12 November 2018 Afternoon Session Analysis

Dollar remains solid amid expected policy tightening.

US dollar continue to inch higher following increasing expectation on Fed to keep tightening monetary policy. Following an upbeat economy data and rising wage pressures, the Fed has reaffirmed its plan and expected to hike interest rate by 25 basis points in December. It is also speculated that there will be two more potential rate hikes by mid-2019. Besides that, Fed hawkish tone on last week policy meeting remains to provide support and bullish momentum for the dollar. As of writing, dollar index has rose 0.10% to 96.80. Meanwhile, GBP/USD has slumped 0.34% to 1.2927 at the time of writing amid continuous Brexit fears where negotiations remain stuck over backup plans for Ireland border issue if both countries unable to reach a deal.

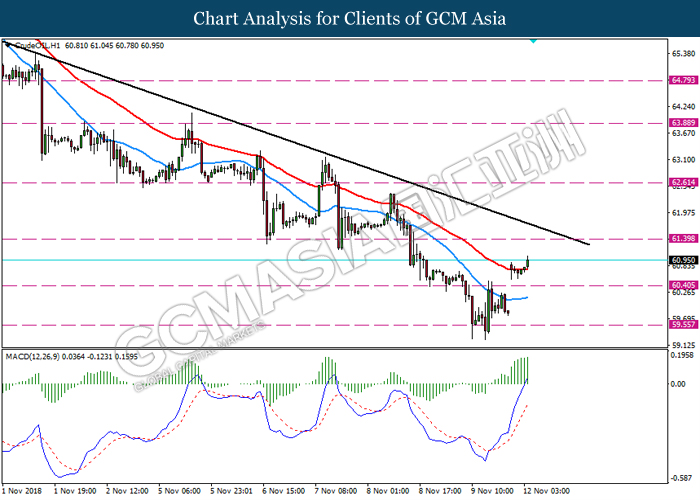

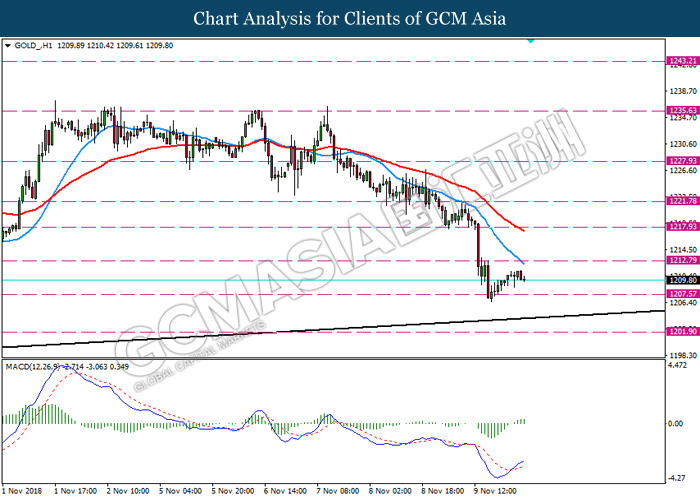

As for commodities market, crude oil price soars 1.67% to $60.80 per barrel after amid Saudi Arabia has announced a reduction in supply and plans to reduce oil supply to global markets by 0.5 million bpd in December. On the other hand, gold price recovers 0.04% to 1210.11 amid bid safe haven from equity selloffs.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:30 (13th) USD FOMC Member Daly Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

