12 September 2022 Morning Session Analysis

Greenback revived amid the hawkish stance from Fed’s Bullard.

The dollar index, which was traded against a basket of six major currencies, regained its foot after slumping 3 consecutive days as Federal Reserve member reiterated his hawkish stance on the monetary policy path. Last Friday, Federal Reserve Bank of St. Louis President James Bullard revealed that he was leaning toward a third straight 75 basis-point of rate hike in the upcoming meeting, while commented that the market is actually underestimating the rate hikes path of the Federal Reserve. Moreover, he also added that the job reports were reasonably good in the past week, which indicating that the labor market in the US remain tight. This week, the long-awaited inflation figure – CPI will be released, and all the market participants are actually eyeing on the data to react accordingly. Despite, Bullard said a good CPI report should not affect the September rate hike, where the rates of 3.75-4% by end of 2022 is in his pocket. As of writing, the dollar index dropped 0.19% to 108.80.

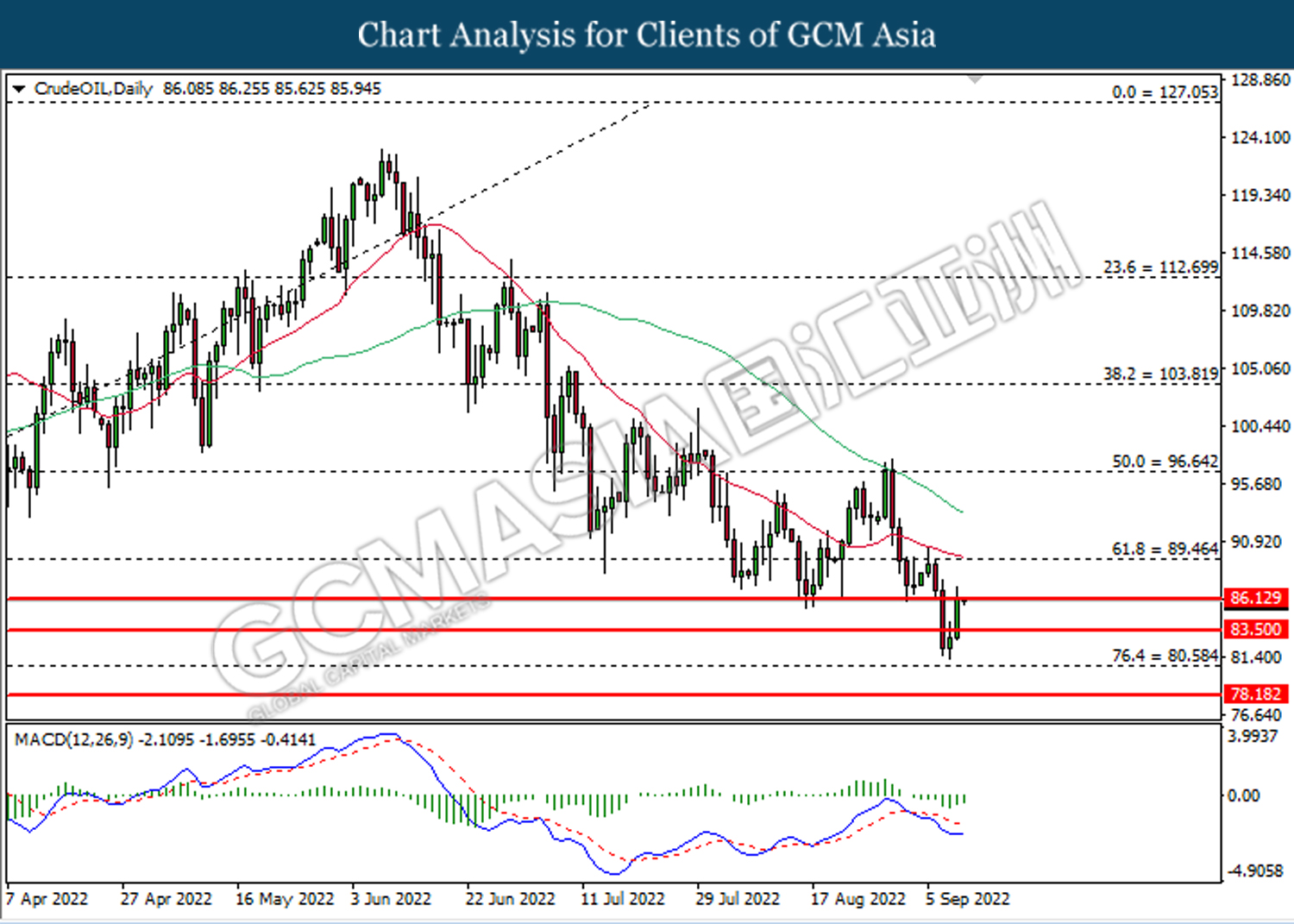

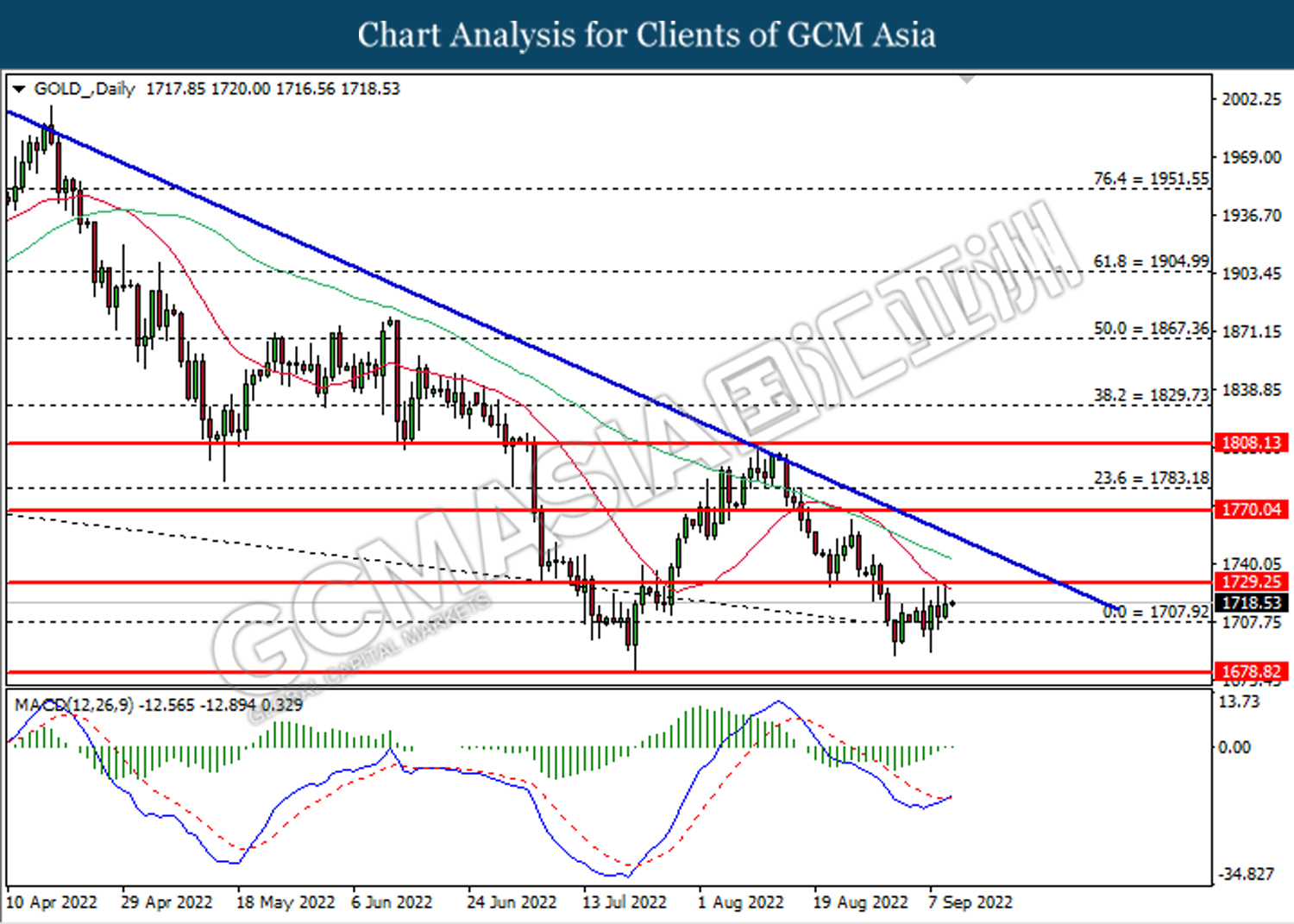

In the commodities market, the crude oil price went up 0.30% to $86.05 as a new nuclear deal between Iran and the western countries is off the table and will not be signed in the foreseeable future, according to the conversation between Joe Biden and Yair Lapid (Prime Minister of Israel). Besides, the gold prices edged up by 0.06% to $1718.50 per troy ounce following the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CNY Mid-Autumn Moon Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | -0.6% | 0.3% | – |

| 14:00 | GBP –Manufacturing Production (MoM) (Jul) | -1.6% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 109.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

