13 April 2023 Morning Session Analysis

US dollar plunged amid inflation continued to ease.

The dollar index, which is traded against a basket of six mainstream currencies, lost its ground as the inflation data showed a sign of further cooling in March. Yesterday, the US Labor Department released the long-waited inflation data, Consumer Price Index (CPI). The data came in at 5.0%, significantly lower than the prior reading at 6.0%, while beating the consensus forecast at 5.2%, mirroring that the rate hikes plan successfully cooled down the inflationary pressures in the US. Besides, the core CPI, which excludes volatile items such as food and energy, increased by 0.4%, as widely expected. Since almost a year ago, the Fed has been implementing its rate hikes plan at an aggressive pace, a total of 9 times rate hikes that bring the benchmark interest rate to 4.75% as of last month’s central bank meeting. Notably, despite the sharp drop in March’s CPI figure, the US policymakers still target inflation around 2% as a healthy and sustainable growth level. Hence, the chances of one more rate hike in the upcoming meeting do not rule out from the table of the Fed. On top of that, the Fed meeting minutes released early today showed that the office of the Fed was considering pausing its rate hike due to their concerns about the contagion of recent banking turmoil. Besides, the financial chaos also led the members to forecast that the US economy might fall into a mild recession later this year. As of writing, the dollar index dropped -0.66% to 101.55.

