12 December 2018 Morning Session Analysis

Sterling dejected over Brexit menace.

Greenback edges higher on Tuesday against other major currencies over the backdrop of optimistic US wholesale inflation data. The dollar index was quoted up 0.24%, last seen around 93.37 during Asian trading session. According to the Labor Department, its Core Producer Price Index increased by 0.3% for the month of November, above economist forecast for an increase of only 0.1%. Regrettably, the data failed to alter market expectation towards US Federal Reserve as investors continued to price in at only 76% chance for an interest rate hike next week. Furthermore, prior softness in US economic data such as GDP and Nonfarm Payrolls has kept a lid over market’s optimism upon future economic growth outlook. On the other hand, pound sterling extended its losses for second consecutive day following higher Brexit and political uncertainty in Britain. Question’s over UK Prime Minister Theresa May’s future continue to arise as she made little progress in convincing lawmakers in Brussels to amend the terms of her Brexit deal. In addition, reports showed that several UK lawmakers have sent letters of “No Confidence” against her, raising doubt over her future. Pair of GBP/USD was down 0.03% to 1.2493 as of writing.

As for commodities market, crude oil price rose 0.13% to $51.98 during Asian trading session. Oil prices ended higher on yesterday as investor’s poured in to buy back from a lower price range. However, volatility on the commodity is expected following contradicting signals in the market between rising US oil output and OPEC’s decision to cut oil supply next year. On the other hand, gold price ticked down 0.02% to $1,243.12 a troy ounce as dollar rises.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:20 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.2% | 0.2% | – |

| 23:30 | CrudeOIL – EIA Crude Oil Inventories | -7.323M | -2.990M | – |

Technical Analysis

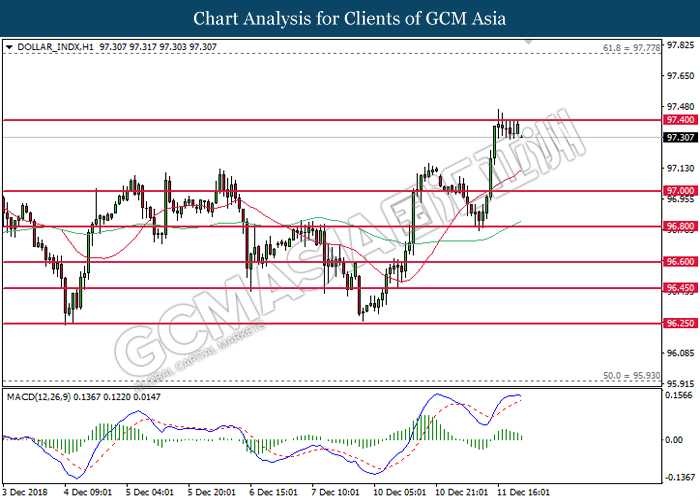

DOLLAR_INDX, H1: Dollar index was traded lower following prior retrace from the strong resistance of 97.40. MACD which illustrate diminished upward momentum suggests the index to be traded lower in short-term as technical correction.

Resistance level: 97.40, 97.80

Support level: 97.00, 96.80

GBPUSD, Daily: GBPUSD extended its losses after closing below the strong support of 1.2700. MACD which illustrate bearish signal suggests the pair to extend its losses after closing below the target at 1.2500.

Resistance level: 1.2700, 1.2900

Support level: 1.2500, 1.2380

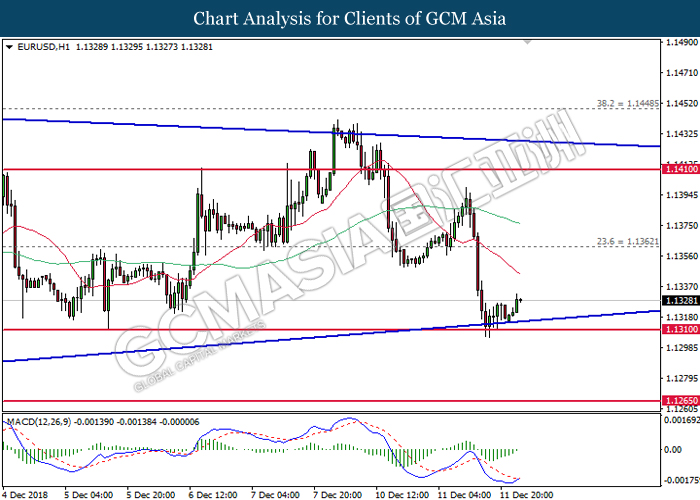

EURUSD, H1: EURUSD was traded higher following prior rebound from the support level at 1.1310. MACD which begins to form a bullish signal suggests the pair to be traded higher in short-term, towards the direction of 1.1360.