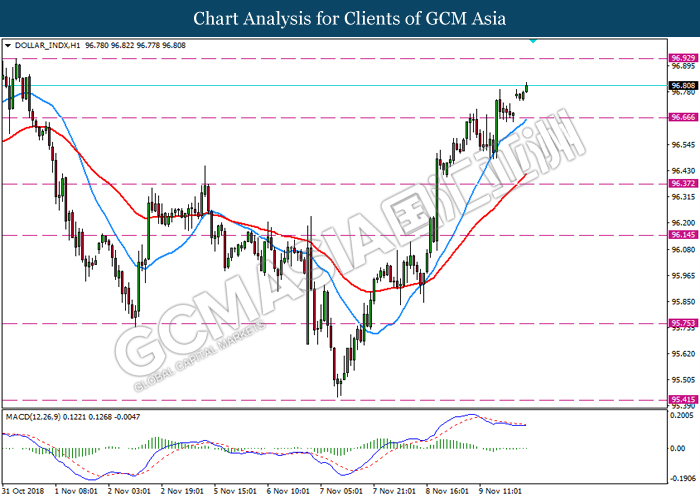

DOLLAR_INDX, H1: Dollar index was traded higher following prior breakout from the previous resistance level 96.65. MACD which indicated starting of bullish momentum suggest the pair to extend its gains towards the resistance level 96.90.

Resistance level: 96.90, 97.45

Support level: 96.40, 96.15

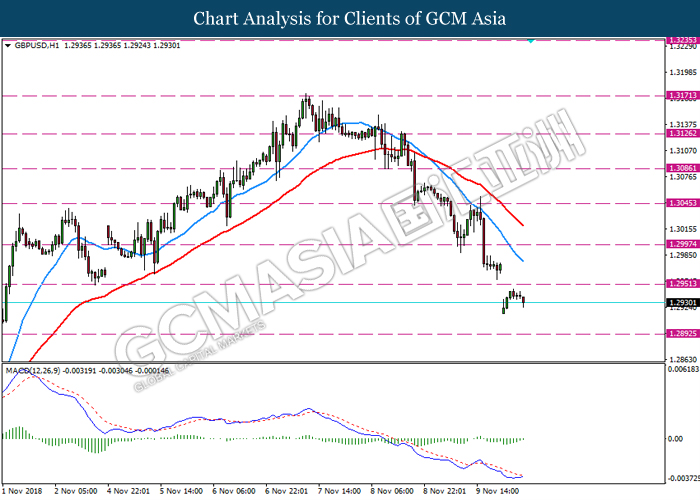

GBPUSD, H1: GBPUSD was traded lower following prior retracement near the resistance level 1.2950. MACD which show diminished bearish momentum suggest the pair to experience a short-term technical correction towards the resistance level 1.2950.

Resistance level: 1.2950, 1.2995

Support level: 1.2930, 1.2890

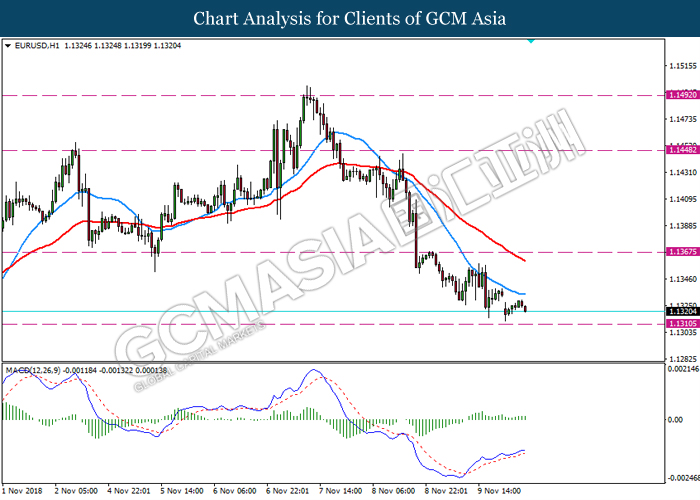

EURUSD, H1: EURUSD was traded lower while currently testing near the support level 1.1310. MACD which display bullish momentum with the formation of golden cross suggest the pair to traded higher in short term as a technical correction towards the resistance level 1.1365.

