12 August 2022 Morning Session Analysis

US Dollar weakened over the easing inflationary pressure.

The Dollar Index which traded against a basket of six major currencies slipped on yesterday after the inflationary data has been released. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) MoM for July notched down from the previous reading of 1.0% to -0.5%, missing the market anticipation of 0.2%. The PPI data is one of the crucial data to gauge the inflationary pressure in a nation. Thus, the lower-than-expected figures had showed that the inflation risk in the US was cooling down, which suggested a rate hikes which is less forceful would be implemented. According to CME FedWatch Tool, the possibility of 50 basis point rate increase had raised to about 61.5%, which indicated that the majority of investors are predicting that the half-of-percentage rate hikes from Fed would be decided instead of 75 basis point. Nonetheless, the losses experienced by the Dollar Index was limited amid the upbeat employment data. The US Initial Jobless Claims posted at the reading of 262K, which is lower than the market forecast of 263K. As of writing, the Dollar Index depreciated by 0.10% to 104.98.

In the commodities market, the crude oil price dropped by 0.38% to $93.98 per barrel as of writing. However, the oil price surged on yesterday amid the International Energy Agency (IEA) raised its oil demand growth forecast for this year. On the other hand, the gold price eased by 0.21% to $1787.42 per troy ounce as of writing following the bullish employment data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q2) | 8.70% | 2.80% | – |

| 14:00 | GBP – GDP (QoQ) (Q2) | 0.80% | -0.20% | – |

| 14:00 | GBP – GDP (MoM) | 0.50% | -1.20% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Jun) | 1.40% | -1.20% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.40% | – | – |