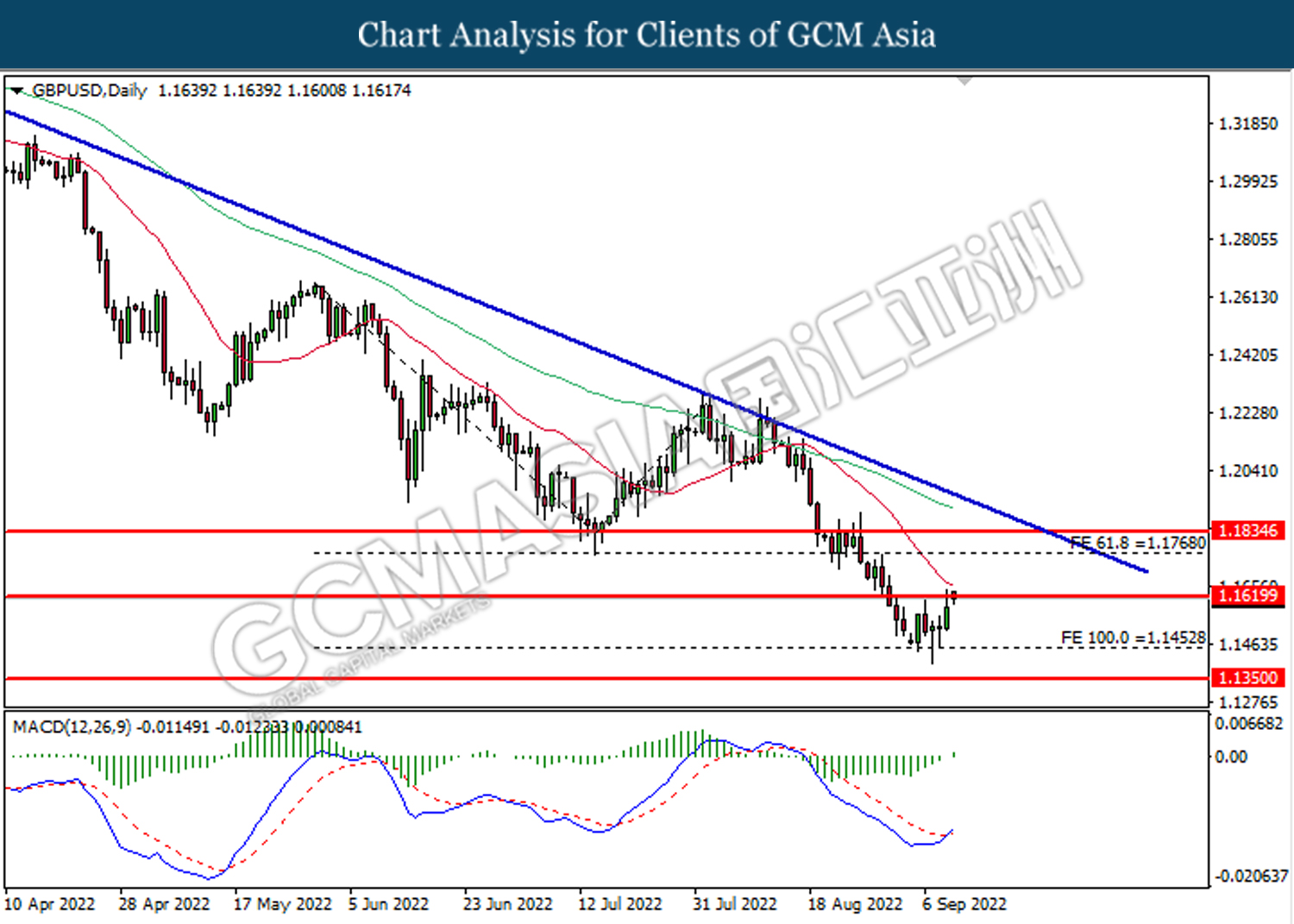

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1770

Support level: 1.1455, 1.1350

