12 December 2018 Afternoon Session Analysis

Dollars gains amid Trump comments.

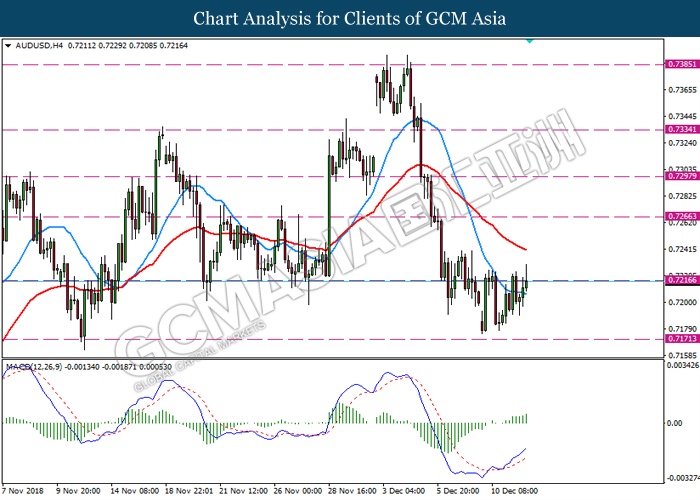

US dollar remains firm against its basket of six major rival pairs following optimistic statement by US President Donald Trump on US-China relations. Speaking to Reuters, US President Donald Trump have mentioned that he would intervene in the Huawei CFO arrest case if it could assist in attaining a trade deal with China and improve national security at the same time. Besides that, he also added that he is ready to meet China’s Premier Xi JinPing if it is necessary for trade negotiations which is currently taking place. Dollar index rose 0.05% to 97.25 as of writing. Meanwhile, AUDUSD recovers 0.17% to 0.7215 after slumping to one-month lows but remains stuck at 0.7200 level. The currency continues its oscillation after Westpac Consumer Confidence data disappoints with the reading of only 0.1%, lower than previous month reading of 2.8%. Besides that, overall sentiment towards the Australian counterpart was also affected by the trade war between China and US as Australia is the biggest trading partner with China.

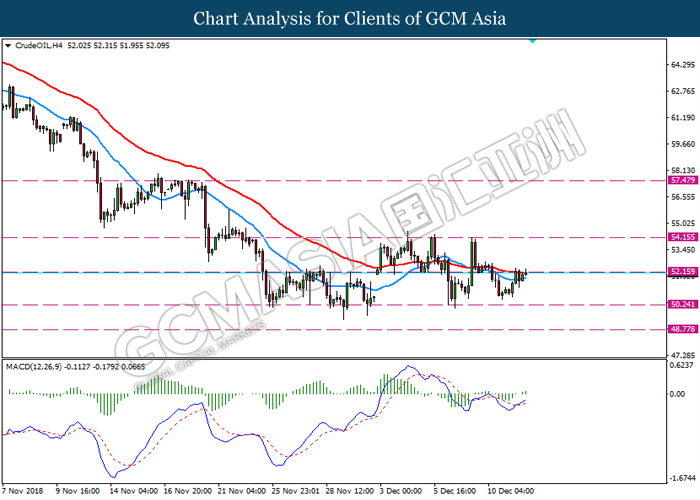

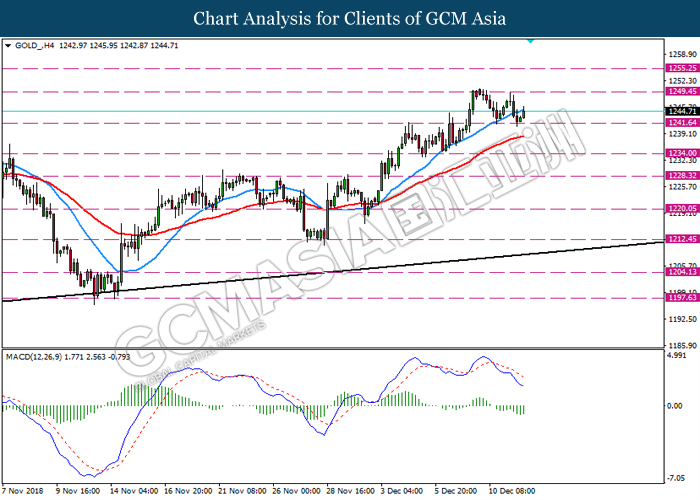

As for commodities market, crude oil price soars 0.40% to $52.15 per barrel as of writing amid Libyan oil supply shortage. According to reports, Libya’s national oil company has declared halt on its El Sharara field export after the field was attacked by a local militia group at weekend and 400,000 bpd are missing due to production interrupted by the militia group. On the other hand, gold price rebound 0.17% to $1245.09 from its lows amid safe haven asset demand increase due to uncertainty in US-China trade war.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:20 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.2% | 0.2% | – |

