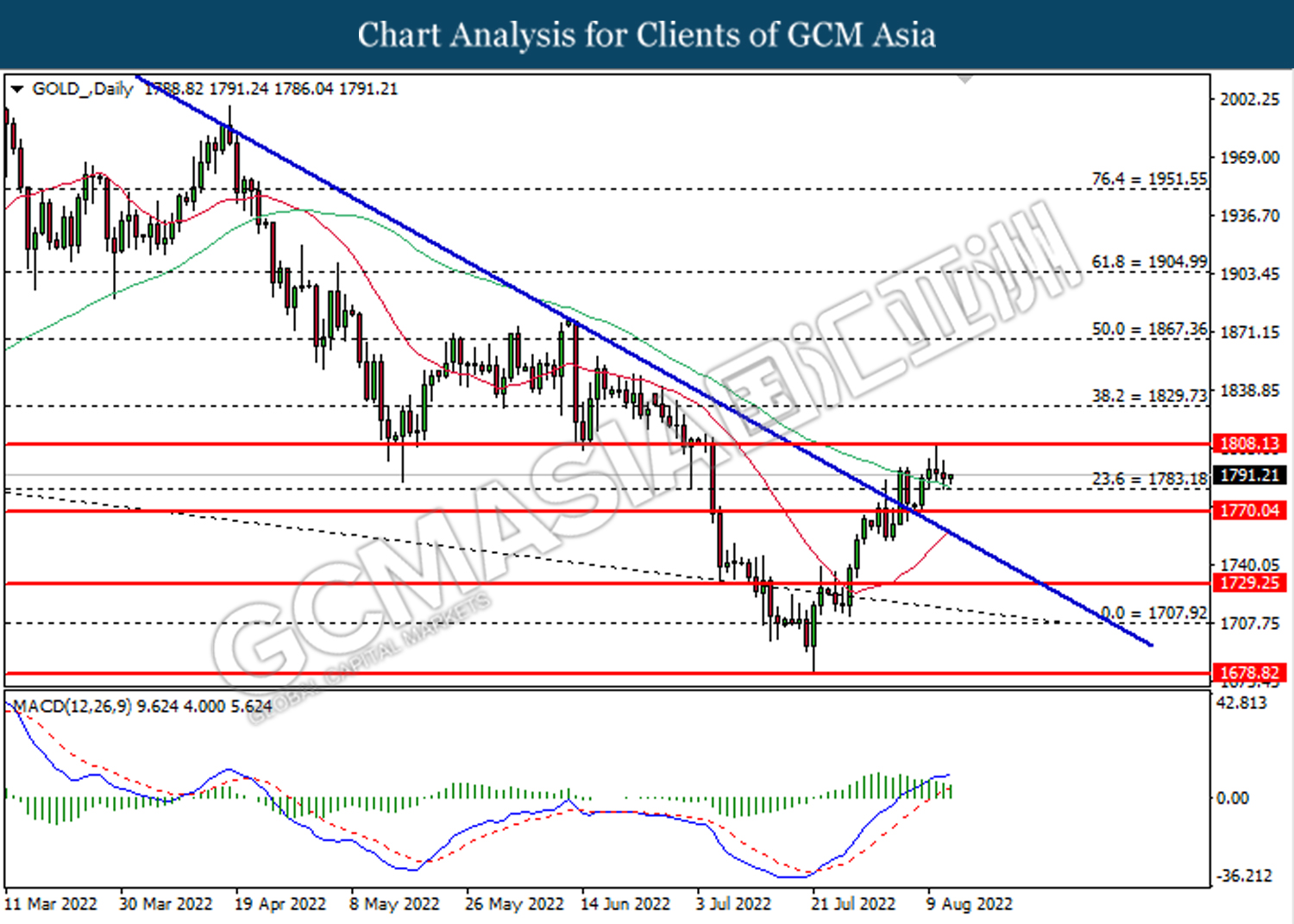

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1783.20. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1808.15, 1829.75

Support level: 1783.20, 1770.05