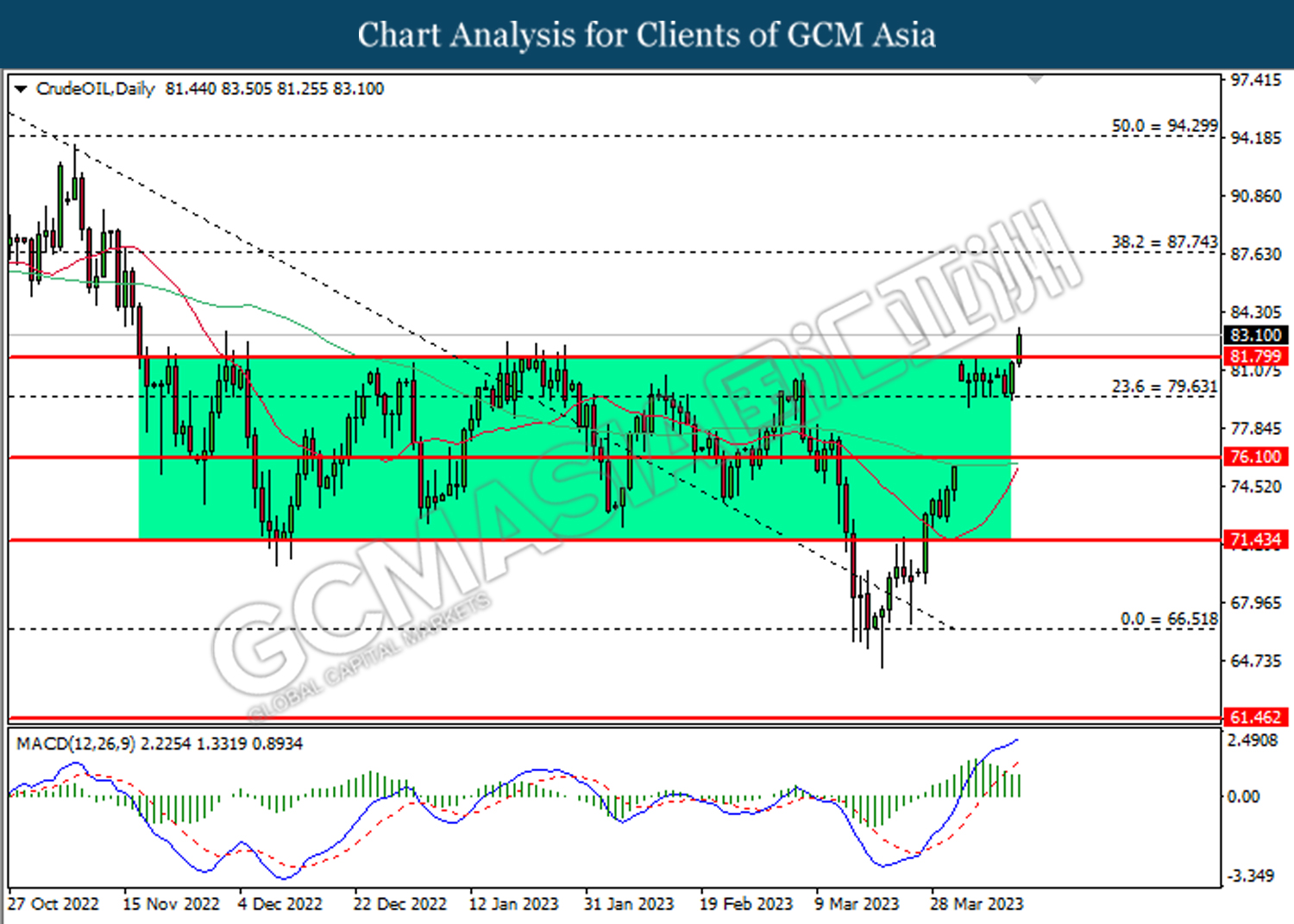

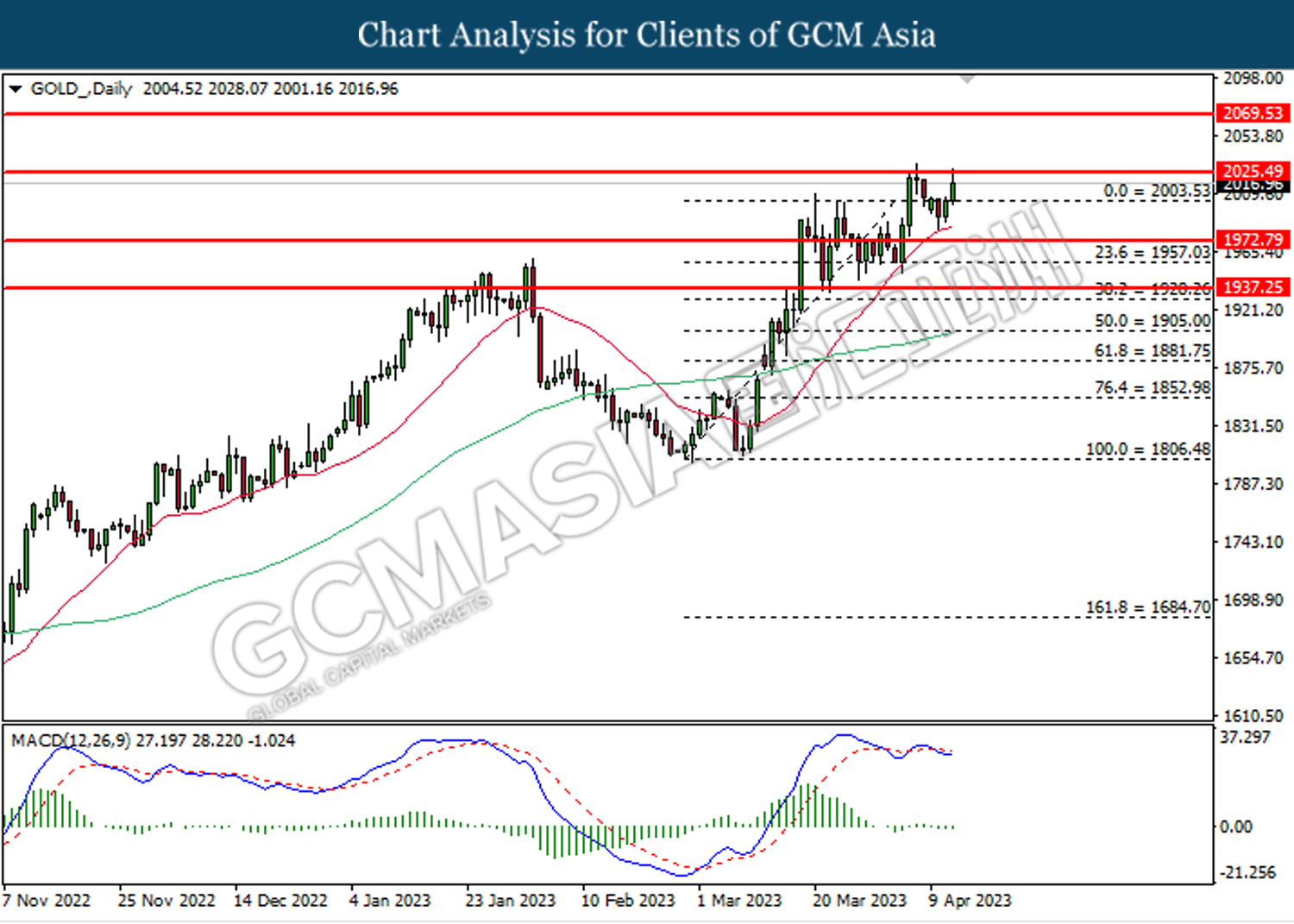

In the commodities market, crude oil prices edged down by -0.24% to $83.00 per barrel after rising sharply amid the dollar weakening, which has prompted non-US oil buyers to rush into the oil market. Besides, gold prices were traded up by 0.05% to $2015.00 per troy ounce as the CPI data showed further signs of cooling inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) (Feb) | 0.3% | 0.1% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Feb) | -0.4% | 0.2% | – |

