12 October 2022 Morning Session Analysis

Pound Sterling slipped as UK financial market remained fragile.

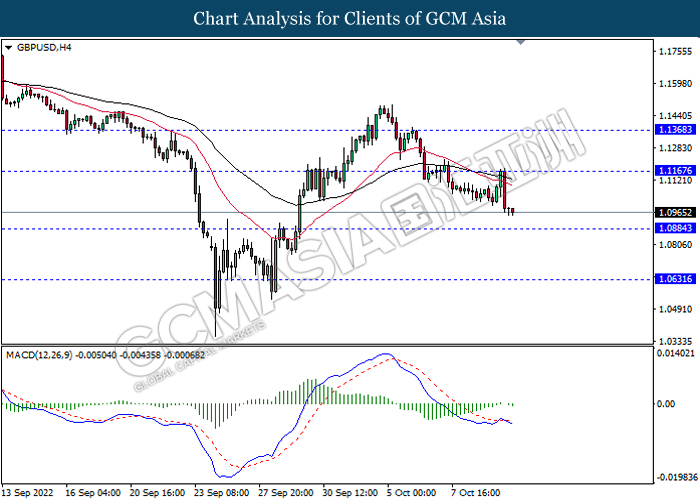

The GBP/USD, which is widely traded by global investors dropped significantly amid the instability of UK financial markets. According to CNBC, Bank of England Governor Andrew Bailey claimed on today early morning that the market volatility was over bank stress test, which lead a serious risk on the UK financial markets. Besides that, he reiterated that the bond buying program was “temporary”, saying that the support from the UK central bank is about to end soon while the gilts market condition still remained fragile, which diminishing the market confidence on the UK economic progression. Nonetheless, the losses experienced by Pound Sterling was limited over the upbeat economic data. According to Office for National Statistics, the UK Average Earnings Index + Bonus notched up from the previous reading of 5.5% to 6.0%, exceeding the consensus forecast of 5.9%. As of now, investors would continue to scrutinize the unleash of UK GDP data in order to gauge the likelihood movement of the pairing. As of writing, GBP/USD edged up by 0.10% to 1.0975.

In the commodities market, the crude oil price depreciated by 0.83% to $88.60 per barrel as of writing as China suffered another wave of Covid-19 pandemic, which prompted local authorities hastily closing schools, entertainment venues and tourist spots. On the other hand, the gold price eased by 0.83% to $1665.39 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.2% | 0.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Aug) | 0.1% | 0.2% | – |

