13 January 2023 Afternoon Session Analysis

Pound surged ahead of GDP data.

The Pound sterling, which was mainly traded by global investors, extended its rally during the early Asian trading session as the downbeat US CPI data boosted the appeal of riskier assets. According to the US Bureau of Statistics, the nation’s CPI plummeted from the prior month’s reading of 7.1% to 6.5% in the month of December 2022. The inflationary pressures continued to ease in December amid the steep drop in energy prices, especially gasoline. With that, the pair of GBP/USD skyrocketed ahead of the announcement of GDP data. At this juncture, the UK GDP data is highly focused on by the investors as the data could provide a further picture of the UK economic performance. Prior to that, the Bank of England (BoE) had given a pessimistic view toward the economic outlook of the nation, whereby they were expecting the country would be trapped in a recession or economic downturn until the end of 2023. As of writing, the pair of GBP/USD edged up by 0.02% to 1.2200.

In the commodities market, the crude oil price was down by -0.18% to $78.15 per barrel after recording some gains during the previous trading session amid the sharp decline in the value of the US dollar. Besides, gold prices rose by 0.07% to $1898.15 per troy ounce following the release of downbeat CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) | 1.5% | 0.3% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Nov) | 0.70% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar was traded lower following a prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum with death cross signal suggested the index extend its losses toward the support level at 101.65.