| 14:00 | EUR – German CPI (MoM) (Mar) | 0.8% | 0.8% | – |

| 20:30 | USD – Initial Jobless Claims | 228K | 232K | – |

| 20:30 | USD – PPI (MoM) (Mar) | -0.1% | 0.1% | – |

Technical Analysis

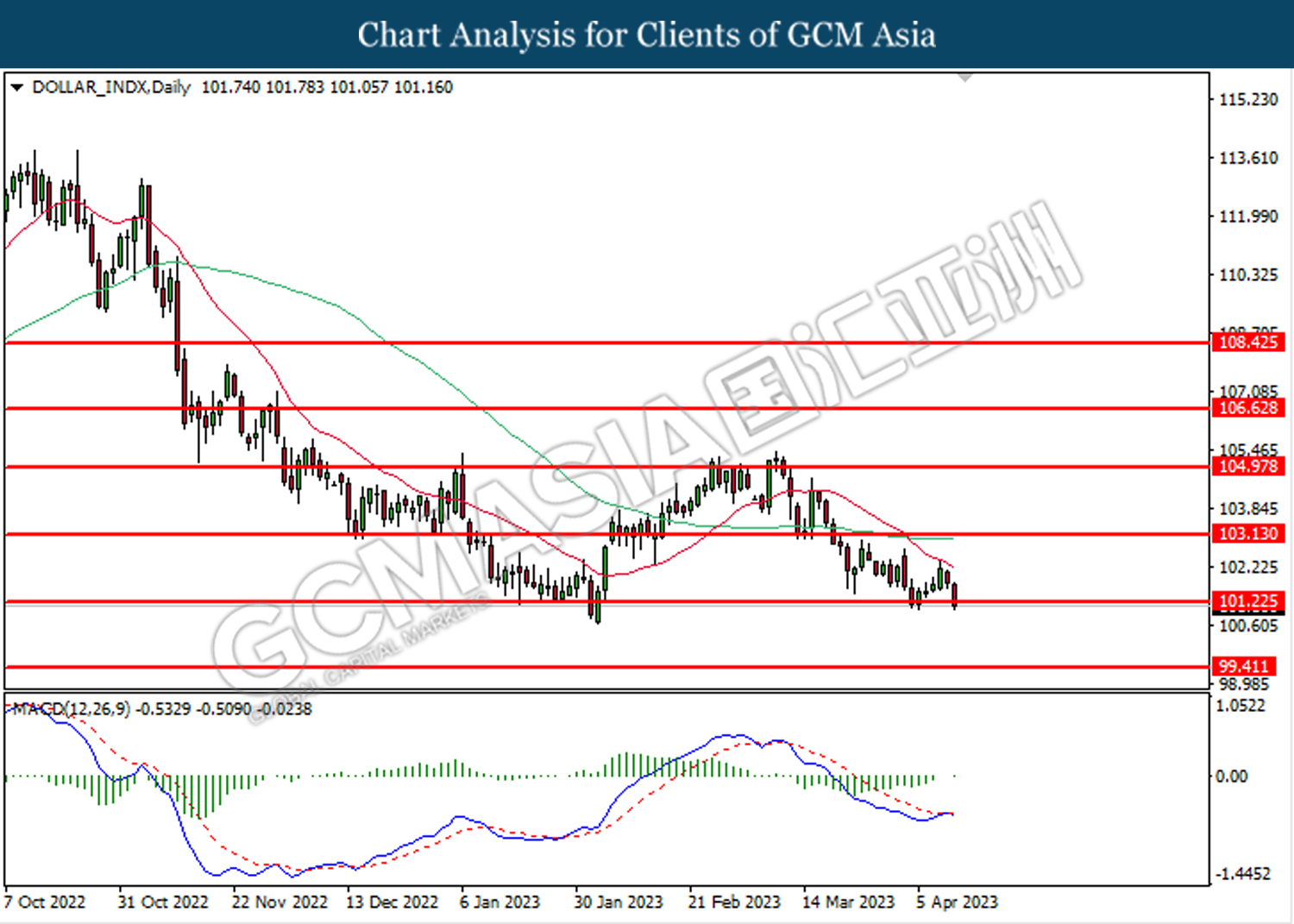

