13 April 2022 Morning Session Analysis

US Dollar extend its gains as rising inflation rate triggered rate hike expectation.

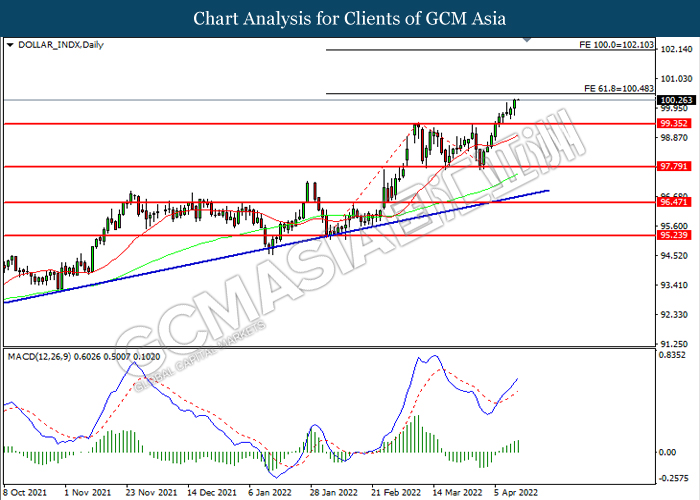

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of spiking inflation data yesterday, raising probability for rate hike from Federal Reserve while sending the US 10-Year Treasury note to hover at recent high. According to US Bureau of Labor Statistics, the US Consumer Price Index (CPI) climbed at their highest rates since 1981, increasing 8.5% over the year to the end of March as rising tensions between Russia-Ukraine continue to drive up energy costs. Besides, the Federal Reserve Governor Lael Brainard claimed that the Federal Reserve would likely to conduct a series of rate hikes and begin to reduce its massive bond buying program as soon as June to combat the high inflation rate. As of writing, the Dollar Index appreciated by 0.38% to 100.31.

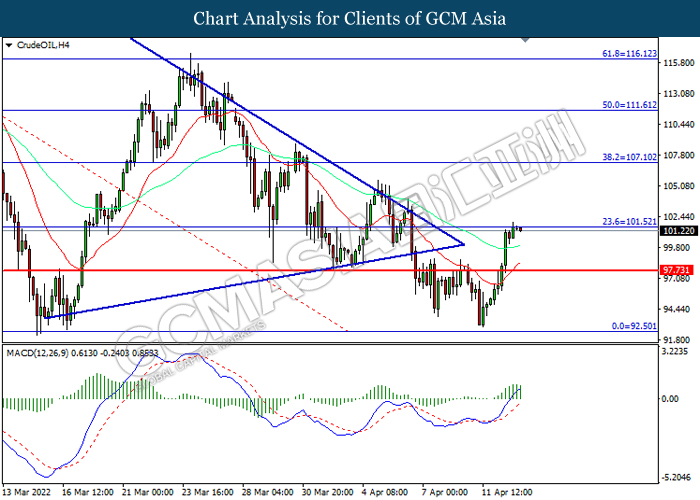

In the commodities market, the crude oil price appreciated by 0.44% to $102.00 per barrel as of writing. The oil market edged higher as the Chinese authorities had eased the Covid-19 restriction in China. On the other hand, the gold price appreciated by 0.04% to $1965.57 per troy ounces as of writing as investors shift their portfolio toward safe-haven gold to hedge against the inflation risk in future.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 6.20% | 6.70% | – |

| 20:30 | USD – PPI (MoM) (Mar) | 0.80% | 1.10% | – |

| 22:00 | CAD – BoC Monetary Policy Report | – | – | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.50% | 1.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.421M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