Resistance Level: 103.15, 104.55

Support Level : 101.65, 100.30

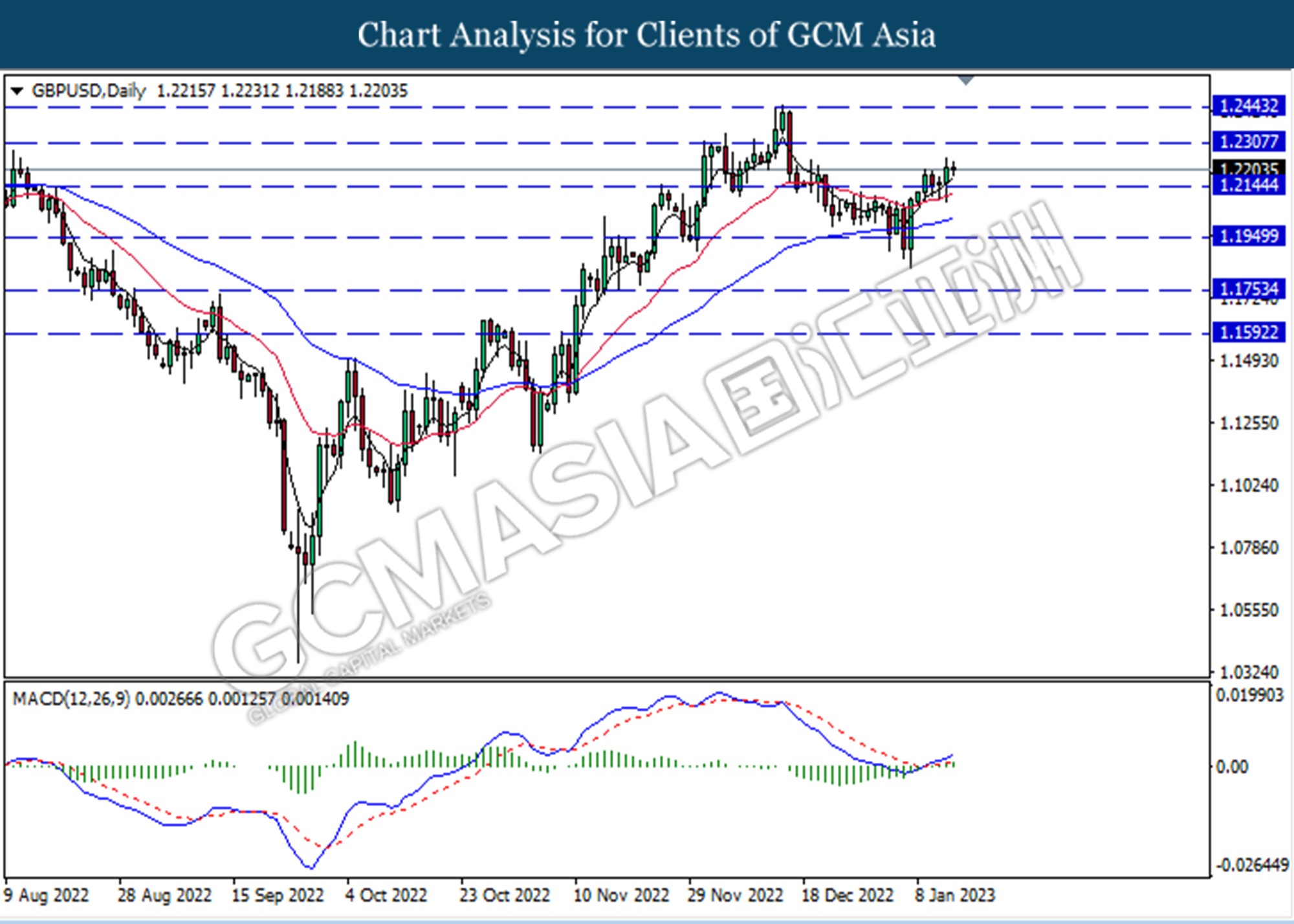

GBPUSD, Daily: GBPUSD was traded higher following a prior rebound from the support level at 1.2145. MACD which illustrated increasing bullish momentum suggested the pair extend its gains toward the resistance level at 1.2305.