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

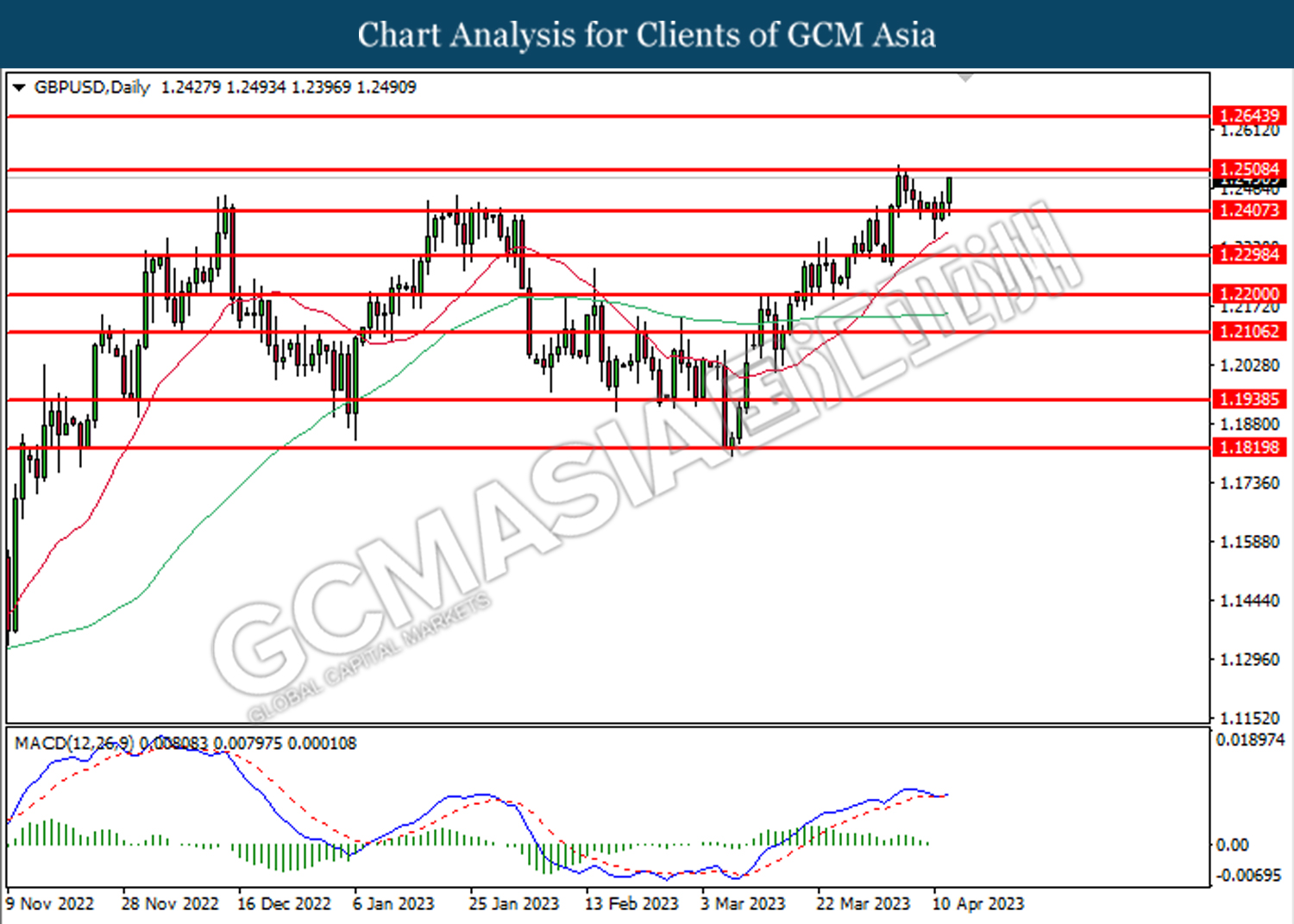

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2510, 1.2645

Support level: 1.2405, 1.2300

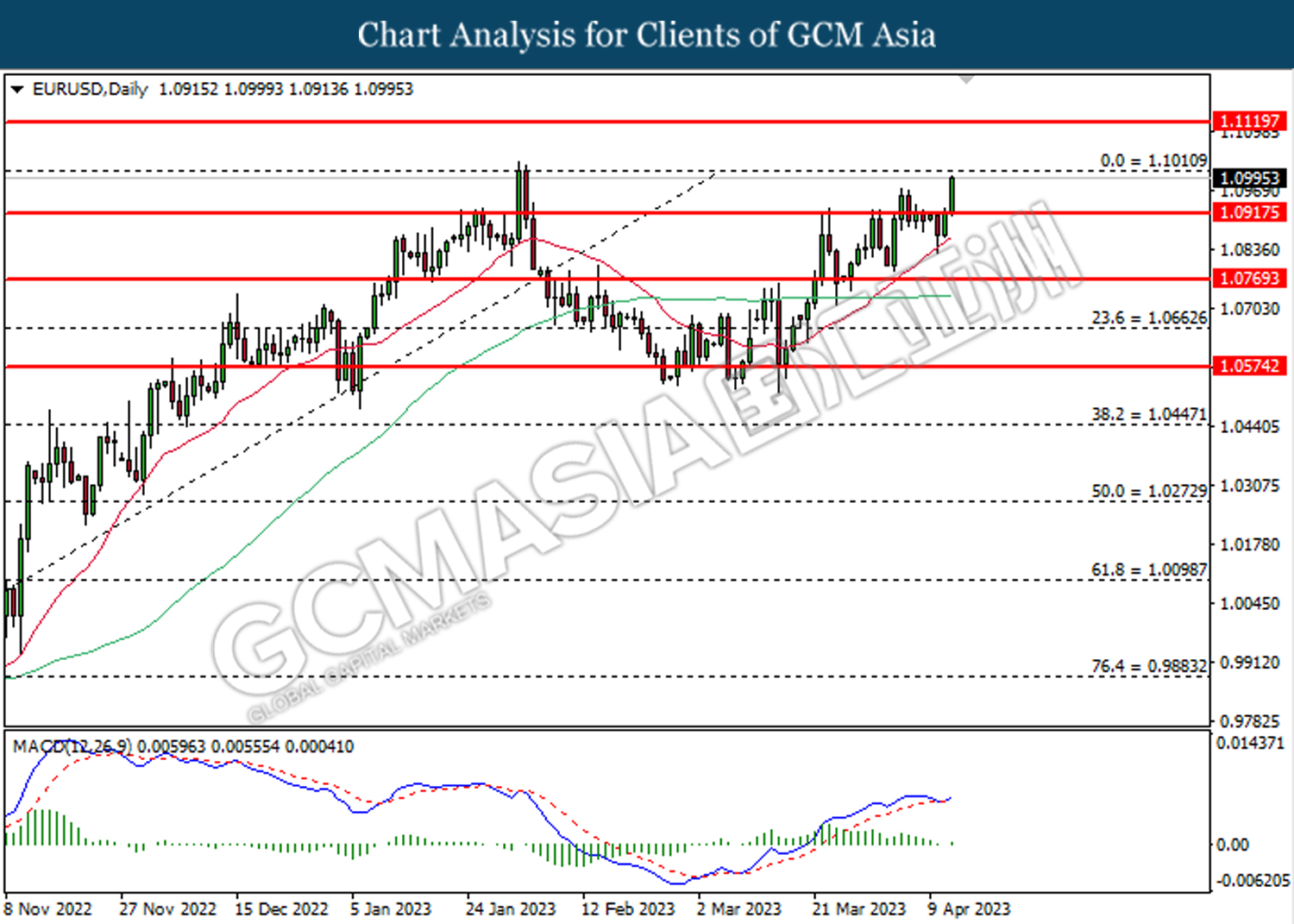

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