| 23:30 | CrudeOIL – EIA Crude Oil Inventories | -7.323M | -2.990M | – |

Technical Analysis

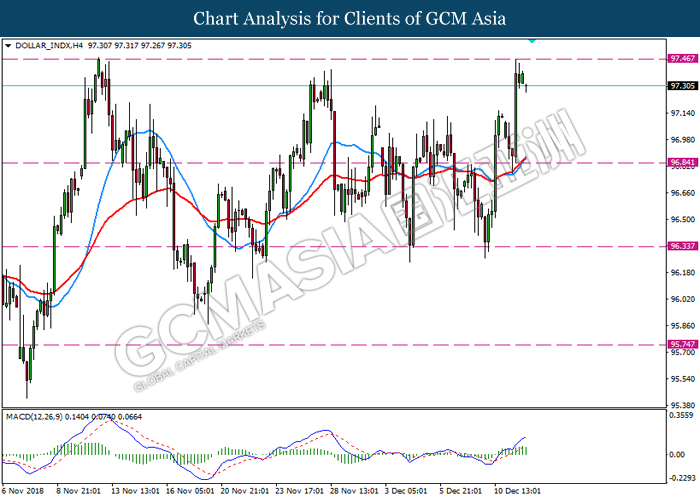

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level 97.45. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracements towards the support level 96.85.

Resistance level: 97.45, 98.30

Support level: 96.85, 96.35

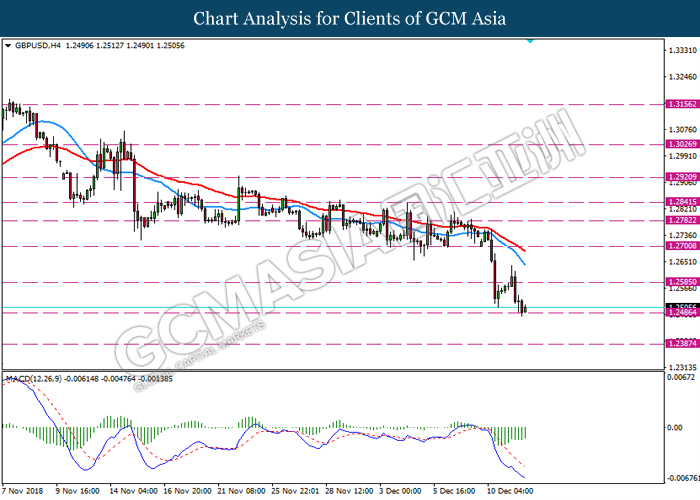

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level 1.2485. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.2585.

Resistance level: 1.2585, 1.2700

Support level: 1.2485, 1.2385

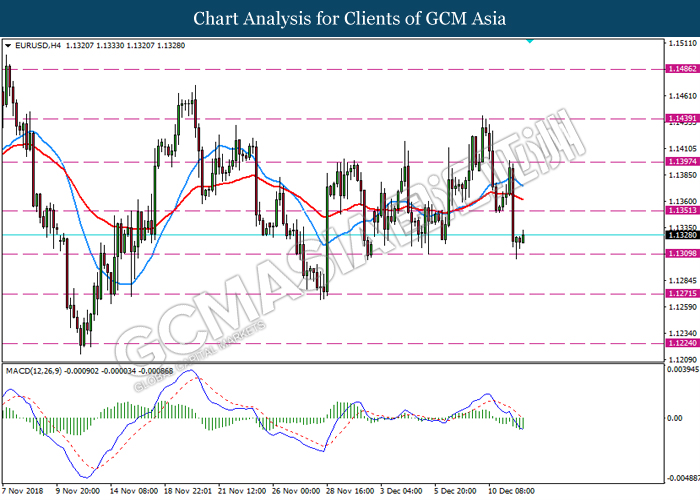

EURUSD, H4: EURUSD was trading higher following recent rebound from the support level 1.1350. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.1350.

Resistance level: 1.1350, 0.1395

Support level: 1.1310, 1.1270

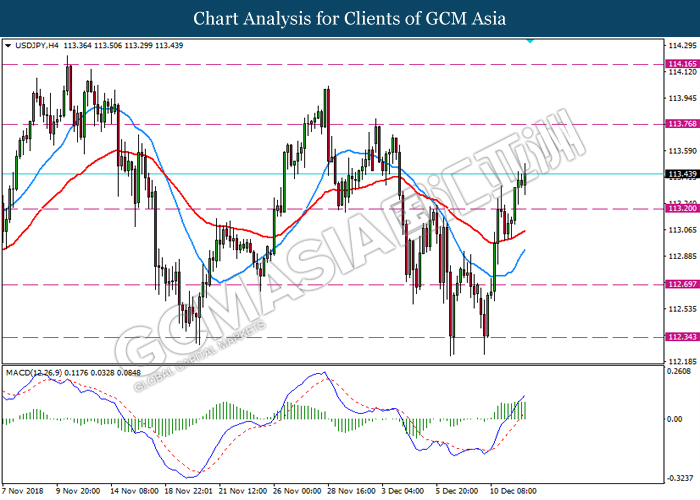

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 113.20. MACD which illustrate persistent bullish momentum suggest the pair extend its gains towards the resistance level 113.75.