Resistance Level:1.2305, 1.2440

Support Level :1.2145, 1.1950

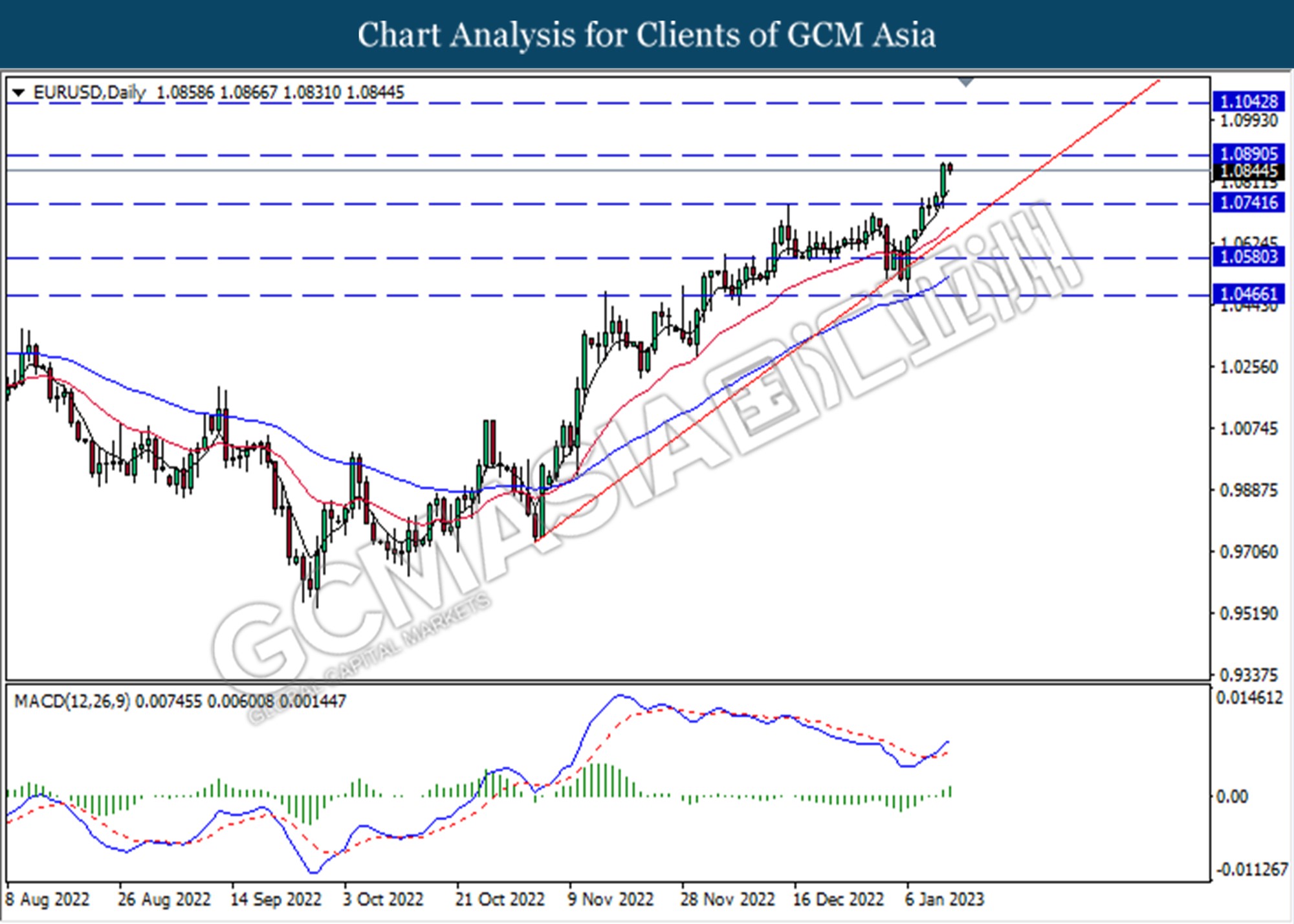

EURUSD, Daily: EURUSD was traded higher following a prior break above the previous resistance line. MACD which illustrated increasing bullish momentum suggested the pair extend it gains towards resistance level at 1.0890.

