13 April 2020 Morning Session Analysis

Dollar seesawed as low liquidity during Easter holiday.

Dollar index which gauges its value against a basket of six major currencies hovered near the lowest level in one month as market lack of catalyst since last Friday amid Good Friday’s holiday. However, a downbeat economic data from US region continued to suppress the appeal of dollar index, keeping the value of greenback at recent low level. According to US Bureau of Labour Statistics, US Core CPI for the month of March came in at a pessimistic reading of -0.1%, blowing the estimates of 0.1%, while indicating that Coronavirus pandemic has sent the US economy into deep freeze. As of now, majority of the market participants are now eye on the global development of Covid-19 to scrutinize the market sentiment and risk appetite. Prior to now, US government and Federal Reserve has unveiled a series of stimulus program to support the household and local businesses go through the hardship which due to virus spreading. Last Saturday, US surpassed Italy as the country with the highest coronavirus death in the world, resulted a catastrophic damage to entire economy. During Asian early trading session, dollar index notched down by 0.01% to 99.50.

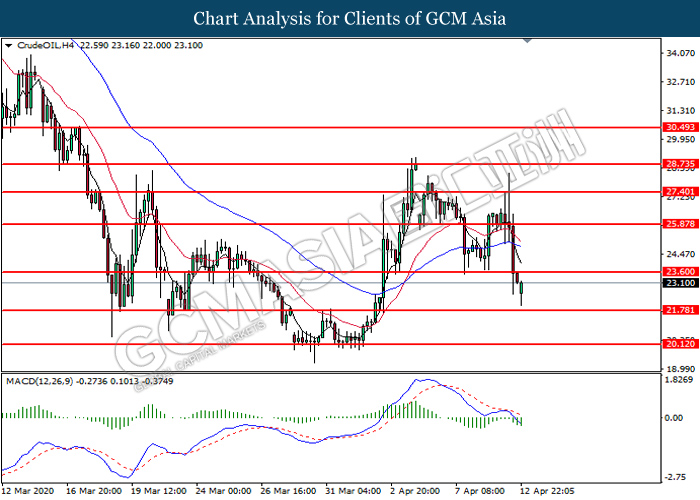

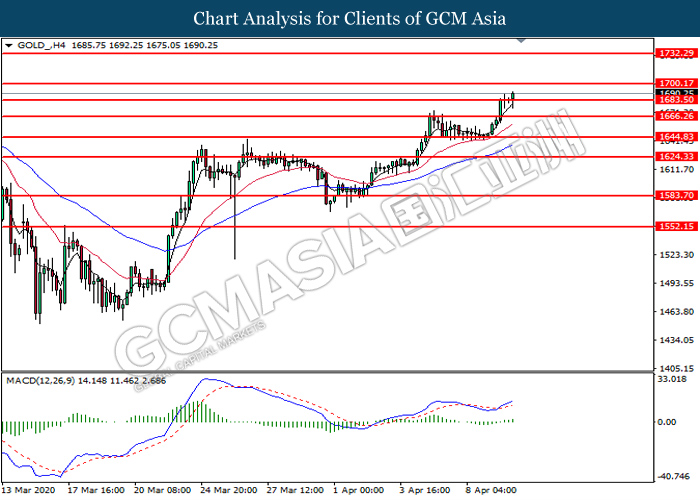

In the commodities market, crude oil price depreciated by 2.60% to $22.45 per barrel as after OPEC+ agreed to cut their oil production by 9.7 million barrels per day, amounting to around 10% of global supply to stabilize the oil market. However, the oil cut plan is seemingly insufficient to head off the oversupply in oil market. Besides, gold price appreciated by 0.05% to $1685.00 a troy ounce due to exacerbating of global virus spreading.

Today’s Holiday Market Close

Time Market Event

All Day GBP Easter Monday

All Day EUR Easter Monday

All Day CHF Easter Monday

All Day AUD Easter Monday

All Day NZD Easter Monday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

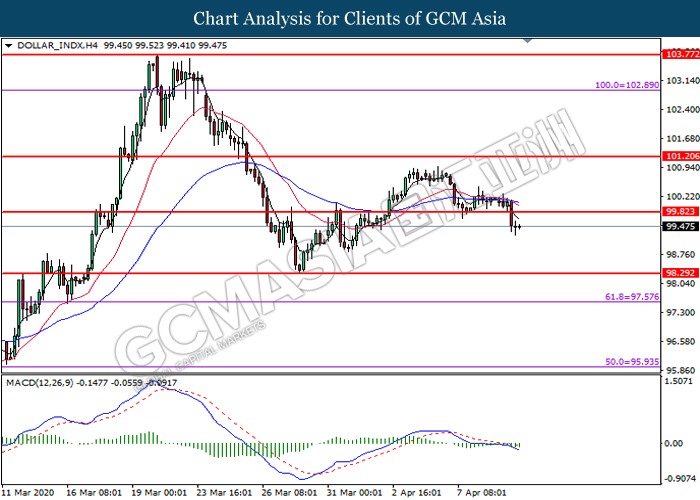

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 99.80. MACD which illustrate bearish bias momentum suggest the dollar to extend its losses toward the support level at 98.30.

