13 January 2023 Morning Session Analysis

US Dollar plunged after the essential inflation data announced.

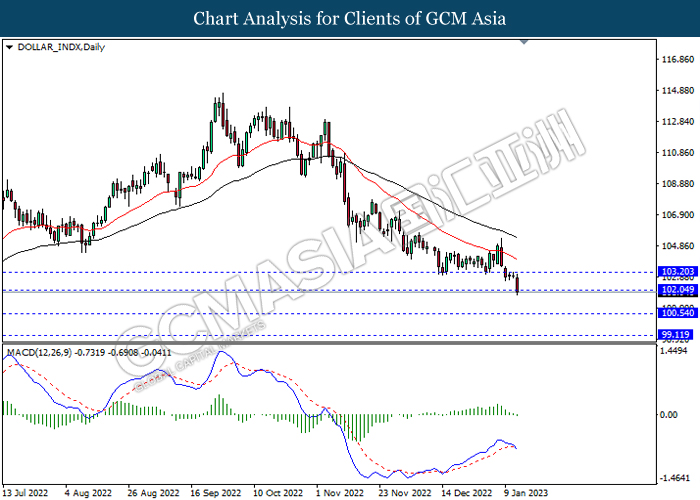

The Dollar Index which traded against a basket of six major currencies received a significant bearish momentum following the inflationary risk in the US was lowered, which buoyed the expectation of lower rate hikes by Fed. According to the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) MoM for December notched down from the previous reading of 0.1% to -0.1%, which is the first decline since June 2020. Last year, the US central bank had aggressively raised their interest rate as they committed to bring down the spiking inflation risk. As of now, the rate hike path has come out with a desired effect, as well as the market participants was anticipating that Fed would likely to scale back its rate hike pace. However, the losses experienced by US Dollar was limited after Fed members reiterated their aggressive rate hike stance. St. Louis Fed President James Bullard claimed on yesterday that the inflation target had went in the right direction. Nonetheless, he suggested the US central bank to increase its rate by exceeding 5% as soon as possible following the inflation remains far above the Fed’s 2% target. As of writing, the Dollar Index eased by 0.90% to 102.00.

In the commodity market, the crude oil price dropped by 0.05% to $78.25 per barrel as of writing. Yesterday, the oil price spiked over the reducing of inflation risk in the US has dialed down the worries of recession. On the other hand, the gold price appreciated by 0.05% to $1897.64 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) | 1.5% | 0.3% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Nov) | 0.70% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