Resistance Level: 1.0890, 1.1040

Support Level : 1.0740, 1.0580

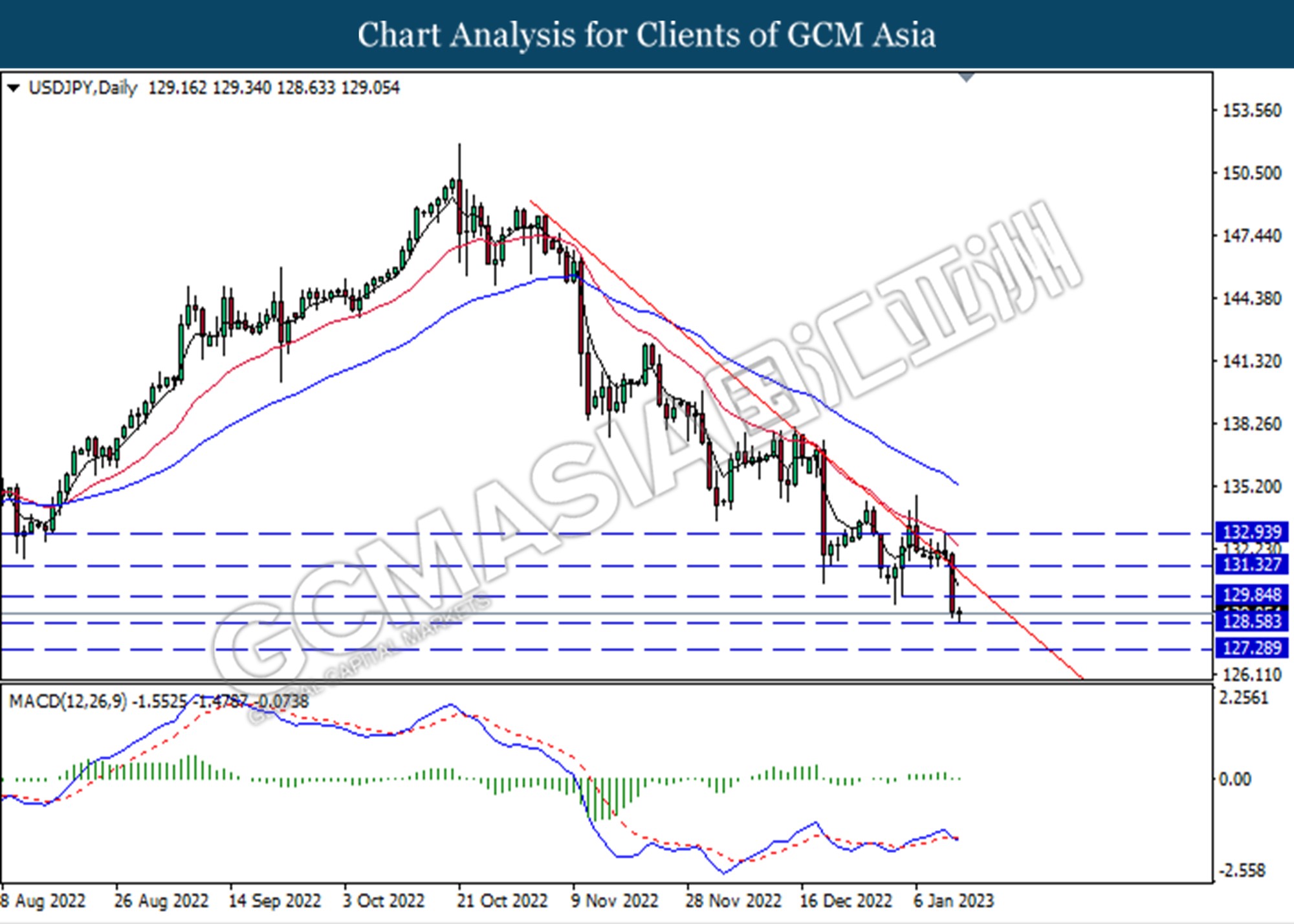

USDJPY, Daily: USDJPY was traded lower following a prior break below the previous support level. MACD which illustrated bearish bias momentum suggested the pair extend it losses if successfully break below the support at 128.60.