Resistance level: 99.80, 101.20

Support level: 98.30, 97.60

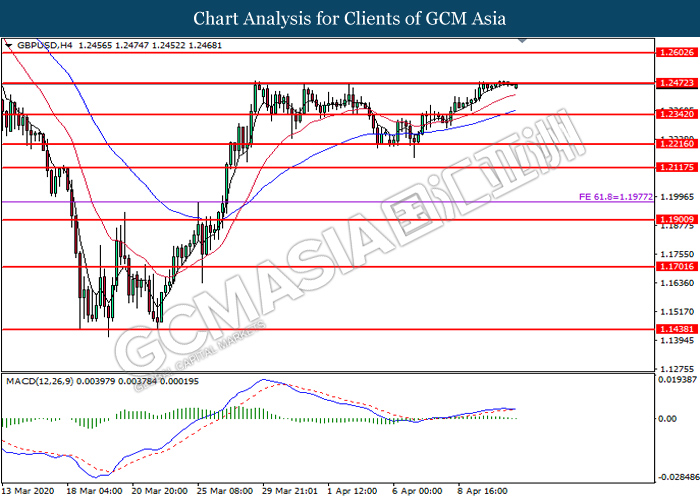

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2470. MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower toward the support level at 1.2340.

Resistance level: 1.2470, 1.2605

Support level: 1.2340, 1.2215

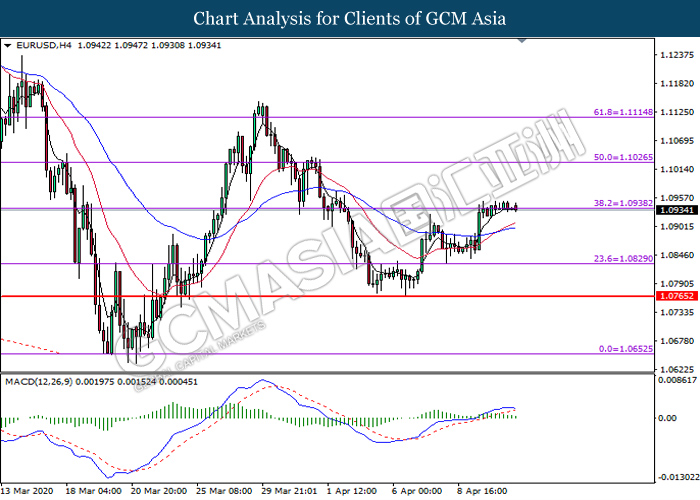

EURUSD, H4: EURUSD was traded flat above the support level at 1.0940. MACD which illustrate diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.0940.

Resistance level: 1.1025, 1.1115

Support level: 1.0940, 1.0830

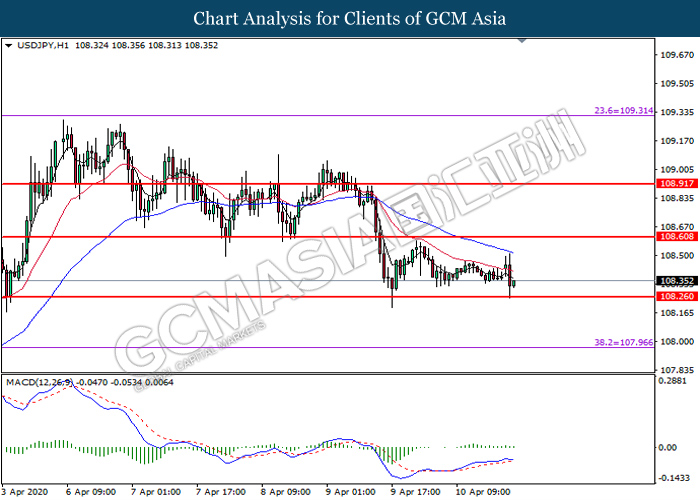

USDJPY, H1: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminishing bullish momentum signal suggests the pair to extend its losses toward the support level at 108.25.

Resistance level: 108.60, 108.90

Support level: 108.25, 107.95

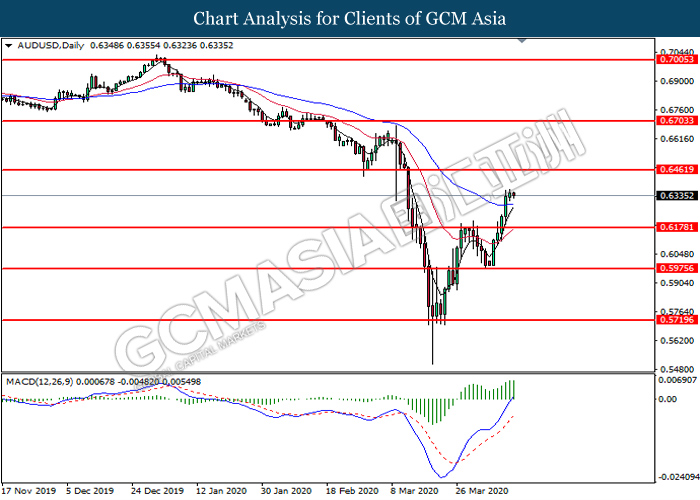

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6180. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6460.