Resistance level: 1.1365, 1.1450

Support level: 1.1310, 1.1255

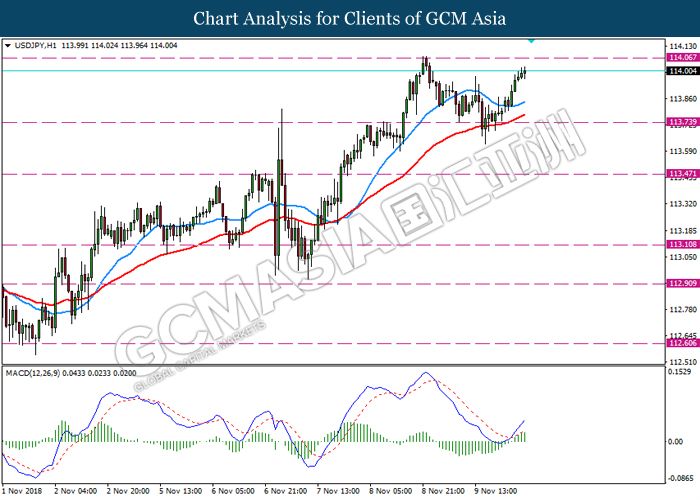

USDJPY, H1: USDJPY was traded higher following prior rebound from the support level 113.75. MACD which illustrate the formation of golden cross suggests the pair to extend its gains towards the resistance level 114.05

Resistance level: 114.05, 114.50

Support level: 113.75, 113.45

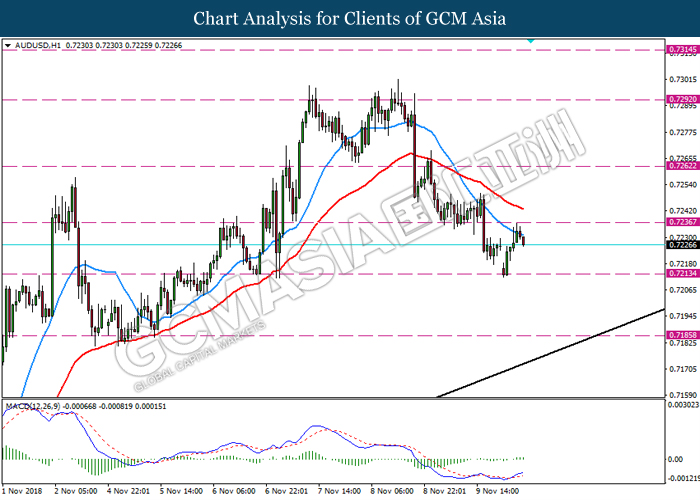

AUDUSD, H1: AUDUSD was traded lower following prior retracement from the resistance level 0.7235. Due to the lack of clear direction and signal from MACD, it is suggested to wait until further clear signal appears such as breakout from the nearest resistance or support level before entering the market.

Resistance level: 0.7235, 0.7260

Support level: 0.7215, 0.7185

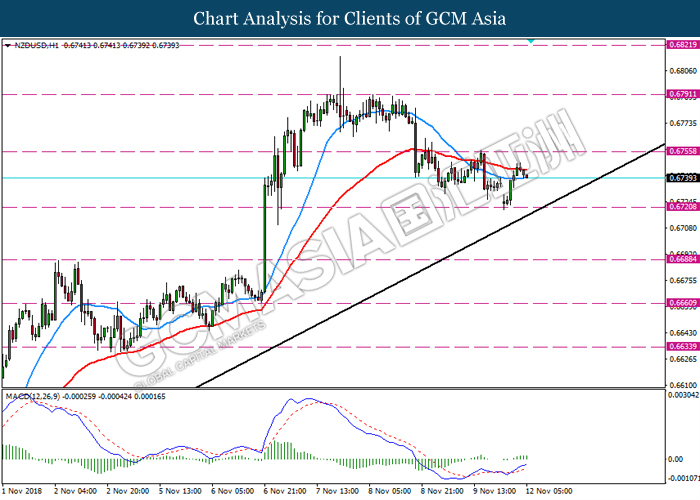

NZDUSD, H1: NZDUSD was traded higher following recent rebound from the support level 0.6720. Due to the lack of clear direction and signal from MACD, it is suggested to wait until further clear signal appears such as breakout from the nearest resistance or support level before entering the market.