Resistance Level: 129.85, 131.30

Support Level : 128.60, 127.30

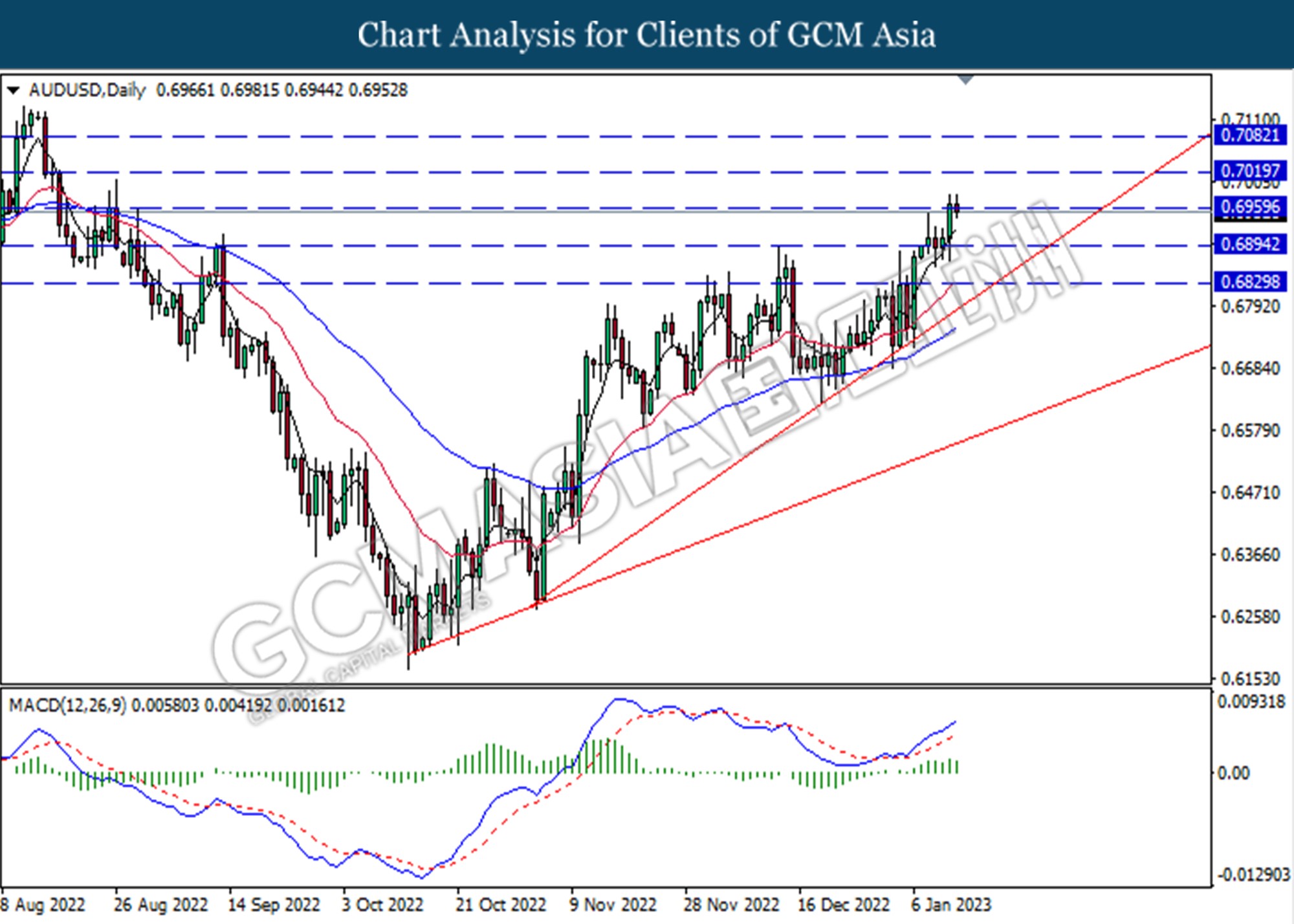

AUDUSD, Daily: AUDISD was traded higher currently testing for resistance level at 0.6960. MACD which illustrated increasing bullish momentum suggested the pair extend its gains if successfully break above the resistance level.