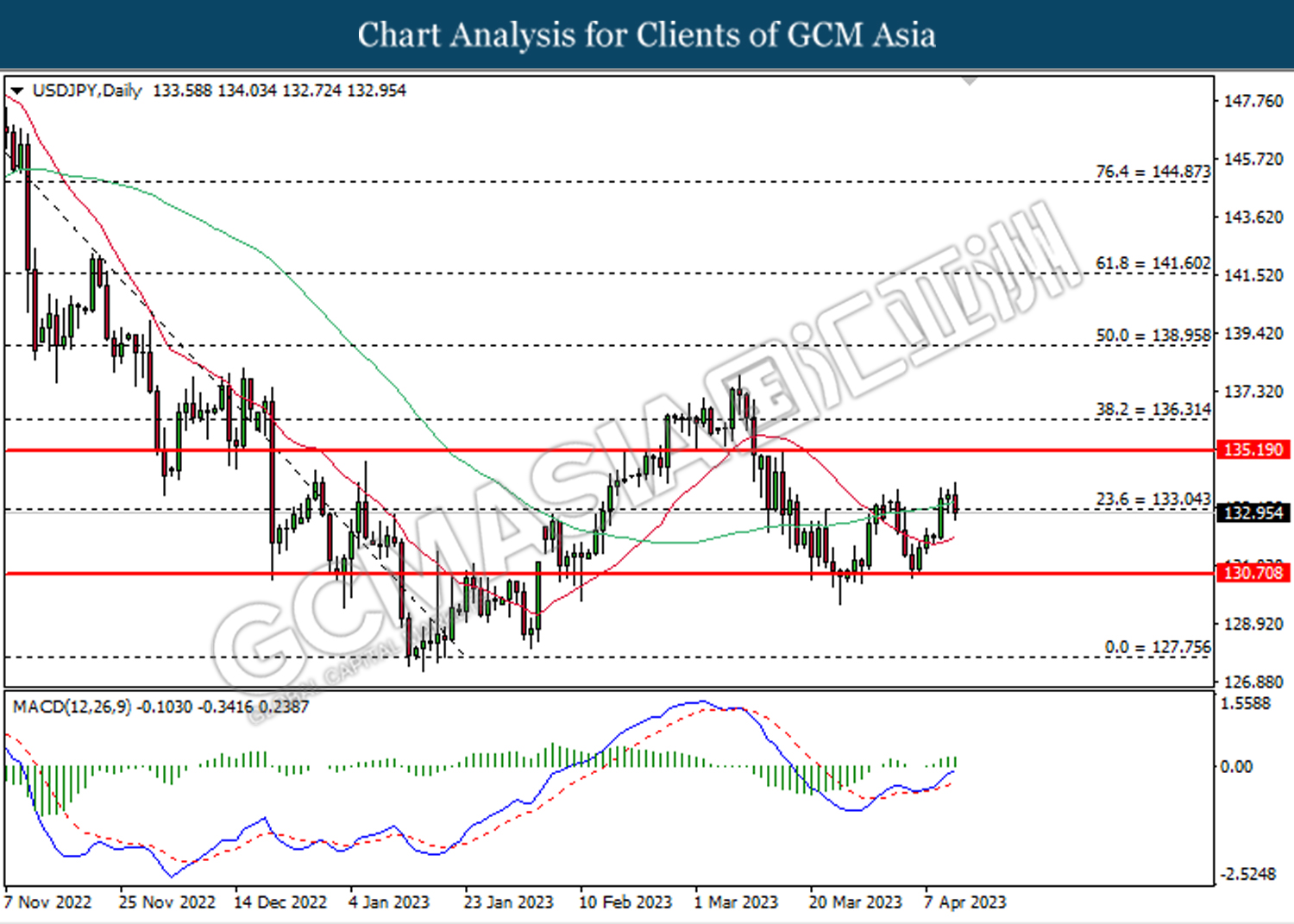

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

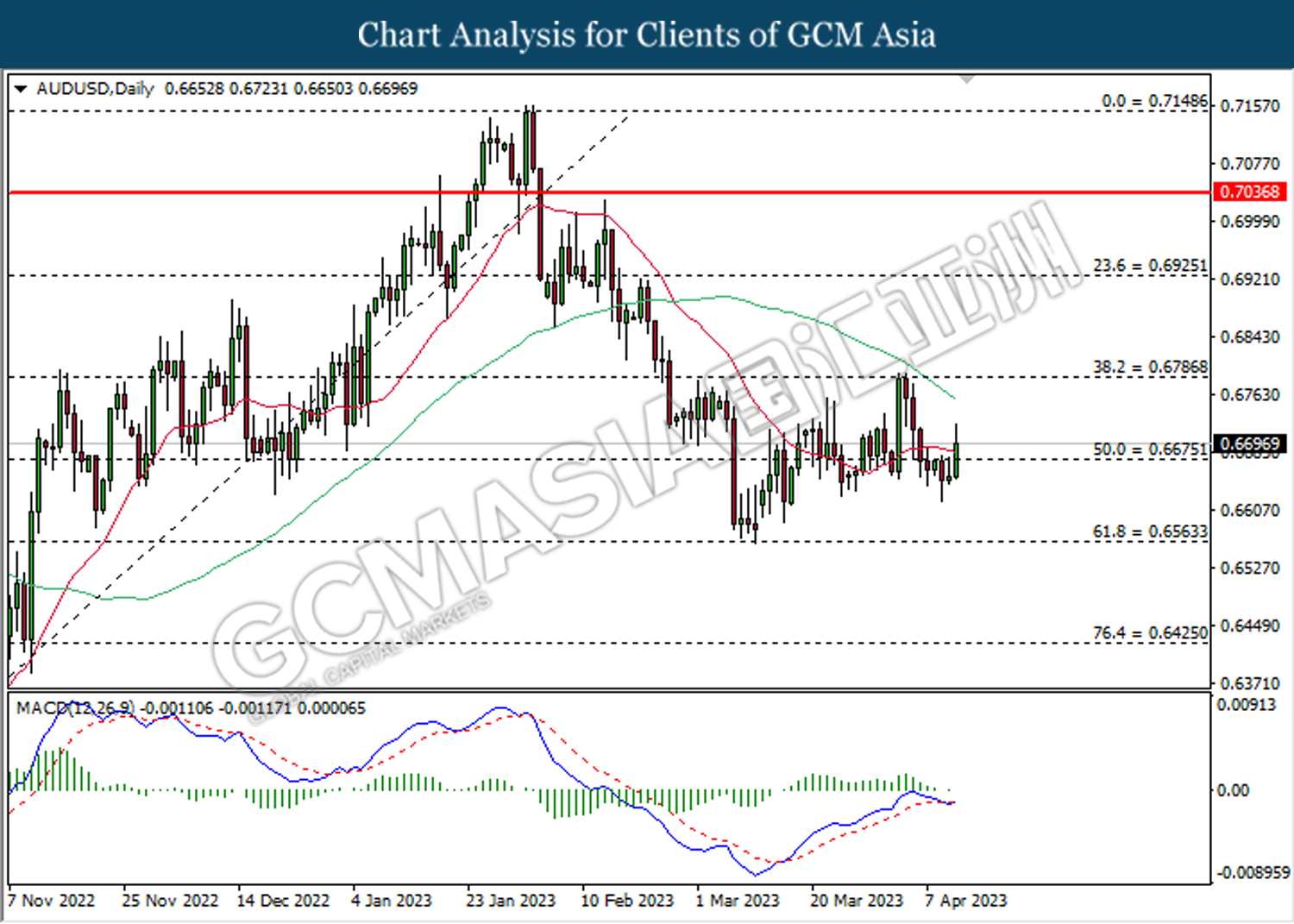

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

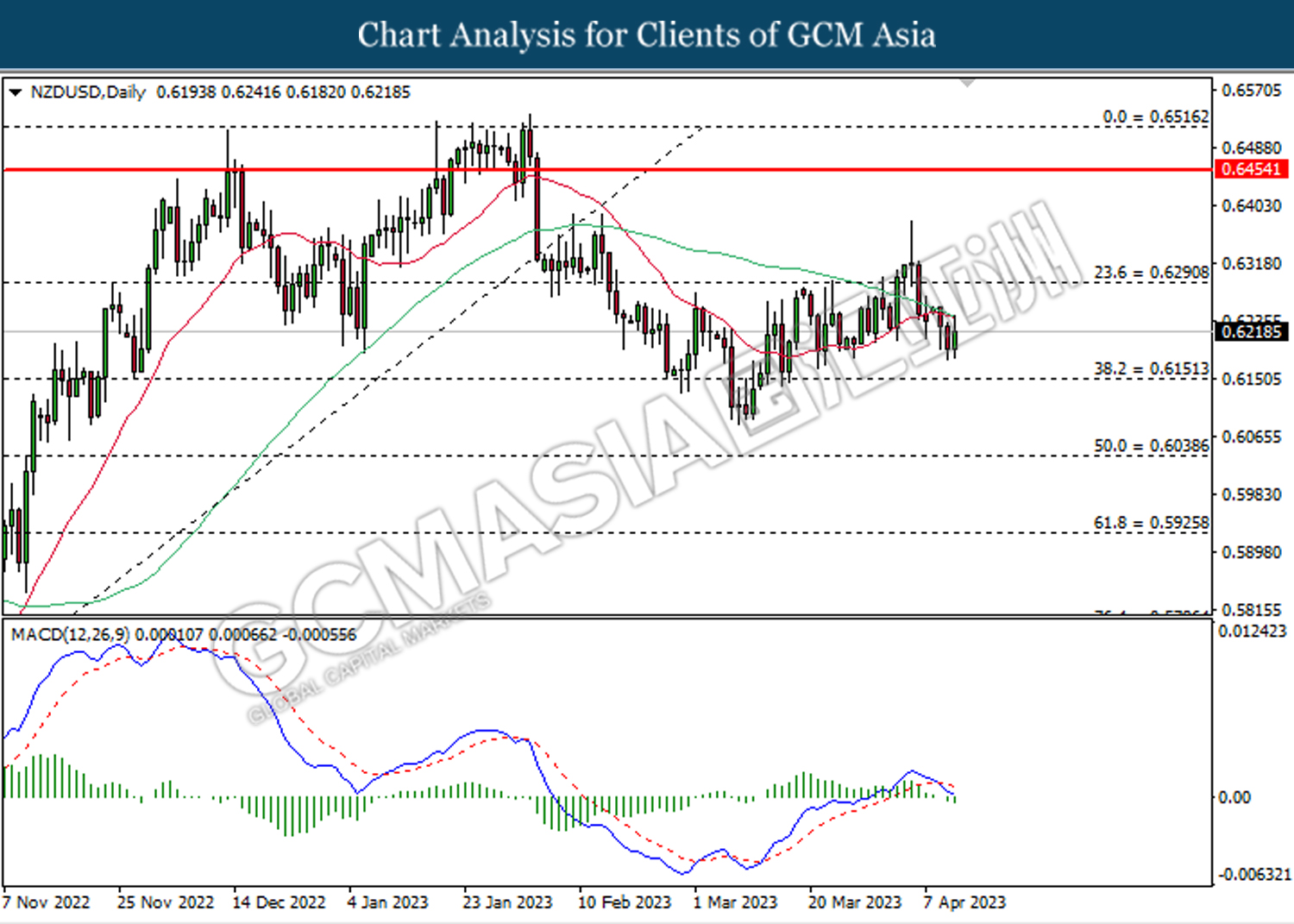