| 20:30 | USD – PPI (MoM) (Sep) | -0.1% | 0.2% | – |

Technical Analysis

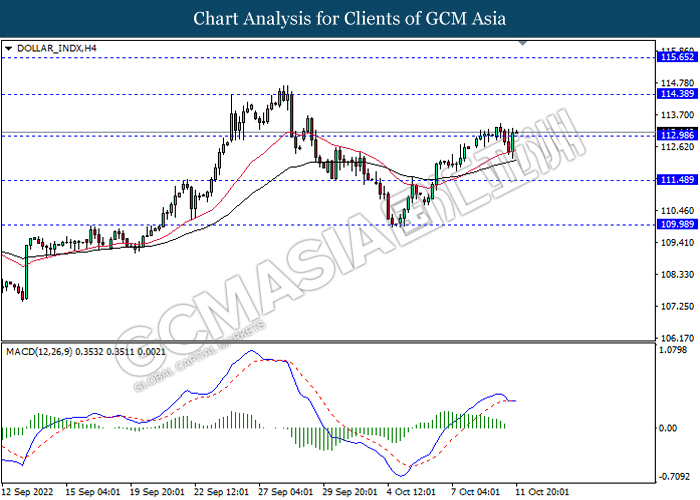

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.40, 115.65

Support level: 113.00, 111.50

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1165, 1.1370

Support level: 1.0885, 1.0630

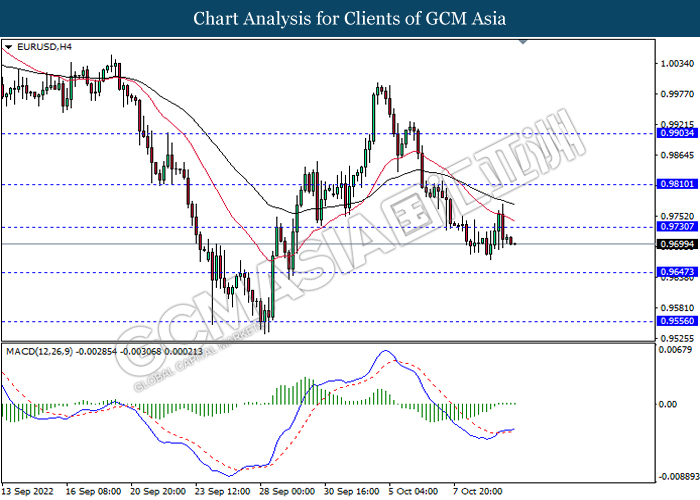

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9730, 0.9810

Support level: 0.9645, 0.9555

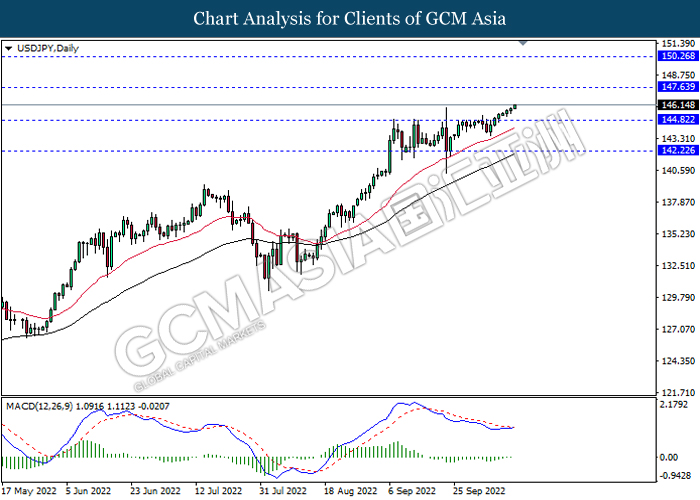

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

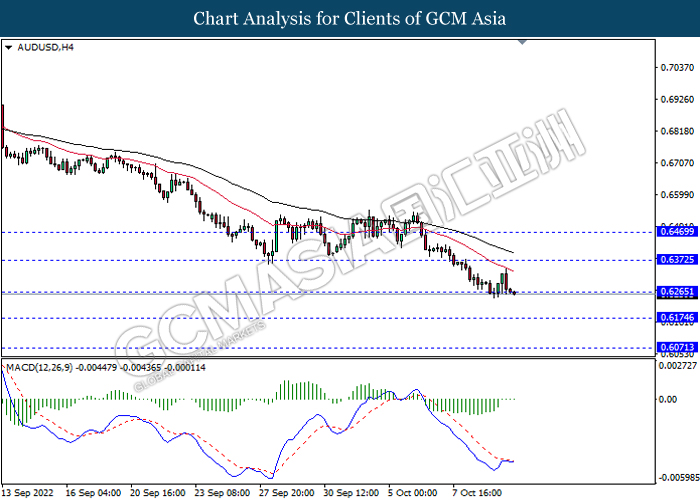

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6265, 0.6370