Technical Analysis

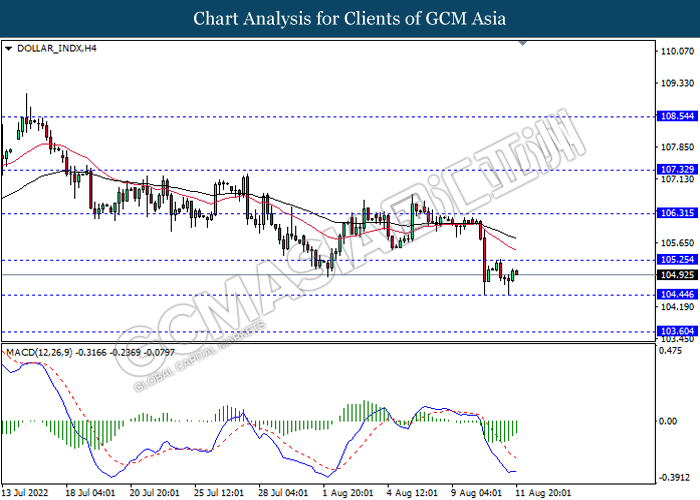

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 105.25, 106.30

Support level: 104.45, 103.60

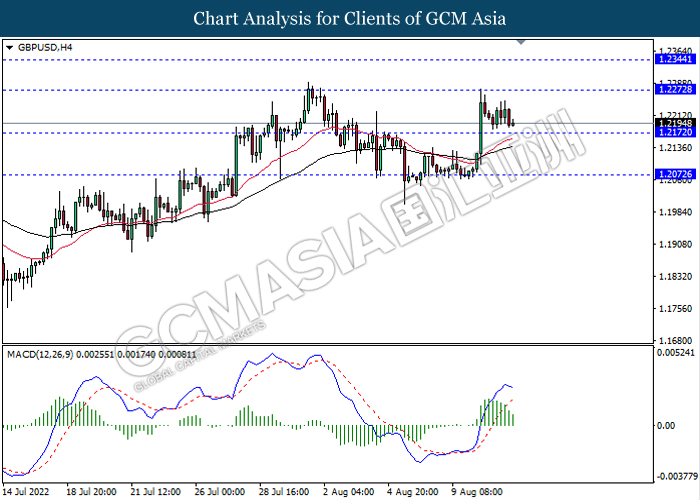

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2270, 1.2345

Support level: 1.2170, 1.2070

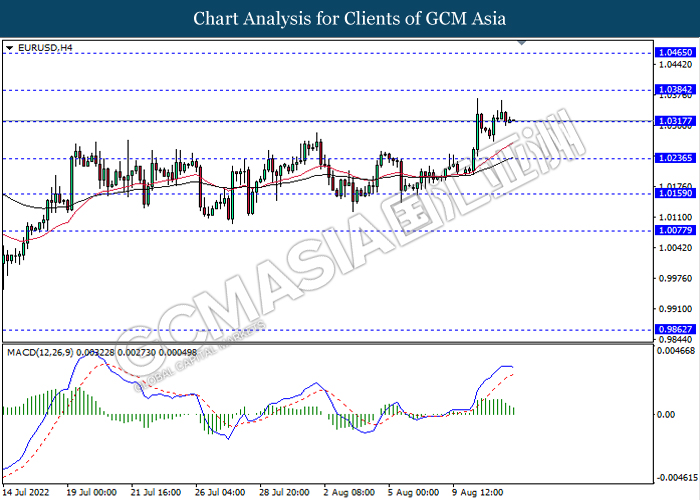

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0385, 1.0465

Support level: 1.0315, 1.0235

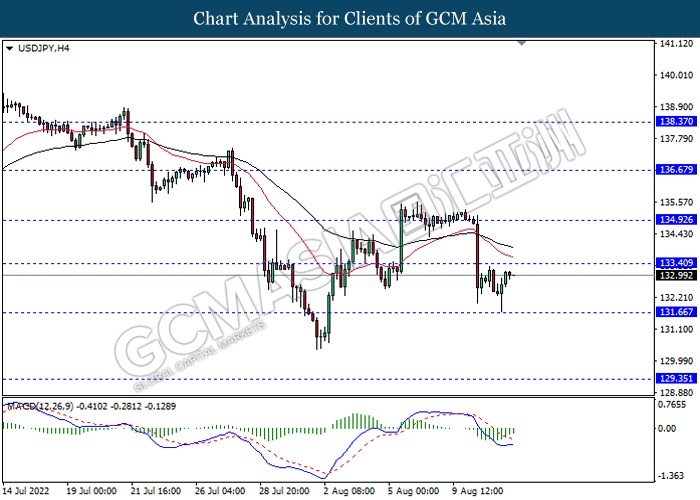

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 133.40, 134.90

Support level: 131.65, 129.35

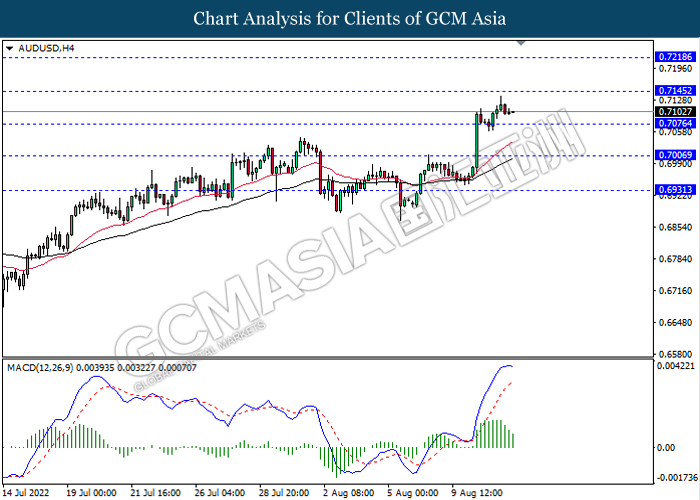

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7145, 0.7220

Support level: 0.7075, 0.7005

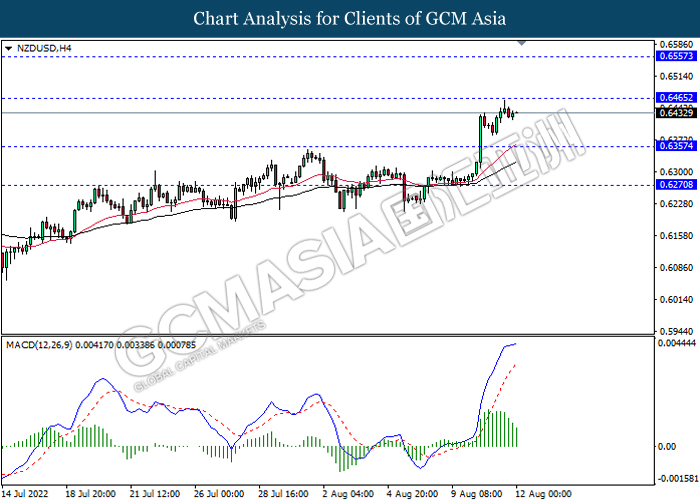

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6465, 0.6555

Support level: 0.6355, 0.6270

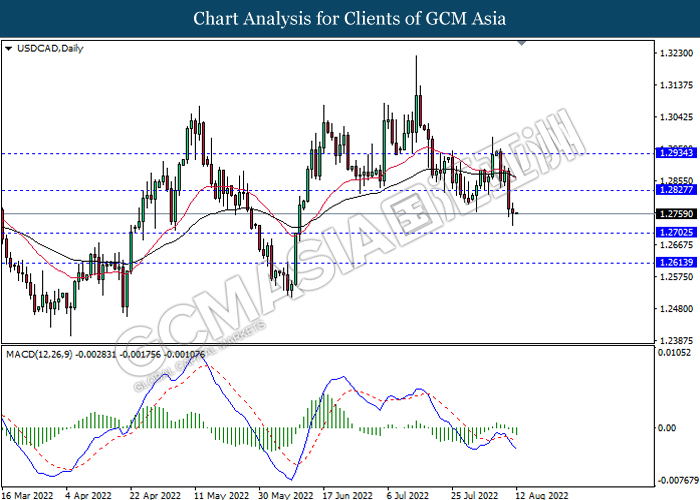

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2825, 1.2935

Support level: 1.2700, 1.2615

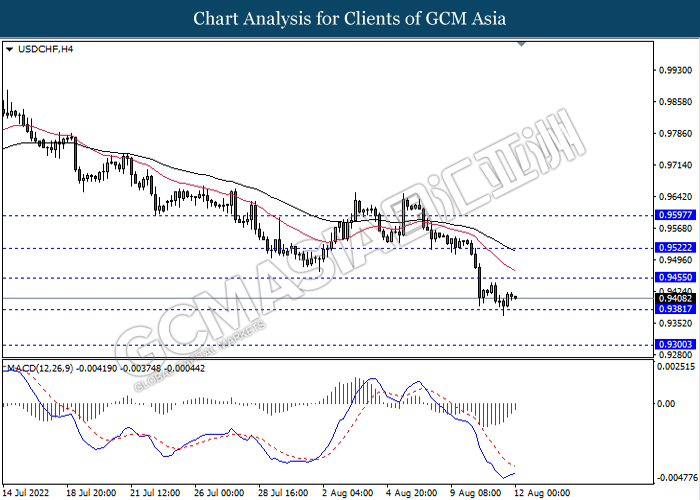

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9455, 0.9520

Support level: 0.9380, 0.9300

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 95.35, 97.70

Support level: 93.25, 91.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95