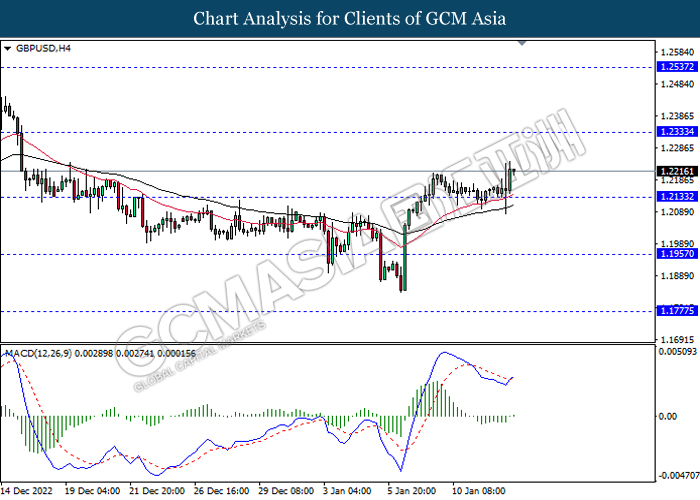

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

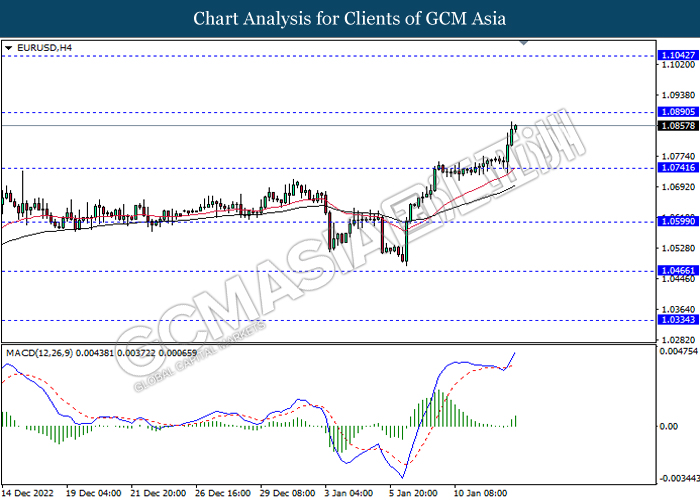

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0890, 1.1040

Support level: 1.0740, 1.0600

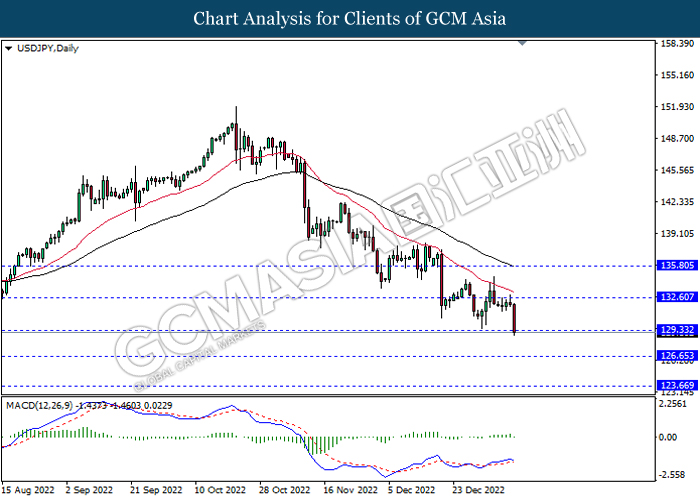

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 129.35, 132.60

Support level: 126.65, 123.65

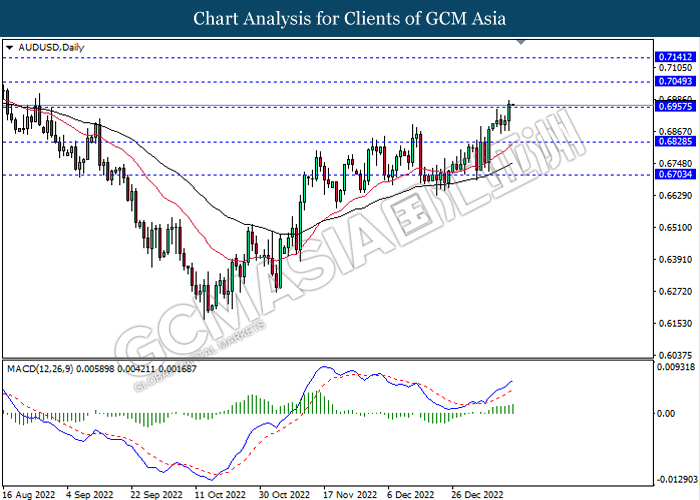

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7050, 0.7140

Support level: 0.6955, 0.6830