Support level: 0.6175, 0.6070

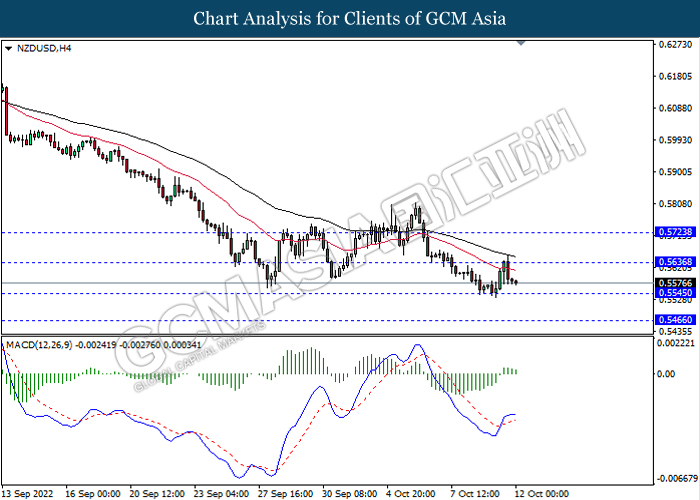

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.5635, 0.5725

Support level: 0.5545, 0.5465

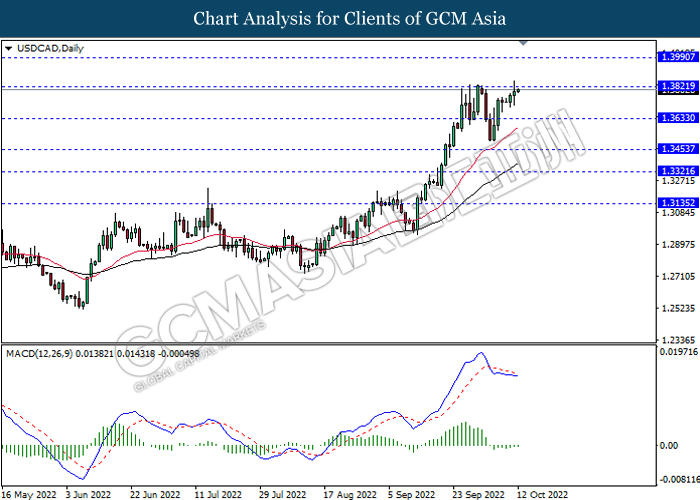

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

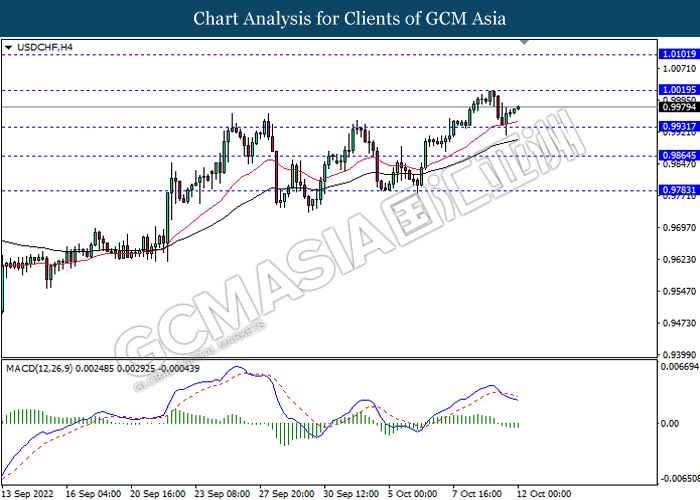

USDCHF, H4: USDCHF was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0020, 1.0100

Support level: 0.9930, 0.9865

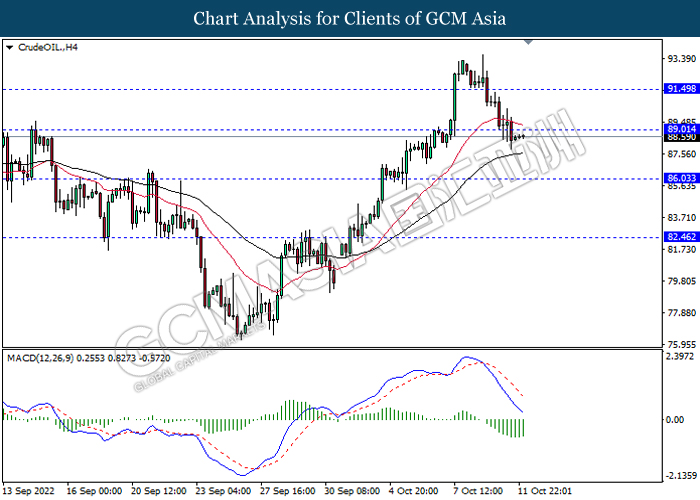

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.00, 91.50

Support level: 86.05, 82.45

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1678.65, 1693.95

Support level: 1659.90, 1637.75