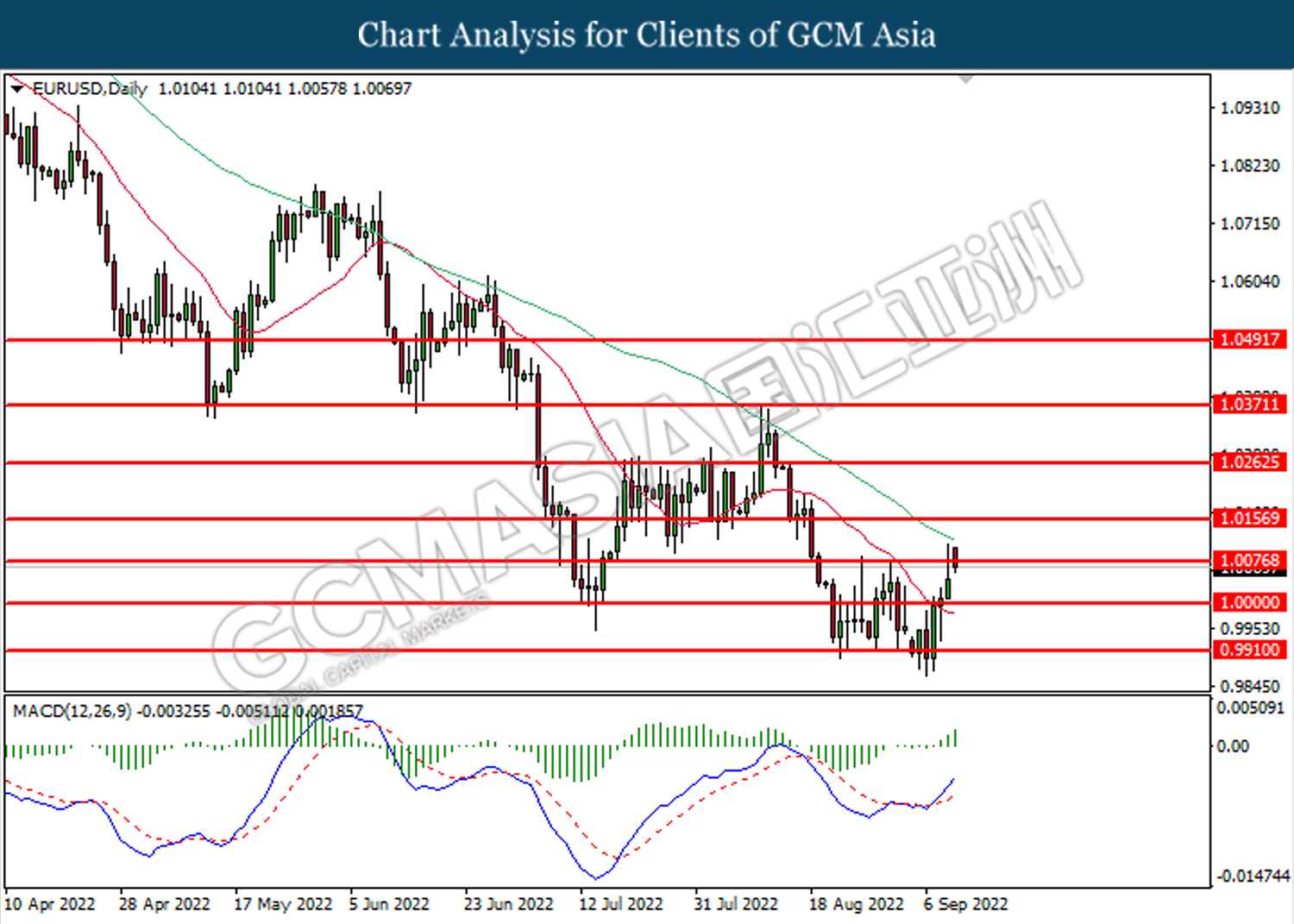

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 1.0000

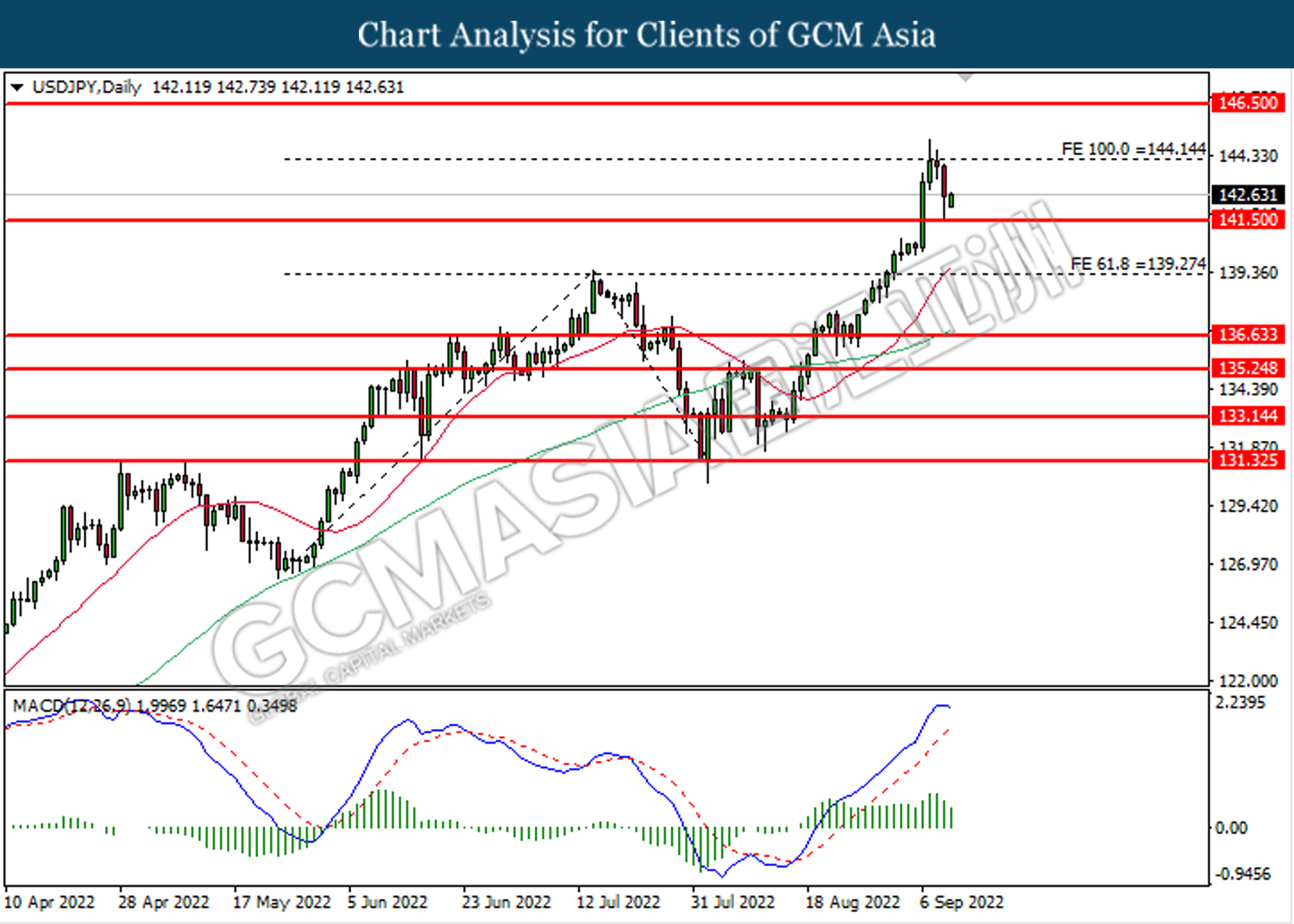

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 144.15. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