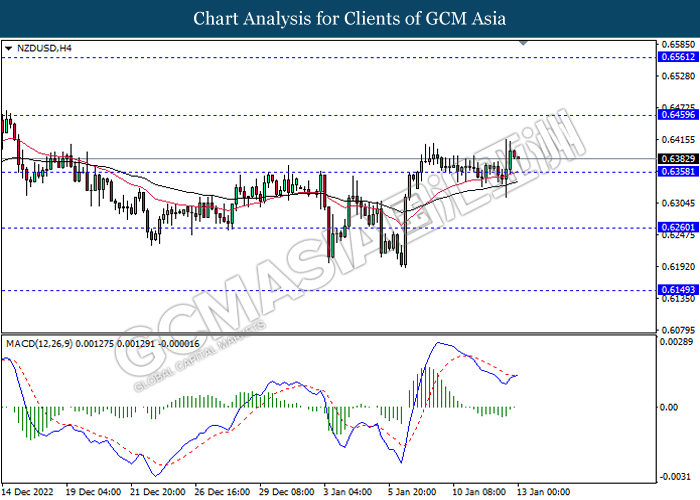

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

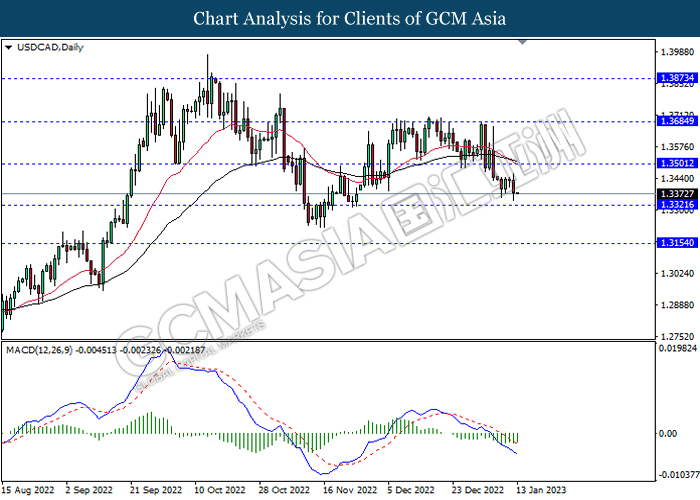

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3155

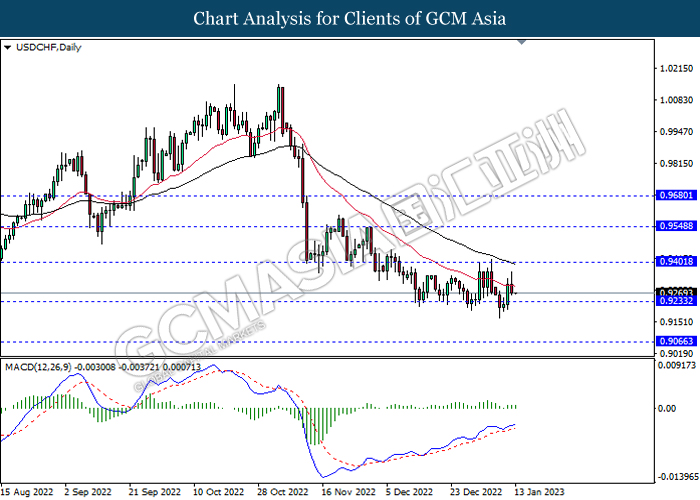

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

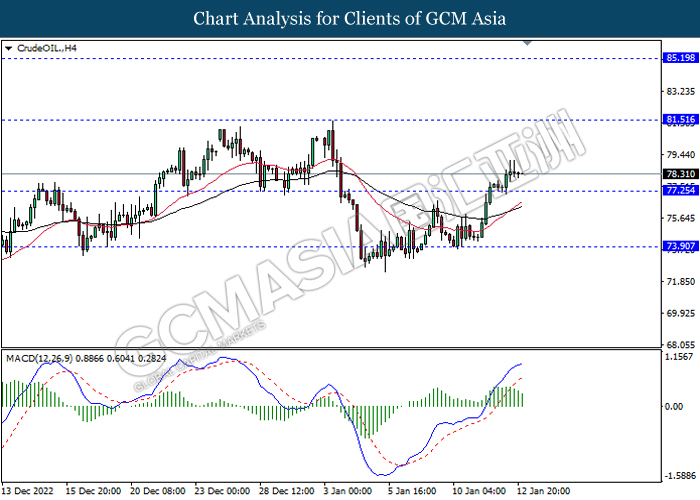

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

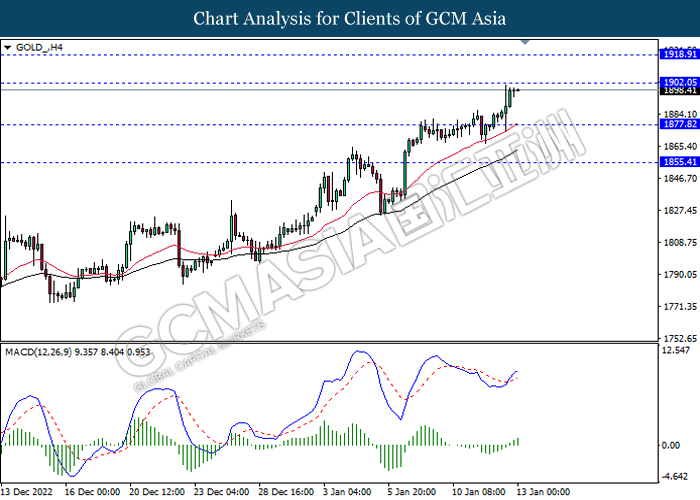

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1902.05, 1918.90

Support level: 1877.80, 1855.40