13 March 2023 Morning Session Analysis

US Dollar dived after disappoint jobs data unleashed.

The Dollar Index which traded against a basket of six major currencies slumped on last Friday after the downbeat economic data has been released. According to Bureau of Labor Statistics, the US Nonfarm Payrolls posted at the reading of 311K, which is better than the consensus forecast of 205K. However, the US Dollar received significant bearish momentum after the unemployment rate has unexpectedly increased in February. The US Unemployment Rate has notched up from the previous reading of 3.4% to 3.6%, which signaling the recent labor market in the US had become fragile. Following to that, the anticipation of 50 basis point rate hike has been reduced. According to CME FedWatch Tool, the likelihood of half-percentage rate increase has dropped from the prior 40.2% to 39.5%. Though, the losses experienced by the Dollar Index was limited following the closing of SVB Financial Group, while it suggested that a serious economic crisis is brewing. As a safe-haven assets, the US Dollar has been put under the spotlight by investors. On the economic data front, investors would highly eye on the announcement of CPI data which scheduled on tomorrow in order to gauge the next step of Fed. As of writing, the Dollar Index depreciated by 0.27% to 103.87.

In the commodity market, the crude oil price appreciated by 0.57% to $77.13 per barrel as of writing following the fears of aggressive rate hike has reduced. On the other hand, the gold price rose by 0.91% to $1879.13 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

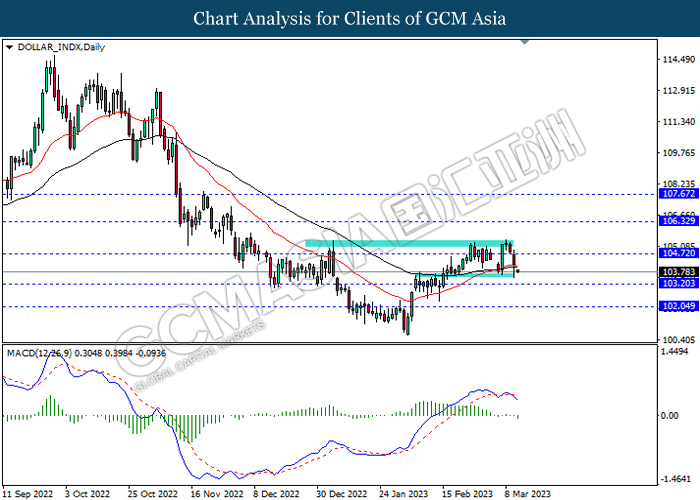

DOLLAR_INDX, Daily: Dollar index was traded following prior breakout below the previous support level. MACD which illustrated increasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