Resistance level: 113.75, 114.15

Support level: 113.20, 112.70

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.7215. MACD which display bullish momentum with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 0.7215.

Resistance level: 0.7215, 0.7265

Support level: 0.7170, 0.7140

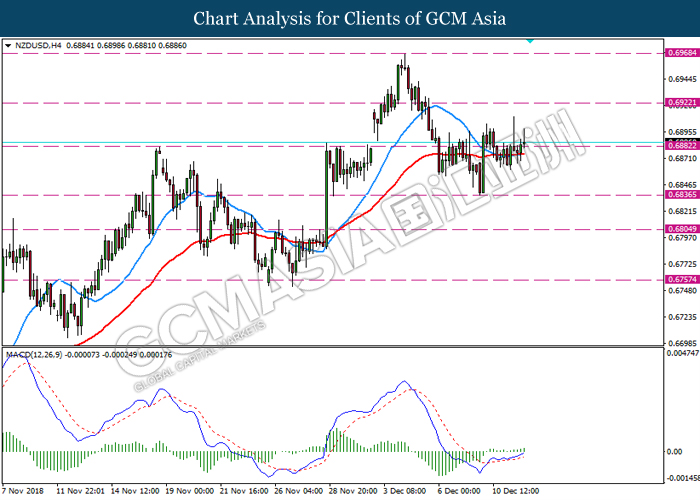

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6880. MACD which illustrate bullish momentum suggest the pair to extend its gains towards the resistance level 0.6920.

Resistance level: 0.6920, 0.6970

Support level: 0.6880, 0.6840

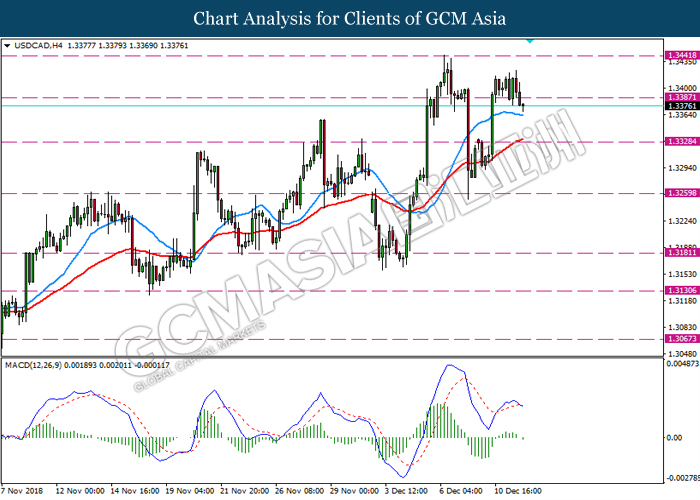

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3380. MACD which illustrate bearish bias with the formation of death cross suggest the pair to extend its retracement towards the support level 1.3330

Resistance level: 1.3385, 1.3440

Support level: 1.3330, 1.3260

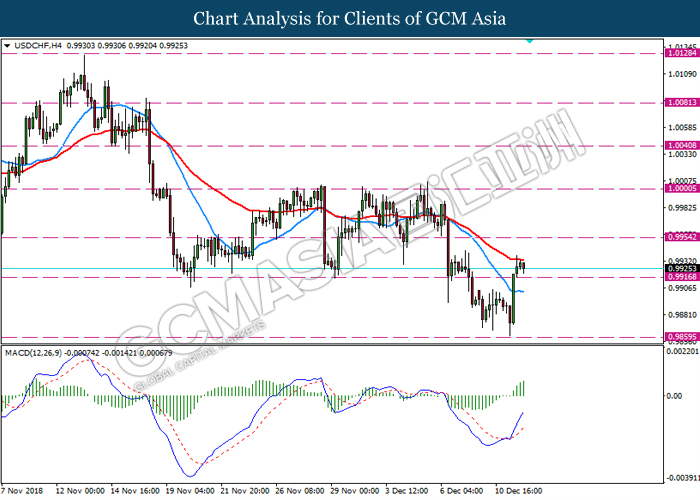

USDCHF, H4: USDCHF was traded higher following recent breakout above the previous resistance level 0. 9955.MACD which illustrate bullish momentum suggest the pair to extend its gains towards the resistance level 0.9955.

Resistance level: 0.9955, 1.0000

Support level: 0.9915, 0.9860

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 52.15. MACD which illustrate bullish bias with the formation of golden cross suggest the commodity to extend its gains after it breaks above the resistance level 52.12

Resistance level: 52.15, 54.15

Support level: 50.25, 48.75

GOLD_, H4: Gold was traded higher following recent rebound from the support level 1241.50. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its gains towards the resistance level 1249.50

Resistance level: 1249.50, 1255.25

Support level: 1241.50, 1234.00