Resistance Level: 0.6960, 0.7020

Support Level : 0.6895, 06830

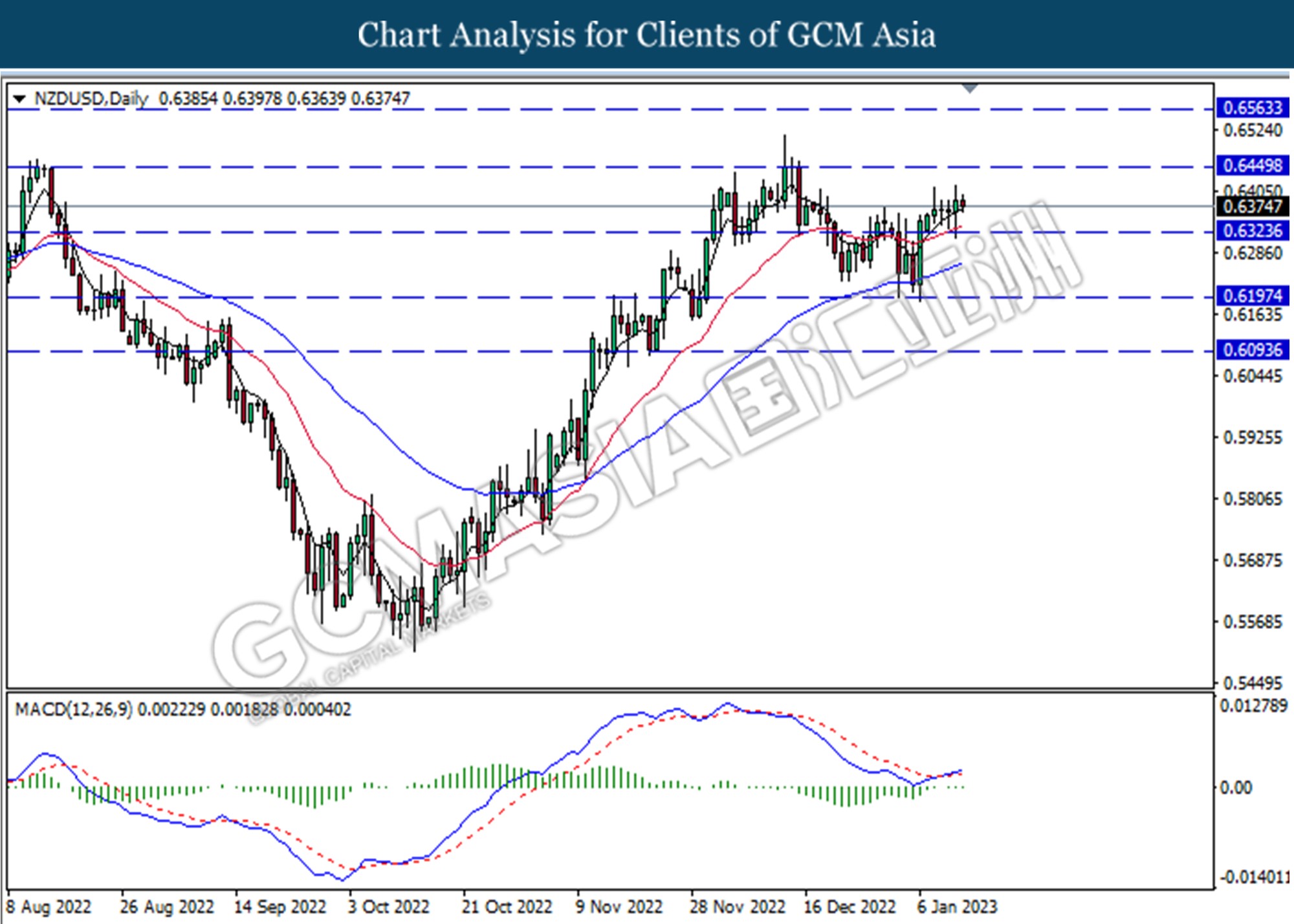

NZDUSD, Daily: NZDUSD was traded higher following a prior rebound from support level at 0.6325. MACD which illustrated diminishing bearish bias momentum suggested the pair extend its gains toward resistance level at 0.6450.