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

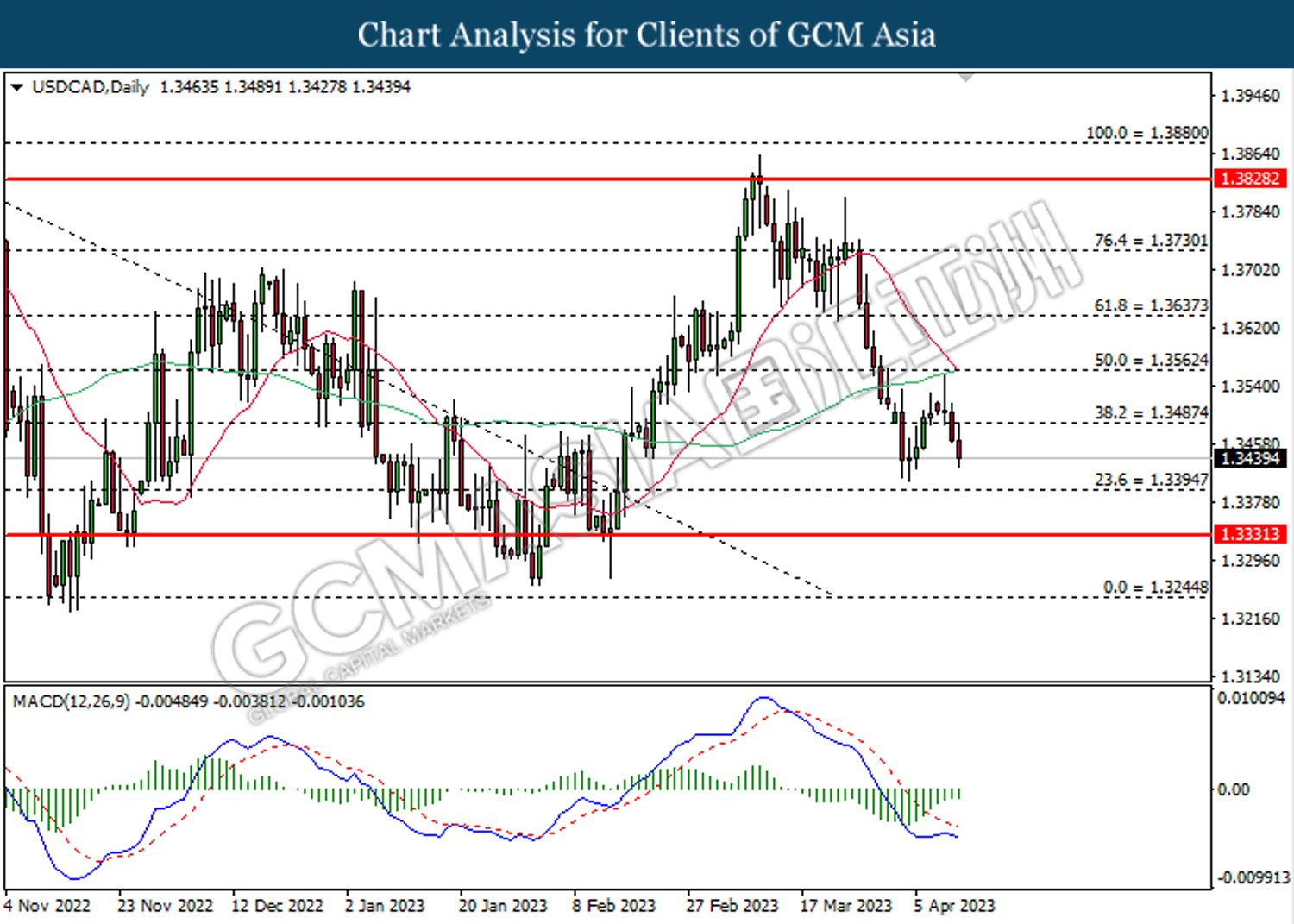

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3485. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3395.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