Resistance level: 1.1360, 1.1410

Support level: 1.1310, 1.1265

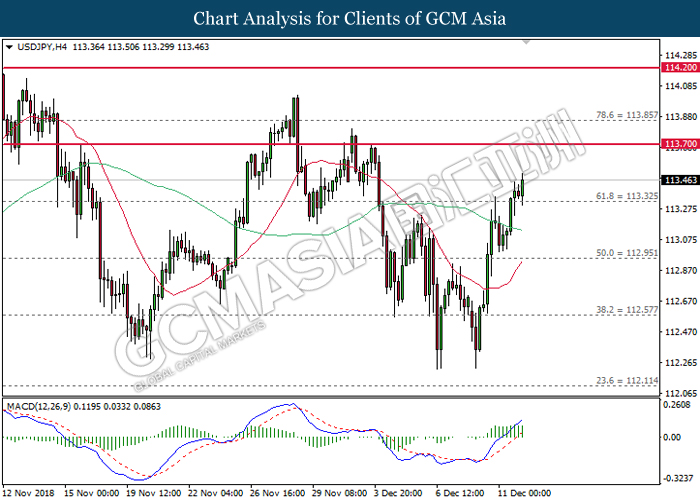

USDJPY, H4: USDJPY was traded higher following prior closure above 113.30. MACD which illustrate bullish signal suggests the pair to advance further upwards, towards the direction of 113.70.

Resistance level: 113.70, 113.85

Support level: 113.30, 112.95

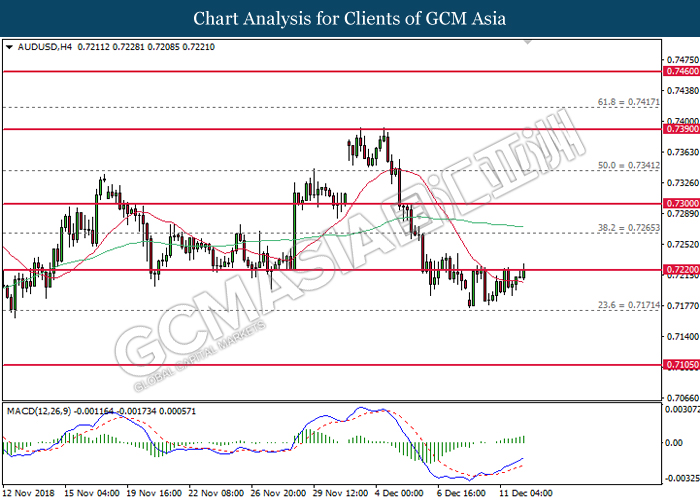

AUDUSD, H4: AUDUSD was traded higher following prior rebound from 0.7170. MACD which illustrate bullish signal suggests the pair to extend its gains after successfully closing above the resistance level near 0.7220.

Resistance level: 0.7220, 0.7265

Support level: 0.7170, 0.7105

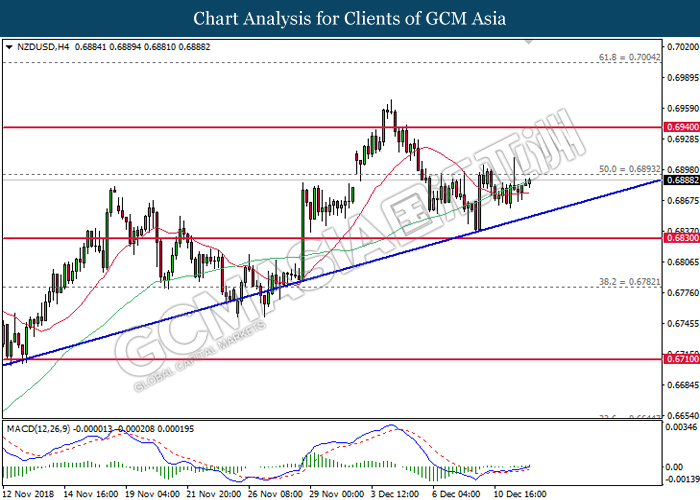

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the upward trendline. MACD which illustrate bullish signal suggests the pair to extend its gains further after closing above the resistance level near 0.6890.

Resistance level: 0.6890, 0.6940

Support level: 0.6830, 0.6780

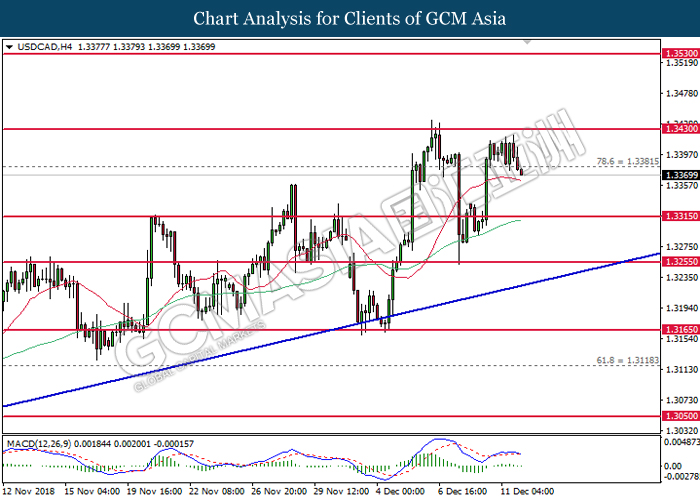

USDCAD, H4: USDCAD was traded lower following prior formation of double top with strong resistance near 1.3430. MACD which illustrate bearish signal suggests the pair to extend its losses, towards the direction of 1.3315.