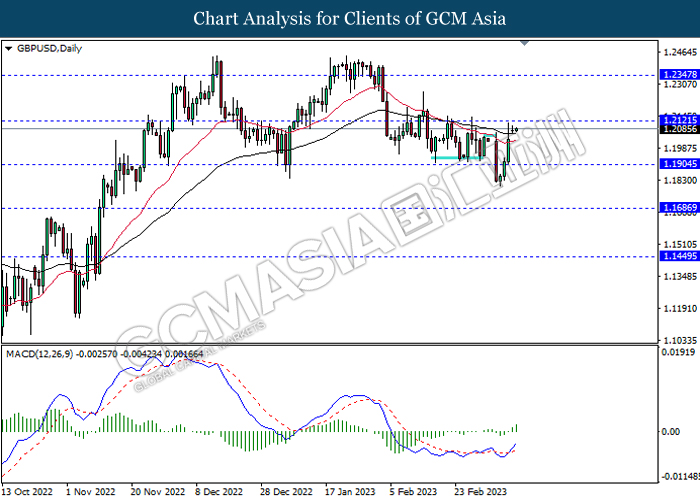

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2120, 1.2345

Support level: 1.1905, 1.1685

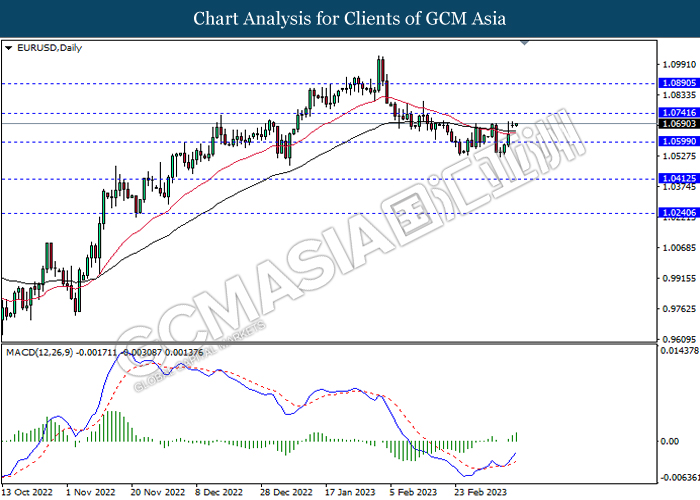

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

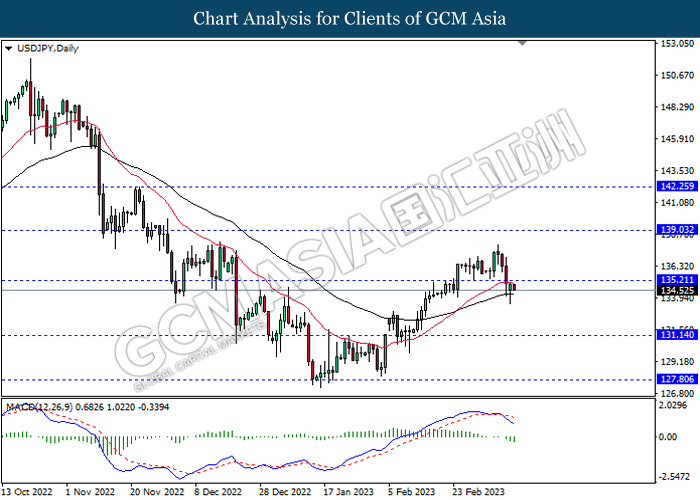

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

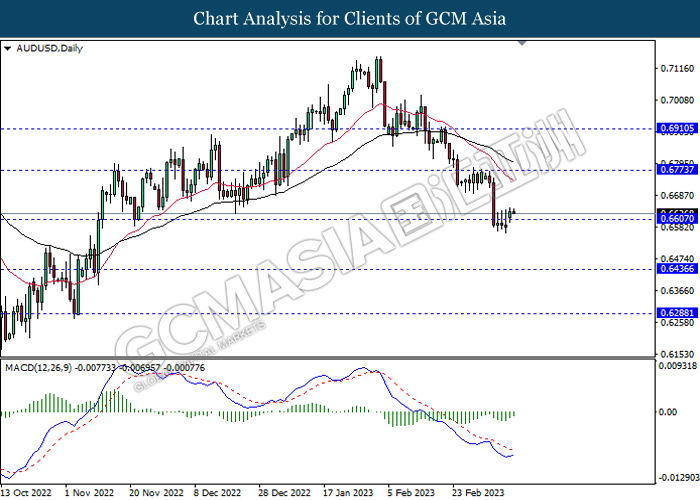

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

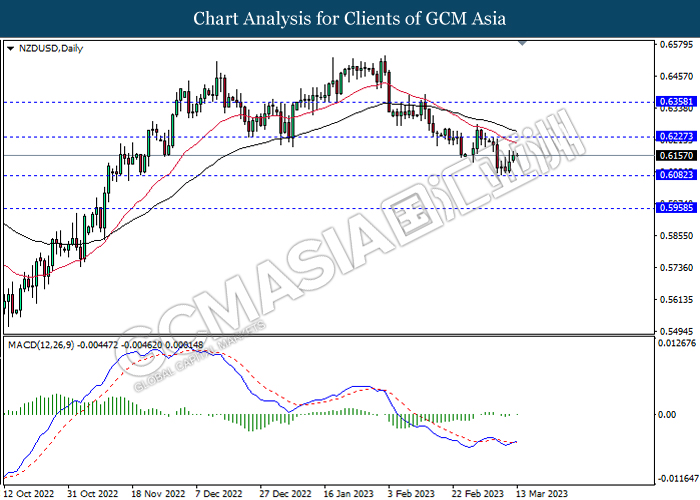

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