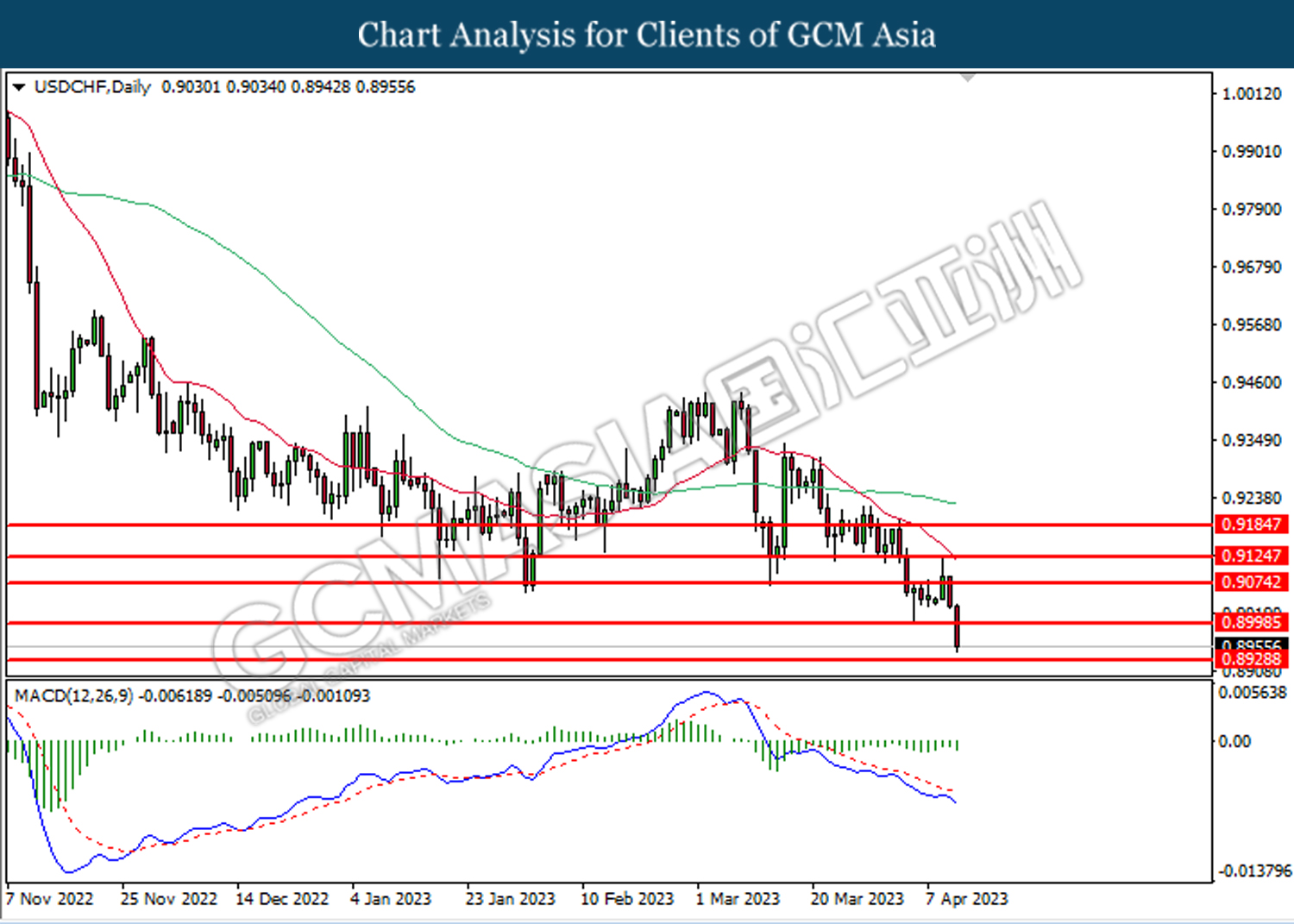

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8995. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully close below the support level.

Resistance level: 0.9075, 0.9125

Support level: 0.9000, 0.8930

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.80. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.80, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2025.50. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2025.50, 2069.55

Support level: 2003.55, 1972.80