Resistance level: 1.3380, 1.3430

Support level: 1.3315, 1.3255

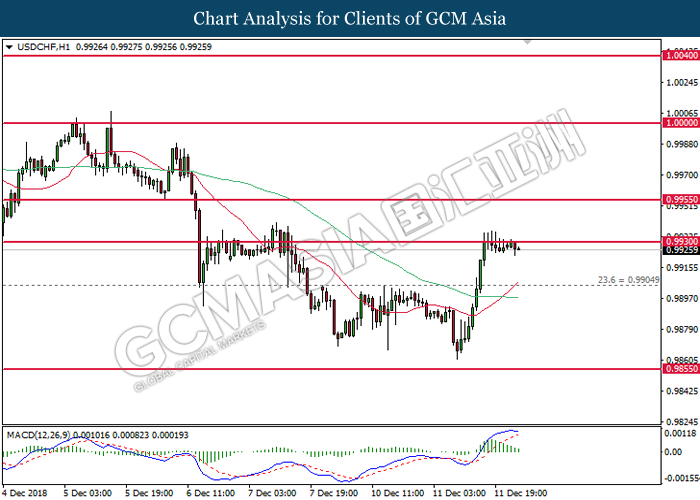

USDCHF, H1: USDCHF was traded flat and currently testing near the resistance of 0.9930. MACD which illustrate diminishing upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9930, 0.9955

Support level: 0.9905, 0.9855

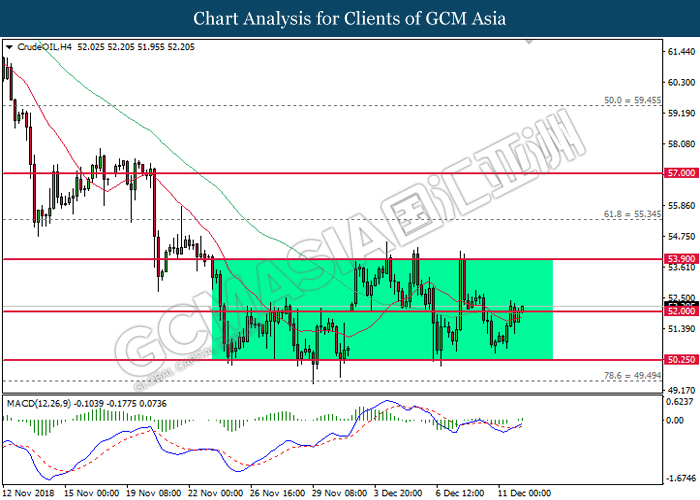

CrudeOIL, H4: Crude oil price remains traded within a sideways channel following prior rebound from the lower level. MACD which illustrate bullish signal suggests the commodity price to extend its gains in short-term, towards 53.90.

Resistance level: 53.90, 55.35

Support level: 52.00, 50.25

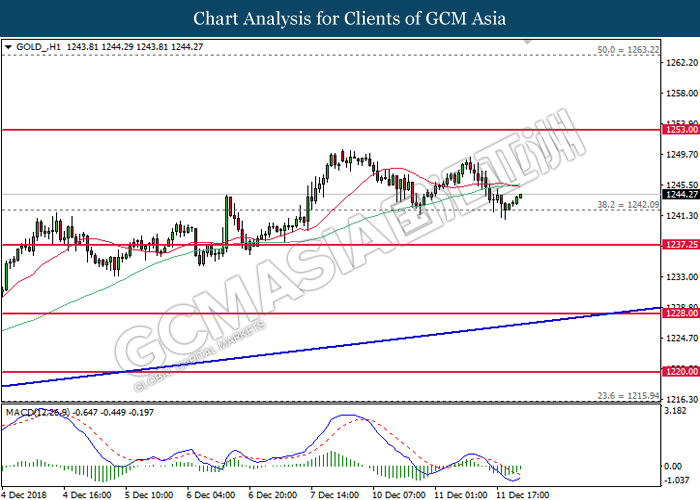

GOLD_, H1: Gold price was traded higher following prior rebound from the strong support at 1242.10. MACD which illustrate diminishing downward momentum suggests its prices to extend its gains, towards the direction of 1253.00.

Resistance level: 1253.00, 1263.20

Support level: 1242.10, 1237.25