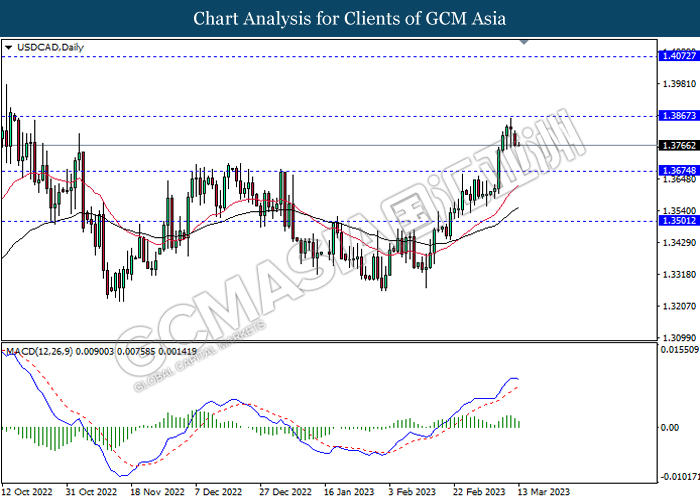

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

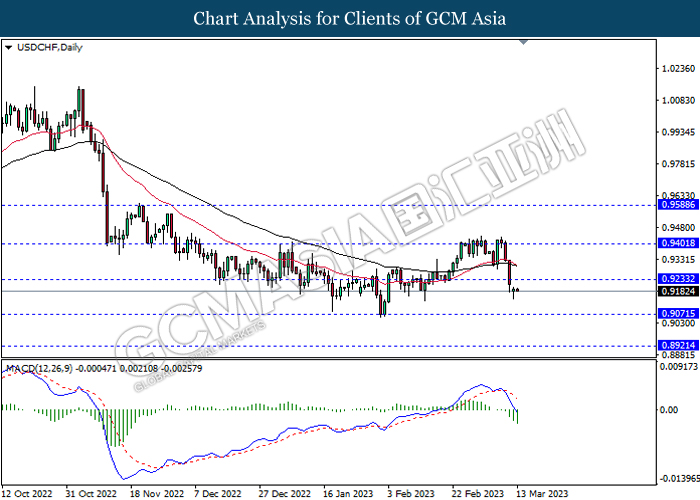

USDCHF, Daily: USDCHF was traded lower following prior breakout above the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

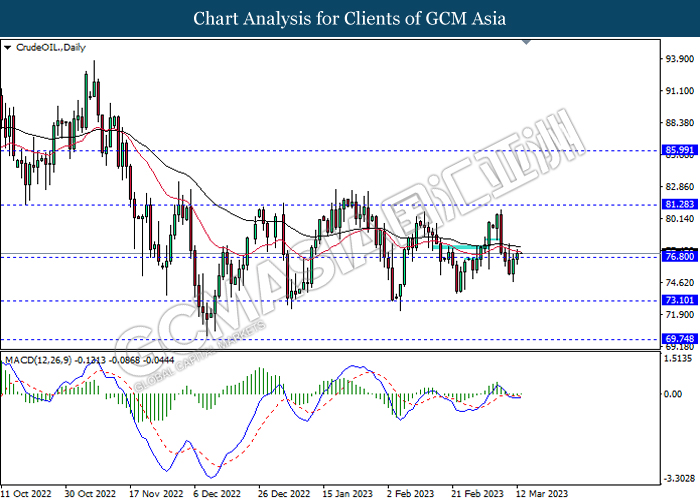

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

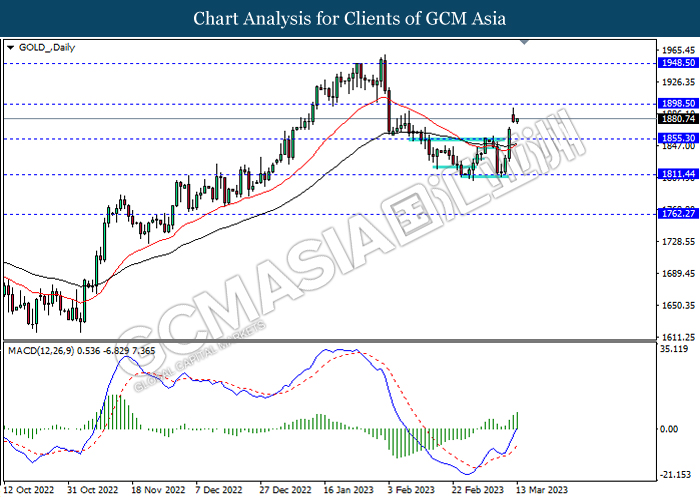

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1898.50, 1948.50

Support level: 1855.30, 1811.45