Resistance level: 0.6755, 0.6790

Support level: 0.6720, 0.6690

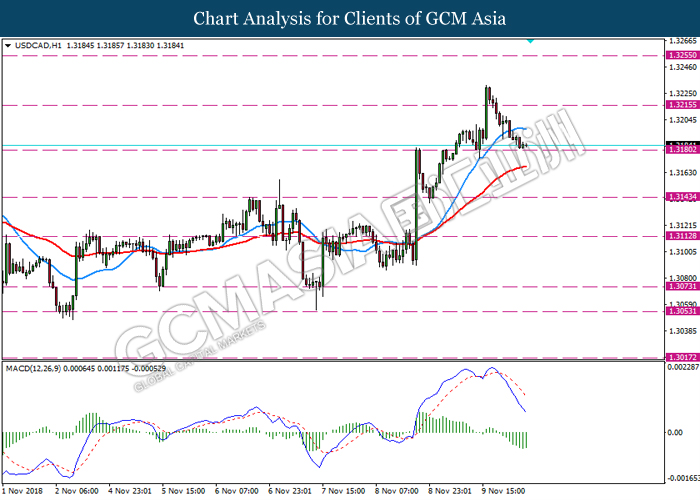

USDCAD, H1: USDCAD was traded lower while currently testing the support level 1.3180. MACD which illustrate diminished bearish momentum suggest the pair to experience a technical correction in short term towards the resistance level 1.3215.

Resistance level: 1.3215, 1.3255

Support level: 1.3180, 1.3145

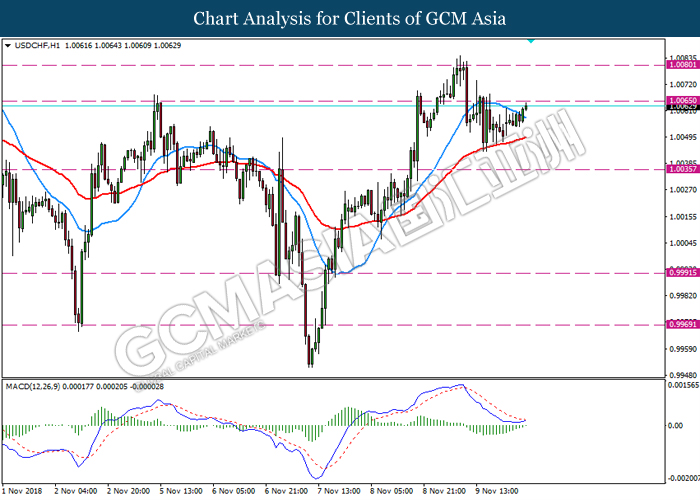

USDCHF, H1: USDCHF was traded higher while currently testing the resistance level 1.0065. MACD which illustrate bullish momentum with the starting formation of golden cross suggest the pair to extend gains after it breaks above the resistance level 1.0065.

Resistance level: 1.0065, 1.0080

Support level: 1.0035, 0.9990

CrudeOIL, H1: Crude oil was traded higher following prior breakout from previous resistance level 60.40. MACD which illustrate bullish momentum suggest the commodity to extend its gains towards the resistance level 61.40.

Resistance level: 61.40, 62.60

Support level: 60.40, 59.55

GOLD_, H1: Gold price was traded higher following recent rebound from the support level 1207.50. MACD which illustrate bullish momentum with golden cross suggest the pair extend its rebound towards the resistance level 1212.50

Resistance level: 1212.50, 1222.00

Support level: 1207.50, 1202.00