Resistance Level: 0.6450, 0.6565

Support Level : 0.6320, 0.6200

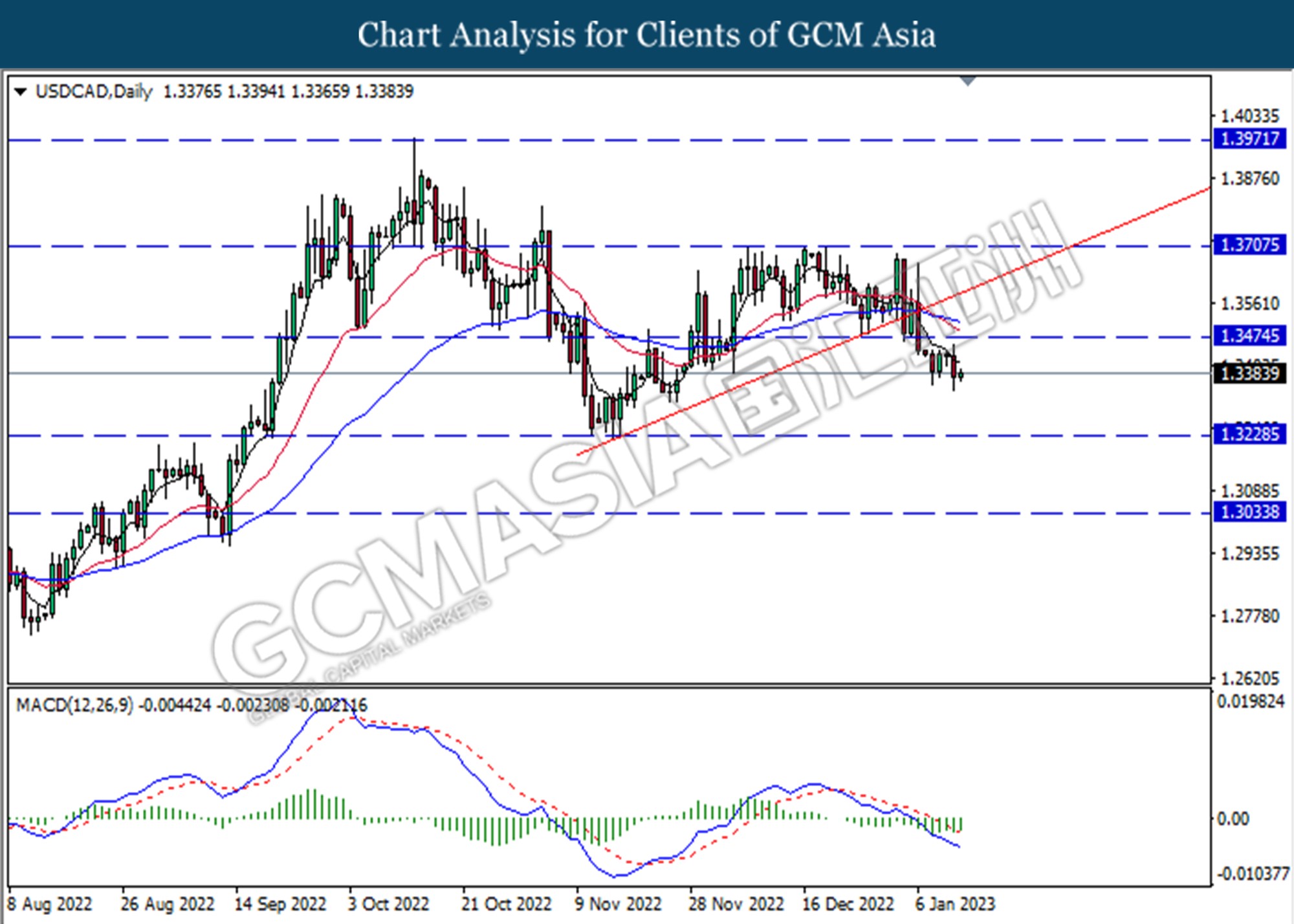

USDCAD, Daily: USDCAD was traded lower following a prior break below the previous support level at 1.3475. MACD which illustrated increasing in bullish momentum suggested the pair extend its losses toward support level at 1.3230 level.

Resistance Level: 1.3475, 1.3705

Support Level : 1.3230, 1.3035

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.9255. However, MACD which illustrated decreasing in bullish momentum suggested the pair will undergo technical correction in short-term.