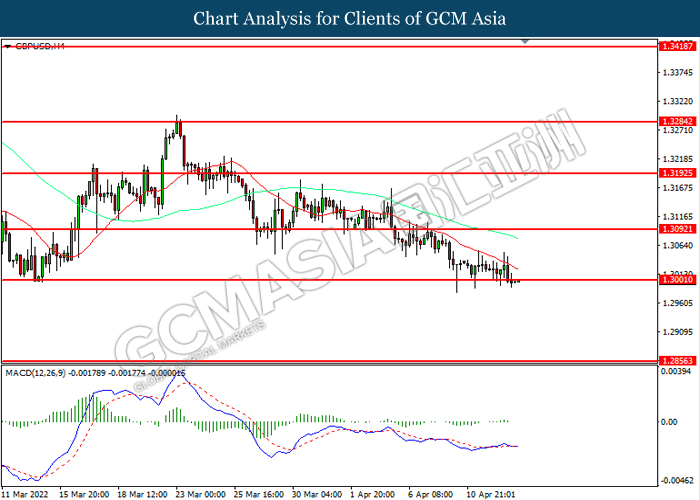

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

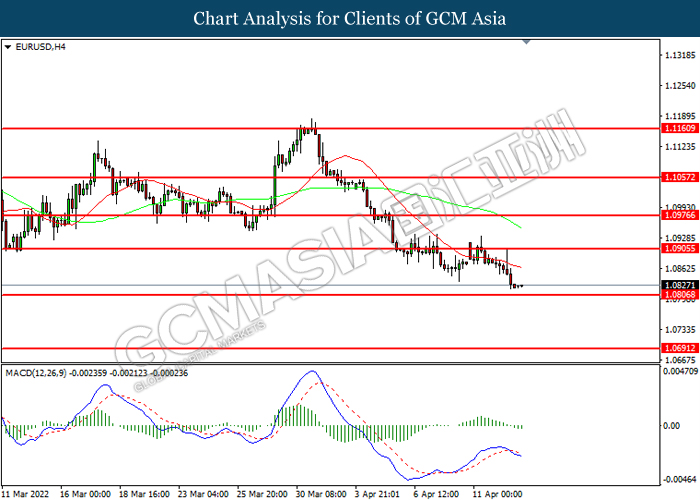

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

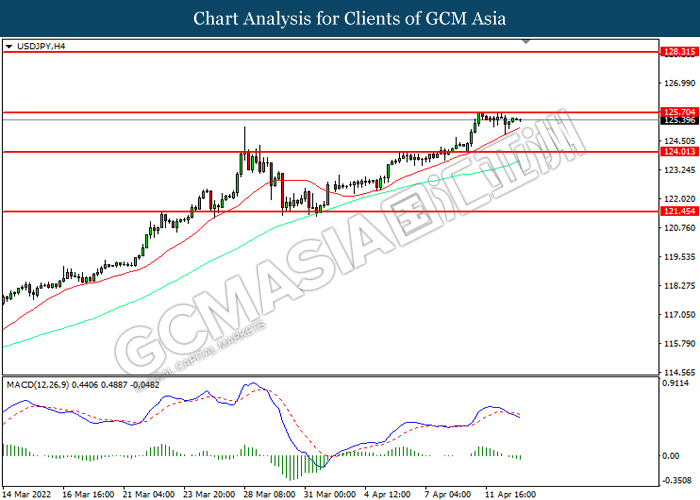

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

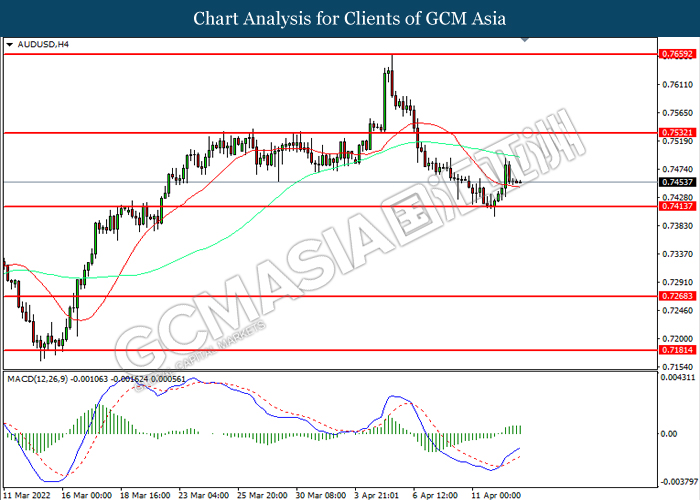

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