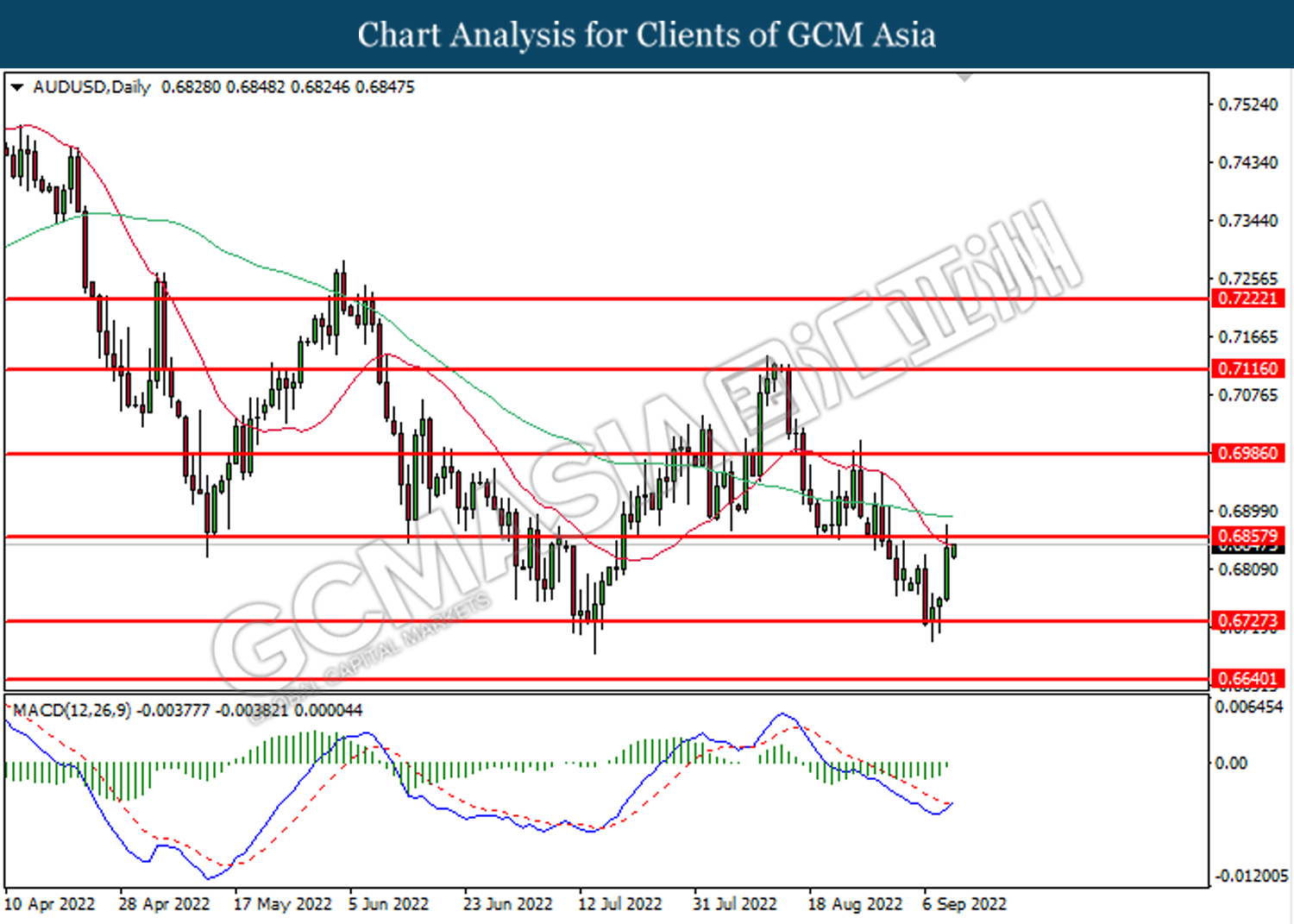

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

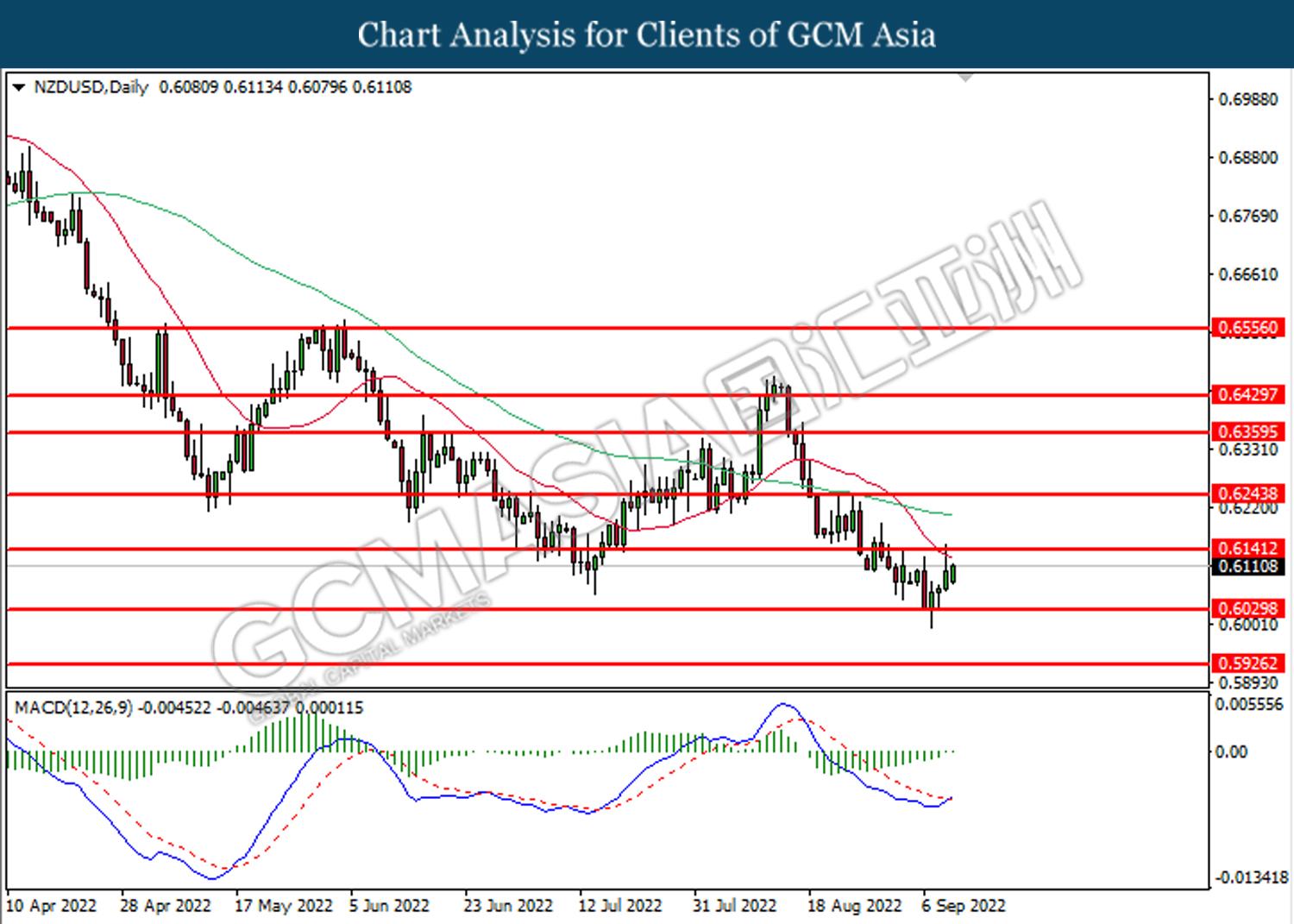

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6140.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3050. MACD which illustrated bearish bias momentum suggests the pair to extend losses toward the support level at 1.2985.

Resistance level: 1.3050, 1.3140

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 86.15, 89.45

Support level: 83.50, 80.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80