Resistance Level: 0.9320, 0.9360

Support Level : 0.9255, 0.9215

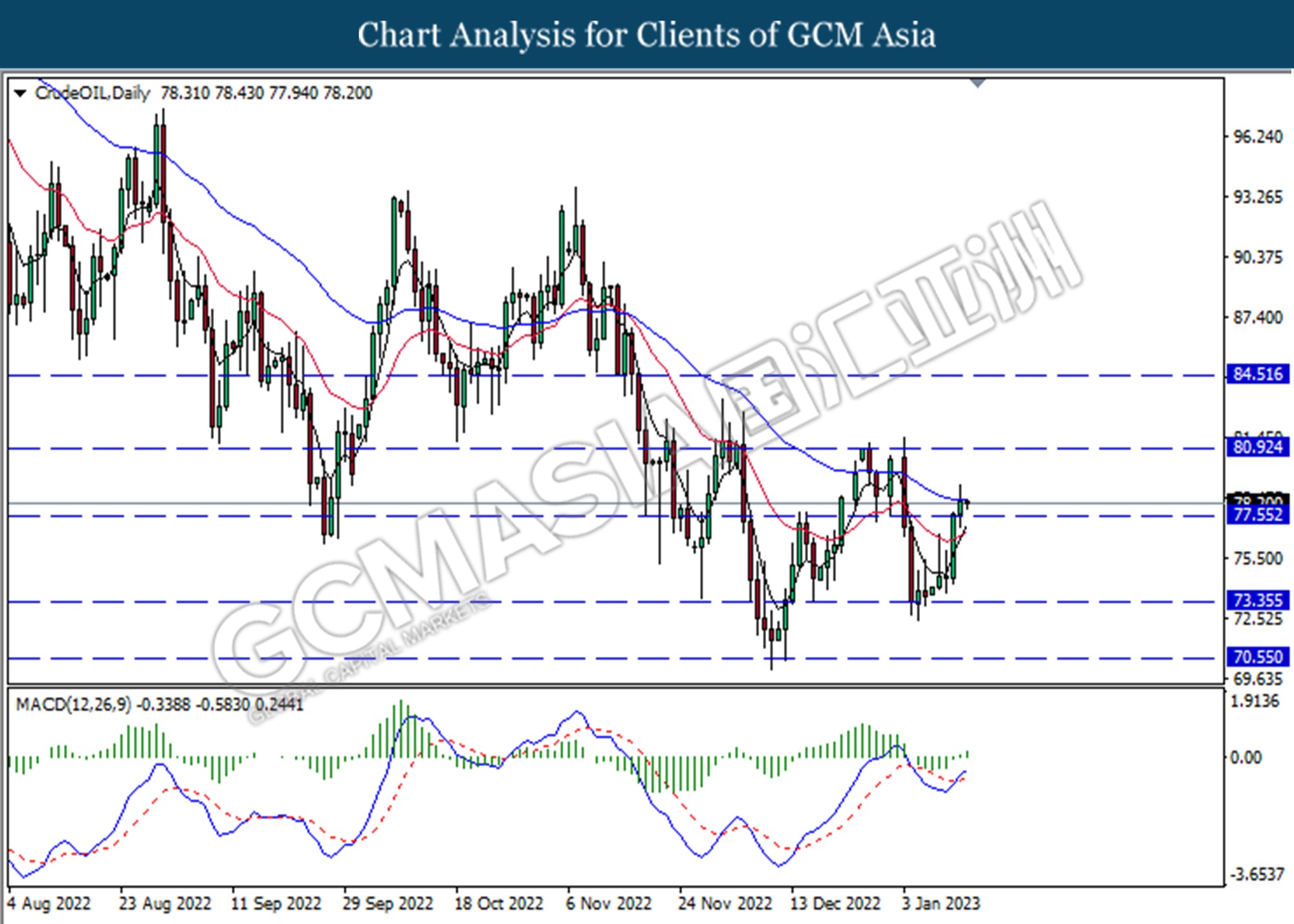

CrudeOIL, Daily: Crude oil was traded higher following a prior breakout above the previous resistance level. MACD which illustrated increasing in bullish momentum suggested the commodity will extend its gains toward resistance level at 80.90.

Resistance Level: 80.95, 84.50

Support Level : 77.55, 73.35

GOLD, Daily: Gold was traded higher following a prior break above the previous resistance level. MACD which illustrated bullish bias momentum suggested the commodity will extend its gains towards resistance level at 1917.50.

Resistance Level: 1917.50, 1950.50

Support Level :1894.30, 1867.85