Resistance level: 0.6460, 0.6705

Support level: 0.6180, 0.5975

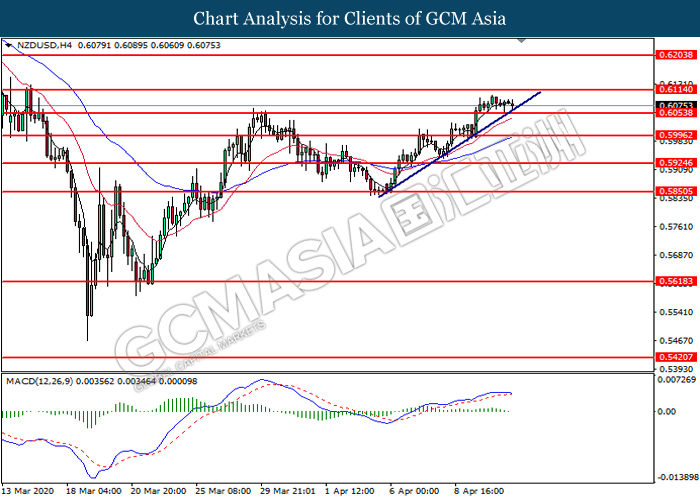

NZDUSD, H4: NZDUSD was traded lower while currently testing the upward trendline. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the upward trendline.

Resistance level: 0.6115, 0.6205

Support level: 0.6055, 0.5995

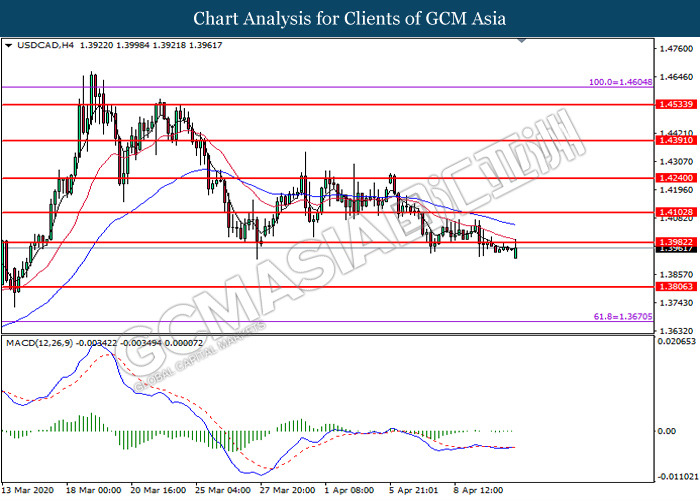

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3980. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1.3980, 1.4105

Support level: 1.3805, 1.3670

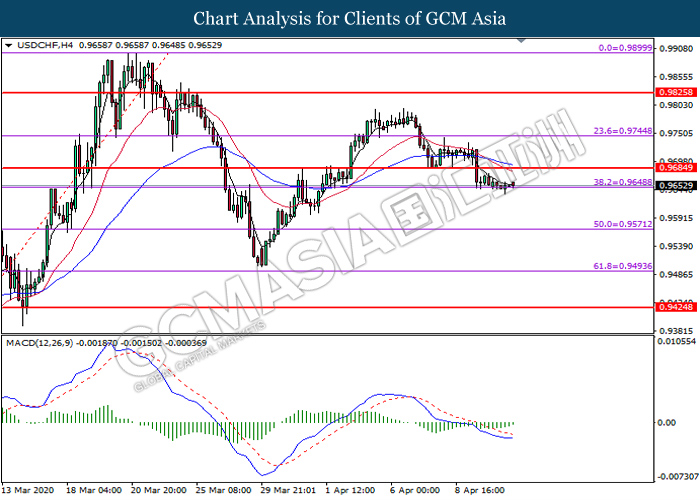

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9650. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9685.

Resistance level: 0.9685, 0.9745

Support level: 0.9650, 0.9570

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 23.60. MACD which illustrate bearish bias momentum suggest the commodity to extend its losses toward the support level at 21.80.

Resistance level: 23.60, 25.90

Support level: 21.80, 20.10

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1683.50. MACD which illustrate bullish bias momentum suggest the pair to extend its gains after its candle successfully close above the resistance level.

Resistance level: 1683.50, 1700.15

Support level: 1666.25, 1644.85