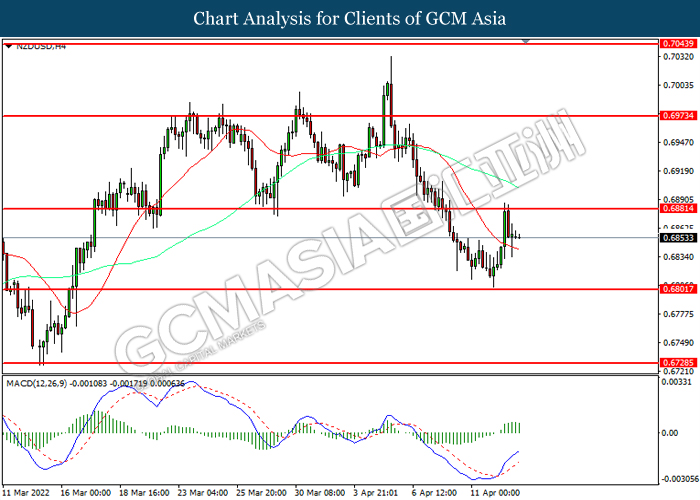

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

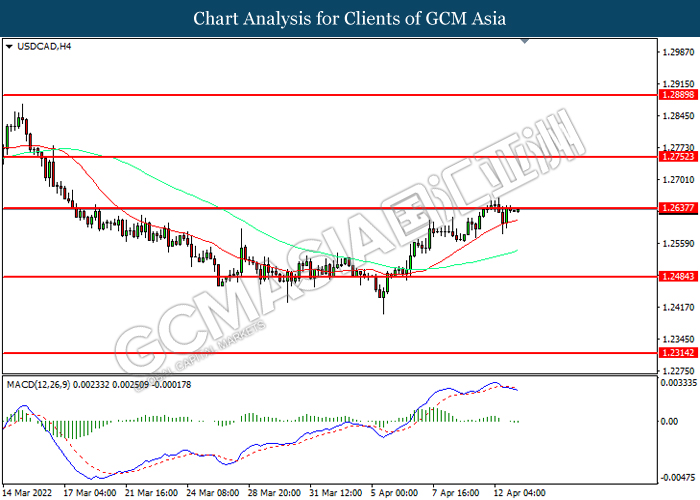

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 101.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 101.50, 107.10

Support level: 97.75, 92.50

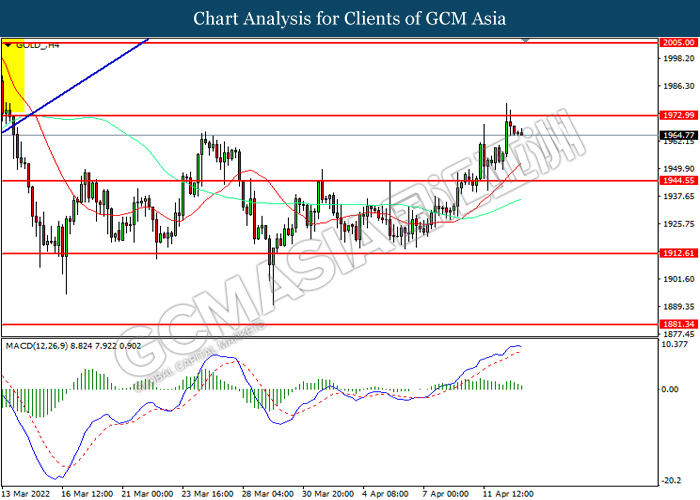

GOLD_, H4: Gold price was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60